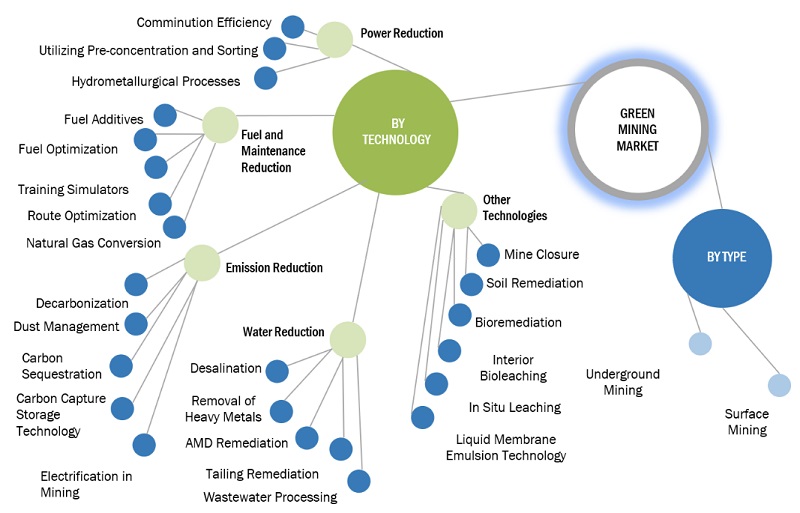

Green Mining Market by Type (Surface Mining, Underground Mining), Technology (Power Reduction, Fuel And Maintenance Reduction, Emission Reduction, Water Reduction) And Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2027

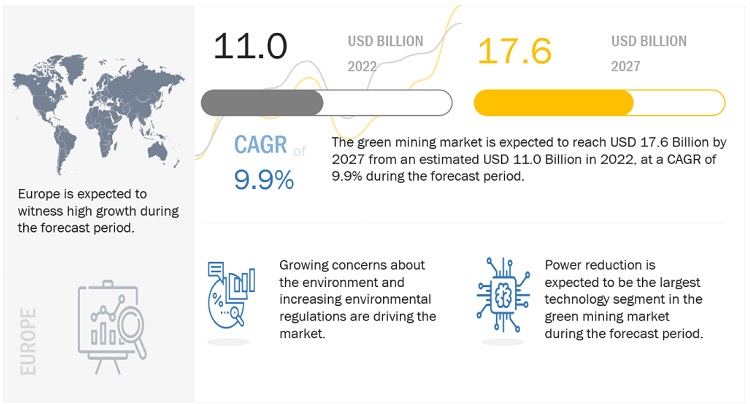

Green Mining Market is expected to grow from USD 11.0 billion in 2022 to USD 17.6 billion by 2027 at a cagr 9.9% during the forecast period. Green mining deals with the technologies, top practices, and procedures implemented by mining companies to make procedures more energy-efficient and reduce the environmental impact related with the extraction and processing of metals and minerals. Some key advantages of green mining include power reduction, fuel and maintenance reduction, emission reduction, water conservation, and mining closure.

The development of cutting-edge green mining technologies aims to raise both the economic and environmental performance of the mining industry. The mining industry will be more likely to be subject to energy and greenhouse gas emission laws due to its high energy consumption and global product trade. The reliability and affordability of water resources and energy supply may be impacted by climate change. For example, rising temperatures will make it more adverse for activities that depend on water in particular mine locations.

