Healthcare Payer Services Market by Service Type (BPO (Claims, Front end, Provider, Product Development, Care Management, Billing, HR), ITO (Provider Network, Accounts, Analytics, Fraud), & KPO), End User (Public and Private) & Region - Global Forecast to 2027

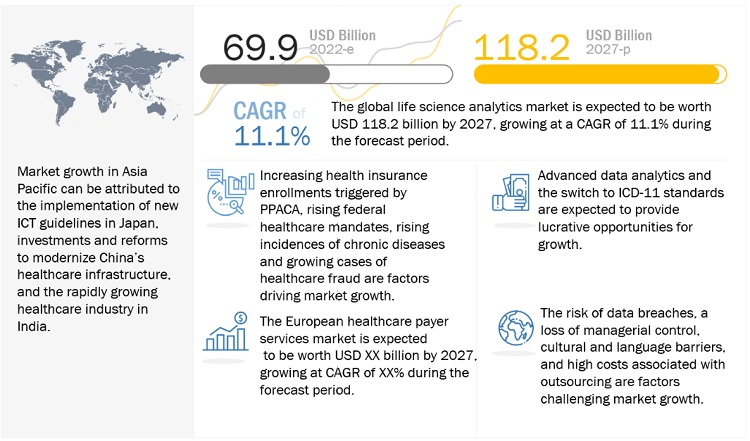

The global healthcare payer services market in terms of revenue was estimated to be worth $69.9 billion in 2022 and is poised to reach $118.2 billion by 2027, growing at a CAGR of 11.1% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Increased health insurance enrollment, rising incidences of healthcare fraud, increased usage of outsourcing, federal mandates, and rising cases of chronic diseases are driving growth in this market. However, the risks of data breaches, loss of managerial control, cultural and linguistic hurdles, and high outsourcing costs are projected to limit the market's growth to some extent.

Healthcare Payer Services Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare Payer Services Market Dynamics

Driver: Outsourcing of services to reduce costs and increase efficiency

Over the past few decades, healthcare costs have been extremely increasing. Rising health insurance costs fuel the rising cost of healthcare, the increasing need for healthcare services, the rising geriatric population worldwide, and the subsequent increase in chronic conditions. Additional factors contributing to healthcare expenses include wasteful use of resources, inflated claims, and administrative costs. Due to the increasing costs associated with healthcare, payers are focusing on leveraging the advantages of outsourcing. The need of outsourcing services to reduce costs and increase efficiency is one of the key growth drivers for the global market.

Restraint: Data breaches and loss of confidentiality

Working with healthcare payer servicing firms increases the danger of security breaches and data leaks. Extremely sensitive and legally protected information such as patient contact information, medical history, insurance plans, and illnesses can significantly impact demand. The healthcare provider could be extremely impacted due to a breach or leak of this data, as it would undermine patient confidence. Additionally, it can result in legal actions, costing the business more losses. Incidents of healthcare data breaches rose by 55% in 2020 over 2019. In 2020, there were around 600 breaches that affected over 26 million people.

Opportunity: Adoption of advanced data analytics

The increasing volume of patient data created by electronic records and various other sources, including connected technologies and devices, has also fueled the expansion of this industry. Since the data is unstructured and raw, analytics is necessary to draw useful conclusions. Business intelligence (BI) tools are used more frequently to interpret this data. Pharma companies, healthcare providers, payers, and patients, continuously produce digital data; using BI technologies not only suggests the best course of action to follow throughout the treatment process but also helps reduce the risk of disease. With a focus on managing medical loss ratios, payers must use data analytics to retain current members and implement effective care management programs. Many payers have started using analytics that extensively uses data, enables statistical and quantitative analysis, and uses predictive models to drive better fact-based decision-making. Due to the benefits of advanced data analytics and its applications, its adoption can be expected to increase; this provides major growth opportunities for the healthcare payer outsourcing market.

