Environmental Remediation Market Size, Share, Trends and Growth

Environmental Remediation Market by Environmental Medium (Soil, Groundwater), Site Type (Private, Public), Technology (Air Sparging, Soil Washing, Chemical Treatment, Bioremediation, Electrokinetic Remediation, Excavation) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The environmental remediation market is projected to reach USD 210.56 billion in 2030 from USD 141.87 billion in 2025, growing at a CAGR of 8.2% during the forecast period. Environmental remediation refers to the application of technologies and processes to remove, contain, or neutralize pollutants from soil, water, and other environmental media, restoring them to safe and usable conditions. The growth is propelled by tightening global environmental regulations, increasing industrial and urban contamination, and the urgent push for sustainable land and water management. Furthermore, heightened public awareness and rising government as well as private investments in eco-innovative remediation solutions are accelerating adoption worldwide.

KEY TAKEAWAYS

- The North America environmental remediation market accounted for a 32.6% revenue share in 2024.

- By environmental medium, the groundwater segment is expected to register the highest CAGR of 9.8%.

- By site type, the private segment is expected to dominate the market.

- By technology, the bioremediation segment is projected to grow at the fastest rate from 2025 to 2030.

- By application, the oil & gas segment is expected to dominate the market, growing at the highest CAGR of 9.7%.

- CLEAN HARBORS, INC., WSP, AECOM were identified as some of the star players in the environmental remediation market, given their strong market share and product footprint.

- DEME Group NV., Bechtel Corporation, and Fluor Corporation, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The environmental remediation market is set for strong growth, underpinned by rising industrial pollution, regulatory enforcement, and increasing emphasis on ESG compliance. Advancements in bioremediation, sustainable soil treatment, and smart monitoring are transforming the industry toward greener, cost-efficient solutions. As governments and corporations intensify commitments to net-zero and sustainable land use, environmental remediation is evolving into a critical enabler of industrial responsibility and resilient urban development.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

As the population grows, oil and gas consumption rises rapidly, leading to higher emissions of methane, benzene, ethylbenzene, n-hexane, and other volatile organic compounds into the environment. This increase will drive greater demand for remediation technologies in the oil and gas sector. The use of nanomaterials and nanotechnologies enhances the detection and cleanup of environmental contaminants. These nanomaterials also hold strong potential for treatment methods for contaminated water, soil, and sediment. Such advances are anticipated to generate new revenue streams for companies in the environmental remediation industry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Enhanced regulatory frameworks for environmental remediation

-

Growing focus on development of environment-friendly industries

Level

-

Slow implementation of environmental protection regulations

-

High cost of excavation equipment

Level

-

Development of advanced remediation technologies

-

Continuous demand generation from oil & gas industry

Level

-

Inconsistencies in government regulations in many countries

-

Technical and non-technical challenges at complex sites

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid population growth and industrialization in developing countries

The increasing pace of population growth and industrialization in developing economies is a key driver of the environmental remediation market. As urban areas expand and industrial centers grow to meet rising demands for housing, infrastructure, and economic activity, the amount of pollutants entering soil, water, and air has risen significantly. This has prompted both government and private organizations to invest substantial funds in regional efforts to clean urban and industrial environments.

Restraint: High-cost of excavation equipment

The significant capital investment needed for excavation equipment remains a barrier for firms providing environmental remediation services, especially small and mid-sized remediation companies. Excavation is often a vital part of remediation, especially for projects with heavily contaminated soil, buried hazardous materials, or complex subsurface conditions. However, the cost of specialized machinery such as excavators, bulldozers, loaders, and vacuum trucks is often a barrier.

Opportunity: Development of advanced remediation technologies

Advances in remediation technologies create significant opportunities for the growth of the environmental remediation market. New methods, such as nanoremediation, in-situ chemical oxidation and reduction, genetically modified microbe-based bioremediation, and electrokinetic remediation, are expanding and increasing the range of site cleanups. These innovative solutions are effective at significant sites and hard-to-reach contaminated areas, such as groundwater aquifers, mining-affected sites, and densely populated urban areas.

Challenge: Inconsistencies in government regulations in many countries

Developing countries are increasingly focusing on environmental protection initiatives to tackle rising concerns about pollution and rapid industrialization. However, there is inconsistency among rules and policies across different emerging nations concerning the adoption of environmental protection equipment and technologies. Such inconsistency is a major barrier to market growth, creating operational and compliance difficulties for remediation companies, especially those working on multinational projects or seeking to expand technology use internationally.

