Gummy Vitamins Market by Product Type (Multivitamins, Single Vitamins), Source (Animal, Plant), Packaging Type (Bottles & Jars, Pouches), Distribution Channel (Store-Based, Online), End User (Adult, Children), and Region - Global Forecast to 2025

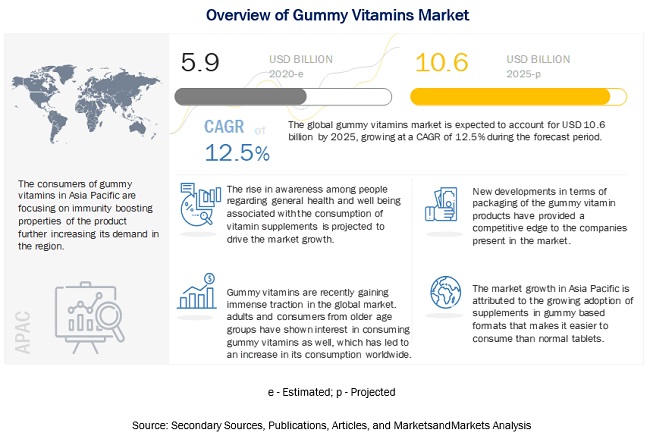

[198 Pages Report] The global gummy vitamins market size is estimated to be valued around USD 5.9 billion in 2020 and is projected to reach USD 10.6 billion by 2025, recording a CAGR of 12.5%, according to MarketsandMarkets. The millennials prefer consuming these gummies due to factors such as busier lifestyles, rising disposal incomes, growing awareness regarding preventive healthcare measures, and maintaining better health. Other factors driving the demand for these gummy vitamins include the rise in incidences of vitamin deficiencies and undernourishment problems in developing and underdeveloped countries.

To know about the assumptions considered for the study, Request for Free Sample Report

Gummy vitamins are chewable vitamins with taste, flavor, color, shape, and size similar to gummy candies. However, these gummies are induced with vitamins to offer various health benefits to end consumers. Gummy vitamins are recently gaining immense traction in the global market. Originally, it was launched to expand the customer base in the kids' segment. However, adults and consumers from older age groups have shown interest in consuming gummy vitamins as well, which has led to an increase in its consumption worldwide. It is targeted at consumers who are accepting new forms or alternatives other than tablets, capsules, and pills, among others, to balance the nutritional deficiency or gap. In addition, consumers opt for these gummies, as they are chewable and are easy to consume, further providing all the necessary benefits as well. According to a study published in the European Journal of Clinical Pharmacology, it revealed that over 30% of consumers have difficulty in swallowing pills, of which a majority are women and older adults that further support the increase in demand for vitamin-infused gummies.

COVID-19 Analysis

The global gummy vitamins market is moderately impacted due to the uncertain pandemic circumstances that occurred across the globe. The effects of COVID-19 have impacted the supply chain of the final products and the availability of raw material ingredients. The North American region, followed by Europe and Asia Pacific, plays a vital role in the gummy vitamins market due to the concentration of several key players operating here. The supply from these regions is affected because of COVID-19 lockdown and restrictions, restricting the transition of goods. However, it is expected that the regional consumption will witness a surge, especially with higher sales across the supermarkets & hypermarkets.

In addition, the consumption of vitamins, such as vitamin C and vitamin D, is associated with immunity-boosting benefits, which will act as another key factor to boost the demand for gummy vitamins. Moreover, the rise in concerns regarding the safety of human health and increase in awareness for immunity boosters and other key vitamins is projected to result in an exponential growth in demand for vitamin-induced products in gummy formats. The growth of the gummy format can be further attributed to facts such as the convenience provided by gummy products and the increasing number of consumers suffering from pill-swallowing issues.

Market Dynamics

Drivers: High demand for on-the-go dietary supplement products

In recent years, health-conscious consumers are looking for nutritional foods and food products with essential health ingredients to prevent diseases and improve physical and mental well-being. The increase in the aging population and rise in consumer awareness in developing and developed countries are the key factors that have led to the rise in consumer preference for products with healthy ingredients, such as vitamins, required for the prevention or treatment of specific existing conditions. The increase in demands for such products has led several manufacturers to launch various products infused with vitamins in the dietary supplements market.

However, the millennials across regions and countries are witnessing busier work schedules and the increase in the geriatric population that are experiencing problems with pill-consumption. Due to these factors, consumers in the market are witnessing high demand for convenient vitamin-based products that can be consumed on-the-go and are easy to consume, such as easy to chew instead of swallowing. Gummy vitamins help address these problems and provide consumers with on-the-go consumption characteristics, along with ease in consumption, as they are chewable candies. Apart from this, the pleasant sugar-based flavor coating on gummy vitamins also appeal to a larger consumer base in terms of taste preferences. The geriatric population and children avoid the consumption of dietary supplements due to their harsh, unappealing, and unpleasant strong tastes, due to which gummy vitamin manufacturers witness high growth potential to commercialize a line of their products. In addition, key factors such as the increased quantity of multi-vitamins in gummy vitamins encourage consumers to adopt these products rather than opt for other singular vitamin tablets or capsules, which, in turn, provides them convenience in consumption. Hence, the increase in demand for convenient and on-the-go supplements is further encouraging the demand for gummy vitamins.

