Health Ingredients Market by Type (Vitamins, Minerals, Probiotics starter culture, Prebiotics, Nutritional Lipids, Functional Carbohydrates, Plant and Fruit Extracts, Enzymes, Proteins), Application, Source, Function and Region - Global Forecast to 2027

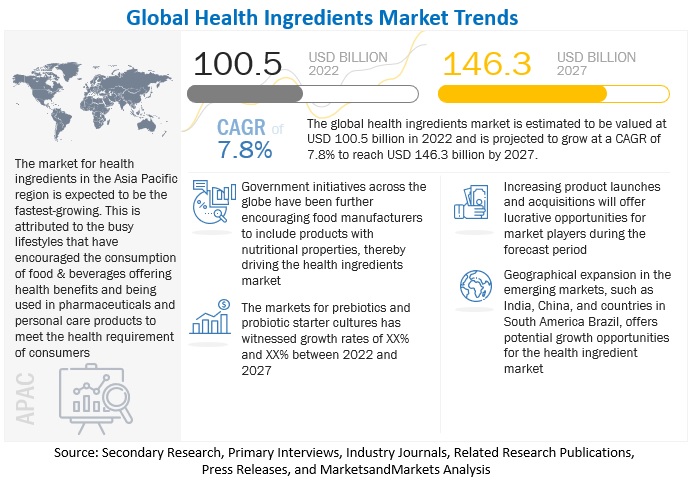

The health ingredients market size is predicted to grow at a CAGR of 7.8% between 2022 and 2027, reaching a value of $146.3 billion by 2027 from a projection of $100.5 billion in 2022. Food industry personalized nutrition trends and nutrigenomics have enabled the market to manufacture need-based products. These products offer functional purposes such as immune system support, digestion aid, mental health promotion, beauty, and cardiovascular health, among others.

To know about the assumptions considered for the study, Request for Free Sample Report

Health Ingredients Market Dynamics

Driver: Increasing instances of chronic diseases

Globally, the prevalence of chronic illnesses and conditions is increasing. These common and expensive long-term health issues are steadily on the rise due to the aging population and changes in societal behavior. Furthermore, the middle class is expanding, and people are adopting a more sedentary lifestyle as urbanization picks up speed. Consequently, more people are becoming obese and developing diseases such as diabetes. Since developing countries are expected to see the greatest population expansion, emerging markets will be the hardest hit.

According to the CDC's National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP) 2022, 6 in 10 adults in the US have a chronic disease. According to an article titled Commentary on Chronic Disease Prevention 2022 published by the National Association of Chronic Disease Directors, nearly 60% of American adults suffer from at least one chronic disease. The major causes of death in the US include chronic diseases like diabetes, cancer, and cardiovascular disease. Heart disease, cancer, stroke, chronic obstructive pulmonary disease, and diabetes together account for more than two-thirds of all deaths.

Restraint: Pricing complexities related to newly introduced health ingredients

The development and commercialization of health ingredients are complicated, costly, and uncertain. Technological conditions, market demand, and legislative regulatory framework are all factors that influence product development success of the health ingredients market. Significant investment is required for the research and development of a strain that will be utilised to produce new ingredients such as probiotics.

Probiotic strains and products are developed and manufactured in accordance with international food regulations. In addition, highly sterilised and technically advanced equipment and processes are required for the manufacturing and extraction of numerous other ingredients. The final product's price is high due to the high cost of production. Marketing and distribution raise the price of the product. Although customers are aware of the health benefits of these costly ingredients, their high pricing restricts them from purchasing the product, posing a challenge for manufacturers.

Opportunity: Shift towards plant-based health ingredients

The market for plant protein ingredients is expanding rapidly, as consumers shift away from animal proteins and toward plant-based proteins. This is quite likely to drive customers toward plant-based herbal supplements and botanicals, generating even more opportunities for the herbal supplements market to grow: Consumer preference for plant extracts is being influenced by a desire for clean-label products, concerns about sustainability, and an urgent need to avoid allergens. The population of these herbal supplements is expanding from vegans to flexitarians, showing shifting customer preferences, which will create opportunities in the health ingredients market.

Challenge: Adherence to stringent international quality standards and regulations

The health ingredients industry faces a legal obligation to abide by the norms and standards of various regulatory standards. International bodies such as the National Food Safety and Quality Service (SENASA), Argentina; Canadian Food Inspection Agency (CFIA), Canada; Food and Drug Administration (FDA); World Health Organization (WHO); and Committee on the Environment; Public Health and Food Safety (EU) are associated with food safety and quality regulations. These organizations control the use of different chemicals, raw materials, and ingredients used in food processing directly or indirectly.

There are different food labeling and packaging guidelines followed by different regional food safety authorities and regulatory bodies. Manufacturers need to adhere to these varied and stringent regional legislations for the manufacturing and packaging of food materials and ingredients. These numerous legislations and regulations make it challenging for new entrants to enter the health ingredients market as the R&D investment is high, and profitability margins are low.

The Probiotics starter culture is projected to achieve the highest CAGR in terms of value

Probiotics, when consumed in sufficient quantities, have desirable effects on the body, such as improved gut health and reduced intestinal inflammation. Probiotics play an important role in preventive healthcare since they strengthen the immune system and so help to prevent disease. According to a survey of 3,000 consumers conducted in May 2020 by DuPont Nutrition & Biosciences (Wilmington, DE), in collaboration with the Natural Marketing Institute, the use of probiotics among consumers in the US, Italy, and China surged during the pandemic. The results show that the number of Americans who use probiotics increased by 66%, accounting for 25% of all supplement users (up from 15% six months earlier).

Among these, Americans who used probiotics daily or more frequently accounted for 61% (up from 37%). Probiotic supplement use among Italian consumers increased by 188%, estimating 26% of all supplement users (up from 9%), while weekly compliance increased by 83%. Probiotic use among Chinese consumers increased by 108%, amounting to 48% of all supplement users (up from 23%). In the long term, consumers surveyed in the US and Italy stated they expect to take probiotics more frequently in the following six months compared to the six months before the pandemic.

Plant-based foods, by source is estimated to achieve the highest market share in health ingredients market during the forecast period

Plant-based diets are becoming more popular as a result of a variety of factors, including vegan culture, increased health awareness, and concerns about animal welfare. These factors have contributed to the expansion of the market for plant-based food ingredients. According to Good Food Institute 2021 report, For the past three years, plant-based foods have exceeded total foods in both dollar and unit sales growth. Over the last three years, overall plant-based food sales increased by 54 percent, while total food sales increased by only 2 percent. Plant-based food unit sales increased by 6% over the last three years, while total food unit sales remained unchanged, indicating that plant-based foods are a primary driver of retail growth of the health ingredients market.

