Geotechnical Instrumentation and Monitoring Market Size, Share, Statistics and Industry Growth Analysis Report by Offering, Networking Technology (Wired, Wireless), Structure (Bridges & Tunnels, Buildings & Utilities, Dams, Others), End User and Geography (2021-2026)

Updated on : October 23, 2024

Geotechnical Instrumentation and Monitoring Market Size & Growth

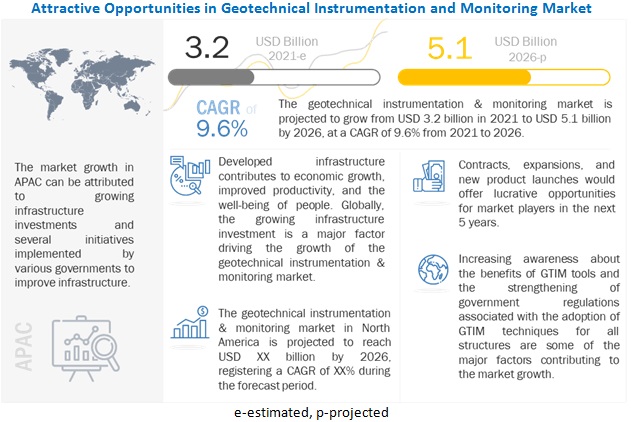

The Geotechnical Instrumentation and Monitoring Market Size is estimated to be worth USD 3.2 billion in 2021 and is projected to reach USD 5.1 billion by 2026, growing at a CAGR of 9.6%during the forecast period from 2021 to 2026.

The geotechnical instrumentation and monitoring market is witnessing robust growth, driven by the increasing need for safety, efficiency, and sustainability in construction and infrastructure projects. As urbanization accelerates and the demand for infrastructure development rises, the importance of monitoring soil conditions, structural integrity, and environmental impacts becomes critical. Key trends influencing the market include the adoption of advanced technologies such as IoT, artificial intelligence, and automation, which enhance data collection and analysis capabilities. Moreover, the growing focus on risk management and compliance with stringent regulatory standards is propelling investments in geotechnical monitoring systems. The rise in infrastructure projects in emerging economies, coupled with the need for maintaining aging infrastructure in developed regions, further fuels demand for geotechnical instrumentation. As stakeholders prioritize safety and performance optimization, the market for geotechnical instrumentation and monitoring is set to expand significantly in the coming years.

Rising infrastructure investments, increasing adoption of geotechnical instruments to prevent structural failures, government regulations for sustainable structures and growing awareness about the benefits of instrumentation and monitoring tools are some of the important factors contributing to the geotechnical instrumentation and monitoring industry growth globally.

Impact of AI on Geotechnical Instrumentation and Monitoring Market

Artificial Intelligence (AI) is significantly transforming the geotechnical instrumentation and monitoring market by enhancing data analysis, predictive capabilities, and real-time decision-making. AI algorithms can analyze vast amounts of data from sensors and instruments embedded in soil, rock, and infrastructure to detect patterns, predict potential risks, and optimize the management of geotechnical projects. In applications such as construction, mining, and civil engineering, AI-powered systems can provide early warnings of ground movement, structural shifts, or seismic activity, helping to prevent costly failures or accidents. Additionally, AI enables autonomous monitoring systems that continuously adjust to changing environmental conditions, improving accuracy and reducing the need for manual intervention. As the demand for smarter, more efficient monitoring solutions grows, AI is driving innovations in geotechnical instrumentation, improving safety, reducing costs, and enhancing overall project efficiency across various industries.

To know about the assumptions considered for the study, Request for Free Sample Report

Geotechnical Instrumentation and Monitoring Market Trends and Dynamics

Driver: Rising infrastructure investments

Developed infrastructure significantly contributes to improved productivity, leading to economic growth and the well-being of the people in many ways. Superior infrastructure facilitates improved productivity in the public and private sectors and is important for regional development. Most countries around the world focus extensively on infrastructure development through heavy investments. A substantial increase in public and private spending on infrastructure development globally is expected to drive the growth of the geotechnical instrumentation and monitoring market. The impact of this driver is presently high and is expected to remain the same during the forecast period as investments in the infrastructure sector are expected to grow every year.

Restraint: High installation and monitoring costs

The cost of geotechnical instruments increases with range, resolution, accuracy, precision, and repeatability. Though these instruments save costs in the long term, the use of advanced sensors, software, and complex data acquisition systems increases the cost of the geotechnical instrumentation and monitoring solutions in the short term. Furthermore, the cost of hardware and software used in instrumentation and monitoring and their related services depends majorly on the complexity of structures. Higher the complexity of the structures, the requirement of sophisticated instruments and advanced tools increases, which increases the overall costs. The high cost required for the installation of geotechnical instrumentation may impede the market’s growth. The high cost of geotechnical instruments acts as a restraining factor for geotechnical instrumentation and monitoring market growth.

Opportunity: Growing opportunities in APAC and GCC countries

The dense population in APAC countries, such as India and China, has paved the way for rapid urbanization. There has been a significant rise in the development of geotechnical structures such as dams, bridges, and tunnels owing to growing infrastructure investments. An increasing number of geotechnical projects has led to the increased adoption of geotechnical instrumentation and monitoring in several developing countries, such as India and China. APAC countries are densely populated, and governments in these countries focus on infrastructural developments for their growth and sustainability. Market players from the Americas and Europe are actively meeting the geotechnical instrumentation and monitoring requirements of various projects in APAC.

APAC countries, such as China, Japan, and Singapore, and GCC countries, such as the UAE, Saudi Arabia, and Qatar, present a huge potential for the geotechnical instrumentation and monitoring market, considering the growing infrastructural investments related to buildings, utilities, bridges, and tunnels in these countries.

Challenge: Lack of skilled operators for installation and calibration of geotechnical instruments

Every infrastructure project has a set of its own critical parameters, and operators of geotechnical instruments are responsible for the identification of the parameters and selecting the appropriate instruments to measure those parameters accordingly. The instrument types as well as their specification, resolution, precision, and range are critical and, hence, skilled operators are needed for handling those instruments. Moreover, the information required during construction and post-construction also changes based on the type of construction. Soil and rock behavior depends on several factors. In some cases, the monitoring of one parameter is sufficient, but in the case of complex structures, the monitoring of several parameters and a correlation between them are essential. To perform all these functions, highly skilled personnel is required. However, the shortage of skilled workforce in APAC and high labor costs in the Americas and Europe are impeding the geotechnical instrumentation and monitoring market growth globally. The impact of this challenge is expected to reduce during the forecast period owing to the growing number of skilled geotechnical instrumentation and monitoring personnel globally.