Restraints: High cost of products

A majority of vitamins available in the market are synthetic in nature. In addition, key factors that have led to the increased popularity of synthetic vitamins among gummy vitamin manufacturers is the low availability of raw materials for naturally sourced vitamins, which results in high production costs associated with naturally sourced vitamins than synthetic vitamins. Most of the synthetic vitamins are produced from petroleum extracts or coal tar derivatives, which serve as cheaper raw materials. Even though naturally sourced vitamins witness an increase in preference among consumers, their production is associated with high production costs and investment.

Furthermore, operational hindrances in the availability of raw materials in the recent past have resulted in interference with the efficient supply of vitamins A and E. There are a few natural foods that provide vitamin D and increase the risk of vitamin D deficiency among consumers. Vitamin D, vitamin A, and several other vitamins face the problem of raw material unavailability, due to which there is an increase in the price. These factors add to the production costs of gummy vitamins. In addition, the formulation of a gummy supplement infused with additional nutrients, flavors, and colors is complicated and costly as compared to formulating tablets or capsules. This, in turn, leads to additional costs of production, which further leads to the premium pricing of gummy vitamins as compared to the conventional vitamin dietary supplements in the form of tablets, capsules, or pills. Thus, fluctuations in the availability of raw materials are projected to impact the pricing of gummy vitamins. Its volatile prices are a key challenging factor inhibiting the growth of the gummy vitamins market.

Opportunities: Synthetic and natural flavor enhancements and developments according to dynamic demands for improved flavors among the consumers

The global gummy vitamins market is gaining immense traction in the market for the last few years. This is attributed to the properties of gummy vitamins, such as flavors, tastes, and convenience of consuming, along with additional health benefits offered. Earlier gummies were offered by key players in limited flavors, colors, shapes, and sizes. However, with the increase in consumption and awareness, the demand for gummy vitamins started witnessing a substantial rise in demand. Key players are focusing on manufacturing a line of gummy vitamins with distinct flavors, such as lime, orange, cherry, strawberry, and similar mainstream flavors. With the rise in popularity of gummies, consumers are witnessing dynamic demands in terms of taste appeal. Due to these factors, key manufacturers are focusing on investing in developing and formulating gummies in new flavors.

Manufacturers have started offering innovative and exotic flavors, such as cherry, cola, peach, raspberry, and others, to widen the scope of opportunities for manufacturers and increase the acceptance and adoption of it among consumers. Some gummies include artificial colors or corn syrups to enhance the flavors in gummies. However, consumers in the market prefer opting for organic, natural flavor, and colorful gummies. This is due to the health benefits associated with organic and natural products. Thus, multiple players in the industry are introducing gummy vitamins made with natural fruit flavors. For instance, Vitafusion (US) has launched a line of products in March 2020, which contain natural peach flavor and apple cider vinegar gummies. These gummies do not contain high fructose corn syrup, dairy, synthetic FD&C dyes, or artificial flavors/sweeteners. Thus, companies are introducing and launching gummies that have a fusion of natural fruit-based flavors, and thereby, cater to the global dynamic demands of consumers for various flavors. This results in increased growth opportunities for the global and regional players operating in the global gummy vitamins market.

Challenges: Formulation challenges for inducing vitamin ingredients in gummies

Gummies are popular formats in the dietary and nutraceutical supplements market. However, the increase in demand for gummies has led to major challenges for manufacturers in the market, including the formulation challenges. The formulations of gummy vitamin products pose additional challenges with respect to a tablet or capsule preparation due to vitamin stability issues in a gummy delivery system. Due to the stability issues, manufacturers add an excessive amount of nutrients during production to compensate for the loss during storage and achieve the declared shelf life. In some cases, the vitamins and minerals can interfere with the actual gelatin or pectin bonds, which further results in issues, such as softness or stability, over a period of time.

Apart from this, manufacturers also face challenges while formulating gummies by replacing gelatin. A number of manufacturers are focusing on producing gelatin-free gummies, and only a few succeed, due to the unique set of texture attributes and functional characteristics that gelatin provides. Another single ingredient cannot replace these characteristics. Many companies seem to have trouble controlling the number of ingredients in each gummy. To overcome such incidences, several gummy vitamin manufacturers spray vitamins and nutrients on the outside of the finished candy-like coating. However, this could lead to stability issues, and gummies can lose potency over time.

