Smart Display Market Size, Share, Statistics and Industry Growth Analysis Report by Smart Home Display (Voice-controlled, Smart Appliance), Smart Display Mirror, Smart Signage (Retail & Hospitality Facilities, Sports & Entertainment Venues), Geography (2022-2027)

Updated on : October 23, 2024

Smart Display Market Size & Growth

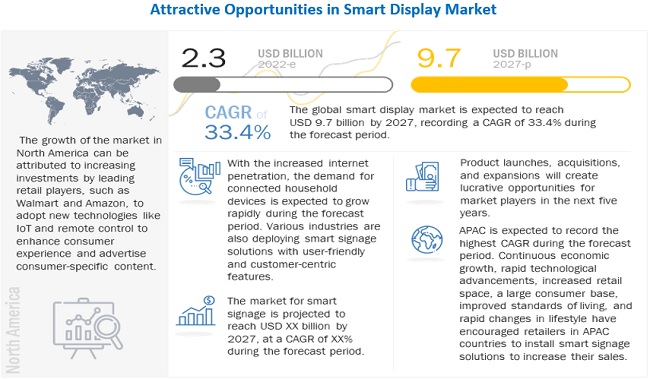

The Smart Display Market Size Report Share is estimated to be USD 2.3 billion in 2022 and expected to reach USD 9.7 billion by 2027, growing at a CAGR of 33.4% during the forecast period from 2022 to 2027.

High demand for smart mirrors from the automotive industry, new and innovative features offered by smart mirrors, an increasing number of internet users and growing adoption of smart devices according to consumer preferences, surging demand for AI-powered and IoT-enabled smart home appliances, increasing trend of context-aware signage, and growing adoption of smart signage in retail sector are the key driving factors for the smart display industry.

Impact of AI on Smart Display Market

Artificial Intelligence (AI) is significantly influencing the smart display market by enhancing user interaction, improving content personalization, and driving more efficient energy usage. AI algorithms enable smart displays to learn user preferences and behavior, offering dynamic content customization, such as adjusting display settings based on time of day or environmental factors. Voice and gesture recognition powered by AI also enable hands-free control, making the experience more intuitive and interactive. In sectors like retail, automotive, healthcare, and consumer electronics, AI is facilitating the integration of smart displays with other IoT devices, creating seamless, connected ecosystems. Additionally, AI helps optimize power consumption by automatically adjusting brightness and resolution based on the content being displayed and external lighting conditions, enhancing energy efficiency. As demand for more intelligent, responsive, and sustainable display solutions grows, AI is playing a pivotal role in driving the evolution of the smart display market.

To know about the assumptions considered for the study, Request for Free Sample Report

Smart Display Market Trends and Dynamics

Driver: Surging demand for AI-powered and IoT-enabled smart home appliances

The advent of high-speed internet broadband, Wi-Fi, and Bluetooth has broadened the use of smart appliances worldwide. Several companies have seen the potential of the successful adoption of smart home technologies. Hence, they have developed smart devices enabling home automation. The increased penetration of smartphones has facilitated the use of smart home devices with the push of a button. Further, with the growth in the number of smartphone users worldwide, the smart home market is expected to witness a major boost during the forecast period. AI-powered smart displays can lead to tremendous investment due to their applications in smart homes for controlling lights, fans, security cameras, TV, and so on. After the success of practical applications of AI in Google Assistant and Amazon Alexa, it is expected to become useful as manufacturers have started designing new integrated techniques to control various gadgets with voice commands. AI assistants will become predominant in devices in the coming years, and this will drive the technology vendors to be relevant in the market.

Restraint: High risks of theft and breach of customer data

Presently, data theft is one of the global risks faced by several sectors, such as the online and offline retail industry, banks, and governments. Smart mirrors are capable of tracking the personal data of users. In the retail industry, these mirrors can track each item taken to the dressing room and keep track of shoppers’ experiences. An item that is frequently carried by the customers to the fitting rooms for trial but does not make to the point of sale could mean that the look is popular among customers, but the fit is not appropriate to them. The tracking function of smart mirrors is not just restricted to clothing activities around dressing rooms; these mirrors also access other customer information, including their entire purchase history, preferences, and interactions with previous sales associates, along with hundreds of other data points. This personal information is at the risk of being transmitted to unintended receivers, which might eventually cause a security breach. Organizations must be able to detect rogue devices trying to interact with their IT infrastructure. The misuse of personal data is a major threat in this data-driven age, where several connected devices use cloud-based software. The impact of this restraint is presently moderate and would remain the same in the coming years.

Opportunity: Increasing number of smart stores worldwide

Increasing purchasing power and basket size of consumers is the backbone of the growing retail industry; shopping malls and retail spaces are growing at a significant rate across the world, thereby contributing to the surging demand for smart signage solutions to grab the attention of passersby and encourage them to enter the store. Thus, these smart stores are keen on increasing brand awareness through programmatic advertising. Additionally, smart signages can become a part of the payment process. Instead of waiting in line at a checkout, customers can pay at a sign using their mobile device. Smart stores are known for offering personalized and enhanced experiences to customers. Currently, several retailers such as Walmart, Alibaba, Amazon, and Carrefour have adopted various smart retail solutions and technologies, including smart signage, to set up smart stores across the world. Retailers worldwide have adopted strategies of expansions and collaborations to establish an increased number of smart and cashier-less stores worldwide.

