Healthcare Contract Management Software Market by Product & Service (Contract Lifecycle Management, Document Management), End User (Healthcare Providers, Hospitals, Physicians, Payers, Medical Device Manufacturers, Pharma) & Region - Global Forecasts to 2024

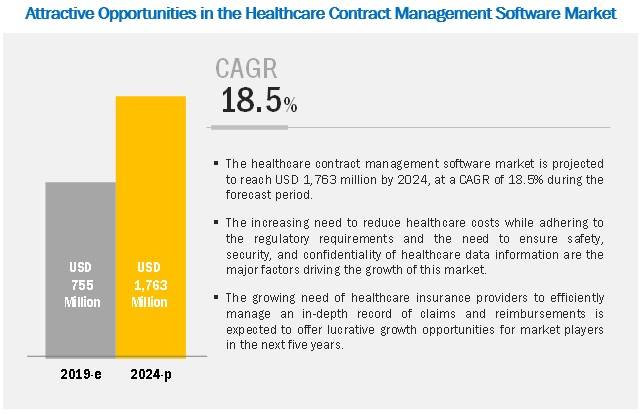

The healthcare contract management software market is projected to reach USD 1,763 million by 2024, growing at a CAGR of 18.5%. The growing need to reduce operational costs (while increasing the operational efficiency of healthcare organizations) and the growing need to maintain compliance with regulatory mandates are key drivers of this market. On the other hand, the dearth of in-house IT expertise and the reluctance of healthcare providers to adopt new methods of contract management are expected to restrain the growth of the healthcare contract management software market to a certain extent during the forecast period.

The market for contract lifecycle management software is projected to grow at the highest CAGR during the forecast period

On the basis of software, the market for contract lifecycle management software is projected to grow at the highest rate during the forecast period. The high growth of this segment is attributed to its rising use in streamlining contract lifecycle processes and maintaining complex contract documents in the contract repository for all contracts.

The market for healthcare payers is expected to witness the highest growth during the forecast period

The market for healthcare payers is projected to grow at the highest rate during the forecast period. The high growth rate of this segment can be attributed to the rising need to minimize regulatory compliance risks among healthcare payers. In addition, implementation of contract management software is vital for healthcare payers as it helps them in the effective management of claims processing and reimbursements.

The APAC region is expected to grow at the fastest rate during the forecast period

The healthcare contract management software market in APAC is expected to grow at the highest CAGR during the forecast period. A majority of this growth is driven by the increasing need for complete transparency, rapid return on investment (ROI), and high level of data security, and increasing demand for effective contract management software. A number of healthcare organizations in Asia are actively moving towards digitization to streamline their entire workflow and ensure patient care and safety that resulted in an increased demand for contract management software to keep the record of patient contracts and patient transfer agreements.

Healthcare Contract Management Software Market Key Players

The key players in the global healthcare contract management software market are Icertis (US), Apttus Corporation (US), Optum Inc. (US), Determine Inc. (US), CobbleStone Software (US), Experian Plc. (Ireland), ScienceSoft (US), nThrive Inc. (US), Concord (US), Coupa Software Inc. (US), and Contract Logix LLC(US).

Icertis (US) is one of the leading players in the market and accounted for the largest share in 2018. Icertis is one of the leading providers of cloud-based contract lifecycle management solutions to various industries, including healthcare. To strengthen its market position and to broaden its geographical presence, the company majorly focuses on geographic expansion. For example, in 2018, the company expanded its presence by introducing new offices in Sydney, Singapore, Bulgaria, London, and Paris.

Apttus (US) held the second-largest share of the market in 2018. In order to sustain its strong position in the market, the company focuses on expanding its product portfolio through organic and inorganic strategies, such as product launches and agreements. For instance, in September 2018, the company entered into an agreement with Thoma Bravo, LLC. (US) to enhance its growth in various sectors. In addition, the company’s strong distribution channels help it to cater to the rising demand for contract management software across the globe.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product & Service, End User, and Region |

|

Geographies covered |

North America, Europe, APAC, and Rest of the World |

|

Companies covered |

Determine Inc. (US), CobbleStone Software (US), Concord (US), Contract Logix LLC (US), Icertis (US), Apttus Corporation (US), Optum Inc. (US), nThrive Inc. (US), Experian Plc. (Ireland), Coupa Software Inc. (US), and ScienceSoft (US). |

The research report categorizes the market into the following segments and subsegments:

By Product & Service

-

Software

- Contract Lifecycle Management

- Contract Repository/Document Management

-

Services

- Support & Maintenance

- Implementation and Integration

- Training & Education

By End User

-

Healthcare Providers

- Hospitals

- Physician Clinics

- Other Healthcare Providers

- Healthcare Payers

- Medical Device Manufacturers and Pharma & Biotechnology Companies

- Research Organizations

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

- Rest of the World (RoW)

Recent Developments

- In October 2018, Icertis opened two new offices in Sydney and Singapore to meet the rising market demand.