Additionally, it has led some manufacturers to put in a high number of certain vitamins than labeled to ensure the product provides at least 100% of the labeled amounts throughout its shelf life. It can be further linked to excessive nutrient intake, leading to human health risks. Thus, formulation challenges for inducing vitamins in gummies act as a major challenging factor in the global gummy vitamins market.

By packaging type, the bottles and jars segment is projected to account for the largest share in the gummy vitamins market during the forecast period

The bottles & jars segment dominated the global gummy vitamins market, on the basis of packaging type, in 2019. This is due to the air-tight characteristics offered by the lid of these bottles & jars, which helps protect the composition of gummies inside and prevent contamination or damages from the external environment. Bottles & jars available in plastic and glass forms are also easy to carry or transport.

By end-user, the adults segment is projected to have the highest growth rate in the gummy vitamins market during the forecast period

The adult segment is projected to have the highest growth rate in the gummy vitamins market during the forecast period. This is attributed to the increase in the geriatric population, which is more prone to the risks of vitamin deficiencies and bone related diseases. In addition, with the increase in age, consumers witness difficulties in swallowing capsules, tablets, and other forms of pharmaceutical products that help in increasing vitamin intake in the body. Hence, gummy vitamins are majorly preferred among the adult population in the world, as they are chewable and offer enhanced taste apart from delivering health benefits.

By distribution channel, the online-based segment is projected to witness a significant growth rate in the gummy vitamins market during the forecast period

The online-based segment is projected to witness a significant growth rate in the global gummy vitamins market, in during the forecast period. The online-based segments are non-store-based distribution channels. They are soon becoming the lucrative alternate among the consumers particularly the younger and tech-savvy population due to discounts on price, higher margins, high availability of products and user-friendly nature. Growth in the segment will be contributed by developing and fast-growing economies like India and China.

By source, the plant segment is projected to have the highest CAGR in the gummy vitamins market during the forecast period

Due to consumers increasing preference for vegetarian and vegan lifestyles, the plant segment is projected to have the highest CAGR in the forecast period. This is also due to increase in awareness and thus a subsequent shift towards plant-based diet.

Gummy Vitamins Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is projected to grow at the highest growth rate during the forecast period

Increase in health awareness, particularly post COVID-19, rapid urbanization, easier availability of products, high prevalence of chronic diseases, undernourished population are some of the crucial factors which will keep Asia-Pacific region on the pedestal in terms of growth rate for the gummy vitamins market. Additionally, being one of the most populated region in the world with some of the fastest growing economies, Asia Pacific is a lucrative market for key players to invest in. Thus, the region is projected to record the highest growth rate during the forecast period and the market is projected to witness a high demand for gummy vitamins in the coming years.

Key Market Players:

Church & Dwight Co. Inc. (US), Life Science Nutritionals (Canada), Bettera Brands LLC (US), The Clorox Company (US), Softigel (US), Nature's Way Products, LLC (US), Zanon Vitamec Inc. (US), Olly Public Benefit Corporation (US), Herbaland Naturals Inc. (Canada), Hero Nutritionals, LLC (US), SmartyPants Inc. (US), The Nature's Bounty Co. (US), IM Healthcare (India), Nutra Solutions (US), Makers Nutrition, LLC (US), Vitakem Nutraceutical Inc. (US), x`Bayer Group (Germany), Ernest Jackson (UK), Boscogen, Inc (US), and Santa Cruz Nutritionals Inc. (US).

Recent Developments

- In April 2019, Church & Dwight, under its brand Vitafusion, launched Vitafusion Organic, a new line of organic supplements, which include women’s multi, men’s multi, Vitamin D3, and Vitamin B-12. This helped the organization in expanding its product portfolio in organic gummy vitamins.

- In March 2018, The Clorox Company’s growth increased through the acquisitions of one of the leading brands, Nutranext. This helped the company to expand its health and wellness product portfolio with Nutranext dietary supplements and RenewLife digestive health products.

Frequently Asked Questions (FAQ):

What are the upcoming trends or opportunities that a start-up company can look at, in the gummy vitamins market?

Start-up companies can invest in R&D activities to innovate and formulated gummies from vegan and sugar-free sources. This is causing the consumers are now shifting towards these options in the global market.

Which region witnesses to have a lucrative market?

Asia Pacific regional market exhibits lucrative opportunities. A number of dietary supplement manufacturers have started investing in the region, owing to the market been at a nascent stage and the potential of high growth due to a rise in awareness and consumption.

Does the report provide bifurcation of the region into countries and provide insights?

Yes, the report provides further bifurcation of regions into countries. The data and insights have been provided for individual countries, which will help the companies or manufacturers understand country-level insights.

Can you provide company profiling for additional or customized companies?

Yes, we can provide additional profiling of companies.

Does the report provide COVID-19 impact analysis?

