GPU Database Market by Application (GRC, Threat Intelligence, CEM, Fraud Detection and Prevention, SCM), Tools (GPU-accelerated Databases and GPU-accelerated Analytics), Deployment Model, Vertical, and Region - Global Forecast to 2023

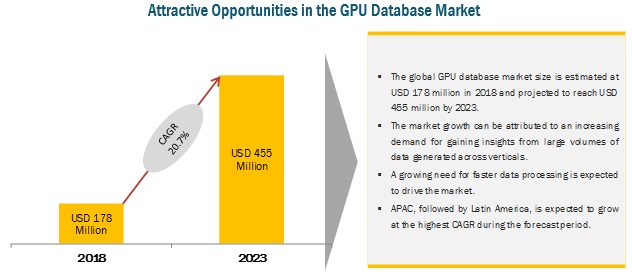

[129 Pages Report] The global GPU database market size is expected to grow from USD 178 million in 2018 to USD 455 million by 2023, at a Compound Annual Growth Rate (CAGR) of 20.7% during the forecast period. The study involved 4 major activities to estimate the current market size for market. An exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, have been referred to for identifying and collecting information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications and articles by recognized authors; gold standard and silver standard websites; GPU database technology Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary research

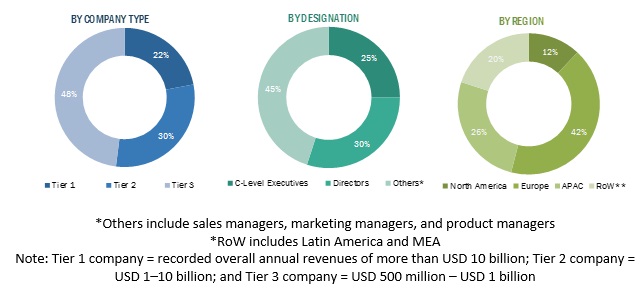

Various primary sources from both supply and demand sides of the GPU database market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors that provide the GPU database software, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

GPU Database Market size estimation

For making market estimates and forecasting the GPU database market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global GPU database market using key companies’ revenues and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined with the help of the primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report objectives

- To define, describe, and forecast the GPU database market based on applications, components, deployment models, verticals, and regions

- To provide detailed information related to major factors, such as drivers, restraints, opportunities, and challenges, influencing the market growth

- To analyze the market’s subsegments with respect to the individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide the competitive landscape of the market

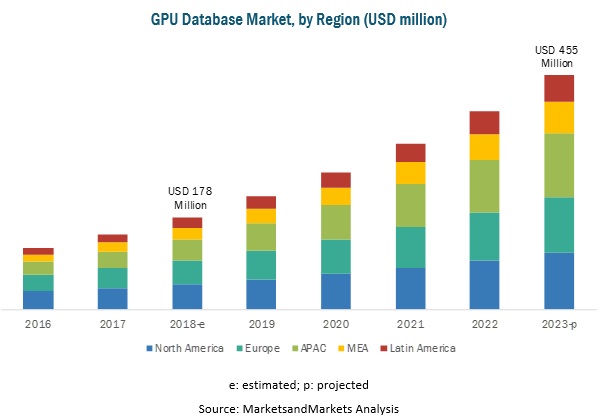

- To forecast the revenue of the market’s segments with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their recent developments and positioning in the GPU database market

- To analyze the competitive developments, such as mergers and acquisitions, new product developments, and R&D activities in the market

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Application, Component, Deployment Model, and Vertical, Region |

|

Geographies covered |

North America, APAC, Europe, Latin America, and MEA |

|

Companies covered |

Kinetica (US), OmniSci (US), SQream (US), Neo4j (US), NVIDIA (US), Brytlyt (UK), Blazegraph (US), BlazingDB (US), Zilliz (China), Jedox (Germany), HeteroDB (Japan), H2O.ai (US), FASTDATA.io (US), Fuzzy Logix (US), Anaconda (US), and Graphistry (US). |

This research report categorizes the GPU database market based on applications, components, deployment models, verticals, and regions.