Challenge: Risk of device malfunctioning

Smart home systems are majorly dependent on device interconnectivity standards, communication protocols, and network technologies. The operations of smart home products depend on the interoperability of all the devices. The smart home ecosystem includes the hardware, software, and service segments. For the efficient and reliable functioning of every single product, the smooth and collective operation of all the 3 segments is essential. The malfunctioning or disconnection of any of these may lead to several complications for users in terms of cost and technical complexities. It is, therefore, a major challenge for smart home solution providers to eliminate the risks of device malfunctioning and ensure their smooth functioning. However, smart home device manufacturers are signing collaboration or partnership agreements with software and connectivity technology providers to design innovative offerings specific to the market, which could help them overcome the challenge of interoperability, thereby reducing the chances of device malfunctioning.

In-Home Display Market Insights and Growth Prospects

The in-home display market is experiencing significant growth as part of the broader smart display ecosystem, driven by increasing consumer demand for energy-efficient solutions and real-time energy monitoring capabilities. These displays enable households to visualize and manage energy consumption, promoting cost savings and sustainable energy practices. Advances in IoT and smart home technologies further bolster the adoption of in-home displays, which seamlessly integrate with connected devices to provide actionable insights. With growing environmental awareness and supportive government initiatives promoting smart metering and energy efficiency, the in-home display market is poised for robust expansion across residential sectors globally.

Smart Display Market Segmentation

Smart signage to account for a larger share of the smart display market by 2027

Smart signage is expected to hold a larger share of the smart display market in 2027. Nowadays, the trend of implementing smart signage solutions is increasing rapidly due to their attractive features, such as the ability to connect with IoT-enabled products and display consumer-specific advertisements, which creates a highly personalized in-store shopping experience for customers. Technological advances have transformed brick-and-mortar stores into modernized ones, thereby attracting more customers by reducing their frustration and boredom and displaying important information about product lines, discounts, etc., which influence their shopping behavior.

Smart Display Industry Regional Analysis

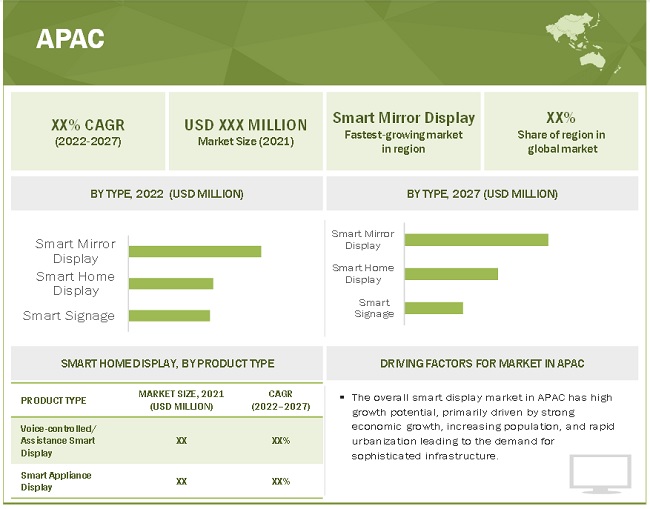

APAC to witness the highest CAGR in the smart display market during the forecast period

APAC is expected to witness the highest CAGR during the forecast period. The growth of the market in the region can be attributed to the presence of numerous small and medium-scale retailers in the region. Moreover, APAC is home to some leading market players, including LG Display (South Korea) and Samsung (South Korea). Moreover, continuous economic growth, rapid technological advancements, increased retail space, a large base of consumers, improved standards of living, and change in lifestyle of masses have encouraged retailers in APAC countries to install smart signage solutions to increase their sales.

To know about the assumptions considered for the study, download the pdf brochure

Top Smart Display Companies - Key Market Players

- Samsung Electronics (South Korea),

- LG Electronics(South Korea),

- NEC Corporation(Japan),

- Sony (Japan),

- Panasonic Corporation (Japan),

- Amazon(US),

- Apple(US),

- Facebook(US),

- Gentex(US),

- Magna(Canada) are among the key players operating in the smart display Companies.

Smart Display Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 2.3 Billion in 2022 |

| Revenue Forecast in 2027 | USD 9.7 Billion by 2027 |

| Growth Rate | 33.4% |

| Base Year Considered | 2021 |

|

Historical Data Available for Years |

2018–2027 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

|

|

Regions covered |

|

|

|

|

| Top Companies in North America |

|

| Key Market Driver | Surging demand for AI-powered and IoT-enabled smart home appliances |

| Key Market Opportunity | Increasing number of smart stores worldwide |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Smart signage |

This research report categorizes the smart display market share based on Smart Display Mirror, Smart Home Display, Smart Signage, and Region.