The Food segment, by application, is estimated to achieve the highest market share during the forecast period

Health ingredients are food ingredients that are combined with food products during manufacture to provide relatively healthier food products that increase consumer functionality. The ingredients in food can also be customized based on the nutritional needs of different consumers who work out every day and have differing needs for proteins, carbohydrates, and other vitamins. With the increasing preference for palatable and convenient food that is also healthy, manufacturers of bakery products are using various ingredients in their products. For instance, in the Asia Pacific region, George Western Foods (Australia), a subsidiary of Associated British Foods (UK) widely, uses omega-3 fatty acids in bakery products under its Tip Top brand.

To know about the assumptions considered for the study, download the pdf brochure

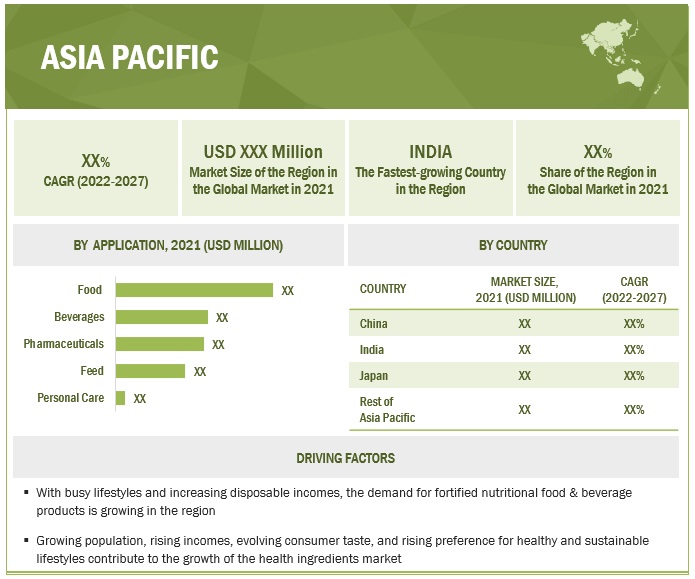

APAC is projected to account for the highest CAGR in health ingredients market during the forecast period

Asia-Pacific region is one of the world's largest markets for health ingredients, owing to the region's rapid urbanisation, which has resulted in a majority of the population suffering from vitamin and mineral insufficiency, providing an opportunity for major manufacturers of dietary supplements and functional foods and beverages to expand their footprints and strengthen their position as regional market leaders. Increasing incidences of chronic illnesses such as diabetes, cardiovascular diseases, osteoporosis, and arthritis were reported in the Asia Pacific region.

According to Indian statistics data for 2020, obesity rates have increased by 20%, and cardiovascular diseases (CVDs) are responsible for 40% of deaths in the country. India is projected to become the diabetes capital of the world by 2030, with 67 million diabetic patients and 30 million in pre-diabetic conditions. These factors are projected to drive the demand for health ingredients products in India. Major players such as Amway, Dabur, Novartis, and Aventis Pharma focus on providing various products to fulfill the consumer demand for dietary supplements.

Top Companies in the health ingredients market

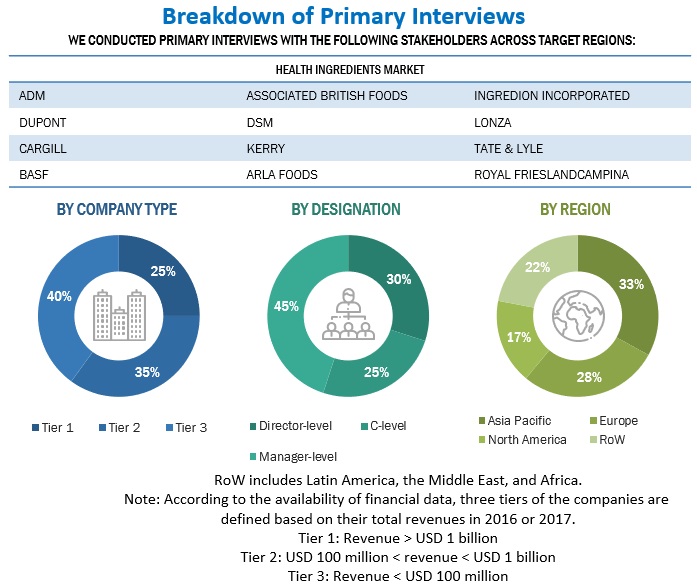

The key players in this market include Archer Daniels Midland Company (ADM) (US), Associated British Foods PLC (UK), International Flavors & Fragrances Inc. (US), Kerry Group PLC (Ireland), DSM (Netherlands), BASF SE (Germany), Cargill Incorporated (US), Ingredion (US), Arla Foods (Denmark), Tate & Lyle (UK), Lonza (Switzerland), Royal FrieslandCampina N.V. (Netherlands), Glanbia PLC (Ireland), CHR Hansen Holdings A/S, (Denmark), and Probi (Sweden).

Strategic partnerships were the dominant strategy adopted by the key players, followed by expansions and new product launches. These strategies have helped them to increase their presence in different regions and industrial segments. These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the Health Ingredients Market Report

|

Report Metric |

Details |

|

Market valuation in 2022 |

USD 100.5 billion |

|

Revenue forecast in 2027 |

USD 146.3 billion |

|

Progress rate |

CAGR of 7.8% from 2022 - 2027 |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Driving factors of the health ingredients market |

Increasing instances of chronic diseases across the globe |

|

Opportunities |

Growing shift towards plant-based health ingredients |

|

Largest growing region |

Asia Pacific |

|

Companies studied |

|

Health Ingredients Market Report Segmentation

The study categorizes the market based type, application, source, function and region

|

Aspect |

Details |

|

By Type |

|

|

By Application |

|

|

Health Ingredients Market By Source |

|

|

By Function |

|

|

By Region |

|

Recent Developments in the Health Ingredients Market

- In August 2022, ADM announced a partnership with Benson Hill, a food technology company, to scale innovative soy ingredients to meet the demand for plant-based proteins. This partnership will serve a variety of plant-based food & beverage markets. Through an exclusive North American licensing partnership, ADM will process and commercialize a portfolio of proprietary ingredients derived from Benson Hill Ultra-High Protein (UHP) soybeans. This partnership will expand the brand's product portfolio.

- In July 2022, BASF SE announced the expansion of vitamin A formulation capacities at its Verbund site in Ludwigshafen. Increasing capacities for vitamin A powder in line with higher vitamin A acetate production capacity. This expansion would increase the company revenue and market share for vitamin A in animal nutrition.

