2

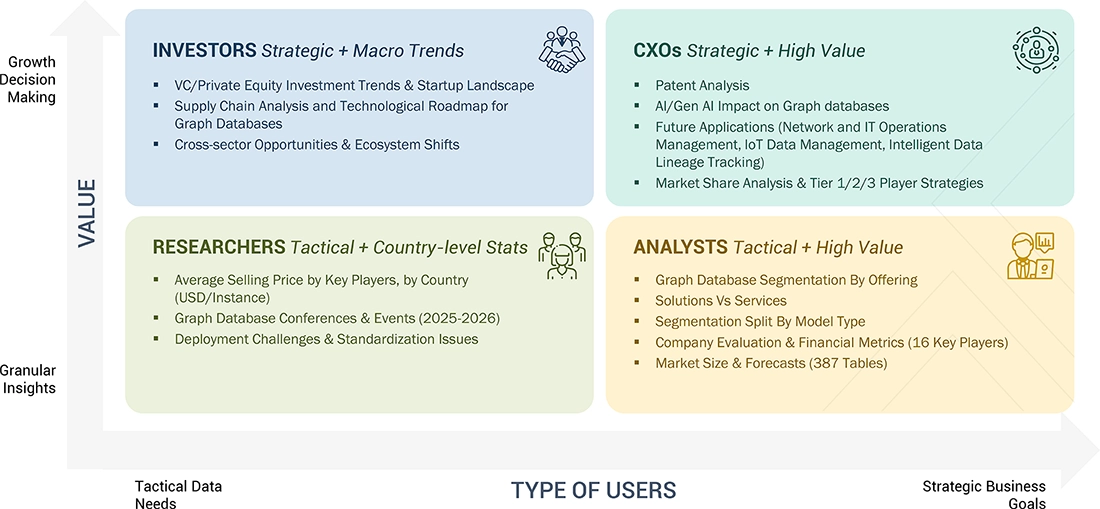

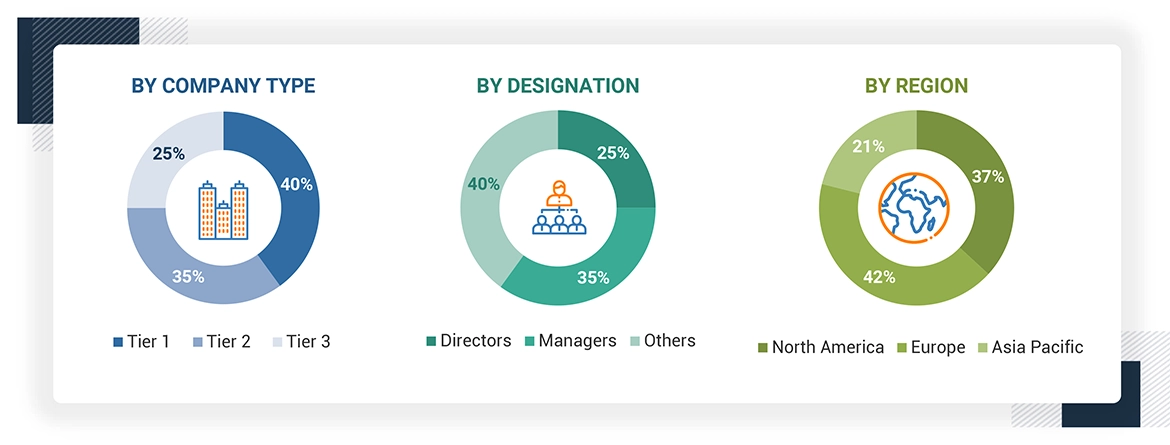

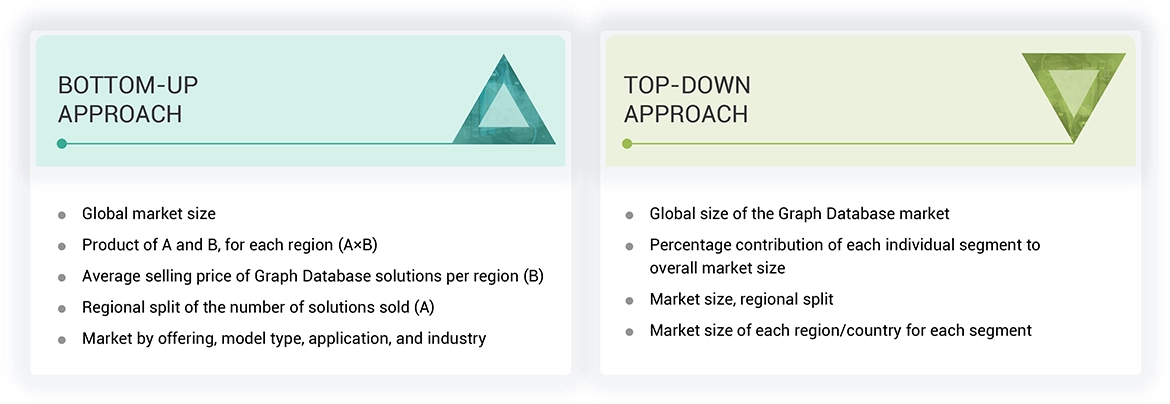

RESEARCH METHODOLOGY

47

5

MARKET OVERVIEW AND INDUSTRY TRENDS

Gen AI and real-time data mining drive demand for advanced, low-latency big data solutions.

63

5.1.1.1

INCREASING GEN AI APPLICATIONS

5.1.1.2

SURGING NEED FOR INCORPORATING REAL-TIME BIG DATA MINING WITH RESULT VISUALIZATION

5.1.1.3

RISING DEMAND FOR SOLUTIONS THAT CAN PROCESS LOW-LATENCY QUERIES

5.1.1.4

RAPID USE OF VIRTUALIZATION FOR BIG DATA ANALYTICS

5.1.1.5

GROWING DEMAND FOR SEMANTIC SEARCH ACROSS UNSTRUCTURED CONTENT

5.1.2.1

LACK OF STANDARDIZATION AND PROGRAMMING EASE

5.1.2.2

RAPID PROLIFERATION OF DATA MANAGEMENT TECHNOLOGIES

5.1.2.3

HIGH IMPLEMENTATION COSTS

5.1.3.1

DATA UNIFICATION AND RAPID PROLIFERATION OF KNOWLEDGE GRAPHS

5.1.3.2

PROVISION OF SEMANTIC KNOWLEDGEABLE GRAPHS TO ADDRESS COMPLEX-SCIENTIFIC RESEARCH

5.1.3.3

EMPHASIS ON EMERGENCE OF OPEN KNOWLEDGE NETWORKS

5.1.4.1

LACK OF TECHNICAL EXPERTISE

5.1.4.2

DIFFICULTY IN DEMONSTRATING BENEFITS OF KNOWLEDGE GRAPHS IN SINGLE APPLICATION OR USE CASE

5.2

BEST PRACTICES IN GRAPH DATABASE MARKET

5.2.1

VALIDATION OF USE CASES

5.2.2

AVOIDANCE OF INEFFICIENT TRAVERSAL PATTERNS

5.2.3

USAGE OF DATA MODELING

5.2.4

ENSURING DATA CONSISTENCY

5.2.5

PARTITIONING OF COSMOS DB

5.2.6

FOSTERING TEAM EXPERTISE IN GRAPH DATABASE

5.3

EVOLUTION OF GRAPH DATABASE MARKET

5.5.1

NEO4J-POWERED KNOWLEDGE GRAPH HELPED INTUIT PROVIDE REAL-TIME INSIGHTS AND FACILITATE SWIFT RESPONSES TO SECURITY THREATS

5.5.2

WESTJET IMPROVED ITS CUSTOMER BOOKING EXPERIENCE BY INTEGRATING NEO4J'S GRAPH TECHNOLOGY

5.5.3

NEWDAY IMPROVED FRAUD DETECTION CAPABILITIES WITH TIGERGRAPH CLOUD

5.5.4

CYBER RESILIENCE LEADER LEVERAGED TIGERGRAPH TO ELEVATE ITS NEXT-GENERATION CLOUD-BASED CYBERSECURITY SERVICES

5.5.5

XBOX CHOSE TIGERGRAPH TO EMPOWER ITS GRAPH ANALYTICS CAPABILITIES

5.5.6

DGRAPH'S CUTTING-EDGE DATABASE SOLUTION ENABLED MOONCAMP TO STREAMLINE ITS BACKEND OPERATIONS

5.5.7

NEO4J’S GRAPH DATABASE AND APPLICATION PLATFORM HELPED KERBEROS CONTROL COMPLEX LEGAL OBLIGATIONS

5.5.8

BLAZEGRAPH HELPED YAHOO7 DRIVE NATIVE REAL-TIME ADVERTISING USING GRAPH QUERIES

5.5.9

NEO4J ENABLED ICU’S TEAM TO VISUALIZE AND ANALYZE CONNECTIONS BETWEEN ELEMENTS OF PANAMA PAPERS LEAKS

5.5.10

NEO4J’S GRAPH TECHNOLOGY HELPED US ARMY BY TRACKING AND ANALYZING EQUIPMENT MAINTENANCE

5.5.11

JAGUAR LAND ROVER ACHIEVED REDUCED INVENTORY COSTS AND HIGHER PROFITABILITY USING TIGERGRAPH’S SOLUTION

5.5.12

MACY'S REDUCED CATALOG DATA REFRESH TIME BY SIX-FOLD

5.5.13

METAPHACTS AND ONTOTEXT ENABLED GLOBAL PHARMA COMPANY TO BOOST R&D KNOWLEDGE DISCOVERY

5.6

SUPPLY CHAIN ANALYSIS

5.7

INVESTMENT AND FUNDING SCENARIO

5.8

IMPACT OF GENERATIVE AI ON GRAPH DATABASE MARKET

5.8.1

USE CASES OF GENERATIVE AI IN GRAPH DATABASE

5.8.1.1

NEO4J LLM KNOWLEDGE GRAPH BUILDER ENABLED USERS TO EXTRACT NODES AND RELATIONSHIPS FROM UNSTRUCTURED TEXT

5.8.1.2

DATA²’S FLAGSHIP ANALYTICS PLATFORM, REVIEW, DELIVERED POWERFUL INSIGHTS BY INTEGRATING CUSTOMER DATA INTO NEO4J-BACKED KNOWLEDGE GRAPH