Based on applications, the GPU database market has been segmented as follows:

- GRC

- Threat Intelligence

- CEM

- Fraud Detection and Prevention

- Predictive Maintenance

- SCM

- Others (Network Management and Campaign Management)

Based on components, the GPU database market has been segmented as follows:

- Tools

- GPU-accelerated Databases

- GPU-accelerated Analytics

- Services

Based on deployment models, the GPU database market has been segmented as follows

- On-premises

- Cloud

Based on verticals, the GPU database market has been segmented as follows:

- BFSI

- Retail and eCommerce

- Healthcare and Pharmaceuticals

- Telecommunications and IT

- Transportation and Logistics

- Government and Defense

- Others (Energy and Utilities, Oil and Gas, Media and Entertainment, and Manufacturing)

Based on regions, the GPU database market has been segmented as follows:

- North America

- Europe

- APAC

- Latin America

- MEA

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Company information

- Detailed analysis and profiling of additional market players up to 5

The global GPU database market size is expected to grow from USD 178 million in 2018 to USD 455 million by 2023, at a Compound Annual Growth Rate (CAGR) of 20.7% during the forecast period. The demand for GPU database is expected to rise over the next 5 years owing to several factors, including massive data generation across BFSI, retail, and media and entertainment industry verticals which would require high performance computing capability to process the data, availability of open source solutions, and growing applications areas. A high demand for solutions enabling high-performance computing in various data-intensive verticals creates ample opportunities for the adoption of GPU databases. Hence. GPU database vendors can monetize growth opportunities created by enterprises’ increasing interest in AI and machine learning facilitated workloads.

The GPU database market study aims at estimating the market size and growth potential of the market across segments, such as component (tools and services), application, deployment model, vertical, and region.

Tools segment to hold the largest market size during the forecast period

The GPU database tools segment is further bifurcated into GPU-accelerated Databases and GPU-accelerated Analytics. Vendors in the GPU database market are offering various GPU-accelerated databases and analytics tools to cater to the various data and analytics requirements of organizations across business lines and applications. Organizations are looking for data and analytics solutions to effectively utilize the massive data being generated to increase their operational efficiency and maximize their value proposition to gain an edge in the highly competitive business environment. GPU-accelerated tools with their high-performance can fulfill the requirement. They enable organizations with highly complex data streams and extreme workloads to derive insights in milliseconds reducing latency to a significant degree as compared to traditional CPU-accelerated solutions.

CEM application segment holds the largest market size in 2018

GPU-accelerated databases with their brute force computing power can ingest vast amount of data related to customers from a variety of sources. Enterprises can analyze this data and gain real-time insights into their consumer’s buying behavior, understand market dynamics and trends, forecast demand and supply, and identify service issues and performance bottlenecks in the service chain. This high-performance computing capability is crucial to customer-focused verticals, including retail and eCommerce, telecom, and BFSI, where customer experience can make a significant difference with the highly competitive environment.

Supply chain management segment to grow at the highest CAGR during the forecast period

The GPU databases can provide a significant advantage to enterprises by facilitating their supply chain operations and enabling them to optimize it by providing real-time, location-based insights in the entire supply chain. Many enterprises have digitalized their enterprise and field operations and are rapidly adopting advanced technologies including mobile workforce, sensors-equipped fleets, AI-assisted work stations and automated vehicles, and drones. The digitalization has led to the generation of large volumes of data in different forms and at speed is exceeding the expectations of enterprises with traditional tools and practices in place to handle the data. Enterprises with GPU-boosted data management and analytics capabilities can gain a comprehensive view of their supply chain and crucial insights to manage their value chain incorporating suppliers, distributors, logistics, transportation, and retail locations to understand and forecast demand, manage supply, and track inventory in real time.