Geotechnical Instrumentation and Monitoring Market Segmentation

Wireless networking technology to grow at the highest CAGR during the forecast period

Advancements related to wireless technologies have led to the development of devices to which conventional instruments such as strain gauges, piezometers, inclinometers, linear voltage displacement transducers, and accelerometers can be attached for centralized data collection and analysis. The growing demand for wireless networking technologies for geotechnical instrumentation and monitoring is a major factor contributing to the high market growth for wireless networking technology. However, wired networking technology is expected to hold the largest share of the market owing to the larger adoption of wired instruments for geotechnical monitoring.

Buildings & Infrastructures to dominate the geotechnical instrumentation and monitoring market during the forecast period

Increasing awareness about the benefits of geotechnical instrumentation and monitoring and government mandates in several countries for compulsory geotechnical monitoring of structures are some of the major factors contributing to the growth of this segment. The need for regular monitoring of critical structures, such as dams, tunnels, bridges, and buildings, is another major factor contributing to the market growth. The buildings & infrastructure segment is also an early adopter of geotechnical instrumentation and monitoring techniques. Hence, it is likely to continue to lead the market in the coming years.

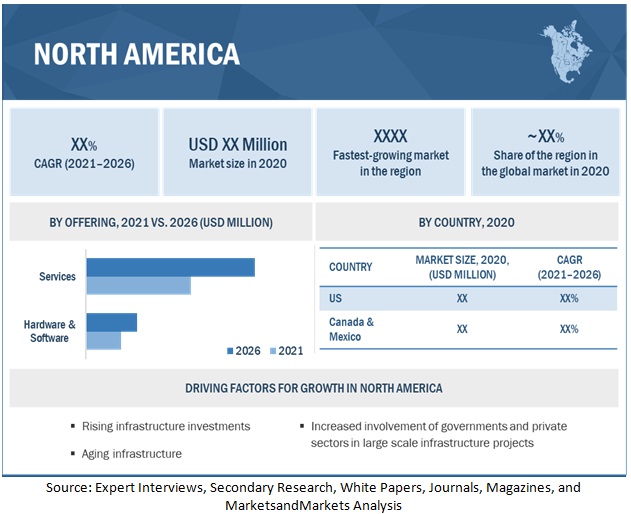

Services to account for the largest share of the geotechnical instrumentation and monitoring market during the forecast period

The number of market players offering geotechnical instrumentation and monitoring services is more than the companies offering instruments and software. Different types of instruments needed for geotechnical monitoring include inclinometers, piezometers, extensometers, and sensors among others. The data collected from these instruments is provided to the software for analysis. These solutions help to identify structural damages at an early stage and enable a high degree of structural safety. The higher concentration of service providers offering various kinds of services is a major factor contributing to the market growth for geotechnical instrumentation and monitoring services.

To know about the assumptions considered for the study, download the pdf brochure

Top Geotechnical Instrumentation and Monitoring Companies - Key Market Players

The major players in the geotechnical instrumentation and monitoring companies are

- Fugro (Netherlands),

- Keller Group (UK),

- Nova Metrix LLC (US),

- Geokon (US),

- Geocomp Corporation (US).

Geotechnical Instrumentation and Monitoring Market Report Scope

|

Report Metric |

Scope |

|

Estimated Market Size |

USD 3.2 billion |

|

Expected Market Size |

USD 5.1 billion |

|

Growth Rate |

CAGR of 9.6% |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Offering, By Networking Technology, By Structure, By End User |

|

Geographies covered |

Americas, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The major players in the geotechnical instrumentation and monitoring market are Fugro (Netherlands), Keller Group (UK), Nova Metrix LLC (US), Geokon (US), Geocomp Corporation (US), Sisgeo S.r.l. (Italy), COWI A/S (Denmark), James Fisher and Sons (UK), Deep Excavation LLC (US) and RST Instruments (Canada). |

The study categorizes the geotechnical instrumentation and monitoring market based on offering, networking technology, structure and end user at the regional and global level.

By Offering

- Hardware & Software

- Services

By Networking Technology

- Wired

- Wireless

By Structure

- Bridges & Tunnels

- Buildings & Utilities

- Dams

- Others

By End User

- Buildings & Infrastructure

- Energy & Power

- Oil & Gas

- Mining

By Region

- Americas

- Europe

- Asia Pacific

- Rest of the World

Recent Developments in Geotechnical Instrumentation and Monitoring Industry

- In August 2021, Fugro (Netherlands) was awarded a design, soil investigation, and monitoring contract for the Tiel-Waardenburg Dike reinforcement project by Mekante Diek. Fugro's scope of work majorly includes design services, consultancy, soil testing, and construction management.

- In July 2021, Keller Group (UK) announced the acquisition of Recon Services (US), a geotechnical and industrial services company. This acquisition was not subjected to any regulatory approvals and was for an initial cash consideration of USD 23 million.

- In June 2020, Geokon (US) launched GK-406, a vibrating wire analyzer that saves data and communicates the results in various formats. It uses spectral analysis technology, which enables the device to read data even in harsh environments.

- In May 2019, Soil Instruments, a brand of Nova Metrix LLC (US), announced the launch of GEOSmart in-place inclinometer. This device consists of MEMS sensors that are mounted on a single cable.

- In January 2015, Geocomp Corporation (US) was awarded a contract by Kajima Corporation, one of the oldest and largest construction companies in Japan, to provide engineering services on the construction and evaluation of an Ice Wall groundwater barrier around the Fukushima Daini Nuclear Power Plant. This contract helped the company to enhance its reputation outside of the US market.

Frequently Asked Questions (FAQ):

What is the current size of the global geotechnical instrumentation and monitoring market?

The geotechnical instrumentation and monitoring market is estimated to be worth USD 3.2 billion in 2021 and is projected to reach USD 5.1 billion by 2026, at a CAGR of 9.6%. Rising infrastructure investments, increasing adoption of geotechnical instruments to prevent structural failures, government regulations for sustainable structures and the growing awareness about the benefits of instrumentation and monitoring tools are some of the prominent factors driving the growth of the geotechnical instrumentation and monitoring market globally.

