Gummy Supplements Market

Gummy Supplements Market by Type (Vitamin & Minerals, Omega-3 Fatty Acid, Collagen), End-use Demographics (Adults, Children), Functionality Distribution Channel (Hypermarkets & Supermarkets, Pharmacies & Drugstores), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The gummy supplements market is projected to grow from USD 24.39 billion in 2025 to USD 47.79 billion by 2030, registering a CAGR of 14.4% during the forecast period. This growth is driven by the rising consumer demand for convenient, enjoyable, and functional nutrition formats that align with wellness-focused lifestyles. As health awareness increases, manufacturers are prioritizing the development of gummies that deliver targeted benefits such as immunity support, sleep improvement, stress relief, and beauty-from-within effects, while ensuring product safety, efficacy, and regulatory compliance. Additionally, the expansion of nutraceutical consumption in emerging economies and the growing emphasis on clean-label, plant-based, and clinically backed formulations are compelling companies to innovate in formulation, delivery technology, and ingredient sourcing to maintain quality, transparency, and competitiveness in the global market.

KEY TAKEAWAYS

-

Product TypeThe product segment includes vitamin and mineral gummies, omega-3 fatty acid gummies, collagen gummies, CBD gummies, and other product types. Innovation and variety in gummy formulations are expanding to meet the diverse health needs of consumers.

-

DemographicsDemographics involves adults, children, and geriatrics. Gummy consumption is influenced by age-specific preferences and lifestyle requirements.

-

FunctionalityFunctionality comprises immunity support, general health & wellness, bone & joint health, weight management, beauty & skin health, and other functionalities. Demand is driven by multifunctional health benefits, addressing preventive and targeted wellness.

-

Distribution ChannelThe distribution channels include hypermarkets & supermarkets, pharmacies & drugstores, convenience stores, online retail stores, and direct sales & MLM. Consumer accessibility and convenience across multiple retail and online channels shape growth.

-

Starch IngredientsThis segment includes starchless and with starch systems. Product texture and formulation flexibility influence acceptance and adoption.

-

Ingredient SourceIngredient sources comprise animal-based and plant-based sources. Sustainability, ethical choices, and consumer awareness are guiding ingredient sourcing trends.

-

RegionThe market is analyzed across North America (US, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, and other European countries), Asia Pacific (China, India, Japan, Australia & New Zealand, and other Asia Pacific countries), South America (Brazil, Argentina, and rest of South America), and the Rest of the World (Middle East & Africa).

-

Competitive LandscapeThe competitive landscape features established multinational players and innovative regional brands. Key players, including Nestlé, Unilever, Bayer, Church & Dwight, H&H Group, Amway, Clorox, Haleon, and other companies, are adopting strategies that emphasize clean-label, plant-based, sugar-free, and science-backed formulations. Olly and Vitafusion focus on taste, convenience, and targeted health benefits, while others leverage personalized nutrition, advanced formulation technologies, and transparent sourcing to build credibility and meet regulatory standards. Regional dynamics indicate that North America leads in market share, driven by high consumer awareness. Meanwhile, Europe emphasizes clean-label and vegan products, while the Asia Pacific region experiences rapid growth, fueled by a rising health consciousness. Overall, players are combining product innovation, scientific validation, and consumer-centric strategies to capture market share in this fast-expanding segment of the nutraceutical industry.

Market growth is being driven by evolving consumer preferences toward convenient, palatable, and functionally enriched supplement formats. The increasing focus on preventive health and wellness has prompted manufacturers to expand their product portfolios with clean-label, vegan, and sugar-free formulations that address specific health needs, such as sleep, stress, and immunity. The rising regulatory standards and the need for validated product claims are encouraging greater investment in formulation innovation, quality assurance, and transparent sourcing, positioning gummy supplements as a key growth segment within the broader nutraceutical industry.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The future trend distribution in the gummy supplements market reflects a clear shift from traditional segmentation—based on product type and demographics—to a more innovation-driven and functional approach. As brands develop, future revenue growth will mainly stem from new ingredient sources and positioning, innovative product formats and delivery methods, and formulations tailored to health needs. This shift is driven by growing consumer interest in targeted wellness benefits such as improved sleep, better cognition, stress reduction, and beauty-from-within effects. Therefore, manufacturers and formulators are focusing on integrating botanical actives, marine peptides, and slow-release technologies to deliver higher efficacy, personalization, and convenience, eventually redefining how consumers experience health and nutrition through gummies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for convenient and enjoyable supplement formats Growing awareness of preventive health and personalized nutrition

