Contract Management Software Market by Component (Software and Services), Business Function (Legal, Sales, Procurement, and Finance), Deployment Type (On-premises and Cloud), Organization Size, Vertical, and Region - Global Forecast to 2024

[146 Pages Report] MarketsandMarkets projects the Contract management software market to grow from USD 1.5 billion in 2019 to USD 2.9 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 13.5% during the forecast period. Major factors expected to drive the growth of the market include increasing demand for agile contract management, changes in compliance, and increased complexity owing to diversity in sales and licensing models.

By vertical, Healthcare and Lifesciences to hold a larger market size during the forecast period

As with other large organizations, hospitals manage large volumes of contracts, all of which must follow various compliance regulations and performance standards. The use of advanced contract management software in hospitals streamlines their workflow, saving time, and mitigating the risk of missing any important steps. Over the years, contract management software has also undergone significant technological evolution. The latest contract management software available in the market is fully compliant with HIPAA and other international standards regarding the privacy and security of patient information and other legal documents. This is driving the uptake of contract management software among hospitals. The effective management of critical contract documents and patient information and records with less manual labor is regarded as one of the key areas for reducing healthcare costs. Moreover, unwanted expenses owing to errors and denials and penalties regarding data breaches and litigation make it more important for healthcare organizations to manage their contracts and documents efficiently and effectively.

SMEs segment to grow at a higher CAGR during the forecast period

Organizations with less than 1,000 employees are considered under the small & medium enterprises sector. Maximum productivity and reduced cost are crucial factors for these enterprises, as they have limited budgets to keep track of their contracts. Hence, these organizations require a cost-effective solution that can help them optimize their contracts.

SMEs have a lower volume of contracts to manage in comparison to that of large enterprises. Hence, there is a lack of proactively managing contracts as they can be postponed without significant penalty. With a comparatively small number of contracts, SMEs can oversee the contracts manually, thereby, saving on the software costs. However, over time, the number of new contracts will grow while existing contracts will renew on different terms or closeout. And this is where the risks associated with an SMEs contracts start to multiply rapidly. The implementation of contract management software is expected to result in better risk mitigation, reduced administrative overhead, reduced cost of compliance, favorable business outcome, and improved business efficiency for small & medium enterprises.

North America to account for the largest market size during the forecast period.

North America is the prominent revenue contributor to Contract management software market, in 2019. The presence of key players such as Coupa, Docusign, Icertis, Apttus, and Zycus etc. in the region is a major driving factor for the growth of North American market. Contract management software market players in this region invest heavily in research and development. For instance, Coupa spent 23.7% of their annual revenue in 2018 in research and development amounting to around USD 62 million. Also, North America has well developed BFSI, IT and Healthcare sector, which represents a significant opportunity for the Contract management software service providers.

In North America, organizations must maintain an organized record of contracts. By implementing clear policies and using streamlined contract management tools, these organizations can bring transparency to their contract management. Moreover, favorable regulations such as the Health Insurance Portability & Accountability Act (HIPAA) boost the adoption of contract management software in the region.

Key Contract management software market Players

Key and emerging market players include Aaveneir (US), Agiloft (US), Apptus (US), CLM Matrix (US), CobbleStone Software (US), Conga (US), Concord (US), ContractWorks (US), ContractsWise (UK), Coupa (US), Determine (US), DocuSign (US), IBM (US), Icertis (US), GEP (US), HighQ (UK), JAGGAER (US), SAP Ariba (US), Synertrade (France), Trackado (Sweden), and Zycus (US. These players have adopted various strategies to grow in the Contract management software market. The companies are focused on inorganic and organic growth strategies to strengthen their market position.

Apttus (US) is one of the prominent enterprise software solutions providers. Launching innovative solutions is a key strategy of Apttus. The companys Intelligent Middle Office platform connects the front office of the enterprises CRM system and the back office ERP system by providing various solutions, such as QTC, Enterprise Contract Management, Digital Commerce, and Supplier Relationship Management processes. The companys contract management solutions make use of AI technology to support and execute the best contract management practices. Its contract management solutions are designed toward providing an accelerated deal of velocity and cost savings. Launching new and advanced products to stay ahead of competition is the key strategy of the company. As the company offers multiple Salesforce-compatible products, it has a significant opportunity to attract businesses that are using Salesforce. The number of innovative solutions offered by the company is expected to drive the sales of the company in near future.

