Functional Food Ingredients Market by Type (Probiotics, Protein & Amino Acids, Phytochemicals & Plant Extracts, Prebiotics, Omega-3 Fatty Acids, Carotenoids, Vitamins), Application, Source, Form, Health Benefits and Region - Global Forecast to 2029

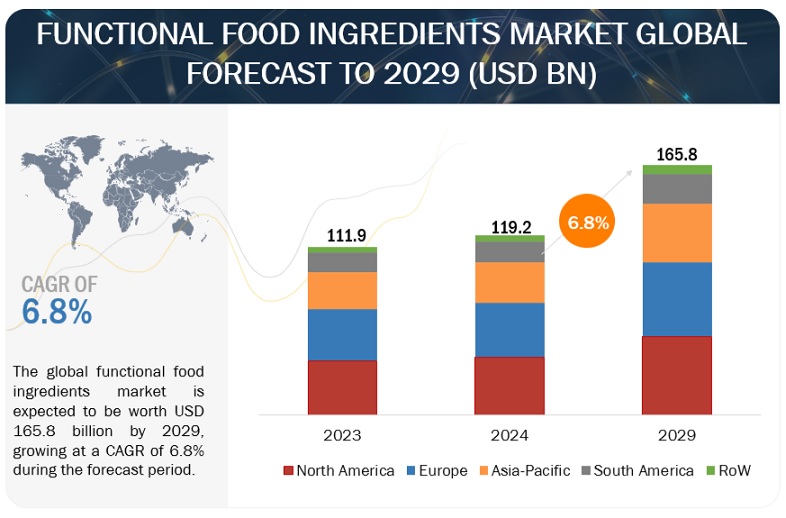

[475 Pages Report] The global functional food ingredients market is on a trajectory of significant expansion, with an estimated value projected to reach USD 165.8 billion by 2029 from the 2024 valuation of USD 119.2 billion, displaying a promising Compound Annual Growth Rate (CAGR) of 6.8%. The demand for functional food enriched with nutritious ingredients originates from evolving consumer desires for healthier eating habits and lifestyles. Increasing awareness of nutrition and overall well-being motivates individuals to seek out products offering specific health benefits, such as improved digestion or enhanced immune function.

The rising prevalence of lifestyle diseases such as obesity and diabetes has underscored the importance of preventive healthcare. In 2022, the World Health Organization (WHO) reported 2.5 billion adults over 18 were overweight, with over 890 million living with obesity. WHO also mentioned that the obesity rates more than doubled globally from 1990 to 2022. Consumers are increasingly seeking food and beverages fortified with functional ingredients known to promote health and wellness, such as probiotics, omega-3 fatty acids, and vitamins.

Moreover, increased consumer awareness regarding the correlation between diet and health has led to a shift in consumption patterns. Healthy food and beverages are now prioritized, with consumers willing to pay premium prices for products perceived to offer functional benefits. This trend is particularly pronounced among urban populations with rising disposable incomes. For instance, in October 2022, Kerry Group plc (Ireland) conducted research surveying 10,000 consumers from 18 countries across North America, South America Europe, Asia Pacific, South Africa, and Australia, revealing shifting priorities in functional beverages. The research found that immune support remains paramount globally, with 53% expressing interest in science-backed ingredients such as vitamins, omega-3, and probiotics. Customized solutions for different age groups are sought, emphasizing holistic wellness encompassing inner and outer health. Beauty concerns, including skin and hair, are rising, alongside a growing demand for products aiding weight management, heart health, and sports performance. This trend fuels increased demand for functional food ingredients catering to diverse consumer needs.

Additionally, the aging population worldwide has contributed to the demand for functional food ingredients targeting age-related health concerns, including cognitive decline and bone health. However, despite the growing demand, stringent regulations and approval processes pose challenges for market players. Compliance with regulatory standards and obtaining necessary approvals for new ingredients can be time-consuming and costly, inhibiting market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers: Increase in consumption of nutritive convenience and fortified food products

Busy schedules, rising health consciousness, and awareness about nutritional deficiencies drive consumers to seek out products that offer both convenience and health benefits. Nutritive convenience foods, such as pre-packaged salads, smoothies, and meal replacement bars, provide quick and easy solutions for individuals on the go, while fortified food products, including fortified cereals, milk, and beverages, address specific nutrient deficiencies and offer added health benefits.