5.8.1.3

JPMORGAN LEVERAGED LLMS TO DETECT FRAUDULENT ACTIVITIES

5.8.1.4

MASTERCARD LEVERAGED GENAI CAPABILITIES TO STRENGTHEN ITS FRAUD DETECTION SYSTEM

5.9

TECHNOLOGY ROADMAP OF GRAPH DATABASE MARKET

5.10

REGULATORY LANDSCAPE

5.10.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2.1.1

SCR 17: ARTIFICIAL INTELLIGENCE BILL (CALIFORNIA)

5.10.2.1.2

S1103: ARTIFICIAL INTELLIGENCE AUTOMATED DECISION BILL (CONNECTICUT)

5.10.2.1.3

NATIONAL ARTIFICIAL INTELLIGENCE INITIATIVE ACT (NAIIA)

5.10.2.1.4

THE ARTIFICIAL INTELLIGENCE AND DATA ACT (AIDA) - CANADA

5.10.2.1.5

CYBERSECURITY MATURITY MODEL CERTIFICATION (CMMC) (US)

5.10.2.2.1

THE EUROPEAN UNION (EU) - ARTIFICIAL INTELLIGENCE ACT (AIA)

5.10.2.2.2

GENERAL DATA PROTECTION REGULATION (EUROPE)

5.10.2.3.1

INTERIM ADMINISTRATIVE MEASURES FOR GENERATIVE ARTIFICIAL INTELLIGENCE SERVICES (CHINA)

5.10.2.3.2

NATIONAL AI STRATEGY (SINGAPORE)

5.10.2.3.3

HIROSHIMA AI PROCESS COMPREHENSIVE POLICY FRAMEWORK (JAPAN)

5.10.2.4

MIDDLE EAST & AFRICA

5.10.2.4.1

NATIONAL STRATEGY FOR ARTIFICIAL INTELLIGENCE (UAE)

5.10.2.4.2

NATIONAL ARTIFICIAL INTELLIGENCE STRATEGY (QATAR)

5.10.2.4.3

AI ETHICS PRINCIPLES AND GUIDELINES (DUBAI)

5.10.2.5.1

THE SANTIAGO DECLARATION (CHILE)

5.10.2.5.2

BRAZILIAN ARTIFICIAL INTELLIGENCE STRATEGY - EBIA

5.11.2

LIST OF MAJOR PATENTS

5.12.1.2

GENERATIVE AI AND NATURAL LANGUAGE PROCESSING

5.12.2

COMPLEMENTARY TECHNOLOGIES

5.12.2.3

BIG DATA & ANALYTICS

5.12.2.4

GRAPH NEURAL NETWORKS

5.12.2.5

VECTOR DATABASES AND FULL-TEXT SEARCH ENGINES

5.12.2.6

MULTIMODAL DATABASES

5.12.3

ADJACENT TECHNOLOGIES

5.13.1

AVERAGE SELLING PRICE OF KEY PLAYERS, BY COUNTRY, 2023

5.13.2

INDICATIVE PRICING ANALYSIS, BY KEY PLAYER, 2023

5.14

KEY CONFERENCES AND EVENTS, 2025–2026

5.15

PORTER’S FIVE FORCES ANALYSIS

5.15.1

THREAT OF NEW ENTRANTS

5.15.2

THREAT OF SUBSTITUTES

5.15.3

BARGAINING POWER OF SUPPLIERS

5.15.4

BARGAINING POWER OF BUYERS

5.15.5

INTENSITY OF COMPETITIVE RIVALRY

5.16

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.17

KEY STAKEHOLDERS AND BUYING CRITERIA

5.17.1

KEY STAKEHOLDERS IN BUYING PROCESS

6

GRAPH DATABASE MARKET, BY OFFERING

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 36 Data Tables

114

6.1.1

OFFERING: GRAPH DATABASE MARKET DRIVERS

6.2.1

INCREASING NEED FOR ENHANCING PRODUCTIVITY AND MAINTAINING BUSINESS CONTINUITY TO DRIVE MARKET

6.2.2.2

GRAPH PROCESSING ENGINES

6.2.2.3

NATIVE GRAPH DATABASE

6.2.2.4

KNOWLEDGE GRAPH ENGINES

6.3.1.1

SPECIALIZED SKILLS FOR MAINTAINING AND UPDATING GRAPH DATABASE SOLUTIONS TO DRIVE MARKET

6.3.2

PROFESSIONAL SERVICES

6.3.2.1

CONSULTING SERVICES

6.3.2.1.1

INTEGRATION OF GRAPH DATABASES WITH ANALYTICS AND VIRTUALIZATION FRAMEWORKS TO BOOST MARKET

6.3.2.2

DEPLOYMENT & INTEGRATION SERVICES

6.3.2.2.1

GROWING NEED TO OVERCOME SYSTEM-RELATED ISSUES EFFECTIVELY TO DRIVE MARKET

6.3.2.3

SUPPORT & MAINTENANCE SERVICES

6.3.2.3.1

SERVICES PROVIDED FOR UPGRADATION AND MAINTENANCE OF OPERATING ECOSYSTEM POST-IMPLEMENTATION TO FUEL MARKET GROWTH

7

GRAPH DATABASE MARKET, BY MODEL TYPE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 6 Data Tables

131

7.1.1

MODEL TYPE: GRAPH DATABASE MARKET DRIVERS

7.2

RESOURCE DESCRIPTION FRAMEWORK

7.2.1

NEED FOR INTELLIGENT DATA MANAGEMENT SOLUTIONS TO DRIVE DEMAND FOR GRAPH DATABASE

7.3.1

INCREASING URGE TO FIND RELATIONSHIPS AMONG NUMEROUS ENTITIES TO BOOST MARKET

7.3.1.1

LABELED PROPERTY GRAPH

7.3.1.2

TYPED PROPERTY GRAPH

8

GRAPH DATABASE MARKET, BY APPLICATION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 22 Data Tables

136

8.1.1

APPLICATION: GRAPH DATABASE MARKET DRIVERS

8.2

DATA GOVERNANCE & MASTER DATA MANAGEMENT

8.2.1

NEED FOR MANAGING, INTEGRATING, AND SECURING COMPLEX DATA RELATIONSHIPS TO DRIVE MARKET

8.3

DATA ANALYTICS & BUSINESS INTELLIGENCE

8.3.1

SUPERIOR QUERY PERFORMANCE FOR COMPLEX OPERATIONS TO BOOST MARKET

8.4

KNOWLEDGE & CONTENT MANAGEMENT

8.4.1

INTUITIVE AND DYNAMIC WAY OF ORGANIZING, CONNECTING, AND RETRIEVING INFORMATION TO FUEL MARKET GROWTH

8.5

VIRTUAL ASSISTANTS, SELF-SERVICE DATA, AND DIGITAL ASSET DISCOVERY

8.5.1

PERSONALIZED, INTELLIGENT, AND CONTEXT-AWARE INTERACTIONS TO SUPPORT MARKET GROWTH

8.6

PRODUCT & CONFIGURATION MANAGEMENT

8.6.1

VISIBILITY INTO INTERDEPENDENCIES ACROSS TEAMS TO ENSURE TRACEABILITY AND BETTER DECISION-MAKING

8.7

INFRASTRUCTURE & ASSET MANAGEMENT

8.7.1

MODELING AND ANALYSIS OF INTRICATE RELATIONSHIPS BETWEEN ASSETS TO DRIVE MARKET

8.8

PROCESS OPTIMIZATION & RESOURCE MANAGEMENT

8.8.1

OPTIMIZE PROCESS BY ANALYZING COMPLEX, INTERCONNECTED DATA THROUGH GRAPH DATA SCIENCE

8.9

RISK MANAGEMENT, COMPLIANCE, AND REGULATORY REPORTING

8.9.1

IDENTIFICATION AND ASSESSMENT OF RISKS BY VISUALIZING CONNECTIONS TO BOOST MARKET

8.10

MARKET & CUSTOMER INTELLIGENCE AND SALES OPTIMIZATION

8.10.1

GRAPH DATABASES TO IMPROVE SALES EFFECTIVENESS AND CUSTOMER ENGAGEMENT

9

GRAPH DATABASE MARKET, BY VERTICAL

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 24 Data Tables

150

9.1.1

VERTICAL: GRAPH DATABASE MARKET DRIVERS

9.2

BANKING, FINANCIAL SERVICES, AND INSURANCE

9.2.1

GROWING ADOPTION OF FINANCIAL STANDARDS AND COMPLIANCE WITH REGULATIONS TO DRIVE MARKET

9.2.2.1

FRAUD DETECTION & RISK MANAGEMENT

9.2.2.1.1

NEO4J-POWERED SYSTEM HELPED BNP PARIBAS PERSONAL FINANCE ACHIEVE 20% REDUCTION IN FRAUD

9.2.2.1.2

ZURICH SWITZERLAND ENHANCED FRAUD INVESTIGATIONS WITH NEO4J

9.2.2.2

ANTI-MONEY LAUNDERING

9.2.2.2.1

US BANK LEVERAGED TIGERGRAPH'S GRAPH ANALYTICS CAPABILITIES TO DETECT INTRICATE MONEY LAUNDERING NETWORK

9.2.2.2.2

KERBEROS ENHANCED MONEY LAUNDERING CAPABILITIES WITH NEO4J'S GRAPH DATABASE AND STRUCTR APPLICATION PLATFORM

9.2.2.3

IDENTITY & ACCESS MANAGEMENT

9.2.2.3.1

ABILITY FOR MAPPING AND QUERYING INTRICATE RELATIONSHIPS TO DRIVE MARKET

9.2.2.4.1

RISING USAGE OF GRAPH DATABASE TOOLS AND SERVICES FOR ENHANCING RISK INTELLIGENCE CAPABILITIES TO AID MARKET GROWTH

9.2.2.4.2

UBS IMPLEMENTED NEO4J'S GRAPH DATABASE TO IMPROVE ITS DATA LINEAGE AND GOVERNANCE

9.2.2.4.3

MARIONETE INTEGRATED ITS VARIOUS DATABASES WITH THE NEO4J GRAPH DATABASE, ENABLING IT TO REDUCE CREDIT RISK AND INFLUENCE CHARGES

