Gastrointestinal Stent Market by Product (Biliary Stents, Duodenal Stents, Colonic Stents, Pancreatic Stents and Esophageal Stents), Material (Self-Expanding Metal Stents and Plastic Stents), Application, End User & Region - Global Forecast to 2026

Gastrointestinal Stent Market Size, Share & Trends

Gastrointestinal stent market forecasted to transform from $457 million in 2021 to $600 million by 2026, driven by a CAGR of 5.6%. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics. Gastrointestinal (GI) stents are designed for palliative therapy for various diseases causing obstruction in the GI tract. GI stents have a major role in the recanalization of gastrointestinal (GI) tumours and postoperative leak sealing. Other potential applications of GI stents are drug-eluting devices, tissue modelling for benign conditions, and GI tract drainage or anastomosis. Growth of this market can be attributed to the rising prevalence of GI cancers and other digestive diseases, changing lifestyles, increasing healthcare expenditure on gastrointestinal procedures, and an increasing preference for minimally invasive surgeries.

Gastrointestinal Stent Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Gastrointestinal Stent Market Dynamics

Drivers: Rise in the incidence of gastrointestinal cancers, IBD, and other digestive diseases

Gastrointestinal cancer is one of the leading causes of death worldwide. In the past few years, there has been a steep rise in morbidity and mortality from chronic diseases such as esophageal cancer, colorectal cancer, and gastrointestinal-related critical disorders. According to the International Agency for Research on Cancer (IARC), in 2018, gastrointestinal cancers accounted for 26% of the global burden of cancer incidence and 35% of all cancer-related deaths.

According to the WHO, gastrointestinal cancers, such as colorectal cancer, were responsible for 935,000 deaths globally in 2020, and stomach cancer accounted for 769,000 deaths. Colorectal cancer was the third most common cancer worldwide with 1.93 million new cases diagnosed in 2020.

Restraints: High cost of the procedure and limited reimbursement in developing countries

In recent years, the cost of healthcare has increased significantly across the globe, and the prices of medical devices, including GI stent, has also increased. According to a study reported by PubMed.gov in May 2021, the average price of an endoscopic stenting procedure is about USD 43,798.06. Healthcare providers and payers in developing countries, such as India and Brazil, have low financial resources to invest in such a costly procedure.

Also, in most Asian countries, there is limited or no reimbursement for endoscopic stenting procedures from governments, which is one of the major factors for reluctance, especially in patients and physicians for opting for gastrointestinal stents. Such a high cost and the lack of reimbursement in developing countries, such as India, are expected to limit the adoption of gastrointestinal stents related procedures among the patients.

Opportunities: Development of biodegradable and drug-eluting stents

Biodegradable stents are made of biodegradable materials such as polyesters, polycarbonates, bacterial-derived polymers, and corrodible metals and are mostly used in coronary artery disease. Drug-eluting stents are capable of maintaining luminal patency not only from radial expansion but also from targeted drug delivery directly to tissue, reducing occlusion rates in lumen. Moreover, biodegradable stents help in maintaining the patency of the gastrointestinal tract for a predetermined duration as they gradually degrade and are eventually absorbed from the GI.

Challenges: Stringent regulatory environment

Developed and developing countries are increasingly focused on strengthening and supporting their domestic medical devices industries. However, the ongoing implementation of stringent regulations for imported medical devices that support the sales and the adoption of domestically manufactured medical devices (including GI stents) are expected to reduce the profit margin of the global medical devices manufacturers. Similarly, in Europe, guidelines presented by the European Society of Gastrointestinal Endoscopy (ESGE) are restraining the adoption of GI stents in many cases. For instance, the ESGE does not recommend the use of biodegradable stents over SEMSs in the treatment of benign esophageal strictures. The ESGE does not recommend permanent stent placement for refractory benign esophageal stricture; stents should usually be removed at a maximum of 3 months following insertion.

The Esophageal Stents segment is estimated to grow at the highest CAGR in the gastrointestinal stent, by products, in 2020

Based on product, the gastrointestinal stent market is segmented into biliary stents, duodenal stents, colonic stents, pancreatic stents, and esophageal stents. The biliary stents segment accounted for the largest share in 2020. The Esophageal Stents segment is estimated to grow at the highest CAGR during the forecast period. The increasing prevalence of bile duct cancer and chronic liver disease is one of the prominent factors responsible for the growth of the biliary stents segment. Moreover, The increasing incidence of biliary diseases and the growth in the number of surgical procedures for the treatment of biliary diseases are the other major factors that are expected to support the growth of this market segment during the forecast period.