Who are the winners in the global geotechnical instrumentation and monitoring market?

Companies such as Fugro (Netherlands), Keller Group (UK), Nova Metrix LLC (US), Geokon (US), Geocomp Corporation (US), fall under the winners category.

What is the COVID-19 impact on market players in the geotechnical instrumentation and monitoring market?

The key market players in the geotechnical instrumentation and monitoring market, such as Fugro (Netherlands) and Keller Group (UK) witnessed a higher growth in the third quarter of 2020 as compared with the first two quarters. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 MARKET: GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

1.3.5 INCLUSIONS AND EXCLUSIONS AT TECHNOLOGY LEVEL

1.3.6 INCLUSIONS AND EXCLUSIONS AT STRUCTURE LEVEL

1.3.7 INCLUSIONS AND EXCLUSIONS AT END USER LEVEL

1.3.8 INCLUSIONS AND EXCLUSIONS AT REGIONAL LEVEL

1.3.9 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH APPROACH

FIGURE 3 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing the market share by bottom-up analysis (demand side)

FIGURE 4 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing the market share by top-down analysis (supply side)

FIGURE 5 TOP-DOWN APPROACH

2.2.3 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.2.5 GROWTH FORECAST ASSUMPTIONS

TABLE 1 MARKET GROWTH ASSUMPTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET

3 EXECUTIVE SUMMARY (Page No. - 50)

3.1 POST-COVID-19: REALISTIC SCENARIO

3.2 POST-COVID-19: OPTIMISTIC SCENARIO

3.3 POST-COVID-19: PESSIMISTIC SCENARIO

FIGURE 9 PRE AND POST-COVID-19 SCENARIO ANALYSIS FOR GTIM MARKET, 2017–2026 (USD MILLION)

FIGURE 10 GTIM MARKET, 2021–2026 (USD MILLION)

FIGURE 11 SERVICES ESTIMATED TO ACCOUNT FOR LARGER SHARE OF GTIM MARKET DURING FORECAST PERIOD

FIGURE 12 BRIDGES & TUNNELS ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF GTIM MARKET DURING FORECAST PERIOD

FIGURE 13 WIRELESS NETWORKING TECHNOLOGY TO REGISTER HIGHER GROWTH THAN WIRED NETWORKING TECHNOLOGY DURING FORECAST PERIOD

FIGURE 14 BY END USER, BUILDINGS & INFRASTRUCTURE TO DOMINATE GTIM MARKET DURING FORECAST PERIOD

FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST GROWTH IN GTIM MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET

FIGURE 16 INCREASING INFRASTRUCTURE INVESTMENTS TO SIGNIFICANTLY CONTRIBUTE TO MARKET GROWTH

4.2 MARKET, BY NETWORKING TECHNOLOGY

FIGURE 17 WIRED NETWORKING TECHNOLOGY TO ACCOUNT FOR LARGER MARKET SIZE THAN WIRELESS NETWORKING TECHNOLOGY DURING FORECAST PERIOD

4.3 MARKET, BY STRUCTURE

FIGURE 18 BRIDGES & TUNNELS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY END USER

FIGURE 19 BUILDINGS & INFRASTRUCTURE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY OFFERING

FIGURE 20 SERVICES TO ACCOUNT FOR LARGER MARKET SHARE THAN HARDWARE & SOFTWARE DURING FORECAST PERIOD

4.6 MARKET, BY REGION

FIGURE 21 AMERICAS TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.7 MARKET IN EUROPE, BY STRUCTURE AND COUNTRY, 2020

FIGURE 22 BRIDGES & TUNNELS AND UK ACCOUNTED FOR LARGEST SHARE OF MARKET IN EUROPE IN 2020

5 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 MARKET DYNAMICS: MARKET

5.2.1 DRIVERS

FIGURE 24 IMPACT ANALYSIS OF DRIVERS ON MARKET

5.2.1.1 Rising infrastructure investments

5.2.1.2 Adoption of geotechnical instrumentation to prevent structural failures

5.2.1.3 Government regulations for sustainable structures

5.2.1.4 Growing awareness about benefits of instrumentation and monitoring tools

TABLE 3 KEY BENEFITS OF GEOTECHNICAL INSTRUMENTATION AND MONITORING

FIGURE 25 IMPROVING CONDITION OF BRIDGES IN THE US

5.2.2 RESTRAINTS

FIGURE 26 IMPACT ANALYSIS OF RESTRAINTS ON MARKET

5.2.2.1 High installation and monitoring costs

5.2.3 OPPORTUNITIES

FIGURE 27 IMPACT ANALYSIS OF RESTRAINTS ON MARKET

5.2.3.1 Growing opportunities in APAC and GCC countries

5.2.3.2 Increasing investments in oil & gas and major energy projects

5.2.4 CHALLENGES

FIGURE 28 IMPACT ANALYSIS OF CHALLENGES ON MARKET

5.2.4.1 Lack of skilled operators for installation and calibration of geotechnical instruments

5.2.4.2 Technical challenges and operational factors

5.2.4.3 Generation of inaccurate results owing to errors in readings

TABLE 4 ERRORS AND CORRECTIVE MEASURES

5.2.4.4 Adverse impact of COVID-19 on various industries

FIGURE 29 GLOBAL OIL AND GAS SUPPLY INVESTMENT REDUCED BY 32% FROM 2019 TO 2020 DUE TO PANDEMIC

6 INDUSTRY TRENDS (Page No. - 70)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 30 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET: VALUE CHAIN ANALYSIS

TABLE 5 MARKET: VALUE CHAIN ANALYSIS

6.3 PRICING ANALYSIS: AVERAGE SELLING PRICE TRENDS

FIGURE 31 AVERAGE SELLING PRICE (ASP) OF STANDPIPE PIEZOMETERS, BY DIMENSION (USD)

6.4 LIST OF KEY PATENTS AND INNOVATIONS

FIGURE 32 NUMBER OF PATENTS GRANTED FOR GEOTECHNICAL INSTRUMENTATION AND MONITORING (2010–2020)

FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FOR GEOTECHNICAL INSTRUMENTATION AND MONITORING, 2010–2020

TABLE 6 TOP 20 PATENT OWNERS FOR GEOTECHNICAL INSTRUMENTATION AND MONITORING, 2010–2020

TABLE 7 KEY PATENTS AND INNOVATIONS IN MARKET, 2010–2020

6.5 KEY TECHNOLOGY TRENDS

6.5.1 NON-DESTRUCTIVE FIELD TESTING

6.5.2 WIRED AND WIRELESS SENSOR NETWORKS

6.5.3 DISTRIBUTION OF PROCESSED DATA OVER INTERNET

6.5.4 ULTRA-LOW-POWER STRAIN GAUGES

6.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 MARKET: PORTER’S FIVE FORCES ANALYSIS, 2020

FIGURE 35 IMPACT OF PORTER’S FIVE FORCES ON MARKET, 2020

TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS, 2020

6.6.1 THREAT OF NEW ENTRANTS

6.6.2 THREAT OF SUBSTITUTES

6.6.3 BARGAINING POWER OF SUPPLIERS

6.6.4 BARGAINING POWER OF BUYERS

6.6.5 INTENSITY OF COMPETITIVE RIVALRY

6.7 CASE STUDIES

6.7.1 TUNNEL MONITORING

TABLE 9 ENCARDIO-RITE: ROHTANG PASS TUNNEL MONITORING

6.7.2 BRIDGE MONITORING

TABLE 10 GEOCOMP CORPORATION: BAYONNE BRIDGE INSTRUMENTATION AND MONITORING

6.7.3 GEOTECHNICAL INSTRUMENTATION AND MONITORING FOR HYDROELECTRIC POWER PLANT

TABLE 11 HMA GEOTECHNICAL: INSTRUMENTATION AND MONITORING FOR ASAHAN NO.3 HYDROELECTRIC POWER PLANT, INDONESIA

6.8 TRADE DATA

TABLE 12 EXPORT DATA FOR INSTRUMENTS USED FOR SURVEYING, HS CODE: 9015 (USD MILLION)

FIGURE 36 INSTRUMENTS USED FOR SURVEYING, EXPORT VALUES FOR MAJOR COUNTRIES, 2016–-2020

TABLE 13 IMPORT DATA FOR INSTRUMENTS USED FOR SURVEYING, HS CODE: 9015 (USD MILLION)

FIGURE 37 INSTRUMENTS USED FOR SURVEYING, IMPORT VALUES FOR MAJOR COUNTRIES, 2016–2020

TABLE 14 EXPORT DATA FOR INSTRUMENTS FOR MEASURING LIQUID AND GAS PARAMETERS, HS CODE: 9026 (USD MILLION)

FIGURE 38 INSTRUMENTS FOR MEASURING LIQUID AND GAS PARAMETERS, EXPORT VALUE FOR MAJOR COUNTRIES, 2016-2020

TABLE 15 INSTRUMENTS FOR MEASURING LIQUID AND GAS PARAMETERS, HS CODE: 9026 (USD MILLION)

FIGURE 39 INSTRUMENTS FOR MEASURING LIQUID AND GAS PARAMETERS, IMPORT VALUE FOR MAJOR COUNTRIES, 2016–2020

6.9 REGULATORY ENVIRONMENT

6.9.1 EUROPE

6.9.2 US

6.10 MARKET ECOSYSTEM

FIGURE 40 MARKET ECOSYSTEM

6.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 41 REVENUE SHIFT FOR MARKET

6.11.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

7 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET, BY OFFERING (Page No. - 89)

7.1 INTRODUCTION

FIGURE 42 GTIM MARKET, BY OFFERING

TABLE 16 GTIM MARKET, BY OFFERING, 2017–2020 (USD MILLION)

FIGURE 43 BY OFFERING, SERVICES TO LEAD GTIM MARKET DURING FORECAST PERIOD

TABLE 17 GTIM MARKET, BY OFFERING, 2021–2026 (USD MILLION)

FIGURE 44 PRE-COVID-19 AND POST-COVID-19 ANALYSIS FOR GTIM MARKET FOR HARDWARE & SOFTWARE, 2021–2026 (USD MILLION)

7.2 HARDWARE & SOFTWARE

7.2.1 PROPER HARDWARE COMPONENTS ESSENTIAL FOR MONITORING PRESSURE, LOAD, AND STRAIN AFFECTING THE STRUCTURE

TABLE 18 GTIM MARKET FOR HARDWARE & SOFTWARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 GTIM MARKET FOR HARDWARE & SOFTWARE, BY REGION, 2021–2026 (USD MILLION)

7.2.2 SENSORS

7.2.3 PIEZOMETERS

7.2.4 INCLINOMETERS

7.2.5 EXTENSOMETERS

7.2.5.1 Settlement extensometer

7.2.5.2 Magnet extensometer

7.2.5.3 Rod extensometer

7.2.6 SETTLEMENT GAUGES

7.2.7 SETTLEMENT PLATES

7.2.8 GEODETIC TARGETS AND SURVEY MARKERS

7.2.9 DATA ACQUISITION SYSTEM (DAS)

7.2.10 SOFTWARE

7.2.11 OTHERS

7.3 SERVICES

7.3.1 SEVERAL MARKET PLAYERS OFFER SERVICES RELATED TO DESIGN, INSTALLATION OF INSTRUMENTS, AND CONSULTATION

TABLE 20 GTIM MARKET FOR SERVICES, BY REGION, 2017–2020 (USD MILLION)

FIGURE 45 APAC TO WITNESS HIGHEST GROWTH RATE IN GTIM SERVICES MARKET DURING FORECAST PERIOD

TABLE 21 GTIM MARKET FOR SERVICES, BY REGION, 2021–2026 (USD MILLION)

7.4 IMPACT OF COVID-19 ON OFFERING

8 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET, BY NETWORKING TECHNOLOGY (Page No. - 99)

8.1 INTRODUCTION

FIGURE 46 GTIM MARKET, BY NETWORKING TECHNOLOGY

FIGURE 47 WIRED NETWORKING TECHNOLOGY TO LEAD GTIM MARKET DURING FORECAST PERIOD

TABLE 22 MARKET, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 23 GTIM MARKET, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

8.2 WIRED NETWORKING TECHNOLOGY

8.2.1 WIRED TECHNOLOGY USED FOR SEVERAL APPLICATIONS THAT ARE ESSENTIAL FOR EFFECTIVE MONITORING OF STRUCTURES

TABLE 24 GTIM MARKET FOR WIRED NETWORKING TECHNOLOGY, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 GTIM MARKET FOR WIRED NETWORKING TECHNOLOGY, BY REGION, 2021–2026 (USD MILLION)

