Healthcare Cybersecurity Market by Offering (Solutions and Services), Solution Type, Threat Type, Security Type, End Use Industry (Hospitals and Healthcare Facilities, Medical Device Manufacturers) and Region - Global Forecast to 2028

Healthcare Cybersecurity Market Overview

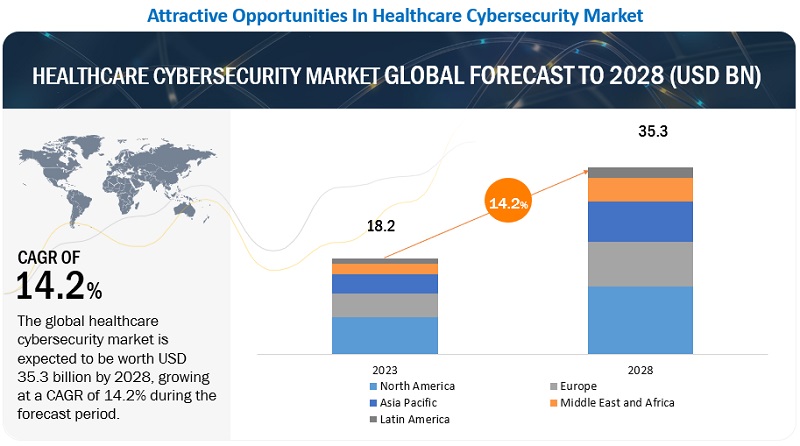

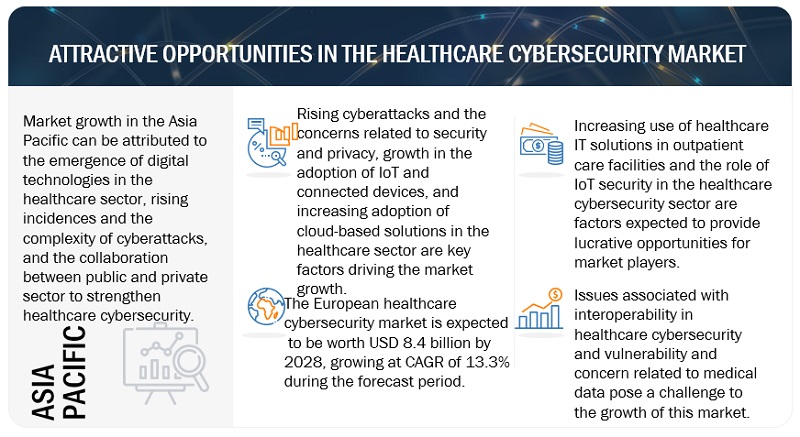

The global Healthcare Cybersecurity Market size was estimated at $18.2 billion in 2023 and is projected to reach $35.3 billion by 2028, growing at a CAGR of 14.2% during the forecast period. The market is driven by the rise in cyberattacks, increasing concerns about data privacy, and the growing adoption of IoT and connected healthcare devices.

Healthcare Cybersecurity Market Key Trends & Insights

- Growing IoT Adoption: Rapid use of IoT and connected devices in healthcare has amplified cybersecurity needs to protect sensitive patient data from external and internal threats.

- Rising Cyber Threat Complexity: Increasing sophistication of zero-day attacks is pushing healthcare providers to adopt advanced security measures.

- IoT Security Opportunities: IoT security plays a critical role in enhancing workforce productivity, operational efficiency, and overall patient care quality.

- Telehealth & Digital Health Expansion: Surge in remote healthcare services is driving demand for strong cybersecurity protocols to secure patient communications and system integrity.

- Managed Services Growth: Outsourced security management is gaining traction as healthcare networks expand and IoT usage grows.

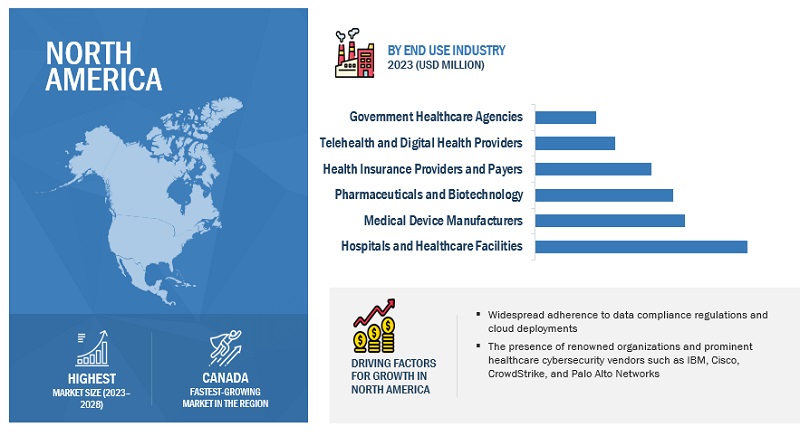

- North America Dominance: Strong regulatory compliance, advanced IT infrastructure, and high adoption of cloud-based healthcare solutions position North America as the largest regional market.

Healthcare Cybersecurity Market Size & Forecast

- 2023 Market Size: USD 18.2 Billion

- 2028 Projected Market Size: USD 35.3 Billion

- CAGR (2023–2028): 14.2%

- Largest Market in 2023: North America

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact

The coronavirus pandemic caused an unbelievable calamity that had an impact on every facet of the contemporary reality. These negative repercussions created the perfect environment for a significant rise in cybercrime targeting vital infrastructures, more especially the health sector, which was the most affected by the epidemic. Cybercriminals continue to target the healthcare industry due to the impact that had been created by the COVID-19 pandemic. Cybercriminals use ransomware, phishing schemes, and other targeted attacks when the healthcare industry is most at risk. Organizations have been unprepared to handle the increased challenges of the pandemic, such as minimal protection for workers who work remotely and comingled data being stored in the cloud without security and privacy measures in place. A decrease in system and security visibility has made it possible for attackers to infiltrate systems covertly, leading to malicious software like ransomware that locks crucial systems and data until a ransom is paid. In order to manage this unprecedented situation, hospitals have transferred their attention and resources to their primary role, managing this extraordinary emergency, which has placed them in a vulnerable situation.