9.2.2.5

DATA INTEGRATION & GOVERNANCE

9.2.2.5.1

OPTIMIZING DATA SECURITY AND PRIVACY

9.2.2.5.2

REAL-TIME MONITORING AND AUDIT

9.2.2.6

KNOW YOUR CUSTOMER (KYC) PROCESS

9.2.2.6.1

NEO4J’S GRAPH TECHNOLOGY HELPED INSTITUTIONS SAVE TIME IN COMPLIANCE WORKFLOWS

9.2.2.7

OPERATIONAL RESILIENCE FOR BANK IT SYSTEMS

9.2.2.7.1

STARDOG’S PLATFORM ALLOWED FOR EASY NAVIGATION THROUGH INTERCONNECTED DATA, HELPING ORGANIZATIONS IDENTIFY DEPENDENCIES AND ANALYZE SYSTEMIC RISKS

9.2.2.8

REGULATORY COMPLIANCE

9.2.2.8.1

STREAMLINING REGULATORY COMPLIANCE WITH RDFOC

9.2.2.9

CUSTOMER 360° VIEW

9.2.2.9.1

UNIFIED, HOLISTIC PERSPECTIVE OF EACH CUSTOMER BY INTEGRATING DATA FROM MULTIPLE SOURCES

9.2.2.10

MARKET ANALYSIS & TREND DETECTION

9.2.2.10.1

GRAPH DATABASES TO HELP GAIN DEEPER INSIGHTS INTO ORGANIZATIONS’ COMPLEX RELATIONSHIPS AND ENHANCE CUSTOMER EXPERIENCES

9.2.2.11

POLICY IMPACT ANALYSIS

9.2.2.11.1

REAL-TIME UPDATES TO ENSURE QUICK ADAPTABILITY TO CHANGING REGULATIONS, MINIMIZING DISRUPTIONS, AND MAINTAINING OPERATIONAL EFFICIENCY

9.2.2.12

SELF-SERVICE DATA AND DIGITAL ASSET DISCOVERY

9.2.2.12.1

EMPOWERMENT OF USERS WITHOUT TECHNICAL EXPERTISE TO INDEPENDENTLY FIND, EXPLORE, AND HANDLE DATA FOSTERS MARKET GROWTH

9.2.2.13

CUSTOMER SUPPORT

9.2.2.13.1

QUICK ISSUE RESOLUTION, PERSONALIZED RESPONSES, AND CUSTOMIZED RECOMMENDATIONS TO BOOST MARKET

9.3.1

INCREASING NEED FOR IDENTIFYING CUSTOMER BEHAVIOR IN REAL-TIME TO DRIVE MARKET

9.3.2.1

FRAUD DETECTION IN ECOMMERCE

9.3.2.1.1

PAYPAL LEVERAGED REAL-TIME GRAPH DATABASES AND GRAPH ANALYSIS TO COMBAT FRAUD EFFECTIVELY

9.3.2.2

DYNAMIC PRICING OPTIMIZATION

9.3.2.2.1

DEPLOYMENT OF NEO4J-BASED SYSTEM SIGNIFICANTLY IMPROVED EFFICIENCY AND SCALABILITY IN MARRIOTT’S PRICING OPERATIONS

9.3.2.3

PERSONALIZED PRODUCT RECOMMENDATIONS

9.3.2.3.1

NEO4J’S GRAPH-BASED APPROACH ALLOWED WALMART TO ENHANCE ONLINE SHOPPING EXPERIENCE AND MAINTAIN COMPETITIVE EDGE

9.3.2.3.2

ABOUTYOU TRANSFORMED PERSONALIZED SHOPPING WITH ARANGODB, BOOSTING ENGAGEMENT AND EFFICIENCY

9.3.2.4

MARKET BASKET ANALYSIS

9.3.2.4.1

ANALYZING RELATIONSHIP BETWEEN PRODUCT PRICING AND CONSUMER BEHAVIOR TO SUPPORT DEVELOPMENT OF OPTIMIZED PRICING STRATEGIES

9.3.2.5

CUSTOMER EXPERIENCE ENHANCEMENT

9.3.2.5.1

RETAILER ACHIEVED ENHANCED STORE OPERATIONS AND IMPROVED CUSTOMER SATISFACTION WITH TIGERGRAPH’S PLATFORM

9.3.2.6

CHURN PREDICTION & PREVENTION

9.3.2.6.1

PREDICTING CHURN HELPS COMPANIES IDENTIFY CUSTOMERS AT RISK OF LEAVING

9.3.2.7

SOCIAL MEDIA INFLUENCE ON BUYING BEHAVIOR

9.3.2.7.1

INCREASING NEED FOR UNDERSTANDING AND LEVERAGING DYNAMICS OF SOCIAL MEDIA INFLUENCING CONSUMER-BUYING DECISIONS TO FUEL MARKET GROWTH

9.3.2.8

PRODUCT CONFIGURATION & RECOMMENDATION

9.3.2.8.1

NEO4J'S GRAPH DATABASE ENABLED EBAY ACHIEVE SEAMLESS AND INTELLIGENT PRODUCT DISCOVERY EXPERIENCE

9.3.2.9

CUSTOMER SEGMENTATION & TARGETING

9.3.2.9.1

TARGETED ADVERTISING AND PERSONALIZED SHOPPING EXPERIENCES TO HELP DRIVE SALES

9.3.2.10

CUSTOMER 360° VIEW

9.3.2.10.1

TRACKING OF CUSTOMER’S PURCHASE BEHAVIOR TO AID MARKET GROWTH

9.3.2.10.2

NEO4J EMPOWERED HÄSTENS TO BUILD COMPREHENSIVE 360-DEGREE VIEW OF ITS DATA, OPERATIONS, CUSTOMERS, AND PARTNERS

9.3.2.11

REVIEW & REPUTATION MANAGEMENT

9.3.2.11.1

TO ENHANCE AND MANAGE CUSTOMER REVIEW TO PROTECT REPUTATION

9.3.2.12

CUSTOMER SUPPORT

9.3.2.12.1

TO IMPROVED CUSTOMER SATISFACTION, FASTER RESPONSE TIMES, AND STRONGER CUSTOMER LOYALTY

9.4.1

SURGING DEMAND FOR IMPROVED SERVICES TO DRIVE MARKET

9.4.2.1

NETWORK OPTIMIZATION & MANAGEMENT

9.4.2.1.1

AUSTRALIA'S LEADING CARRIER ENHANCED NETWORK MONITORING AND SECURITY WITH ARANGODB

9.4.2.2

DATA INTEGRATION & GOVERNANCE

9.4.2.2.1

D&B ACHIEVED SIGNIFICANT REVENUE GROWTH AND EXPANDED ITS CUSTOMER BASE USING NEO4J’S GRAPH TECHNOLOGY

9.4.2.3

IT ASSET MANAGEMENT

9.4.2.3.1

ORANGE LEVERAGED ARANGODB TO BUILD DIGITAL TWIN PLATFORM FOR ENHANCED PROCESS OPTIMIZATION

9.4.2.4

NETWORK SECURITY ANALYSIS

9.4.2.4.1

ZETA GLOBAL CHOSE AMAZON NEPTUNE FOR ITS SCALABILITY, ELASTICITY, AND COST-EFFECTIVENESS

9.4.2.5

IOT DEVICE MANAGEMENT & CONNECTIVITY

9.4.2.5.1

BT GROUP LEVERAGED NEO4J TO DELIVER LIGHTNING-FAST INVENTORY MANAGEMENT AND STREAMLINE OPERATIONS

9.4.2.5.2

AMAZON NEPTUNE'S CAPABILITIES EMPOWERED TELECOM & IT SECTORS TO ACHIEVE ENHANCED DEVICE ORCHESTRATION AND SEAMLESS INTEGRATION OF IOT DATA