- In Feb 2022, International Flavors & Fragrances Inc. announced that it has agreed to acquire Health Wright Products, LLC, which manufactures custom formulations and delivers encapsulation and packaging for probiotic products. This strategic acquisition will bring the ability to formulate capabilities to IFF's Health & Biosciences probiotics, natural extracts, and botanicals businesses.

- In November 2021, Kerry announced the launch of naturally sourced, soluble dietary fiber, Emulgold Fibre, for the white bread manufacturing market. It is made of a natural resin from the acacia tree and delivers a high concentration of soluble dietary fiber (minimum of 85%). This product would expand the company's product portfolio.

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the health ingredients market, and how intense is the competition?

The key players in this market include Archer Daniels Midland Company (ADM) (US), Associated British Foods PLC (UK), International Flavors & Fragrances Inc. (US), Kerry Group PLC (Ireland), DSM (Netherlands), BASF SE (Germany), Cargill Incorporated (US), Ingredion (US), Arla Foods (Denmark), Tate & Lyle (UK), Lonza (Switzerland), Royal FrieslandCampina N.V. (Netherlands), Glanbia PLC (Ireland), CHR Hansen Holdings A/S, (Denmark), and Probi (Sweden). Strategic partnerships were the dominant strategy adopted by the key players, followed by expansions and new product launches. These strategies have helped them to increase their presence in different regions and industrial segments. These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

What are the potential challenges to the health ingredients market?

The health ingredients industry faces a legal obligation to abide by the norms and standards of various regulatory standards. International bodies such as the National Food Safety and Quality Service (SENASA), Argentina; Canadian Food Inspection Agency (CFIA), Canada; Food and Drug Administration (FDA); World Health Organization (WHO); and Committee on the Environment; Public Health and Food Safety (EU) are associated with food safety and quality regulations. These organizations have control over the usage of different chemicals, raw materials, and ingredients used in food processing directly or indirectly. There are different food labeling and packaging guidelines followed by different regional food safety authorities and regulatory bodies. Manufacturers need to adhere to these varied and stringent regional legislations for manufacturing and packaging food materials and ingredients. These numerous legislations and regulations make it challenging for new entrants to enter the health ingredients market as the R&D investment is high, and profitability margins are low.

What are the key market trends in the health ingredients market?

The increase in the number of health-conscious individuals around the world, as well as the rise in the incidence of immune deficiency, has driven the expansion of the health ingredients market.

What are the key development strategies undertaken by companies in the health ingredients market?

Strategies such as new product launches, investments into expansion and development, and research initiatives are the key strategies being used by large players in order to achieve differential positioning in the global market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSHIGH PREVALENCE OF OBESITY- Increasing aging population

-

5.3 MARKET DYNAMICSDRIVERS- Shift in consumer preference from nutrition-based to health-specific food- Increasing instances of chronic disease- Rising demand for fortified food & beverage products- R&D and expansion of production capacity to enhance applicability and accelerate growthRESTRAINTS- Pricing complexities related to newly introduced health ingredients- Rising instances of allergies and intolerances related to soy ingredientsOPPORTUNITIES- Shift toward plant-based health ingredients- Consumer awareness of micronutrient deficienciesCHALLENGES- Complexities related to integration and adulteration issues in health ingredients for functional food products- Adherence to stringent international quality standards and regulations

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISSOURCING OF RAW MATERIALSMANUFACTURINGDISTRIBUTION, MARKETING, AND SALES

-

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

-

6.4 TECHNOLOGY ANALYSISFOOD MICROENCAPSULATION- Encapsulation of omega-3 to mask odorINNOVATIVE AND DISRUPTIVE TECH- Robotics as key technological trend leading to innovations- 3D printing to uplift future of market with high-end products

- 6.5 PRICING ANALYSIS

-

6.6 PATENT ANALYSIS

-

6.7 MARKET MAPUPSTREAM- Ingredient manufacturers- Technology providers- Startups/Emerging companiesDOWNSTREAM- Regulatory bodies- End users

- 6.8 TRADE SCENARIO

- 6.9 KEY CONFERENCES & EVENTS IN 2022-2023

-

6.10 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORK- Organizations/Regulations governing health ingredients market- North America- European Union (EU)- Asia Pacific- Rest of the World (RoW)- Probiotics- Prebiotics

-

6.11 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.12 CASE STUDY ANALYSISMETHODOLOGY FOR QUICK, PRECISE MEASUREMENT OF KEY HEALTH INGREDIENTSFRUNUTTA STARTED OFFERING EASY-TO-USE AND EFFICIENT-TO-TAKE VITAMIN AND MINERAL PILLS THAT DISSOLVE INSTANTLYMINDRIGHT’S BARS HELPED COMBAT MENTAL HEALTH ISSUES

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.14 RECESSION IMPACT ON HEALTH INGREDIENTS MARKETMACRO INDICATORS OF RECESSION- Inflation- GDP growth- Domestic demand- Unemployment- Supply chain disruption

- 7.1 INTRODUCTION

-

7.2 PROTEINSRISING DEMAND FOR NUTRIENT-RICH PRODUCTS TO DRIVE GROWTH

-

7.3 VITAMINSAWARENESS, WIDE ACCEPTANCE, AND EASY AVAILABILITY TO DRIVE MARKET DEMANDVITAMIN AVITAMIN B COMPLEXVITAMIN CVITAMIN DVITAMIN EOTHERS (VITAMIN K AND VITAMIN H)

-

7.4 MINERALSENABLES INCREASED BONE DENSITY, IMPROVED BLOOD COAGULATION, AND ENHANCED FOOD ENERGY CONVERSIONMACRO MINERALSMICRO MINERALS

-

7.5 PREBIOTICSINCREASED CONCERNS ABOUT HEALTH ISSUES TO DRIVE EXPANSION OF PREBIOTICS MARKETOLIGOSACCHARIDESINULINPOLYDEXTROSEOTHERS (LACTITOL, LACTULOSE, LACTOSUCROSE, AND XYLOOLIGOSACCHARIDES)

-

7.6 NUTRITIONAL LIPIDSDEMAND EXPECTED TO RISE AS PEOPLE INCREASINGLY USE OMEGA-3 INGREDIENTS TO ENHANCE HEART AND BRAIN HEALTH

-

7.7 PROBIOTIC STARTER CULTURESHIGH DEMAND FOR SCIENTIFICALLY PROVEN HEALTH FOODS TO OFFER REVENUE GROWTH OPPORTUNITIES

-

7.8 FUNCTIONAL CARBOHYDRATESPREFERENCE FOR FEWER CARBOHYDRATE FOODS TO DRIVE DEMAND

-

7.9 PLANT & FRUIT EXTRACTSNATURAL PLANT EXTRACTS TO GAIN IMMENSE POPULARITYFLAVONOIDSPOLYPHENOLSSTEROLSCAROTENOIDSOTHERS (INCLUDING ANTHOCYANIDINS, CATECHINS, ISOFLAVONES, ISOTHIOCYANATES, AND PHENOLIC COMPOUNDS)