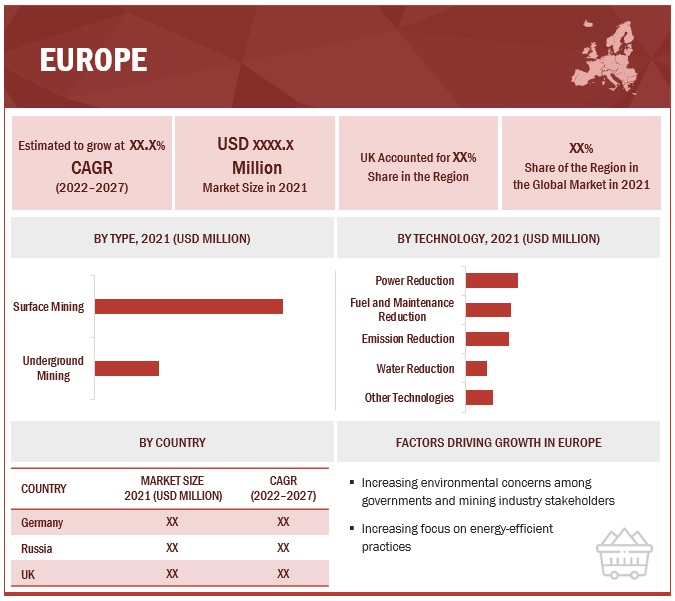

The European market is expected to grow at the fastest CAGR of 11.5% between 2022 and 2027, reaching USD 6,387.1 million by 2027. In terms of value, the UK was Europe's largest market for green mining in 2021. The UK market is expected to grow at a CAGR of 15.0% between 2022 and 2027. Europe is expected to dominate the global green mining market during the forecast period. The region has become the largest consumer and promoter of green mining practices as a result of the growth of sustainable practices in countries such as Germany, Russia, France, the United Kingdom, and Rest of Europe. Green mining is expected to be driven by the desire to protect the environment through better technology in this region.

Attractive Opportunities in the Green Mining Market

To know about the assumptions considered for the study, Request for Free Sample Report

Green Mining Market Dynamics

Driver: Growing focus on eco-friendly and sustainable practices in mining industry to curb environmental concerns

The advancement of cutting-edge green mining technologies seeks to increase both the economic and environmental performance of the mining industry. Ores are extracted using a variety of techniques, endangering the environment severely. Mining operations are not sustainable, and the problems they cause have not yet been fully controlled. Therefore, implementing green mining technology helps in achieving sustainable development and controlling problems to the maximum extent. The mining industry is attempting to address the worrying issue of consistent supply since the cost of energy, especially electricity, has increased sharply. The associated environmental costs are likely to rise as a result of factors like declining ore grades, resource intensity, and the amount of waste produced per unit of resource, which will continue to be a constant challenge for the industry's expansion. In an effort to encourage environmental preservation and monitor safety concerns, mining companies are increasingly starting to implement new and greener technologies such as power reduction and the use of renewable energy (solar/wind). The development of green mining technology is driven by different variables, including growing commodity prices, declining productivity, policy changes, and social justice.

Emerging regulations on greenhouse gas emissions, carbon tax, and investor perspectives about environmental, social, and governance (ESG) are encouraging mining companies to adopt low-carbon pathways and work toward the green energy transition.

Restraint: High initial investments creating financial hurdles for adoption of new green mining technologies

Exploring opportunities for capital expenditures and selecting the appropriate projects for execution will be essential in light of recent underinvestment and fairly limited project pipelines. The majority of the increase in these expenses will be made to support modest growth. The move to more remote areas, the necessity to access deeper resources, and the development of autonomous vehicles are the other developments that are anticipated to require mandate increases.

Several companies are concerned by the changes in the mining industry. Green energy equipment will require different equipment utilization and considerable modifications to the infrastructure of the energy supply chain. This will result in a wider variety of equipment and greater machine customization. Thus, the adoption of new technologies in mining operations may be financially difficult because of the high initial investment. This is a key factor responsible for miners still using traditional methods of mining, which are very harmful to the environment.

Opportunity: Use of solar energy to lower environmental risks

Renewable energy (green energy) is produced from resources that replenish over time. The mining industry's most common sources of renewable energy include wind, solar, biodiesel, geothermal, hydropower, hydrogen, and fuel cell energy. Miners employ renewable energy to crush, mine, and process minerals because it is a cost-effective option.