Environmental Remediation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Executed demolition, environmental remediation, and ecological enhancement of the former Pirbright Institute site, managing radiological, chemical, and biological hazards while preparing the land for residential redevelopment | Safe clearance of contaminated structures, removal of hazards, enhanced biodiversity (bat houses, reptile habitats), strong community engagement, and delivery of a sustainable brownfield redevelopment |

|

Conducted remediation and enabling works at Lombard Square, including demolition, soil remediation, asbestos and UXO removal, bioremediation, groundwater cleanup using the FabEx system, and reuse of remediated soil onsite | Over 38,000 m³ of soil remediated and reused, reduced offsite disposal costs, adaptive contamination management, timely project completion, regulatory approval, and delivery of ready-to-build development platforms |

|

Designed and deployed a rapid-response mobile PFAS water treatment system in Katherine using proprietary SORBIX ion exchange resin technology, followed by a permanent large-scale facility | Emergency system operational in 4 months, >2.3 billion liters of contaminated water treated, immediate restoration of safe drinking water for 10,000 residents, and long-term resilience through a 10 ML/d permanent facility |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The environmental remediation market is highly competitive, with the presence of some major companies, such as CLEAN HARBORS, INC. (US), AECOM (US), Tetra Tech, Inc. (US), WSP (Canada), and Jacobs Solutions Inc. (US). These companies have created a competitive ecosystem by investing in R&D activities to provide highly efficient and reliable environmental remediation services and solutions. Various soil and groundwater remediation service providers offer a wide range of technologies to remove pollutants, such as soil washing, chemical treatment, bioremediation, excavation, in situ grouting, phytoremediation, pump and treat, soil vapor extraction, in situ vitrification, and thermal treatment. These technologies are used in a range of applications such as mining, oil & gas, manufacturing, chemical processing, waste disposal sites, and construction and land development.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Environmental Remediation Market, By Environmental Medium

Soil remediation dominated the environmental remediation market due to widespread contamination from industrial waste, agricultural chemicals, and construction activities. Rising demand for urban land redevelopment and stricter soil quality regulations have further accelerated adoption. Governments and private developers are increasingly prioritizing soil cleanup to enable safe reuse of brownfield sites and promote sustainable land management.

Environmental Remediation Market, By Site Type

Private sites accounted for the largest share of the market, driven by industrial facility cleanups, real estate redevelopment projects, and corporate sustainability commitments. Growing pressure on enterprises to meet ESG compliance and enhance land asset value is fueling investment in remediation activities. Redeveloping contaminated private properties into residential and commercial hubs continues to be a strong market driver.

Environmental Remediation Market, By Technology

Bioremediation is expected to grow at the highest rate, supported by its cost-effectiveness, scalability, and eco-friendly profile. The rising preference for sustainable cleanup solutions, coupled with advances in microbial and enzymatic treatment technologies, is propelling adoption. Increasing government and industry initiatives to minimize reliance on chemical-based methods are further boosting the use of bioremediation.

Environmental Remediation Market, By Application

The oil & gas sector will continue to dominate the market, owing to frequent hydrocarbon spills, leakages, and soil and groundwater contamination across upstream and downstream operations. Regulatory frameworks mandating site restoration and rising public scrutiny of fossil fuel impacts are driving remediation demand. Companies are increasingly adopting advanced solutions to address legacy contamination and ensure compliance with environmental standards.

REGION

Asia Pacific to be fastest-growing region in global environmental remediation market during forecast period

Asia Pacific is projected to witness the fastest growth in the environmental remediation market, fueled by rapid industrialization, urban expansion, and high levels of pollution in countries like China and India. Government-backed cleanup programs, stricter environmental enforcement, and rising awareness of sustainable land and water use are accelerating adoption. Additionally, growing foreign investments in infrastructure and real estate are further strengthening demand for remediation solutions.