-

7.10 ENZYMESINCREASING DEMAND FOR INDUSTRIAL AND SPECIALTY ENZYMES TO DRIVE MARKET GROWTHPROTEASESAMYLASESCELLULASESOTHERS (LACTASE, PECTINASE, LIPASE)

- 8.1 INTRODUCTION

-

8.2 PLANT-BASEDCHANGING CONSUMER PREFERENCES TO DRIVE MARKET FOR PLANT-BASED HEALTH INGREDIENTS

-

8.3 ANIMAL-BASEDCONSUMPTION OF ANIMAL-BASED INGREDIENTS DRIVEN BY BETTER NUTRITIONAL AND FLAVOR PROFILE

-

8.4 MICROBIAL-BASEDGROWTH IN PROBIOTICS AND CAROTENOIDS IN FUNCTIONAL FOODS TO FUEL GROWTH

-

8.5 OTHERS (SYNTHETIC)RISING CONCERNS ABOUT GUT HEALTH TO DRIVE DEMAND FOR BIOTECHNOLOGICALLY PRODUCED PREBIOTICS AND PROBIOTICS

- 9.1 INTRODUCTION

-

9.2 FOODBAKERY- Proteins, vitamins, and fatty acids widely used to improve quality of bakery productsCONFECTIONERY- Hectic consumer lifestyles to fuel production of various confectionery productsSNACKS & MEAL REPLACERS- Consumers increasingly inclined toward snacks with protein-rich ingredientsDAIRY PRODUCTS- Demand for new and improved functional dairy products to rise owing to understanding of health advantages offeredMEAT & POULTRY PRODUCTS- Meat & poultry to have high demand due to their protein-rich characteristicsDIETARY SUPPLEMENTS- Dietary supplements to enable consumers meet their nutritional needsOTHERS

-

9.3 BEVERAGESDAIRY BEVERAGES- Source of high-quality proteins, calcium, potassium, and other nutrientsSPORTS & NUTRITIONAL DRINKS- Consumers becoming more aware of importance of optimal nutrition and healthy lifestylesJUICES- Demand for juices witnessing surge due to functional benefits and growing health concerns among consumers

-

9.4 PHARMACEUTICALSIMPROVED HEART HEALTH AND WEIGHT MANAGEMENT TO SUPPORT DEMAND

-

9.5 FEEDENHANCED DIGESTION AND NUTRIENT SUPPLY TO DRIVE DEMAND FOR HEALTH INGREDIENTS IN FEED

-

9.6 PERSONAL CAREGROWING CONSUMER INTEREST IN HEALTH AND GROOMING TO FUEL DEMAND

- 10.1 INTRODUCTION

- 10.2 WEIGHT MANAGEMENT

- 10.3 IMMUNITY ENHANCEMENT

- 10.4 GUT HEALTH MANAGEMENT

- 10.5 JOINT HEALTH MANAGEMENT

- 10.6 HEART/CARDIOVASCULAR HEALTH MANAGEMENT

- 10.7 EYE HEALTH MANAGEMENT

- 10.8 BRAIN HEALTH MANAGEMENT

- 10.9 OTHERS (STRESS MANAGEMENT AND BEAUTY MANAGEMENT)

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSIS- Indicators impacting North American health ingredients marketUS- Health ingredients to provide immense growth opportunities in USCANADA- Strong support for R&D by government to contribute to market growthMEXICO- Growing health and wellness trend to drive market for health ingredients

-

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSIS- Indicators impacting European health ingredients marketGERMANY- Multiple applications of health ingredients in food & beverages and personal care products to fuel marketFRANCE- Increased health awareness among consumers and strategic government initiatives to lead to market growthUK- Growing food & beverage industry leading to demand for large number of health ingredients to be used in food productsSPAIN- Functional food & beverage products to fuel consumption of health ingredientsITALY- Rising aging population and high prevalence of vitamin D deficiency to drive demand for health ingredientsREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSIS- Indicators impacting Asia Pacific Health ingredients marketCHINA- Changing lifestyles of consumers and preference for fortified products to augment market growthINDIA- Rising hospitalization cost to drive consumer demand for supplements and other nutrientsJAPAN- Government’s support and Japan’s health-conscious population to contribute to growthREST OF ASIA PACIFIC

-

11.5 REST OF THE WORLD (ROW)REST OF THE WORLD: RECESSION IMPACT ANALYSIS- Indicators impacting Rest of the World health ingredients marketSOUTH AMERICA- Rising health consciousness among consumers and growing urbanization to be most important drivers- South America: Recession impact analysis- Indicators impacting the South American health ingredients marketMIDDLE EAST- Increased investments in food and pharma sectors to boost market growthAFRICA- Economic development and increase in health-conscious consumers to be driving factors

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2021

- 12.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

-

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.6 HEALTH INGREDIENTS MARKET: EVALUATION QUADRANT FOR STARTUPS/SMES, 2021PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

- 13.1 INTRODUCTION

-

13.2 KEY COMPANIESADM- Business overview- Products offered- Recent developments- MNM viewASSOCIATED BRITISH FOODS PLC- Business overview- Products offered- Recent developments- MNM viewINTERNATIONAL FLAVORS & FRAGRANCES INC.- Business overview- Products offered- Recent developments- MNM viewKERRY GROUP PLC- Business overview- Products offered- Recent developments- MNM viewDSM- Business overview- Products offered- Recent developments- MNM viewBASF SE- Business overview- Products offered- Recent developments- MNM viewCARGILL INCORPORATED- Business overview- Products offered- Recent developments- MNM viewINGREDION- Business overview- Products offered- Recent developments- MNM viewARLA FOODS- Business overview- Products offered- Recent developments- MNM viewTATE & LYLE- Business overview- Products offered- Recent developments- MNM viewLONZA- Business overview- Products offered- Recent developments- MNM viewROYAL FRIESLANDCAMPINA N.V.- Business overview- Products offered- Recent developments- MNM viewGLANBIA PLC- Business overview- Products offered- Recent developments- MNM viewCHR HANSEN HOLDING A/S- Business overview- Products offered- Recent developments- MNM viewPROBI- Business overview- Products offered- Recent developments- MNM view

-

13.3 OTHER PLAYERSFONTERRA CO-OPERATIVE GROUP LIMITED- Business overview- Products offered- Recent developments- MNM viewBALCHEM INC.- Business Overview- Products offered- Recent developments- MNM viewMARTIN BAUER- Business overview- Products offered- Recent developments- MNM viewROQUETTE FRÈRES- Business overview- Products offered- Recent developments- MNM viewDIVI’S LABORATORIES- Business overview- Products offered- Recent developments- MNM viewNUTRACEUTICALS GROUPCONAGEN, INC.NEXIRABENEO GMBHSYDLER INDIA PVT. LTD.

