Mine Ventilation Market by Offering (Equipment (Ventilation, Heating, Cooling), Software, and Services), Technique (Underground Mining, Surface Mining), and Region (North America, Europe, APAC, RoW) - Global Forecast to 2025-2035

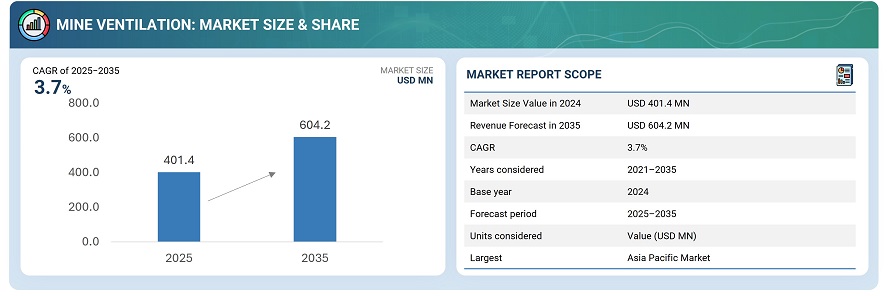

The global mine ventilation market was valued at USD 401.4 million in 2024 and is estimated to reach USD 604.2 million by 2035, at a CAGR of 3.7% between 2025 and 2035.

The global mine ventilation market is driven by the increasing focus on worker safety, air quality management, and operational efficiency in underground mining environments. Growing mining activities and deeper excavation projects are creating demand for advanced ventilation systems that can ensure proper airflow, temperature control, and removal of hazardous gases. Technological advancements in smart sensors, automation, and energy-efficient fans are improving real-time monitoring and reducing energy consumption. Integration with AI-based control systems and predictive maintenance solutions is further enhancing performance and reliability. Overall, the market is becoming more competitive, with equipment manufacturers, technology providers, and mining operators investing in infrastructure upgrades, strategic collaborations, and regional service expansion to strengthen their market presence

Ventilation is an important factor for controlling the movement of the air, its amount, and its direction in mines. Mine ventilation systems enable the flow of sufficient volume of air to remove dust and toxic gases such as methane, CO2, SO2, and NOx from mines and regulate the temperature inside them. Mine ventilation is a highly regulated practice to ensure that diesel emissions, blasting fumes, radiation, and dust are properly diluted. A well-designed and properly installed mine ventilation system improves health, safety, productivity, and performance of mine workers.

Market by Offering

Equipment

The equipment segment is expected to hold the largest market share in the mine ventilation market, driven by the critical role of ventilation, heating, and cooling systems in maintaining safe and efficient underground mining operations. These systems are essential for controlling airflow, regulating temperature, and diluting or removing harmful gases, ensuring compliance with stringent safety and environmental standards. With mines operating at greater depths, the demand for high-capacity fans, air coolers, and heating units continues to rise. Additionally, the adoption of energy-efficient and automated ventilation solutions is further accelerating equipment investments. As mining companies prioritize worker safety, productivity, and operational cost optimization, equipment remains the most capital-intensive and indispensable component of mine ventilation infrastructure.

Services

The services segment is projected to register the highest CAGR in the mine ventilation market due to the growing need for continuous system maintenance, performance optimization, and regulatory compliance support. As mining operations become more complex and energy-intensive, service offerings such as installation, periodic inspections, system upgrades, and real-time monitoring are becoming essential for ensuring reliability and efficiency. The increasing integration of digital solutions, such as AI-driven airflow optimization and remote diagnostics, is also driving demand for specialized service expertise. Moreover, mining companies are increasingly outsourcing maintenance to reduce operational downtime and extend equipment lifespan, fueling long-term service contracts and recurring revenue streams. This strong focus on operational support and lifecycle management is a key factor behind the segment’s rapid growth.

Market by Technique

Underground Mining

The underground mining segment is expected to account for the largest market share in the mine ventilation market, primarily because ventilation systems are critical to ensuring safe and efficient operations in confined mining environments. Unlike surface mining, underground operations require controlled airflow to regulate temperature, remove toxic gases, and provide breathable air for workers. The growing trend of deeper and more complex mining projects is further increasing the need for high-performance ventilation, heating, and cooling solutions. Additionally, stringent safety regulations and environmental standards are driving mining operators to invest heavily in reliable ventilation infrastructure. As a result, underground mining remains the dominant application area for ventilation equipment and services, contributing significantly to overall market demand.