Scope of the Contract management software market Report

|

Report Metrics |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component (Software and Services), Organization Size (SMEs and Large Enterprises), Deployment Type (On-premises and Cloud), Business Functions (Legal, Sales, Procurement, and Others), Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Aaveneir (US), Agiloft (US), Apptus (US), CLM Matrix (US), CobbleStone Software (US), Conga (US), Concord (US), ContractWorks (US), ContractsWise (UK), Coupa (US), Determine (US), DocuSign (US), IBM (US), Icertis (US), GEP (US), HighQ (UK), JAGGAER (US), SAP Ariba (US), Synertrade (France), Trackado (Sweden), and Zycus (US). |

The research report categorizes the contract management software market to forecast the revenues and analyze trends in each of the following subsegments:

By Component

- Software

- Services

- Consulting

- Implementation

- Support and Maintenance

By Deployment Type

- On-premises

- Cloud

By Organization Size

- SMEs

- Large Enterprises

By Business Function

- Legal

- Sales

- Procurement

- Others (IT, HR, and Finance)

By Vertical

- Government

- Retail and eCommerce

- Healthcare and Life Sciences

- Banking, Financial Services and Insurance (BFSI)

- Transportation and Logistics

- Telecom and IT

- Manufacturing

- Others (Energy and Utilities, Media and Entertainment, and Education)

By Region

- North America

- Europe

- APAC

- RoW

Recent Developments

- In May 2019, Coupa completed the acquisition of one of the leading contract management players, Exari. This acquisition enhanced Coupas contract management solution capabilities. Some of the enhanced capabilities of Coupas contract management offerings are functionality for contract creation, collaboration, and discovery.

- In September 2018, DocuSign and SpringCM jointly developed a new contract management solution called DocuSign Gen. DocuSign Gen enables Salesforce users to automate, simplify, and streamline the generation of agreements, such as sales contracts, quotes, and Non-Disclosure Agreements (NDAs).

- In September 2018, DocuSign acquired one of the leading CLM, cloud-based document generation software providers, SpringCM. The acquisition enhanced the contract management software portfolio of the company.

- In June 2019, Microsoft collaborated with Icertis to enhance the blockchain-based contractual offerings. The Icertis Blockchain Framework offers a blockchain-powered solution to track contractual requirements and commitments. This partnership would help Icertis to expand blockchain applications to contract management by implementing the Microsoft Azure Blockchain Workbench for the ICM platform.

- In April 2019, The German car manufacturer Volkswagen partnered with Minespider and Icertis to launch a blockchain pilot to track its battery supply chain for lead from the point of origin to the factory. Through this partnership, Icertis blockchain technology would help Volkswagen with the documentation of contracts in the supply chain, in a bid to vet third-party suppliers.

Critical Questions the Report Answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Contract management software market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Frequently Asked Questions (FAQ):

What is Contract Management?

The contract management market includes contract management software/platform and associated services that help in contract creation, execution, and analysis at both buy and sell sides. This results in improved compliance and enhanced stewardship, security, and continuity around important contract documents.

What are the major verticals that have adopted contract management software?

Contract management software is primarily used in industries where the contracts are more crucial, complex, and a large number of contracts need to be drafted/renewed every year. Some of the industries that are major adopters of contract management software include healthcare and life sciences, BFSI, manufacturing, retail eCommerce, and transportation and logistics.

Which are the top industry players in the Contract Management Software market?

Icertis, Coupa, Apptus, Docusign, SAP Ariba, GEP, and Zycus are some of the top industry players offering contract management software and services.

What are the top trends in Contract Management Software market?