In response to this growing demand, various manufacturers have capitalized on the trend by launching a plethora of functional food and beverage products. These products are formulated with specific ingredients, such as vitamins, minerals, probiotics, and omega-3 fatty acids, to provide additional health benefits beyond basic nutrition. From energy-boosting snacks to immunity-boosting drinks, the functional food and beverage market has witnessed a surge in innovative product offerings catering to diverse consumer needs. For instance, in May 2021, The US Food and Drug Administration (FDA) granted Cargill a letter of no objection for its GRAS notification regarding the incorporation of EpiCor postbiotic into certain food and beverage applications. This dried yeast fermentate, demonstrated in clinical trials for dietary supplements, effectively regulates gut microbiota and offers beneficial support to the immune system. This opens up new avenues for creating innovative products that cater to consumers' growing interest in functional foods and beverages that support gut health and immune function.

This surge in functional food and beverage products, in turn, has fueled the demand for functional food ingredients. Manufacturers are increasingly seeking high-quality, scientifically-backed ingredients that not only enhance the nutritional profile of their products but also offer functional properties, such as improved digestion, enhanced immunity, and better cognitive function.

Restraints: High production costs and requirement for significant R&D investments

High production costs and the necessity for significant R&D investments pose primary constraints within the functional food ingredients market. Production costs soar due to factors such as raw material scarcity and the sourcing complexities of naturally derived ingredients. Extracting bioactive compounds from rare plants or marine organisms, for instance, amplifies expenses owing to cultivation challenges and environmental regulations.

Furthermore, stringent quality and safety standards inflate costs as manufacturers must invest in extensive testing and compliance measures to ensure product consistency and regulatory adherence. Simultaneously, substantial R&D investments are imperative for continuous innovation and product differentiation in this competitive landscape. Research efforts are essential for discovering new bioactive compounds, refining extraction techniques, and enhancing ingredient efficacy.

These high production costs and R&D investments pose barriers for both manufacturers and consumers. Manufacturers face challenges in maintaining competitive pricing while ensuring product quality and innovation. Consequently, consumers may encounter higher prices for functional food products, potentially deterring widespread adoption. Moreover, limited R&D investment may hinder the development of new, more affordable functional ingredients, further constraining market growth.

Opportunities: Use of encapsulation technology

Encapsulation technology involves the process of enclosing active ingredients within a carrier material, forming microscopic capsules. These capsules can protect the active ingredients from degradation, improve their stability, control release rates, and enable targeted delivery. In the functional food ingredients market, encapsulation technology presents significant opportunities. Firstly, encapsulation enhances the efficacy of functional food ingredients by shielding them from environmental factors such as light, heat, moisture, and oxidation. This ensures that the active components remain intact until consumed, maximizing their health benefits. Secondly, encapsulation allows for the controlled release of functional ingredients within the body, optimizing their absorption and utilization. This controlled release mechanism ensures a sustained delivery of nutrients, prolonging their effects and enhancing their bioavailability.

Furthermore, encapsulation enables the incorporation of sensitive or unstable bioactive compounds into various food matrices without affecting taste or texture. This expands the scope of functional food product development, leading to a broader range of fortified foods and beverages appealing to health-conscious consumers.

As a result, the demand for functional food ingredients is expected to surge with the adoption of encapsulation technology. Food manufacturers can create innovative products with enhanced nutritional profiles and targeted health benefits, catering to the growing consumer interest in functional foods. Encapsulation technology thus represents a lucrative opportunity for stakeholders in the functional food ingredients market, driving innovation, and fueling market growth.

Challenges: Complexities related to the integration and adulteration of functional food products

The integration and adulteration of functional food products introduce significant complexities to the functional food ingredients market, posing challenges at various stages of production, distribution, and consumption. Integration involves combining functional ingredients into food products, requiring precise formulation to maintain efficacy and safety. Any deviation from the intended composition can compromise the product's functionality and consumer trust.

Adulteration exacerbates these challenges by introducing unauthorized or inferior ingredients into functional foods, often driven by economic motives. Adulterants can include cheaper substitutes or undisclosed additives, leading to inconsistencies in product quality and potential health risks for consumers. Detecting adulteration requires sophisticated analytical techniques, adding to production costs and regulatory burdens.

These complexities hinder market growth by eroding consumer confidence and regulatory compliance. Consumers demand transparency and authenticity in functional foods, necessitating stringent quality control measures throughout the supply chain. Regulatory bodies impose strict guidelines to ensure product safety and efficacy, increasing compliance costs for manufacturers. Moreover, the global nature of the functional food ingredients market amplifies these challenges, as ingredients may originate from diverse geographic regions with varying regulatory standards and supply chain complexities. Harmonizing regulations and implementing robust traceability systems become imperative to mitigate risks associated with integration and adulteration.

