Green Technology & Sustainability Market

Green Technology & Sustainability Market by Offering (Carbon Accounting Software, ESG Reporting Tools, Compliance & Risk Management Tools), Application (Sustainable Supply Chain & Logistics, Energy & Emission Reduction) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The growing need for data-driven, scalable, and efficient environmental solutions is fueling the green technology and sustainability market, which is expected to register USD 25.47 billion by 2025 and reach USD 73.90 billion by 2030, with a 23.7% CAGR. Efforts are being directed towards using AI, IoT, and cloud computing to optimize renewable energy management, carbon tracking, and resource efficiency. Smart grids and predictive analytics are transforming the energy distribution landscape, while blockchain technology offers transparency in carbon credit trading and sustainable supply chains. The emergence of digital twins and automation is further propelling the move toward energy-efficient buildings and manufacturing. Additionally, new regulatory requirements and investments in environmental sustainability have prompted businesses to utilize digital tools for real-time monitoring and reporting of emissions. With the increasing ambition for global sustainability, digital solutions in green technology are playing a significant role in market growth, enabling industries to transition to an economically circular, ecologically sustainable, and carbon-free future.

KEY TAKEAWAYS

- By Region, North America accounted for largest market share of 31.48% in 2025.

- By Software, the ESG Reporting Tools segment is expected to hold largest market share during forecast period.

- The carbon neutrality & climate strategy segment is projected to grow at the highest CAGR of 26.7% during the forecast period.

- The blockchain segment is projected to grow at the highest CAGR of 26.3% during the forecast period.

- By End User, Manufacturing segment is expected to dominate the market.

- Market leaders like Google, Oracle, and Siemens are combining organic innovation with strategic partnerships and acquisitions to strengthen their portfolios. This dual approach enables faster product evolution, expanded ecosystem coverage, and sustained competitive advantage in a rapidly evolving market.

- Companies like Watershed, Clarity AI, Normative, and Persefoni among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The convergence of consumer preferences, corporate responsibility, and the economic viability of green solutions has positioned sustainability as a transformative force in the global market. Businesses across industries are integrating eco-friendly technologies to enhance operational efficiency, reduce waste, and lower long-term costs. The rise of circular economy models, emphasizing recycling, reuse, and waste reduction, is driving innovation in sustainable materials and production processes. Increasing investor focus on ESG compliance is prompting organizations to adopt greener strategies to attract capital and maintain competitive advantages. As resource scarcity, climate-related risks, and regulatory pressures intensify, companies are prioritizing sustainability-driven innovation. The expansion of carbon markets and green financing mechanisms is further accelerating the transition toward clean energy and responsible consumption.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The green technology & sustainability market is evolving rapidly, driven by regulatory mandates, corporate ESG commitments, and digital innovations. Key trends include the rise of carbon accounting platforms, enabling businesses to measure and reduce emissions with greater precision. The adoption of AI and IoT in sustainability solutions is optimizing resource efficiency across industries such as manufacturing, energy, and agriculture. Regulatory frameworks like the EU Green Deal are accelerating the transition to circular economy models, pushing companies to redesign products for recyclability and minimal waste. Additionally, blockchain-based traceability solutions are enhancing supply chain transparency, helping businesses meet stricter compliance standards. Another disruption is the shift toward green financing, with investors prioritizing companies that align with sustainability goals. Consumer demand for eco-friendly products is prompting brands to integrate sustainability into core business strategies, fostering innovation and competitive differentiation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Global Push Toward Decarbonization and ESG Accountability

-

Consumer Demand for Sustainable Products & Services

Level

-

High Implementation Costs and Data Fragmentation

-

Resistance to Change & Industry-Specific Barriers

Level

-

Digital Transformation Enabling Scalable Sustainability

-

Expansion of Water-Tech & Smart Resource Management

Level

-

Lack of Standardized Frameworks and Reliable Data

-

Lack of tailored solutions to address unique environmental issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Global Push Toward Decarbonization and ESG Accountability

The accelerating transition to a low-carbon economy and stricter ESG disclosure mandates are driving adoption of green technology and sustainability software. Enterprises are investing in carbon tracking platforms, renewable energy analytics, and ESG reporting tools to meet investor expectations and regulatory standards. As governments set net-zero deadlines, sustainability becomes a core business imperative rather than a compliance goal.