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 NUTRACEUTICAL INGREDIENTS MARKETMARKET DEFINITIONMARKET OVERVIEWNUTRACEUTICAL INGREDIENTS MARKET, BY TYPE- IntroductionNUTRACEUTICAL INGREDIENTS MARKET, BY REGION- Introduction

-

14.4 DIETARY SUPPLEMENTS MARKETMARKET DEFINITIONMARKET OVERVIEWDIETARY SUPPLEMENTS MARKET, BY TYPE- IntroductionDIETARY SUPPLEMENTS MARKET, BY REGION- Introduction

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

- TABLE 2 FOODS TO BOOST IMMUNE SYSTEM

- TABLE 3 MICRONUTRIENTS DEFICIENCY CONDITIONS AND THEIR WORLDWIDE PREVALENCE

- TABLE 4 KEY PATENTS PERTAINING TO HEALTH INGREDIENTS MARKET, 2021

- TABLE 5 HEALTH INGREDIENTS MARKET: ECOSYSTEM

- TABLE 6 IMPORT DATA OF VITAMINS FOR KEY COUNTRIES, 2021 (VALUE)

- TABLE 7 EXPORT DATA OF VITAMINS FOR KEY COUNTRIES, 2021 (VALUE)

- TABLE 8 IMPORT DATA OF AMINO ACIDS FOR KEY COUNTRIES, 2021 (VALUE)

- TABLE 9 EXPORT DATA OF AMINO ACIDS FOR KEY COUNTRIES, 2021 (VALUE)

- TABLE 10 HEALTH INGREDIENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 DEFINITIONS & REGULATIONS FOR HEALTH INGREDIENTS WORLDWIDE

- TABLE 17 DEFINITIONS & REGULATIONS FOR HEALTH INGREDIENTS WORLDWIDE

- TABLE 18 SCHEDULE – XI OF FOOD SAFETY AND STANDARDS REGULATIONS, 2015, FOR LIST OF APPROVED PREBIOTIC INGREDIENTS

- TABLE 19 LIST OF ACCEPTED DIETARY FIBERS BY CANADIAN REGULATORY AUTHORITIES & THEIR SOURCES

- TABLE 20 HEALTH INGREDIENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TYPES (%)

- TABLE 22 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 23 HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 24 HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 25 PROTEINS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 26 PROTEINS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 VITAMINS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 28 VITAMINS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 VITAMINS: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 30 VITAMINS: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 31 VITAMIN A CONTENT OF SELECTED FOODS

- TABLE 32 VITAMIN A: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 33 VITAMIN A: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 34 DAILY RECOMMENDATIONS FOR VITAMIN B-COMPLEX SUPPLEMENTS

- TABLE 35 VITAMIN B COMPLEX: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 36 VITAMIN B COMPLEX: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 VITAMIN C: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 38 VITAMIN C: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 VITAMIN D: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 40 VITAMIN D: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 41 VITAMIN E: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 42 VITAMIN E: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 OTHER VITAMINS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 44 OTHER VITAMINS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 MINERALS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 46 MINERALS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 MINERALS: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 48 MINERALS: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 49 MACRO MINERALS AND THEIR FUNCTIONS

- TABLE 50 MACRO MINERALS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 51 MACRO MINERALS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 52 MICRO MINERALS & THEIR FUNCTIONS

- TABLE 53 MICRO MINERALS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 54 MICRO MINERALS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 PREBIOTICS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 56 PREBIOTICS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 57 PREBIOTICS: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 58 PREBIOTICS: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 59 OLIGOSACCHARIDES: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 60 OLIGOSACCHARIDES: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 61 INULIN: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 62 INULIN: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 63 POLYDEXTROSE: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 64 POLYDEXTROSE: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 65 OTHER PREBIOTICS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 66 OTHER PREBIOTICS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 NUTRITIONAL LIPIDS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 68 NUTRITIONAL LIPIDS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 69 PROBIOTIC STARTER CULTURES: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 70 PROBIOTIC STARTER CULTURES: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 71 FUNCTIONAL CARBOHYDRATES: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 72 FUNCTIONAL CARBOHYDRATES: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 73 PLANT & FRUIT EXTRACTS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 74 PLANT & FRUIT EXTRACTS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 75 PLANT & FRUIT EXTRACTS: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 76 PLANT & FRUIT EXTRACTS: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 77 FLAVONOIDS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 78 FLAVONOIDS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 79 COMMON SOURCES OF DIETARY POLYPHENOLS

- TABLE 80 POLYPHENOLS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 81 POLYPHENOLS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 82 STEROLS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 83 STEROLS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 84 SOURCES OF CAROTENOIDS IN FRUITS & VEGETABLES AND THEIR MEDICINAL PROPERTIES

- TABLE 85 CAROTENOIDS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 86 CAROTENOIDS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 87 OTHER PLANT & FRUIT EXTRACTS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 88 OTHER PLANT & FRUIT EXTRACTS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 89 ENZYMES: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 90 ENZYMES: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 91 ENZYMES: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 92 ENZYMES: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 93 IMPORTANT PROTEASE ENZYMES AND THEIR FUNCTIONS

- TABLE 94 PROTEASES: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 95 PROTEASES: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 96 AMYLASES: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 97 AMYLASES: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 98 CELLULASES: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 99 CELLULASES: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 100 OTHER ENZYMES: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 101 OTHER ENZYMES: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 102 HEALTH INGREDIENTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 103 HEALTH INGREDIENTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 104 PLANT-BASED HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 105 PLANT-BASED HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 106 ANIMAL-BASED HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 107 ANIMAL-BASED HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 108 MICROBIAL-BASED HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 109 MICROBIAL-BASED HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 110 OTHERS (SYNTHETIC): HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 111 OTHERS (SYNTHETIC): HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 112 HEALTH INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 113 HEALTH INGREDIENTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 114 FOOD: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 115 FOOD: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 116 BEVERAGES: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 117 BEVERAGES: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 118 PHARMACEUTICALS: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 119 PHARMACEUTICALS: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 120 FEED: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 121 FEED: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 122 PERSONAL CARE: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 123 PERSONAL CARE: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 124 BONE-BUILDING NUTRIENTS & THEIR THERAPEUTIC RANGE