Challenge: Migration from legacy systems

A legacy system is an old method, technology, or application program that continues to be used, typically because it still caters to users’ needs, even though newer technologies and more efficient methods are available. Nearly all companies in the insurance sector offer the same goods. Therefore, one of the most crucial market differentiators is customer service. Bringing consumers closer to the business, providing facilities for easy information and transaction access, and ensuring continuous distributor support are new trends driving this market. Since these platforms are intrinsically limited and unable to support business simplicity and enterprise-wide data interpretation, the legacy landscape is rapidly shifting to support this business change. Legacy systems present difficulties since the application software is typically built in out-of-date programming languages and is typically mainframe-based. Moreover, there also exists a lack of resources with the knowledge of these systems.

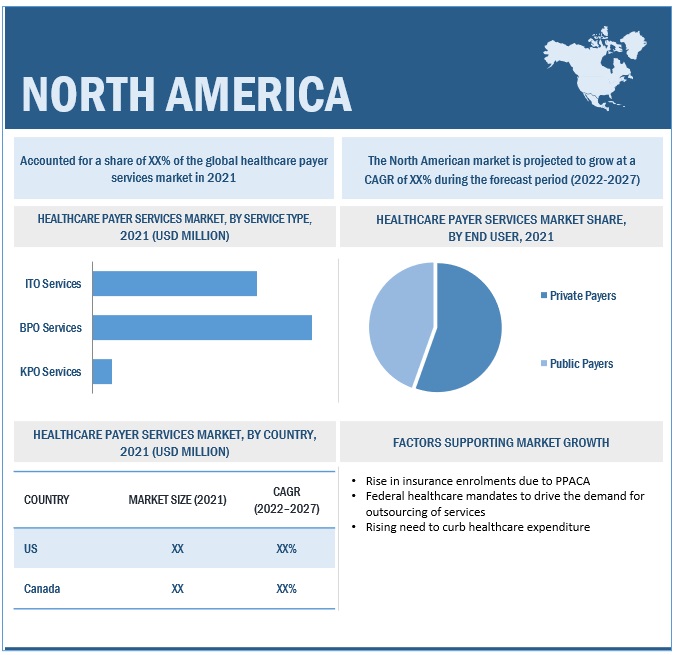

The BPO services segment accounted for the largest share of the healthcare payer services industry, by type of service.

On the basis of service type, the healthcare payer services market is bifurcated into ITO services, BPO services, and KPO services. The BPO services segment accounted for the largest market share. The large share of this segment is primarily attributed to the lower costs, higher efficiency, and ability to concentrate on essential business operations provided by BPO services. This greatly contributes to the fact that BPO services offer administration in important administrative domains. This thus makes it possible for payers to cut costs and accelerate time to market, which is primarily the target of any payer organisation.

The private payer segment is expected to grow at the highest CAGR in the healthcare payer services industry during the forecast period, by end user.

On the basis of the end user, the healthcare payer services market is bifurcated into private payers and public payers. During the forecast period, the private payer segment is expected to grow at the highest CAGR. The high growth of this segment is attributed to the rising competitiveness among private payers, the rising demand for private health insurance due to increasing healthcare costs, and the growing prevalence of chronic diseases.

North America was the most populous region in the healthcare payer services industry.

On the basis of region, the healthcare payer services market is bifurcated into North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America dominated the global market, followed by Asia Pacific. However, Asia Pacific is expected to grow at the highest CAGR during the forecast period. This highest growth in Asia Pacific can be attributed to the implementation of new ICT guidelines in Japan, investments and reforms to modernize China’s healthcare infrastructure, and the rapidly growing healthcare industry in India.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the healthcare payer services market include Accenture (Ireland) Cognizant (US) Tata Consultancy Services (India) XEROX Corporation (US) WNS (Holdings) Limited (India) NTT Data Corporation (Japan)< IQVIA Inc. (US) Mphasis (India) Genpact (US) Wipro (India) Infosys BPM (India) Firstsource Solutions (India) IBM Corporation (US) HCL Technologies (India) Solutions (US) Lonza (Switzerland)< Omega Healthcare (India) R1 RCM, INC. (US) Invensis Technologies (India) UnitedHealth Group (US) Parexel International Corporation (US)

Scope of the Healthcare Payer Services Industry

|

Report Metrics |

Details |

|

Market Revenue in 2022 |

$69.9 billion |

|

Projected Revenue by 2027 |

$118.2 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 11.1% |

|

Market Driver |

Outsourcing of services to reduce costs and increase efficiency |

|

Market Opportunity |

Adoption of advanced data analytics |

The research report categorizes the healthcare payer services market to forecast revenue and analyze trends in each of the following submarkets:

By Service Type

-

BPO Services

- Claims Management Services

- Integrated Front-End Services and Back-Office Operations

- Member Management Services

- Product Development and Business Acquisition Services

- Provider Management Services

- Care Management Services

- Billing And Accounts Management Services

- HR Services

-

ITO Services

- Claims Management Services

- Provider Network Management

- Billing and Accounts Management Services

- Fraud Management Analytics Services

- Other ITO Services

- KPO Services

By End User

- Private Payers

- Public Payers

Recent Developments of Healthcare Payer Services Industry

- In July 2021, Cognizant (US) collaborated with Royal Philips (Netherlands) to create Philips HealthSuite, a cloud-based platform, to deliver and maintain leading-edge digital health solutions, providing advanced connectivity and using big data to create actionable insights.

- In April 2021, Xerox Corporation (US) acquired Groupe CT (Canada), an independent document management provider in Eastern Canada, to accelerate a digital transformation roadmap by combining its document management services expertise and leadership with Xerox’s portfolio of workplace solutions to expand its reach in the North American market.

- In December 2020, Accenture (Ireland) acquired OpusLine (France) to help clients innovate and deliver digital innovation across their organizations.

- In June 2018, WNS (Holdings) Limited (India) entered into a global shared services partnership with Hyperion Insurance Group (UK), which enabled WNS to highlight its position as an industry leader in high-end global insurance BPM.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global healthcare payer services market?

The global healthcare payer services market boasts a total revenue value of $118.2 billion by 2027.

What is the estimated growth rate (CAGR) of the global healthcare payer services market?

The global healthcare payer services market has an estimated compound annual growth rate (CAGR) of 11.1% and a revenue size in the region of $69.9 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising number of healthcare insurance enrollments- Outsourcing of services to reduce healthcare costs- Stringent federal mandates to increase payer workloads- Increasing cases of healthcare fraud- Rising incidence of chronic diseasesRESTRAINTS- Data breaches and loss of confidentiality- High costs associated with outsourcing healthcare payer services- Loss of managerial controlOPPORTUNITIES- Adoption of advanced data analytics- Gradual shift to ICD-11 standards- Service portfolio expansion for vendors- Rising need for cost-effective solutionsCHALLENGES- Migration from legacy systems- Concerns regarding data security- Cultural differences and language barriers

-

5.3 PRICING ANALYSISHEALTHCARE PAYER SERVICES MARKET: BPO PRICING ANALYSISHEALTHCARE PAYER SERVICES MARKET: IT OUTSOURCING PRICING ANALYSIS

-

5.4 REGULATORY ANALYSISNORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST AND AFRICALATIN AMERICA

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 PORTER’S FIVE FORCES ANALYSIS

-

5.7 ECOSYSTEM ANALYSIS

-

5.8 TECHNOLOGY ANALYSISMACHINE LEARNINGARTIFICIAL INTELLIGENCEINTERNET OF THINGSBLOCKCHAINAUGMENTED REALITY

-

5.9 HEALTHCARE PAYER SERVICES MARKET: APPROACHES TO BPO SERVICESBUNDLED SERVICESFEE-FOR-SERVICEFLEXIBLE CONTRACTSBEST-SHORE

-

5.10 HEALTHCARE PAYER SERVICES MARKET: APPROACHES TO BPO MODELSMULTI-SOURCINGCAPTIVE CENTERHYBRID DELIVERY MODELPREFERRED PROVIDERSSTRATEGIC PARTNERSHIPSGLOBAL DELIVERY MODEL

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.12 RECESSION IMPACT ON HEALTHCARE PAYER SERVICES MARKETMACRO INDICATORS OF RECESSION