High Implementation Costs and Data Fragmentation

Despite strong demand, the market faces challenges related to integration complexity, data silos, and high upfront costs. Many organizations struggle to unify ESG data from disparate systems—finance, operations, and supply chain—into a single platform. These barriers delay ROI and limit scalability, particularly for mid-sized enterprises aiming to adopt cloud-based sustainability solutions.

Digital Transformation Enabling Scalable Sustainability

The convergence of AI, cloud, and blockchain technologies is transforming sustainability from reactive reporting to proactive intelligence. Organizations are using real-time analytics, automation, and predictive modeling to optimize carbon reduction strategies, energy usage, and resource efficiency. As global supply chains digitalize, data-driven sustainability ecosystems are emerging—enabling transparency, collaboration, and measurable climate impact.

Lack of Standardized Frameworks and Reliable Data

Inconsistent ESG standards and varying regional regulations make it difficult to compare and validate sustainability performance. The absence of unified measurement frameworks leads to data inconsistencies and greenwashing risks. Establishing global data standards, verification protocols, and transparent audit mechanisms is essential to build credibility and trust in sustainability reporting.

Green Technology and Sustainability Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Gunvor is a largest independent energy trading company focusing on oil, gas, and bulk commodities. Facing challenges gathering accurate GHG emissions data across the supply chain, especially upstream activities, CarbonChain provided an AI-powered carbon accounting software platform that automated the emissions tracking process. | CarbonChain enabled automated emissions data collection and reporting, enhanced compliance with sustainability requirements, reduced manual effort and improved accuracy, gained actionable carbon intensity insights, and enabled continuous, efficient emissions tracking across the supply chain. |

|

Isbank is Turkey's first national bank with over 1,300 branches. Needing a technologically forward data center with optimal design that would be cost-effective, flexible for expansion, and achieve Tier IV and LEED Gold Certifications, Isbank chose ENGIE Impact as partner to help build the data center. | ENGIE Impact helped Isbank build an energy-efficient data center optimized for operations and cost-effectiveness, achieving Uptime Institute Tier IV Certification. It became the first LEED v4 Gold-certified data center in Turkey, significantly increasing efficiency and sustainability for Isbank operations. |

|

A global tire and rubber manufacturer with over USD 15 billion in annual sales faced inefficiencies from manual data collection, lack of standardization, and reporting inconsistencies. AMCS adopted the Sustainability Platform to streamline data management with automated collection, centralized reporting, and enhanced error detection. | The AMCS Sustainability Platform centralized data for better integration across global operations, improved efficiency by automating collection and reporting, reduced errors with advanced detection and validation, and provided real-time insights enabling better decision-making on sustainability initiatives. |

|

Lidl is a global retail chain with significant European presence. Needing to address sustainability issues within its global supply chain, Lidl faced challenges assessing supplier performance and managing risks across diverse geographies and industries. EcoVadis provided a robust sustainability intelligence solution for comprehensive supplier assessments. | EcoVadis improved visibility and transparency in supply chain sustainability, enhanced supplier performance management ensuring alignment with sustainability goals, mitigated environmental, social, and governance risks, and ensured compliance with evolving regulations like EU Corporate Sustainability Reporting Directive. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The green technology & sustainability market ecosystem, comprises carbon accounting software, ESG reporting tools, energy & resource optimization software, supply chain traceability tools, compliance and risk management tools, and others (sustainability analytics and demand management platforms). This segmented ecosystem works collaboratively to drive the transition toward more efficient workflows and output generation, leveraging technology and data to achieve goals.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Green Technology & Sustainability Market, By Offering

Supply chain traceability tools are redefining sustainability by providing end-to-end visibility of raw materials, production, and logistics flows. These platforms help organizations identify inefficiencies, verify ethical sourcing, and measure carbon intensity, ensuring compliance with global sustainability regulations. The shift toward transparent, data-driven supply chains is becoming a cornerstone of modern ESG strategy.