Healthcare Cybersecurity Market Dynamics

Driver: Growing adoption of IoT and connected devices

Healthcare businesses utilize cybersecurity technologies and techniques to protect patient privacy and maintain the privacy of the sensitive medical data. Healthcare cybersecurity ensures that sensitive medical information is restricted and only accessible to authorized users, such as patient’s doctor. Healthcare firms are shielded from external threats by healthcare cybersecurity, including ransomware and hackers looking to steal sensitive personal data to resell on the Dark Web. Moreover, it protects data from internal risks, such as malevolent internal actors like hospital workers and those posed by users who unintentionally endanger sensitive data. For instance, hospital employees who fall prey to phishing schemes could risk hackers accessing sensitive patient information. Thus, to offer complete protection against data security risks, healthcare cybersecurity must be able to enforce data protection requirements over any and all systems used by medical organizations.

Restraint: Insufficient training and dearth of knowledgeable IT staff

With the development of technology, the network architecture for healthcare cybersecurity is growing increasingly complex. In today's virtual world, there are simply too many entry points for threats to exploit, yet there aren't enough skilled cybersecurity specialists to understand and counteract such sophisticated and zero-day attacks. Due to a lack of skilled security professionals, the healthcare industry is in grave danger. Network flaws are exploited by cyber threats to access the network. The number of zero-day attacks has increased as sophistication levels have increased. The tactics and strategies used by attackers to infiltrate the network remain undetected. Businesses fail to adequately invest in their security infrastructure due to a lack of awareness of contemporary cyber dangers, which causes significant losses. Moreover, organizations with urgent cybersecurity needs have seen a severe lack of competent people, which makes them further vulnerable to cyberattacks.

Opportunity: IoT security plays critical role in healthcare cybersecurity sector

IoT security may be classified as a cybersecurity strategy and defensive system that guards against the risk of cyberattacks, which mostly target physically connected loT equipment. Any connected loT device is open to breach, penetration, and control by a bad actor, allowing them to eventually infiltrate, steal user data, and bring down networks. As loT devices currently make up 30% of all devices on enterprise networks, there has been a change in how businesses operate as a result of the loT technology's rapid development in capabilities and adoption. These devices create valuable data that provides insightful information that influences decisions in real time and enables accurate predictive modeling. Moreover, IoT plays a critical role in the company's digital transition by being able to generate workforce productivity, business efficiency, and profitability as well as the overall employee experience.

Challenge: Vulnerability and concern related to medical data

Healthcare cybersecurity has become a distinct concern due to the nature of medical data. One can, for example, block a stolen bank card and obtain a new one. Yet, once information on medical conditions or lab tests has been made public, it is impossible to "remove" it. Patients' health and, in certain situations, lives are in danger when clinical electronic systems fail. Each clinic or hospital has several networks and digital complexes, including electronic health records (EHRs), electronic prescriptions and decision support systems, intelligent heating, ventilation, and air conditioning (HVAC), infusion pumps, medical Internet of things (loMT) devices, and more. All of them are vulnerable to cybercriminals. Healthcare providers and their business partners must also strike a balance between preserving patient privacy and providing quality care and complying with HIPAA, GDPR, and other regulations. It makes it harder to implement security measures, and cybercriminals rush to take advantage of it.

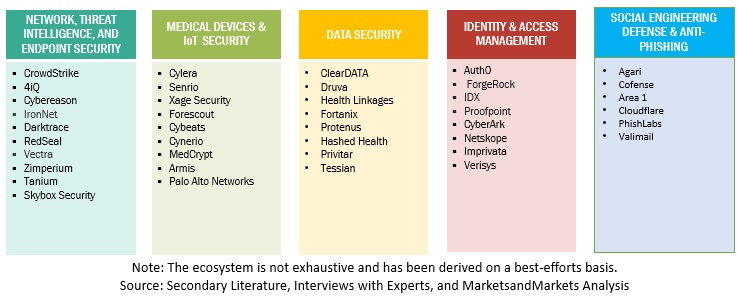

Healthcare Cybersecurity Market Ecosystem

By end use industry, the telehealth and digital health providers segment to grow at the highest CAGR during the forecast period

Telehealth and Digital Health Providers have emerged as important players in the healthcare industry, providing remote healthcare services and digital tools to patients and healthcare providers. In healthcare cybersecurity, these providers confront a variety of specific cybersecurity concerns, such as the need to protect sensitive patient data, secure communication routes, and maintain the integrity of digital health systems. As more people use telehealth and digital health services, the necessity for strong cybersecurity measures to secure patient data and assure the safety and usefulness of these services grows. As a result of these reasons, the telehealth and digital health providers sector is expected to develop at the greatest CAGR during the projection period.

By services, the managed services segment to grow at the highest CAGR during the forecast period

Managed services in healthcare cybersecurity involve outsourcing the management of security systems and infrastructure to a third-party provider. These services provide ongoing monitoring, management, and maintenance of an organization's security systems, such as firewalls, intrusion detection and prevention systems, and SIEM systems. The rise in large-scale networks and Internet of Things (IoT) applications is increasing demand for managed services. Additionally, the managed services segment is expected to have a higher CAGR over the projection period due to the rise in large-scale networks and IoT applications.

By region, North America to account for the highest market size during the forecast period

Many significant market players are present in North America, providing cutting-edge solutions to all regional end customers. In North America, the US and Canada are anticipated to contribute significantly to the expansion of the market for healthcare cybersecurity due to their robust economies. Apart from this aspect, the widespread adherence to data compliance regulations and cloud deployments are influencing the extensive deployments of healthcare cybersecurity systems. Furthermore, the expansive use of personal devices, such as smartphones and laptops, to assist the healthcare industry in continuing their activities, securing data residing within healthcare organizations, and transferring it over business networks amid pandemic, are expected to massively drive the adoption of healthcare cybersecurity solutions in North America. Thus, these factors are anticipated to support the market for global healthcare cybersecurity in North America.