Trends that are impacting the Contract Management Software market includes:

- Increasing demand for agile contract management

- Changing legal compliances

- Rising complexity due to diversity in sales and licensing models

Opportunities for the Contract Management Software market:

- Increasing Demand for Smart Contracts

- Automation of contract management process using AI and ML

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Inclusions and Exclusions

1.4 Market Scope

1.4.1 Market Segmentation

1.4.2 Regions Covered

1.4.3 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

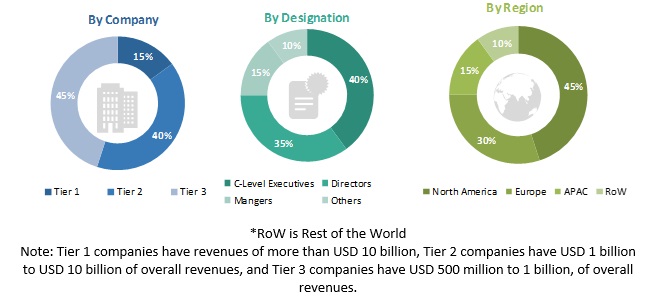

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Competitive Leadership Mapping Research Methodology

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Global Contract Management Software Market

4.2 Market By Component, 2019 vs 2024

4.3 Market By Business Function, 2019

4.4 Market By Service, 2019

4.5 Market By Organization Size

4.6 Market By Deployment Type, 2019

4.7 Market By Vertical, 20172024

4.8 Market Investment Scenario (20192024)

5 Market Overview and Industry Trends (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Agile Contract Management

5.2.1.2 Changing Legal Compliances Driving the Adoption of Contract Management Software

5.2.1.3 Rising Complexity Due to Diversity in Sales and Licensing Models Driving the Demand for Contract Management Software

5.2.2 Opportunities

5.2.2.1 Increasing Demand for Smart Contracts

5.2.2.2 Automation of Contract Management Process Using AI and Ml to Provide Opportunities for Contract Management Software Vendors

5.2.3 Challenges

5.2.3.1 Lack of Skilled Manpower

5.2.3.2 Increased Threat of Cyberattacks

5.2.4 Use Cases

5.2.5 Impact of Disruptive Technologies

5.2.5.1 Artificial Intelligence

5.2.5.2 Robotic Process Automation

5.2.5.3 Blockchain

5.2.6 Contract Lifecycle Management

5.2.6.1 Stage 1: Contract Request

5.2.6.2 Stage 2: Contract Authoring, Review, and Redlining Contract Negotiation

5.2.6.3 Stage 3: Approval and Legal Review

5.2.6.4 Stage 4: Agreement Signing/Execution

5.2.6.5 Stage 5: Contract Database Or Repository Storage

5.2.6.6 Stage 6: Records Management

5.2.6.7 Stage 7: Easy Search and Retrieval

5.2.6.8 Stage 8: User Activity and Reporting

5.2.6.9 Stage 9: Contract Renewals, Amendments, and Disposition

6 Contract Management Software Market By Component (Page No. - 46)

6.1 Introduction

6.2 Software

6.2.1 Contract Management Software Ensures Compliance Adherence and Significantly Reduces Contract- Related Expenses

6.3 Services

6.3.1 Consulting

6.3.1.1 Need for Technical Expertise, Especially in Latin America and MEA Regions, Driving the Demand for Consulting Services

6.3.2 Implementation

6.3.2.1 Implementation Services to Offer Significant Revenue Growth Opportunities in Asia Pacific

6.3.3 Support and Maintenance

6.3.3.1 Customer Service Assurance to Fuel the Demand for Support and Maintenance Services

7 Contract Management Software Market By Organization Size (Page No. - 53)

7.1 Introduction

7.2 Large Enterprises

7.2.1 High Volumes of Contracts to Increase Adoption of Contract Management Software in Large Enterprises

7.3 Small and Medium-Sized Enterprises

7.3.1 Cost-Effectiveness to Drive Contract Management Software Adoption Among Small and Medium-Sized Enterprises

8 Contract Management Software Market By Deployment Type (Page No. - 58)

8.1 Introduction

8.2 On-Premises

8.2.1 Security Concerns to Drive the Demand for On-Premises Contract Management Software

8.3 Cloud

8.3.1 Small and Medium-Sized Enterprises Driving the Demand for Cloud-Based Contract Management Software

9 Contract Management Software Market By Business Function (Page No. - 63)

9.1 Introduction

9.2 Legal

9.2.1 Automated Contract Management Tools Allow Optimization of Legal Processes Related to Contract Life Cycle

9.3 Sales

9.3.1 CRM Integration Enables Sales Teams to Manage Contracts More Efficiently

9.4 Procurement

9.4.1 Improved Compliance Driving the Demand for Contract Management Software

9.5 Others

10 Contract Management Software Market By Vertical (Page No. - 69)

10.1 Introduction

10.2 Government

10.2.1 Increased Demand for Transparency and Visibility in Government Sector to Boost the Need for Contract Management Software in the Coming Years