9.4.2.6

SELF-SERVICE DATA & DIGITAL ASSET DISCOVERY

9.4.2.6.1

OPTIMIZING TELECOM OPERATIONS WITH SELF-SERVICE DATA AND DIGITAL ASSET DISCOVERY

9.4.2.7

IDENTITY & ACCESS MANAGEMENT

9.4.2.7.1

INTERCONNECTED DATA MODEL HELPED TELENOR NORWAY ELIMINATE PERFORMANCE BOTTLENECKS AND DELIVER FASTER INSIGHTS

9.4.2.7.2

ENHANCED IDENTITY MANAGEMENT AND RECOMMENDATIONS WITH TIGERGRAPH

9.4.2.8

METADATA ENRICHMENT

9.4.2.8.1

ENHANCING DOCUMENT FINDABILITY WITH METADATA ENRICHMENT AT CISCO

9.4.2.9

SERVICE INCIDENT MANAGEMENT

9.4.2.9.1

PROACTIVE INCIDENT MANAGEMENT WITH NEO4J-POWERED INTELLIGENT NETWORK ANALYSIS TOOL

9.5

HEALTHCARE, LIFE SCIENCES, AND PHARMACEUTICALS

9.5.1

NEED FOR IMPROVED PATIENT-CENTRIC EXPERIENCE AND REAL-TIME TREATMENT TO DRIVE MARKET

9.5.2.1

DRUG DISCOVERY & DEVELOPMENT

9.5.2.1.1

NOVARTIS HARNESSED CUTTING-EDGE BIOLOGICAL INSIGHTS FOR DRUG DISCOVERY

9.5.2.1.2

REVOLUTIONIZING BIODIVERSITY INSIGHTS WITH GRAPH-POWERED KNOWLEDGE MAPPING

9.5.2.2

CLINICAL TRIAL MANAGEMENT

9.5.2.2.1

NEO4J’S KNOWLEDGE GRAPH-BASED APPLICATION HELPED NOVO NORDISK ACHIEVE END-TO-END CONSISTENCY AND INCREASED AUTOMATION

9.5.2.3

MEDICAL CLAIMS PROCESSING

9.5.2.3.1

UNITEDHEALTH IMPROVED MEDICAL CLAIM PROCESSING WITH GRAPH DATABASES

9.5.2.4

CLINICAL INTELLIGENCE

9.5.2.4.1

UNITEDHEALTH GROUP DEPLOYED GRAPH DATABASE TO ENHANCE PATIENT CARE

9.5.2.4.2

DOOLOO TURNED TO NEO4J’S GRAPH DATA PLATFORM FOR DELIVERING PERSONALIZED, DATA-DRIVEN INSIGHTS

9.5.2.5

HEALTHCARE NETWORK PROVIDER ANALYSIS

9.5.2.5.1

BOSTON SCIENTIFIC UTILIZED NEO4J’S GRAPH DATA SCIENCE LIBRARY TO SIMPLIFY COMPLEX MEDICAL SUPPLY CHAIN ANALYSIS

9.5.2.5.2

AMGEN ENHANCED DATA ANALYSIS AND SCALABILITY WITH TIGERGRAPH FOR HEALTHCARE INSIGHTS

9.5.2.6.1

EXACT SCIENCES ENHANCED CUSTOMER ENGAGEMENT WITH IMPLEMENTATION OF DOCTOR-AND-PRODUCT 360 SOLUTION POWERED BY TIGERGRAPH

9.5.2.6.2

OPTIMIZING HEALTHCARE CUSTOMER SUPPORT WITH GRAPH RAG-POWERED CHATBOTS

9.5.2.7

PATIENT JOURNEY & CARE PATHWAY ANALYSIS

9.5.2.7.1

NEO4J’S SCALABLE AND INTERCONNECTED DATA MODEL EMPOWERED CARE-FOR-RARE TO TRANSFORM VAST, SILOED DATASETS INTO ACTIONABLE MEDICAL INSIGHTS

9.5.2.8

SELF-SERVICE DATA & DIGITAL ASSET DISCOVERY

9.5.2.8.1

STARDOG-POWERED ENTERPRISE KNOWLEDGE GRAPH ENABLED BOEHRINGER INGELHEIM TO ADDRESS ITS CHALLENGE OF SILOED RESEARCH DATA

9.6

GOVERNMENT & PUBLIC SECTOR

9.6.1

RISING NEED FOR ENHANCED DATA SECURITY AND ADVANCED INTELLIGENCE TO DRIVE MARKET

9.6.2.1

GOVERNMENT SERVICE OPTIMIZATION

9.6.2.1.1

EMPOWERING GOVERNMENT AGENCIES WITH STARDOG VOICEBOX FOR SEAMLESS DATA INSIGHTS AND ENHANCED DECISION-MAKING

9.6.2.2

LEGISLATIVE & REGULATORY ANALYSIS

9.6.2.2.1

STREAMLINING LEGISLATIVE AND REGULATORY ANALYSIS WITH GRAPH DATABASES FOR ENHANCED COMPLIANCE AND DECISION-MAKING

9.6.2.3

CRISIS MANAGEMENT & DISASTER RESPONSE PLANNING

9.6.2.3.1

STRENGTHENING CYBERSECURITY WITH GRAPH DATABASES FOR PROACTIVE THREAT DETECTION AND RISK MANAGEMENT

9.6.2.4

ENVIRONMENTAL IMPACT ANALYSIS & ESG

9.6.2.4.1

NASA LEVERAGED STARDOG’S ENTERPRISE KNOWLEDGE PLATFORM, ENABLING SEAMLESS INTEGRATION AND ANALYSIS

9.6.2.5

SOCIAL NETWORK ANALYSIS FOR SECURITY AND LAW ENFORCEMENT

9.6.2.5.1

GLOBAL FINANCIAL INSTITUTION LEVERAGED NEO4J AND LINKURIOUS ENTERPRISE (LE) TO ENHANCE FRAUD DETECTION

9.6.2.6

POLICY IMPACT ANALYSIS

9.6.2.6.1

TRANSFORMING INFORMATION ACCESS AT IDB WITH KNOWLEDGE GRAPHS

9.6.2.7

KNOWLEDGE MANAGEMENT

9.6.2.7.1

NEO4J’S GRAPH DATABASE HELPED NASA LEVERAGE HISTORICAL INSIGHTS TO REDUCE PROJECT TIMELINES AND PREVENT DISASTERS

9.6.2.8

DATA INTEGRATION & GOVERNANCE

9.6.2.8.1

TRANSFORMING PRODUCT LIFECYCLE MANAGEMENT WITH GRAPH TECHNOLOGY

9.7

MANUFACTURING & AUTOMOTIVE

9.7.1

GROWING NEED FOR EXTENDING FACTORY EQUIPMENT LIFESPAN AND REDUCING PRODUCTION RISK DELAYS TO BOOST GROWTH

9.7.2.1

EQUIPMENT MANAGEMENT & PREDICTIVE MAINTENANCE

9.7.2.1.1

LEVERAGING GRAPH DATABASES FOR FLEXIBLE AND ROBUST OPERATIONS

9.7.2.2

PRODUCT LIFECYCLE MANAGEMENT

9.7.2.2.1

JAPANESE AUTOMOTIVE MANUFACTURER OPTIMIZED PRODUCT LIFE CYCLE AND VALIDATION WITH NEO4J-POWERED KNOWLEDGE GRAPH

9.7.2.3

MANUFACTURING PROCESS OPTIMIZATION

9.7.2.3.1

OPTIMIZING MANUFACTURING PROCESSES WITH STARDOG VOICEBOX AND DATABRICKS FOR ENHANCED QUALITY AND EFFICIENCY

9.7.2.3.2

FORD ENHANCED MANUFACTURING EFFICIENCY WITH TIGERGRAPH

9.7.2.4

ENHANCED VEHICLE SAFETY AND RELIABILITY

9.7.2.4.1

INCREASE VEHICLE SAFETY WITH ADVANCED TECHNOLOGIES AND GRAPH DATABASES

9.7.2.5

OPTIMIZATION OF INDUSTRIAL PROCESSES

9.7.2.5.1

ENHANCING SMART MANUFACTURING WITH SIEMENS' KNOWLEDGE GRAPH AND AI-DRIVEN AUTOMATION

9.7.2.5.2

OPTIMIZING AUTOMOTIVE PRICING AND PROCESSES WITH NEO4J AND AWS

9.7.2.6

ROOT CAUSE ANALYSIS

9.7.2.6.1

LEVERAGING KNOWLEDGE GRAPHS FOR TRANSPARENT AND EFFECTIVE ROOT CAUSE ANALYSIS

9.7.2.7

INVENTORY MANAGEMENT & DEMAND FORECASTING

9.7.2.7.1

OPTIMIZING INVENTORY MANAGEMENT WITH DYNAMIC STOCK CALCULATION AND COST ANALYSIS

9.7.2.8

SERVICE INCIDENT MANAGEMENT

9.7.2.8.1

IMPROVING SERVICE INCIDENT MANAGEMENT WITH GRAPH DATABASES IN MANUFACTURING AND AUTOMOTIVE

9.7.2.9

STAFF & RESOURCE ALLOCATION

9.7.2.9.1

ENHANCING RESOURCE AND STAFF ALLOCATION EFFICIENCY USING GRAPH DATABASES

9.7.2.10

PRODUCT CONFIGURATION & RECOMMENDATION

9.7.2.10.1

COX AUTOMOTIVE BUILT IDENTITY GRAPH USING AMAZON NEPTUNE TO CONNECT AND ANALYZE LARGE DATASETS OF SHOPPER INFORMATION

9.8

MEDIA & ENTERTAINMENT

9.8.1

DEMAND FOR MODELING-USER PREFERENCES AND CONTENT INTERACTIONS TO FOSTER MARKET GROWTH

9.8.2.1

CONTENT RECOMMENDATION & PERSONALIZATION

9.8.2.1.1

GRAPH DATABASES ENABLE MEDIA COMPANIES TO PROVIDE HIGHLY ACCURATE CONTENT RECOMMENDATIONS AND PERSONALIZED EXPERIENCES

9.8.2.1.2

KICKDYNAMIC ADOPTED TIGERGRAPH ON AWS CLOUD TO POWER ITS RECOMMENDATION ENGINE

9.8.2.1.3

MUSIMAP ADOPTED NEO4J GRAPH DATABASE TO OFFER PERSONALIZED MUSIC RECOMMENDATIONS

9.8.2.2

SOCIAL MEDIA INFLUENCE ANALYSIS

9.8.2.2.1

MYNTELLIGENCE OPTIMIZED SOCIAL MEDIA CAMPAIGNS WITH TIGERGRAPH'S REAL-TIME ANALYTICS

9.8.2.2.2

TIGERGRAPH’S ADVANCED ANALYTICS ENABLE OPENCORPORATES TO SUPPORT COMPLEX INVESTIGATIVE QUERIES WITH REAL-TIME RESPONSE TIMES

9.8.2.3

CONTENT RECOMMENDATION SYSTEM

9.8.2.3.1

IPPENDIGITAL’S ADOPTION OF TIGERGRAPH’S GRAPH DATABASE TECHNOLOGY HELPED DELIVER HYPER-PERSONALIZED CONTENT RECOMMENDATIONS