The self-expanding metal stent segment will dominate the gastrointestinal stent market, by material during the forecast period

Based on material, the global market is segmented into self-expanding metal stents and plastic stents. Self-expanding metal stents are further sub-segmented into nitinol, stainless steel, and other metal stents. Factors such as the increased demand for Self-expanding metal stents due to advantages offered by these stents such as ease of insertion, a lower possibility of dislodgment or migration, longer patency. Metal stents are usually made of stainless steel, nitinol, cobalt-chromium, and platinum-chromium with or without coating. Self-expanding metal stents are used for the treatment of benign gastrointestinal leaks and perforations. These stents act as a support to keep the gastrointestinal tract open and provide easy unobstructed drainage of food and water.

The Gastrointestinal Cancers segment to register the fastest growth in the gastrointestinal stent market, by application, during the forecast period

Based on application, the global market is segmented into biliary diseases, irritable bowel syndrome, and gastrointestinal cancers. The gastrointestinal cancers segment is further categorized into colorectal cancer, stomach cancer, esophageal cancer, and pancreatic cancer. The biliary diseases segment accounted for the largest share in 2020. The gastrointestinal cancers segment is projected to have the highest CAGR during the forecast period. The growth of this segment is attributed to the increased prevalence and incidences of gastrointestinal cancers. For instance, According to a report by the American Cancer Society, Colorectal Cancer Facts & Figures 2020-2022, in 2020, there were an estimated 104,610 new cases of colon cancer and 43,340 cases of rectal cancer diagnosed in the US.

Hospitals and clinics are the largest end users of gastrointestinal stent

Based on end users, the gastrointestinal stent market is segmented into hospitals and clinics and ambulatory surgical centers. The hospitals and clinics segment accounted for the largest share of in 2020. The large share of this segment can be attributed to the large number of endoscopic retrograde cholangio-pancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) procedures performed in hospitals for different disease indications, favorable reimbursement scenarios, and increased government initiatives to provide quality treatment for gastrointestinal diseases.

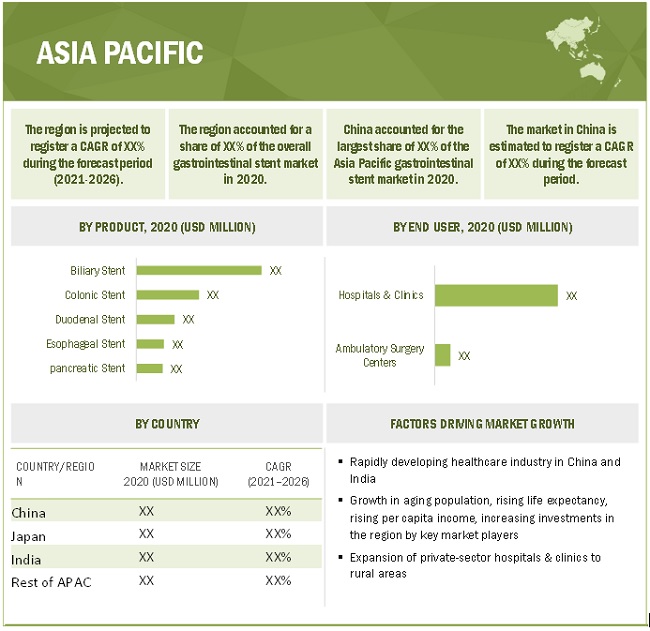

Asia Pacific market to witness the highest growth during the forecast period

The gastrointestinal stent is divided into five regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. These regions are further analyzed at the country levels. North America held the largest share of the gastrointestinal stent market in 2020, followed by Europe and the Asia Pacific. The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. Market growth in the APAC region is mainly driven by the rise in incidences of gastrointestinal disorders, growth in aging population, rapidly developing healthcare industry in China and India, rising life expectancy, rising per capita income, increasing investments in the region by key market players.

To know about the assumptions considered for the study, download the pdf brochure

The gastrointestinal stent market is dominated by a few globally established players such as Boston Scientific Corporation (US), Cook Group (US), Micro-Tech (Nanjing) Co., Ltd. (China), Taewoong Medical (South Korea), and Olympus Corporation (Japan).

Gastrointestinal Stent Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$457 million |

|

Estimated Value by 2026 |

$600 million |

|

Growth Rate |

Poised to grow at a CAGR of 5.6% |

|

Segments covered |

By Products, By Material, By Application, By End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

The study categorizes the gastrointestinal stent market into following segments and sub-segments:

By Products

- Biliary stents

- Duodenal stents

- Colonic stents

- Pancreatic stents

- Esophageal stents

By Material

- Self-expanding metal stents

- Nitinol

- Stainless steel

- Other metal stents

- Plastic stents

By Application

- Biliary diseases

- Irritable bowel syndrome

- Gastrointestinal cancers

- Colorectal cancer

- Stomach cancer

- Esophageal cancer

- Pancreatic cancer

By End Users

- Hospitals and Clinics

- Ambulatory Surgical Centers

Recent Developments

- In November 2020, Boston Scientific Corporation (US) has received 510(k) approval from the U.S. Food and Drug Administration (FDA) and CE Mark approval to market its WallFlex Fully Covered Esophageal Stent for the treatment of malignant esophageal strictures caused by esophageal cancer.

