Healthcare Fraud Analytics Market by Solution Type (Descriptive, Predictive, Prescriptive), Application (Insurance Claim, Payment Integrity), Delivery (On-premise, Cloud), End User (Government, Employers, Payers) & Region - Global Forecast to 2026

Market Growth Outlook Summary

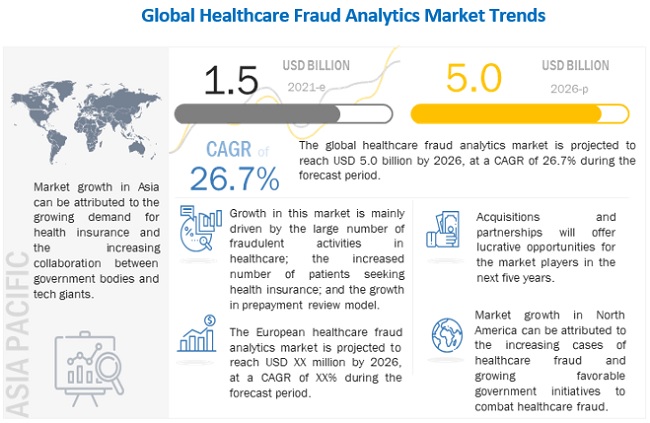

The global healthcare fraud analytics market growth forecasted to transform from $1.5 billion in 2021 to $5.0 billion by 2026, driven by a CAGR of 26.7%. The market is driven by the rise in fraudulent healthcare activities, an increasing number of patients seeking health insurance, and the rising number of pharmacy claims-related frauds. Data limitations in Medicaid services and a lack of skilled personnel pose challenges to market growth. The growth opportunities are driven by the emergence of social media in healthcare and the growing need for data analytics to prevent fraud. The market is dominated by North America, with significant players like IBM Corporation, Optum, Cotiviti, and Change Healthcare leading innovations in fraud detection solutions. The healthcare fraud analytics market is segmented by solution type (descriptive, predictive, prescriptive analytics), delivery model (on-premise, on-demand), application (insurance claims review, pharmacy billing misuse), and end user. Descriptive analytics and insurance claims review segments lead the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare Fraud Analytics Market Dynamics

Driver: Increased number of patients seeking health insurance

The number of people utilising various healthcare programmes has increased significantly over the years. The ageing population, increased healthcare expenditure, and increased disease burden are all factors contributing to the growth of the health insurance market. In the US, the number of citizens without health insurance has significantly decreased, from 48 million in 2010 to 28.6 million in 2016. In 2017, 12.2 million people signed up for or renewed their health insurance during the 2017 open enrollment period (source: National Center for Health Statistics).

Emerging markets such as Asia promise significant growth in health insurance coverage, mainly due to increasing government initiatives, rising government and private investments, and growing income levels. This growth is aided by the increasing affordability of health insurance for the middle class in this region and the rising awareness regarding the benefits of health insurance. As per a new regulatory policy (2017), any citizen residing and working in the UAE needs to be medically insured. Such regulatory changes in the buying behaviour of employers (from employer-based plans to providing individual spending allowances to staff) are driving the health insurance market in the region.

Restraint: Limitations in the data capturing process in Medicaid services

As per the US Department of Health and Human Services' findings from 2018, national Medicaid data has shortcomings that could hinder the process of fraud detection in the public sector. According to the OIG, Medicaid data is frequently incomplete and inaccurate, affecting the process of detecting fraudulent claims and resulting in the waste of billions of dollars due to FWA.

Opportunity: Emergence of social media and its impact on the healthcare industry

The healthcare industry is changing at an incredible rate, and one of the major contributors to this change is the increasing popularity of healthcare communication through social media. Not only has social media become a place where people seek health information, but social media channels also allow for two-way public communication between patients, providers, and other third parties. This helps create a large forum for health discussions globally.