Kay Market Players

IBM (US), Cisco (US), Palo Alto Networks (US), Check Point (Israel), Fortinet (US), Trend Micro (Japan), Dell EMC (US), CrowdStrike (US), Kudelski Security (Switzerland), CloudWave (US), Claroty (US), Imperva (US), LogRhythm (US), Kaspersky (Russia), Sophos (UK), Juniper (US), Forcepoint (US), Verimatrix (US), Forescout (US), Imprivata (US), SailPoint Technologies (US), Saviynt (US), JFrog (US), Fortified (US), ClearDATA (US), Cynerio (US), MedCrypt (US), Armis (US), Cylera (US), Zeguro (US), Virta Laboratories (US), Protenus (US), Censinet (US), and Sternum (Israel) are the key players and other players in the healthcare cybersecurity market.

Healthcare Cybersecurity Market Scope

|

Report Metrics |

Details |

|

Market value in 2028 |

USD 35.3 Billion |

|

Market value in 2023 |

USD 18.2 Billion |

|

Market Growth Rate |

14.2% CAGR |

|

Largest Market |

North America |

|

Healthcare Cybersecurity Market Drivers |

|

|

Healthcare Cybersecurity Market Opportunities |

|

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Segments covered |

Offerings, Services, Solution Type, Threat Type, Security Type, End Use Industry, and Regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Major vendors in the global healthcare cybersecurity market include IBM (US), Cisco (US), Palo Alto Networks (US), Check Point (Israel), Fortinet (US), Trend Micro (Japan), Dell EMC (US), CrowdStrike (US) And many more |

The study categorizes the healthcare cybersecurity market by offerings, services, solution type, threat type, security type, end-user, and region.

By Offering:

- Solutions

- Services

By Services:

- Professional Services

- Managed Services

By Solution Type:

- IAM

- Antivirus/Antimalware

- Log Management and SIEM

- Firewall

- Encryption and Tokenization

- Compliance and Policy Management

- Patch Management

- Other Solution Types (data backup and recovery and asset identification and visibility)

By Threat Type:

- Phishing

- Ransomware

- Malware

- DDoS

- APT

- Other Threat Types (account hijacking, code injection, website defacement, and unauthorized access)

By Security Type:

- Network Security

- Cloud Security

- Application Security

- Endpoint and IoT Security

By End Use Industry:

- Hospitals and Healthcare Facilities

- Medical Device Manufacturers

- Pharmaceuticals and Biotechnology

- Health Insurance Providers and Payers

- Telehealth and Digital Health Providers

- Government Healthcare Agencies

By Region:

- North America

- Europe

- Middle East and Africa

- Asia Pacific

- Latin America

Recent Developments

- In March 2023, IBM (US) collaborated with Cohesity (US) to provide better data security and reliability in hybrid cloud settings. IBM Storage Defender solution combines data protection, cyber resilience, and data management capabilities to protect enterprises' data layers from threats such as ransomware, human error, and sabotage. It also has a cyber vault and clean room capabilities, as well as automatic recovery operations to help retrieve business-critical data in hours or minutes rather than days or weeks.

- In December 2022, Cisco (US) collaborated with Cylera (US) to solve complex security issues in the medical space. Cylera's MedCommand automates the inventory, risk analysis, and profiling of IoT devices for Cisco's ISE, HIoT devices, OT equipment, and key hospital building management systems. It also looks for anomalous traffic requests and flags them to network monitoring tools and security incident and event management systems.

- In December 2022, Palo Alto Networks (US) unveiled Medical IoT Security, a Zero Trust security solution for medical devices that eliminates implicit trust by continuously verifying every user and device. It enables healthcare organizations to deploy and manage new connected technologies quickly and securely.

- In August 2021, Check Point (Israel) acquired Avanan (US). With this acquisition, Avanan will integrate into the Check Point Infinity consolidated architecture to deliver the world’s most secure email security offering. By utilizing patented technology designed and built for cloud email environments, this will be the only unified solution in the market to protect remote workforce from malicious files, URLs and Phishing across email, collaboration suites, web, network, and endpoint.

- In March 2021, Trend Micro (Japan) collaborated with Nuffield Health (UK). Through this collaboration, Trend Micro’s Vision One platform assists Nuffield Health by enabling quicker and earlier threat detection, analysis, and remediation. It helps Nuffield Health safely meeting the demand for its clients by reducing threat detection and response times and increasing in-house IT efficiency.

Frequently Asked Questions (FAQ):

What are the opportunities in the global healthcare cybersecurity market?

Increasing use of healthcare IT solutions in outpatient care facilities and IoT security playing a critical role in healthcare cybersecurity sector are the market opportunities for the global healthcare cybersecurity market.

What is the definition of the healthcare cybersecurity market?

Healthcare cybersecurity is a strategic necessity for every medical firm, from healthcare providers to insurance to pharmaceutical, biotechnology, and medical device corporations. It entails a number of steps designed to safeguard companies from external and internal cyberattacks while also ensuring the availability of medical services, the functioning of medical systems and equipment, patient data security and integrity, and compliance with industry rules.

Which region is expected to show the highest market share in the healthcare cybersecurity market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors, namely, include IBM (US), Cisco (US), Palo Alto Networks (US), Check Point (Israel), Fortinet (US), Trend Micro (Japan), Dell EMC (US), CrowdStrike (US), Kudelski Security (Switzerland), CloudWave (US), Claroty (US), Imperva (US), LogRhythm (US), Kaspersky (Russia), Sophos (UK), Juniper (US), Forcepoint (US), Verimatrix (US), Forescout (US), Imprivata (US), SailPoint Technologies (US), Saviynt (US), JFrog (US), Fortified (US), ClearDATA (US), Cynerio (US), MedCrypt (US), Armis (US), Cylera (US), Zeguro (US), Virta Laboratories (US), Protenus (US), Censinet (US), and Sternum (Israel).