Solar energy, one of the most environmentally friendly forms of energy production, uses the sun's rays to produce concentrated solar power (CSP) or photovoltaic power (PV). The environmental problems connected with nuclear power, water pollution, nitrogen oxides, and other toxic byproducts are not present in solar energy generation. Also, solar energy is available at a lower cost. Renewable energy sources not only reduce the consequences of pollution but also ensure that new technologies in the mining sector operate responsibly. Renewable energy technology is improving the mining industry with cheaper mining operations, more opportunities for engineers to work, less greenhouse gas emissions, support for sustainable development, and increased energy efficiency on mine sites.

Challenges: Illegal mining and its environmental implications

Environmental issues like water pollution, deforestation, poor soil fertility, and restricted access to land for productive agriculture have all been linked to illegal mining activities. Sinkholes, soil contamination, ground and surface water pollution, and biodiversity loss are all results of illegal mining activities. The activities of illegal mining have negatively impacted well-known agricultural practices, such as terracing, crop rotation, utilization of domestic waste/manure, and irrigation of crops. The consequences of illegal mining activities drastically degrade the soil and other resources. Also, illegal mining operations are responsible for the destruction of rainforests and rich topsoil for cultivation. Due to the lucrative nature of unregulated gold rush opportunities, illegal gold mining in many areas is on the rise. This is negatively affecting resilient food systems and sustainable agriculture.

Green Mining Market: Ecosystem

Surface mining is projected to be the fastest-growing during the forecast period.

Surface mining is more productive than underground mining. As a result, this type of mining has a lower production cost. Underground mining equipments are more expensive than surface mining equipments in order to maintain productivity. In addition, an open pit allows for a large production scale. The high proportion of open-pit mines has created the opportunity to mass-produce open-pit equipment.

Power Reduction technology is the fastest-growing technology during the forecast period in the Green mining market.

Power-consuming processes, such as Comminution, is a term used to describe the process of reducing solid materials from average particle size to smaller particle size by crushing, grinding, cutting, vibrating, or other similar methods. It is a high-energy process that involves both crushing and grinding. Because mines rarely have control over energy costs, it is critical that the comminution process meet the requirements while using as little energy as possible.

The Europe is estimated to account for the biggest Green mining market share during the forecast period.

Europe is expected to dominate the global green mining market during the forecast period. Because of the growth of sustainable and environmental friendly practices in countries such as Germany, Russia, France, the United Kingdom, and the rest of Europe, the region has emerged as the largest consumer and supporter of green mining practises. The ambition to protect the environment through technological improvements is expected to drive this region's green mining market.

To know about the assumptions considered for the study, download the pdf brochure

Green Mining Market Players

The major players in the Green mining industry are BHP Billiton, Anglo American PLC, Rio Tinto Group, VALE S.A., Glencore PLC, Tata Steel Limited, Jiangxi Copper Corporation Limited, Dundee Precious Metals, Liebherr, among others.

Green Mining Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 11.0 Billion |

|

Revenue Forecast in 2027 |

USD 17.6 Billion |

|

CAGR |

9.9% |

|

Years Considered |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Million) |

|

Segments |

Type, Technology, and Region |

|

Regions |

North America, Europe, Asia-Pacific, Middle East and Africa, and South America |

|

Companies |

BHP Billiton, Anglo American PLC, Rio Tinto Group, VALE S.A., Glencore PLC, Tata Steel Limited, Jiangxi Copper Corporation Limited, Dundee Precious Metals, Liebherr, among others are covered in the green mining market. |

This research report categorizes the global green mining market on the basis of Type, Technology, and Region.

Green Mining Market, By Type

- Surface

- Underground

Green Mining Market, By Technology

- Power Reduction

- Fuel and Maintenance Reduction

- Emission Reduction

- Water Reduction

- Others

Green Mining Market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In May 2021, BHP partnered with Rio Tinto and Vale to launch the ‘Charge on Innovation Challenge,’ a mining truck electrification initiative. The initiative aims to develop innovative charging infrastructures in parallel with the development of battery-powered electric trucks.