- In February 2018, Cobblestone Software launched a new mobile contract management software app for Android and Apple iOS devices.

- In October 2018, Contract Logix launched the Express Contract Management Software and Premium Contract Lifecycle Management.

- In December 2018, Determine Inc. entered into an agreement with Axbility Consulting (US) that provided greater opportunities to Determine.

- In March 2017, nThrive Inc. acquired e4e Healthcare Services to expand its service offerings.

Critical questions the report answers:

- Where will all these developments take the industry in the mid-to-long term?

- What are the major end users and the benefits they avail by implementing healthcare contract management software?

- What are the trends going on in the healthcare contract management software market?

- What are the major market dynamics and their impact on market growth?

- What is the global scenario of the healthcare contract management software market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 18)

2.1 Research Approach

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumption

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 31)

4.1 Healthcare Contract Management Software: Market Overview

4.2 Asia Pacific: Healthcare Contract Management Software Market, By End User (2018)

4.3 Geographic Snapshot of the Healthcare Contract Management Software Market

4.4 Regional Mix: Healthcare Contract Management Software Market

4.5 Healthcare Contract Management Software Market: Developing Vs. Developed Countries

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Key Market Drivers

5.2.1.1 Growing Need to Increase the Operational Efficiency of Healthcare Organizations While Decreasing Operational Costs

5.2.1.2 Growing Need to Maintain Compliance With Regulatory Mandates

5.2.1.3 High Returns on Investment

5.2.2 Key Market Restraints

5.2.2.1 Reluctance to Switch From Conventional Methods

5.2.2.2 IT Infrastructural Limitations in Developing Countries

5.2.3 Key Market Opportunities

5.2.3.1 Declining Reimbursements and Competitive Rivalry Among Healthcare Payers

5.2.4 Key Market Challenges

5.2.4.1 Security Concerns

5.2.4.2 Dearth of Skilled IT Professionals

6 Industry Insights (Page No. - 43)

6.1 Industry Trends

6.1.1 Growing Preference for Cloud-Based Contract Management Solutions

6.1.2 Chatbots/Intelligent Agents for End-To-End Contract Cycle Management

6.1.3 Growing Demand for Self-Service Features in Contract Management

6.2 Customer Challenges

7 Healthcare Contract Management Software Market, By Product & Service (Page No. - 46)

7.1 Introduction

7.2 Services

7.2.1 Support & Maintenance Services

7.2.1.1 Rising Trend of Outsourcing is Driving the Market for Support & Maintenance Services

7.2.2 Implementation & Integration Services

7.2.2.1 Need to Comply With National Healthcare Safety Network Standards Related to Secure Access Management and the Requirement of Interoperability of Software to Boost Market Growth

7.2.3 Training & Education Services

7.2.3.1 Training & Education Services Increase Healthcare Providers’ Awareness of the Latest Contract Management Solutions Available in the Market

7.3 Software

7.3.1 Contract Lifecycle Management Software

7.3.1.1 Contract Lifecycle Management Software Ensures Increase in Visibility, Prevention From Litigation Issues, and Efficient Compliance

7.3.2 Contract Repository/Document Management Software

7.3.2.1 Contract Repository/Document Management Software is Used to Store Contract Documents and Serve as A Repository for All the Contracts in A Healthcare Organization

8 Healthcare Contract Management Software Market, By End User (Page No. - 56)

8.1 Introduction

8.2 Healthcare Providers

8.2.1 Hospitals

8.2.1.1 Growing Need to Improve the Profitability of Healthcare Operations is Driving the Use of Contract Management Software in Hospitals