What is the current size of the global healthcare cybersecurity market?

The global healthcare cybersecurity market size is projected to grow from USD 18.2 billion in 2023 to USD 35.3 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 14.2% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing cyberattacks and concerns related to security and privacy- Rising adoption of IoT and connected devices- Increasing adoption of cloud-based solutions in healthcare industryRESTRAINTS- Security budget constraints in developing economies- Insufficient training and dearth of knowledgeable IT staffOPPORTUNITIES- Increasing use of healthcare IT solutions in outpatient care facilities- IoT security plays critical role in healthcare cybersecurity sectorCHALLENGES- Interoperability issues in healthcare cybersecurity- Vulnerability and concern related to medical data

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: SAFE SECURITY SOLUTION TO SAFEGUARD STORING, PROCESSING, AND MANAGING PHI OF MOLINA HEALTHCARE’S CRITICAL APPLICATIONSCASE STUDY 2: ATOS HELPED LEADING HEALTHCARE FIRMS UNCOVER EXISTING HIDDEN CYBER THREATSCASE STUDY 3: NUVENTO CYBERSECURITY SOLUTION HELPED DRUG MANUFACTURING COMPANY FROM RANSOMWARE

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

-

5.8 TECHNOLOGY ANALYSISMULTI-FACTOR AUTHENTICATIONVIRTUAL REALITY AND AUGMENTED REALITYBIG DATA AND PREDICTIVE ANALYTICSINTERNET OF MEDICAL THINGSAUTOMATED DIAGNOSIS USING ARTIFICIAL INTELLIGENCEBLOCKCHAIN TO IMPROVE SECURITY OF HEALTH DATAINTERNET OF THINGS AND SMART DEVICES TO TRANSFORM PATIENT CARE

-

5.9 PATENT ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING BUYERS

-

5.11 TARIFF AND REGULATORY LANDSCAPEINTRODUCTIONNATIONAL INSTITUTE OF STANDARDS AND TECHNOLOGY FRAMEWORKCALIFORNIA CONSUMER PRIVACY ACTISO/IEC 27001PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACTPAYMENT CARD INDUSTRY DATA SECURITY STANDARDSQUALITY SYSTEM REGULATIONHITRUST (ORIGINALLY HEALTH INFORMATION TRUST) COMMON SECURITY FRAMEWORKFEDERAL INFORMATION PROCESSING STANDARDSGRAMM-LEACH-BLILEY ACT OF 1999EUROPEAN UNION GENERAL DATA PROTECTION REGULATIONSERVICE ORGANIZATION CONTROL 2 COMPLIANCEHIPAA COMPLIANCECONTROL OBJECTIVES FOR INFORMATION AND RELATED TECHNOLOGY (COBIT)

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.13 KEY CONFERENCES AND EVENTS, 2023

-

6.1 INTRODUCTIONOFFERINGS: HEALTHCARE CYBERSECURITY MARKET DRIVERS

-

6.2 SOLUTIONSSMART TECHNOLOGIES TO MITIGATE ADVANCED CYBERATTACKS

-

6.3 SERVICESPRESENCE OF CYBERSECURITY SERVICE PROVIDERSPROFESSIONAL SERVICES- Presence of service providers to facilitate security concerns- Design, consulting, and implementation- Risk and threat management- Training and education- Support and maintenanceMANAGED SERVICES- High cost and resource constraints to boost adoption of managed services

-

7.1 INTRODUCTIONSOLUTION TYPES: HEALTHCARE CYBERSECURITY MARKET DRIVERS

-

7.2 IAMREDUCTION IN RISK OF UNAUTHORIZED ACCESS TO SECURE CRITICAL SYSTEMS

-

7.3 ANTIVIRUS/ANTIMALWAREINNOVATIVE SOLUTIONS TO OFFER SECURED TEST ENVIRONMENT

-

7.4 LOG MANAGEMENT AND SIEM360-DEGREE APPROACH TO FIGHT AGAINST CYBER THREATS

-

7.5 FIREWALLSAFEGUARDS NETWORK USING NGFWS

-

7.6 ENCRYPTION AND TOKENIZATIONSAFEGUARDS SENSITIVE DATA OUTSIDE INTERNAL SYSTEMS

-

7.7 COMPLIANCE AND POLICY MANAGEMENTSTRICT LAWS AND REGULATIONS TO HELP COMPANIES IDENTIFY CRITICAL IT ASSETS

-

7.8 PATCH MANAGEMENTSHORT-TERM SOLUTIONS FOR DETECTION AND PREVENTION OF SECURITY THREATS

- 7.9 OTHER SOLUTION TYPES

-

8.1 INTRODUCTIONTHREAT TYPES: HEALTHCARE CYBERSECURITY MARKET DRIVERS

-

8.2 PHISHINGSAFEGUARDS AGAINST ADVANCED PHISHING TECHNIQUES

-

8.3 RANSOMWAREREDUCES AND LIMITS FREQUENCY OF ATTACKS

-

8.4 MALWAREEMPHASIZING NEED FOR PROTECTING PATIENT DATABASES

-

8.5 DISTRIBUTED DENIAL OF SERVICEUSE OF CLOUD-BASED PREVENTIVE MEASURES FOR DDOS THREATS

-

8.6 ADVANCED PERSISTENT THREATEMPHASIZING NEED FOR PROTECTING PATIENT PRIVACY

- 8.7 OTHER THREAT TYPES

-

9.1 INTRODUCTIONSECURITY TYPES: HEALTHCARE CYBERSECURITY MARKET DRIVERS

-

9.2 NETWORK SECURITYINCREASING BYOD TREND TO GENERATE GREATER DEMAND FOR CYBERSECURITY SOLUTIONS

-

9.3 CLOUD SECURITYINCREASED DEMAND FROM SMES FOR CLOUD-BASED HEALTHCARE SOLUTIONS

-

9.4 APPLICATION SECURITYRISING DEMAND TO REDUCE ATTACKS ON BUSINESS-SENSITIVE APPLICATIONS

-

9.5 ENDPOINT AND IOT SECURITYRISING DEMAND TO CURB THEFTS USING IOMT SECURITY

-

10.1 INTRODUCTIONEND-USE INDUSTRIES: HEALTHCARE CYBERSECURITY MARKET DRIVERS

-

10.2 HOSPITALS AND HEALTHCARE FACILITIESEMPHASIZING NEED FOR PROTECTING PATIENT PRIVACYACUTE CARE HOSPITALSLONG-TERM CARE HOSPITALSAMBULATORY CARE CENTERSPHYSICIAN PRACTICESSPECIALTY CLINICS