10.3 Retail and eCommerce

10.3.1 Rise in eCommerce to Drive the Growth of the Contract Management Software in the Retail and eCommerce Vertical

10.4 Healthcare and Life Sciences

10.4.1 Growing Need to Increase the Operational Efficiency of Healthcare Organizations Driving the Contract Management Software Market in the Healthcare and Life Sciences Vertical

10.5 Banking, Financial Services, and Insurance

10.5.1 Digital Transformation of the BFSI Sector Driving the Adoption of the Contract Management Software

10.6 Transportation and Logistics

10.6.1 Increasing Need for Digital Transformation to Drive the Market in the Transportation and Logistics Industry

10.7 Manufacturing

10.7.1 Organizations in the Manufacturing Sector to Opt for Contract Management Software Solutions for Overcoming Complex Contract Management Related Challenges

10.8 Telecom and It

10.8.1 Reduced Transactional Costs Using Contract Management Software to Drive the Adoption of Contract Management Software in the Telecom and It Industry

10.9 Others

11 Contract Management Software Market, By Region (Page No. - 79)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 Highly Developed BFSI, Telecom, and Healthcare Verticals to Drive the Market Growth in the US

11.2.2 Canada

11.2.2.1 Highly Developed Retail, Healthcare, and Manufacturing Verticals and Government Initiatives to Boost AI to Drive the Market Growth in Canada

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 Increasing Demand for Digital Transformation to Boost the Market Growth in the UK

11.3.2 Germany

11.3.2.1 Adoption of Favorable AI Strategy By German Government to Boost the Market Growth

11.3.3 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 High Adoption of AI and Automation Technologies in the Legal System in China to Drive the Market Growth

11.4.2 Japan

11.4.2.1 Highly Developed It Infrastructure to Drive the Market Growth in Japan

11.4.3 Rest of Asia Pacific

11.5 Rest of the World

11.5.1 Middle East and Africa

11.5.1.1 Rising AI Adoption and Increasing Number of Contract Management Startups to Drive the Market Growth in the Middle East and Africa

11.5.2 Latin America

11.5.2.1 Lack of Contract Standards is Expected to Boost the Demand for the Contract Management Software in Latin America

12 Competitive Landscape (Page No. - 114)

12.1 Competitive Leadership Mapping

12.1.1 Visionary Leaders

12.1.2 Innovators

12.1.3 Dynamic Differentiators

12.1.4 Emerging Companies

12.2 Market Ranking Analysis, 2019

13 Company Profiles (Page No. - 117)

13.1 Introduction

(Business Overview, Solutions, Products & Software, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.2 SAP Ariba

13.3 Coupa

13.4 Docusign

13.5 Icertis

13.6 Apttus

13.7 Zycus

13.8 GEP

13.9 Agiloft

13.10 Cobblestone Software

13.11 Clm Matrix

13.12 Conga

13.13 Concord

13.14 Determine

13.15 Jaggaer

13.16 IBM

13.17 Contractswise

13.18 Contractworks

13.19 Synertrade

13.20 Aavenir

13.21 Trackado

13.22 Highq

13.23 Volody

*Details on Business Overview, Solutions, Products & Software, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 140)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customization

14.4 Related Reports

14.5 Author Details

List of Tables (115 Tables)

Table 1 United States Dollar Exchange Rate, 20162018

Table 2 Factor Analysis

Table 3 Use Case 1: SAP Ariba

Table 4 Use Case 2: Apttus

Table 5 Use Case 3: Coupa

Table 6 Use Case 4: Icertis

Table 7 Use Case 5: Cobblestone Software

Table 8 Contract Management Software Market Size, By Component, 20172024 (USD Million)

Table 9 Software: Market Size By Region, 20172024 (USD Million)

Table 10 Services: Market Size By Type, 20172024 (USD Million)

Table 11 Services: Market Size By Region, 20172024 (USD Million)

Table 12 Consulting Market Size, By Region, 20172024 (USD Million)