Smart Display Market, by Type

-

Smart Display Mirror

-

Smart Display Mirror Market, By Type

- Automotive Smart Display Mirrors

- Other Smart Display Mirrors

-

Smart Display Mirror Market, By Type

-

Smart Home Display

-

Smart Home Display Market, By Product Type

- Voice-controlled/Assistance Smart Display

- Smart Appliance Display

-

Smart Home Display Market, By Product Type

-

Smart Signage

- Smart Signage Market, By Application

- Smart Signage Market, By Component

- Smart Signage Market, By Region

Smart Display Market, by Region

- North America

- Europe

- APAC

- RoW

Recent Developments in Smart Display Industry

- In December 2021, Samsung Electronics has announced the launch of HDR10+ GAMING standards which will be compatible with 4K and 8K smart displays. This will give users an immersive, ultra-responsive HDR gaming experience.

- In October 2021, NEC Corporation announced the launch of the C Series large format display C750Q and C860Q, useful for corporates, retail and educational applications.

- In January 2021, LG Electronics is expanding its presence in the global esports industry by collaborating with Gen.G (Seoul) Esports, one of the biggest esports organizations in South Korea. Both companies will be developing esports internationally with the help of LG Electronics’ ultra-gear gaming monitor.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the smart display market share?

The product launch , agreements and partnership has been and continues to be some of the major strategies adopted by the key players to grow in the smart display market.

Which are the opportunities in smart display market share?

There are significant opportunities in the smart display market such as increasing number of smart stores worldwide, growing utilization of smart signage in tradeshows and events, growing applications of smart mirrors in smart homes, increasing popularity of smart home devices, and rising trend of consolidation of smart speakers with displays.

What region dominates smart display market?

APAC region will dominate smart display market

Who are the major companies in the smart display market share?

Samsung Electronics (South Korea), LG Electronics (South Korea), NEC Corporation (Japan), Sony (Japan) and Panasonic Corporation (Japan). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SMART DISPLAY MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 PROCESS FLOW: SMART DISPLAY MARKET SIZE ESTIMATION

FIGURE 3 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key industry insights

2.1.3.2 Primary interviews with experts

2.1.3.3 List of key primary respondents

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 4 SUPPLY-SIDE ANALYSIS: SMART DISPLAY MARKET (1/2)

FIGURE 5 SUPPLY-SIDE ANALYSIS: SMART DISPLAY MARKET (2/2)

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 42)

3.1 SMART DISPLAY MARKET: POST-COVID-19

3.1.1 REALISTIC SCENARIO

FIGURE 8 REALISTIC SCENARIO: MARKET, 2018–2027 (USD MILLION)

3.1.2 PESSIMISTIC SCENARIO

FIGURE 9 PESSIMISTIC SCENARIO: MARKET, 2018–2027 (USD MILLION)

3.1.3 OPTIMISTIC SCENARIO

FIGURE 10 OPTIMISTIC SCENARIO: MARKET, 2018–2027 (USD MILLION)

FIGURE 11 IMPACT OF COVID-19 ON MARKET

FIGURE 12 SMART SIGNAGE TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN SMART DISPLAY MARKET

FIGURE 14 APAC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.2 MARKET, BY TYPE

FIGURE 15 SMART SIGNAGE TO HOLD LARGEST MARKET SIZE IN 2027

4.3 SMART SIGNAGE MARKET, BY APPLICATION

FIGURE 16 RETAIL AND HOSPITALITY FACILITIES TO HOLD LARGEST SIZE OF SMART SIGNAGE MARKET, BY APPLICATION, IN 2027

4.4 SMART HOME DISPLAY MARKET, BY PRODUCT TYPE

FIGURE 17 VOICE-CONTROLLED/ASSISTANCE SMART HOME DISPLAYS TO HAVE HIGHEST MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY REGION (2027)

FIGURE 18 APAC TO RECORD HIGHEST CAGR FOR SMART DISPLAY MARKET IN 2027

5 SMART DISPLAY MIRROR MARKET (Page No. - 50)

5.1 INTRODUCTION

TABLE 3 SMART DISPLAY MIRROR MARKET, IN TERMS OF VALUE AND VOLUME, 2018–2021

TABLE 4 SMART DISPLAY MIRROR MARKET, IN TERMS OF VALUE AND VOLUME, 2022–2027

5.2 MARKET DYNAMICS

FIGURE 19 MARKET DYNAMICS: SMART DISPLAY MIRROR MARKET

5.2.1 DRIVERS

5.2.1.1 Rising demand for smart mirrors from automotive industry

TABLE 5 ADVANCED DRIVER ASSISTANCE SYSTEMS, BY AUTOMATION LEVEL

FIGURE 20 ADAS PENETRATION RATE IN GLOBAL SALES OF LIGHT VEHICLES, BY LEVEL, 2017–2050

FIGURE 21 IMPACT OF SMART MIRRORS ON ADAS PENETRATION, 2017–2050

5.2.1.2 New and innovative features of smart mirrors

5.2.1.3 Upsurge in online/digital retail shopping due to COVID-19 pandemic

5.2.1.4 Transition from traditional stores to smart stores in retail industry

FIGURE 22 COMPONENTS OF SMART RETAIL

5.2.2 RESTRAINTS

5.2.2.1 High risks of customer data theft and breach of customer data privacy

5.2.3 OPPORTUNITIES

5.2.3.1 Growing applications of smart mirrors in smart homes

5.2.3.2 Increasing use of smart digital mirrors in healthcare solutions

5.2.3.3 High growth potential in retail sector

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness regarding smart mirrors and high costs