- In October 2020, Olympus Corporation (Japan) launched HANAROSTENT Esophagus TTS Self-expanding Metal Stents (SEMS) made by MI-Tech and distributed exclusively through Olympus in the US.

- In June 2019, Merit Medical System Inc. (US) acquired Brightwater Medical inc. (US) with an upfront payment of USD 35 million. Brightwater Medical Inc. has received the FDA clearance for the ConvertX biliary stent device.

- In June 2018, Cook Medical (US) entered into a distribution agreement with Taewoong Medical (South Korea) to distribute GI stents into the US. The new deal includes the Niti-S Esophageal Stent, the flagship product of Taewoong Medical’s Self-Expandable line of metal GI stents.

Frequently Asked Questions (FAQs):

What is the projected market value of the global Gastrointestinal Stent Market?

The global market of Gastrointestinal Stent Market is projected to reach USD 600 Million.

What is the estimated growth rate (CAGR) of the global Gastrointestinal Stent Market for the next five years?

The global Gastrointestinal Stent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% from 2021 to 2026

What are the major revenue pockets in the Gastrointestinal Stent Market currently?

North America held the largest share of the gastrointestinal stent market in 2020, followed by Europe and the Asia Pacific. The Asia Pacific market is projected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 GASTROINTESTINAL STENT MARKET

1.3.2 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH APPROACH

FIGURE 2 GASTROINTESTINAL STENT MARKET: RESEARCH METHODOLOGY STEPS

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS (GLOBAL MARKET)

FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 7 SUPPLY SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: BOSTON SCIENTIFIC CORPORATION

FIGURE 9 SUPPLY SIDE MARKET SIZE ESTIMATION: GLOBAL MARKET (2020)

FIGURE 10 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

FIGURE 11 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR GASTROINTESTINAL STENT MARKET (2021–2026)

FIGURE 12 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 13 MARKET DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS

2.5.1 METHODOLOGY-RELATED LIMITATIONS

2.6 RISK ASSESSMENT

2.7 ASSESSMENT OF IMPACT OF COVID-19 ON GLOBAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 14 GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 15 GLOBAL MARKET, BY MATERIAL, 2021 VS. 2026 (USD MILLION)

FIGURE 16 GLOBAL MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 17 GLOBAL MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 18 GEOGRAPHIC SNAPSHOT OF GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 GASTROINTESTINAL STENT MARKET OVERVIEW

FIGURE 19 RISE IN INCIDENCE OF GASTROINTESTINAL CANCERS, IBD, AND OTHER DIGESTIVE DISEASES DRIVE GLOBAL MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY PRODUCT AND COUNTRY

FIGURE 20 BILIARY STENT HELD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2020

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 21 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 GLOBAL MARKET: REGIONAL MIX

FIGURE 22 NORTH AMERICA TO BE LARGEST MARKET FOR GASTROINTESTINAL STENT THROUGHOUT FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 GASTROINTESTINAL STENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rise in the incidence of gastrointestinal cancers, IBD, and other digestive diseases

TABLE 2 GLOBAL INCIDENCE OF COLORECTAL CANCER, 2020

TABLE 3 GLOBAL GASTROINTESTINAL CANCER INCIDENCE, 2020

5.2.1.2 Increasing healthcare expenditure on gastrointestinal procedures

FIGURE 24 EUROPE: COSTS OF GASTROINTESTINAL CANCERS (USD BILLION), 2018

5.2.1.3 Ongoing technological advancements in business space

5.2.1.4 Increasing preference for minimally invasive surgeries

5.2.2 RESTRAINTS

5.2.2.1 Major complications associated with GI stent implementation

TABLE 4 FREQUENCY OF MOST COMMON STENT-RELATED COMPLICATIONS IN VARIOUS ANATOMIC SITES

5.2.2.2 High cost of the procedure and limited reimbursement in developing countries

5.2.3 OPPORTUNITIES

5.2.3.1 Development of biodegradable and drug eluting stents

5.2.3.2 Growing healthcare sector in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Stringent regulatory environment

6 INDUSTRY INSIGHT S (Page No. - 63)

6.1 TECHNOLOGY ANALYSIS

6.1.1 RECENT ADVANCES IN GASTROINTESTINAL STENTING TO OFFER IMPROVED STENT PATENCY AND REDUCED STENT-INDUCED COMPLICATIONS, RESULTING IN IMPROVED QUALITY OF LIFE