Green Technology & Sustainability Market, By Application

Carbon neutrality and climate strategy initiatives are accelerating adoption of green technology solutions. Companies are deploying carbon accounting and emissions tracking tools to align with net-zero targets and improve operational efficiency. These applications enable science-based goal setting, performance benchmarking, and sustainability-driven innovation, strengthening enterprise resilience against climate risks.

Green Technology & Sustainability Market, By Technology

Blockchain is emerging as a key enabler of trust and transparency in sustainability reporting. By recording verified environmental and social data on immutable ledgers, organizations can track emissions, trace materials, and verify green investments with higher accuracy. Blockchain-based ESG solutions are driving accountability, auditability, and trust across value chains.

Green Technology & Sustainability Market, By End User

Transportation and logistics providers are increasingly using sustainability platforms to optimize fleet operations, reduce emissions, and enable carbon-neutral delivery models. By integrating IoT sensors, telematics, and blockchain-based traceability, companies can measure their environmental footprint and align with global Scope 3 emissions targets, reshaping the future of sustainable logistics.

REGION

Asia Pacific to be fastest-growing region in global Green Technology & Sustainability Market during forecast period

Asia Pacific is expected to grow at the highest CAGR in the green technology and sustainability market due to strong government initiatives promoting carbon neutrality, renewable energy adoption, and sustainable industrial practices. Rapid urbanization and rising corporate ESG commitments are driving investments in clean technologies and energy-efficient infrastructure. The region’s expanding electric vehicle ecosystem, smart grid projects, and circular economy initiatives further accelerate market growth. Additionally, supportive regulatory frameworks and public-private partnerships are fostering large-scale deployment of green innovations across Asia Pacific.

Green Technology and Sustainability Market: COMPANY EVALUATION MATRIX

In the Green Technology & Sustainability market matrix, GE (Star) leads with its extensive portfolio of clean energy, smart grid, and decarbonization solutions that drive global efforts toward a more sustainable industrial ecosystem. Its leadership in renewable energy technologies, energy efficiency innovations, and digital optimization tools reinforces its position as a key enabler of the global energy transition. Microsoft (Emerging Leader) is gaining momentum with its ambitious sustainability initiatives and AI-driven platforms that help organizations measure, reduce, and report their environmental impact. Its commitment to achieving carbon negativity and leveraging cloud technology for environmental intelligence positions it as a fast-rising force in the green technology and sustainability landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 25.47 BN |

| Market Forecast in 2030 (value) | USD 73.90 BN |

| Growth Rate | 23.70% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | USD Million |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Green Technology and Sustainability Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Green Technology & Sustainability Vendor |

|

|

| Leading Green Technology & Sustainability Vendor |

|

|

RECENT DEVELOPMENTS

- February 2025 : Siemens Advanta prioritized sustainability by integrating green technologies into its offerings, such as energy-efficient solutions for hospitals and sustainable manufacturing practices. This approach supported global efforts to meet stricter environmental regulations while driving innovation.

- January 2025 : Microsoft enhanced its Cloud for Sustainability with AI-driven tools like Microsoft Sustainability Manager and Copilot. These updates simplify ESG reporting by automating data integration, providing templates for various regulatory frameworks, and enabling natural language-driven report generation and analysis.

- December 2024 : Schneider Electric and Alstom announced partnering to reduce the environmental impact of the mobility sector by advancing sustainable technologies. Its focus included decarbonization, energy efficiency, and promoting greener transportation solutions, positioning them within the growing green technology and sustainability markets.

- December 2024 : Google partnered with Intersect Power and TPG Rise Climate to co-develop industrial parks where new data centers will be co-located with clean energy facilities. This initiative aims to accelerate power project deployment, reduce grid constraints, and provide carbon-free energy for AI-driven operations.

- September 2024 : SCC and IBM partnered to improve sustainable IT practices using advanced technologies like IBM's Envizi platform for sustainability reporting and Maximo for asset management. This partnership aims to enhance decarbonization efforts and optimize environmental impact planning while aligning with shared net-zero commitments.