8.2.2 Physician Clinics

8.2.2.1 For Physicians, Contract Management Solutions Increase Compliance, Efficiency, and Financial Performance

8.2.3 Other Healthcare Providers

8.3 Healthcare Payers

8.3.1 Payer Contract Management is Vital in Ensuring That Reimbursement is Correctly Issued

8.4 Medical Device Manufacturers and Pharma & Biotech Companies

8.4.1 Need to Adapt to A Changing Regulatory Scenario has Driven Solution Uptake Among Manufacturers and Companies

8.5 Research Organizations

8.5.1 Contracted Clinical Trials and Drug Development Services Require Effective Software Solutions for Management

9 Healthcare Contract Management Software Market, By Region (Page No. - 66)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US Dominates the North American Healthcare Contract Management Software Market

9.2.2 Canada

9.2.2.1 Growing Need for Cost Containment in Healthcare to Boost Market Growth

9.3 Europe

9.3.1 Germany

9.3.1.1 Rising Focus on Digitizing the Healthcare System in the Country to Support the Growth of the Contract Management Software Market in Germany

9.3.2 UK

9.3.2.1 Healthcare Providers in the UK are Actively Looking Towards Transforming Their Organizations Into Paperless Environments Through Electronic Ehrs and Contract Management Software

9.3.3 Rest of Europe (RoE)

9.4 Asia Pacific (APAC)

9.4.1 Japan

9.4.1.1 Japan is the Largest Market for Healthcare Contract Management Software in APAC

9.4.2 China

9.4.2.1 Rising Demand for Healthcare Services and Rising Medical Insurance Claims to Support Market Growth

9.4.3 India

9.4.3.1 Growth in the Healthcare Sector and Growing Investments for Modernization of the Country’s Healthcare Infrastructure to Support Market Growth

9.4.4 Rest of Asia Pacific (RoAPAC)

9.5 Rest of the World (RoW)

10 Competitive Landscape (Page No. - 109)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

10.4 Competitive Situation and Trends

10.4.1 New Product Launches

10.4.2 Expansions

10.4.3 Acquisitions

10.4.4 Other Strategies

11 Company Profiles (Page No. - 118)

(Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Icertis Inc.

11.2 Apttus Corporation

11.3 CobbleStone Software

11.4 Concord

11.5 Contract Logix LLC.

11.6 Determine Inc.

11.7 Experian PLC.

11.8 nThrive Inc.

11.9 Optum Inc.

11.10 ScienceSoft

11.11 Coupa Software Inc.

* Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 141)

12.1 Insights of Industry Experts

12.2 Market Sizing & Validation Approach

12.3 Discussion Guide

12.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (103 Tables)

Table 1 Healthcare Contract Management Software Market Snapshot, 2019 Vs. 2024

Table 2 Market Dynamics: Market Impact

Table 3 Large Healthcare Data Breaches in the US (2010–2018)

Table 4 Market, By Product & Service, 2017–2024 (USD Million)

Table 5 Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 6 Healthcare Contract Management Software Services Market, By Country, 2017–2024 (USD Million)

Table 7 Market for Support & Maintenance Services, By Country, 2017–2024 (USD Million)

Table 8 Market for Implementation & Integration Services, By Country, 2017–2024 (USD Million)

Table 9 Market for Training & Education Services, By Country, 2017–2024 (USD Million)

Table 10 Market, By Software Type, 2017–2024 (USD Million)

Table 11 Market, By Country, 2017–2024 (USD Million)

Table 12 Healthcare Contract Lifecycle Management Software Market, By Country, 2017–2024 (USD Million)

Table 13 Healthcare Contract Repository/Document Management Software Market, By Country, 2017–2024 (USD Million)

Table 14 Market, By End User, 2017–2024 (USD Million)

Table 15 Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 16 Market for Healthcare Providers, By Country, 2017–2024 (USD Million)

Table 17 Market for Hospitals, By Country, 2017–2024 (USD Million)

Table 18 Market for Physician Clinics, By Country, 2017–2024 (USD Million)

Table 19 Market for Other Healthcare Providers, By Country, 2017–2024 (USD Million)

Table 20 Market for Healthcare Payers, By Country, 2017–2024 (USD Million)

Table 21 Market for Medical Device Manufacturers and Pharma & Biotech Companies, By Country, 2017–2024 (USD Million)

Table 22 Market for Research Organizations, By Country, 2017–2024 (USD Million)

Table 23 Market, By Region, 2017–2024 (USD Million)

Table 24 North America: Market, By Country, 2017–2024 (USD Million)

Table 25 North America: Market, By Product & Service, 2017–2024 (USD Million)