6.2 PRICING ANALYSIS

TABLE 5 PRICES FOR GI STENTS (USD)

6.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING MANUFACTURING PHASE

6.4 ECOSYSTEM MAPPING

FIGURE 26 GASTROINTESTINAL STENT MARKET: ECOSYSTEM ANALYSIS

6.5 SUPPLY CHAIN ANALYSIS

FIGURE 27 GLOBAL MARKET: STAKEHOLDERS IN SUPPLY CHAIN

6.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

6.6.1 THREAT OF NEW ENTRANTS

6.6.1.1 High capital requirement

6.6.1.2 High preference for products from well-established brands

6.6.2 THREAT OF SUBSTITUTES

6.6.2.1 Substitute therapies for gastrointestinal stents

6.6.3 BARGAINING POWER OF SUPPLIERS

6.6.3.1 Presence of few raw material suppliers

6.6.3.2 Supplier switching cost

6.6.4 BARGAINING POWER OF BUYERS

6.6.4.1 Few companies offer premium products at global level

6.6.5 INTENSITY OF COMPETITIVE RIVALRY

6.6.5.1 Increasing demand for high-quality and innovative products

6.6.5.2 Lucrative growth potential in emerging markets

6.7 REGULATORY ANALYSIS

TABLE 7 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING THE GASTROINTESTINAL STENT MARKET

6.7.1 NORTH AMERICA

6.7.1.1 US

TABLE 8 US FDA: CLASSIFICATION OF MEDICAL DEVICES

6.7.1.2 Canada

6.7.2 EUROPE

6.7.3 ASIA PACIFIC

6.7.3.1 India

6.7.3.2 China

TABLE 9 NMPA MEDICAL DEVICE CLASSIFICATION

6.7.3.3 Japan

TABLE 10 PMDA: CLASSIFICATION OF MEDICAL DEVICES

6.8 PATENT ANALYSIS

6.8.1 PATENT PUBLICATION TRENDS FOR GASTROINTESTINAL STENTS

FIGURE 28 GLOBAL PATENT PUBLICATION TRENDS IN GLOBAL MARKET, 2015–2021

6.8.2 TOP APPLICANTS (COMPANIES) OF GASTROINTESTINAL STENTS PATENTS

FIGURE 29 TOP COMPANIES THAT APPLIED FOR GASTROINTESTINAL STENTS PATENTS, 2018 AND 2021

6.8.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN GLOBAL MARKET

FIGURE 30 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR GASTROINTESTINAL STENT PATENTS, 2015–2021

6.9 YC–YCC TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

FIGURE 31 YC–YCC SHIFT IN GLOBAL MARKET

6.10 IMPACT OF COVID-19 ON GLOBAL MARKET

TABLE 11 IMPACT OF COVID-19 ON SALES OF KEY MARKET PLAYERS

7 GASTROINTESTINAL STENT MARKET, BY PRODUCT (Page No. - 78)

7.1 INTRODUCTION

FIGURE 32 BILIARY SEGMENT TO DOMINATE GLOBAL MARKET BY 2026

TABLE 12 GLOBAL GLOBAL MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 13 GLOBAL MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2 BILIARY STENTS

7.2.1 INCREASING PREVALENCE OF BILE DUCT CANCER AND CHRONIC LIVER DISEASE TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 14 BILIARY STENTS: KEY PRODUCTS OFFERED BY PROMINENT PLAYERS

TABLE 15 BILIARY STENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 COLONIC STENTS

7.3.1 RISING DEMAND FOR COLONIC STENTS DUE TO HIGH INCIDENCE OF COLORECTAL CANCER TO DRIVE SEGMENT GROWTH

TABLE 16 COLONIC STENTS: KEY PRODUCTS OFFERED BY PROMINENT PLAYERS

TABLE 17 COLONIC STENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 DUODENAL STENTS

7.4.1 INCREASING PREVALENCE OF INTESTINAL MALIGNANCY TO ADOPT DUODENAL STENTS

TABLE 18 DUODENAL STENTS: KEY PRODUCTS OFFERED BY PROMINENT PLAYERS

TABLE 19 DUODENAL STENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 PANCREATIC STENTS

7.5.1 RISING NUMBER OF ERCP AND PTC PROCEDURES TO DRIVE SEGMENT GROWTH

TABLE 20 PANCREATIC STENTS: KEY PRODUCTS OFFERED BY PROMINENT PLAYERS

TABLE 21 PANCREATIC STENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6 ESOPHAGEAL STENTS

7.6.1 INCREASING INCIDENCE OF ESOPHAGEAL CANCER TO DRIVE ESOPHAGEAL STENTS MARKET

TABLE 22 ESOPHAGEAL STENTS: KEY PRODUCTS OFFERED BY PROMINENT PLAYERS

TABLE 23 ESOPHAGEAL STENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 GASTROINTESTINAL STENT MARKET, BY MATERIAL (Page No. - 88)