Market Ecosystem

Probiotics, By Type, Accounted For The Highest Market Share Among Type Segment In 2023.

Probiotics play a pivotal role in maintaining human health, particularly by fostering a balanced gut microbiome. The gut microbiome influences various bodily functions, from digestion and nutrient absorption to immune response and even mental health. Its impact extends far beyond the digestive system, affecting systemic inflammation, metabolism, and overall well-being. Gut health is intricately linked to the body's immune system, with about 70% of the immune system residing in the gut-associated lymphoid tissue (GALT). Probiotics help modulate this immune response, enhancing the body's ability to defend against pathogens while reducing the risk of inflammatory diseases.

Given the profound influence of gut health on overall wellness, probiotics emerge as a crucial functional food ingredient. Probiotics, by type segment, are estimated to dominate the functional food ingredients market due to their multifaceted benefits and the impact they have on overall health. While vitamins, minerals, and proteins are essential, probiotics offer unique advantages, they not only support digestion and nutrient absorption but also bolster immune function, regulate inflammation, and promote mental well-being through the gut-brain axis.

Additionally, probiotics have demonstrated efficacy in addressing specific health concerns such as irritable bowel syndrome, inflammatory bowel disease, and antibiotic-associated diarrhea, further fueling their market dominance. Their versatility and demonstrated health benefits position probiotics as indispensable functional food ingredients for maintaining holistic health and vitality. Some of the key players that offer probiotics include Cargill, Incorporated (US), Chr. Hansen A/S (Denmark), and A&B Ingredients, Inc. (US).

Companies involved in offering and utilizing strategic developments in probiotics ingredients are poised to meet the evolving demands of health-conscious consumers, capitalize on the growing interest in gut health, and drive innovation in the development of functional foods. For instance, in October 2022, TEIJIN LIMITED (Japan) took a significant step forward in its dedication to developing and producing probiotics for functional foods with the establishment of Teijin Japan Limited, marking a significant milestone for the company. This new subsidiary is committed to addressing the evolving needs of health-conscious consumers by leveraging expertise in probiotics, which are essential for improving intestinal health, in addition to prebiotics that promote their growth.

Food, By Application, Accounted For The Highest Market Share Among Form Segment In 2023.

With the largest market share of all the segments, the food segment emerged as the dominant segment in the market for functional food ingredients. The market for functional food ingredients is experiencing growth fueled by a rising preference for convenient, nutritious food options and an increasing demand for fortified food and beverage products. This expansion is driven by a rapidly growing health-conscious population, especially evident in emerging markets, which seek out fortified food products incorporating functional food ingredients.

Functional foods are becoming increasingly popular among consumers who are looking for specific health benefits like better digestion, immune system support, or increased energy levels in addition to nutritional value.

To satisfy the many demands and inclinations of health-conscious consumers, food manufacturers are actively introducing functional ingredients into a broad variety of food products, from snacks and beverages to dairy products and baked goods by meeting sustainability demands. For instance, in March 2023, ADM introduced the Knwble Grwn brand of functional food ingredients, aimed at offering consumers sustainably sourced, plant-based food ingredients that prioritize wholesomeness. These products are cultivated by small or underrepresented farmers utilizing regenerative agricultural practices, contributing to environmental conservation efforts. This new brand aligns with ADM's existing sustainability initiatives, further reinforcing the company's commitment to environmental stewardship and responsible sourcing practices.

Asia Pacific Is The Fastest-Growing Market For Functional Food Ingredients Among The Regions.

Shifting dietary preferences and rising health consciousness among consumers drive the demand for functional foods fortified with specific ingredients targeting various health benefits in the Asia Pacific region. This trend is particularly pronounced in countries such as China, India, and Japan, where there is a growing awareness of the importance of preventive healthcare. Additionally, the rich and diverse food culture in Asia Pacific countries, coupled with the prevalence of traditional medicine systems such as Ayurveda and Traditional Chinese Medicine, creates opportunities for the incorporation of functional ingredients derived from natural sources. Moreover, the Asia Pacific region boasts a burgeoning population, rapid urbanization, and increasing disposable incomes, all of which contribute to increased consumer spending on health-enhancing products.

The Asia Pacific market benefits from a larger consumer base, a cultural inclination towards holistic health practices, untapped market potential, and a more receptive attitude towards incorporating functional foods into daily diets unlike other regions, such as North America and Europe. In addition, the relatively lower penetration of functional food products in the Asia Pacific region presents ample opportunities for market expansion and growth, making it a focal point for industry players seeking to capitalize on emerging trends and preferences.