Table 13 Implementation Market Size, By Region, 20172024 (USD Million)

Table 14 Support and Maintenance Market Size, By Region, 20172024 (USD Million)

Table 15 Contract Management Software Market Size, By Organization Size, 20172024 (USD Million)

Table 16 Large Enterprises: Market Size By Region, 20172024 (USD Million)

Table 17 Large Enterprises: Market Size By Business Function, 20172024 (USD Million)

Table 18 Small and Medium-Sized Enterprises: Market Size By Region, 20172024 (USD Million)

Table 19 Small and Medium-Sized Enterprises: Market Size By Business Function, 20172024 (USD Million)

Table 20 Contract Management Software Market Size, By Deployment Type, 20172024 (USD Million)

Table 21 On-Premises: Market Size By Region, 20172024 (USD Million)

Table 22 On-Premises: Market Size By Vertical, 20172024 (USD Million)

Table 23 Cloud: Market By Region, 20172024 (USD Million)

Table 24 Cloud: Market By Vertical, 20172024 (USD Million)

Table 25 Contract Management Software Market Size, By Business Function, 20172024 (USD Million)

Table 26 Legal: Market Size By Region, 20172024 (USD Million)

Table 27 Sales: Market Size By Region, 20172024 (USD Million)

Table 28 Procurement: Market Size By Region, 20172024 (USD Million)

Table 29 Others Business Functions: Market Size By Region, 20172024 (USD Million)

Table 30 Contract Management Software Market Size, By Vertical, 20172024 (USD Million)

Table 31 Government: Market Size By Region, 20172024 (USD Million)

Table 32 Retail and eCommerce: Market Size By Region, 20172024 (USD Million)

Table 33 Healthcare and Life Sciences: Market Size By Region, 20172024 (USD Million)

Table 34 Banking, Financial Services, and Insurance: Market Size By Region, 20172024 (USD Million)

Table 35 Transportation and Logistics: Market Size By Region, 20172024 (USD Million)

Table 36 Manufacturing: Market Size By Region, 20172024 (USD Million)

Table 37 Telecom and It: Market Size By Region, 20172024 (USD Million)

Table 38 Others Vertical: Market Size By Region, 20172024 (USD Million)

Table 39 Contract Management Software Market Size, By Region, 20172024 (USD Million)

Table 40 North America: Contract Management Software Market Size, By Component, 20172024 (USD Million)

Table 41 North America: Market Size By Service, 20172024 (USD Million)

Table 42 North America: Market Size By Deployment Type, 20172024 (USD Million)

Table 43 North America: Market Size By Organization Size, 20172024 (USD Million)

Table 44 North America: Market Size By Business Function, 20172024 (USD Million)

Table 45 North America: Legal Market Size, By Organization Size, 20172024 (USD Million)

Table 46 North America: Sales Market Size, By Organization Size, 20172024 (USD Million)

Table 47 North America: Procurement Market Size, By Organization Size, 20172024 (USD Million)

Table 48 North America: Others Market Size, By Organization Size, 20172024 (USD Million)

Table 49 North America: Contract Management Software Market Size, By Vertical, 20172024 (USD Million)

Table 50 North America: Government Market Size, By Deployment Type, 20172024 (USD Million)

Table 51 North America: Retail and eCommerce Market Size, By Deployment Type, 20172024 (USD Million)

Table 52 North America: Healthcare and Life Sciences Market Size, By Deployment Type, 20172024 (USD Million)

Table 53 North America: Banking, Financial Services, and Insurance Market Size, By Deployment Type, 20172024 (USD Million)

Table 54 North America: Transportation and Logistics Market Size, By Deployment Type, 20172024 (USD Million)

Table 55 North America: Manufacturing Market Size, By Deployment Type, 20172024 (USD Million)

Table 56 North America: Telecom and It Market Size, By Deployment Type, 20172024 (USD Million)

Table 57 North America: Others Market Size, By Deployment Type, 20172024 (USD Million)

Table 58 North America: Contract Management Software Market Size, By Country, 20172024 (USD Million)

Table 59 Europe: Contract Management Software Market Size, By Component, 20172024 (USD Million)

Table 60 Europe: Market Size By Service, 20172024 (USD Million)