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS FOR SMART DISPLAY MIRRORS

5.3.1 R&D ENGINEERS

5.3.2 ORIGINAL EQUIPMENT MANUFACTURERS

5.3.3 KEY TECHNOLOGY PROVIDERS AND SYSTEM INTEGRATORS

5.3.4 DISTRIBUTORS AND MARKETING TEAMS

5.3.5 END USERS

5.4 SMART DISPLAY MIRROR MARKET ECOSYSTEM ANALYSIS

TABLE 6 SMART DISPLAY MIRROR MARKET: ECOSYSTEM

5.5 SMART DISPLAY MIRROR MARKET, BY MIRROR TYPE

5.5.1 INTRODUCTION

TABLE 7 SMART DISPLAY MIRROR MARKET, BY MIRROR TYPE, 2018–2021 (USD MILLION)

TABLE 8 SMART DISPLAY MIRROR MARKET, BY MIRROR TYPE, 2022–2027 (USD MILLION)

TABLE 9 SMART DISPLAY MIRROR MARKET, BY MIRROR TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 10 SMART DISPLAY MIRROR MARKET, BY MIRROR TYPE, 2022–2027 (THOUSAND UNITS)

5.5.2 AUTOMOTIVE SMART DISPLAY MIRRORS

5.5.2.1 Introduction

FIGURE 24 AUTOMOTIVE SMART DISPLAY MIRRORS MARKET SEGMENTATION

5.5.2.2 Automotive smart display mirrors market, by mirror type

TABLE 11 AUTOMOTIVE SMART DISPLAY MIRRORS MARKET, BY MIRROR TYPE, 2018–2021 (USD MILLION)

TABLE 12 AUTOMOTIVE SMART DISPLAY MIRRORS MARKET, BY MIRROR TYPE, 2022–2027 (USD MILLION)

FIGURE 25 OEM REARVIEW DISPLAY MIRRORS TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 13 AUTOMOTIVE SMART DISPLAY MIRRORS MARKET, BY MIRROR TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 14 AUTOMOTIVE SMART DISPLAY MIRRORS MARKET, BY MIRROR TYPE, 2022–2027 (THOUSAND UNITS)

5.5.2.2.1 OEM rearview display mirror

5.5.2.2.2 Aftermarket rearview display mirror

5.5.2.2.3 Side-view display mirror

5.5.2.3 Automotive smart display mirrors market, by component

TABLE 15 AUTOMOTIVE SMART DISPLAY MIRRORS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 16 AUTOMOTIVE SMART DISPLAY MIRRORS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

5.5.2.3.1 Display panels

5.5.2.3.2 Camera and sensor modules

5.5.2.3.3 Glass and other hardware

5.5.2.3.4 Software

5.5.2.4 Automotive smart display mirrors market, by region

TABLE 17 AUTOMOTIVE SMART DISPLAY MIRRORS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 18 AUTOMOTIVE SMART DISPLAY MIRRORS MARKET, BY REGION, 2022–2027 (USD MILLION)

5.5.2.4.1 North America

5.5.2.4.2 Europe

5.5.2.4.3 APAC

5.5.2.4.4 RoW

5.5.3 OTHER SMART DISPLAY MIRRORS

5.5.3.1 Introduction

FIGURE 26 OTHER SMART DISPLAY MIRRORS MARKET SEGMENTATION

5.5.3.2 Other smart display mirrors market, by application

FIGURE 27 RETAIL & HOSPITALITY APPLICATION TO WITNESS HIGHER DEMAND FOR OTHER SMART DISPLAY MIRRORS DURING FORECAST PERIOD

TABLE 19 OTHER SMART DISPLAY MIRRORS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 20 OTHER SMART DISPLAY MIRRORS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

5.5.3.2.1 Retail & hospitality

5.5.3.2.2 Smart home & others

5.5.3.3 Other smart display mirrors market, by region

FIGURE 28 NORTH AMERICA EXPECED TO HAVE HIGHEST DEMAND FOR OTHER SMART DISPLAY MIRRORS DURING FORECAST PERIOD

TABLE 21 OTHER SMART DISPLAY MIRRORS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 OTHER SMART DISPLAY MIRRORS MARKET, BY REGION, 2022–2027(USD MILLION)