9.8.2.3.2

NETFLIX LEVERAGED GRAPH DATABASES FOR PERSONALIZATION AND SCALABILITY

9.8.2.4

USER ENGAGEMENT ANALYSIS

9.8.2.4.1

ENABLING ENTERPRISES TO CAPTURE AND DISSECT INTRICATE ASSOCIATIONS AMONG USERS

9.8.2.4.2

GRAPH TECHNOLOGY POWERED PERSONALIZED SMART HOME AUTOMATION FOR XFINITY

9.8.2.5

COPYRIGHT AND LICENSING MANAGEMENT

9.8.2.5.1

ENHANCING LICENSE AND COPYRIGHT MANAGEMENT IN MEDIA & ENTERTAINMENT INDUSTRY THROUGH GRAPH DATABASE TECHNOLOGY

9.8.2.6

KNOWLEDGE MANAGEMENT

9.8.2.6.1

GRAPH TECHNOLOGY TO ENHANCE COLLABORATION AND ACCELERATE DECISION-MAKING

9.8.2.7

AUDIENCE SEGMENTATION AND TARGETING

9.8.2.7.1

OPTIMIZING AUDIENCE SEGMENTATION AND TARGETING FOR MAXIMUM IMPACT

9.8.2.8

SELF-SERVICE DATA AND DIGITAL ASSET DISCOVERY

9.8.2.8.1

CONSISTENT METADATA MANAGEMENT, ROBUST SECURITY, USER TRAINING, AND SCALABILITY REQUIRED TO HANDLE GROWING VOLUME OF ASSETS EFFECTIVELY

9.9.1

SURGING DEMAND FOR DECREASING OPERATIONAL RISKS AND COSTS TO DRIVE MARKET

9.9.2.1

SMART GRID MANAGEMENT

9.9.2.1.1

ADOPTION OF GRAPH DATABASE TO MANAGE COMPLEX RELATIONSHIPS AND INTERCONNECTED DATA

9.9.2.2

ENERGY TRADING OPTIMIZATION

9.9.2.2.1

UNLOCKING EFFICIENT ENERGY TRADING WITH GRAPH DATABASE TECHNOLOGY

9.9.2.3

RENEWABLE ENERGY INTEGRATION & OPTIMIZATION

9.9.2.3.1

GRAPH DATABASES TO ENHANCE VISIBILITY INTO ENTIRE ENERGY ECOSYSTEM

9.9.2.4

PUBLIC INFRASTRUCTURE MANAGEMENT

9.9.2.4.1

ENHANCING PUBLIC INFRASTRUCTURE MANAGEMENT WITH GRAPH DATABASES

9.9.2.5

CUSTOMER ENGAGEMENT AND BILLING

9.9.2.5.1

EASE BILLING PROCESS TO IMPROVE CUSTOMER SATISFACTION

9.9.2.6

SERVICE INCIDENT MANAGEMENT

9.9.2.6.1

ENXCHANGE TRANSFORMED ENERGY GRID MANAGEMENT WITH GRAPH-BASED DIGITAL TWINS FOR REAL-TIME INSIGHTS AND COST SAVINGS

9.9.2.7

ENVIRONMENTAL IMPACT ANALYSIS AND ESG

9.9.2.7.1

OPTIMIZING ENERGY SUSTAINABILITY AND ENVIRONMENTAL IMPACT WITH GRAPH DATABASES

9.9.2.7.2

INTEGRATION OF ADVANCED TECHNOLOGIES TO ENHANCE DATA MANAGEMENT AND INSIGHTS

9.9.2.8

RAILWAY ASSET MANAGEMENT

9.9.2.8.1

CUSTOMIZED KNOWLEDGE GRAPHS ENABLE SMARTER DECISION-MAKING, PREDICTIVE MAINTENANCE, AND COST-EFFECTIVE OPERATIONS

9.9.2.9

STAFF AND RESOURCE ALLOCATION

9.9.2.9.1

OPTIMIZING STAFF AND RESOURCE ALLOCATION FOR SUSTAINABLE ENERGY OPERATIONS

9.10

TRAVEL & HOSPITALITY

9.10.1

FOCUS ON FOSTERING TRAVEL PLANS FOR BETTER CUSTOMER EXPERIENCES TO DRIVE MARKET EXPANSION

9.10.2.1

PERSONALIZED TRAVEL RECOMMENDATIONS

9.10.2.1.1

REVOLUTIONIZING PERSONALIZED TRAVEL RECOMMENDATIONS WITH GRAPH DATABASES

9.10.2.2

DYNAMIC PRICING OPTIMIZATION

9.10.2.2.1

TRANSFORMING DYNAMIC PRICE MANAGEMENT WITH GRAPH DATABASES

9.10.2.3

CUSTOMER JOURNEY MAPPING

9.10.2.3.1

CUSTOMER JOURNEY MAPPING TO GIVE PERSONALIZED RECOMMENDATIONS

9.10.2.4

BOOKING AND RESERVATION MANAGEMENT

9.10.2.4.1

GRAPH DATABASES ENSURE SEAMLESS CUSTOMER EXPERIENCES AND EFFICIENT OPERATIONS

9.10.2.5

CUSTOMER EXPERIENCE MANAGEMENT

9.10.2.5.1

TRANSFORMING CUSTOMER EXPERIENCE WITH UNIFIED DATA AND ACTIONABLE INSIGHTS

9.10.2.6

PRODUCT CONFIGURATION AND RECOMMENDATION

9.10.2.6.1

DYNAMIC PRODUCT CONFIGURATION AND PERSONALIZED RECOMMENDATIONS IN TRAVEL AND HOSPITALITY

9.11

TRANSPORTATION & LOGISTICS

9.11.1

RISING NEED FOR GAINING COMPLETE AND REAL-TIME VISIBILITY TO DRIVE MARKET

9.11.2

TRANSPORT FOR LONDON (TFL) REDUCED CONGESTION BY 10% USING DIGITAL TWIN POWERED BY NEO4J

9.11.3.1

ROUTE OPTIMIZATION AND FLEET MANAGEMENT

9.11.3.1.1

CAREEM ACHIEVED ENHANCED FRAUD DETECTION WITH AWS

9.11.3.1.2

OPTIMIZING DELIVERY ROUTES AND SCALING LOGISTICS WITH PRECISION DATA

9.11.3.2

SUPPLY CHAIN MANAGEMENT

9.11.3.2.1

TRANSFORMING SUPPLY CHAINS WITH GOOGLE CLOUD AND NEO4J

9.11.3.3

ASSET TRACKING AND MANAGEMENT

9.11.3.3.1

GRAPH DATABASES TO MODEL INTRICATE RELATIONSHIPS AND DEPENDENCIES BETWEEN ASSETS, LOCATIONS, AND STAKEHOLDERS

9.11.3.4

EQUIPMENT MAINTENANCE AND PREDICTIVE MAINTENANCE

9.11.3.4.1

OPTIMIZING EQUIPMENT MAINTENANCE WITH PREDICTIVE INSIGHTS POWERED BY GRAPH DATABASES

9.11.3.5

SUPPLY CHAIN MANAGEMENT

9.11.3.5.1

REVOLUTIONIZING SUPPLY CHAIN VISIBILITY THROUGH REAL-TIME DIGITAL TWIN SOLUTIONS

9.11.3.6

VENDOR AND SUPPLIER ANALYSIS

9.11.3.6.1

GRAPH DATABASE TO ENABLE COMPREHENSIVE VIEW OF SUPPLY CHAIN

9.11.3.7

OPERATIONAL EFFICIENCY & DECISION-MAKING

9.11.3.7.1

OPTIMIZING DELIVERY ROUTES AND SCALING LOGISTICS WITH PRECISION DATA

10

GRAPH DATABASE MARKET, BY REGION

Comprehensive coverage of 7 Regions with country-level deep-dive of 19 Countries | 206 Data Tables.

205

10.2.1

NORTH AMERICA: MACROECONOMIC OUTLOOK

10.2.2.1

INCREASING USE OF GRAPH DATABASES IN MEDICAL SCIENCE AND POLITICAL CAMPAIGNS TO FOSTER MARKET GROWTH

10.2.3.1

STRINGENT DATA REGULATION AND EXTENSIVE APPLICATIONS OF GRAPH DATABASES IN RESEARCH TO DRIVE GROWTH

10.3.1

EUROPE: MACROECONOMIC OUTLOOK

10.3.2.1

GOVERNMENT INITIATIVES AND HEALTHCARE-FOCUSED PROJECTS TO DRIVE MARKET GROWTH

10.3.3.1

INCREASING USE OF GRAPH DATABASES IN FINANCIAL SECTOR TO ACCELERATE MARKET GROWTH

10.3.4.1

INCREASING FOCUS ON ENHANCING INTEROPERABILITY TO BOOST MARKET

10.3.5.1

GRAPH DATABASES TO DRIVE INNOVATION, ENABLING DATA-DRIVEN DECISION-MAKING ACROSS KEY INDUSTRIES

10.3.6.1

GOVERNMENT INITIATIVES AND GEOGRAPHICAL RESEARCH TO BOLSTER MARKET GROWTH

10.4.1

ASIA PACIFIC: MACROECONOMIC OUTLOOK

10.4.2.1

MAJOR PLAYERS AND USE OF GRAPH DATABASES IN TELECOM FUELING MARKET GROWTH

10.4.3.1

INCREASING FOCUS ON DIGITAL TRANSFORMATION TO SUPPORT MARKET GROWTH

10.4.4.1

INTEGRATION OF KNOWLEDGE GRAPHS WITH GENERATIVE AI TO FUEL MARKET GROWTH

10.4.5

AUSTRALIA & NEW ZEALAND

10.4.5.1

STRATEGIC INITIATIVES AND PRESENCE OF MAJOR PLAYERS TO DRIVE ADOPTION OF GRAPH DATABASES

10.4.6.1

INCREASING APPLICATIONS OF GRAPH DATABASES IN FRAUD DETECTION, NETWORK ANALYSIS, AND AI-POWERED INNOVATIONS TO AID MARKET GROWTH