Table 61 Europe: Market Size By Deployment Type, 20172024 (USD Million)

Table 62 Europe: Market Size By Organization Size, 20172024 (USD Million)

Table 63 Europe: Market Size By Business Function, 20172024 (USD Million)

Table 64 Europe: Legal Market Size, By Organization Size, 20172024 (USD Million)

Table 65 Europe: Sales Market Size, By Organization Size, 20172024 (USD Million)

Table 66 Europe: Procurement Market Size, By Organization Size, 20172024 (USD Million)

Table 67 Europe: Others Market Size, By Organization Size, 20172024 (USD Million)

Table 68 Europe: Contract Management Software Market Size, By Vertical, 20172024 (USD Million)

Table 69 Europe: Government Market Size, By Deployment Type, 20172024 (USD Million)

Table 70 Europe: Retail and eCommerce Market Size, By Deployment Type, 20172024 (USD Million)

Table 71 Europe: Healthcare and Life Sciences Market Size, By Deployment Type, 20172024 (USD Million)

Table 72 Europe: Banking, Financial Services, and Insurance Market Size, By Deployment Type, 20172024 (USD Million)

Table 73 Europe: Transportation and Logistics Market Size, By Deployment Type, 20172024 (USD Million)

Table 74 Europe: Manufacturing Market Size, By Deployment Type, 20172024 (USD Million)

Table 75 Europe: Telecom and It Market Size, By Deployment Type, 20172024 (USD Million)

Table 76 Europe: Others Market Size, By Deployment Type, 20172024 (USD Million)

Table 77 Europe: Contract Management Software Market Size, By Country, 20172024 (USD Million)

Table 78 Asia Pacific: Contract Management Software Market Size, By Component, 20172024 (USD Million)

Table 79 Asia Pacific: Market Size By Service, 20172024 (USD Million)

Table 80 Asia Pacific: Market Size By Deployment Type, 20172024 (USD Million)

Table 81 Asia Pacific: Market Size By Organization Size, 20172024 (USD Million)

Table 82 Asia Pacific: Market Size By Business Function, 20172024 (USD Million)

Table 83 Asia Pacific: Legal Market Size, By Organization Size, 20172024 (USD Million)

Table 84 Asia Pacific: Sales Market Size, By Organization Size, 20172024 (USD Million)

Table 85 Asia Pacific: Procurement Market Size, By Organization Size, 20172024 (USD Million)

Table 86 Asia Pacific: Others Market Size, By Organization Size, 20172024 (USD Million)

Table 87 Asia Pacific: Contract Management Software Market Size, By Vertical, 20172024 (USD Million)

Table 88 Asia Pacific: Government Market Size, By Deployment Type, 20172024 (USD Million)

Table 89 Asia Pacific: Retail Market Size, By Deployment Type, 20172024 (USD Million)

Table 90 Asia Pacific: Healthcare and Life Sciences Market Size, By Deployment Type, 20172024 (USD Million)

Table 91 Asia Pacific: Banking, Financial Services, and Insurance Market Size, By Deployment Type, 20172024 (USD Million)

Table 92 Asia Pacific: Transportation and Logistics Market Size, By Deployment Type, 20172024 (USD Million)

Table 93 Asia Pacific: Manufacturing Market Size, By Deployment Type, 20172024 (USD Million)

Table 94 Asia Pacific: Telecom and It Market Size, By Deployment Type, 20172024 (USD Million)

Table 95 Asia Pacific: Others Market Size, By Deployment Type, 20172024 (USD Million)

Table 96 Asia Pacific: Contract Management Software Market Size, By Country, 20172024 (USD Million)

Table 97 Rest of the World: Market Size By Component, 20172024 (USD Million)

Table 98 Rest of the World: Market Size By Service, 20172024 (USD Million)

Table 99 Rest of the World: Market Size By Deployment Type, 20172024 (USD Million)

Table 100 Rest of the World: Contract Management Software Market Size, By Organization Size, 20172024 (USD Million)

Table 101 Rest of the World: Market Size By Business Function, 20172024 (USD Million)

Table 102 Rest of the World: Legal Market Size, By Organization Size, 20172024 (USD Million)

Table 103 Rest of the World: Sales Market Size, By Organization Size, 20172024 (USD Million)