Yes, the report includes COVID-19 impact analysis. Also, it is further extended into every individual segment of the reports .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

FIGURE 1 MARKET SEGMENTATION

1.3 REGIONS COVERED

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2019

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Secondary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 GUMMY VITAMINS MARKET SIZE ESTIMATION- METHOD 1

2.2.2 GUMMY VITAMINS MARKET SIZE ESTIMATION- METHOD 2

2.2.3 GUMMY VITAMINS MARKET SIZE ESTIMATION NOTES

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 36)

TABLE 2 GUMMY VITAMINS MARKET SNAPSHOT, 2020 VS. 2025

FIGURE 4 MARKET SIZE, BY PRODUCT TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 5 GUMMY VITAMINS MARKET SIZE, BY SOURCE, 2020 VS. 2025 (USD MILLION)

FIGURE 6 MARKET SIZE, BY PACKAGING TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 7 GUMMY VITAMINS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020 VS. 2025 (USD MILLION)

FIGURE 8 MARKET SIZE, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 9 MARKET SHARE (VALUE), BY REGION, 2019

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 GROWTH OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 10 GROWING HEALTH AWARENESS AND ACCEPTANCE OF CHEWABLE FORMAT OF SUPPLEMENTS TO DRIVE THE MARKET

4.2 GUMMY VITAMINS MARKET, BY APPLICATION, 2019

FIGURE 11 ADULT SEGMENT TO ACCOUNT FOR A HIGHER SHARE IN THE MARKET

4.3 NORTH AMERICA: GUMMY VITAMINS MARKET, BY KEY END USER AND COUNTRY

FIGURE 12 NORTH AMERICA: HIGH ADOPTION OF CHEWABLE VITAMIN SUPPLEMENT PRODUCTS IN THE US TO BOOST THE MARKET GROWTH

4.4 GUMMY VITAMINS MARKET, BY END USER AND REGION, 2019

FIGURE 13 NORTH AMERICA ACCOUNTED FOR THE LARGEST SHARE IN THE MARKET IN 2019

4.5 GUMMY VITAMINS MARKET, BY KEY COUNTRY, 2019

FIGURE 14 US ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

FIGURE 15 EXPERIENCES OF CONSUMERS SURVEYED WITH SWALLOWING PROBLEMS

5.2 MARKET DYNAMICS

FIGURE 16 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in incidences of vitamin deficiencies and undernourishment in developing and underdeveloped countries and regions

5.2.1.2 High demand for on-the-go dietary supplement products

5.2.1.3 Increase in need to improve immunity and maintain health encourages consumption of gummies to balance daily vitamin requirements

FIGURE 17 SURVEY OF 990 RESPONDENTS ON THE TYPES OF SUPPLEMENTS CONSUMED IN THE UK, 2018

5.2.2 RESTRAINTS

5.2.2.1 High sugar content in gummy vitamin products results in other health-related problems among consumers

5.2.2.2 High cost of the products

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in demand for vegan and sugar-free gummies instead of gelatin and sugar gummies

FIGURE 18 UK: VEGAN POPULATION, 2014-2018

5.2.3.2 Synthetic and natural flavor enhancements and developments according to the dynamic demands for improved flavors among consumers

5.2.4 CHALLENGES

5.2.4.1 Risks and side-effects associated with the overconsumption of gummy formats

5.2.4.2 Formulation challenges for inducing vitamin ingredients in gummies

5.3 TRADING AND QUALITY PRACTICES FOR GUMMY VITAMINS

5.4 PRICING ANALYSIS OF GUMMY VITAMINS

5.5 PATENT ANALYSIS

FIGURE 19 GEOGRAPHICAL ANALYSIS: PATENT APPROVAL FOR THE MARKET, 2015–2020

TABLE 3 LIST OF IMPORTANT PATENTS FOR GUMMY VITAMINS, 2015-2020

5.6 REGULATIONS RELATED TO THE SUPPLEMENTS AND GUMMY VITAMINS PRODUCTS

5.6.1 INTRODUCTION

TABLE 4 DEFINITIONS AND REGULATIONS FOR DIETARY SUPPLEMENTS AROUND THE WORLD

5.7 NORTH AMERICA

5.7.1 CANADA

5.7.2 US

5.7.3 MEXICO

5.8 EUROPEAN UNION (EU)

5.8.1 FRANCE

5.8.2 RUSSIA

5.8.3 SPAIN

5.9 ASIA PACIFIC

5.9.1 JAPAN

5.9.2 CHINA

5.9.3 INDIA

5.9.4 AUSTRALIA & NEW ZEALAND

5.10 SOUTH AMERICA

5.10.1 BRAZIL

5.10.2 ARGENTINA

5.11 MIDDLE EAST & AFRICA

5.11.1 ISRAEL

6 ECOSYSTEM/ MARKET MAP (Page No. - 64)

FIGURE 20 PROTEINS, VITAMINS & MINERALS: ECOSYSTEM VIEW

FIGURE 21 PROTEINS, VITAMINS & MINERALS: MARKET MAP

FIGURE 22 NUTRACEUTICALS AND DIETARY SUPPLEMENTS: ECOSYSTEM VIEW

FIGURE 23 NUTRACEUTICALS AND DIETARY SUPPLEMENTS: MARKET MAP

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 24 GUMMY VITAMINS: SUPPLY CHAIN