This vast network of healthcare influencers, leaders, patients, providers, organizations, and governmental entities creates a massive amount of healthcare data on a regular basis. This data, if segregated, segmented, and analyzed in a meaningful way, can offer incredible value for improving treatment efficiencies and health outcomes. This has created a demand for data aggregation and analytical tools and thus acts as an opportunity for the healthcare fraud analytics industry during the forecast period.

Challenge: Time-consuming deployment and the need for frequent upgrades

The deployment of fraud analytics solutions is a time-consuming process. The process involves creating user interfaces, new databases, and predictive models; evaluating and deploying models, and monitoring their effectiveness. In this process, data analysts continuously run algorithms until they get the most effective predictive model.

Analysts may not always find the best predictive model for expected outcomes, resulting in time waste. This means they must start the same process again with new data. Thus, if data analysts fail at one stage, the whole process is disturbed. Furthermore, the software requires frequent upgrades as fraudsters constantly change tactics. This adds to the total cost of fraud analytics solutions.

The descriptive analytics segment dominated the healthcare fraud analytics industry in 2020

The healthcare fraud analytics market is segmented based on solution type, delivery model, application, and end user. Based on solution type, the descriptive analytics segment accounted for the largest share of the market in 2019. Descriptive analytics forms the base for the effective application of predictive or prescriptive analytics. Hence, these analytics use the basics of descriptive analytics and integrate them with additional sources of data in order to produce meaningful insights.

The insurance claims review segment accounted for the largest share of the healthcare fraud analytics industry

On the basis of application, the healthcare fraud analytics market is segmented into insurance claims review, pharmacy billing misuse, payment integrity, and other applications. In 2019, the insurance claims review segment dominated the global market. The increasing number of patients seeking health insurance, the rising number of fraudulent claims, and the growing adoption of the prepayment review model are expected to drive the growth of this segment in the coming years.

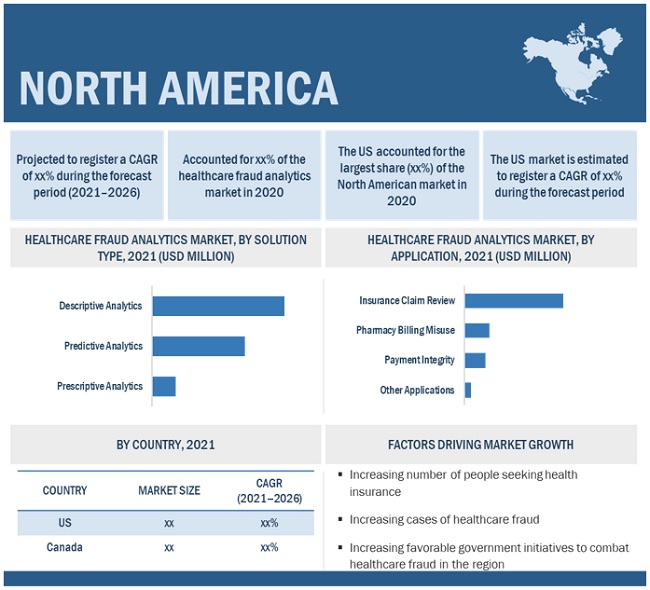

North America will dominate the healthcare fraud analytics industry from 2021–2026

Geographically, the global healthcare fraud analytics market is segmented into North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa. North America accounted for the largest share of the global market in 2019. The high share of the North American market is attributed to the large number of people having health insurance, growing healthcare fraud, favorable government anti-fraud initiatives, the pressure to reduce healthcare costs, technological advancements, and greater product and service availability in this region. Moreover, a majority of leading players in the healthcare fraud detection market have their headquarters in North America.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in healthcare fraud analytics market are IBM Corporation (US), Optum, Inc. (US), Cotiviti, Inc. (US), Change Healthcare (US), Fair Isaac Corporation (US), SAS Institute Inc. (US), EXLService Holdings, Inc. (US), Wipro Limited (India), Conduent, Incorporated (US), CGI Inc. (Canada), HCL Technologies Limited (India), Qlarant, Inc. (US), DXC Technology (US), Northrop Grumman Corporation (US), LexisNexis (US), Healthcare Fraud Shield (US), Sharecare, Inc. (US), FraudLens, Inc. (US), HMS Holding Corp. (US), Codoxo (US), H20.ai (US), Pondera Solutions, Inc. (US), FRISS (The Netherlands), Multiplan (US), FraudScope (US), and OSP Labs (US).