FIGURE 48 PRE-COVID-19 AND POST-COVID-19 ANALYSIS OF GTIM MARKET FOR WIRELESS NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

8.3 WIRELESS NETWORKING TECHNOLOGY

8.3.1 WIRELESS INSTRUMENTS EXTENSIVELY USED IN GEOTECHNICAL APPLICATIONS

TABLE 26 GTIM MARKET FOR WIRELESS NETWORKING TECHNOLOGY, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 GTIM MARKET FOR WIRELESS NETWORKING TECHNOLOGY, BY REGION, 2021–2026 (USD MILLION)

8.4 IMPACT OF COVID-19 ON GTIM MARKET, BY NETWORKING TECHNOLOGY

9 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET, BY STRUCTURE (Page No. - 105)

9.1 INTRODUCTION

FIGURE 49 GTIM MARKET, BY STRUCTURE

TABLE 28 GTIM MARKET, BY STRUCTURE, 2017-2020 (USD MILLION)

FIGURE 50 BY STRUCTURE, BRIDGES & TUNNELS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 29 GTIM MARKET, BY STRUCTURE, 2021–2026 (USD MILLION)

FIGURE 51 PRE-COVID-19 AND POST-COVID-19 ANALYSIS OF GTIM MARKET FOR TUNNELS & BRIDGES, 2021–2026 (USD MILLION)

9.2 BRIDGES & TUNNELS

9.2.1 INCREASING NUMBER OF TUNNEL PROJECTS EXPECTED TO DRIVE GROWTH OF GTIM MARKET FOR BRIDGES & TUNNELS

TABLE 30 MAJOR BRIDGE & TUNNEL PROJECTS

TABLE 31 GTIM MARKET FOR BRIDGES & TUNNELS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 52 AMERICAS TO ACCOUNT FOR LARGEST SHARE OF GTIM MARKET FOR BRIDGES & TUNNELS DURING FORECAST PERIOD

TABLE 32 GTIM MARKET FOR BRIDGES & TUNNELS, BY REGION, 2021–2026 (USD MILLION)

9.3 BUILDINGS & UTILITIES

9.3.1 GROWING URBANIZATION HAS LED TO INCREASING NUMBER OF BUILDINGS GLOBALLY

TABLE 33 MAJOR BUILDING & UTILITY PROJECTS

TABLE 34 GTIM MARKET FOR BUILDINGS & UTILITIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 GTIM MARKET FOR BUILDINGS & UTILITIES, BY REGION, 2021–2026 (USD MILLION)

9.4 DAMS

9.4.1 NEED TO ENSURE SAFETY LED TO INCREASED ADOPTION OF GTIM TECHNIQUES FOR DAMS

TABLE 36 GTIM MARKET FOR DAMS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 53 APAC TO REGISTER HIGHEST GROWTH IN GTIM MARKET FOR DAMS DURING FORECAST PERIOD

TABLE 37 GTIM MARKET FOR DAMS, BY REGION, 2021–2026 (USD MILLION)

9.5 OTHERS

TABLE 38 MARKET FOR OTHER STRUCTURES, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 GTIM MARKET FOR OTHER STRUCTURES, BY REGION, 2021–2026 (USD MILLION)

9.6 IMPACT OF COVID-19 ON STRUCTURES

10 APPLICATIONS OF GTIM TECHNIQUES (Page No. - 116)

10.1 INTRODUCTION

FIGURE 54 APPLICATIONS OF GTIM TECHNIQUES

TABLE 40 APPLICATIONS, PURPOSE OF MONITORING, AND INSTRUMENTS USED

10.2 MEASUREMENT OF PORE WATER PRESSURE

10.2.1 PREDICTION OF SLOPE STABILITY

10.3 MEASUREMENT OF ROCK AND SOIL STRESS

10.3.1 SOIL STABILITY

10.3.2 ROCK STABILITY

10.4 MONITORING OF LATERAL DEFORMATION

10.5 MONITORING OF VERTICAL DEFORMATION

11 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET, BY END USER (Page No. - 119)

11.1 INTRODUCTION

FIGURE 55 GTIM MARKET, BY END USER

TABLE 41 MARKET, BY END USER, 2017-2020 (USD MILLION)

FIGURE 56 BY END USER, BUILDINGS & INFRASTRUCTURE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 42 GTIM MARKET, BY END USER, 2021–2026 (USD MILLION)

FIGURE 57 PRE-COVID-19 AND POST-COVID-19 ANALYSIS OF GTIM MARKET FOR BUILDINGS & INFRASTRUCTURE, 2021–2026 (USD MILLION)

11.2 BUILDINGS & INFRASTRUCTURE

11.2.1 INCREASING INFRASTRUCTURE INVESTMENTS TO PROPEL GTIM MARKET FOR BUILDINGS & INFRASTRUCTURE IN AMERICAS

TABLE 43 GTIM MARKET FOR BUILDINGS & INFRASTRUCTURE, BY REGION, 2017–2020 (USD MILLION)

FIGURE 58 AMERICAS TO ACCOUNT FOR LARGEST SHARE OF GTIM MARKET FOR BUILDINGS & INFRASTRUCTURE DURING FORECAST PERIOD

TABLE 44 GTIM MARKET FOR BUILDINGS & INFRASTRUCTURE, BY REGION, 2021–2026 (USD MILLION)

11.3 ENERGY & POWER

11.3.1 INCREASING NUCLEAR, WIND ENERGY, HYDROELECTRIC POWER, AND GEOTHERMAL PROJECTS TO PROPEL MARKET GROWTH

TABLE 45 GTIM MARKET FOR ENERGY & POWER, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 GTIM MARKET FOR ENERGY & POWER, BY REGION, 2021–2026 (USD MILLION)

11.4 OIL & GAS

11.4.1 GTIM TECHNIQUES ENABLE EVALUATION OF SUBSURFACE STABILITY IN OIL & GAS SECTOR

TABLE 47 MARKET FOR OIL & GAS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 59 APAC TO REGISTER HIGHEST CAGR IN GTIM MARKET FOR OIL & GAS DURING FORECAST PERIOD

TABLE 48 GTIM MARKET FOR OIL & GAS, BY REGION, 2021–2026 (USD MILLION)