Surface Mining

Surface mining is expected to grow in the mine ventilation market as more open-pit projects are developed to meet rising demand for minerals like coal, iron ore, and copper. Stricter environmental regulations and worker safety standards are pushing operators to invest in efficient dust control and air quality systems. The lower extraction cost of surface mining compared to underground methods further supports this shift

Market by Geography

Asia Pacific is projected to be the fastest-growing region in the mine ventilation market, driven by rapid industrialization, expanding mining activities, and rising investments in mineral and metal exploration. Countries such as China, India, and Australia are increasing underground mining operations to meet the growing demand for coal, iron ore, and rare earth minerals. This expansion is creating strong demand for advanced ventilation, heating, and cooling systems to ensure worker safety and operational efficiency. Additionally, governments in the region are tightening safety and environmental regulations, pushing mining companies to adopt modern, energy-efficient ventilation solutions. Growing infrastructure development and technological adoption further position Asia Pacific as a key growth engine for the global market.

Market Dynamics

Driver: Rising focus on worker safety and regulatory compliance

A key driver for the mine ventilation market is the growing emphasis on worker health and safety in underground mining environments. Ventilation systems play a crucial role in maintaining air quality, controlling temperature, and removing harmful gases such as methane and carbon monoxide. With governments and regulatory bodies enforcing stricter occupational safety standards, mining operators are increasingly investing in advanced ventilation, heating, and cooling technologies. This regulatory push, combined with the need to ensure operational continuity and prevent accidents, is significantly driving market growth.

Restraint: High capital and operational costs

One of the major restraints for the mine ventilation market is the high cost associated with installing and maintaining advanced ventilation systems. Equipment such as high-capacity fans, heating and cooling units, and control systems require substantial upfront investment. Additionally, operational expenses related to energy consumption and periodic maintenance can be significant, especially in deep or large-scale mines. For smaller mining operators, these costs can act as a barrier to adopting modern ventilation solutions, slowing down overall market penetration.

Opportunity: Integration of smart and energy-efficient technologies

The growing adoption of digital and energy-efficient solutions presents a strong opportunity for market expansion. Technologies such as AI-based airflow optimization, remote monitoring, and automated control systems are helping mining operators improve ventilation efficiency while reducing energy consumption and operational costs. Companies offering integrated smart solutions can tap into this demand, as mining firms increasingly prioritize sustainability, real-time monitoring, and operational optimization. This shift is expected to create new revenue streams and drive long-term growth.

Challenge: Ventilation management in deep and complex mines

A significant challenge in the mine ventilation market is effectively managing airflow in deep, large, and increasingly complex mining operations. As mines extend further underground, ensuring adequate air circulation, temperature control, and gas removal becomes technically demanding and costly. Traditional ventilation methods are often insufficient for such environments, requiring customized designs, advanced monitoring systems, and high energy inputs. This complexity not only increases operational risk but also places pressure on mining companies to adopt innovative and reliable ventilation solutions.

Future Outlook

The mine ventilation market is expected to witness steady growth through 2034, driven by increasing underground mining activity, stricter worker safety regulations, and rising adoption of energy-efficient and automated ventilation technologies. As mining projects go deeper and become more complex, the demand for advanced ventilation, heating, and cooling systems will continue to rise. Technologies such as AI-based ventilation control, real-time monitoring through IoT sensors, and ventilation-on-demand solutions are expected to play a major role in improving operational efficiency and reducing energy costs. Asia Pacific is projected to remain the fastest-growing region, supported by strong mining investments in China, India, and Australia. Additionally, equipment upgrades and long-term service contracts will drive recurring revenue streams for solution providers. However, high operational costs and technical challenges in complex mine structures will remain key hurdles. Overall, the market outlook remains positive, with strong opportunities for innovation, digital integration, and sustainable ventilation practices through 2034.