Scope of the Healthcare Fraud Analytics Industry

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$1.5 billion |

|

Projected Revenue by 2026 |

$5.0 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 26.7% |

|

Market Driver |

Increased number of patients seeking health insurance |

|

Market Opportunity |

Emergence of social media and its impact on the healthcare industry |

The study categorizes the healthcare fraud analytics market to forecast revenue and analyze trends in each of the following submarkets

By Solution Type

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

By Delivery Model

- On-premise

- On-demand

By Application

-

Insurance Claims Review

- Postpayment Review

- Prepayment Review

- Pharmacy Billing Misuse

- Payment Integrity

- Other applications

By End User

- Public & Government Agencies

- Private Insurance Payers

- Third-party service providers

- Employers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia

- China

- Japan

- Rest of Asia

-

Pacific

- Latin America

- Middle East & Africa

Recent Developments of Healthcare Fraud Analytics Industry

- In January 2019, LexisNexis Risk Solutions collaborated with QuadraMed to enable patient identification capabilities and reduce the number of duplicate identities & fraudulent claims.

- In August 2018, Verscend Technologies acquired Cotiviti Holdings. This acquisition helped improve the affordability of fraud detection solutions.

- In June 2018, SAS Institute & Prime Therapeutics LLC teamed up, enabling Prime Therapeutics to utilize SAS’s analytic capabilities to combat the opioid crisis in the US

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global healthcare fraud analytics market?

The global healthcare fraud analytics market boasts a total revenue value of $5.0 billion by 2026.

What is the estimated growth rate (CAGR) of the global healthcare fraud analytics market?

The global healthcare fraud analytics market has an estimated compound annual growth rate (CAGR) of 26.7% and a revenue size in the region of $1.5 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 HEALTHCARE FRAUD ANALYTICS INDUSTRY DEFINITION & SCOPE

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKET SEGMENTATION

FIGURE 1 HEALTHCARE FRAUD ANALYTICS MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY SOURCES

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY SOURCES

TABLE 2 LIST OF STAKEHOLDERS INTERVIEWED FOR THE STUDY

2.1.2.1 Key data from primary sources

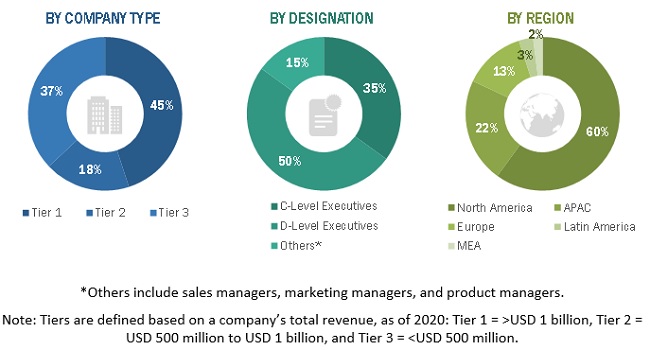

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 5 HEALTHCARE FRAUD ANALYTICS MARKET, BY SOLUTION TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 6 GLOBAL HEALTHCARE FRAUD ANALYTICS INDUSTRY, BY DELIVERY MODEL, 2021 VS. 2026 (USD MILLION)

FIGURE 7 GLOBAL HEALTHCARE FRAUD ANALYTICS INDUSTRY, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 8 GLOBAL HEALTHCARE FRAUD ANALYTICS INDUSTRY, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 9 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL HEALTHCARE FRAUD ANALYTICS INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 HEALTHCARE FRAUD ANALYTICS MARKET OVERVIEW