11.5 MINING

11.5.1 GTIM TECHNIQUES HELP IN PREDICTING ALARMING SITUATIONS TO ENSURE SAFETY OF MINES AND MINERS FROM HAZARDS

TABLE 49 MARKET FOR MINING, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 GTIM MARKET FOR MINING, BY REGION, 2021–2026 (USD MILLION)

11.6 IMPACT OF COVID-19 ON END USER

12 GEOGRAPHIC ANALYSIS (Page No. - 129)

12.1 INTRODUCTION

FIGURE 60 GTIM MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 51 GTIM MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 GTIM MARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 61 PRE-COVID-19 AND POST-COVID-19 ANALYSIS OF GTIM MARKET IN AMERICAS, 2021–2026 (USD MILLION)

12.2 AMERICAS

TABLE 53 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 GTIM MARKET IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

TABLE 55 MARKET IN AMERICAS, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 56 MARKET IN AMERICAS, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 57 MARKET IN AMERICAS, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 58 MARKET IN AMERICAS, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 59 MARKET IN AMERICAS, BY STRUCTURE, 2017–2020 (USD MILLION)

TABLE 60 GTIM MARKET IN AMERICAS, BY STRUCTURE, 2021–2026 (USD MILLION)

TABLE 61 MARKET IN AMERICAS, BY END USER, 2017–2020 (USD MILLION)

TABLE 62 MARKET IN AMERICAS, BY END USER, 2021–2026 (USD MILLION)

12.2.1 NORTH AMERICA

FIGURE 62 SNAPSHOT OF GTIM MARKET IN NORTH AMERICA

TABLE 63 GTIM MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 64 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 65 MARKET IN NORTH AMERICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 66 MARKET IN NORTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 67 MARKET IN NORTH AMERICA, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 68 GTIM MARKET IN NORTH AMERICA, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.2.1.1 US

12.2.1.1.1 Increasing infrastructure investments and aging infrastructure to drive market growth in US

TABLE 69 GTIM MARKET IN US, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 70 MARKET IN US, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 71 MARKET IN US, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 72 MARKET IN US, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.2.1.2 Canada & Mexico

12.2.1.2.1 Growing infrastructure projects in Canada & Mexico to drive market growth

TABLE 73 GTIM MARKET IN CANADA & MEXICO, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 74 MARKET IN CANADA & MEXICO, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 75 MARKET IN CANADA & MEXICO, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 76 MARKET IN CANADA & MEXICO, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.2.2 SOUTH AMERICA

12.2.2.1 Growing demand for new infrastructure to create growth opportunities in South America

FIGURE 63 SNAPSHOT OF GTIM MARKET IN SOUTH AMERICA

TABLE 77 GTIM MARKET IN SOUTH AMERICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 78 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET IN SOUTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 79 GTIM MARKET IN SOUTH AMERICA, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 80 GTIM MARKET IN SOUTH AMERICA, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.2.3 IMPACT OF COVID-19 ON AMERICAS

12.3 EUROPE

FIGURE 64 SNAPSHOT OF GTIM MARKET IN EUROPE

TABLE 81 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 82 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 83 MARKET IN EUROPE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 84 MARKET IN EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 85 GTIM MARKET IN EUROPE, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 86 MARKET IN EUROPE, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 87 MARKET IN EUROPE, BY STRUCTURE, 2017–2020 (USD MILLION)

TABLE 88 MARKET IN EUROPE, BY STRUCTURE, 2021–2026 (USD MILLION)

TABLE 89 MARKET IN EUROPE, BY END USER, 2017–2020 (USD MILLION)

TABLE 90 MARKET IN EUROPE, BY END USER, 2021–2026 (USD MILLION)

12.3.1 UK

12.3.1.1 Growing demand for monitoring increasing number of structures expected to drive market growth in UK

TABLE 91 GTIM MARKET IN UK, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 92 MARKET IN UK, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 93 MARKET IN UK, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 94 MARKET IN UK, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Growing number of infrastructure projects expected to drive market growth in Germany

TABLE 95 GTIM MARKET IN GERMANY, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 96 MARKET IN GERMANY, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 97 MARKET IN GERMANY, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 98 MARKET IN GERMANY, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.3.3 NETHERLANDS

12.3.3.1 Growing R&D activities related to GTIM solutions to drive market growth in Netherlands

TABLE 99 GTIM MARKET IN NETHERLANDS, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 100 MARKET IN NETHERLANDS, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 101 MARKET IN NETHERLANDS, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 102 MARKET IN NETHERLANDS, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Increasing construction projects and infrastructure investments to fuel market growth in France

TABLE 103 GTIM MARKET IN FRANCE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 104 MARKET IN FRANCE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 105 MARKET IN FRANCE, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 106 MARKET IN FRANCE, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.3.5 ITALY

12.3.5.1 Market in Italy expected to witness robust growth due to increasing number of construction projects

TABLE 107 GTIM MARKET IN ITALY, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 108 MARKET IN ITALY, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 109 MARKET IN ITALY, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 110 MARKET IN ITALY, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.3.6 REST OF EUROPE

TABLE 111 GTIM MARKET IN REST OF EUROPE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 112 MARKET IN REST OF EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 113 MARKET IN REST OF EUROPE, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 114 MARKET IN REST OF EUROPE, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.3.7 IMPACT OF COVID-19 ON EUROPE

12.4 ASIA PACIFIC (APAC)

FIGURE 65 SNAPSHOT OF GTIM MARKET IN APAC

TABLE 115 GTIM MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 116 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 117 MARKET IN APAC, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 118 MARKET IN APAC, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 119 GTIM MARKET IN APAC, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 120 MARKET IN APAC, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 121 MARKET IN APAC, BY STRUCTURE, 2017–2020 (USD MILLION)

TABLE 122 MARKET IN APAC, BY STRUCTURE, 2021–2026 (USD MILLION)

TABLE 123 MARKET IN APAC, BY END USER, 2017–2020 (USD MILLION)

TABLE 124 GTIM MARKET IN APAC, BY END USER, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Development of advanced GTIM solutions and growing infrastructure investments to drive market growth in China

TABLE 125 GTIM MARKET IN CHINA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 126 GTIM MARKET IN CHINA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 127 GTIM MARKET IN CHINA, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 128 GTIM MARKET IN CHINA, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Increasing number of infrastructure projects and need for regular monitoring of structures to drive market growth in Japan