6.2 YC AND YCC SHIFT

FIGURE 25 YC AND YCC SHIFT FOR THE GUMMY VITAMINS MARKET

7 CASE STUDY ANALYSIS (Page No. - 68)

7.1 CASE STUDIES ON TOP INDUSTRY INNOVATIONS AND BEST PRACTICES

7.1.1 NEWER FORMULATIONS WITH NUTRITION-DENSE INGREDIENTS AND CLEAN LABELS

7.1.2 EXPANDING FLAVORING OPTIONS OFFERED BY KEY PLAYERS WITH NATURAL AND APPEALING FLAVORS

7.1.3 HIGH INVESTMENTS BY MANUFACTURERS IN ADVANCED TECHNOLOGY AND RISE IN OPERATIONAL EFFICIENCIES TO REDUCE THE OVERALL COST

8 GUMMY VITAMINS MARKET, BY PRODUCT TYPE (Page No. - 70)

8.1 INTRODUCTION

FIGURE 26 MARKET SIZE, BY PRODUCT TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 5 MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

8.2 COVID-19 IMPACT ANALYSIS

TABLE 6 COVID-19 IMPACT ANALYSIS – BY PRODUCT TYPE (OPTIMISTIC SCENARIO)

TABLE 7 COVID-19 IMPACT ANALYSIS – BY PRODUCT TYPE (REALISTIC SCENARIO)

TABLE 8 COVID-19 IMPACT ANALYSIS – BY PRODUCT TYPE (PESSIMISTIC SCENARIO)

8.3 SINGLE VITAMIN

TABLE 9 SINGLE VITAMIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.4 MULTIVITAMIN

TABLE 10 MULTIVITAMIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 GUMMY VITAMINS MARKET, BY SOURCE (Page No. - 75)

9.1 INTRODUCTION

FIGURE 27 MARKET SIZE, BY SOURCE, 2020 VS. 2025 (USD MILLION)

TABLE 11 MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

9.2 COVID-19 IMPACT ANALYSIS

TABLE 12 COVID-19 IMPACT ANALYSIS – BY SOURCE (OPTIMISTIC SCENARIO)

TABLE 13 COVID-19 IMPACT ANALYSIS – BY SOURCE (REALISTIC SCENARIO)

TABLE 14 COVID-19 IMPACT ANALYSIS – BY SOURCE (PESSIMISTIC SCENARIO)

9.3 ANIMAL

TABLE 15 ANIMAL GUMMY VITAMINS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.4 PLANT

TABLE 16 PLANT GUMMY VITAMINS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 GUMMY VITAMINS MARKET, BY PACKAGING TYPE (Page No. - 80)

10.1 INTRODUCTION

FIGURE 28 GUMMY VITAMINS MARKET SIZE, BY PACKAGING TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 17 GUMMY VITAMINS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

10.2 COVID-19 IMPACT ANALYSIS

TABLE 18 COVID-19 IMPACT ANALYSIS – BY PACKAGING TYPE (OPTIMISTIC SCENARIO)

TABLE 19 COVID-19 IMPACT ANALYSIS – BY PACKAGING TYPE (REALISTIC SCENARIO)

TABLE 20 COVID-19 IMPACT ANALYSIS – BY PACKAGING TYPE (PESSIMISTIC SCENARIO)

10.3 BOTTLES & JARS

10.3.1 IMPROVED SUSTAINABILITY AND SHELF LIFE OFFERED BY BOTTLES & JARS FOR GUMMY VITAMIN PRODUCTS TO DRIVE THE GROWTH OF THE MARKET

TABLE 21 GUMMY VITAMIN MARKET SIZE FOR BOTTLES & JARS, BY REGION, 2018–2025 (USD MILLION)

10.4 POUCHES

10.4.1 INCREASE IN INNOVATIONS AND DEVELOPMENTS IN THE PACKAGING INDUSTRY TO REDUCE COSTS AND EFFORTS REQUIRED TO SHIP PRODUCTS AND KEEP THEIR NUTRITIONAL VALUE INTACT DRIVES THE DEMAND

TABLE 22 GUMMY VITAMINS MARKET SIZE FOR POUCHES, BY REGION, 2018–2025 (USD MILLION)

11 GUMMY VITAMINS MARKET, BY DISTRIBUTION CHANEL (Page No. - 86)

11.1 INTRODUCTION

FIGURE 29 GUMMY VITAMINS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020 VS. 2025 (USD MILLION)