10.4.7

REST OF ASIA PACIFIC

10.5

MIDDLE EAST & AFRICA

10.5.1

MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

10.5.2.1.1

DIGITALIZATION INITIATIVES TO DRIVE MARKET GROWTH

10.5.2.2.1

INCREASING APPLICATIONS OF GRAPH DATABASES FOR ENVIRONMENTAL INSIGHTS AND RESEARCH COLLABORATION TO DRIVE MARKET GROWTH

10.5.2.3.1

RISING DEMAND FOR ADVANCED DATA ANALYTICS AND INTERCONNECTED DATA MANAGEMENT SOLUTIONS TO DRIVE MARKET GROWTH

10.5.2.4.1

INCREASING ADOPTION OF GRAPH TECHNOLOGIES TO ADDRESS CHALLENGES IN DATA ANALYTICS, DECISION-MAKING, AND INNOVATION

10.5.2.5

REST OF MIDDLE EAST

10.5.3.1

STRATEGIC INVESTMENTS IN CLOUD AND AI TECHNOLOGIES TO DRIVE ADOPTION OF GRAPH DATABASES

10.6.1

LATIN AMERICA: MACROECONOMIC OUTLOOK

10.6.2.1

GROWING ADOPTION OF GRAPH DATABASES ACROSS INDUSTRIES AND KEY COLLABORATIVE INITIATIVES TO DRIVE MARKET

10.6.3.1

ADVANCEMENTS IN CLOUD INFRASTRUCTURE AND AI TO FURTHER ENABLE SCALABLE DEPLOYMENT OF GRAPH DATABASES

10.6.4.1

INCREASING INVESTMENTS IN CLOUD INFRASTRUCTURE TO ACCELERATE ADOPTION OF GRAPH DATABASES

10.6.5

REST OF LATIN AMERICA

11

COMPETITIVE LANDSCAPE

Discover market dominance shifts and strategic insights shaping competitive advantage in 2024.

283

11.2

KEY PLAYER STRATEGIES/RIGHT TO WIN

11.3

MARKET SHARE ANALYSIS, 2024

11.3.1

MARKET RANKING ANALYSIS

11.4

REVENUE ANALYSIS, 2019–2023

11.5

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

11.5.5

COMPANY FOOTPRINT: KEY PLAYERS, 2024

11.5.5.1

COMPANY FOOTPRINT

11.5.5.2

OFFERING FOOTPRINT

11.5.5.3

MODEL TYPE FOOTPRINT

11.5.5.4

APPLICATION FOOTPRINT

11.5.5.5

VERTICAL FOOTPRINT

11.5.5.6

REGION FOOTPRINT

11.6

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

11.6.1

PROGRESSIVE COMPANIES

11.6.2

RESPONSIVE COMPANIES

11.6.5

COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

11.6.5.1

DETAILED LIST OF KEY STARTUPS/SMES

11.6.5.2

COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.7

COMPETITIVE SCENARIO

11.7.1

PRODUCT LAUNCHES AND ENHANCEMENTS

11.9

COMPANY VALUATION AND FINANCIAL METRICS

12

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

304

12.1.1.1

BUSINESS OVERVIEW

12.1.1.2

PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.1.3

RECENT DEVELOPMENTS

12.1.1.3.1

PRODUCT LAUNCHES AND ENHANCEMENTS

12.1.1.4.2

STRATEGIC CHOICES

12.1.1.4.3

WEAKNESSES AND COMPETITIVE THREATS

12.1.2

AMAZON WEB SERVICES, INC

12.1.7

MICROSOFT CORPORATION, INC.

12.1.10

ORACLE CORPORATION

12.1.11

PROGRESS SOFTWARE

12.1.15

OPENLINK SOFTWARE

12.2.1

OXFORD SEMANTIC TECHNOLOGIES

13

ADJACENT AND RELATED MARKETS

351

13.3

CLOUD DATABASE AND DBAAS MARKET

13.3.2.1

CLOUD DATABASE AND DBAAS MARKET, BY COMPONENT

13.3.2.2

CLOUD DATABASE AND DBAAS MARKET, BY DEPLOYMENT MODEL

13.3.2.3

CLOUD DATABASE AND DBAAS MARKET, BY ORGANIZATION SIZE

13.3.2.4

CLOUD DATABASE AND DBAAS MARKET, BY VERTICAL

13.3.2.5

CLOUD DATABASE AND DBAAS MARKET, BY REGION

13.4

VECTOR DATABASE MARKET

13.4.2

VECTOR DATABASE MARKET, BY OFFERING

13.4.3

VECTOR DATABASE MARKET, BY TECHNOLOGY

13.4.4

VECTOR DATABASE MARKET, BY VERTICAL

13.4.5

VECTOR DATABASE MARKET, BY REGION

14.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3

CUSTOMIZATION OPTIONS

TABLE 1

USD EXCHANGE RATE, 2021–2023

TABLE 2

PRIMARY INTERVIEWS WITH EXPERTS

TABLE 4

GRAPH DATABASE MARKET: ECOSYSTEM

TABLE 5

TECHNOLOGY ROADMAP OF GRAPH DATABASE MARKET, 2024–2030

TABLE 6

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9

REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10

GRAPH DATABASE MARKET: KEY PATENTS, 2014–2022

TABLE 11

AVERAGE SELLING PRICES OF GRAPH DATABASE SOLUTIONS, BY REGION, 2023

TABLE 12

INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, 2023 (USD)

TABLE 13

GRAPH DATABASE MARKET: CONFERENCES AND EVENTS, 2025–2026

TABLE 14

IMPACT OF PORTER’S FIVE FORCES ON GRAPH DATABASE MARKET

TABLE 15

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

TABLE 16

KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

TABLE 17

GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 18

GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 19

GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 20

GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 21

SOLUTIONS: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 22

SOLUTIONS: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 23

GRAPH EXTENSIONS: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 24

GRAPH EXTENSIONS: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 25

GRAPH PROCESSING ENGINES: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 26

GRAPH PROCESSING ENGINES: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 27

NATIVE GRAPH DATABASE: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 28

NATIVE GRAPH DATABASE: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 29

KNOWLEDGE GRAPH ENGINES: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 30

KNOWLEDGE GRAPH ENGINES: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 31

GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 32

GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 33

CLOUD: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 34

CLOUD: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 35

ON-PREMISES: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 36

ON-PREMISES: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 37

GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 38

GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 39

SERVICES: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 40

SERVICES: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 41

MANAGED SERVICES: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 42

MANAGED SERVICES: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 43

PROFESSIONAL SERVICES: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 44

PROFESSIONAL SERVICES: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 45

GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 46

GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 47

CONSULTING SERVICES: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 48

CONSULTING SERVICES: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 49

DEPLOYMENT & INTEGRATION SERVICES: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 50

DEPLOYMENT & INTEGRATION SERVICES: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 51

SUPPORT & MAINTENANCE SERVICES: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 52

SUPPORT & MAINTENANCE SERVICES: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 53

GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 54

GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 55

RESOURCE DESCRIPTION FRAMEWORK: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 56

RESOURCE DESCRIPTION FRAMEWORK: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 57

PROPERTY GRAPH: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 58

PROPERTY GRAPH: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 59

GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 60

GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 61

DATA GOVERNANCE & MASTER DATA MANAGEMENT: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 62

DATA GOVERNANCE & MASTER DATA MANAGEMENT: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 63

DATA ANALYTICS & BUSINESS INTELLIGENCE: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 64

DATA ANALYTICS & BUSINESS INTELLIGENCE: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 65

KNOWLEDGE & CONTENT MANAGEMENT: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 66

KNOWLEDGE & CONTENT MANAGEMENT: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 67

VIRTUAL ASSISTANTS, SELF-SERVICE DATA, AND DIGITAL ASSET DISCOVERY: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 68

VIRTUAL ASSISTANTS, SELF-SERVICE DATA, AND DIGITAL ASSET DISCOVERY: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 69

PRODUCT & CONFIGURATION MANAGEMENT: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 70

PRODUCT & CONFIGURATION MANAGEMENT: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 71

INFRASTRUCTURE & ASSET MANAGEMENT: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 72

INFRASTRUCTURE & ASSET MANAGEMENT: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 73

PROCESS OPTIMIZATION & RESOURCE MANAGEMENT: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 74

PROCESS OPTIMIZATION & RESOURCE MANAGEMENT: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 75

RISK MANAGEMENT, COMPLIANCE, AND REGULATORY REPORTING: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 76

RISK MANAGEMENT, COMPLIANCE, AND REGULATORY REPORTING: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 77

MARKET & CUSTOMER INTELLIGENCE AND SALES OPTIMIZATION: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 78

MARKET & CUSTOMER INTELLIGENCE AND SALES OPTIMIZATION: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 79

OTHER APPLICATIONS: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 80

OTHER APPLICATIONS: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 81

GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 82

GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 83

BANKING, FINANCIAL SERVICES, AND INSURANCE: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 84

BANKING, FINANCIAL SERVICES, AND INSURANCE: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 85

RETAIL & ECOMMERCE: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 86

RETAIL & ECOMMERCE: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 87

TELECOM & TECHNOLOGY: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 88

TELECOM & IT: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 89

HEALTHCARE, LIFESCIENCES, AND PHARMACEUTICALS: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 90

HEALTHCARE, LIFESCIENCES, AND PHARMACEUTICALS: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 91

GOVERNMENT & PUBLIC SECTOR: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 92

GOVERNMENT & PUBLIC SECTOR: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 93

MANUFACTURING & AUTOMOTIVE: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 94

MANUFACTURING & AUTOMOTIVE: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 95

MEDIA & ENTERTAINMENT: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 96

MEDIA & ENTERTAINMENT: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 97

ENERGY & UTILITIES: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 98

ENERGY & UTILITIES: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 99

TRAVEL & HOSPITALITY: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 100

TRAVEL & HOSPITALITY: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 101

TRANSPORTATION & LOGISTICS: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 102