- 6.1 INTRODUCTION

-

6.2 BUSINESS PROCESS OUTSOURCING (BPO) SERVICESCLAIMS MANAGEMENT SERVICES- Voluntary agreements between healthcare providers & payers to fuel uptakeINTEGRATED FRONT-END SERVICES AND BACK-OFFICE OPERATIONS- Reduced overhead expenses and improved efficiency offered by outsourcing companies to support market growthMEMBER MANAGEMENT SERVICES- Ability to manage member-related eligibility data strategically across enterprises to drive marketPROVIDER MANAGEMENT SERVICES- Outsourcing provider management services to third-party vendors for operational efficiency to drive marketPRODUCT DEVELOPMENT AND BUSINESS ACQUISITION SERVICES (PDBA)- Rising focus on customer engagement and retention to drive marketCARE MANAGEMENT SERVICES- Ability to execute appropriate clinical coverage decisions to support market growthBILLING AND ACCOUNTS MANAGEMENT SERVICES- Reduced process time and minimal burden on payer staff to drive marketHR SERVICES- Outsourcing of human resource services for improved employee experiences to support market growth

-

6.3 INFORMATION TECHNOLOGY OUTSOURCING (ITO) SERVICESCLAIMS MANAGEMENT SERVICES- Rapid turnaround time with low errors & costs to drive outsourcing of operationsPROVIDER NETWORK MANAGEMENT SERVICES- Rising focus on core functions to support market growthBILLING AND ACCOUNTS MANAGEMENT SERVICES- Rising cash flow and low space requirements to drive marketFRAUD ANALYTICS SERVICES- Rising volume of fraudulent claims to drive adoption of analyticsOTHER ITO SERVICES

-

6.4 KNOWLEDGE PROCESS OUTSOURCING SERVICESRISING NUMBER OF FRAUD CLAIMS TO DRIVE KPO SERVICES

- 7.1 INTRODUCTION

-

7.2 PRIVATE PAYERSPROVISION OF CONSUMER-FOCUSED HEALTHCARE PLANS TO FUEL UPTAKE OF SOLUTIONS

-

7.3 PUBLIC PAYERSRISING NEED FOR DIVERSE HEALTHCARE IT SOLUTIONS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Increasing insurance enrolments and rising need to curb healthcare expenditure to drive marketCANADA- Rising focus on delivering improved services to drive market uptake

-

8.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- High adoption of EHR systems among primary care physicians to drive marketUK- Rising government support for healthcare digitalization to drive marketFRANCE- Shortage of skilled personnel to drive demandITALY- Rising need to improve patient care to drive adoption of healthcare payer solutionsSPAIN- High level of mobile phone penetration to fuel uptake of risk management compliance servicesREST OF EUROPE

-

8.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISINDIA- Availability of highly skilled personnel at low cost to support market growthJAPAN- Rising geriatric population to drive adoption of payer solutions for EHRsCHINA- Strong government support for HCIT to drive marketREST OF ASIA PACIFIC

-

8.5 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACT ANALYSIS

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 GEOGRAPHIC REVENUE ASSESSMENT OF KEY PLAYERS

- 9.4 MARKET RANKING

- 9.5 MARKET SHARE ANALYSIS

-

9.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

-

9.7 COMPANY EVALUATION QUADRANT FOR STARTUPSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

9.8 COMPETITIVE BENCHMARKINGCOMPANY PRODUCT FOOTPRINTCOMPANY REGION FOOTPRINT

-

9.9 COMPETITIVE SCENARIOSERVICE LAUNCHES & APPROVALSDEALSOTHER DEVELOPMENTS

-

10.1 KEY PLAYERSACCENTURE- Business overview- Services offered- Recent developments- MnM viewCOGNIZANT- Business overview- Services offered- Recent developments- MnM viewTATA CONSULTANCY SERVICES- Business overview- Services offered- Recent developments- MnM viewXEROX CORPORATION- Business overview- Services offered- Recent developments- MnM viewWNS (HOLDINGS) LTD.- Business overview- Services offered- Recent developments- MnM viewNTT DATA CORPORATION- Business overview- Services offered- Recent developmentsMPHASIS- Business overview- Services offered- Recent developmentsGENPACT LIMITED- Business overview- Services offered- Recent developmentsWIPRO LIMITED- Business overview- Services offered- Recent developmentsINFOSYS BPM- Business overview- Services offered- Recent developmentsFIRSTSOURCE SOLUTIONS- Business overview- Services offered- Recent developmentsDELL INC.- Business overview- Services offeredORACLE CORPORATION- Business overview- Services offered- Recent developmentsIBM- Business overview- Services offered- Recent developmentsIQVIA INC.- Business overview- Services offered- Recent developments

-

10.2 OTHER PLAYERSCONDUENT, INC.CONIFER HEALTH SOLUTIONS, LLCOMEGA HEALTHCAREINOVALONSAS INSTITUTE, INC.UNITEDHEALTH GROUPHCL TECHNOLOGIES LIMITEDPAREXEL INTERNATIONAL CORPORATIONR1RCM, INC.ALLSCRIPTS HEALTHCARE, LLC.