TABLE 23 MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2025 (USD MILLION)

11.2 COVID-19 IMPACT ANALYSIS

TABLE 24 COVID-19 IMPACT ANALYSIS – BY DISTRIBUTION CHANNEL (OPTIMISTIC SCENARIO)

TABLE 25 COVID-19 IMPACT ANALYSIS – BY DISTRIBUTION CHANNEL (REALISTIC SCENARIO)

TABLE 26 COVID-19 IMPACT ANALYSIS – BY DISTRIBUTION CHANNEL (PESSIMISTIC SCENARIO)

11.3 STORE-BASED

11.3.1 PREFERRED PURCHASING DESTINATION AMONG CONSUMERS AND THE AVAILABILITY OF VARIOUS PRODUCT VARIANTS TO DRIVE THE GROWTH

TABLE 27 GUMMY VITAMIN MARKET SIZE IN STORE-BASED, BY REGION, 2018–2025 (USD MILLION)

TABLE 28 GUMMY VITAMIN MARKET SIZE IN STORE-BASED, BY SUBTYPE, 2018–2025 (USD MILLION)

11.3.2 HYPERMARKETS & SUPERMARKETS

11.3.3 DRUGSTORE OR PHARMACIES

11.3.4 CONVENIENCE STORES

11.3.5 OTHER STORE-BASED CHANNELS

11.4 ONLINE

11.4.1 RISE IN DEMAND FROM END-CONSUMERS ACROSS THE GLOBE AND INCREASE IN PREFERENCE TO PURCHASE HEALTH-RELATED PRODUCTS THROUGH ONLINE RETAILING DRIVES THE MARKET GROWTH

TABLE 29 GUMMY VITAMINS MARKET SIZE IN ONLINE, BY REGION, 2018–2025 (USD MILLION)

12 GUMMY VITAMINS MARKET, BY END USER (Page No. - 93)

12.1 INTRODUCTION

TABLE 30 FEW DISEASES CAUSED DUE TO DEFICIENCY OF VITAMINS

FIGURE 30 GUMMY VITAMINS MARKET SIZE, BY END USER, 2020 VS. 2025 (USD MILLION)

TABLE 31 GUMMY VITAMINS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.2 COVID-19 IMPACT ANALYSIS

TABLE 32 COVID-19 IMPACT ANALYSIS – BY END USER (OPTIMISTIC SCENARIO)

TABLE 33 COVID-19 IMPACT ANALYSIS – BY END USER (REALISTIC SCENARIO)

TABLE 34 COVID-19 IMPACT ANALYSIS – BY END USER (PESSIMISTIC SCENARIO)

12.3 ADULT

12.3.1 INCREASE IN OSTEOMALACIA, OSTEOPOROSIS, AND OTHER SIMILAR DISEASE-RELATED CASES HAS LED TO HEALTH ISSUES IN ADULTS DRIVING THE MARKET FOR GUMMY VITAMINS

TABLE 35 GUMMY VITAMINS MARKET SIZE FOR ADULTS, BY REGION, 2018–2025 (USD MILLION)

12.4 CHILDREN

12.4.1 RISE IN PREVALENCE OF VITAMIN A AND D DEFICIENCIES AMONG CHILDREN TO DRIVE THE MARKET GROWTH

TABLE 36 GUMMY VITAMINS MARKET SIZE FOR CHILDREN, BY REGION, 2018–2025 (USD MILLION)

13 GUMMY VITAMINS MARKET, BY REGION (Page No. - 99)

13.1 INTRODUCTION

FIGURE 31 CHINA AND INDIA ACCOUNTED FOR THE HIGHEST GROWTH RATE IN THE GLOBAL MARKET IN 2019

TABLE 37 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 MARKET SIZE, BY REGION, 2018–2025 (KT)

13.2 COVID-19 IMPACT ANALYSIS

TABLE 39 COVID-19 IMPACT ANALYSIS – BY REGION (OPTIMISTIC SCENARIO)

TABLE 40 COVID-19 IMPACT ANALYSIS – BY REGION (REALISTIC SCENARIO)

TABLE 41 COVID-19 IMPACT ANALYSIS – BY REGION (PESSIMISTIC SCENARIO)

13.3 NORTH AMERICA

FIGURE 32 NORTH AMERICA SNAPSHOT: GUMMY VITAMINS MARKET

TABLE 42 NORTH AMERICA: GUMMY VITAMINS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA:MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2025 (USD MILLION)

TABLE 47 NORTH AMERICA:MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.3.1 US

13.3.1.1 High concentration of key players in the country and various healthcare trends to drive the growth of the market in the coming years

TABLE 48 US: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 49 US: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.3.2 CANADA