Table 26 North America: Market, By Software Type, 2017–2024 (USD Million)

Table 27 North America: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 28 North America: Market, By End User, 2017–2024 (USD Million)

Table 29 North America: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 30 US: Key Macroindicators

Table 31 US: Market, By Product & Service, 2017–2024 (USD Million)

Table 32 US: Market, By Software Type, 2017–2024 (USD Million)

Table 33 US: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 34 US: Market, By End User, 2017–2024 (USD Million)

Table 35 US: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 36 Canada: Key Macroindicators

Table 37 Canada: Market, By Product & Service, 2017–2024 (USD Million)

Table 38 Canada: Market, By Software Type, 2017–2024 (USD Million)

Table 39 Canada: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 40 Canada: Market, By End User, 2017–2024 (USD Million)

Table 41 Canada: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 42 Europe: Market, By Country, 2017–2024 (USD Million)

Table 43 Europe: Market, By Product & Service, 2017–2024 (USD Million)

Table 44 Europe: Market, By Software Type, 2017–2024 (USD Million)

Table 45 Europe: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 46 Europe: Market, By End User, 2017–2024 (USD Million)

Table 47 Europe: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 48 Germany: Key Macroindicators

Table 49 Germany: Market, By Product & Service, 2017–2024 (USD Million)

Table 50 Germany: Market, By Software Type, 2017–2024 (USD Million)

Table 51 Germany: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 52 Germany: Market, By End User, 2017–2024 (USD Million)

Table 53 Germany: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 54 UK: Key Macroindicators

Table 55 UK: Market, By Product & Service, 2017–2024 (USD Million)

Table 56 UK: Market, By Software Type, 2017–2024 (USD Million)

Table 57 UK: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 58 UK: Market, By End User, 2017–2024 (USD Million)

Table 59 UK: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 60 RoE: Market, By Product & Service, 2017–2024 (USD Million)

Table 61 RoE: Market, By Software Type, 2017–2024 (USD Million)

Table 62 RoE: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 63 RoE: Market, By End User, 2017–2024 (USD Million)

Table 64 RoE: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 65 APAC: Market, By Country, 2017–2024 (USD Million)

Table 66 APAC: Market, By Product & Service, 2017–2024 (USD Million)

Table 67 APAC: Market, By Software Type, 2017–2024 (USD Million)

Table 68 APAC: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 69 APAC: Market, By End User, 2017–2024 (USD Million)

Table 70 APAC: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 71 Japan: Key Macroindicators

Table 72 Japan: Market, By Product & Service, 2017–2024 (USD Million)

Table 73 Japan: Market, By Software Type, 2017–2024 (USD Million)

Table 74 Japan: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 75 Japan: Market, By End User, 2017–2024 (USD Million)

Table 76 Japan: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 77 China: Key Macroindicators

Table 78 China: Market, By Product & Service, 2017–2024 (USD Million)

Table 79 China: Market, By Software Type, 2017–2024 (USD Million)

Table 80 China: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 81 China: Market, By End User, 2017–2024 (USD Million)

Table 82 China: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 83 India: Key Macroindicators

Table 84 India: Market, By Product & Service, 2017–2024 (USD Million)

Table 85 India: Market, By Software Type, 2017–2024 (USD Million)

Table 86 India: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 87 India: Market, By End User, 2017–2024 (USD Million)

Table 88 India: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 89 RoAPAC: Market, By Product & Service, 2017–2024 (USD Million)

Table 90 RoAPAC: Market, By Software Type, 2017–2024 (USD Million)

Table 91 RoAPAC: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 92 RoAPAC: Market, By End User, 2017–2024 (USD Million)

Table 93 RoAPAC: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 94 RoW: Market, By Product & Service, 2017–2024 (USD Million)

Table 95 RoW: Market, By Software Type, 2017–2024 (USD Million)

Table 96 RoW: Healthcare Contract Management Software Services Market, By Type, 2017–2024 (USD Million)

Table 97 RoW: Market, By End User, 2017–2024 (USD Million)

Table 98 RoW: Market for Healthcare Providers, By Type, 2017–2024 (USD Million)

Table 99 Healthcare Contract Management Software: Market Ranking Analysis

Table 100 New Product Launches, January 2016 – April 2019

Table 101 Expansions, January 2016–April 2019

Table 102 Acquisitions, January 2016–April 2019

Table 103 Other Strategies, January 2016–April 2019

List of Figures (28 Figures)