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 HEALTHCARE PAYER SERVICES MARKET: RISK ANALYSIS

- TABLE 3 HEALTHCARE PAYER SERVICES MARKET: AVERAGE SELLING PRICE FOR BPO SERVICES

- TABLE 4 HEALTHCARE IT INTEGRATION SOLUTIONS: PRICING MODEL

- TABLE 5 HEALTHCARE PAYER SERVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON END USERS FOR BUYING PROCESS (%)

- TABLE 7 KEY BUYING CRITERIA FOR HCIT COMPONENTS

- TABLE 8 HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 9 HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 10 HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 11 COMMERCIALLY AVAILABLE CLAIMS MANAGEMENT SOLUTIONS

- TABLE 12 HEALTHCARE PAYER SERVICES MARKET FOR BPO CLAIMS MANAGEMENT SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 13 HEALTHCARE PAYER SERVICES MARKET FOR BPO INTEGRATED FRONT-END SERVICES AND BACK-OFFICE OPERATIONS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 14 COMMERCIALLY AVAILABLE MEMBER MANAGEMENT SOLUTIONS

- TABLE 15 HEALTHCARE PAYER SERVICES MARKET FOR BPO MEMBER MANAGEMENT SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 16 HEALTHCARE PAYER SERVICES MARKET FOR BPO PROVIDER MANAGEMENT SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 17 HEALTHCARE PAYERS MARKET FOR BPO PRODUCT DEVELOPMENT AND BUSINESS ACQUISITION SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 18 HEALTHCARE PAYER SERVICES MARKET FOR BPO CARE MANAGEMENT SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 19 HEALTHCARE PAYER SERVICES MARKET FOR BPO BILLING AND ACCOUNTS MANAGEMENT SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 20 HEALTHCARE PAYER SERVICES MARKET FOR BPO HR SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 21 HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 22 HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 23 HEALTHCARE PAYER SERVICES MARKET FOR ITO CLAIMS MANAGEMENT SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 24 HEALTHCARE PAYER SERVICES MARKET FOR ITO PROVIDER NETWORK MANAGEMENT SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 25 HEALTHCARE PAYER SERVICES MARKET FOR ITO BILLING AND ACCOUNTS MANAGEMENT SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 26 HEALTHCARE PAYER SERVICES MARKET FOR ITO FRAUD ANALYTICS SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 27 HEALTHCARE PAYER SERVICES MARKET FOR OTHER ITO SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 28 HEALTHCARE PAYER SERVICES MARKET FOR KPO SERVICES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 29 HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 30 HEALTHCARE PAYER SERVICES MARKET FOR PRIVATE PAYERS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 31 HEALTHCARE PAYER SERVICES MARKET FOR PUBLIC PAYERS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 32 HEALTHCARE PAYER SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 33 NORTH AMERICA: HEALTHCARE PAYER SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 34 NORTH AMERICA: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 35 NORTH AMERICA: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 36 NORTH AMERICA: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 37 NORTH AMERICA: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 38 US: MACROECONOMIC INDICATORS FOR HEALTHCARE

- TABLE 39 US: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 40 US: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 41 US: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 42 US: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 43 CANADA: MACROECONOMIC INDICATORS FOR HEALTHCARE