TABLE 129 GTIM MARKET IN JAPAN, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 130 GTIM MARKET IN JAPAN, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 131 GTIM MARKET IN JAPAN, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 132 GTIM MARKET IN JAPAN, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.4.3 AUSTRALIA

12.4.3.1 Adoption of GTIM solutions for almost all structures expected to drive market growth in Australia

TABLE 133 GTIM MARKET IN AUSTRALIA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 134 GTIM MARKET IN AUSTRALIA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 135 GTIM MARKET IN AUSTRALIA, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 136 GTIM MARKET IN AUSTRALIA, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.4.4 SOUTH KOREA

12.4.4.1 Increasing number of skyscrapers and other infrastructure projects expected to drive market growth in South Korea

TABLE 137 GTIM MARKET IN SOUTH KOREA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 138 GTIM MARKET IN SOUTH KOREA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 139 GTIM MARKET IN SOUTH KOREA, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 140 GTIM MARKET IN SOUTH KOREA, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.4.5 INDIA

12.4.5.1 Growing number of infrastructure projects to boost market growth in India

TABLE 141 GTIM MARKET IN INDIA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 142 GTIM MARKET IN INDIA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 143 GTIM MARKET IN INDIA, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 144 GTIM MARKET IN INDIA, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.4.6 INDONESIA

12.4.6.1 Aggressive investments to drive market growth in Indonesia

TABLE 145 GTIM MARKET IN INDONESIA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 146 GTIM MARKET IN INDONESIA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 147 GTIM MARKET IN INDONESIA, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 148 GTIM MARKET IN INDONESIA, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.4.7 SINGAPORE

12.4.7.1 Commencement of mega construction projects to drive market growth in Singapore

TABLE 149 GTIM MARKET IN SINGAPORE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 150 GTIM MARKET IN SINGAPORE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 151 GTIM MARKET IN SINGAPORE, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 152 GTIM MARKET IN SINGAPORE, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.4.8 REST OF APAC

TABLE 153 GTIM MARKET IN REST OF APAC, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 154 GTIM MARKET IN REST OF APAC, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 155 GTIM MARKET IN REST OF APAC, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 156 GTIM MARKET IN REST OF APAC, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.4.9 IMPACT OF COVID-19 ON APAC

12.5 REST OF THE WORLD (ROW)

TABLE 157 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 158 GTIM MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 159 GTIM MARKET IN ROW, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 160 GTIM MARKET IN ROW, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 161 GTIM MARKET IN ROW, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 162 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET IN ROW, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 163 GTIM MARKET IN ROW, BY STRUCTURE, 2017–2020 (USD MILLION)

TABLE 164 GTIM MARKET IN ROW, BY STRUCTURE, 2021–2026 (USD MILLION)

TABLE 165 GTIM MARKET IN ROW, BY END USER, 2017–2020 (USD MILLION)

TABLE 166 GTIM MARKET IN ROW, BY END USER, 2021–2026 (USD MILLION)

12.5.1 MIDDLE EAST

12.5.1.1 Increasing number of buildings and growing need to monitor skyscrapers to drive market growth in Middle East

TABLE 167 MARKET IN MIDDLE EAST, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 168 GTIM MARKET IN MIDDLE EAST, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 169 GTIM MARKET IN MIDDLE EAST, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 170 GTIM MARKET IN MIDDLE EAST, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.5.2 AFRICA

12.5.2.1 Mega infrastructure and energy projects to drive market growth in Africa

TABLE 171 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET IN AFRICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 172 GTIM MARKET IN AFRICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 173 GTIM MARKET IN AFRICA, BY NETWORKING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 174 GTIM MARKET IN AFRICA, BY NETWORKING TECHNOLOGY, 2021–2026 (USD MILLION)

12.5.3 IMPACT OF COVID-19 ON ROW

13 COMPETITIVE LANDSCAPE (Page No. - 174)

13.1 INTRODUCTION

FIGURE 66 COMPANIES ADOPTED CONTRACT AS KEY GROWTH STRATEGY FROM 2018 TO 2020

13.2 MARKET SHARE ANALYSIS

TABLE 175 MARKET SHARE ANALYSIS OF KEY COMPANIES IN GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET, 2020

13.3 MARKET EVALUATION FRAMEWORK

FIGURE 67 MARKET EVALUATION FRAMEWORK

13.4 HISTORICAL REVENUE ANALYSIS, 2016-2020

FIGURE 68 HISTORICAL REVENUE ANALYSIS OF MAJOR COMPANIES IN MARKET, 2016-2020 (USD BILLION)

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STAR

13.5.2 EMERGING LEADER

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

FIGURE 69 MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2020

13.6 STARTUP/SME EVALUATION QUADRANT

13.6.1 PROGRESSIVE COMPANIES

13.6.2 RESPONSIVE COMPANIES

13.6.3 DYNAMIC COMPANIES

13.6.4 STARTING BLOCKS

FIGURE 70 MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2020

TABLE 176 COMPANY PRODUCT FOOTPRINT

TABLE 177 COMPANY APPLICATION FOOTPRINT

TABLE 178 COMPANY INDUSTRY FOOTPRINT

TABLE 179 COMPANY REGION FOOTPRINT

13.7 COMPETITIVE SCENARIO

13.7.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 180 MARKET, PRODUCT LAUNCHES & DEVELOPMENTS, 2016-2021

13.7.2 DEALS

TABLE 181 GEOTECHNICAL INSTRUMENTATION AND MONITORING MARKET, DEALS (CONTRACTS, PARTNERSHIPS, AGREEMENTS, COLLABORATIONS, AND MERGERS & ACQUISITIONS), 2015–2021