Key Market Players

The key players in this market include Cargill, Incorporated (US), BASF SE (Germany), ADM (US), International Flavors & Fragrances Inc. (US), Arla Foods amba (Denmark), Kerry Group plc (Ireland), Ajinomoto Co., Inc. (Japan), DSM (Netherlands), Ingredion (US), and Tate & Lyle (UK).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period considered |

2024–2029 |

|

Units considered |

Value (USD), Volume (Ton) |

|

Segments Covered |

By Source, Type, Form, Application, Health Benefits (Qualitative) And Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

This research report categorizes the functional food ingredients market, based on source, source, type, application, health benefits, and region.

Target Audience

- Functional food ingredients manufacturers

- Functional food ingredients Equipment Manufacturers

- Government Agencies (related to food safety and pharmaceutical regulations such as FDA, EFSA, and FSSAI)

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Functional Food Ingredients Market:

By Technology (Qualitative)

- Digestive Health

- Immune Support

- Energy & Metabolism

- Heart Health

- Bone & Joint Health

- Weight Management

- Others

By Type

- Probiotics

- Protein & Amino Acids

- Phytochemicals & Plant Extracts

- Prebiotics

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Carotenoids

- Vitamins

-

Minerals

- Macrominerals

- Microminerals

By Form

- Powders

- Liquids

- Capsules & Tablets

- Others

By Source

-

Natural Functional Food Ingredients

- Plant-based sources

- Animal-based Sources

- Mineral Sources

- Microbial and Fermentation Sources

- Dairy-derived Ingredients

-

Synthetic Functional Food Ingredients

- Synthetic Vitamins and Minerals

- Functional Lipids

- Phytochemicals

- Amino Acids

- Others

-

Hybrid or Blended Sources

- Fortified or Enriched Ingredients

- Bio-based Synthesis

By Application

-

Food

- Infant Food

- Dairy Products

- Bakery Products

- Confectionery Products

- Snacks

- Meat & Meat Products

- Other Types

-

Beverages

- Energy Drinks

- Juices

- Health Drinks

- Nutraceuticals and Dietary Supplements

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In February 2024, Cargill, Incorporated (US) and ENOUGH (UK) expanded their partnership to innovate sustainable protein options using ENOUGH's fermented mycoprotein technology. Cargill, Incorporated's investment, and commercial agreement will boost ABUNDA mycoprotein production, known for its meat-like texture and sustainability. This partnership allows Cargill, Incorporated to tap into the growing demand for alternative protein sources, enhancing its position in the functional food ingredients market and leveraging its global footprint to scale up production efficiently.

- In September 2023, BASF SE (Germany) unveiled Product Carbon Footprints (PCFs) for selected human nutrition ingredients including Vitamin AP 1,7 TOC and Vitamin E Acetate 98%. Certified methodology reveals at least 20% lower emissions compared to the global market average. This initiative, under ISO 14067:2018, aids BASF SE in offering a competitive advantage while supporting customer emission reduction goals. By showcasing superior PCFs for functional food ingredients, this initiative not only strengthens BASF's competitive edge but also enhances its reputation as a sustainable leader in the functional food ingredients market, fostering trust and loyalty among consumers and partners.

- In June 2023, ADM (US) and Brightseed (US) formed a global partnership to develop evidence-based functional synbiotic products targeting microbiome optimization, utilizing Brightseed's AI platform, Forager. By decoding molecular interactions between dietary plants and gut microbes, ADM aims to lead in precision health solutions, meeting rising consumer demand for natural, plant-based products promoting immune function, metabolic health, and mental well-being. This collaboration positions ADM as an innovator in the functional food ingredients market, leveraging an advanced understanding of bioactive and microbiome science to create impactful health solutions.

Frequently Asked Questions (FAQ):

What is the current size of the functional food ingredients market?

The functional food ingredients market is estimated at USD 119.2 billion in 2024 and is projected to reach USD 165.8 billion by 2029, at a CAGR of 6.8% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

The key players in the functional food ingredients market include Cargill, Incorporated (US), BASF SE (Germany), ADM (US), International Flavors & Fragrances Inc. (US), Arla Foods amba (Denmark), Kerry Group plc (Ireland), Ajinomoto Co., Inc. (Japan), DSM (Netherlands), Ingredion (US), Tate & Lyle (UK), and TEIJIN LIMITED (Japan).