Environmental Remediation Market: COMPANY EVALUATION MATRIX

In the environmental remediation companies matrix, Clean Harbors (Star) leads with a strong market presence, comprehensive service portfolio, and proven expertise in large-scale hazardous waste management and site cleanups, driving adoption across industrial, municipal, and government sectors. Fluor Corporation (Emerging Leader) is gaining traction with integrated engineering, procurement, and construction (EPC)-driven remediation solutions, leveraging its global project execution capabilities. While Clean Harbors dominates with scale and established regulatory partnerships, Fluor demonstrates strong growth potential to advance toward the leaders’ quadrant by expanding its environmental services footprint.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 130.40 Billion |

| Market Forecast in 2030 (Value) | USD 210.56 Billion |

| Growth Rate | CAGR of 8.2% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Rest of the World |

WHAT IS IN IT FOR YOU: Environmental Remediation Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Oil & Gas Company | • Comparative benchmarking of remediation technologies (bioremediation, chemical treatment, thermal desorption) for hydrocarbon spill cleanups • Cost–benefit analysis of in-situ vs. ex-situ methods • Regional regulatory frameworks for site restoration | • Optimized technology selection for diverse contamination scenarios • Reduced cleanup costs through efficient method deployment • Enhanced compliance with global environmental standards |

| Real Estate Developer (Brownfield Redevelopment) | • Feasibility study on remediation approaches for contaminated urban lands • Analysis of soil stabilization and reuse practices • Case studies of successful residential & commercial brownfield conversions | • Accelerated land redevelopment approvals • Increased asset value through safe land reuse • Strengthened ESG positioning with sustainable site cleanup |

| Government Environmental Agency | • National mapping of contaminated sites and priority remediation zones • Assessment of public-private partnership (PPP) models for large-scale cleanups • Evaluation of eco-innovative solutions (phytoremediation, permeable reactive barriers) | • Improved policy formulation and budget allocation • Faster project delivery through PPP models • Adoption of low-carbon, eco-friendly remediation practices |

| Mining & Metals Company | • Lifecycle analysis of remediation needs across active and closed mining sites • Technology roadmap for acid mine drainage (AMD) and heavy metal contamination treatment • Benchmarking of global best practices in mining remediation | • Mitigated long-term environmental liabilities • Reduced operational risks and regulatory penalties • Enhanced corporate reputation through sustainable mining practices |

| Investment & Private Equity Firm | • Market opportunity assessment of remediation technology providers • Identification of high-growth startups in eco-friendly remediation solutions • Five-year revenue projections by technology and application segment | • Informed investment decisions in green technologies • Diversified portfolio with sustainable infrastructure assets • Strengthened ROI through entry into a high-growth ESG-driven market |

RECENT DEVELOPMENTS

- May 2025 : Jacobs Solutions Inc. (US) secured a USD 1.5 billion, 10-year IDIQ Multiple Award Task Order Contract (MATOC) from the US Air Force Civil Engineer Center to provide environmental architecture and engineering services. The contract includes restoration, planning, conservation, and quality work across Air Force and DoD sites.

- June 2024 : AECOM (US) and Aquatech (US) partnered to accelerate the deployment of DE-FLUORO, AECOM’s proprietary PFAS destruction technology. This collaboration combines AECOM’s top-ranked environmental expertise with Aquatech’s process and electrochemical technology capabilities, enabling full-service commercialization of PFAS treatment.

- May 2024 : Terra Systems (US) partnered with Allonnia (US) to distribute its 1,4 D-Stroy in situ bioremediation solution across North America. Terra Systems will deploy the technology at contaminated groundwater sites in the US and Canada, with Allonnia providing technical support.

- April 2024 : CLEAN HARBORS, INC. (US) introduced its “Total PFAS Solution,” the industry’s first customizable end-to-end service for managing PFAS contamination. Covering lab analysis, filtration, removal, and destruction, the solution helps industries and government agencies with scalable, cradle-to-grave services.

- February 2024 : Bechtel Corporation (US) and Extrakt Process Solutions (US) formed a strategic partnership to commercialize Extrakt's TNS solid-liquid separation technology. This partnership aims to tackle mine tailings, dewatering, and product recovery challenges in the energy and mining sectors.