- TABLE 125 HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 126 HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 127 NORTH AMERICA: HEALTH INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 128 NORTH AMERICA: HEALTH INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 129 NORTH AMERICA: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 130 NORTH AMERICA: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 131 NORTH AMERICA: HEALTH INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 132 NORTH AMERICA: HEALTH INGREDIENTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 133 NORTH AMERICA: HEALTH INGREDIENTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 134 NORTH AMERICA: HEALTH INGREDIENTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 135 US: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 136 US: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 137 ESTIMATED PREVALENCE AND COST OF DIABETES

- TABLE 138 CANADA: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 139 CANADA: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 140 MEXICO: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 141 MEXICO: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 142 EUROPE: HEALTH INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 143 EUROPE: HEALTH INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 144 EUROPE: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 145 EUROPE: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 146 EUROPE: HEALTH INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 147 EUROPE: HEALTH INGREDIENTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 148 EUROPE: HEALTH INGREDIENTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 149 EUROPE: HEALTH INGREDIENTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 150 GERMANY: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 151 GERMANY: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 152 FRANCE: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 153 FRANCE: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 154 UK: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 155 UK: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 156 SPAIN: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 157 SPAIN: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 158 ITALY: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 159 ITALY: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 160 REST OF EUROPE: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 161 REST OF EUROPE: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 162 ASIA PACIFIC: HEALTH INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 163 ASIA PACIFIC: HEALTH INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 164 ASIA PACIFIC: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 165 ASIA PACIFIC: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 166 ASIA PACIFIC: HEALTH INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 167 ASIA PACIFIC: HEALTH INGREDIENTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 168 ASIA PACIFIC: HEALTH INGREDIENTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 169 ASIA PACIFIC: HEALTH INGREDIENTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 170 CHINA: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 171 CHINA: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 172 INDIA: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 173 INDIA: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 174 JAPAN: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 175 JAPAN: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 178 ROW: HEALTH INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 179 ROW: HEALTH INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 180 ROW: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 181 ROW: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 182 ROW: HEALTH INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 183 ROW: HEALTH INGREDIENTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 184 ROW: HEALTH INGREDIENTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 185 ROW: HEALTH INGREDIENTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 186 SOUTH AMERICA: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 187 SOUTH AMERICA: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 188 MIDDLE EAST: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 189 MIDDLE EAST: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 190 AFRICA: HEALTH INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 191 AFRICA: HEALTH INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 192 HEALTH INGREDIENTS MARKET: DEGREE OF COMPETITION

- TABLE 193 COMPANY FOOTPRINT, BY TYPE

- TABLE 194 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 195 COMPANY FOOTPRINT, BY REGION

- TABLE 196 OVERALL COMPANY FOOTPRINT

- TABLE 197 HEALTH INGREDIENTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 198 HEALTH INGREDIENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- TABLE 199 HEALTH INGREDIENTS MARKET: PRODUCT LAUNCHES, 2020–2021

- TABLE 200 HEALTH INGREDIENTS MARKET: DEALS, 2018–2022

- TABLE 201 HEALTH INGREDIENTS MARKET: OTHERS, 2018-2022

- TABLE 202 ADM: BUSINESS OVERVIEW

- TABLE 203 ADM: PRODUCTS OFFERED

- TABLE 204 ADM: PRODUCT LAUNCH

- TABLE 205 ADM: DEALS

- TABLE 206 ADM: OTHERS

- TABLE 207 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

- TABLE 208 ASSOCIATED BRITISH FOODS PLC: PRODUCTS OFFERED

- TABLE 209 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- TABLE 210 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS OFFERED

- TABLE 211 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCT LAUNCH

- TABLE 212 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- TABLE 213 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