Table of Contents

Methodology

The research methodology for the global green technology & sustainability market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders; subject matter experts on circularity and sustainability, third-party service providers, consulting service providers, and end users; high-level executives of multiple companies offering green technology & sustainability & services; and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications such as Journal of Industrial Ecology, International Journal of Sustainable Energy Planning and Management, International Journal of Green Economics, GAIA: Ecological Perspectives for Science and Society; and articles from recognized associations and government publishing sources including but not limited to United Nations Environment Program (UNEP), Ecodesign for Sustainable Products Regulation (ESPR), Ellen MacArthur Foundation, World Resources Institute (WRI), European Environmental Agency, Global Reporting Initiative (GRI), Carbon Disclosure Project (CDP), Climate Disclosure Standards Board (CDSB), and Natural Resources Defense Council (NRDC).

The secondary research was used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

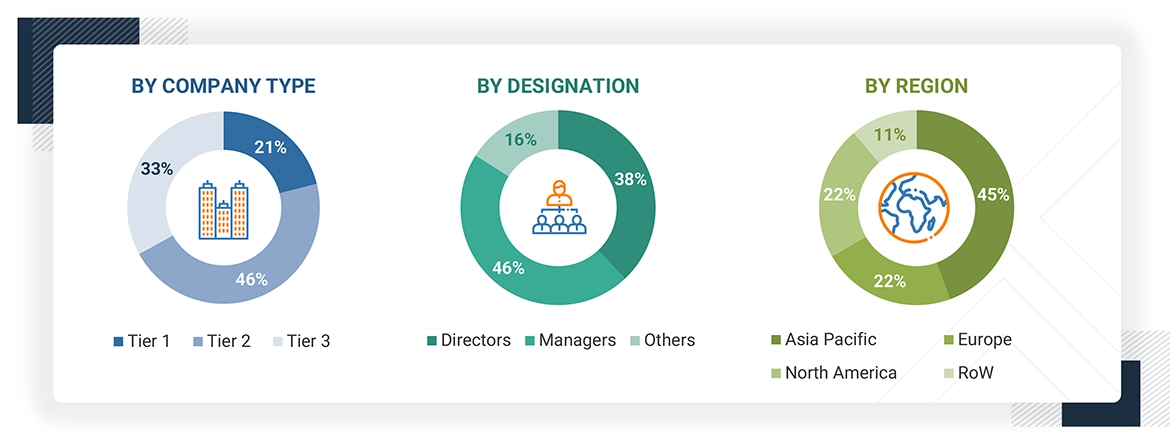

In the primary research process, a diverse range of stakeholders from both the supply and demand sides of the green technology & sustainability ecosystem were interviewed to gather qualitative and quantitative insights specific to this market. From the supply side, key industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology & innovation directors, as well as technical leads from vendors offering green technology & sustainability & services were consulted. Additionally, system integrators, service providers, and IT service firms that implement and support green technology & sustainability were included in the study. On the demand side, input from IT decision-makers, infrastructure managers, and sustainability/circular economy heads was collected to understand the user perspectives and adoption challenges within targeted industries.

The primary research ensured that all crucial parameters affecting the green technology & sustainability market—from technological advancements and evolving use cases (Corporate ESG & compliance, energy & emission reduction, sustainable supply chain & logistics etc.) to regulatory and compliance needs (US Clean Power Plan, EU Green Deal, NAPCC India, PNMC Brazil etc.) were considered. Each factor was thoroughly analyzed, verified through primary research, and evaluated to obtain precise quantitative and qualitative data for this market.

Once the initial phase of market engineering was completed, including detailed calculations for market statistics, segment-specific growth forecasts, and data triangulation, an additional round of primary research was undertaken. This step was crucial for refining and validating critical data points, such as green technology & sustainability offerings (green technology & sustainability software & services), industry adoption trends, the competitive landscape, and key market dynamics like demand drivers (Rise in government initiatives for low-carbon policies, corporate net-zero & ESG commitments, consumer demand for sustainable products & services, energy transition & decarbonization goals), challenges (Data Complexity & lack of standardized reporting frameworks, lack of tailored solutions to address unique environmental issues), and opportunities (Expansion of water-tech & smart resource management, growth in AI & digital carbon management solutions, carbon markets & decentralized trading platforms).