FIGURE 10 LARGE NUMBER OF FRAUDULENT ACTIVITIES IN HEALTHCARE TO DRIVE MARKET GROWTH

4.2 ASIA: GLOBAL MARKET, BY SOLUTION TYPE AND COUNTRY

FIGURE 11 DESCRIPTIVE ANALYTICS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE ASIAN GLOBAL MARKET IN 2020

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 12 US TO REGISTER THE HIGHEST REVENUE GROWTH DURING FORECAST PERIOD

4.4 GLOBAL MARKET: REGIONAL MIX

FIGURE 13 NORTH AMERICA WILL CONTINUE TO DOMINATE THE MARKET IN 2026

4.5 GLOBAL MARKET: DEVELOPING VS. DEVELOPED REGIONS

FIGURE 14 DEVELOPED MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 HEALTHCARE FRAUD ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Large number of fraudulent activities in healthcare

FIGURE 16 US NATIONAL HEALTHCARE FRAUD AND OPIOID TAKEDOWN TRENDS

FIGURE 17 INCIDENCE OF FRAUDULENT CLAIMS—GLOBAL SCENARIO (2019)

5.2.1.2 Increased number of patients seeking health insurance

5.2.1.3 Prepayment review model

5.2.1.4 High returns on investment

5.2.1.5 Rise in pharmacy claims-related fraud

5.2.2 RESTRAINTS

5.2.2.1 Limitations in the data capturing process in Medicaid services

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of healthcare fraud analytics in developing countries

5.2.3.2 Emergence of social media and its impact on the healthcare industry

5.2.3.3 Role of AI in healthcare fraud detection

5.2.4 CHALLENGES

5.2.4.1 Dearth of skilled personnel

5.2.4.2 Time-consuming deployment and the need for frequent upgrades

6 INDUSTRY INSIGHTS (Page No. - 48)

6.1 HEALTHCARE FRAUD ANALYTICS INDUSTRY TRENDS

6.1.1 SHIFTING FOCUS FROM ON-PREMISE MODELS TO CLOUD-BASED ON-DEMAND MODELS

6.1.2 MERGERS AND ACQUISITIONS: THE MOST ADOPTED STRATEGY

FIGURE 18 MAJOR MERGERS AND ACQUISITIONS IN THE GLOBAL MARKET

6.1.3 TECHNOLOGICAL ADVANCEMENTS

TABLE 3 COMPANIES OFFERING INNOVATIVE FRAUD ANALYTICS SOLUTIONS

6.1.4 NEW USE CASE: OPIOID EPIDEMIC CRISIS

6.1.5 END-USER TRENDS: ADOPTION OF HEALTHCARE FRAUD ANALYTICS SOLUTIONS BY PHARMACY BENEFIT MANAGERS

7 HEALTHCARE FRAUD ANALYTICS MARKET, BY SOLUTION TYPE (Page No. - 51)

7.1 INTRODUCTION

TABLE 4 GLOBAL HEALTHCARE FRAUD ANALYTICS INDUSTRY, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

7.2 DESCRIPTIVE ANALYTICS

7.2.1 DESCRIPTIVE ANALYTICS SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARE

TABLE 5 DESCRIPTIVE ANALYTICS SOLUTIONS FOR HEALTHCARE FRAUD DETECTION

TABLE 6 DESCRIPTIVE ANALYTICS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 7 DESCRIPTIVE ANALYTICS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 PREDICTIVE ANALYTICS

7.3.1 PREDICTIVE ANALYTICS HELPS IN SIMULATING FUTURE EVENTS AND TRENDS THAT CAN ENABLE PAYERS TO PREDICT PREVEN TABLE EVENTS

TABLE 8 PREDICTIVE ANALYTICS SOLUTIONS FOR HEALTHCARE FRAUD DETECTION

TABLE 9 PREDICTIVE ANALYTICS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 10 PREDICTIVE ANALYTICS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 PRESCRIPTIVE ANALYTICS

7.4.1 PRESCRIPTIVE MODELS OFFER ADDITIONAL ADVANTAGES RELATING TO THE INVESTIGATION OF SUSPICIOUS BEHAVIOR TO GENERATE COMPREHENSIVE INSIGHTS