TRANSPORTATION & LOGISTICS: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 103

OTHER VERTICALS: GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 104

OTHER VERTICALS: GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 105

GRAPH DATABASE MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 106

GRAPH DATABASE MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 107

NORTH AMERICA: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 108

NORTH AMERICA: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 109

NORTH AMERICA: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 110

NORTH AMERICA: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 111

NORTH AMERICA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 112

NORTH AMERICA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 113

NORTH AMERICA: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 114

NORTH AMERICA: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 115

NORTH AMERICA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 116

NORTH AMERICA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 117

NORTH AMERICA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 118

NORTH AMERICA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 119

NORTH AMERICA: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 120

NORTH AMERICA: GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 121

NORTH AMERICA: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 122

NORTH AMERICA: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 123

NORTH AMERICA: GRAPH DATABASE MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 124

NORTH AMERICA: GRAPH DATABASE MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 125

US: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 126

US: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 127

US: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 128

US: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 129

US: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 130

US: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 131

US: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 132

US: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 133

US: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 134

US: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 135

US: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 136

US: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 137

US: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 138

US: GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 139

US: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 140

US: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 141

EUROPE: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 142

EUROPE: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 143

EUROPE: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 144

EUROPE: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 145

EUROPE: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 146

EUROPE: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 147

EUROPE: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 148

EUROPE: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 149

EUROPE: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 150

EUROPE: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 151

EUROPE: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 152

EUROPE: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 153

EUROPE: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 154

EUROPE: GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 155

EUROPE: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 156

EUROPE: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 157

EUROPE: GRAPH DATABASE MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 158

EUROPE: GRAPH DATABASE MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 159

UK: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 160

UK: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 161

UK: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 162

UK: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 163

UK: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 164

UK: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 165

UK: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 166

UK: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 167

UK: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 168

UK: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 169

UK: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 170

UK: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 171

UK: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 172

UK: GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 173

UK: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 174

UK: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 175

ITALY: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 176

ITALY: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 177

ITALY: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 178

ITALY: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 179

ITALY: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 180

ITALY: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 181

ITALY: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 182

ITALY: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 183

ITALY: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 184

ITALY: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 185

ITALY: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 186

ITALY: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 187

ITALY: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 188

ITALY: GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 189

ITALY: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 190

ITALY: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 191

ASIA PACIFIC: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 192

ASIA PACIFIC: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 193

ASIA PACIFIC: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 194

ASIA PACIFIC: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 195

ASIA PACIFIC: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 196

ASIA PACIFIC: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 197

ASIA PACIFIC: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 198

ASIA PACIFIC: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 199

ASIA PACIFIC: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 200

ASIA PACIFIC: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 201

ASIA PACIFIC: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 202

ASIA PACIFIC: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 203

ASIA PACIFIC: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 204

ASIA PACIFIC: GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 205

ASIA PACIFIC: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 206

ASIA PACIFIC: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 207

ASIA PACIFIC: GRAPH DATABASE MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 208

ASIA PACIFIC: GRAPH DATABASE MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 209

CHINA: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 210

CHINA: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 211

CHINA: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 212

CHINA: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 213

CHINA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 214

CHINA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 215

CHINA: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 216

CHINA: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 217

CHINA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 218

CHINA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 219

CHINA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 220

CHINA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 221

CHINA: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 222

CHINA: GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 223

CHINA: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 224

CHINA: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 225

INDIA: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 226

INDIA: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 227

INDIA: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 228

INDIA: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 229

INDIA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 230

INDIA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 231

INDIA: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 232

INDIA: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 233

INDIA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 234

INDIA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 235

INDIA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 236

INDIA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 237

INDIA: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 238

INDIA: GRAPH DATABASE MARKET, BY APPLICATIONS, 2024–2030 (USD MILLION)

TABLE 239

INDIA: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 240

INDIA: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 241

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 242

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 243

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 244

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 245

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 246

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 247

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 248

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 249

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 250

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 251

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 252

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 253

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 254

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 255

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 256

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 257

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 258

MIDDLE EAST & AFRICA: GRAPH DATABASE MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 259

MIDDLE EAST: GRAPH DATABASE MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 260

MIDDLE EAST: GRAPH DATABASE MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 261

KSA: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 262

KSA: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 263

KSA: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 264

KSA: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 265

KSA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 266

KSA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 267

KSA: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 268

KSA: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 269

KSA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 270

KSA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 271

KSA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 272

KSA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 273

KSA: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 274

KSA: GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 275

KSA: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 276

KSA: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 277

LATIN AMERICA: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 278

LATIN AMERICA: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 279

LATIN AMERICA: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 280

LATIN AMERICA: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 281

LATIN AMERICA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 282

LATIN AMERICA: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 283

LATIN AMERICA: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 284

LATIN AMERICA: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 285

LATIN AMERICA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 286

LATIN AMERICA: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 287

LATIN AMERICA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 288

LATIN AMERICA: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 289

LATIN AMERICA: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 290

LATIN AMERICA: GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 291

LATIN AMERICA: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 292

LATIN AMERICA: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 293

LATIN AMERICA: GRAPH DATABASE MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 294

LATIN AMERICA: GRAPH DATABASE MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 295

BRAZIL: GRAPH DATABASE MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 296

BRAZIL: GRAPH DATABASE MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 297

BRAZIL: GRAPH DATABASE MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

TABLE 298

BRAZIL: GRAPH DATABASE MARKET, BY SOLUTION, 2024–2030 (USD MILLION)

TABLE 299

BRAZIL: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 300

BRAZIL: GRAPH DATABASE MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 301

BRAZIL: GRAPH DATABASE MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 302

BRAZIL: GRAPH DATABASE MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 303

BRAZIL: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 304

BRAZIL: GRAPH DATABASE MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 305

BRAZIL: GRAPH DATABASE MARKET, BY MODEL TYPE, 2019–2023 (USD MILLION)

TABLE 306

BRAZIL: GRAPH DATABASE MARKET, BY MODEL TYPE, 2024–2030 (USD MILLION)

TABLE 307

BRAZIL: GRAPH DATABASE MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 308

BRAZIL: GRAPH DATABASE MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 309

BRAZIL: GRAPH DATABASE MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

TABLE 310

BRAZIL: GRAPH DATABASE MARKET, BY VERTICAL, 2024–2030 (USD MILLION)

TABLE 311

OVERVIEW OF STRATEGIES DEPLOYED BY KEY GRAPH DATABASE MARKET PLAYERS, 2021–2024

TABLE 312

GRAPH DATABASE MARKET: DEGREE OF COMPETITION

TABLE 313

GRAPH DATABASE MARKET: OFFERING FOOTPRINT

TABLE 314

GRAPH DATABASE MARKET: MODEL TYPE FOOTPRINT

TABLE 315

GRAPH DATABASE MARKET: APPLICATION FOOTPRINT

TABLE 316

GRAPH DATABASE MARKET: VERTICAL FOOTPRINT

TABLE 317

GRAPH DATABASE MARKET: REGION FOOTPRINT

TABLE 318

GRAPH DATABASE MARKET: LIST OF KEY STARTUPS/SMES

TABLE 319

COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 320

GRAPH DATABASE: PRODUCT LAUNCHES AND ENHANCEMENTS, SEPTEMBER 2022–OCTOBER 2024

TABLE 321

GRAPH DATABASE MARKET: DEALS, JANUARY 2023–NOVEMBER 2024

TABLE 322

NEO4J: COMPANY OVERVIEW

TABLE 323

NEO4J: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 324

NEO4J: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 326

AMAZON WEB SERVICES: COMPANY OVERVIEW

TABLE 327

AMAZON WEB SERVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 328

AMAZON WEB SERVICES: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 329

AMAZON WEB SERVICES: DEALS

TABLE 330

TIGERGRAPH: COMPANY OVERVIEW

TABLE 331

TIGERGRAPH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 332

TIGERGRAPH: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 333

TIGERGRAPH: DEALS

TABLE 334

RELATIONALAI: COMPANY OVERVIEW

TABLE 335

RELATIONALAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 336

RELATIONALAI: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 337

GRAPHWISE: COMPANY OVERVIEW

TABLE 338

GRAPHWISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 339

GRAPHWISE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 340

GRAPHWISE: DEALS

TABLE 341

IBM: COMPANY OVERVIEW

TABLE 342

IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 344

MICROSOFT: COMPANY OVERVIEW

TABLE 345

MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 346

MICROSOFT: DEALS

TABLE 347

STARDOG: COMPANY OVERVIEW

TABLE 348

STARDOG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 349

STARDOG: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 351

ALTAIR: COMPANY OVERVIEW

TABLE 352

ALTAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 353

ALTAIR: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 355

ORACLE: COMPANY OVERVIEW

TABLE 356

ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 357

ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 358

PROGRESS SOFTWARE: COMPANY OVERVIEW

TABLE 359

PROGRESS SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 360

PROGRESS SOFTWARE: DEALS

TABLE 361

FRANZ INC: COMPANY OVERVIEW

TABLE 362

FRANZ INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 363

FRANZ INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 364

DATASTAX: COMPANY OVERVIEW

TABLE 365

DATASTAX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 366

DATASTAX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 367

DATASTAX: DEALS

TABLE 368

CLOUD DATABASE AND DBAAS MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

TABLE 369

CLOUD DATABASE AND DBAAS MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

TABLE 370

CLOUD DATABASE AND DBAAS MARKET, BY SERVICE, 2018–2022 (USD MILLION)

TABLE 371

CLOUD DATABASE AND DBAAS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

TABLE 372

CLOUD DATABASE AND DBAAS MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

TABLE 373

CLOUD DATABASE AND DBAAS MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

TABLE 374

CLOUD DATABASE AND DBAAS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

TABLE 375

CLOUD DATABASE AND DBAAS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

TABLE 376

CLOUD DATABASE AND DBAAS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

TABLE 377

CLOUD DATABASE AND DBAAS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

TABLE 378

CLOUD DATABASE AND DBAAS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 379