Key Market Players

Top mine ventilation market companies include ABB (Switzerland), Epiroc AB (Sweden), Howden Group Holdings Ltd. (UK), Stantec (Canada), and TWIN CITY FAN (US).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Market Definition and Scope

1.3 Inclusions and Exclusions

1.4 Study Scope

1.4.1 Markets Covered

1.4.2 Years Considered

1.5 Currency

1.6 Limitations

1.7 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Arriving at Market Size Using Bottom-Up Analysis

2.2.2 Top-Down Approach

2.2.2.1 Approach for Arriving at Market Size Using Top-Down Analysis

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Mine Ventilation Market, 2019–2024 (USD Million)

4.2 Mine Ventilation Market, By Offering

4.3 Mine Ventilation Equipment Market, By Type

4.4 Mine Ventilation Market, By Technique and Region

4.5 Mine Ventilation Market, By Geography

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Requirement for Optimized and Quality Airflow in Mines

5.2.1.2 Rise in Number of Infrastructure Development Projects

5.2.2 Restraints

5.2.2.1 Depletion of Natural Resources

5.2.2.2 Electrification of Mine Equipment and Machinery

5.2.3 Opportunities

5.2.3.1 Rise in Number of Planned Mining Activities Worldwide

5.2.4 Challenges

5.2.4.1 Revised Trade Agreements and Continuous Changes in Environmental Regulations That Impact Global Mining Industry

5.2.4.2 High Operational Costs of Mine Ventilation Systems

5.3 Value Chain Analysis

6 Mine Ventilation Market, By Offering (Page No. - 42)

6.1 Introduction

6.2 Equipment

6.2.1 Requirement for Safe and Comfortable Working Conditions for Miners Projected to Lead to Growth of Mine Ventilation Equipment Market From 2019 to 2024

6.2.2 Ventilation

6.2.2.1 Fans Segment Projected to Account for the Largest Size of Ventilation Equipment Market From 2019 to 2024

6.2.2.1.1 Fans

6.2.2.1.2 Compressors

6.2.2.1.3 Blowers

6.2.3 Cooling

6.2.3.1 Air Coolers Segment of Cooling Equipment Market Projected to Grow at A Higher Rate Than Refrigerating Units Segment From 2019 to 2024

6.2.3.1.1 Air Coolers

6.2.3.1.2 Refrigerating Units

6.2.4 Heating

6.2.4.1 Heaters Segment Projected to Hold A Larger Size of Heating Equipment Market From 2019 to 2024

6.2.4.1.1 Heaters

6.2.4.1.2 Heat Exchangers

6.3 Software

6.3.1 Increased Use of Software to Design Mine Ventilation Systems to Fuel Growth of Software Segment From 2019 to 2024

6.4 Services

6.4.1 Services Segment of Mine Ventilation Market Projected to Grow at the Highest Rate From 2019 to 2024

7 Mine Ventilation Market, By Technique (Page No. - 53)

7.1 Introduction

7.2 Underground Mining

7.2.1 Underground Mining Segment Projected to Lead Mine Ventilation Market From 2019 to 2024

7.3 Surface Mining

7.3.1 Services Segment of Mine Ventilation Market for Surface Mining Projected to Grow at the Highest CAGR From 2019 to 2024

8 Geographic Analysis (Page No. - 59)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Increasing Number of Mining Activities Fueling Growth of Mine Ventilation Market in US

8.2.2 Canada

8.2.2.1 Ongoing Mining Operations Projected to Contribute to Growth of Mine Ventilation Market in Canada

8.2.3 Mexico

8.2.3.1 Increasing Foreign Direct Investments in Mining Industry to Upsurge Demand for Mine Ventilation Equipment in Mexico

8.3 Europe

8.3.1 Russia

8.3.1.1 Ongoing Discoveries of New Gold Deposits Expected to Contribute to Growth of Mining Industry of Russia

8.3.2 Germany

8.3.2.1 Mining of Lithium Expected to Lead to Increased Demand for Mine Ventilation Equipment in Germany

8.3.3 Norway

8.3.3.1 Upcoming Mining Projects to Boost Growth of Mine Ventilation Market in Norway

8.3.4 Rest of Europe

8.3.4.1 Increasing Number of Mining Activities Projected to Contribute to Growth of Mine Ventilation Market in Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.1.1 China Projected to Account for the Largest Size of Mine Ventilation Market in APAC