North America to hold the largest market size during the forecast period

The global GPU database market by region covers 5 major geographic regions: North America, Asia Pacific (APAC), Europe, the Middle East and Africa (MEA), and Latin America. North America constitutes the highest market share, owing to the early adoption of GPU-accelerated solutions as well as initiatives taken by industry players in the form of partnerships with technology players to offer rapid analytics and data processing solutions. The US and Canada are 2 prominent markets in North America, which are witnessing healthy adoption of such GPU- accelerated tools across industry verticals.

Key Market Players

The GPU database market comprises major GPU-accelerated databases and analytics providers, such as Kinetica, OmniSci, SQream, Neo4j, NVIDIA, Brytlyt, Blazegraph, BlazingDB, Zilliz, Jedox, HeteroDB, H2O.ai, FASTDATA.io, Fuzzy Logix, Anaconda, and Graphistry. The study includes in-depth competitive analysis of these key players in the GPU database market with their company profiles, recent developments, and key market strategies.

Initially, developed for the US Army Intelligence and Security Command, the GPU-accelerated platform from Kinetica has found applications across verticals such as finance, supply chain and logistics, healthcare and pharmaceuticals, energy and utilities, retail and ecommerce, government and defense, and telecom. Kinetica provides solutions for risk and fraud detection, smart-grid infrastructure management, real-time supply chain and inventory management, genomics research, real-time location-based analytics for route optimization, real-time drilling and well analytics, counterterrorism, and cybersecurity across the above-mentioned verticals.

OmniSci is a leading player in the GPU database market. The company offers various solutions for data processing, analytics, and visualizations. Its flagship GPU-accelerated database product, GPU Core, uses in-memory storage. In addition, it leverages modern SSDs for persistent storage that empowers users to gain quick response even in microseconds. The company has received regular funding, which gave it the boost to innovate its products and expand its geographic reach. Partnerships with major technology players such as IBM and Google have helped OmniSci broaden its customer base. The demand for GPU-accelerated database solutions is rising gradually with an increasing need for real-time analytics.

Recent Developments:

- In June 2018, Kinetica collaborated with Dell EMC OEM Solutions to offer a bundled solution to develop a data platform that can correlate massive data sets across users, digital things, and edge devices. The joint solution by Kinetica and Dell EMC enables enterprises to process massive data sets and create actionable insights by combining acceleration hardware with an NVIDIA GPU-accelerated database, machine learning, and visualization engine.

- In April 2018, OmniSci introduced MapD Cloud, a SaaS offering of GPU-accelerated analytics. It would help users to access the fastest open source SQL engine and visual analytics platform.

- In October 2018, NVIDIA launched an open source GPU-acceleration software platform for data science and machine learning. It is designed to provide data scientists the tools to run entire data science pipeline on GPUs.

Key Questions addressed by the report:

- Where will all these developments take the market in the mid to long term?

- What are the upcoming industry applications for GPU database?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakup of Primary Profiles

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the GPU Database Market

4.2 GPU Database Market, By Application (2018-2023)

4.3 GPU Database Market, By Deployment Model

4.4 GPU Database Market: Market Share Across Regions

5 Market Overview and Industry Trends (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Massive Data Generation Across BFSI, Retail, and Media and Entertainment Industries to Drive the Adoption of GPU-Accelerated Tools