Level

-

High pricing of premium gummy supplements Limited awareness in certain emerging markets

Level

-

Expansion of plant-based, sugar-free, and clean-label gummies Growth in online retail and direct-to-consumer channels

Level

-

Regulatory compliance and verified product claims Shelf-life and stability issues of gummy formulations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for convenient and enjoyable supplement formats

The rising demand for convenient and enjoyable supplement formats highlights a significant shift in consumer preferences toward products that seamlessly fit into daily routines without compromising on taste or experience. Traditional tablets and capsules are often perceived as difficult to consume or unappealing, leading consumers to seek alternatives that are both effective and enjoyable. Gummies, with their chewable texture, fruity flavors, and visually appealing forms, meet this need by making supplementation a more pleasant experience. This trend is further driven by busy lifestyles, where time constraints make convenience essential, and by rising health awareness, which encourages consumers to select products that effortlessly support wellness and enjoyment. Consequently, supplement manufacturers are developing innovative gummy options that merge functionality with sensory appeal, improving adherence and attracting a broader consumer base.

Restraint: High pricing of premium gummy supplements

The high pricing of premium gummy supplements acts as a key restraint in market growth, limiting accessibility for price-sensitive consumers. These products often incorporate specialized ingredients, such as plant-based sources, collagen, or science-backed actives, which increase production costs and retail prices. As a result, while they appeal to health-conscious and affluent consumers, a significant portion of the market may be unable or unwilling to pay the premium, slowing widespread adoption. This pricing barrier encourages manufacturers to strike a balance between product innovation and cost efficiency, making gummies more accessible without compromising on quality or efficacy.

Challenge: Shelf-life and stability issues of gummy formulations

Shelf-life and stability issues pose a significant challenge for gummy supplements, as their chewy texture and moisture content make them more susceptible to degradation over time. Factors such as temperature, humidity, and exposure to air can affect the product’s texture, taste, and potency of active ingredients. Maintaining consistent quality and efficacy throughout the product’s shelf-life requires advanced formulation techniques, proper packaging, and storage conditions. These challenges add complexity and cost to manufacturing, making it essential for producers to invest in robust solutions to ensure consumer trust and satisfaction.

Opportunity: Expansion of plant-based, sugar-free, and clean-label gummies

The expansion of plant-based, sugar-free, and clean-label gummies presents a significant opportunity for the market, driven by growing consumer demand for healthier and ethically sourced products. Consumers are increasingly seeking supplements that align with vegan lifestyles, reduce sugar intake, and feature transparent ingredient sourcing. This trend encourages manufacturers to innovate with alternative gelling agents, natural sweeteners, and functional ingredients, enabling the development of products that cater to health-conscious and environmentally aware consumers. By tapping into this opportunity, brands can differentiate themselves, attract new customer segments, and strengthen loyalty among existing users.

Gummy Supplements Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers a wide range of gummies targeting immunity, cognitive health, and wellness, combining taste and functional benefits | Strengthens brand leadership, drives consumer loyalty, and captures high-demand wellness segments |

|

Provides age-specific and personalized gummy supplements for adults and children through a direct-selling model | Expands reach, enhances customer engagement, and builds recurring sales through personalized nutrition solutions |

|

Produces gummies for vitamins and minerals targeting general health, energy, and immunity in adults and children | Maintains strong U.S. market presence, increases consumer trust, and ensures high brand recognition |

|

Offers gummy multivitamins and targeted formulations for specific health needs such as bone, heart, and immune health | Leverages scientific credibility, strengthens global market presence, and diversifies product portfolio |

|

Develops plant-based and sugar-free gummies targeting wellness, beauty, and immune support, with global distribution. | Captures emerging health-conscious consumers, differentiates via innovative formulations, and expands international reach |

|

Introduces gummy supplements with functional ingredients focusing on preventive health and clean-label products | Enhances innovation reputation, aligns with consumer health trends, and expands portfolio in the functional nutrition segment |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The gummy supplement market ecosystem comprises a diverse network of key stakeholders that collectively drive product innovation, manufacturing, distribution, and consumption. Core participants include raw material suppliers providing gelatin, pectin, sweeteners, and active ingredients such as vitamins, botanicals, and probiotics; manufacturers and contract formulators responsible for product development and large-scale production; and brand owners who focus on marketing, regulatory compliance, and consumer engagement. Retailers (online and offline) serve as critical distribution channels, while regulatory bodies oversee safety and labeling standards. Additionally, packaging innovators, ingredient testing labs, and logistics providers play supporting roles in ensuring product quality, differentiation, and timely market delivery. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and other national health authorities, ensure product safety, quality, and compliance with labeling standards.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