-

10.3 MEDICAL DEVICE MANUFACTURERSNEED FOR INCORRUPTIBLE AND SECURE MEDICAL DEVICESIMPLANTABLE MEDICAL DEVICESDIAGNOSTIC EQUIPMENTMONITORING AND THERAPEUTIC EQUIPMENTHEALTHCARE IT SYSTEMS

-

10.4 PHARMACEUTICALS AND BIOTECHNOLOGYADDRESSING CYBERSECURITY CHALLENGES IN DRUG DEVELOPMENT AND MANUFACTURINGDRUG DISCOVERY AND DEVELOPMENTCLINICAL TRIALS

-

10.5 HEALTH INSURANCE PROVIDERS AND PAYERSCYBERSECURITY RISKS AND MITIGATION STRATEGIES

-

10.6 TELEHEALTH AND DIGITAL HEALTH PROVIDERSSAFEGUARDING INTEGRITY OF SENSITIVE DATA

-

10.7 GOVERNMENT HEALTHCARE AGENCIESNEED FOR REGULATORY AGENCIES TO SAFEGUARD CRITICAL PUBLIC DATAREGULATORY AGENCIESPUBLIC HEALTH ORGANIZATIONSRESEARCH INSTITUTIONS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: HEALTHCARE CYBERSECURITY MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Presence of major solution vendors and expensive cyberattacks to drive marketCANADA- Technological advancements and stringent regulations

-

11.3 EUROPEEUROPE: HEALTHCARE CYBERSECURITY MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Initiatives by government to prevent attacksGERMANY- Robust economy and digitalization of healthcare industry by governmentFRANCE- Highly digital and technologically advanced country with rampant cybersecurity attacksREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: HEALTHCARE CYBERSECURITY MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Technology-focused country resulted in huge cybersecurity issuesJAPAN- Implementation of digital governance by government boosted marketINDIA- Increased digitalization led healthcare sector prone to cyberattacksREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: HEALTHCARE CYBERSECURITY MARKET DRIVERSMIDDLE EAST AND AFRICA: RECESSION IMPACTMIDDLE EAST AND AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Digitalization and modernization of healthcare system to increase cyber threatsAFRICA- Weak networks and lack of robust cybersecurity policies

-

11.6 LATIN AMERICALATIN AMERICA: HEALTHCARE CYBERSECURITY MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Early adopter of technology and hotspot for cybercrimeMEXICO- Rise in digitization and increased internet penetrationREST OF LATIN AMERICA

- 12.1 INTRODUCTION

- 12.2 REVENUE SHARE ANALYSIS OF LEADING PLAYERS

- 12.3 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- 12.4 HISTORICAL REVENUE ANALYSIS

- 12.5 RANKING OF KEY PLAYERS

-

12.6 EVALUATION MATRIX FOR KEY PLAYERSDEFINITION AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 COMPETITIVE BENCHMARKINGEVALUATION CRITERIA FOR KEY COMPANIESEVALUATION CRITERIA FOR STARTUPS/SMES

-

12.8 EVALUATION MATRIX FOR STARTUPS/SMESDEFINITIONS AND METHODOLOGYPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.9 COMPETITIVE SCENARIOPRODUCT/SOLUTION LAUNCHESDEALS

-

13.1 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCISCO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPALO ALTO NETWORKS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHECK POINT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFORTINET- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTREND MICRO- Business overview- Products/Solutions/Services offered- Recent developmentsDELL EMC- Business overview- Products/Solutions/Services offered- Recent developmentsCROWDSTRIKE- Business overview- Products/Solutions/Services offered- Recent developmentsKUDELSKI SECURITY- Business overview- Products/Solutions/Services offered- Recent developmentsCLOUDWAVE- Business overview- Products/Solutions/Services offered- Recent developmentsCLAROTY- Business overview- Products/Solutions/Services offered- Recent developmentsIMPERVA- Business overview- Products/Solutions/Services offered- Recent developmentsLOGRHYTHM- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSKASPERSKYSOPHOSJUNIPERFORCEPOINTVERIMATRIXFORESCOUTIMPRIVATASAILPOINTSAVIYNTJFROGFORTIFIEDCLEARDATACYNERIOMEDCRYPTARMISCYLERAZEGUROVIRTA LABSPROTENUSCENSINETSTERNUM

- 14.1 INTRODUCTION TO ADJACENT MARKETS

- 14.2 LIMITATIONS

-

14.3 HEALTHCARE CYBERSECURITY ECOSYSTEM AND ADJACENT MARKETSHEALTHCARE IT MARKETCYBERSECURITY MARKET

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 HEALTHCARE CYBERSECURITY MARKET AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 4 MARKET AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 MARKET: PRICING LEVELS