5.5.3.3.1 North America

5.5.3.3.2 Europe

5.5.3.3.3 APAC

5.5.3.3.4 RoW

6 SMART HOME DISPLAY MARKET (Page No. - 76)

6.1 INTRODUCTION

TABLE 23 SMART HOME DISPLAY MARKET, IN TERMS OF VALUE AND VOLUME, 2018–2021

TABLE 24 SMART HOME DISPLAY MARKET, IN TERMS OF VALUE AND VOLUME, 2022–2027

6.2 MARKET DYNAMICS

FIGURE 29 MARKET DYNAMICS: SMART HOME DISPLAY MARKET

6.2.1 DRIVERS

6.2.1.1 Increasing number of internet users and growing adoption of smart devices

FIGURE 30 INTERNET USERS TILL 2021, BY REGION

6.2.1.2 Surging demand for AI-powered and IoT-enabled smart home appliances

6.2.1.3 Growing focus of many players on expansion of smart home product portfolios

6.2.1.4 Escalating demand for security systems and video identification systems

6.2.2 RESTRAINTS

6.2.2.1 Issues related to security and privacy

6.2.3 OPPORTUNITIES

6.2.3.1 Increasing popularity of smart home devices

FIGURE 31 SMART HOME PENETRATION WORLDWIDE, 2016 VS. 2020

6.2.3.2 Rising trend of consolidating smart speakers with displays

6.2.4 CHALLENGES

6.2.4.1 Supply chain disruptions due to COVID-19 pandemic

6.2.4.2 Risk of device malfunctioning

6.2.4.3 Device compatibility issues due to lack of common standards and communication protocols

6.3 SMART HOME DISPLAY VALUE CHAIN ANALYSIS

FIGURE 32 VALUE CHAIN ANALYSIS OF SMART HOME DISPLAYS

6.4 SMART HOME DISPLAY MARKET ECOSYSTEM ANALYSIS

TABLE 25 SMART HOME DISPLAY MARKET: ECOSYSTEM

6.5 PROTOCOLS AND STANDARDS

6.5.1 DALI

6.5.2 NEMA

6.5.3 KNX

6.5.4 DMX

6.5.5 LONWORKS

FIGURE 33 LONWORKS NETWORK SET-UP

6.5.6 ETHERNET

6.5.7 MODBUS

6.5.8 BACNET

6.5.9 BLACK BOX

6.5.10 PLC

6.6 WIRELESS COMMUNICATION TECHNOLOGY ANALYSIS

FIGURE 34 WIRELESS COMMUNICATION TECHNOLOGIES

6.6.1 ZIGBEE

6.6.2 Z-WAVE

6.6.3 WI-FI

6.6.4 BLUETOOTH

6.6.5 ENOCEAN

6.6.6 THREAD

6.6.7 INFRARED

6.7 SMART HOME DISPLAY MARKET, BY PRODUCT TYPE

FIGURE 35 SMART HOME DISPLAY MARKET, BY PRODUCT TYPE

TABLE 26 SMART HOME DISPLAY MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 27 SMART HOME DISPLAY MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 28 SMART HOME DISPLAY MARKET, BY PRODUCT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 29 SMART HOME DISPLAY MARKET, BY PRODUCT TYPE, 2022–2027 (THOUSAND UNITS)

6.7.1 VOICE-CONTROLLED/ASSISTANCE SMART DISPLAY

6.7.1.1 Introduction

TABLE 30 LEADING PLAYERS AND THEIR VOICE-CONTROLLED SMART DISPLAY DEVICES, 2021

6.7.1.2 Voice-controlled smart display market, by component

FIGURE 36 SOFTWARE SEGMENT TO RECORD HIGHEST CAGR IN VOICE-CONTROLLED SMART DISPLAY MARKET DURING FORECAST PERIOD

TABLE 31 VOICE-CONTROLLED MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 32 VOICE-CONTROLLED MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.7.1.2.1 Display panels

6.7.1.2.2 Other hardware components

6.7.1.2.3 Software

6.7.1.3 Voice-controlled smart display market, by region

FIGURE 37 APAC TO RECORD HIGHEST CAGR IN VOICE-CONTROLLED SMART DISPLAY MARKET DURING FORECAST PERIOD

TABLE 33 VOICE-CONTROLLED MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 VOICE-CONTROLLED MARKET, BY REGION, 2022–2027 (USD MILLION)

6.7.1.3.1 North America

6.7.1.3.2 Europe

6.7.1.3.3 APAC

6.7.1.3.4 RoW

6.7.2 SMART APPLIANCE DISPLAY

6.7.2.1 Introduction

FIGURE 38 SMART APPLIANCE DISPLAY MARKET SEGMENTATION

6.7.2.2 Smart appliance display market, by component

FIGURE 39 DISPLAY PANELS TO CAPTURE LARGEST SHARE OF SMART APPLIANCE DISPLAY MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

TABLE 35 SMART APPLIANCE DISPLAY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 36 SMART APPLIANCE DISPLAY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.7.2.2.1 Display panels

6.7.2.2.2 Other hardware components

6.7.2.2.3 Software

6.7.2.3 Smart appliance display market, by region

TABLE 37 SMART APPLIANCE DISPLAY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 SMART APPLIANCE DISPLAY MARKET, BY REGION, 2022–2027 (USD MILLION)