By Product Type

Vitamin and mineral gummies account for the largest share of the gummy supplements market due to their widespread appeal and essential role in daily nutrition. These gummies cater to a broad consumer base seeking to maintain overall health, fill nutrient gaps, and support general wellness. Their popularity is reinforced by their versatility, as they can be formulated with various vitamins and minerals targeting different health benefits, such as immunity, energy, and metabolic support. Additionally, the familiarity and trust associated with vitamin and mineral supplements make them a preferred choice among consumers, contributing to their dominant market position despite the emergence of niche products, such as collagen, omega-3, and herbal gummies.

By Demographics

Adults constitute the largest demographic segment in the gummy supplements market, reflecting the growing focus on preventive health and lifestyle management. Busy schedules, increasing health awareness, and a desire for convenient and enjoyable supplement formats drive adult consumption. Gummies appeal to this group because they combine functionality with taste, making adherence to supplementation easier compared to traditional tablets or capsules. Moreover, adults often seek targeted benefits such as immunity support, energy enhancement, and stress management, which are effectively addressed through versatile gummy formulations. Their large consumer base and consistent demand solidify adults as the leading demographic in the gummy supplements market.

By Ingredient Source

In the gummy supplements market, the plant-based ingredient segment is projected to witness the fastest growth rate during the forecast period. This surge is driven by the rising preference for vegan, allergen-free, and sustainable formulations, as consumers increasingly seek alternatives to gelatin-based gummies. Manufacturers are responding by utilizing pectin, agar, and starch-derived bases to develop gummies that align with clean-label and ethical consumption trends. The strong momentum of plant-based innovation reflects the broader industry shift toward health-conscious and environmentally responsible nutrition solutions.

REGION

The Asia Pacific region is emerging as the fastest-growing market for gummy supplements

The Asia Pacific region is witnessing the fastest growth in the gummy supplements market, driven by a combination of rising health consciousness, increasing disposable incomes, and a rapidly expanding urban population. Consumers in this region are becoming increasingly aware of the importance of preventive healthcare and are actively seeking convenient, enjoyable, and functional supplement formats that fit into their busy lifestyles. The rise of retail chains, supermarkets, pharmacies, and e-commerce has increased access to gummy supplements, boosting adoption in urban and semi-urban areas. Cultural trends in wellness, beauty, and holistic health lead brands to launch region-specific products. Supportive policies, interest in plant-based and clean-label items, and the younger, open-minded population accelerate market growth, making Asia Pacific a global leader in gummy supplements.

Gummy Supplements Market: COMPANY EVALUATION MATRIX

In the global gummy supplements market, Unilever stands out as the star player, leveraging its wellness-focused brands to deliver science-backed, consumer-friendly gummy products that combine taste with health functionality. The company emphasizes innovation and clinical validation, allowing it to maintain a dominant market presence. In contrast, Amway is an emerging leader, capitalizing on personalized nutrition and its strong direct-selling network to expand its reach and engage consumers seeking tailored health solutions. Other players in the market are also actively pursuing growth through strategies, such as introducing plant-based and sugar-free formulations, expanding online and retail distribution channels, focusing on clean-label and ethically sourced ingredients, and developing products with multifunctional health benefits. Collectively, these strategies reflect a competitive landscape centered on innovation, consumer engagement, and diversification of product offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 24.39 BN |

| Market Forecast in 2030 (Value) | USD 47.79 BN |

| Growth Rate | CAGR of 14.4% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (KT) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

WHAT IS IN IT FOR YOU: Gummy Supplements Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Gummy Supplement Manufacturers & Brand Owners | 1. Quality & safety benchmarking by product type (vitamins, minerals, collagen, CBD, herbal/probiotic) 2. Regulatory compliance matrix by region 3. Stability, shelf-life, and contamination risk profiles for formulations | 1. Faster compliance and market entry 2. Reduced product recalls and safety risks 3. Enhanced formulation quality and consumer trust |

| Analytical & Testing Labs | 1. Technology adoption roadmap (manual vs automated testing for gummies) 2. Accuracy & throughput benchmarking of testing methods 3. Updates on regional testing protocols and regulatory impacts | 1. Optimized lab workflows and efficiency 2. Competitive differentiation through validated services 3. Alignment with emerging regulations and standards |

| Regulatory Authorities & Food Safety Agencies | 1. Comprehensive review of testing standards for gummy supplements 2. Data on contaminants, heavy metals, allergens, and adulterants 3. Compliance reporting frameworks for manufacturers and retailers | 1. Improved oversight and enforcement effectiveness 2. Streamlined regulatory processes 3. Enhanced consumer safety and public health protection |