The functional food ingredients market witnesses increased scope for growth. The market is seeing an increase in the number of joint ventures, acquisitions, and new expansions. Moreover, the companies involved in manufacturing functional food ingredients products are investing a considerable proportion of their revenues in research and development activities.

Which region is projected to account for the largest share of the functional food ingredients market?

The North American market is expected to dominate during the forecast period. North America's dominance in the functional food ingredients market stems from a robust consumer awareness regarding health and wellness that has driven demand for functional foods. Additionally, the region boasts advanced food technology and research infrastructure, facilitating innovation in ingredient development. Moreover, stringent regulations ensure quality and safety standards, enhancing consumer trust. Unlike other regions, North America's affluent population and dietary preferences favor premium functional ingredients, further solidifying its market leadership.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What are the factors driving the functional food ingredients market?

The demand for functional food ingredients is surging globally due to increasing health consciousness among consumers. These ingredients offer added health benefits beyond basic nutrition, addressing specific health concerns such as heart health, digestion, and immunity. With rising incidences of lifestyle diseases such as obesity and diabetes, consumers are seeking functional foods enriched with ingredients such as probiotics, omega-3 fatty acids, and prebiotics to improve overall well-being, thus driving market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

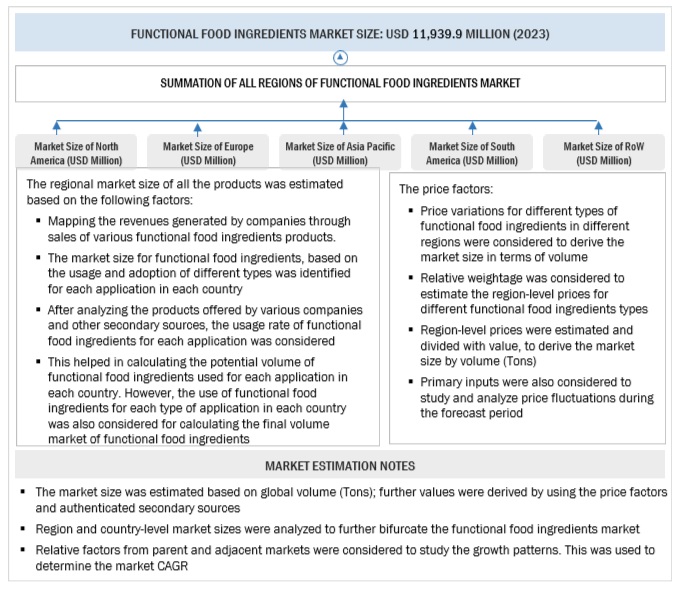

The study involved two major segments in estimating the current size of the functional food ingredients market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the functional food ingredients market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

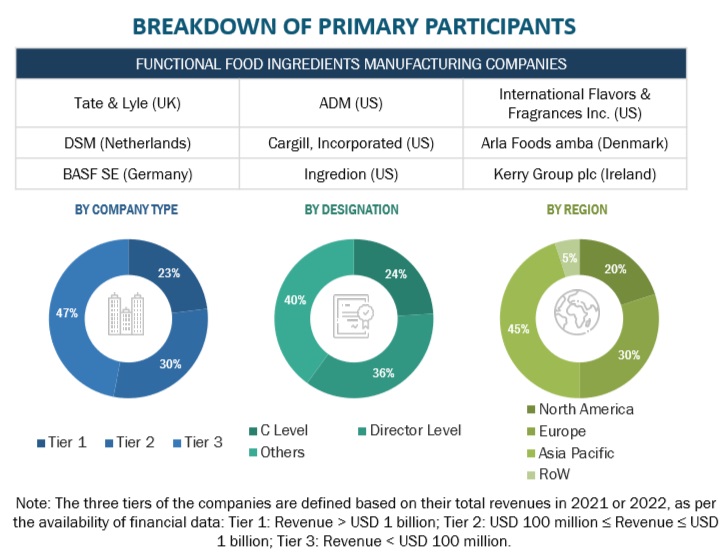

Extensive primary research was conducted after obtaining information regarding the functional food ingredients market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, research, and development teams, and related key executives from distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to functional food ingredients type, source, form, application, and region. Stakeholders from the demand side, such as prebiotics, probiotics, proteins & amino acids, fibers & specialty carbohydrates, vitamins, minerals, etc products manufacturers who avail the functional food ingredients services were interviewed to understand the buyer’s perspective on the suppliers, services, and their current usage of functional food ingredients and the outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