6.7.2.3.1 North America

6.7.2.3.2 Europe

6.7.2.3.3 APAC

6.7.2.3.4 RoW

7 SMART SIGNAGE MARKET (Page No. - 104)

7.1 INTRODUCTION

FIGURE 40 SMART SIGNAGE MARKET SEGMENTATION

TABLE 39 SMART SIGNAGE MARKET, IN TERMS OF VALUE AND VOLUME, 2018–2021

TABLE 40 SMART SIGNAGE MARKET, IN TERMS OF VALUE AND VOLUME, 2022–2027

7.2 MARKET DYNAMICS

FIGURE 41 MARKET DYNAMICS: SMART SIGNAGE MARKET

7.2.1 DRIVERS

7.2.1.1 Increasing trend of context-aware signage

7.2.1.2 Growing adoption of smart signage in retail sector

7.2.1.3 Surging use of AI-based smart signage to understand customer demand

7.2.2 RESTRAINTS

7.2.2.1 Complexities in manufacturing all-weather display-based smart signage systems for outdoor applications

7.2.3 OPPORTUNITIES

7.2.3.1 Increasing number of smart stores worldwide

7.2.3.2 Growing utilization of smart signage in tradeshows and events

7.2.4 CHALLENGES

7.2.4.1 Higher costs of installation, ownership, and maintenance

7.2.4.2 Lower level of awareness about advantages and components of smart signage solutions

7.3 PRICING ANALYSIS

TABLE 41 INDICATIVE PRICES OF SMART SIGNAGE DEVICES

7.4 PATENT ANALYSIS

TABLE 42 NOTICEABLE PATENTS REGISTERED: SMART DISPLAY MARKET

7.5 TARIFFS AND REGULATIONS REGARDING SMART SIGNAGE SOLUTIONS

7.5.1 REGULATIONS: SMART DISPLAYS

TABLE 43 REGULATIONS: SMART DISPLAYS

7.5.2 TARIFFS: DISPLAY PANELS

7.6 CASE STUDIES

7.6.1 INTRODUCTION

7.6.2 SMART SIGNAGE IN RESTAURANTS

TABLE 44 SMART SIGNAGE ACCELERATES FULL DIGITALIZATION OF MCDONALD’S DRIVE THRU LOCATION

7.6.3 SMART SIGNAGE FOR CORPORATES

TABLE 45 INDOOR SMART LED DISPLAYS EMPOWER MICROSOFT TO ACHIEVE MORE

7.6.4 SMART SIGNAGE IN AIRPORTS

TABLE 46 SMART LED DISPLAYS TRANSFORM PASSENGER EXPERIENCE AT HELSINKI AIRPORT

7.6.5 SMART SIGNAGE IN HEALTHCARE

TABLE 47 FUTURAMEDIA AND SCALA DRIVE FRENCH PHARMACY SALES WITH DIGITAL SIGNAGE

7.6.6 SMART SIGNAGE IN RETAIL

TABLE 48 SCALA HELPS HUNKEMOLLER PROVIDE NEW DIMENSION TO SHOPPING EXPERIENCE

7.6.7 SMART SIGNAGE IN SHOPPING CENTERS

TABLE 49 POSNANIA SHOPPING COMPLEX OPENS WITH REVOLUTIONARY DIGITAL SIGNAGE SYSTEM

7.6.8 SMART SIGNAGE IN HOSPITALITY

TABLE 50 MSC CRUISES PARTNERS WITH SAMSUNG TO ENHANCE PASSENGER EXPERIENCE

7.7 TRADE ANALYSIS

7.7.1 EXPORT SCENARIO OF BOARDS, PANELS, CONSOLES, DESKS, CABINETS, AND OTHER BASES

FIGURE 42 BOARDS, PANELS, CONSOLES, DESKS, CABINETS, AND OTHER BASES EXPORT, BY KEY COUNTRY, 2020

7.7.2 IMPORT SCENARIO OF BOARDS, PANELS, CONSOLES, DESKS, CABINETS, AND OTHER BASES

FIGURE 43 BOARDS, PANELS, CONSOLES, DESKS, CABINETS, AND OTHER BASES IMPORT, BY KEY COUNTRY, 2020

7.8 SMART SIGNAGE MARKET ECOSYSTEM ANALYSIS

TABLE 51 SMART SIGNAGE MARKET: ECOSYSTEM

7.9 SMART SIGNAGE MARKET, BY APPLICATION

7.9.1 INTRODUCTION

FIGURE 44 SMART SIGNAGE MARKET, BY APPLICATION

FIGURE 45 RETAIL AND HOSPITALITY FACILITIES TO HOLD LARGEST SIZE OF SMART SIGNAGE MARKET DURING FORECAST PERIOD

TABLE 52 SMART SIGNAGE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 53 SMART SIGNAGE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.9.2 RETAIL AND HOSPITALITY FACILITIES

TABLE 54 SMART SIGNAGE MARKET FOR RETAIL AND HOSPITALITY FACILITIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 SMART SIGNAGE MARKET FOR RETAIL AND HOSPITALITY FACILITIES, BY REGION, 2022–2027 (USD MILLION)

7.9.3 TRANSPORTATION HUBS AND PUBLIC PLACES

TABLE 56 SMART SIGNAGE MARKET FOR TRANSPORTATION HUBS AND PUBLIC PLACES, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 SMART SIGNAGE MARKET FOR TRANSPORTATION HUBS AND PUBLIC PLACES, BY REGION, 2022–2027 (USD MILLION)