- TABLE 7 MARKET: PATENTS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 9 CONFERENCES AND EVENTS, 2023

- TABLE 10 MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 11 HEALTHCARE CYBERSECURITY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 12 SOLUTIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 13 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 14 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 15 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 17 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 18 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 19 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 MANAGED SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 21 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 HEALTHCARE CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 23 MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 24 IAM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 25 IAM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 ANTIVIRUS/ANTIMALWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 27 ANTIVIRUS/ANTIMALWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 LOG MANAGEMENT AND SIEM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 29 LOG MANAGEMENT AND SIEM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 FIREWALL: HEALTHCARE CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 31 FIREWALL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 ENCRYPTION AND TOKENIZATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 ENCRYPTION AND TOKENIZATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 COMPLIANCE AND POLICY MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 COMPLIANCE AND POLICY MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 PATCH MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 37 PATCH MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 OTHER SOLUTION TYPES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 OTHER SOLUTION TYPES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 HEALTHCARE CYBERSECURITY MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 41 MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 42 PHISHING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 PHISHING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 RANSOMWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 RANSOMWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 MALWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 MALWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 DDOS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 DDOS: HEALTHCARE CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 APT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 APT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 OTHER THREAT TYPES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 53 OTHER THREAT TYPES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 55 MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 56 NETWORK SECURITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 NETWORK SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 CLOUD SECURITY: HEALTHCARE CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 CLOUD SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 APPLICATION SECURITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 61 APPLICATION SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 ENDPOINT AND IOT SECURITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 63 ENDPOINT AND IOT SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 65 MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 66 HOSPITALS AND HEALTHCARE FACILITIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 67 HOSPITALS AND HEALTHCARE FACILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 MEDICAL DEVICE MANUFACTURERS: HEALTHCARE CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 69 MEDICAL DEVICE MANUFACTURERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 PHARMACEUTICALS AND BIOTECHNOLOGY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 71 PHARMACEUTICALS AND BIOTECHNOLOGY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 HEALTH INSURANCE PROVIDERS AND PAYERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 73 HEALTH INSURANCE PROVIDERS AND PAYERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 TELEHEALTH AND DIGITAL HEALTH PROVIDERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 75 TELEHEALTH AND DIGITAL HEALTH PROVIDERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 GOVERNMENT HEALTHCARE AGENCIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 77 GOVERNMENT HEALTHCARE AGENCIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 79 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: HEALTHCARE CYBERSECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: HEALTHCARE CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 US: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 95 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 96 US: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 97 US: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 98 US: HEALTHCARE CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 99 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 100 US: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 101 US: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 102 US: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 103 US: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 104 US: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 105 US: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 106 CANADA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 107 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 108 CANADA: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 109 CANADA: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 110 CANADA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 111 CANADA: HEALTHCARE CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 112 CANADA: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 113 CANADA: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 114 CANADA: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 115 CANADA: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 116 CANADA: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 117 CANADA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 118 EUROPE: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 119 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 120 EUROPE: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 121 EUROPE: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 122 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 123 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 124 EUROPE: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 125 EUROPE: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 127 EUROPE: HEALTHCARE CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 EUROPE: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 129 EUROPE: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 131 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 132 UK: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 133 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 134 UK: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 135 UK: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 136 UK: HEALTHCARE CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 137 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 138 UK: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 139 UK: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 140 UK: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 141 UK: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 142 UK: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 143 UK: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 144 GERMANY: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 145 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 146 GERMANY: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 147 GERMANY: HEALTHCARE CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 148 GERMANY: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 149 GERMANY: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 150 GERMANY: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 151 GERMANY: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 152 GERMANY: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 153 GERMANY: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 154 GERMANY: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 155 GERMANY: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 156 FRANCE: HEALTHCARE CYBERSECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 157 FRANCE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 158 FRANCE: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 159 FRANCE: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 160 FRANCE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 161 FRANCE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 162 FRANCE: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 163 FRANCE: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 164 FRANCE: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 165 FRANCE: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 166 FRANCE: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 167 FRANCE: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 168 REST OF EUROPE: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 169 REST OF EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 170 REST OF EUROPE: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 171 REST OF EUROPE: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 172 REST OF EUROPE: HEALTHCARE CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 173 REST OF EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 174 REST OF EUROPE: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 175 REST OF EUROPE: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 176 REST OF EUROPE: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 177 REST OF EUROPE: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 178 REST OF EUROPE: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 179 REST OF EUROPE: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 183 ASIA PACIFIC: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 185 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 187 ASIA PACIFIC: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 189 ASIA PACIFIC: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: HEALTHCARE CYBERSECURITY MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 191 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 192 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 193 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 194 CHINA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 195 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 196 CHINA: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 197 CHINA: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 198 CHINA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 199 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 200 CHINA: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 201 CHINA: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 202 CHINA: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 203 CHINA: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 204 CHINA: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 205 CHINA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 206 JAPAN: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 207 JAPAN: HEALTHCARE CYBERSECURITY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 208 JAPAN: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 209 JAPAN: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 210 JAPAN: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 211 JAPAN: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 212 JAPAN: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 213 JAPAN: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 214 JAPAN: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 215 JAPAN: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 216 JAPAN: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 217 JAPAN: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 218 INDIA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 219 INDIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 220 INDIA: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 221 INDIA: HEALTHCARE CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 222 INDIA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 223 INDIA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 224 INDIA: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 225 INDIA: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 226 INDIA: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 227 INDIA: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 228 INDIA: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 229 INDIA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 230 REST OF ASIA PACIFIC: HEALTHCARE CYBERSECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 231 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 232 REST OF ASIA PACIFIC: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 233 REST OF ASIA PACIFIC: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 234 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 235 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 236 REST OF ASIA PACIFIC: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 240 REST OF ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 242 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 243 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 244 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 245 MIDDLE EAST AND AFRICA: HEALTHCARE CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 246 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 247 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 248 MIDDLE EAST AND AFRICA: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 249 MIDDLE EAST AND AFRICA: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 250 MIDDLE EAST AND AFRICA: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 251 MIDDLE EAST AND AFRICA: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 252 MIDDLE EAST AND AFRICA: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 253 MIDDLE EAST AND AFRICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 254 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 255 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 256 MIDDLE EAST: HEALTHCARE CYBERSECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 257 MIDDLE EAST: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 258 MIDDLE EAST: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 259 MIDDLE EAST: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 260 MIDDLE EAST: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 261 MIDDLE EAST: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 262 MIDDLE EAST: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 263 MIDDLE EAST: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 264 MIDDLE EAST: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 265 MIDDLE EAST: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 266 MIDDLE EAST: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 267 MIDDLE EAST: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 268 AFRICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 269 AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 270 AFRICA: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 271 AFRICA: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 272 AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 273 AFRICA: HEALTHCARE CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 274 AFRICA: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 275 AFRICA: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 276 AFRICA: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 277 AFRICA: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 278 AFRICA: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 279 AFRICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 280 LATIN AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 281 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 282 LATIN AMERICA: HEALTHCARE CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 283 LATIN AMERICA: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 284 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 285 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 286 LATIN AMERICA: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 287 LATIN AMERICA: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 288 LATIN AMERICA: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 289 LATIN AMERICA: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 290 LATIN AMERICA: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 291 LATIN AMERICA: HEALTHCARE CYBERSECURITY MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 292 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 293 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 294 BRAZIL: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 295 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 296 BRAZIL: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 297 BRAZIL: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 298 BRAZIL: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 299 BRAZIL: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 300 BRAZIL: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 301 BRAZIL: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 302 BRAZIL: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 303 BRAZIL: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 304 BRAZIL: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 305 BRAZIL: HEALTHCARE CYBERSECURITY MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 306 MEXICO: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 307 MEXICO: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 308 MEXICO: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 309 MEXICO: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 310 MEXICO: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 311 MEXICO: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 312 MEXICO: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 313 MEXICO: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 314 MEXICO: HEALTHCARE CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 315 MEXICO: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 316 MEXICO: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 317 MEXICO: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 318 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 319 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 320 REST OF LATIN AMERICA: MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 321 REST OF LATIN AMERICA: MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 322 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 323 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 324 REST OF LATIN AMERICA: MARKET, BY THREAT TYPE, 2017–2022 (USD MILLION)