TABLE 11 PRESCRIPTIVE ANALYTICS SOLUTIONS FOR HEALTHCARE FRAUD DETECTION

TABLE 12 PRESCRIPTIVE ANALYTICS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 13 PRESCRIPTIVE ANALYTICS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 HEALTHCARE FRAUD ANALYTICS MARKET, BY DELIVERY MODEL (Page No. - 58)

8.1 INTRODUCTION

TABLE 14 GLOBAL HEALTHCARE FRAUD ANALYTICS INDUSTRY, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

8.2 ON-PREMISE DELIVERY MODELS

8.2.1 ON-PREMISE MODELS ACCOUNT FOR THE LARGEST SHARE OF THE MARKET

TABLE 15 KEY VENDORS OFFERING ON-PREMISE SOLUTIONS IN THE MARKET

TABLE 16 GLOBAL MARKET FOR ON-PREMISE DELIVERY MODEL, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 GLOBAL MARKET FOR ON-PREMISE DELIVERY MODEL, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 ON-DEMAND DELIVERY MODELS

8.3.1 CLOUD-BASED DELIVERY MODELS OFFER ORGANIZATIONS INCREASED SCALABILITY AND SPEED

TABLE 18 KEY VENDORS PROVIDING ON-DEMAND SOLUTIONS

TABLE 19 GLOBAL MARKET FOR ON-DEMAND DELIVERY MODEL, BY REGION, 2019–2026 (USD MILLION)

TABLE 20 GLOBAL MARKET FOR ON-DEMAND DELIVERY MODEL, BY COUNTRY, 2019–2026 (USD MILLION)

9 HEALTHCARE FRAUD ANALYTICS MARKET, BY APPLICATION (Page No. - 64)

9.1 INTRODUCTION

TABLE 21 GLOBAL HEALTHCARE FRAUD ANALYTICS INDUSTRY, BY APPLICATION, 2019–2026 (USD MILLION)

9.2 INSURANCE CLAIMS REVIEW

TABLE 22 DEPLOYMENT OF PREPAYMENT VS. POSTPAYMENT ANALYTICS SYSTEMS

TABLE 23 GLOBAL MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 24 GLOBAL MARKET FOR INSURANCE CLAIMS REVIEW, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 GLOBAL MARKET FOR INSURANCE CLAIMS REVIEW, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.1 POSTPAYMENT REVIEW

9.2.1.1 Postpayment review dominates the healthcare fraud analytics insurance claims review market

TABLE 26 GLOBAL MARKET FOR POSTPAYMENT CLAIMS REVIEW, BY REGION, 2019–2026 (USD MILLION)

TABLE 27 GLOBAL MARKET FOR POSTPAYMENT CLAIMS REVIEW, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.2 PREPAYMENT REVIEW

9.2.2.1 The majority of prepayment models use predictive analytics to detect fraud and stop fraudulent claims payments

TABLE 28 GLOBAL MARKET FOR PREPAYMENT CLAIMS REVIEW, BY REGION, 2019–2026 (USD MILLION)

TABLE 29 GLOBAL MARKET FOR PREPAYMENT CLAIMS REVIEW, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 PHARMACY BILLING MISUSE

9.3.1 FRAUD, WASTE, AND ABUSE CASES IN PHARMACY AND PRESCRIPTION DRUG AREAS TO DRIVE THE DEMAND FOR ANALYTICS

TABLE 30 GLOBAL MARKET FOR PHARMACY BILLING MISUSE APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 GLOBAL MARKET FOR PHARMACY BILLING MISUSE APPLICATION, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 PAYMENT INTEGRITY

9.4.1 CHANGES IN REGULATORY GUIDELINES HAVE AIDED THE ADOPTION OF PAYMENT INTEGRITY SOFTWARE

TABLE 32 GLOBAL MARKET FOR PAYMENT INTEGRITY APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 33 GLOBAL MARKET FOR PAYMENT INTEGRITY APPLICATION, BY COUNTRY, 2019–2026 (USD MILLION)