- TABLE 44 CANADA: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 45 CANADA: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 46 CANADA: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 47 CANADA: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 48 EUROPE: HEALTHCARE PAYER SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 49 EUROPE: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 50 EUROPE: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 51 EUROPE: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 52 EUROPE: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 53 GERMANY: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 54 GERMANY: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 55 GERMANY: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 56 GERMANY: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 57 UK: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 58 UK: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICE, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 59 UK: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 60 UK: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 61 FRANCE: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 62 FRANCE: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 63 FRANCE: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 64 FRANCE: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 65 ITALY: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 66 ITALY: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 67 ITALY: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 68 ITALY: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 69 SPAIN: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 70 SPAIN: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 71 SPAIN: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 72 SPAIN: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 73 REST OF EUROPE: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 74 REST OF EUROPE: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 75 REST OF EUROPE: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 76 REST OF EUROPE: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 77 ASIA PACIFIC: HEALTHCARE PAYER SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 78 ASIA PACIFIC: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 79 ASIA PACIFIC: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 80 ASIA PACIFIC: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 82 INDIA: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 83 INDIA: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 84 INDIA: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 85 INDIA: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 86 JAPAN: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 87 JAPAN: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 88 JAPAN: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 89 JAPAN: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 90 CHINA: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 91 CHINA: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 92 CHINA: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 93 CHINA: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD THOUSAND)

- TABLE 96 REST OF ASIA PACIFIC: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 98 REST OF THE WORLD: HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

- TABLE 99 REST OF THE WORLD: HEALTHCARE PAYER SERVICES MARKET FOR BPO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 100 REST OF THE WORLD: HEALTHCARE PAYER SERVICES MARKET FOR ITO SERVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 101 REST OF THE WORLD: HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 102 HEALTHCARE PAYER SERVICES MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 103 HEALTHCARE PAYER SERVICES MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 104 COMPANY PRODUCT FOOTPRINT

- TABLE 105 COMPANY REGION FOOTPRINT

- TABLE 106 HEALTHCARE PAYER SERVICES MARKET: KEY SERVICE LAUNCHES & APPROVALS

- TABLE 107 HEALTHCARE PAYER SERVICES MARKET: KEY DEALS

- TABLE 108 HEALTHCARE PAYER SERVICES MARKET: OTHER KEY DEVELOPMENTS

- TABLE 109 ACCENTURE: BUSINESS OVERVIEW

- TABLE 110 COGNIZANT: BUSINESS OVERVIEW

- TABLE 111 TATA CONSULTANCY SERVICES: BUSINESS OVERVIEW

- TABLE 112 XEROX CORPORATION: BUSINESS OVERVIEW

- TABLE 113 WNS (HOLDINGS) LTD.: BUSINESS OVERVIEW

- TABLE 114 NTT DATA CORPORATION: BUSINESS OVERVIEW

- TABLE 115 MPHASIS: BUSINESS OVERVIEW

- TABLE 116 GENPACT: BUSINESS OVERVIEW

- TABLE 117 WIPRO LIMITED: BUSINESS OVERVIEW

- TABLE 118 INFOSYS BPM: BUSINESS OVERVIEW

- TABLE 119 FIRSTSOURCE SOLUTIONS: BUSINESS OVERVIEW

- TABLE 120 DELL INC.: BUSINESS OVERVIEW

- TABLE 121 ORACLE CORPORATION: BUSINESS OVERVIEW

- TABLE 122 IBM: BUSINESS OVERVIEW

- TABLE 123 IQVIA INC.: BUSINESS OVERVIEW

- FIGURE 1 HEALTHCARE PAYER SERVICES MARKET: RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 CAGR PROJECTION FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022–2027)

- FIGURE 7 CAGR PROJECTION: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 HEALTHCARE PAYER SERVICES MARKET, BY SERVICE TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 HEALTHCARE PAYER SERVICES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 HEALTHCARE PAYER SERVICES MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 12 RISING NEED TO CURB HEALTHCARE COSTS TO DRIVE MARKET

- FIGURE 13 JAPAN TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 14 BPO SEGMENT IN THE US ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 HEALTHCARE PAYER SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 HEALTHCARE PAYER SERVICES MARKET: VALUE-CHAIN ANALYSIS

- FIGURE 18 HIGH INTENSITY OF COMPETITIVENESS AMONG PLAYERS

- FIGURE 19 HEALTHCARE PAYER SERVICES MARKET: ECOSYSTEM ANALYSIS MAP

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 21 KEY BUYING CRITERIA FOR HEALTHCARE PAYER COMPONENTS

- FIGURE 22 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 23 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 24 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 25 HEALTHCARE PAYERS SERVICES MARKET: KEY DEVELOPMENTS (2019–2022)