- TABLE 214 KERRY GROUP PLC: BUSINESS OVERVIEW

- TABLE 215 KERRY GROUP PLC: PRODUCTS OFFERED

- TABLE 216 KERRY GROUP PLC: PRODUCT LAUNCH

- TABLE 217 KERRY GROUP PLC: DEALS

- TABLE 218 KERRY GROUP PLC: OTHERS

- TABLE 219 DSM: BUSINESS OVERVIEW

- TABLE 220 DSM: PRODUCTS OFFERED

- TABLE 221 DSM: DEALS

- TABLE 222 BASF SE: BUSINESS OVERVIEW

- TABLE 223 BASF SE: PRODUCTS OFFERED

- TABLE 224 BASF SE: OTHERS

- TABLE 225 CARGILL INCORPORATED: BUSINESS OVERVIEW

- TABLE 226 CARGILL INCORPORATED: PRODUCTS OFFERED

- TABLE 227 CARGILL INCORPORATED: PRODUCT LAUNCH

- TABLE 228 CARGILL INCORPORATED: DEALS

- TABLE 229 CARGILL INCORPORATED: OTHERS

- TABLE 230 INGREDION: BUSINESS OVERVIEW

- TABLE 231 INGREDION: PRODUCT OFFERINGS

- TABLE 232 INGREDION: PRODUCT LAUNCH

- TABLE 233 INGREDION: DEALS

- TABLE 234 INGREDION: OTHERS

- TABLE 235 ARLA FOODS: BUSINESS OVERVIEW

- TABLE 236 ARLA FOODS: PRODUCTS OFFERED

- TABLE 237 TATE & LYLE: BUSINESS OVERVIEW

- TABLE 238 TATE & LYLE: PRODUCTS OFFERED

- TABLE 239 TATE & LYLE: PRODUCT LAUNCH

- TABLE 240 TATE & LYLE: DEALS

- TABLE 241 TATE & LYLE: OTHERS

- TABLE 242 LONZA: BUSINESS OVERVIEW

- TABLE 243 LONZA: PRODUCTS OFFERED

- TABLE 244 LONZA: PRODUCT LAUNCH

- TABLE 245 ROYAL FRIESLANDCAMPINA N.V.: BUSINESS OVERVIEW

- TABLE 246 ROYAL FRIESLANDCAMPINA N.V.: PRODUCTS OFFERED

- TABLE 247 GLANBIA PLC: BUSINESS OVERVIEW

- TABLE 248 GLANBIA PLC: PRODUCTS OFFERED

- TABLE 249 GLANBIA PLC: PRODUCT LAUNCH

- TABLE 250 GLANBIA PLC: DEALS

- TABLE 251 GLANBIA PLC: OTHERS

- TABLE 252 CHR HANSEN HOLDING A/S: BUSINESS OVERVIEW

- TABLE 253 CHR HANSEN HOLDING A/S: PRODUCTS OFFERED

- TABLE 254 CHR HANSEN HOLDING A/S: PRODUCT LAUNCH

- TABLE 255 CHR HANSEN HOLDING A/S: DEALS

- TABLE 256 CHR HANSEN HOLDING A/S: OTHERS

- TABLE 257 PROBI: BUSINESS OVERVIEW

- TABLE 258 PROBI: PRODUCTS OFFERED

- TABLE 259 PROBI: PRODUCT LAUNCH

- TABLE 260 PROBI: DEALS

- TABLE 261 FONTERRA CO-OPERATIVE GROUP LIMITED: BUSINESS OVERVIEW

- TABLE 262 FONTERRA CO-OPERATIVE GROUP LIMITED: PRODUCTS OFFERED

- TABLE 263 FONTERRA CO-OPERATIVE GROUP LIMITED: DEALS

- TABLE 264 BALCHEM INC.: BUSINESS OVERVIEW

- TABLE 265 BALCHEM INC.: PRODUCTS OFFERED

- TABLE 266 BALCHEM INC.: DEALS

- TABLE 267 MARTIN BAUER: BUSINESS OVERVIEW

- TABLE 268 MARTIN BAUER: PRODUCT OFFERINGS

- TABLE 269 MARTIN BAUER: DEALS

- TABLE 270 MARTIN BAUER: OTHERS

- TABLE 271 ROQUETTE FRÈRES: BUSINESS OVERVIEW

- TABLE 272 ROQUETTE FRÈRES: PRODUCTS OFFERED

- TABLE 273 ROQUETTE FRÈRES: OTHERS

- TABLE 274 DIVI’S LABORATORIES: BUSINESS OVERVIEW

- TABLE 275 DIVI’S LABORATORIES: PRODUCT OFFERINGS

- TABLE 276 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 277 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 278 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 279 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 280 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 281 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 282 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 283 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 284 DIETARY SUPPLEMENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 285 DIETARY SUPPLEMENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 HEALTH INGREDIENTS MARKET SEGMENTATION

- FIGURE 2 HEALTH INGREDIENTS MARKET, BY REGION

- FIGURE 3 HEALTH INGREDIENTS: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION: SUPPLY SIDE

- FIGURE 8 DATA TRIANGULATION: DEMAND SIDE

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 HEALTH INGREDIENTS MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 HEALTH INGREDIENTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 HEALTH INGREDIENTS MARKET, BY APPLICATION, 2022 VS. 2027 (USD BILLION)

- FIGURE 13 HEALTH INGREDIENTS MARKET, BY REGION, 2021

- FIGURE 14 INCREASED CONSUMPTION OF FORTIFIED FOODS DUE TO GROWING HEALTH CONSCIOUSNESS TO DRIVE MARKET GROWTH

- FIGURE 15 CHINA AND PROTEINS ACCOUNTED FOR LARGEST SHARES IN 2021

- FIGURE 16 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 EUROPE DOMINATED HEALTH INGREDIENTS MARKET ACROSS ALL APPLICATIONS IN 2022

- FIGURE 18 PROTEINS SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2027

- FIGURE 19 PLANT-BASED SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2027

- FIGURE 20 FOOD APPLICATION ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 21 PROJECTED RATES OF OBESITY

- FIGURE 22 HEALTH EXPENDITURE ON OVERWEIGHT AND RELATED CONDITIONS, 2020-2050

- FIGURE 23 US POPULATION AGED 65 AND OLDER, 2000–2060 (MILLION)

- FIGURE 24 AGING POPULATION IN JAPAN, 2017–2021

- FIGURE 25 AGING POPULATION IN UK, 2017–2021

- FIGURE 26 AGING POPULATION IN GERMANY, 2017–2021

- FIGURE 27 HEALTH INGREDIENTS MARKET DYNAMICS

- FIGURE 28 DIETS FOLLOWED BY CONSUMERS IN 2021

- FIGURE 29 HEALTH BENEFITS SOUGHT FROM FOOD

- FIGURE 30 CHRONIC DISEASES AMONG THE TOP TEN CAUSES OF DEATH WORLDWIDE AMONGST ALL AGES, 2019

- FIGURE 31 NUMBER OF AMERICANS WITH CHRONIC CONDITIONS

- FIGURE 32 CONSUMERS’ PERCEPTION REGARDING WHAT TO CONSUME OR AVOID

- FIGURE 33 NUMBER OF COUNTRIES MANDATING FOOD FORTIFICATION, 2011–2021

- FIGURE 34 PLANT-BASED FOODS SALES (USD BILLION)

- FIGURE 35 TOTAL US PLANT-BASED FOODS SALES, BY CATEGORY, IN 2021 (USD BILLION)

- FIGURE 36 VALUE CHAIN: HEALTH INGREDIENTS MARKET

- FIGURE 37 REVENUE SHIFT FOR HEALTH INGREDIENTS MARKET

- FIGURE 38 PRICING ANALYSIS, 2017–2023 (MILLION/KT)

- FIGURE 39 PRICING TREND OF TYPES OF HEALTH INGREDIENTS, 2017–2023 (MILLION/KT)

- FIGURE 40 PATENTS GRANTED FOR HEALTH INGREDIENTS MARKET, 2011-2021

- FIGURE 41 REGIONAL ANALYSIS OF PATENTS GRANTED FOR HEALTH INGREDIENTS MARKET, 2011-2021

- FIGURE 42 HEALTH INGREDIENTS MARKET: MARKET MAP

- FIGURE 43 VITAMINS: IMPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 44 VITAMINS: EXPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 45 AMINO ACIDS: IMPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 46 AMINO ACIDS: EXPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 47 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SOURCES

- FIGURE 48 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- FIGURE 49 INDICATORS OF RECESSION

- FIGURE 50 WORLD INFLATION RATE: 2011-2021

- FIGURE 51 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 52 GLOBAL HEALTH INGREDIENTS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 53 RECESSION INDICATORS AND THEIR IMPACT ON HEALTH INGREDIENTS MARKET

- FIGURE 54 HEALTH INGREDIENTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 55 HEALTH INGREDIENTS MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- FIGURE 56 HEALTH INGREDIENTS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 57 SHARE OF NEW PLANT-BASED SPORTS NUTRITION LAUNCHES TRACKED IN EUROPE, 2019

- FIGURE 58 US HELD LARGEST SHARE IN HEALTH INGREDIENTS MARKET, 2021

- FIGURE 59 NORTH AMERICAN HEALTH INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 60 MEXICO: PER CAPITA EXPENDITURE ON FOOD, 2010–2018