9.5 OTHER APPLICATIONS

TABLE 34 GLOBAL MARKET FOR OTHER APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 35 GLOBAL MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

10 HEALTHCARE FRAUD ANALYTICS MARKET, BY END USER (Page No. - 75)

10.1 INTRODUCTION

TABLE 36 GLOBAL HEALTHCARE FRAUD ANALYTICS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.2 PUBLIC & GOVERNMENT AGENCIES

10.2.1 PUBLIC & GOVERNMENT AGENCIES DOMINATE THE GLOBAL MARKET

TABLE 37 GLOBAL MARKET FOR PUBLIC & GOVERNMENT AGENCIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 38 GLOBAL MARKET FOR PUBLIC & GOVERNMENT AGENCIES, BY COUNTRY, 2019–2026 (USD MILLION)

10.3 PRIVATE INSURANCE PAYERS

10.3.1 PRIVATE INSURANCE PAYERS ARE FOCUSED ON DEPLOYING ANALYTICS TO COMBAT INCREASING MONETARY LOSSES

TABLE 39 GLOBAL MARKET FOR PRIVATE INSURANCE PAYERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 GLOBAL MARKET FOR PRIVATE INSURANCE PAYERS, BY COUNTRY, 2019–2026 (USD MILLION)

10.4 THIRD-PARTY SERVICE PROVIDERS

10.4.1 ADOPTION OF FRAUD ANALYTICS SOLUTIONS BY PUBLIC INSURERS PUTS PRIVATE BODIES AT RISK, DRIVING ATTENTION TOWARD OUTSOURCING

TABLE 41 GLOBAL MARKET FOR THIRD-PARTY SERVICE PROVIDERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 42 GLOBAL MARKET FOR THIRD-PARTY SERVICE PROVIDERS, BY COUNTRY, 2019–2026 (USD MILLION)

10.5 EMPLOYERS

10.5.1 EMPLOYERS ARE CONSIDERING FRAUD ANALYTICS SOLUTIONS AS A STEP TOWARD BETTER COST MANAGEMENT

TABLE 43 GLOBAL MARKET FOR EMPLOYERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 44 GLOBAL MARKET FOR EMPLOYERS, BY COUNTRY, 2019–2026 (USD MILLION)

11 HEALTHCARE FRAUD ANALYTICS MARKET, BY REGION (Page No. - 83)

11.1 INTRODUCTION

TABLE 45 GLOBAL MARKET, BY REGION, 2019–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 19 NORTH AMERICA: MARKET SNAPSHOT

TABLE 46 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.2.1 US

11.2.1.1 US dominates the global market

TABLE 52 US: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 53 US: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 54 US: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 55 US: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing adoption of data-crunching technologies like predictive analytics to drive market growth

TABLE 57 CANADA: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 58 CANADA: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 59 CANADA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 60 CANADA: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 61 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3 EUROPE

TABLE 62 LIST OF SOME OF THE EHFCN MEMBER ORGANIZATIONS ACROSS EUROPE

TABLE 63 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 67 EUROPE: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany is the fastest-growing market for healthcare fraud analytics solutions in Europe

TABLE 69 GERMANY: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 70 GERMANY: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 71 GERMANY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 72 GERMANY: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.2 UK

11.3.2.1 Launch of initiatives such as NHSCFA will support the market for fraud analytics solutions in the UK

TABLE 74 UK: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 75 UK: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 76 UK: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 77 UK: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Increasing adoption of information technology for the detection of healthcare fraud—a key factor driving market growth

TABLE 79 FRANCE: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 80 FRANCE: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 81 FRANCE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 82 FRANCE: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Increasing government support for the adoption of fraud analytics solutions

TABLE 84 ITALY: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 85 ITALY: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 86 ITALY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 87 ITALY: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 ITALY: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Advanced healthcare infrastructure to propel the adoption of innovative technologies like fraud analytics