13.3.2.1 Rise in demand among local consumers and the increase in government initiatives to drive the market growth

TABLE 50 CANADA: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 51 CANADA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.3.3 MEXICO

13.3.3.1 Increase in awareness about health dietary supplements in chewable formats to drive the growth of the Mexican market

TABLE 52 MEXICO: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 53 MEXICO:MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.4 EUROPE

FIGURE 33 EUROPE: ESTIMATED NUMBER OF INDIVIDUALS AGED 50+ WITH OSTEOPOROSIS, 2015

FIGURE 34 EUROPE: ANNUAL FRACTURE COSTS (EURO BILLION)

TABLE 54 EUROPE: GUMMY VITAMINS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 56 EUROPE: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 57 EUROPE: MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 58 EUROPE: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2025 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.4.1 UK

13.4.1.1 Rise in demand for vitamin-infused products to drive the growth of the market

TABLE 60 UK: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 61 UK: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.4.2 FRANCE

13.4.2.1 High awareness regarding health and wellness among consumers and the rise in government initiatives to widen the growth prospects for manufacturers

TABLE 62 FRANCE: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 63 FRANCE: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.4.3 GERMANY

13.4.3.1 Rising demand for functional products with vitamins to drive the demand for gummy vitamins

TABLE 64 GERMANY: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 65 GERMANY: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.4.4 ITALY

13.4.4.1 Increase in consumption of supplements among consumers to drive the demand for gummy vitamins

TABLE 66 ITALY: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 67 ITALY: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.4.5 SPAIN

13.4.5.1 High acceptance of dietary supplements due to nutritional inadequacies among local consumers to drive the growth of the market

TABLE 68 SPAIN: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 69 SPAIN: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.4.6 REST OF EUROPE

13.4.6.1 Increase in awareness and introduction of newer formats of supplements by manufacturers in these countries to drive the market growth

TABLE 70 REST OF EUROPE: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 71 REST OF EUROPE: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.5 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC MARKET SNAPSHOT TABLE 72 ASIA PACIFIC: GUMMY VITAMINS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2025 (USD MILLION)

TABLE 77 ASIA PACIFIC:MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.5.1 CHINA

13.5.1.1 Increase in prevalence of diseases due to vitamin deficiencies, a surge in government initiatives, and rise in preference of consumers toward preventive healthcare to drive the market growth

TABLE 78 CHINA: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 79 CHINA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.5.2 INDIA

13.5.2.1 High awareness among consumers regarding the consumption of gummy vitamins for maintaining the required vitamin levels to drive the demand

TABLE 80 INDIA: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 81 INDIA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.5.3 AUSTRALIA & NEW ZEALAND

13.5.3.1 High demand for dietary supplements, particularly in new formats, to drive the market growth

TABLE 82 AUSTRALIA & NEW ZEALAND: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 83 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.5.4 JAPAN

13.5.4.1 Increase in awareness and shift in preference of consumers toward the adoption of dietary supplements to drive the market growth

TABLE 84 JAPAN: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 85 JAPAN: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.5.5 SOUTH KOREA

13.5.5.1 High acceptance of dietary supplements among local consumers and rise in the prevalence of vitamin D deficiencies to drive the market growth

TABLE 86 SOUTH KOREA: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 87 SOUTH KOREA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.5.6 REST OF ASIA PACIFIC

13.5.6.1 High adoption of healthier lifestyle to drive the market growth for gummy vitamins

TABLE 88 REST OF ASIA PACIFIC: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 89 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.6 SOUTH AMERICA

TABLE 90 SOUTH AMERICA: GUMMY VITAMINS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 91 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 92 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 93 SOUTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 94 SOUTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2025 (USD MILLION)

TABLE 95 SOUTH AMERICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.6.1 BRAZIL

13.6.1.1 Consumer preference for vitamin-based products due to increased awareness regarding the association of vitamin deficiencies with diseases to drive the demand for gummy vitamins

TABLE 96 BRAZIL: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 97 BRAZIL: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.6.2 ARGENTINA

13.6.2.1 High awareness among consumers regarding the consumption of gummy vitamins for maintaining the required vitamin levels to drive the demand

TABLE 98 ARGENTINA: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 99 ARGENTINA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.6.3 REST OF SOUTH AMERICA

13.6.3.1 Introduction of new and cheaper gummies and rise in awareness regarding healthier lifestyles to encourage the market growth

TABLE 100 REST OF SOUTH AMERICA: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 101 REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.7 REST OF THE WORLD

TABLE 102 REST OF WORLD: GUMMY VITAMINS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 103 REST OF WORLD: MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 104 REST OF WORLD: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 105 RETS OF WORLD: MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 106 REST OF WORLD: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2025 (USD MILLION)

TABLE 107 REST OF WORLD: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.7.1 MIDDLE EAST

13.7.1.1 Increase in the purchasing power of consumers and inclination toward premium food products with value-added health benefits to drive the demand for gummy vitamins