8.1 INTRODUCTION

FIGURE 33 SELF-EXPANDING METAL STENTS SEGMENT TO DOMINATE GLOBAL MARKET BY 2026

TABLE 24 GLOBAL MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

8.2 SELF-EXPANDING METAL STENTS

8.2.1 INCREASING ADOPTION OF SELF-EXPANDING METAL STENTS IN HOSPITAL SETTINGS TO DRIVE THE SEGMENT

TABLE 25 SELF-EXPANDING METAL STENTS: KEY PRODUCTS OFFERED BY THE PROMINENT PLAYERS

TABLE 26 SELF-EXPANDING METAL STENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 27 GASTROINTESTINAL SELF-EXPANDING METAL STENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.2 NITINOL STENTS

8.2.2.1 Ease of deployment for nitinol stents to drive segment growth

TABLE 28 NITINOL STENTS: KEY PRODUCTS OFFERED BY THE PROMINENT PLAYERS

TABLE 29 NITINOL STENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.3 STAINLESS STEEL STENTS

8.2.3.1 Excellent mechanical properties and medical efficiency of stainless-steel stents to support segment growth

TABLE 30 STAINLESS STEEL STENTS: KEY PRODUCTS OFFERED BY THE PROMINENT PLAYERS

TABLE 31 STAINLESS STEEL STENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.4 OTHER METAL STENTS

TABLE 32 OTHER METAL STENTS: KEY PRODUCTS OFFERED BY THE PROMINENT PLAYERS

TABLE 33 OTHER METAL STENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 PLASTIC STENTS

8.3.1 FAVORABLE REIMBURSEMENT POLICIES FOR PLASTIC STENTS AND INCREASED DEMAND FOR SHORT-TERM USE OF STENTS TO DRIVE SEGMENT GROWTH

TABLE 34 PLASTIC STENTS: KEY PRODUCTS OFFERED BY PROMINENT PLAYERS

TABLE 35 PLASTIC STENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9 GASTROINTESTINAL STENT MARKET, BY APPLICATION (Page No. - 98)

9.1 INTRODUCTION

FIGURE 34 BILIARY DISEASES TO DOMINATE GLOBAL MARKET, BY APPLICATION, IN 2026

TABLE 36 GLOBAL MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2 BILIARY DISEASES

9.2.1 INCREASED AGING POPULATION AND PREVALENCE OF GALLSTONES TO DRIVE GROWTH

TABLE 37 BILIARY DISEASES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 GASTROINTESTINAL CANCER

9.3.1 GASTROINTESTINAL CANCER IS THE LARGEST APPLICATION SEGMENT FOR GASTROINTESTINAL STENT

TABLE 38 GASTROINTESTINAL CANCER STENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 39 GASTROINTESTINAL CANCER STENT MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.2 COLORECTAL CANCER

9.3.2.1 Rise of colorectal cancer cases to drive segment growth

TABLE 40 COLORECTAL CANCER STENT MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.3 STOMACH CANCER

9.3.3.1 High incidence rate of stomach cancer to drive market share for stomach cancer

TABLE 41 STOMACH CANCER STENT MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.4 PANCREATIC CANCER

9.3.4.1 Increased prevalence of pancreatic cancer and adoption of stents in endoscopic procedures to drive segment growth

TABLE 42 PANCREATIC CANCER STENT MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.5 ESOPHAGEAL CANCER

9.3.5.1 Increasing number of esophageal cancer to increase adoption of esophageal stents

TABLE 43 ESOPHAGEAL CANCER STENT MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 IRRI TABLE BOWEL SYNDROME

9.4.1 INCREASED PREVALENCE OF IRRI TABLE BOWEL SYNDROME TO DRIVE DEMAND FOR GI STENTS

TABLE 44 IRRITABLE BOWEL SYNDROME STENT MARKET, BY COUNTRY/REGION, 2019–2026 (USD MILLION)

10 GASTROINTESTINAL STENT MARKET, BY END USER (Page No. - 108)

10.1 INTRODUCTION

FIGURE 35 HOSPITALS & CLINICS SEGMENT TO DOMINATE GLOBAL MARKET BY 2026

TABLE 45 GLOBAL MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2 HOSPITALS & CLINICS

10.2.1 HIGH VOLUME OF MINIMALLY INVASIVE PROCEDURES TO DRIVE DEMAND FOR GASTROINTESTINAL STENTS IN HOSPITALS & CLINICS

TABLE 46 REIMBURSEMENT IN HOSPITAL OUTPATIENTS FOR ERCP STENTING PROCEDURES (USD)