8.4.2 Australia

8.4.2.1 Increased Number of Mining Activities Expected to Fuel Growth of Mine Ventilation Market in Australia

8.4.3 India

8.4.3.1 Government Initiatives to Boost Domestic Steel Sector Expected to Lead to Rise in Demand for Mining Activities and Mine Ventilation Equipment in India

8.4.4 Rest of APAC

8.4.4.1 Rise in Mining Activities Expected to Drive Growth of Mine Ventilation Market in Rest of APAC

8.5 RoW

8.5.1 South America

8.5.1.1 Increased Mining Investments Expected to Fuel Growth of Mine Ventilation Market in South America

8.5.2 Middle East

8.5.2.1 Rise in Number of Metal Production Projects Expected to Drive Growth of Mine Ventilation Market in Middle East

8.5.3 Africa

8.5.3.1 Presence of Rich Mineral Deposits Expected to Fuel Growth of Mine Ventilation Market in Africa

9 Competitive Landscape (Page No. - 93)

9.1 Overview

9.2 Ranking of Players in Mine Ventilation Market

9.3 Competitive Leadership Mapping

9.3.1 Visionaries

9.3.2 Dynamic Differentiators

9.3.3 Innovators

9.3.4 Emerging Companies

9.4 Competitive Situations & Trends

9.4.1 Product Launches

9.4.2 Contracts & Agreements, Mergers & Acquisitions, and Collaborations

10 Company Profiles (Page No. - 99)

(Business Overview, Products, Solutions & Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

10.1 Key Players

10.1.1 ABB

10.1.2 Epiroc

10.1.3 Howden

10.1.4 Stantec

10.1.5 Twin City Fan

10.1.6 ABC Industries

10.1.7 Chicago Blower

10.1.8 DMT

10.1.9 TLT-Turbo

10.1.10 New York Blower Company

10.1.11 Zitron

10.2 Right to Win

10.3 Other Companies

10.3.1 Gefa System

10.3.2 Hurley Ventilation

10.3.3 Sibenergomash

10.3.4 Bbe Consulting

10.3.5 Schauenburg Industries

10.3.6 Stiavelli

10.3.7 ABC Ventilation Systems

10.3.8 Clempcorp Australia

10.3.9 Minetek

10.3.10 Zibo Fans

*Details on Business Overview, Products, Solutions & Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 120)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (103 Tables)

Table 1 Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 2 Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 3 Mine Ventilation Equipment Market, By Technique, 2016–2024 (USD Million)

Table 4 Mine Equipment Ventilation Market, By Region, 2016–2024 (USD Million)

Table 5 Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 6 Ventilation Equipment Market, By Technique, 2016–2024 (USD Million)

Table 7 Ventilation Equipment Market, By Region, 2016–2024 (USD Million)

Table 8 Cooling Equipment Market, By Type, 2016–2024 (USD Million)

Table 9 Cooling Equipment Market, By Technique, 2016–2024 (USD Million)

Table 10 Cooling Equipment Market, By Region, 2016–2024 (USD Million)

Table 11 Direct Air Heaters vs Indirect Air Heaters

Table 12 Heating Equipment Market, By Type, 2016–2024 (USD Million)

Table 13 Heating Equipment Market, By Technique, 2016–2024 (USD Million)

Table 14 Heating Equipment Market, By Region, 2016–2024 (USD Million)

Table 15 Mine Ventilation Software Market, By Technique, 2016–2024 (USD Million)

Table 16 Mine Ventilation Software Market, By Region, 2016–2024 (USD Million)

Table 17 Mine Ventilation Services Market, By Technique, 2016–2024 (USD Million)

Table 18 Mine Ventilation Services Market, By Region, 2016–2024 (USD Million)

Table 19 Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 20 Mine Ventilation Market for Underground Mining, By Offering, 2016–2024 (USD Million)

Table 21 Mine Ventilation Equipment Market for Underground Mining, By Type, 2016–2024 (USD Million)

Table 22 Mine Ventilation Market for Underground Mining, By Region, 2016–2024 (USD Million)

Table 23 Mine Ventilation Market for Surface Mining, By Offering, 2016–2024 (USD Million)

Table 24 Mine Ventilation Equipment Market for Surface Mining, By Type, 2016–2024 (USD Million)

Table 25 Mine Ventilation Market for Surface Mining, By Region, 2016–2024 (USD Million)