- FIGURE 61 FREQUENCY OF CONSUMPTION OF VITAMINS VIA FOOD SUPPLEMENTS IN GERMANY, 2021

- FIGURE 62 CONSUMED VITAMINS VIA FOOD SUPPLEMENTS IN GERMANY, 2021

- FIGURE 63 ASIA PACIFIC: HEALTH INGREDIENTS MARKET SNAPSHOT

- FIGURE 64 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2017–2021 (USD BILLION)

- FIGURE 65 HEALTH INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- FIGURE 66 HEALTH INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

- FIGURE 67 ADM: COMPANY SNAPSHOT

- FIGURE 68 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- FIGURE 69 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 70 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 71 DSM: COMPANY SNAPSHOT

- FIGURE 72 BASF SE: COMPANY SNAPSHOT

- FIGURE 73 CARGILL INCORPORATED: COMPANY SNAPSHOT

- FIGURE 74 INGREDION: COMPANY SNAPSHOT

- FIGURE 75 ARLA FOODS: COMPANY SNAPSHOT

- FIGURE 76 TATE & LYLE: COMPANY SNAPSHOT

- FIGURE 77 LONZA: COMPANY SNAPSHOT

- FIGURE 78 ROYAL FRIESLANDCAMPINA N.V.: COMPANY SNAPSHOT

- FIGURE 79 GLANBIA PLC: COMPANY SNAPSHOT

- FIGURE 80 CHR HANSEN HOLDING A/S: COMPANY SNAPSHOT

- FIGURE 81 PROBI: COMPANY SNAPSHOT

- FIGURE 82 FONTERRA CO-OPERATIVE GROUP LIMITED: COMPANY SNAPSHOT

- FIGURE 83 BALCHEM INC.: COMPANY SNAPSHOT

- FIGURE 84 DIVI’S LABORATORIES: COMPANY SNAPSHOT

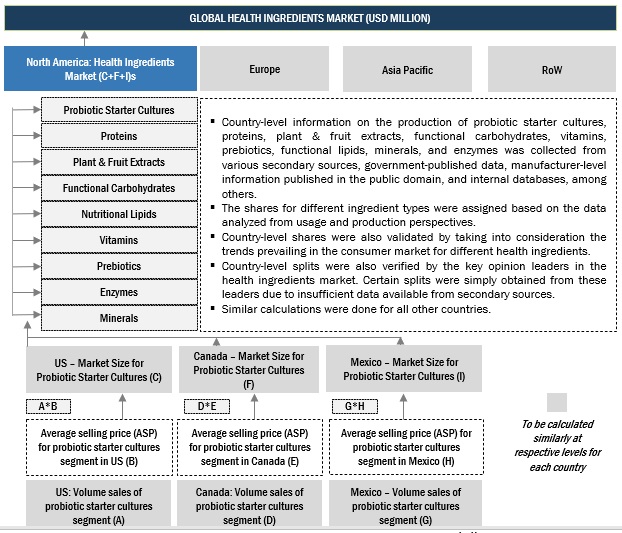

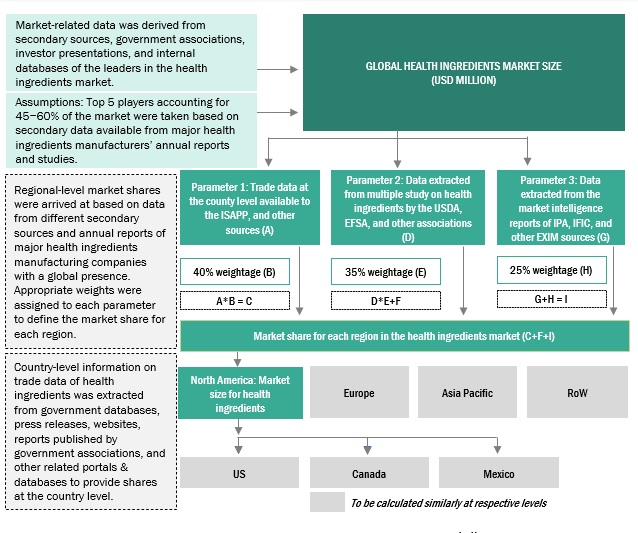

The study involved four major steps in estimating the size of the health ingredients market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), Animal Feed Manufacturers Association (AFMA), Food Safety Council (FSC), Food and Drug Administration (FDA), European Food Safety Authority (EFSA), Food Standards Australia New Zealand (FSANZ), Dietary Supplement Health and Education Act (DSHEA), and Organisation for Economic Co-operation and Development (OECD) were referred to, to identify and collect information for this study. The secondary sources also include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly used to obtain key information about the health ingredients markets's supply chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, including suppliers, manufacturers, and end-product manufacturers. Various primary sources from both the supply and demand sides of both markets were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs of the food, beverage, animal nutrition, personal care, and pharmaceutical industries. The primary sources from the supply side include research institutions involved in R&D, key opinion leaders, and health ingredient manufacturing companies.

To know about the assumptions considered for the study, download the pdf brochure

Health Ingredients Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These approaches have also been used extensively to determine the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The health ingredients value chain and market size in terms of value and volume have been determined through primary and secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the health ingredients market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Bottom-Up

- In the bottom-up approach, health ingredients for type, application, source, and region were added to arrive at the global and regional market size and CAGR.

- The bottom-up procedure has been employed to arrive at the overall size of the health ingredients market from the revenues of key players (companies) and their product share in the market.

Market Size Estimation Methodology: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down

In the top-down approach, the overall market size was used to estimate the size of individual markets (type, source, application, and region) through percentage splits from secondary and primary research. To calculate specific market segments, the most appropriate and immediate parent market size was used, implementing the top-down approach. The data obtained was further validated by conducting primary interviews with industry experts, key suppliers, and manufacturers of health ingredients.

Health Ingredients Market Size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market estimation process explained above, the total market was split into several segments and subsegments. To complete the overall health ingredients market and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Health Ingredients Market Report Objectives

Market Intelligence

- Determining and projecting the size of the market based on type, application, source, function, and region over a five-year period ranging from 2022 to 2027

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

Competitive Intelligence

- Identifying and profiling the key market players in the health ingredients market

- Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments in product innovations and technology in the health ingredients market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of the European health ingredients market into the Netherlands, Finland, Denmark, Norway, Belgium, and Russia

- Further breakdown of the Rest of Asia Pacific market into Indonesia, South Korea, Malaysia, Singapore, Australia & New Zealand, and Vietnam

- Further breakdown of the RoW market into South American, Middle Eastern, and Sub-Saharan African countries

Application Analysis

- Further breakdown of the application by country

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Health Ingredients Market