5.2.1.2 Availability of Open Source Solutions and Their Growing Applications Areas

5.2.1.3 Regulations Creating Demand for Solutions That Provide Performance-At-Scale

5.2.2 Restraints

5.2.2.1 Unavailability of Sufficient Technical Expertise and Domain Knowledge

5.2.3 Opportunities

5.2.3.1 Growing Demand for High-Performance Computing in Various Data-Intensive Industries

5.2.3.2 Increasing Inclination of Enterprises Toward AI and Machine Learning Facilitated Workloads

5.2.4 Challenges

5.2.4.1 Lack of Adequate Data Security Measures

5.2.4.2 Limited Capabilities of Available GPU Databases to Perform Crucial Operations in Analytics Use Cases

5.3 Industry Trends

5.3.1 Evolution

5.3.2 GPU Database Workflow

5.3.3 GPU Database Market: Use Cases

5.3.3.1 Use Case 1: Increased Speed of Operation With Cost Reduction

5.3.3.2 Use Case 2: Improving Network and Maintaining Customer Loyalty With GPU-Based Smart Benchmarking Dashboard

5.3.3.3 Use Case 3: Enhancing Interaction Among GPU Clusters Through Traditional Query Language

5.3.4 Key Emerging Trends in the GPU Database Market

5.3.4.1 GPU-Accelerated Databases to Bring A Radical Change to IoT and Real-Time Data Analytics Applications

5.3.4.2 GPU-Accelerated Computing Would Continue to Enhance Machine Learning and Deep Learning Use-Cases

5.3.4.3 Applications Incorporating Location-Based Intelligence Would Benefit From GPU-Accelerated Databases

5.3.5 GPU Database Market: Future Outlook

6 GPU Database Market, By Component (Page No. - 42)

6.1 Introduction

6.2 Tools

6.2.1 GPU-Accelerated Databases

6.2.1.1 High-Performance Computing Capabilities of GPU-Accelerated Databases to Increase Their Deployment Across Various Business Applications

6.2.2 GPU-Accelerated Analytics

6.2.2.1 Need for Solutions Handling Extreme Analytics Workloads Without Cost-Burdening Organizations to Create Demand for GPU-Accelerated Analytics Solutions

6.3 Services

6.3.1 Consulting

6.3.1.1 Need for A Strategic Outlook Exploring New Avenues for Improving Business Performance to Drive the Growth of Consulting Services

6.3.2 Support and Maintenance

6.3.2.1 Complexity of Operations and the Need for Regular Assistance During the Software Lifecycle to Foster the Growth of Support and Maintenance

7 GPU Database Market, By Application (Page No. - 49)

7.1 Introduction

7.2 Governance, Risk, and Compliance

7.2.1 Demand for High-Performance Computing to Effectively Deal With Increased Regulatory and Data Security Requirements to Drive the Growth of the Governance, Risk, and Compliance Segment

7.3 Threat Intelligence

7.3.1 Need to Predict Cyber Threats in Advance to Drive the Growth of the Threat Intelligence Segment

7.4 Customer Experience Management

7.4.1 Need for Real-Time Insights Into Customer Data and Service Chain Performance to Drive the Growth of the Cem Segment

7.5 Fraud Detection and Prevention

7.5.1 Need for A Robust Infrastructure With High-Performance Computing and Scalability Required to Identify Fraud in Real Time to Drive the Growth of the Fraud Detection and Prevention Segment

7.6 Predictive Maintenance

7.6.1 Need to View and Monitor Real-Time Performance and Maintain Availability of Critical Assets to Drive the Growth of the Predictive Maintenance Segment

7.7 Supply Chain Management

7.7.1 Need to Efficiently Manage the Supply Chain and Cater Effectively to Consumers Dynamic Requirements to Drive the Growth of the SCM Segment

7.8 Others

8 GPU Database Market, By Deployment Model (Page No. - 57)

8.1 Introduction

8.2 On-Premises

8.2.1 Data Security and Privacy Requirements to Remain Factors Dominating Cloud-Based GPU Database Solutions

8.3 Cloud

8.3.1 24×7 Access to Worldwide Data to Drive the Growth of Cloud-Based GPU Database Tools and Services

9 GPU Database Market, By Vertical (Page No. - 61)

9.1 Introduction

9.2 BFSI

9.2.1 Parallel Computing With GPU-Accelerated Toolenable Organizations to Monitor for Anomalies in Diverse Streams of Transactions and Log Data

9.3 Retail and Ecommerce

9.3.1 Understanding Customer Behavior in Real Time to Improve Decision-Making

9.4 Healthcare and Pharmaceuticals

9.4.1 Emerging Applications, Such as Drug Discovery, Patient Care, and Insurance Fraud Detection, to Drive the Adoption of GPU-Accelerated Tools