Table 26 Mine Ventilation Market, By Region, 2016–2024 (USD Million)

Table 27 North America Mine Ventilation Market, By Country, 2016–2024 (USD Million)

Table 28 North America Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 29 North America Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 30 North America Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 31 US Mineral Raw Material Production, 2014–2017 (Tonnes)

Table 32 US Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 33 US Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 34 US Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 35 Canada Mineral Raw Mineral Production, 2014–2017 (Tonnes)

Table 36 Canada Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 37 Canada Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 38 Canada Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 39 Mexico Mineral Raw Material Production, 2014–2017 (Tonnes)

Table 40 Mexico Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 41 Mexico Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Thousand)

Table 42 Mexico Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 43 Europe Mine Ventilation Market, By Country, 2016–2024 (USD Million)

Table 44 Europe Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 45 Europe Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 46 Europe Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 47 Russia Mineral Raw Material Production, 2014–2017 (Tonnes)

Table 48 Russia Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 49 Russia Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 50 Russia Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 51 Germany Mineral Raw Material Production, 2014–2017 (Tonnes)

Table 52 Germany Mine Ventilation Market, By Offering, 2016–2024 (USD Thousand)

Table 53 Germany Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Thousand)

Table 54 Germany Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 55 Norway Mineral Raw Material Production, 2014–2017 (Tonnes)

Table 56 Norway Mine Ventilation Market, By Offering, 2016–2024 (USD Thousand)

Table 57 Norway Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Thousand)

Table 58 Norway Mine Ventilation Market, By Technique, 2016–2024 (USD Thousand)

Table 59 Rest of Europe Mineral Raw Material Production, By Country, 2014–2017 (Tonnes)

Table 60 Rest of Europe Mine Ventilation Market, By Offering, 2016–2024 (USD Thousand)

Table 61 Rest of Europe Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Thousand)

Table 62 Rest of Europe Mine Ventilation Market, By Technique, 2016–2024 (USD Thousand)

Table 63 APAC Mine Ventilation Market, By Country, 2016–2024 (USD Million)

Table 64 APAC Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 65 APAC Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 66 APAC Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 67 China Mineral Raw Material Production, 2014–2017 (Tonnes)

Table 68 China Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 69 China Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 70 China Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 71 Australia Mineral Raw Material Production, 2014–2017 (Tonnes)

Table 72 Australia Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 73 Australia Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 74 Australia Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 75 India Mineral Raw Material Production, 2014–2017 (Tonnes)

Table 76 India Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 77 India Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 78 India Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 79 Rest of APAC Mineral Raw Material Production, By Country, 2014–2017 (Tonnes)

Table 80 Rest of APAC Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 81 Rest of APAC Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 82 Rest of APAC Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 83 RoW Mine Ventilation Market, By Region, 2016–2024 (USD Million)

Table 84 RoW Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 85 RoW Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 86 RoW Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 87 South America Mineral Raw Material Production, 2014–2017 (Tonnes)

Table 88 South America Mine Ventilation Market, By Country, 2016–2024 (USD Thousand)

Table 89 South America Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 90 South America Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Thousand)

Table 91 South America Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 92 Middle East Mineral Raw Material Production, 2014–2017(Tonnes)

Table 93 Middle East Mine Ventilation Market, By Country, 2016–2024 (USD Million)

Table 94 Middle East Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 95 Middle East Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Million)

Table 96 Middle East Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 97 Africa Mineral Raw Material Production, 2014–2017 (Tonnes)

Table 98 Africa Mine Ventilation Market, By Country, 2016–2024 (USD Thousand)

Table 99 Africa Mine Ventilation Market, By Offering, 2016–2024 (USD Million)

Table 100 Africa Mine Ventilation Equipment Market, By Type, 2016–2024 (USD Thousand)

Table 101 Africa Mine Ventilation Market, By Technique, 2016–2024 (USD Million)

Table 102 Product Launches, 2017–2019

Table 103 Contracts & Agreements, Mergers & Acquisitions, and Collaborations, 2017–2019

List of Figures (36 Figures)

Figure 1 Mine Ventilation Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown and Data Triangulation

Figure 5 Assumption for Research Study

Figure 6 Equipment Segment Accounted for the Largest Share of Mine Ventilation Market in 2018

Figure 7 Ventilation Segment Accounted for the Largest Share of Mine Ventilation Equipment Market in 2018