TABLE 89 SPAIN: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 90 SPAIN: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 91 SPAIN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 92 SPAIN: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 94 ROE: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 95 ROE: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 96 ROE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 97 ROE: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 ROE: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4 ASIA

FIGURE 20 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 99 ASIA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 100 ASIA: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 101 ASIA: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 102 ASIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 103 ASIA: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 ASIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Increasing fraud cases in medical billing to drive market growth

TABLE 105 JAPAN: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 106 JAPAN: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 107 JAPAN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 108 JAPAN: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Growing need for advanced healthcare systems for a better outcome to drive the demand for fraud analytics solutions

TABLE 110 CHINA: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 111 CHINA: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 112 CHINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 113 CHINA: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.3 ROA

11.4.3.1 Increasing initiatives for establishing healthcare IT solutions to support market growth

TABLE 115 ROA: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 116 ROA: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 117 ROA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 118 ROA: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 ROA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.5 PACIFIC

11.5.1 GROWING NEED FOR INSURANCE COVERAGES AND MEDICAL CLAIMS TO DRIVE MARKET GROWTH

TABLE 120 PACIFIC: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 121 PACIFIC: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 122 PACIFIC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 123 PACIFIC: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 PACIFIC: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 INCREASING PENETRATION OF HEALTH INSURANCE TO DRIVE VOLUME OF CLAIMS PROCESSING IN LATIN AMERICAN COUNTRIES

TABLE 125 LATIN AMERICA: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 126 LATIN AMERICA: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 127 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 128 LATIN AMERICA: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 LATIN AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.7 MIDDLE EAST & AFRICA

11.7.1 HEALTHCARE FRAUD IS ONE OF THE LEADING CRIMES IN SOUTH AFRICA

TABLE 130 MEA: MARKET, BY DELIVERY MODEL, 2019–2026 (USD MILLION)

TABLE 131 MEA: MARKET, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

TABLE 132 MEA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 133 MEA: MARKET FOR INSURANCE CLAIMS REVIEW, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 MEA: MARKET, BY END USER, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 123)

12.1 INTRODUCTION

FIGURE 21 KEY DEVELOPMENTS IN THE HEALTHCARE FRAUD ANALYTICS MARKET BETWEEN JANUARY 2018 AND AUGUST 2021

12.2 COMPETITIVE SITUATION AND TRENDS

12.2.1 DEALS

TABLE 135 DEALS, 2018-2021

12.3 COMPETITIVE LEADERSHIP MAPPING

12.3.1 STARS

12.3.2 EMERGING LEADERS

12.3.3 PERVASIVE PLAYERS

12.3.4 PARTICIPANTS

FIGURE 22 GLOBAL HEALTHCARE FRAUD ANALYTICS INDUSTRY: COMPETITIVE LEADERSHIP MAPPING, 2020

13 COMPANY PROFILES (Page No. - 128)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 KEY PLAYERS

13.1.1 IBM CORPORATION

TABLE 136 IBM CORPORATION: BUSINESS OVERVIEW

FIGURE 23 IBM CORPORATION: COMPANY SNAPSHOT (2020)

13.1.2 OPTUM, INC. (A PART OF UNITEDHEALTH GROUP)

TABLE 137 OPTUM, INC.: BUSINESS OVERVIEW

13.1.3 COTIVITI, INC.

TABLE 138 COTIVITI, INC.: BUSINESS OVERVIEW

13.1.4 FAIR ISAAC CORPORATION

TABLE 139 FAIR ISAAC CORPORATION: BUSINESS OVERVIEW

FIGURE 24 FAIR ISAAC CORPORATION: COMPANY SNAPSHOT (2020)

13.1.5 SAS INSTITUTE INC.

TABLE 140 SAS INSTITUTE INC.: BUSINESS OVERVIEW

13.1.6 CHANGE HEALTHCARE

TABLE 141 CHANGE HEALTHCARE: BUSINESS OVERVIEW

13.1.7 PONDERA SOLUTIONS, INC. (A SUBSIDIARY OF THOMSON REUTERS CORPORATION)

TABLE 142 PONDERA SOLUTIONS, INC.: BUSINESS OVERVIEW

13.1.8 EXLSERVICE HOLDINGS, INC.

TABLE 143 EXLSERVICE HOLDINGS, INC.: BUSINESS OVERVIEW

FIGURE 25 EXLSERVICE HOLDINGS, INC.: COMPANY SNAPSHOT (2020)