VECTOR DATABASE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

TABLE 380

VECTOR DATABASE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 381

VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

TABLE 382

VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

TABLE 383

VECTOR DATABASE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

TABLE 384

VECTOR DATABASE MARKET, BY REGION, 2019–2022 (USD MILLION)

TABLE 385

VECTOR DATABASE MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 386

VECTOR DATABASE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

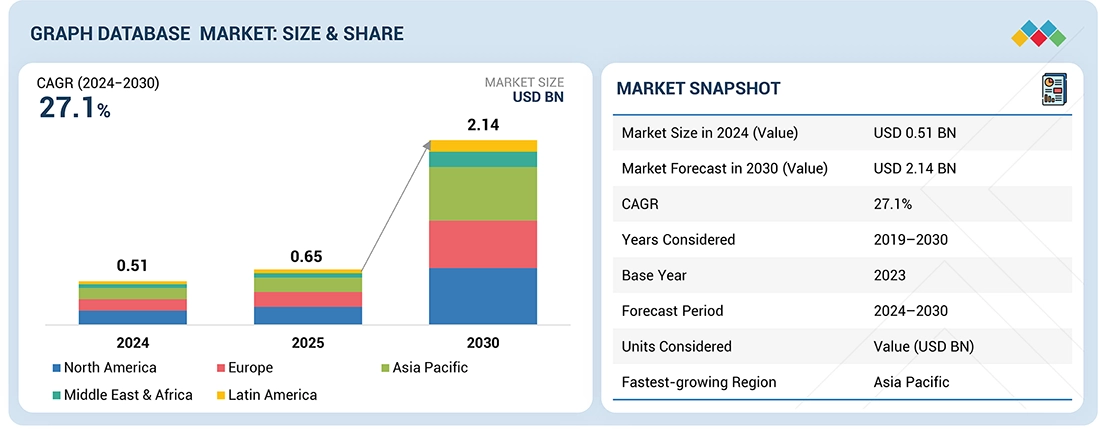

FIGURE 1

GRAPH DATABASE MARKET: RESEARCH DESIGN

FIGURE 2

KEY DATA FROM SECONDARY SOURCES

FIGURE 3

TOP-DOWN APPROACH

FIGURE 4

APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN GRAPH DATABASE MARKET, 2024

FIGURE 5

BOTTOM-UP APPROACH

FIGURE 6

DEMAND-SIDE ANALYSIS

FIGURE 7

BOTTOM-UP (SUPPLY SIDE) ANALYSIS: COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES OF EMOTION AI MARKET

FIGURE 8

DATA TRIANGULATION

FIGURE 9

GRAPH DATABASE MARKET, 2024–2030 (USD MILLION)

FIGURE 10

GRAPH DATABASE MARKET, BY REGION (2024)

FIGURE 11

INCREASING RELIANCE ON REAL-TIME ANALYTICS FOR CRITICAL DECISION-MAKING ACROSS INDUSTRIES TO DRIVE MARKET

FIGURE 12

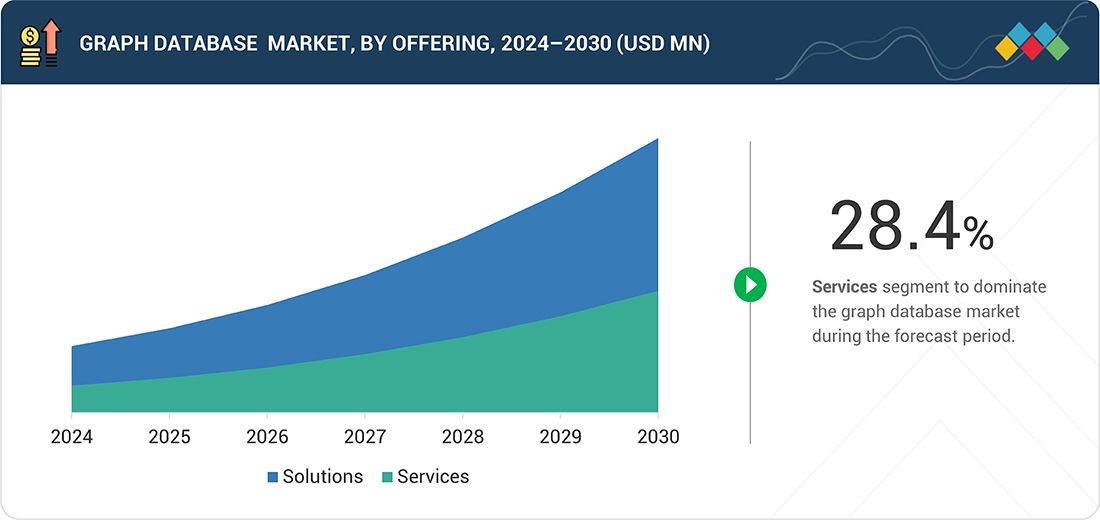

SOLUTIONS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 13

MANAGED SERVICES SEGMENT TO ACCOUNT FOR HIGHER CAGR DURING FORECAST PERIOD

FIGURE 14

DEPLOYMENT & INTEGRATION SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

FIGURE 15

DATA GOVERNANCE & MASTER DATA MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 16

PROPERTY GRAPH TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 17

BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 18

SOLUTIONS & PROPERTY GRAPH SEGMENTS TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2024

FIGURE 19

GRAPH DATABASE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 20

EVOLUTION OF GRAPH DATABASE MARKET

FIGURE 21

GRAPH DATABASE MARKET: ECOSYSTEM ANALYSIS

FIGURE 22

GRAPH DATABASE MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 23

GRAPH DATABASE MARKET: INVESTMENT AND FUNDING SCENARIO, 2020–2024 (USD MILLION)

FIGURE 24

USE CASES OF GENERATIVE AI IN GRAPH DATABASE MARKET

FIGURE 25

LIST OF MAJOR PATENTS FOR GRAPH DATABASE MARKET (2014–2024)

FIGURE 26

AVERAGE SELLING PRICE OF KEY PLAYERS, BY COUNTRY, 2023

FIGURE 27

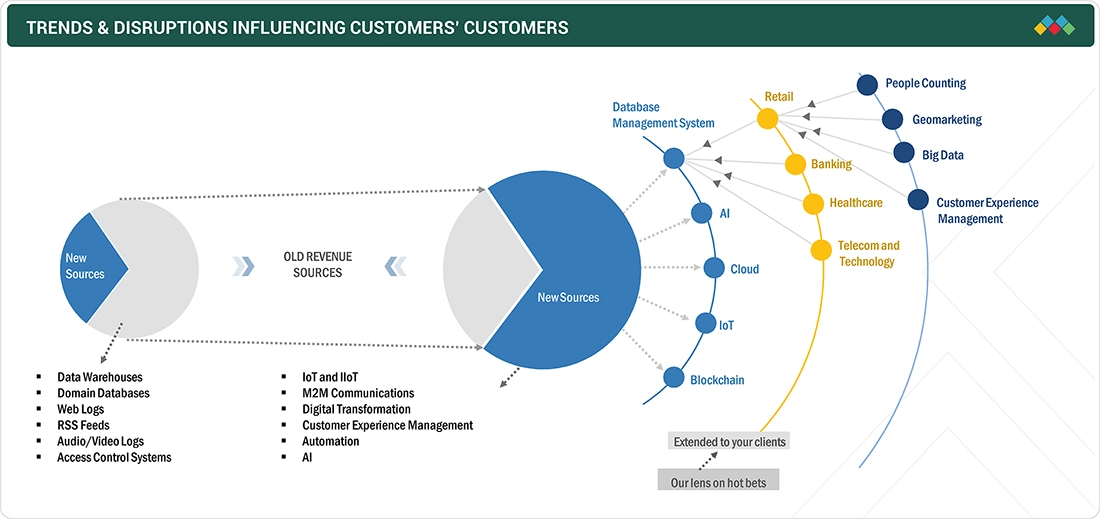

GRAPH DATABASE MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 28

GRAPH DATABASE MARKET: TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

FIGURE 29

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

FIGURE 30

KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

FIGURE 31

SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 32

KNOWLEDGE GRAPH ENGINES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 33

MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 34

SUPPORT & MAINTENANCE SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 35

RESOURCE DESCRIPTION FRAMEWORK SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 36

VIRTUAL ASSISTANTS, SELF-SERVICE DATA, AND DIGITAL ASSET DISCOVERY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 37

BFSI TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

FIGURE 38

NORTH AMERICA: GRAPH DATABASE MARKET SNAPSHOT

FIGURE 39

ASIA PACIFIC: GRAPH DATABASE MARKET SNAPSHOT

FIGURE 40

SHARE ANALYSIS OF LEADING COMPANIES IN GRAPH DATABASE MARKET, 2024

FIGURE 41

MARKET RANKING ANALYSIS OF TOP FIVE PLAYERS

FIGURE 42

REVENUE ANALYSIS OF KEY PLAYERS IN GRAPH DATABASE MARKET, 2019–2023 (USD BILLION)

FIGURE 43

GRAPH DATABASE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

FIGURE 44

GRAPH DATABASE MARKET: COMPANY FOOTPRINT

FIGURE 45

GRAPH DATABASE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

FIGURE 46

BRAND COMPARISON

FIGURE 47

COMPANY VALUATION

FIGURE 48

FINANCIAL METRICS

FIGURE 49

AMAZON WEB SERVICES: COMPANY SNAPSHOT

FIGURE 50

IBM: COMPANY SNAPSHOT

FIGURE 51

MICROSOFT: COMPANY SNAPSHOT

FIGURE 52

ALTAIR: COMPANY SNAPSHOT

FIGURE 53

ORACLE: COMPANY SNAPSHOT

FIGURE 54

PROGRESS SOFTWARE: COMPANY SNAPSHOT

Growth opportunities and latent adjacency in Graph Database Market