Table of Contents

Methodology

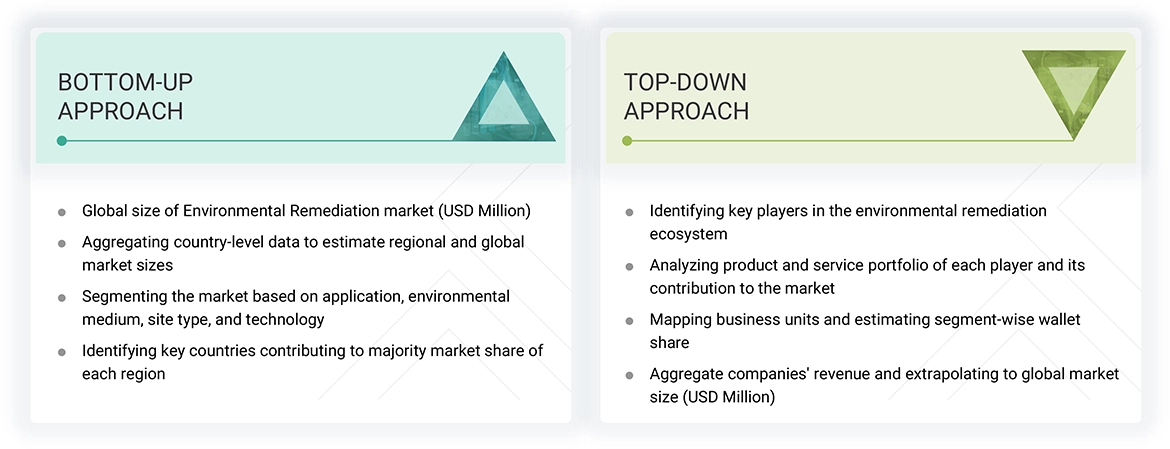

The study involved four main activities to estimate the current size of the environmental remediation market. Extensive secondary research gathered information on the market, peer markets, and parent markets. The next step was to verify these findings, assumptions, and size estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to calculate the overall market size. Following that, market segmentation and data triangulation techniques were applied to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved reviewing various secondary sources to gather the necessary information for this study. These sources included annual reports, press releases, and investor presentations from companies; white papers; journals and accredited publications; and articles from reputable authors, websites, directories, and databases. The secondary research aimed to gather vital information about the industry’s supply chain, the market’s value chain, the complete pool of key players, market segmentation based on industry trends (down to the most detailed level), regional markets, and significant developments from both market and technology perspectives. The collected secondary data was analyzed to determine the overall market size and was further validated through primary research.

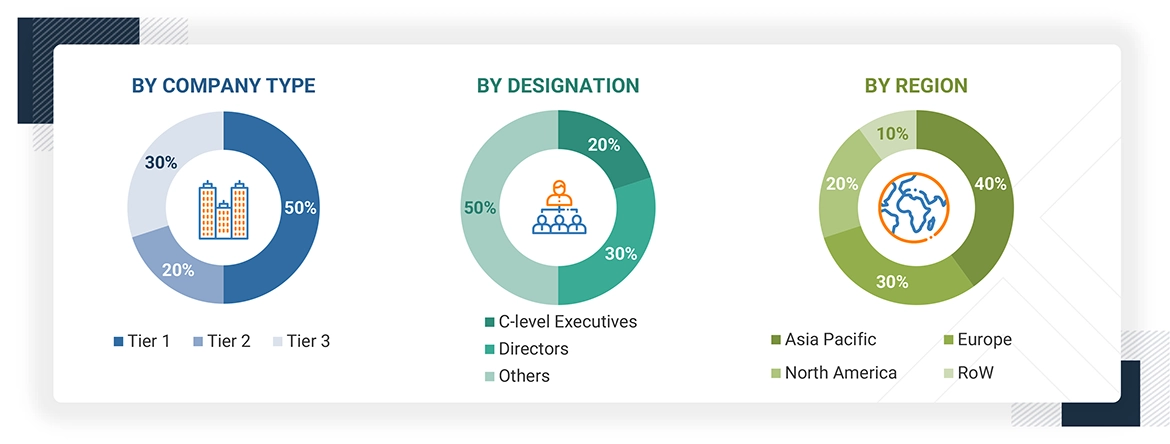

Primary Research

Extensive primary research was conducted after acquiring knowledge about the current scenario of the environmental remediation market through secondary research. Several interviews with experts from the demand and supply sides were carried out across four major regions: North America, Europe, Asia Pacific, and RoW. This primary data was gathered through questionnaires, emails, and telephone interviews.

Note: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers.