Figure 8 Underground Mining Segment Accounted for A Larger Share of Mine Ventilation Market Than Surface Mining Segment in 2018

Figure 9 Mine Ventilation Market in APAC Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 10 Increasing Number of Infrastructure Development Projects Expected to Fuel Growth of Mine Ventilation Market From 2019 to 2024

Figure 11 Equipment Segment Projected to Account for the Largest Size of Mine Ventilation Market From 2019 to 2024

Figure 12 Ventilation Segment to Hold the Largest Size of Mine Ventilation Equipment Market From 2019 to 2024

Figure 13 Underground Mining Segment and APAC Accounted for Larger Shares in Mine Ventilation Market in 2018

Figure 14 China Estimated to Hold the Largest Share of Mine Ventilation Market in 2019

Figure 15 Mine Ventilation Market Dynamics

Figure 16 Drivers for Mine Ventilation Market and Their Impact

Figure 17 Restraints for Mine Ventilation Market and Their Impact

Figure 18 Opportunities for Mine Ventilation Market and Their Impact

Figure 19 Challenges for Mine Ventilation Market and Their Impact

Figure 20 Value Chain Analysis: Mine Ventilation Market

Figure 21 Mine Ventilation Market, By Offering

Figure 22 Equipment Segment Projected to Account for the Largest Size of Mine Ventilation Market From 2019 to 2024

Figure 23 Mine Ventilation Market, By Technique

Figure 24 Underground Mining Segment Expected to Lead Mine Ventilation Market From 2019 to 2024

Figure 25 Mine Ventilation Market in Australia Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 26 North America Mine Ventilation Market Snapshot

Figure 27 Europe Mine Ventilation Market Snapshot

Figure 28 APAC Mine Ventilation Market Snapshot

Figure 29 RoW Mine Ventilation Market Snapshot

Figure 30 Mergers and Acquisitions Emerged as Key Growth Strategy Adopted By Players in Mine Ventilation Market From 2017 to 2019

Figure 31 Ranking of Top 5 Players in Mine Ventilation Market, 2018

Figure 32 Mine Ventilation Market (Global) Competitive Leadership Mapping, 2019

Figure 33 Product Launches Was the Key Strategy Adopted By Leading Market Players From 2017 to 2019

Figure 34 ABB: Company Snapshot

Figure 35 Epiroc: Company Snapshot

Figure 36 Stantec: Company Snapshot

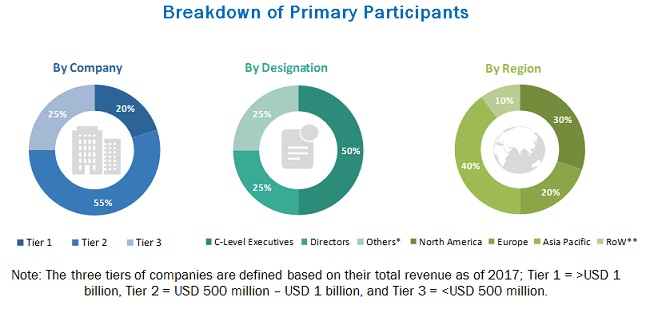

The study involves major activities for estimating the current size of the mine ventilation market. Exhaustive secondary research was carried out to collect information on the market. The next step involved the validation of these findings, assumptions, and sizing with industry experts, identified in the value chain, through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, and databases [National Mining Association, International Organizing Committee for the World Mining Congresses, The Mine Ventilation Society of South Africa, Investor Presentations, OneSource, and Factiva] have been used to identify and collect information for an extensive technical and commercial study of the mine ventilation market.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess prospects. Key players in the mine ventilation market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the mine ventilation market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall mine ventilation market size through the estimation process, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

The objectives of the study are as follows:

- To describe and forecast the mine ventilation market, in terms of value, segmented into offering and technique

- To describe and forecast the market size, in terms of value, by equipment type—ventilation, heating, and cooling

- To describe and forecast the market size, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing growth (drivers, restraints, opportunities, and challenges) of the market

- To provide a detailed overview of the value chain of the mine ventilation market ecosystem

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze the major growth strategies implemented by the key market players, such as product launches, contracts & agreements, mergers & acquisitions, and collaborations

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report.

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Mine Ventilation Market