13.1.9 WIPRO LIMITED

TABLE 144 WIPRO LIMITED: BUSINESS OVERVIEW

FIGURE 26 WIPRO LIMITED: COMPANY SNAPSHOT (2021)

13.1.10 CONDUENT INCORPORATED

TABLE 145 CONDUENT INCORPORATED: BUSINESS OVERVIEW

FIGURE 27 CONDUENT INCORPORATED: COMPANY SNAPSHOT (2020)

13.1.11 HCL TECHNOLOGIES LIMITED

TABLE 146 HCL TECHNOLOGIES LIMITED.: BUSINESS OVERVIEW

FIGURE 28 HCL TECHNOLOGIES LIMITED.: COMPANY SNAPSHOT (2021)

13.1.12 CGI INC.

TABLE 147 CGI INC.: BUSINESS OVERVIEW

FIGURE 29 CGI INC.: COMPANY SNAPSHOT (2020)

13.1.13 DXC TECHNOLOGY

TABLE 148 DXC TECHNOLOGY COMPANY: BUSINESS OVERVIEW

FIGURE 30 DXC TECHNOLOGY COMPANY: COMPANY SNAPSHOT (2021)

13.1.14 NORTHROP GRUMMAN CORPORATION

TABLE 149 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 31 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT (2020)

13.1.15 LEXISNEXIS (A PART OF RELX GROUP)

TABLE 150 LEXISNEXIS: BUSINESS OVERVIEW

FIGURE 32 RELX GROUP: COMPANY SNAPSHOT (2020)

13.1.16 QLARANT, INC.

TABLE 151 QLARANT, INC.: BUSINESS OVERVIEW

13.1.17 H2O.AI

TABLE 152 H2O.AI: BUSINESS OVERVIEW

13.1.18 MULTIPLAN

TABLE 153 MULTIPLAN: BUSINESS OVERVIEW

13.1.19 FRISS

TABLE 154 FRISS: BUSINESS OVERVIEW

13.1.20 OSP LABS

TABLE 155 OSP LABS: BUSINESS OVERVIEW

13.2 OTHER PLAYERS

13.2.1 SHARECARE, INC. (A SUBSIDIARY OF FALCON CAPITAL ACQUISITION CORP.)

13.2.2 HEALTHCARE FRAUD SHIELD

13.2.3 FRAUDLENS, INC.

13.2.4 HMS HOLDINGS CORP.

13.2.5 CODOXO

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 169)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the healthcare fraud analytics market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the healthcare fraud analytics market. Primary participants mainly include CEOs, consultants, subject-matter experts, SIU directors, claims processing personnel, general managers, and sales executives.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the healthcare fraud analytics market was arrived at after data triangulation from different approaches, as mentioned below. After each approach, the weighted average of the approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, and forecast the global healthcare fraud analytics industry with respect to solution type, delivery model, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall healthcare fraud analytics industry

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the healthcare fraud analytics industry with respect to six major regions—North America, Europe, Asia, Pacific, Latin America, and the Middle East & Africa

- To profile key market players in the healthcare fraud analytics industry and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments, such as mergers & acquisitions, product enhancements, and expansions of the leading players in the global healthcare fraud analytics industry

- To benchmark players within the healthcare fraud analytics industry using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Latin America healthcare fraud analytics industry into Brazil, Mexico, and other countries

- Further breakdown of the Rest of Asia Pacific healthcare fraud analytics industry into India, Australia, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Fraud Analytics Market

Which of the geographical segment is supposed to hold the major share of the global Healthcare Fraud Analytics Market?

Which factors are majorly influencing the global growth of Healthcare Fraud Analytics Market?