RECENT DEVELOPMENTS

- December 2024 : Haleon Pakistan will start local manufacturing of Centrum multivitamins in 2025 to meet domestic demand and expand exports. Initially launching through imports in Q1 2025, the company plans to produce market-specific variants locally. Haleon aims to grow its share in Pakistan’s Rs 24 billion supplement market and expand exports to 19 countries, supported by a USD 10 million investment in manufacturing.

- September 2024 : Unilever ventures has invested USD 5 million in create wellness, a US based startup known for its gummy creatine supplements, as part of its series a funding round. This strategic move supports Unilever’s expansion into the health and wellness sector, aiming to diversify its portfolio and boost innovation in functional nutrition.

- April 2024 : Unilever's Olly launched a new cognitive supplement line targeting both adults and children with individually wrapped gummies. The launch aims to capture the growing demand for brain health and convenient, on-the-go supplementation.

- August 2023 : Unilever Ventures invested in What’s Up Wellness, an Indian startup offering diverse gummy supplements. This partnership helps Unilever expand its footprint in the Asia-Pacific wellness market and tap into emerging consumer segments.

- April 2023 : Centrum launched nutrition gummies specific to Indian needs. Centrum has ventured into a new range of high-science supplements in a delicious gummy format, called "Benefit Blends." The multivitamin brand of Haleon, earlier known as GSK Consumer Healthcare, entered the Indian market in September last year. Centrum Sleep & Refresh gummies help improve sleep quality. The probiotic and prebiotic content in "Centrum Digestive Balance" gummies supports gut health and digestion. "Centrum Immune Defense" gummies with clinically validated Wellmune beta-glucan, vitamin C, and zinc support defenses of the body against infection.

- February 2023 : Unilever, as a leader in the business of gummy supplements, entered into the fitness sector with two gummy products. Though the business of the fitness segment has been increasing fast, it may contribute a small part to the company's overall revenue growth. One of the products may be for energy production, and the second one is to support muscle strength and recharging.

- January 2023 : Amway introduced Nutrilite Kids Power of Gummies, a new range of gummy vitamins for children. This expansion supports Amway’s strategy to strengthen its portfolio in age-specific health supplements and enhance consumer engagement.

- October 2022 : Haleon and Microsoft are announcing a collaborative initiative that puts artificial intelligence that reads product labels into action to make health items more accessible for consumers who are blind or visibly impaired. Updates have been made to the free Microsoft Seeing AI app, increasing its accessibility and promoting inclusion. It will read consumers' key label information for more than 1,500 everyday consumer health products in the UK and US, including Sensodyne, Centrum, Aquafresh, ChapStick, and Emergen-C.

Table of Contents

Methodology

The study employed two primary approaches to estimate the current size of the gummy supplements market. Exhaustive secondary research was conducted to gather information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were used to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study extensively utilized secondary sources, including directories and databases such as Bloomberg Businessweek and Factiva, to identify and collect information relevant to a technical, market-oriented, and commercial study of the market. In the secondary research process, various sources, including company annual reports, press releases, investor presentations, white papers, food journals, certified publications, articles by recognized authors, directories, and databases, were utilized to identify and collect information.

Secondary research was primarily used to gather key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation based on the industry trends to the most granular level, including regional markets and key developments from the market- and technology-oriented perspectives.