The three tiers of the companies are based on their total revenues as of 2024 - Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches, along with several data triangulation methods, were used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This process includes studying the annual and financial reports of leading market players and conducting extensive interviews for key insights-both quantitative and qualitative-with industry experts such as CEOs, VPs, directors, and marketing executives. All percentage shares, splits, and breakdowns were calculated using secondary sources and verified through primary sources. All factors influencing the markets covered in this research were carefully considered, examined in detail, verified through primary research, and analyzed to produce the final quantitative and qualitative data. This data was consolidated and enriched with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Environmental Remediation Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments using the market size estimation processes explained above. Data triangulation and market breakdown procedures were employed to complete the entire market engineering process and determine the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides in the environmental remediation market.

Market Definition

Environmental remediation refers to the process of removing, reducing, or neutralizing pollutants and contaminants from soil, groundwater, surface water, or sediments to restore the environment to a safe and usable state. It involves a variety of technologies and methods, such as excavation, bioremediation, chemical treatment, and pump-and-treat systems to address contamination caused by industrial activities, waste disposal, oil spills, and other sources. The goal is to protect human health, support ecological recovery, and enable safe land and water use for future development.

Key Stakeholders

- Heavy equipment manufacturers and providers

- Chemical solution providers

- Original equipment manufacturers (OEMs)

- Environmental technology and service providers

- Environmental service contractors

- Market research and consulting firms

- Associations, organizations, forums, standards, and alliances related to the environmental remediation industry

- Technology investors

- Governments and financial institutions

- Venture capitalists, private equity firms, and start-up companies

- End users

Report Objectives

- To define, describe, and forecast the environmental remediation market, in terms of value, based on environmental medium, site type, technology, application, and region

- To forecast the market size, in terms of value, about four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To provide an analysis of the value chain, ecosystem, regulations, patent & trade scenario, technological landscape, pricing, key conferences & events, case studies, key stakeholders & buying criteria, and the impact of the 2025 US tariffs; to conduct Porter’s Five Forces analysis on the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the value chain of environmental remediation services

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape of the market

- To analyze competitive developments in the environmental remediation market, such as product launches and developments, partnerships, contracts, joint ventures, expansion, and research and development

- To analyze the impact of the macroeconomic outlook for each region

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis

- Further country-wise breakdown for the environmental remediation market, Further breakdown of the environmental remediation market in the application-specific market

Company Information:

- Detailed analysis and profiling of market players and additional market players (up to five)

Key Questions Addressed by the Report

Which are the major companies in the environmental remediation market?

Major companies in the environmental remediation market are CLEAN HARBORS, INC. (US), WSP (Canada), AECOM (US), Jacobs Solutions Inc. (US), and Tetra Tech, Inc. (US).

Which application in the environmental remediation market is likely to exhibit a higher CAGR during the forecast period?

Oil and gas applications are expected to grow rapidly due to the increasing number of exploration and production activities, rising soil and groundwater contamination, and the enforcement of strict environmental regulations requiring site cleanup.

Which technology in the environmental remediation market is likely to dominate over the coming years?

Bioremediation technology will lead the environmental remediation market because it offers an eco-friendly, cost-effective, and efficient way to break down organic contaminants using microorganisms, especially at large-scale oil and chemical spill sites.

What are the drivers and opportunities for the environmental remediation market?

Enhanced regulatory frameworks for environmental remediation, increased focus on developing environmentally friendly industries, advancements in remediation technologies, and ongoing demand from the oil & gas industry are the major drivers and opportunities for the environmental remediation market.

What are the restraints and challenges for the players in the environmental remediation market?

Slow implementation of environmental protection regulations, high costs of excavation equipment, inconsistencies in government regulations across many countries, and technical and non-technical challenges at complex sites are the main obstacles market players face.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Environmental Remediation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Environmental Remediation Market

Roger

Feb, 2019

I am looking to see the market size for the reagents used in situ chemical oxidation in remediation, particularly persulfate and permanganate oxidants. My interest is more historical than projected..

Shamanth

Jun, 2017

We want Bioremediation, soil and groundwater contaminated with chlorinated solvents and hexavalent chromium, Bio stimulation, Bio Augmentation, India market..

Peter

Dec, 2019

I'm developing a software tool and want to understand if it's applicable to the environmental remediation industry and we can generate revenue through it..

Michael

Sep, 2022

Working to understand the remediation market - post Covid. .

Anda

Aug, 2017

We want environmental Remediation Market, By Technology, By Application Numbers..