FIGURE 36 PREVALENCE (%) OF VITAMIN D DEFICIENCY AND INSUFFICIENCY IN THE MIDDLE EAST, BY COUNTRY, 2017

TABLE 108 MIDDLE EAST: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 109 MIDDLE EAST: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13.7.2 AFRICA

13.7.2.1 Increase in the prevalence of vitamin deficiencies and government initiatives is projected to drive the market growth

TABLE 110 AFRICA: GUMMY VITAMINS MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 111 AFRICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 143)

14.1 OVERVIEW

14.2 COMPETITIVE LEADERSHIP MAPPING

14.2.1 STARS

14.2.2 EMERGING LEADER

14.2.3 PERVASIVE

14.2.4 EMERGING COMPANIES

FIGURE 37 GLOBAL GUMMY VITAMINS MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

14.3 START-UP MICROQUADRANT

14.3.1 PROGRESSIVE COMPANIES

14.3.2 RESPONSIVE COMPANIES

14.3.3 DYNAMIC COMPANIES

14.3.4 STARTING BLOCKS

FIGURE 38 GLOBAL GUMMY VITAMIN MARKET SME’S/ START-UP COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 39 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE MARKET, 2017–2020

14.4 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS IN THE MARKET 2019

FIGURE 40 CHURCH & DWIGHT COMPANY LED THE MARKET IN 2019

FIGURE 41 REVENUE OF THE TOP FIVE COMPANIES

14.4.1 NEW PRODUCT LAUNCHES

TABLE 112 NEW PRODUCT LAUNCHES

14.4.2 EXPANSIONS & INVESTMENTS

TABLE 113 EXPANSIONS & INVESTMENTS

14.4.3 MERGERS & ACQUISITIONS

TABLE 114 MERGERS & ACQUISITIONS

14.5 COVID-19 IMPACT ANALYSIS, BY KEY PLAYERS

14.5.1 CHURCH & DWIGHT

14.5.2 BAYER GROUP

14.5.3 THE CLOROX COMPANY

14.5.4 OTHERS

15 COMPANY PROFILES (Page No. - 152)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

15.1 LIFE SCIENCE NUTRITIONALS INC

15.2 BETTERA BRANDS

15.3 SOFTIGEL BY PROCAPS

15.4 NATURE'S WAY PRODUCTS, LLC.

15.5 ZANONVITAMEC

15.6 OLLY PUBLIC BENEFIT CORPORATION.

15.7 HERBALAND

15.8 HERO NUTRITIONALS

15.9 SMARTYPANTS VITAMINS

15.10 THE NATURE'S BOUNTY CO.

15.11 IM HEALTHCARE

15.12 NUTRA SOLUTIONS USA

15.13 MAKERS NUTRITION, LLC.

15.14 VITAKEM NUTRACEUTICAL INC.

15.15 CHURCH & DWIGHT CO., INC.

FIGURE 42 CHURCH & DWIGHT CO., INC.: COMPANY SNAPSHOT

15.16 BAYER AG

FIGURE 43 BAYER AG: COMPANY SNAPSHOT

15.17 THE CLOROX COMPANY

FIGURE 44 THE CLOROX COMPANY: COMPANY SNAPSHOT

15.18 ERNEST JACKSON

15.19 BOSCOGEN, INC

15.20 SANTA CRUZ NUTRITIONALS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 191)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

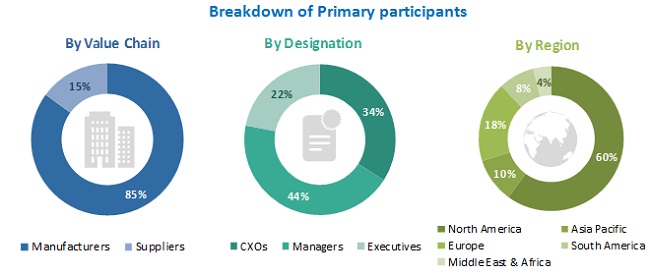

The study involved four major activities in estimating the gummy vitamins market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of enzyme manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors, and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To describe and forecast the gummy vitamins market, in terms of product type, source, packaging type, distribution channel, end user, and region

- To describe and forecast the global market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the global market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as acquisitions & divestments, expansions, product launches & approvals, and agreements, in the market.

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Geographic Analysis

- Further breakdown of the Rest of the World gummy vitamins market into Middle East & Africa.

- Further breakdown of the Rest of European gummy vitamins market into Poland, Portugal, and Finland.

- Further breakdown of the Rest of Asia Pacific includes Singapore and Thailand.

- Further breakdown of the Rest of South America includes Chile, Colombia, and Peru.

Segment Analysis

- Further breakdown of the end-user and product type segment into major countries.

Growth opportunities and latent adjacency in Gummy Vitamins Market