TABLE 47 HOSPITALS & CLINICS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

10.3 AMBULATORY SURGICAL CENTERS

10.3.1 LOWER COSTS AND SHORTER PATIENT STAYS TO DRIVE AMBULATORY SURGICAL CENTERS

TABLE 48 US: NUMBER OF ASCS, (2013–2018)

TABLE 49 REIMBURSEMENT IN ASC FOR ERCP STENTING PROCEDURES (USD)

TABLE 50 AMBULATORY SURGICAL CENTERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

11 GASTROINTESTINAL STENT MARKET, BY REGION (Page No. - 114)

11.1 INTRODUCTION

FIGURE 36 GEOGRAPHIC SNAPSHOT: ASIA PACIFIC TO BE FASTEST-GROWING REGIONAL SEGMENT DURING FORECAST PERIOD

TABLE 51 GLOBAL MARKET, BY REGION, 2019–2026 (USD MILLION)

11.2 NORTH AMERICA

TABLE 52 NORTH AMERICA: GASTROINTESTINAL CANCER INCIDENCE, ESTIMATED DEATHS, AND 5 YEAR PREVALENCE ( 2020)

FIGURE 37 NORTH AMERICA: GASTROINTESTINAL STENT MARKET SNAPSHOT

TABLE 53 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: GASTROINTESTINAL CANCER STENTS MARKET, BY GASTROINTESTINAL CANCERS, 2019–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.2.1 US

11.2.1.1 US to dominate North America gastrointestinal stent market during forecast period

TABLE 60 US: ESTIMATED CASES OF DIGESTIVE SYSTEM CANCER BY GASTROINTESTINAL CANCER (2020)

TABLE 61 US: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 62 US: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 63 US: GASTROINTESTINAL SELF-EXPANDING METAL STENTS MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 64 US: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 65 US: GASTROINTESTINAL CANCER STENT MARKET, BY GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 66 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing geriatric population and increased incidence of gastrointestinal disorders to drive gastrointestinal stents demand

TABLE 67 CANADA: ESTIMATED CASES OF DIGESTIVE SYSTEM CANCER, BY GASTROINTESTINAL CANCER (2020)

TABLE 68 CANADA: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 69 CANADA: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 70 CANADA: GASTROINTESTINAL SELF-EXPANDING METAL STENTS MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 71 CANADA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 72 CANADA: GASTROINTESTINAL CANCER STENTS MARKET, BY GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 73 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3 EUROPE

TABLE 74 EUROPE: GASTROINTESTINAL CANCER INCIDENCE, BY GASTROINTESTINAL CANCER (2020)

FIGURE 38 EUROPE: GASTROINTESTINAL STENT MARKET SNAPSHOT

TABLE 75 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 80 EUROPE: GASTROINTESTINAL CANCER STENT MARKET, BY GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany dominated the European gastrointestinal stent market in 2020

TABLE 82 GERMANY: GI CANCER INCIDENCE, IN 2020

TABLE 83 GERMANY: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 86 GERMANY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 87 GERMANY: GASTROINTESTINAL CANCER STENTS MARKET, BT GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 88 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 Favorable statutory health insurance system to boost gastrointestinal stents adoption

TABLE 89 FRANCE: GI CANCER INCIDENCE, (2020)

TABLE 90 FRANCE: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 91 FRANCE: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 92 FRANCE: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 93 FRANCE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 94 FRANCE: GASTROINTESTINAL CANCER STENTS MARKET, BY GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 95 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.3 UK

11.3.3.1 Increased incidence of gastrointestinal cancers and minimally invasive surgeries to increase gastrointestinal stents adoption

TABLE 96 UK: GASTROINTESTINAL CANCER INCIDENCE (2020)

TABLE 97 UK: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 98 UK: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 99 UK: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 100 UK: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 101 UK: GASTROINTESTINAL CANCER STENTS MARKET, BT GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 102 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Aging population and initiatives to build awareness about digestive health to increase gastrointestinal stent adoption

TABLE 103 ITALY: GASTROINTESTINAL CANCER INCIDENCE (2020)

TABLE 104 ITALY: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 105 ITALY: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 106 ITALY: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 107 ITALY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 108 ITALY: GASTROINTESTINAL CANCER STENT MARKET, BT GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 109 ITALY: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Increased prevalence of gastrointestinal diseases to raise demand for gastrointestinal stent

TABLE 110 SPAIN: GASTROINTESTINAL CANCER INCIDENCE (2020)

TABLE 111 SPAIN: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 112 SPAIN: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 113 SPAIN: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 114 SPAIN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 115 SPAIN: GASTROINTESTINAL CANCER STENTS MARKET, BT GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 116 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 117 ROE: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 118 ROE: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 119 ROE: GASTROINTESTINAL SELF-EXPANDING METAL STENTS MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 120 ROE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 121 ROE: GASTROINTESTINAL CANCER STENTS MARKET, BT GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 122 ROE: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 123 ASIA PACIFIC: GASTROINTESTINAL CANCER INCIDENCE (2020)