Table 104 Rest of the World: Procurement Market Size, By Organization Size, 20172024 (USD Million)

Table 105 Rest of the World: Others Market Size, By Organization Size, 20172024 (USD Million)

Table 106 Rest of the World: Contract Management Software Market Size, By Vertical, 20172024 (USD Million)

Table 107 Rest of the World: Government Market Size, By Deployment Type, 20172024 (USD Million)

Table 108 Rest of the World: Retail Market Size, By Deployment Type, 20172024 (USD Million)

Table 109 Rest of the World: Healthcare and Life Sciences Market Size, By Deployment Type, 20172024 (USD Million)

Table 110 Rest of the World: Banking, Financial Services, and Insurance Market Size, By Deployment Type, 20172024 (USD Million)

Table 111 Rest of the World: Transportation and Logistics Market Size, By Deployment Type, 20172024 (USD Million)

Table 112 Rest of the World: Manufacturing Market Size, By Deployment Type, 20172024 (USD Million)

Table 113 Rest of the World: Telecom and It Market Size, By Deployment Type, 20172024 (USD Million)

Table 114 Rest of the World: Others Market Size, By Deployment Type, 20172024 (USD Million)

Table 115 Rest of the World: Contract Management Software Market Size, By Region, 20172024 (USD Million)

List of Figures (30 Figures)

Figure 1 Global Contract Management Software Market: Research Design

Figure 2 Market: Top-Down and Bottom-Up Approaches

Figure 3 Competitive Leadership Mapping: Criteria Weightage

Figure 4 Market to Witness Significant Growth During the Forecast Period

Figure 5 Fastest-Growing Subsegments in the Global Market in 2019

Figure 6 Contract Management Software Market: Regional Snapshot

Figure 7 Rising Compliance Cost Driving the Global Market Growth

Figure 8 Software Segment to Hold A Higher Market Share in the Market During the Forecast Period

Figure 9 Legal Segment to Lead the Market During the Forecast Period

Figure 10 Support and Maintenance Segment to Lead the Market in 2019

Figure 11 Small and Medium-Sized Enterprises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 12 Cloud Segment to Hold A Higher Market Share in 2019

Figure 13 Healthcare and Life Sciences Vertical to Lead the Contract Management Software Market During the Forecast Period

Figure 14 Asia Pacific Considered as the Best Market to Invest During 20192024

Figure 15 Drivers, Opportunities, and Challenges: Contract Management Software Market

Figure 16 Software Segment to Grow at A Higher Growth Rate During the Forecast Period

Figure 17 Support and Maintenance Segment to Account for the Largest Market Size During the Forecast Period

Figure 18 Small and Medium-Sized Enterprises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 19 Cloud Deployment Type to Hold A Larger Market Size During the Forecast Period

Figure 20 Legal Segment to have the Largest Market Size By 2024

Figure 21 Healthcare and Life Sciences Segment to have the Largest Market Size During the Forecast Period

Figure 22 North America to Be the Largest Contract Management Software Market During the Forecast Period

Figure 23 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 24 North America: Market Snapshot

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Contract Management Software Market (Global) Competitive Leadership Mapping

Figure 27 Top 5 Companies in the Market

Figure 28 SAP: Company Snapshot

Figure 29 Coupa: Company Snapshot

Figure 30 Docusign: Company Snapshot

The study involved four major activities in estimating the current size of the contract management software market. An extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred, to identify and collect information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, articles by The International Association for Contract & Commercial Management (IACCM) and National Contract Management Association (NCMA), and other recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both the supply and demand sides of the Contract management software market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing contract management software in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The following is the breakup of the primary respondents profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make market estimations and forecast the contract management software market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall size of the global market using the revenues and offerings of the key companies in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To determine and forecast the global contract management software market based on components (software and services), business functions, deployment types, organization sizes, verticals, and regions from 2019 to 2024, and analyze the various macro and microeconomic factors that affect the market growth

- To forecast the size of the market segments for four main regionsNorth America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors (drivers, opportunities, and challenges) influencing the growth of the contract management software market

- To analyze each submarket for individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key market players comprising top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and to illustrate the markets competitive landscape

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakup of the North American Contract management software market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the RoW market

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Contract Management Software Market