- FIGURE 26 HEALTHCARE PAYER SERVICES MARKET: REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 27 HEALTHCARE PAYER SERVICES MARKET: GEOGRAPHIC REVENUE MIX

- FIGURE 28 HEALTHCARE PAYER SERVICES MARKET: MARKET RANKING OF LEADING COMPANIES (2022)

- FIGURE 29 HEALTHCARE PAYER SERVICES MARKET: MARKET SHARE ANALYSIS

- FIGURE 30 HEALTHCARE PAYER SERVICES MARKET: COMPANY EVALUATION QUADRANT (2021)

- FIGURE 31 HEALTHCARE PAYER SERVICES MARKET: COMPANY EVALUATION QUADRANT FOR STARTUPS (2021)

- FIGURE 32 ACCENTURE: COMPANY SNAPSHOT (2022)

- FIGURE 33 COGNIZANT: COMPANY SNAPSHOT (2021)

- FIGURE 34 TATA CONSULTANCY SERVICES: COMPANY SNAPSHOT (2021)

- FIGURE 35 XEROX CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 36 WNS (HOLDINGS) LTD.: COMPANY SNAPSHOT (2021)

- FIGURE 37 NTT DATA CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 38 MPHASIS: COMPANY SNAPSHOT (2021)

- FIGURE 39 GENPACT: COMPANY SNAPSHOT (2020)

- FIGURE 40 WIPRO LIMITED: COMPANY SNAPSHOT (2022)

- FIGURE 41 INFOSYS BPM: COMPANY SNAPSHOT (2022)

- FIGURE 42 FIRSTSOURCE SOLUTIONS: COMPANY SNAPSHOT (2021)

- FIGURE 43 DELL INC.: COMPANY SNAPSHOT (2021)

- FIGURE 44 ORACLE CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 45 IBM: COMPANY SNAPSHOT (2021)

- FIGURE 46 IQVIA INC.: COMPANY SNAPSHOT (2021)

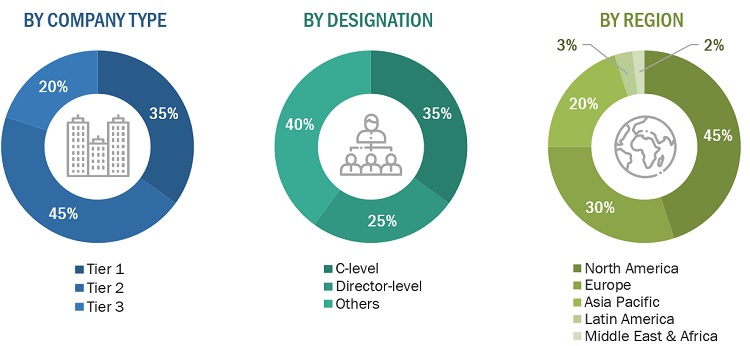

The study involved four major activities in estimating the current size of the global healthcare payer services market. Exhaustive secondary research was done to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing values with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was mainly used to identify and collect information for the extensive, technical, market-oriented, and commercial study of the market. Secondary sources include directories; databases such as Bloomberg Business, Factiva, and Wall Street Journal; white papers; and annual reports were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess the prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of primary respondents:

Note: Tiers are defined based on a company’s total revenue. As of 2021, Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 = <USD 500 million.

* Others include sales managers, marketing managers, and product manager

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the healthcare payer services market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The revenue generated from the sale of healthcare payer services solutions and services by leading players has been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the market based on service type, end user, and region.

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the global market with respect to five geographic regions—North America, Europe, the Asia Pacific, and the Rest of the World

- To profile key players and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as agreements, partnerships, collaborations, acquisitions, service launches, and R&D activities of leading players

- To analyze the impact of the recession on the healthcare payers market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs.

The following customization options are available for this report.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the RoAPAC market into South Korea, Australia, New Zealand, and others

- Further breakdown of the RoE market into Belgium, Russia, the Netherlands, Switzerland, and others

- Further breakdown of the RoW market into Latin America (LATAM), Middle East, and Africa (MEA)

Company Information

- Detailed analysis and profiling of additional market players (Up to Five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Payer Services Market