FIGURE 39 ASIA PACIFIC: GASTROINTESTINAL STENT MARKET SNAPSHOT

TABLE 124 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 129 ASIA PACIFIC: GASTROINTESTINAL CANCER STENTS MARKET, BT GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Increasing healthcare expenditure and government initiatives to modernize healthcare system and support market growth

TABLE 131 CHINA: GASTROINTESTINAL CANCER INCIDENCE, (2020)

TABLE 132 CHINA: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 133 CHINA: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 134 CHINA: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 135 CHINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 136 CHINA: GASTROINTESTINAL CANCER STENTS MARKET, BT GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 137 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Strong healthcare system and increased geriatric population to drive market growth

TABLE 138 JAPAN: GASTROINTESTINAL CANCER INCIDENCE (2020)

TABLE 139 JAPAN: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 140 JAPAN: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 141 JAPAN: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 142 JAPAN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 143 JAPAN: GASTROINTESTINAL CANCER STENTS MARKET, BY GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 144 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Increasing prevalence of gastrointestinal disorders and presence of global and local market players to drive market growth

TABLE 145 INDIA: GASTROINTESTINAL CANCER INCIDENCE (2020)

TABLE 146 INDIA: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 147 INDIA: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 148 INDIA: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 149 INDIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 150 INDIA: MARKET, BY GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 151 INDIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.4 REST OF ASIA PACIFIC

TABLE 152 ROAPAC: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 153 ROAPAC: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 154 ROAPAC: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 155 ROAPAC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 156 ROAPAC: MARKET, BY GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 157 ROAPAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.5 LATIN AMERICA

11.5.1 INCREASING DISPOSABLE INCOME AND BURDEN OF GASTRIC CANCER TO DRIVE MARKET GROWTH

TABLE 158 LATIN AMERICA: GASTROINTESTINAL CANCER INCIDENCE, 2020

TABLE 159 BRAZIL: GASTROINTESTINAL CANCER INCIDENCE, 2020

TABLE 160 LATIN AMERICA: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 164 LATIN AMERICA: GASTROINTESTINAL CANCER STENTS MARKET, BT GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

11.6.1 MIDDLE EAST & AFRICA IS THE SMALLEST MARKET FOR GASTROINTESTINAL STENT PRODUCTS

TABLE 166 MIDDLE EAST & AFRICA: GASTROINTESTINAL CANCER INCIDENCE (2020)

TABLE 167 MIDDLE EAST & AFRICA: GASTROINTESTINAL STENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY SELF-EXPANDING METAL, 2019–2026 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY GASTROINTESTINAL CANCER, 2019–2026 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 167)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

12.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

12.4 KEY PLAYERS RANKING (2020)

FIGURE 41 MARKET SHARE ANALYSIS, BY KEY PLAYERS, 2020

12.5 COMPETITIVE BENCHMARKING

12.5.1 COMPANY FOOTPRINT FOR KEY PLAYERS

12.5.2 PRODUCT AND REGIONAL FOOTPRINT OF COMPANIES IN GASTROINTESTINAL STENT MARKET

TABLE 173 PRODUCT TYPE FOOTPRINT OF COMPANIES (20 MARKET PLAYERS)

TABLE 174 MATERIAL FOOTPRINT OF COMPANIES (20 MARKET PLAYERS)

TABLE 175 REGIONAL FOOTPRINT OF COMPANIES (20 MARKET PLAYERS)

12.6 COMPETITIVE LEADERSHIP MAPPING

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 42 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING (2020)

12.7 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS

12.7.1 PROGRESSIVE COMPANIES

12.7.2 DYNAMIC COMPANIES

12.7.3 STARTING BLOCKS

12.7.4 RESPONSIVE COMPANIES

FIGURE 43 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS (2020)

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES & APPROVALS

TABLE 176 GLOBAL MARKET: KEY PRODUCT LAUNCHES & APPROVALS, 2018–2021

12.8.2 DEALS

TABLE 177 GLOBAL MARKET: KEY DEALS, 2018–2021

13 COMPANY PROFILES (Page No. - 180)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats)*

13.1.1 BOSTON SCIENTIFIC CORPORATION

TABLE 178 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

FIGURE 44 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2020)

13.1.2 COOK GROUP

TABLE 179 COOK GROUP: BUSINESS OVERVIEW

13.1.3 TAEWOONG MEDICAL

TABLE 180 TAEWOONG MEDICAL: BUSINESS OVERVIEW

13.1.4 MICRO-TECH (NANJING) CO., LTD.

TABLE 181 MICRO-TECH (NANJING) CO., LTD.: BUSINESS OVERVIEW

13.1.5 OLYMPUS CORPORATION

TABLE 182 OLYMPUS CORPORATION: BUSINESS OVERVIEW

FIGURE 45 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2020)