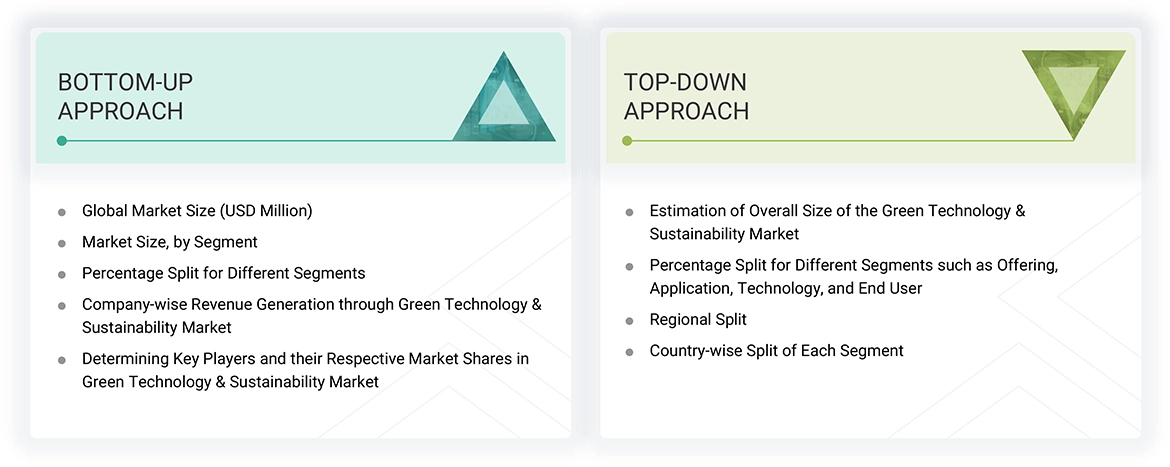

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1 = revenue more than USD 1 billion, tier 2 = revenue between USD 1 billion and 500 million, tier 3 = revenue less than USD 500 million

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and forecast the green technology & sustainability market and its dependent submarkets, both top-down and bottom-up approaches were employed. This multi-layered analysis was further reinforced through data triangulation, incorporating both primary and secondary research inputs. The market figures were also validated against the existing MarketsandMarkets repository for accuracy. The following research methodology has been used to estimate the market size:

Green Technology & Sustainability Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The green technology & sustainability market encompasses digital solutions that enable industries to track, optimize, and reduce their environmental impact through AI-driven intelligence, blockchain-enabled transparency, and cloud-based sustainability management. Unlike traditional sustainability efforts focused on material recovery, energy offsets, and waste management, this market is centered on software-driven decarbonization, ESG compliance, and real-time emissions intelligence. Key technologies such as carbon accounting platforms, supply chain traceability tools, AI-powered energy management software, and sustainability analytics dashboards empower enterprises to integrate environmental responsibility into their core business operations. With industries under increasing regulatory and stakeholder pressure to disclose Scope 1, 2, and 3 emissions, the role of digital sustainability intelligence has evolved from a compliance function to a strategic imperative for long-term business resilience, operational efficiency, and climate risk mitigation.

Stakeholders

- Vendors offering green technology & sustainability software and services

- Circular economy companies

- Generative AI/AI technology providers

- Business analysts

- Distributors and Value-added Resellers (VARs)

- Government agencies

- Independent Software Vendors (ISV)

- Market research and consulting firms

- Support & maintenance service providers

- Digital Product Passport (DPP) providers

- Manufacturers & suppliers

- Recyclers and waste management companies

- Academia & research institutions

- Certification & compliance bodies

- Refurbishing marketplaces

- Investors & venture capital firms

Report Objectives

- To define, describe, and forecast the green technology & sustainability market, by offering, application, technology and end user

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the green technology & sustainability market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the Green technology & sustainability market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakup of the North American market for Green Technology & Sustainability

- Further breakup of the European market for Green Technology & Sustainability

- Further breakup of the Asia Pacific market for Green Technology & Sustainability

- Further breakup of the Middle Eastern & African market for Green Technology & Sustainability

- Further breakup of the Latin American market for Green Technology & Sustainability

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Green Technology & Sustainability Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Green Technology & Sustainability Market