9.5 Telecommunications and IT

9.5.1 Reduced Churn Rate, Improved Services, and Enhanced Customer Loyalty With GPU-Accelerated Tools to Drive the Market Growth

9.6 Transportation and Logistics

9.6.1 Need to Improve Efficiency and Customer Experience to Drive the Adoption of GPU Database in the Transportation and Logistics Vertical

9.7 Government and Defense

9.7.1 GPU-Accelerated Database to Analyze Any Data to Assess Terrorists and Other National Security Threats in Real Time

9.8 Others

10 GPU Database Market, By Region (Page No. - 70)

10.1 Introduction

10.2 North America

10.2.1 Growing Adoption of GPU-Accelerated Tools in the US and Canada Across Retail and Ecommerce, BFSI, and Government and Defense Verticals to Fuel the Market Growth

10.3 Europe

10.3.1 Enormous Data Generation and the Need for Interactive Analytics to Drive the Market Growth in the Region

10.4 Asia Pacific

10.4.1 Growing Technological Adoption, as Well as Increasing Presence of Industry Players in the Region, to Fuel the Demand for GPU-Accelerated Tools in the Region

10.5 Latin America

10.5.1 Digitalization and Favourable Government Policies to Drive the Growth of the Market in Latin America

10.6 Middle East and Africa

10.6.1 Middle East and Africa Countries, Including UAE, Qatar, Ksa, and South Africa, to Witness Significant Market Growth

11 Competitive Landscape (Page No. - 87)

11.1 Overview

11.2 Competitive Scenario

11.2.1 New Product Launches and Product Upgradations

11.2.2 Partnerships and Collaborations

11.2.3 Business Expansions

11.3 GPU Database Market: Prominent Players

12 Company Profiles (Page No. - 92)

(Business Overview, Tools and Services Offered, Recent Developments, SWOT Analysis, and MNM View)*

12.1 Kinetica

12.2 Omnisci

12.3 Sqream

12.4 Neo4j

12.5 Nvidia

12.6 Brytlyt

12.7 Jedox

12.8 Blazegraph

12.9 Blazingdb

12.10 Zilliz

12.11 Heterodb

12.12 H2o.Ai

12.13 Fastdata.Io

12.14 Fuzzy Logix

12.15 Graphistry

12.16 Anaconda

*Details on Business Overview, Tools and Services Offered, Recent Developments, SWOT Analysis, and MNM View might not be captured in case of unlisted companies.

13 Appendix (Page No. - 121)

13.1 Key Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customization

13.5 Related Reports

13.6 Author Details

List of Tables (57 Tables)

Table 1 GPU Database Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 2 Recent Venture Funding in GPU Database Market, 2017–2018

Table 3 GPU Database Market Size, By Component, 2016–2023 (USD Million)

Table 4 Tools: GPU Database Market Size, By Type, 2016–2023 (USD Million)

Table 5 Tools: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 6 GPU-Accelerated Databases Market Size, By Region, 2016–2023 (USD Million)

Table 7 GPU-Accelerated Analytics Market Size, By Region, 2016–2023 (USD Million)

Table 8 Services: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 9 GPU Database Market Size, By Application, 2016–2023 (USD Million)

Table 10 Governance, Risk, and Compliance: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 11 Threat Intelligence: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 12 Customer Experience Management: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 13 Fraud Detection and Prevention: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 14 Predictive Maintenance: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 15 Supply Chain Management: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 16 Others: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 17 GPU Database Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 18 On-Premises: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 19 Cloud: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 20 GPU Database Market Size, By Vertical, 2016–2023 (USD Million)

Table 21 BFSI: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 22 Retail and Ecommerce: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 23 Healthcare and Pharmaceuticals: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 24 Telecommunications and IT: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 25 Transportation and Logistics: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 26 Government and Defense: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 27 Others: GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 28 GPU Database Market Size, By Region, 2016–2023 (USD Million)

Table 29 North America: GPU Database Market Size, By Component, 2016–2023 (USD Million)

Table 30 North America: GPU Database Market Size, By Application, 2016–2023 (USD Million)