13.2 OTHER PLAYERS

13.2.1 MERIT MEDICAL SYSTEMS

TABLE 183 MERIT MEDICAL SYSTEMS: BUSINESS OVERVIEW

FIGURE 46 MERIT MEDICAL SYSTEMS: COMPANY SNAPSHOT

13.2.2 BECTON, DICKINSON AND COMPANY

TABLE 184 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 47 BECTON, DICKINSON AND COMPANY.: COMPANY SNAPSHOT (2020)

13.2.3 MEDTRONIC

TABLE 185 MEDTRONIC: BUSINESS OVERVIEW

FIGURE 48 MEDTRONIC: COMPANY SNAPSHOT (2020)

13.2.4 CANTEL MEDICAL

TABLE 186 CANTEL MEDICAL: BUSINESS OVERVIEW

FIGURE 49 CANTEL MEDICAL: COMPANY SNAPSHOT (2020)

13.2.5 CONMED CORPORATION

TABLE 187 CONMED CORPORATION: BUSINESS OVERVIEW

FIGURE 50 CONMED CORPORATION: COMPANY SNAPSHOT (2020)

13.2.6 ELLA-CS, S.R.O.

TABLE 188 ELLA-CS, S.R.O.: BUSINESS OVERVIEW

13.2.7 ENDO-FLEX GMBH

TABLE 189 ENDO-FLEX GMBH: BUSINESS OVERVIEW

13.2.8 MI-TECH

TABLE 190 MI-TECH : BUSINESS OVERVIEW

13.2.9 HOBBS MEDICAL INC.

TABLE 191 HOBBS MEDICAL INC.: BUSINESS OVERVIEW

13.2.10 QUALIMED

TABLE 192 QUALIMED: BUSINESS OVERVIEW

13.2.11 UK MEDICAL

TABLE 193 UK MEDICAL: BUSINESS OVERVIEW

13.2.12 CITEC

TABLE 194 CITEC: BUSINESS OVERVIEW

13.2.13 MEDORAH MEDITEK PVT. LTD.

TABLE 195 MEDORAH MEDITEK PVT. LTD.: BUSINESS OVERVIEW

13.2.14 BCM CORPORATION

TABLE 196 BCM CORPORATION: BUSINESS OVERVIEW

13.2.15 LEUFEN MEDICAL GMBH

TABLE 197 LEUFEN MEDICAL GMBH: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 216)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

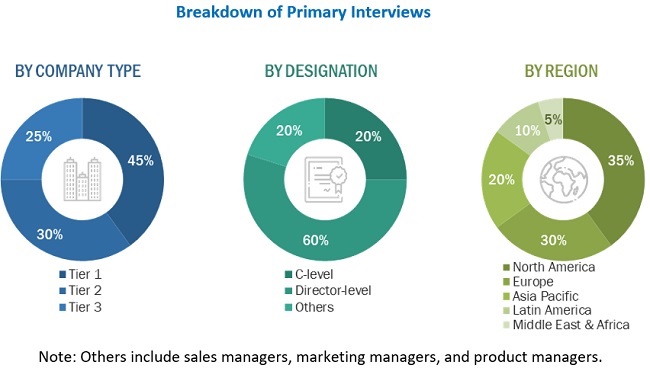

This study involved four major activities for estimating the current size of the gastrointestinal stent market. Exhaustive secondary research was conducted to collect information on the market as well as its peer markets. The next step focused on validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Revenue Share Analysis and top-down approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to identify and collect information for this study. These secondary sources include annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the Gastrointestinal Stent market. Primary sources from the demand side include experts from hospitals and clinics and ambulatory surgical centers. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on the key industry trends and key market dynamics, such as market drivers, restraints, challenges, and opportunities.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the Gastrointestinal Stent market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the Gastrointestinal Stent market

The size of the Gastrointestinal Stent market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global Gastrointestinal Stent market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the Gastrointestinal Stent market on the basis of product, material, application, and end user

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to the individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, along with major countries in these regions

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 in the gastrointestinal stent market

- To track and analyze competitive developments such as partnerships, agreements, collaborations, acquisitions, new product developments, geographic expansions, and research and development activities in the Gastrointestinal Stent market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the RoAPAC market into South Korea, New Zealand, Australia, Singapore, and other countries

- Further breakdown of the RoE market into Russia, the Netherlands, Switzerland, and other countries

Company Information

- Detailed analysis and profiling of additional market players, up to five

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Gastrointestinal Stent Market