Primary Research

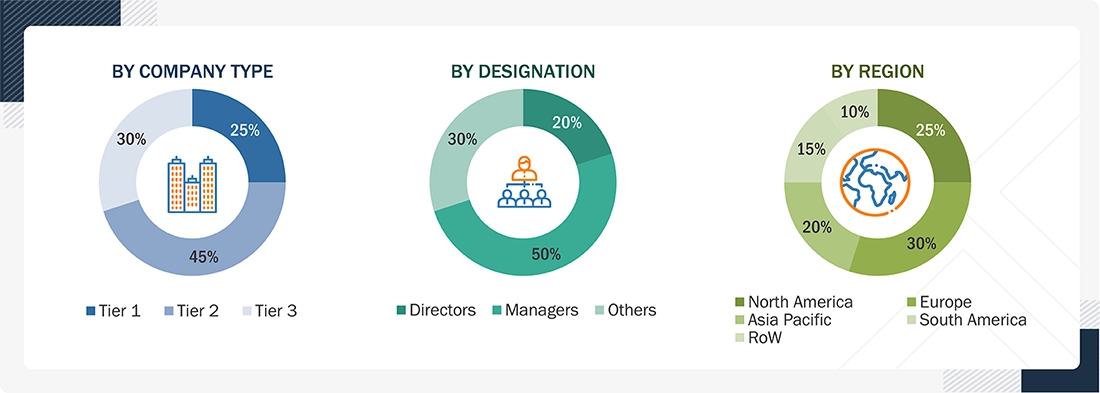

Extensive primary research was conducted after obtaining information regarding the gummy supplements market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephone interviews. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, research, and development teams, and key opinion leaders.

Primary interviews were conducted to gather insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to gummy supplements segments based on type, end-use demographics, functionality, distribution channel, by starch ingredients, by ingredients source, and region. Stakeholders from the demand side, including research institutions, universities, and third-party vendors, were interviewed to gain insight into the buyer’s perspective on the service, their current use of gummy supplements and fungicides, and their business outlook, which will influence the overall market situation.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, as per the

availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue = USD 1 billion; Tier 3:

Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the gummy supplements market. These approaches were also used extensively to determine the size of various market segments. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Gummy Supplements Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process explained above, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall gummy supplements market and determine the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

According to the FDA, “Dietary supplements are intended to add to or supplement the diet and are different from conventional food. If a product is meant to treat, diagnose, cure, or prevent diseases, it is considered a drug, even if it is labeled as a dietary supplement. Supplements are ingested and come in various forms, including tablets, capsules, soft gels, gel caps, powders, bars, gummies, and liquids.”

The Dietary Supplement Health and Education Act (DSHEA) of 1994 defines a dietary supplement as “A dietary supplement is a product intended for ingestion that, among other requirements, contains a “dietary ingredient” intended to supplement the diet. The term “dietary ingredient” includes vitamins and minerals; herbs and other botanicals; amino acids; “dietary substances” that are part of the food supply, such as enzymes and live microbials (commonly referred to as “probiotics”); and concentrates, metabolites, constituents, extracts, or combinations of any dietary ingredient from the preceding categories.”

Gummy supplements are chewable dietary substances containing bioactive ingredients, such as vitamins, minerals, omega fatty acids, probiotics, prebiotics, and other substances having antioxidant properties that promote human health. Gummy supplements resemble the taste and texture of gummy candies. They are offered in various colors, flavors, and shapes, making them increasingly appealing, particularly to children. Gummy vitamins are commonly made from sugar, cornstarch, gelatin, water, and added colorings. Jellifying agents, such as pectins, modified starches, gelatin, and sugars, form the foundation of gummy bears, allowing water-soluble elements to dissolve while insoluble ones are suspended in the viscous matrix. Main flavors of gummy vitamins include raspberry, lemon, orange, and cherry.

Stakeholders

- Raw material suppliers

- Vitamin manufacturers/suppliers

- Commercial research & development (R&D) institutions and financial institutions

- Traders, distributors, and retail suppliers of gummy vitamins

- Government and research organizations

-

Associations, regulatory bodies, food safety agencies, and other industry-related bodies:

- International Alliance for Dietary Supplements Associations (IADSA)

- Health Foods and Dietary Supplements Association (HADSA)

- Food and Drug Administration (FDA)

- European Food Safety Authority (EFSA)

- United States Department of Agriculture (USDA)

- Food Standards Australia New Zealand (FSANZ)

Report Objectives

- To determine and project the size of the gummy supplements market with respect to by type (vitamin & minerals, omega-3 fatty acid, collagen, CBD and other product types), end-use demographics (adults, children and geriatrics), functionality (immunity support, general health & wellness, bone & joint health, beauty & skin health and others), distribution channel (hypermarkets & supermarkets, pharmacies & drugstores, convenience stores, online retail stores and direct sales & MLM (multi-level marketing)), starch ingredients (with starch and starchless systems), by ingredients source (animal-based and plant-based), and region in terms of value over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the gummy supplements market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Service Matrix, which gives a detailed comparison of the service portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of the European gummy supplements market into key countries

- Further breakdown of the Rest of Asia Pacific gummy supplements market into key countries

- Further breakdown of the Rest of the South American gummy supplements market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Gummy Supplements Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Gummy Supplements Market