- In October 2022, Rio Tinto collaborated with Scania to establish an R&D unit for autonomous technologies, including electric-powered vehicles.

Frequently Asked Questions (FAQ):

What are the driving factors for green mining?

The growing concern about the environment and to mitigate the damages done to the environment by carrying out inefficient and hazardous mining activities. Climate change is also driving the mining companies to choose green mining options.

What are the technologies adopted by mining companies for green mining?

The most prevalent mining technologies include power reduction, fuel, and maintenance reduction, toxicity reduction, emission reduction, water reduction and others.

What are the prevalent types of mining in Green Mining?

The most prevalent type of green mining is underground mining and surface mining.

What are the opportunities for green mining?

The introduction of electric vehicles and renewable sources of energy has led to high demand for cobalt and lithium. Many mining companies are implementing green mining techniques to mine these minerals. .

What are the restraints for green mining?

Green mining activities is a costly affair Often investor is not interested in investing green mining initiatives. This has become a big restraint for the growth of green mining activities.

What are some challenges in green mining activity?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and adopting green technologies.

What is the current competitive landscape in the Green mining market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and adopting green technologies.

Which all regions are considered in the report?

North America, Europe, Asia-Pacific, Middle East and Africa, and South America, these regions are considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

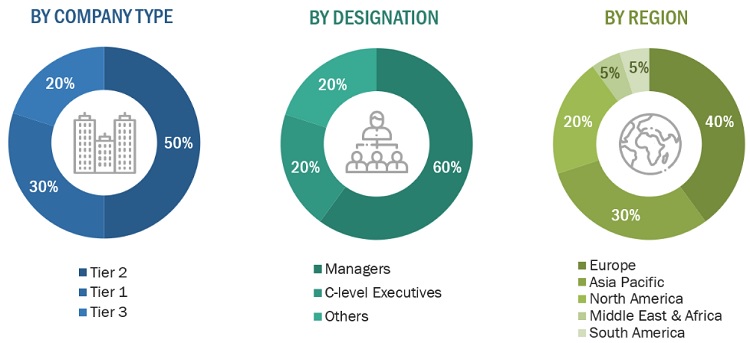

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, ICIS articles, Factiva, and Bloomberg Businessweek, to identify and gather information for a technical, market-oriented, and commercial study of the green mining market. The primary sources include industry experts from core and related industries and preferred suppliers, regulatory bodies, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with different primary respondents, such as key industry participants, subject matter experts (SMEs), C-Level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies; white papers; publications from recognized websites; and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Primary Research

After the complete market estimation process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research has been conducted to gather information and to verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, industry trends, key players, competitive landscape, industry trends, strategies of key players, and key market dynamics such as drivers, restraints, opportunities, and challenges.

In the primary research process, different primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information. The primary sources include industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the green mining market.

Following is the breakdown of primary respondents—

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 billion; Tier 2: USD 500 million–1 billion; and Tier 3: <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market size estimation process, both the top-down and bottom-up approaches have been used, along with several data triangulation methods to carry out estimations and projections for the overall market and its sub-segments listed in this report. Extensive qualitative and quantitative analyses have been carried out on the complete process to list key information/insights throughout the report. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Supply side estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the process explained above, the total market has been split into several segments and sub-segments. To complete the overall market size estimation process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. In addition, the market size has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the green mining market in terms of value and volume.

- To provide detailed information regarding the key factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges.

- To analyze and forecast the market size based on form, molecular weight, application

- To analyze and forecast the market size in terms of value and volume, with respect to four main regions: North America, Europe, Asia-Pacific, Middle East and Africa, and South America.

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze competitive developments, such as products & services offered, and expansion, in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC Green mining market

- Further breakdown of Rest of Europe Green mining market

- Further breakdown of the Rest of Middle East & Africa Green mining market

- Further breakdown of Rest of South America Green mining market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Green Mining Market