Figure 1 Healthcare Contract Management Software: Market

Figure 2 Research Design

Figure 3 Data Triangulation Methodology

Figure 4 Healthcare Contract Management Software: Market, By Product and Service, 2019 Vs. 2024 (USD Million)

Figure 5 Healthcare Contract Management Software: Market, By Software Type, 2019 Vs. 2024 (USD Million)

Figure 6 Healthcare Contract Management Software: Market, By Service, 2019 Vs. 2024 (USD Million)

Figure 7 Healthcare Contract Management Software: Market, By End User, 2019 Vs. 2024 (USD Million)

Figure 8 Healthcare Contract Management Software: Market for Healthcare Providers, By Type, 2019 Vs. 2024 (USD Million)

Figure 9 Geographical Snapshot of the Healthcare Contract Management Software: Market

Figure 10 Growing Need to Reduce Operational Costs is Expected to Drive Market Growth

Figure 11 Healthcare Providers Commanded the Largest Share of the APAC Healthcare Contract Management Software: Market in 2018

Figure 12 US Accounted for the Largest Share of the Market in 2018

Figure 13 Asia Pacific Market to Witness the Highest Growth During the Forecast Period

Figure 14 Developing Countries to Register Higher Growth During the Forecast Period

Figure 15 Number of Data Breaches in the US (2009–2018)

Figure 16 Cloud Adoption in the US Health Sector (2016)

Figure 17 Customer Challenges Related to Manual Contract Management

Figure 18 Software Segment to Witness the Highest Growth in the Healthcare Contract Management Market During the Forecast Period

Figure 19 Healthcare Payers Segment to Witness the Highest Growth During the Forecast Period

Figure 20 North America: Healthcare Contract Management Software Market Snapshot

Figure 21 Europe: Healthcare Contract Management Software Market Snapshot

Figure 22 APAC: Healthcare Contract Management Software Market Snapshot

Figure 23 Product Launches— Key Growth Strategies Adopted By Market Players From 2016 to April 2019

Figure 24 Healthcare Contract Management Software Market: Competitive Leadership Mapping (2018)

Figure 25 Determine Inc.: Company Snapshot (2018)

Figure 26 Experian PLC.: Company Snapshot (2018)

Figure 27 Optum Inc.: Company Snapshot (2018)

Figure 28 Coupa Software Inc.: Company Snapshot (2018)

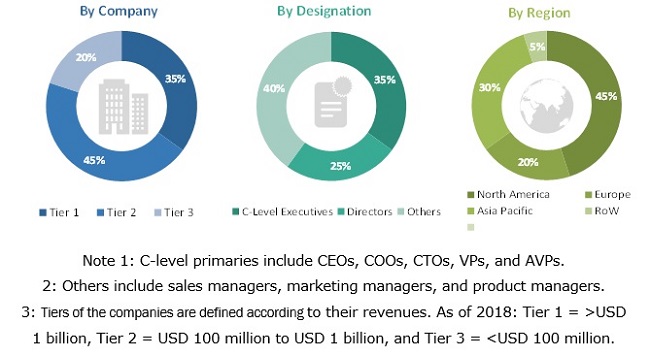

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the healthcare contract management software market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, industry experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Industry experts from the supply side include CEOs, vice presidents, marketing and sales directors, contract managers, business development managers, technology and innovation directors of companies providing contract management software, key opinion leaders, and suppliers and distributors. The industry experts from the demand side include hospitals, physician clinics, medical device manufacturers and pharma & biotech companies, research laboratories, and insurance companies.

Following the breakdown of primary respondents-

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by products & services, end user, and region).

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation and market breakdown procedures were employed, wherever applicable

Objectives of the Study:

- To define, describe, and forecast the global healthcare contract management software market by product & service, end user, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the healthcare contract management software market in four regions (along with major countries)—North America, Europe, Asia Pacific, and Rest of the World.

- To profile key players in the healthcare contract management software market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as mergers and acquisitions; new product/technology launches; expansions; collaborations, partnerships, and agreements; and R&D activities of the leading players in the global healthcare contract management software market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific healthcare contract management software: market into South Korea, Australia, New Zealand, and other countries

- Further breakdown of the Rest of Europe healthcare contract management software: market into Belgium, Russia, the Netherlands, Switzerland, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Contract Management Software Market