7.9.4 SPORTS AND ENTERTAINMENT VENUES

TABLE 58 SMART SIGNAGE MARKET FOR SPORTS AND ENTERTAINMENT VENUES, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 SMART SIGNAGE MARKET FOR SPORTS AND ENTERTAINMENT VENUES, BY REGION, 2022–2027 (USD MILLION)

7.9.5 OTHERS

TABLE 60 SMART SIGNAGE MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 SMART SIGNAGE MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

7.10 SMART SIGNAGE MARKET, BY OFFERING

7.10.1 INTRODUCTION

FIGURE 46 SMART SIGNAGE MARKET, BY OFFERING

TABLE 62 SMART SIGNAGE MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 63 SMART SIGNAGE MARKET, BY OFFERING, 2022–2027 (USD MILLION)

7.10.2 DISPLAYS

7.10.3 MEDIA PLAYERS

7.10.4 SOFTWARE SOLUTIONS/PLATFORMS

7.10.5 SERVICES

7.11 SMART SIGNAGE MARKET, BY REGION

7.11.1 INTRODUCTION

FIGURE 47 NORTH AMERICA TO ACCOUNT FOR LARGEST SIZE OF SMART SIGNAGE MARKET DURING FORECAST PERIOD

TABLE 64 SMART SIGNAGE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 SMART SIGNAGE MARKET, BY REGION, 2022–2027 (USD MILLION)

7.11.2 NORTH AMERICA

TABLE 66 SMART SIGNAGE MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 67 SMART SIGNAGE MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

7.11.3 EUROPE

TABLE 68 SMART SIGNAGE MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 69 SMART SIGNAGE MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

7.11.4 APAC

TABLE 70 SMART SIGNAGE MARKET IN APAC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 71 SMART SIGNAGE MARKET IN APAC, BY APPLICATION, 2022–2027 (USD MILLION)

7.11.5 ROW

TABLE 72 SMART SIGNAGE MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 73 SMART SIGNAGE MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

8 GEOGRAPHIC ANALYSIS (Page No. - 132)

8.1 INTRODUCTION

FIGURE 48 SMART DISPLAY MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 49 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 74 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 MARKET, BY REGION, 2022–2027(USD MILLION)

TABLE 76 SMART DISPLAY MIRROR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 SMART DISPLAY MIRROR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 78 SMART HOME DISPLAY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 SMART HOME DISPLAY MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 50 SNAPSHOT OF MARKET IN NORTH AMERICA

FIGURE 51 SMART HOME DISPLAY SEGMENT TO DOMINATE MARKET IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 80 MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 81 MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

FIGURE 52 IMPACT OF COVID-19 ON NORTH AMERICA

TABLE 82 POST-COVID19: MARKET IN NORTH AMERICA 2018–2027 (USD MILLION)

TABLE 83 SMART HOME DISPLAY MARKET IN NORTH AMERICA, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 84 SMART HOME DISPLAY MARKET IN NORTH AMERICA, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 85 SMART DISPLAY MIRROR MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 86 SMART DISPLAY MIRROR MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

8.3 EUROPE

FIGURE 53 SNAPSHOT OF SMART DISPLAY MARKET IN EUROPE

FIGURE 54 SMART SIGNAGE TO ACCOUNT FOR MAJOR SHARE OF MARKET IN EUROPE DURING FORECAST PERIOD

TABLE 87 MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 88 MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

FIGURE 55 IMPACT OF COVID-19 ON EUROPE

TABLE 89 POST-COVID19: MARKET IN EUROPE, 2018–2027 (USD MILLION)

TABLE 90 SMART HOME DISPLAY MARKET IN EUROPE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 91 SMART HOME DISPLAY MARKET IN EUROPE, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 92 SMART DISPLAY MIRROR MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 93 SMART DISPLAY MIRROR MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

8.4 APAC

FIGURE 56 SNAPSHOT OF SMART DISPLAY MARKET IN APAC

FIGURE 57 SMART SIGNAGE DISPLAY SEGMENT EXPECTED TO LEAD MARKET IN APAC BY 2027

TABLE 94 MARKET IN APAC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 95 MARKET IN APAC, BY TYPE, 2022–2027 (USD MILLION)

FIGURE 58 IMPACT OF COVID-19 ON APAC

TABLE 96 POST-COVID19: MARKET IN APAC, 2018–2027 (USD MILLION)

TABLE 97 SMART HOME DISPLAY MARKET IN APAC, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 98 SMART HOME DISPLAY MARKET IN APAC, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 99 SMART DISPLAY MIRROR MARKET IN APAC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 100 SMART DISPLAY MIRROR MARKET IN APAC, BY TYPE, 2022–2027 (USD MILLION)

8.5 ROW

TABLE 101 MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 102 MARKET IN ROW, BY TYPE, 2022–2027 (USD MILLION)

FIGURE 59 IMPACT OF COVID-19 ON ROW

TABLE 103 POST-COVID19: MARKET IN ROW, 2018–2027 (USD MILLION)