Table 31 North America: GPU Database Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 32 North America: GPU Database Market Size, By Tool, 2016–2023 (USD Million)

Table 33 North America: GPU Database Market Size, By Vertical, 2016–2023 (USD Million)

Table 34 Europe: GPU Database Market Size, By Component, 2016–2023 (USD Million)

Table 35 Europe: GPU Database Market Size, By Application, 2016–2023 (USD Million)

Table 36 Europe: GPU Database Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 37 Europe: GPU Database Market Size, By Tool, 2016–2023 (USD Million)

Table 38 Europe: GPU Database Market Size, By Vertical, 2016–2023 (USD Million)

Table 39 Asia Pacific: GPU Database Market Size, By Component, 2016–2023 (USD Million)

Table 40 Asia Pacific: GPU Database Market Size, By Application, 2016–2023 (USD Million)

Table 41 Asia Pacific: GPU Database Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 42 APAC: GPU Database Market Size, By Tool, 2016–2023 (USD Million)

Table 43 APAC: GPU Database Market Size, By Vertical, 2016–2023 (USD Million)

Table 44 Latin America: GPU Database Market Size, By Component, 2016–2023 (USD Million)

Table 45 Latin America: GPU Database Market Size, By Application, 2016–2023 (USD Million)

Table 46 Latin America: GPU Database Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 47 Latin America: GPU Database Market Size, By Tool, 2016–2023 (USD Million)

Table 48 Latin America: GPU Database Market Size, By Vertical, 2016–2023 (USD Million)

Table 49 Middle East and Africa: GPU Database Market Size, By Component, 2016–2023 (USD Million)

Table 50 Middle East and Africa: GPU Database Market Size, By Application, 2016–2023 (USD Million)

Table 51 Middle East and Africa: GPU Database Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 52 Middle East and Africa: GPU Database Market Size, By Tool, 2016–2023 (USD Million)

Table 53 Middle East and Africa: GPU Database Market Size, By Vertical, 2016–2023 (USD Million)

Table 54 New Product Launches and Product Upgradations, 2018

Table 55 Partnerships and Collaborations, 2017–2018

Table 56 Business Expansions, 2018

Table 57 Key Players in the GPU Database Market

List of Figures (29 Figures)

Figure 1 GPU Database Market: Research Design

Figure 2 GPU Database Market: Bottom-Up Approach

Figure 3 GPU Database Market: Top-Down Approach

Figure 4 GPU Database Market Overview

Figure 5 GPU Database Market to Witness High Growth During the Forecast Period

Figure 6 GPU Database Market, By Component (2018 vs 2023)

Figure 7 GPU Database Market, By Tool (2018–2023)

Figure 8 Increasing Need to Analyze the Real-Time Consumer Data for Informed Decision-Making to Drive the GPU Database Market

Figure 9 GPU Database Market, By Application (2018–2023)

Figure 10 GPU Database Market, By Deployment Model (2018–2023)

Figure 11 North America to Account for the Highest Market Share in 2018

Figure 12 Drivers, Restraints, Opportunities, and Challenges: GPU Database Market

Figure 13 GPU Database Market: Evolution

Figure 14 GPU Database: Workflow

Figure 15 Tools Segment to Account for A Larger Market Size During the Forecast Period

Figure 16 GPU-Accelerated Databases Segment to Grow at A Higher CAGR During the Forecast Period

Figure 17 SCM Segment to Grow at the Highest CAGR During the Forecast Period

Figure 18 On-Premises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 19 Retail and Ecommerce Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 20 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 21 North America: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Key Developments By the Leading Players in the GPU Database Market, 2017–2018

Figure 24 SWOT Analysis: Kinetica

Figure 25 SWOT Analysis: Omnisci

Figure 26 SWOT Analysis: Sqream

Figure 27 SWOT Analysis: Neo4j

Figure 28 Nvidia: Company Snapshot

Figure 29 SWOT Analysis: Nvidia

Growth opportunities and latent adjacency in GPU Database Market