14 COMPANY PROFILES (Page No. - 195)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 FUGRO

TABLE 182 FUGRO: COMPANY OVERVIEW

FIGURE 71 FUGRO: COMPANY SNAPSHOT

TABLE 183 FUGRO: DEALS

14.2.1.4 MnM view

14.2.2 KELLER GROUP

TABLE 184 KELLER GROUP: COMPANY OVERVIEW

FIGURE 72 KELLER GROUP: COMPANY SNAPSHOT

TABLE 185 KELLER GROUP: DEALS

TABLE 186 KELLER GROUP: OTHERS

14.2.3 NOVA METRIX LLC

TABLE 187 NOVA METRIX LLC: COMPANY OVERVIEW

TABLE 188 NOVA METRIX LLC: PRODUCT LAUNCHES

14.2.4 GEOKON

TABLE 189 GEOKON: COMPANY OVERVIEW

TABLE 190 GEOKON: PRODUCT LAUNCHES

TABLE 191 GEOKON: OTHERS

14.2.5 GEOCOMP CORPORATION

TABLE 192 GEOCOMP CORPORATION: COMPANY OVERVIEW

TABLE 193 GEOCOMP CORPORATION: DEALS

14.2.6 SISGEO S.R.L.

TABLE 194 SISGEO S.R.L.: COMPANY OVERVIEW

TABLE 195 SISGEO S.R.L.: PRODUCT LAUNCHES

TABLE 196 SISGEO S.R.L.: DEALS

14.2.7 COWI A/S

TABLE 197 COWI A/S: COMPANY OVERVIEW

FIGURE 73 COWI A/S: COMPANY SNAPSHOT

TABLE 198 COWI A/S: DEALS

14.2.8 JAMES FISHER AND SONS

TABLE 199 JAMES FISHER AND SONS: COMPANY OVERVIEW

FIGURE 74 JAMES FISHER AND SONS: COMPANY SNAPSHOT

TABLE 200 JAMES FISHER AND SONS: DEALS

14.2.9 DEEP EXCAVATION LLC

TABLE 201 DEEP EXCAVATION LLC: COMPANY OVERVIEW

TABLE 202 DEEP EXCAVATION LLC: PRODUCT LAUNCHES

14.2.10 RST INSTRUMENTS

TABLE 203 RST INSTRUMENTS: COMPANY OVERVIEW

TABLE 204 RST INSTRUMENTS: PRODUCT LAUNCHES

14.3 OTHER KEY PLAYERS

14.3.1 GEOMOTION SINGAPORE

14.3.2 EUSTIS ENGINEERING

14.3.3 DST CONSULTING ENGINEERS INC.

14.3.4 GEOSIG LTD.

14.3.5 SMART STRUCTURES

14.3.6 AMBERG TECHNOLOGIES

14.3.7 PMT INFRASCIENCE

14.3.8 TERRACON

14.3.9 GAIACOMM LTD.

14.3.10 GEOTECHNICS LIMITED

14.3.11 MAE ADVANCED GEOPHYSICS INSTRUMENTS

14.3.12 PETRA GEOSCIENCES, INC.

14.3.13 GEOCISA UK

14.3.14 GEOSENSE

14.3.15 S.W. COLE ENGINEERING, INC.

14.3.16 WOOD PLC

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 239)

15.1 INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

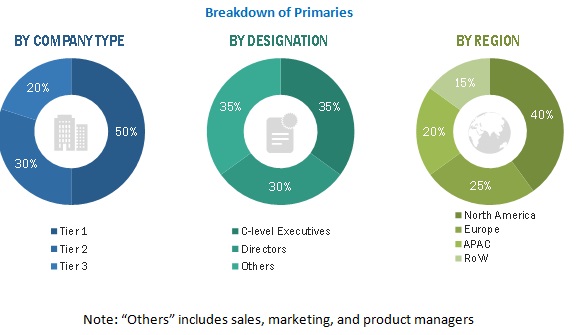

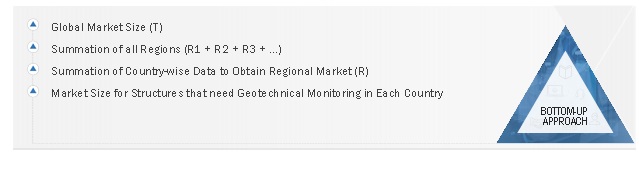

The research study involved 4 major activities in estimating the size of the geotechnical instrumentation and monitoring market. Exhaustive secondary research has been done to collect important information about the market, peer market, and the parent market. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In secondary research, various secondary sources have been referred to for obtaining the information that was needed for the study. Various secondary sources that were used for the research include corporate filings such as annual reports, press releases, investor presentations, and financial statements, trade, business, and professional associations, white papers, geotechnical instrumentation and monitoring-based marketing-related journals, certified publications, and articles from recognized authors and databases.

In the geotechnical instrumentation and monitoring market report, the top-down, as well as the bottom-up approaches, have been used for the estimation of the global market size, along with several other dependent submarkets. The major players in the market were identified with the help of extensive secondary research and their presence in the market using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding the geotechnical instrumentation and monitoring market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific, and the Rest of the World Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the geotechnical instrumentation and monitoring market, as well as that of various other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top line investments and spending in the ecosystems. Further, major developments in the key market area have been considered

- Information related to the revenue generated by key players in the market was obtained

- Multiple on-field discussions have been conducted with key opinion leaders from major companies that develop geotechnical instruments and software and provide geotechnical services as well as supply-related services

- Geographic splits have been estimated using secondary sources based on various factors, such as the number of players in a specific region, types of services provided by them or the instruments manufactured, and the various end users related to the market

- Analyzing the market in each country and identifying instrument manufacturers, software providers and service providers in the geotechnical instrumentation and monitoring market

- Estimating the size of the market in each country

- Estimating the size of the market in each region by the summation of country-wise markets

- Identifying the upcoming geotechnical instrumentation and monitoring projects by various companies in different regions and forecasting the market size based on these developments and other critical parameters.

- Arriving at the global market size by the summation of the market size for all regions

Market Size Estimation Methodology-Bottom-up approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall geotechnical instrumentation and monitoring market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market size has been validated using both top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, describe, segment, and forecast the size of the geotechnical instrumentation and monitoring market, by offering, networking technology, structure, and end user, in terms of value

- To forecast the market size for various segments with respect to four main regions, namely, the Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW)– in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze macro and micro markets with respect to growth trends, prospects, and contributions to the overall market

- To analyze industry trends, pricing data, patents and innovations, and trade data (exports and imports data) related to the market

- To analyze opportunities for various stakeholders and provide a detailed competitive landscape of the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To analyze competitive developments such as contracts, product launches/developments, expansions, and research and development (R&D) activities carried out by market players in the geotechnical instrumentation and monitoring market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and RoW

- Detailed analysis of various offerings (hardware & software, services) for each country

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Geotechnical Instrumentation and Monitoring Market