- TABLE 325 REST OF LATIN AMERICA: MARKET, BY THREAT TYPE, 2023–2028 (USD MILLION)

- TABLE 326 REST OF LATIN AMERICA: MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 327 REST OF LATIN AMERICA: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 328 REST OF LATIN AMERICA: HEALTHCARE CYBERSECURITY MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 329 REST OF LATIN AMERICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 330 MARKET: DEGREE OF COMPETITION

- TABLE 331 REGION FOOTPRINT OF KEY COMPANIES

- TABLE 332 REGION FOOTPRINT OF STARTUPS/SMES COMPANIES

- TABLE 333 STARTUP INFORMATION

- TABLE 334 MARKET: PRODUCT/SOLUTION LAUNCHES, 2020–2023

- TABLE 335 MARKET: DEALS, 2020–2023

- TABLE 336 IBM: BUSINESS OVERVIEW

- TABLE 337 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 338 IBM: PRODUCT LAUNCHES

- TABLE 339 IBM: DEALS

- TABLE 340 CISCO: BUSINESS OVERVIEW

- TABLE 341 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 342 CISCO: PRODUCT LAUNCHES

- TABLE 343 CISCO: DEALS

- TABLE 344 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- TABLE 345 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 346 PALO ALTO NETWORKS: PRODUCT LAUNCHES

- TABLE 347 PALO ALTO NETWORKS: DEALS

- TABLE 348 CHECK POINT: BUSINESS OVERVIEW

- TABLE 349 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 350 CHECK POINT: PRODUCT LAUNCHES

- TABLE 351 CHECK POINT: DEALS

- TABLE 352 FORTINET: BUSINESS OVERVIEW

- TABLE 353 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 354 FORTINET: PRODUCT LAUNCHES

- TABLE 355 FORTINET: DEALS

- TABLE 356 TREND MICRO: BUSINESS OVERVIEW

- TABLE 357 TREND MICRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 358 TREND MICRO: PRODUCT LAUNCHES

- TABLE 359 TREND MICRO: DEALS

- TABLE 360 DELL EMC: BUSINESS OVERVIEW

- TABLE 361 DELL EMC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 362 DELL EMC: PRODUCT LAUNCHES

- TABLE 363 DELL EMC: DEALS

- TABLE 364 CROWDSTRIKE: BUSINESS OVERVIEW

- TABLE 365 CROWDSTRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 366 CROWDSTRIKE: PRODUCT LAUNCHES

- TABLE 367 CROWDSTRIKE: DEALS

- TABLE 368 KUDELSKI SECURITY: BUSINESS OVERVIEW

- TABLE 369 KUDELSKI SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 370 KUDELSKI SECURITY: PRODUCT LAUNCHES

- TABLE 371 KUDELSKI SECURITY: DEALS

- TABLE 372 CLOUDWAVE: BUSINESS OVERVIEW

- TABLE 373 CLOUDWAVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 374 CLOUDWAVE: PRODUCT LAUNCHES

- TABLE 375 CLOUDWAVE: DEALS

- TABLE 376 CLAROTY: BUSINESS OVERVIEW

- TABLE 377 CLAROTY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 378 CLAROTY: PRODUCT LAUNCHES

- TABLE 379 CLAROTY: DEALS

- TABLE 380 IMPERVA: BUSINESS OVERVIEW

- TABLE 381 IMPERVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 382 IMPERVA: PRODUCT LAUNCHES

- TABLE 383 IMPERVA: DEALS

- TABLE 384 LOGRHYTHM: BUSINESS OVERVIEW

- TABLE 385 LOGRHYTHM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 386 LOGRHYTHM: PRODUCT LAUNCHES

- TABLE 387 LOGRHYTHM: DEALS

- TABLE 388 ADJACENT MARKETS AND FORECASTS

- TABLE 389 HEALTHCARE IT MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

- TABLE 390 HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 391 HEALTHCARE IT SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 392 HEALTHCARE IT HARDWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 393 HEALTHCARE IT MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 394 CYBERSECURITY MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 395 CYBERSECURITY MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 396 PROFESSIONAL SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 397 PROFESSIONAL SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 398 MANAGED SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 399 MANAGED SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 HEALTHCARE CYBERSECURITY MARKET: RESEARCH FLOW