TABLE 104 SMART HOME DISPLAY MARKET IN ROW, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 105 SMART HOME DISPLAY MARKET IN ROW, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 106 SMART DISPLAY MIRROR MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 107 SMART DISPLAY MIRROR MARKET IN ROW, BY TYPE, 2022–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 149)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

9.3 REVENUE ANALYSIS OF TOP 5 COMPANIES

FIGURE 60 REVENUE ANALYSIS (USD BILIION), 2016-2020

9.4 MARKET SHARE ANALYSIS

TABLE 108 MARKET: DEGREE OF COMPETITION (2020)

FIGURE 61 MARKET SHARE ANALYSIS: MARKET, 2020

9.5 MARKET EVALUATION FRAMEWORK

FIGURE 62 MARKET EVALUATION FRAMEWORK

FIGURE 63 MARKET RANKING ANALYSIS

9.6 COMPANY EVALUATION QUADRANT FOR SMART DISPLAY MARKET, 2021

9.6.1 STAR

9.6.2 EMERGING LEADER

9.6.3 PERVASIVE

9.6.4 PARTICIPANT

FIGURE 64 MARKET: COMPANY EVALUATION QUADRANT, 2021

9.7 STARTUP/SME EVALUATION MATRIX: SMART DISPLAY MARKET, 2021

9.7.1 PROGRESSIVE COMPANIES

9.7.2 RESPONSIVE COMPANIES

9.7.3 DYNAMIC COMPANIES

9.7.4 STARTING BLOCKS

FIGURE 65 MARKET: STARTUP /SME EVALUATION MATRIX, 2021

9.8 COMPETITIVE SCENARIO AND TRENDS

9.8.1 NEW PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 109 MARKET: NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2018–2021

9.8.2 DEALS

TABLE 110 MARKET: DEALS, 2018–2021

10 COMPANY PROFILES (Page No. - 161)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

10.1 INTRODUCTION

10.2 KEY PLAYERS

10.2.1 SAMASUNG ELECTRONICS

FIGURE 66 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

10.2.2 LG ELECTRONICS

FIGURE 67 LG ELECTRONICS: COMPANY SNAPSHOT

10.2.3 NEC

FIGURE 68 NEC CORPORATION: COMPANY SNAPSHOT

10.2.4 SONY

FIGURE 69 SONY: COMPANY SNAPSHOT

10.2.5 PANASONIC CORPORATION

FIGURE 70 PANASONIC: COMPANY SNAPSHOT

10.2.6 AMAZON

FIGURE 71 AMAZON: COMPANY SNAPSHOT

10.2.7 APPLE

FIGURE 72 APPLE: COMPANY SNAPSHOT

10.2.8 FACEBOOK

FIGURE 73 FACEBOOK: COMPANY SNAPSHOT

10.2.9 GENTEX

FIGURE 74 GENTEX: COMPANY SNAPSHOT

10.2.10 MAGNA INTERNATIONAL

FIGURE 75 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

10.3 OTHER KEY PLAYERS

10.3.1 QUALCOMM

10.3.2 INTEL

10.3.3 HONEYWELL

10.3.4 LENOVO

10.3.5 ELECTRIC MIRROR

10.3.6 QISDA

10.3.7 ALPHABET(GOOGLE)

10.3.8 LEYARD OPTOELECTRONIC (PLANAR)

10.3.9 ROBERT BOSCH GMBH

10.3.10 APLS ALPINE CO., LTD.

10.3.11 IBM

10.3.12 SMART PARKING

10.3.13 OAK LABS

10.3.14 DIRROR

10.3.15 MYRA MIRRORS

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 208)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATION

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

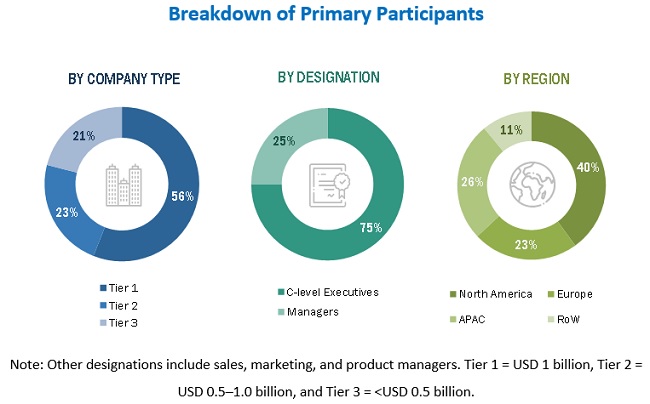

The study involved four major activities in estimating the current size of the smart display market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include smart display journals and magazines, annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the smart display market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the smart display market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Smart Display Market: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides.

Report Objectives

The following are the primary objectives of the study.

- To define, describe, and forecast the smart display market, in terms of smart display mirror market, smart home display market, smart signage market and region.

- To provide the market size estimation for North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth.

- To provide a detailed overview of the smart display market value chain

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their ranking based on their revenues and core competencies.

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market.

- To analyze competitive developments in the market, such as expansion, agreements, partnerships, contracts, product developments, and research and development (R&D)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Display Market