Designation |

|

Cargill, Incorporated (US) |

Territory Manager |

|

ADM (US) |

Sales Manager |

|

Tate & Lyle (UK) |

General Manager |

|

BASF SE (Germany) |

Head of logistics department |

|

Ingredion (US) |

Marketing Manager |

|

DSM (Netherlands) |

Sales Executive |

Market Size Estimation

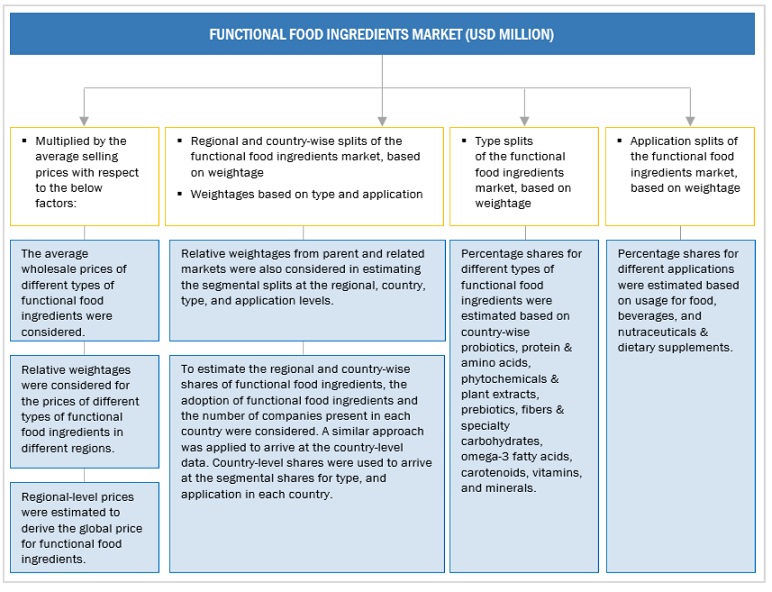

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the functional food ingredients market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Global Functional food ingredients Market: Bottom-Up Approach.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Functional Food Ingredients Market: Top-Down Approach.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to estimate the functional food ingredients market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying numerous factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Functional food ingredients are largely defined as those ingredients that have been demonstrated to have specific physiological benefits, apart from the main nutritional benefits that are derived from food and beverages. The use of functional food ingredients in the manufacturing of functional food & beverage products is expected to provide nutritive health benefits, prevent/resist chronic diseases, or act as energy boosters.

According to the British Nutrition Foundation, “Functional food ingredients deliver additional or enhanced benefits over and above their basic nutritional value. Some functional foods are generated around a particular functional ingredient, such as probiotics, prebiotics, or plant stanols and sterols. Other functional foods or drinks can be foods fortified with a nutrient that would not usually be present to any great extent (e.g., vitamin D in milk).”

Key Stakeholders

- Raw material suppliers

- Functional Food Ingredients manufacturers and suppliers

- Functional Food ingredient processors

- Food & beverage manufacturers/suppliers

- Commercial research & development (R&D) institutions and financial institutions

- Importers and exporters of functional food ingredient

- Food & beverage traders, distributors, and suppliers

-

Associations and government agencies:

- European Communities

- World Health Organization (WHO)

- OECD-FAO Agricultural Outlook

- Organizations such as the Food and Drug Administration (FDA)

- United States Department of Agriculture (USDA)

- European Food Safety Agency (EFSA)

- Ministry of Food and Drug Safety (MFDS)

- China Dood and Drug Administration (CFDA)

- Codex Alimentarius Commission

- Food Safety Australia and New Zealand (FSANZ)

Report Objectives

- Determining and projecting the size of the functional food ingredients market based on source, type, form, application, and region over a five-year period ranging from 2024 to 2029.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Service Analysis

- Service Matrix, which gives a detailed comparison of the service portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of the European market for functional food ingredients into Poland, the Netherlands, Belgium, Finland, Norway, Greece, Denmark, Switzerland, and Ireland.

- Further breakdown of the Rest of Asia Pacific market for functional food ingredients into New Zealand, Vietnam, Indonesia, Malaysia, Taiwan, and South Korea.

- Further breakdown of the Rest of South American market for functional food ingredients into Colombia, Peru, Chile, and Venezuela.

- Further breakdown of the Rest of the World into the Middle East (Saudi Arabia, UAE, and the Rest of the Middle East) and Africa (South Africa, Nigeria, and the Rest of Africa).

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Functional Food Ingredients Market