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF HEALTHCARE CYBERSECURITY VENDORS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (DEMAND SIDE), TOP-DOWN APPROACH

- FIGURE 5 LIMITATIONS OF MARKET

- FIGURE 6 GLOBAL HEALTHCARE CYBERSECURITY MARKET SIZE AND Y-O-Y GROWTH RATE

- FIGURE 7 MARKET SHARE OF SEGMENTS WITH HIGH GROWTH RATES DURING FORECAST PERIOD

- FIGURE 8 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 9 RISING ADOPTION OF IOT AND CONNECTED DEVICES TO DRIVE HEALTHCARE CYBERSECURITY SOLUTIONS

- FIGURE 10 HOSPITALS AND HEALTHCARE FACILITIES SEGMENT AND NORTH AMERICA TO HOLD LARGEST MARKET SHARES IN 2023

- FIGURE 11 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 PROFESSIONAL SERVICES TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 13 ANTIVIRUS/ANTIMALWARE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 14 RANSOMWARE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 15 APPLICATION SECURITY SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 16 HOSPITALS AND HEALTHCARE FACILITIES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 17 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 18 CYBERATTACKS AND SECURITY ISSUES IN HEALTHCARE SECTOR

- FIGURE 19 HEALTHCARE CYBERSECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 VALUE CHAIN ANALYSIS: MARKET

- FIGURE 21 MARKET: ECOSYSTEM

- FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 PATENT ANALYSIS: HEALTHCARE CYBERSECURITY MARKET

- FIGURE 24 CHANGES AND TRENDS AFFECTING BUYERS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 26 SERVICES SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 27 PROFESSIONAL SERVICES SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 28 ANTIVIRUS/ANTIMALWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 29 RANSOMWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 30 APPLICATION SECURITY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 31 HOSPITALS AND HEALTHCARE FACILITIES VERTICAL TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR BY 2028

- FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 35 REVENUE SHARE ANALYSIS OF HEALTHCARE CYBERSECURITY MARKET, 2023

- FIGURE 36 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS (USD MILLION)

- FIGURE 37 RANKING OF TOP FIVE HEALTHCARE CYBERSECURITY PLAYERS, 2023

- FIGURE 38 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 39 EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 40 EVALUATION QUADRANT FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 41 EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 42 IBM: COMPANY SNAPSHOT

- FIGURE 43 CISCO: COMPANY SNAPSHOT

- FIGURE 44 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- FIGURE 45 CHECK POINT: COMPANY SNAPSHOT

- FIGURE 46 FORTINET: COMPANY SNAPSHOT

- FIGURE 47 TREND MICRO: COMPANY SNAPSHOT

- FIGURE 48 DELL EMC: COMPANY SNAPSHOT

- FIGURE 49 CROWDSTRIKE: COMPANY SNAPSHOT

The study involved major activities in estimating the current market size for the healthcare cybersecurity market. Exhaustive secondary research was done to collect information on the healthcare cybersecurity industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the healthcare cybersecurity market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information regarding the study. The secondary sources included annual reports, press releases, investor presentations of healthcare cybersecurity software and service vendors, forums, certified publications, and white papers. The secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources. The factors considered for estimating the regional market size are technological initiatives undertaken by governments of different countries, Gross Domestic Product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of major healthcare cybersecurity solution providers.

Primary Research

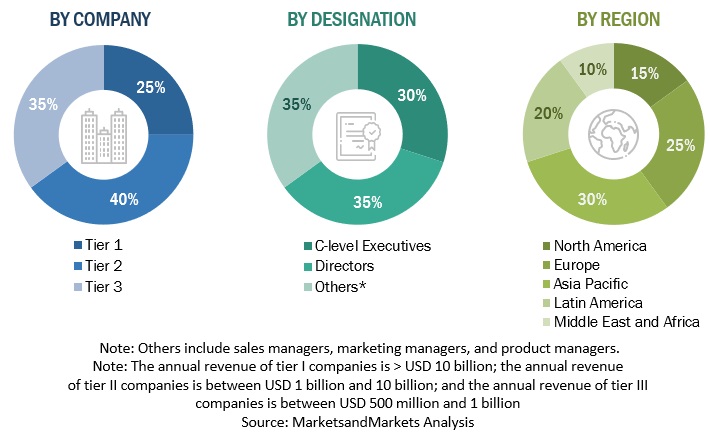

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the healthcare cybersecurity market.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of healthcare cybersecurity market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global healthcare cybersecurity market and estimate the size of various other dependent sub-segments in the overall healthcare cybersecurity market. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Healthcare cybersecurity is a strategic imperative for any organization in the medical industry, from healthcare providers to insurers to pharmaceutical, biotechnology, and medical device companies. It involves a variety of measures to protect organizations from external and internal cyberattacks and ensure the availability of medical services, proper operation of medical systems and equipment, preservation of confidentiality and integrity of patient data, and compliance with industry regulations.

Key Stakeholders

-

Government bodies and public safety agencies

Project managers

Developers

Business analysts

Quality Assurance (QA)/test engineers

Cybersecurity specialists

Cybersecurity solution and service providers

Consulting firms

Third-party vendors

Investors and venture capitalists

System Integrators (SIs)

Technology providers

Healthcare organizations

Medical Device Manufacturers

Report Objectives

To define, describe, and forecast the healthcare cybersecurity market based on offerings, services, solution type, threat type, security type, end-use industry, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the healthcare cybersecurity market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the healthcare cybersecurity market

- To profile the key players of the healthcare cybersecurity market and comprehensively analyze their market size and core competencies.

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global healthcare cybersecurity market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Cybersecurity Market