North America Healthcare IT Market

North America Healthcare IT Market by Solution (Provider, Payer (Clinical (EHR, PHM, PACS & VNA, Telehealth, RCM, CDSS), Nonclinical (Analytics, Pharmacy, Interoperability)), Service (Claim, Billing)), End User (Hospital, Payer) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

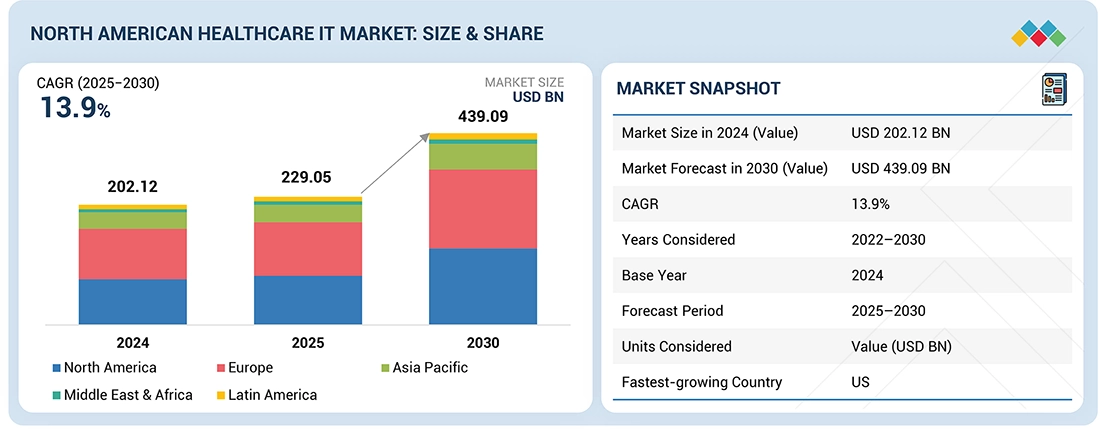

The global North America healthcare IT market, valued at USD 202.12 billion in 2024, stood at USD 229.05 billion in 2025 and is projected to advance at a resilient CAGR of 13.9% from 2025 to 2030, culminating in a forecast valuation of USD 439.09 billion by the end of the period. The growth of the North America Healthcare IT market is driven by technological advancements, regulatory support, and increasing demand for digital health solutions.

KEY TAKEAWAYS

-

BY SOLUTION & SERVICEBased on Solution & Services the North American Healthcare IT market is segemented into Healthcare Provider Solutions , Healthcare Payer Solutions and HCIT Outsourcing Services. The Healthcare Provider Solutions segment accounted for the largest share of the North American healthcare IT market in 2024. The growth is driven by increasing adoption of electronic health records (EHRs), telemedicine platforms, and integrated care management solutions by hospitals and clinics.

-

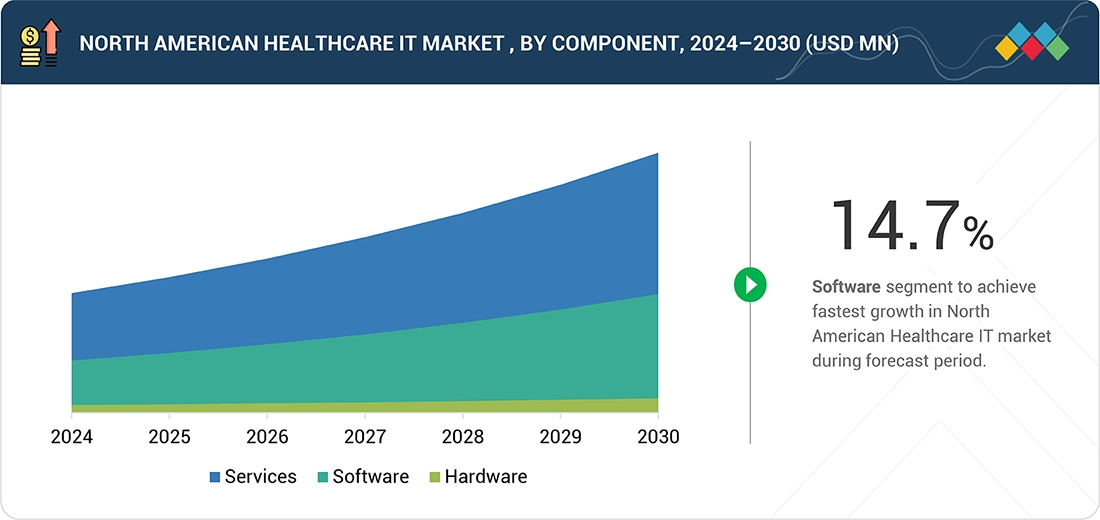

BY COMPONENTBased on Component the North American Healthcare IT market is segemented into Services, Software and Hardware. In 2024, the services segment held the largest share of this market. This growth can be attributed to the increasing need for the implementation, integration, support, and maintenance of complex healthcare IT systems across hospitals, clinics, and payer organizations.

-

BY END USERBased on End User the North American Healthcare IT market is segemented into healthcare providers, healthcare payers and life science industry. The healthcare providers segment accounted for the largest share in the North American healthcare IT market, driven by several key factors. Hospitals, clinics, and ambulatory care centers are increasingly investing in IT solutions to manage the growing burden of chronic diseases and to meet rising patient expectations for convenience and quality of care.

-

BY COUNTRYBased on Country the North American Healthcare IT market is segemented into US and Canada. In 2024, the US accounted for the largest share of the North American healthcare IT market. This dominance can be attributed to its strong healthcare infrastructure, heightened awareness of the benefits of digital health, and the widespread adoption of advanced technologies such as artificial intelligence (AI) and cloud solutions.

-

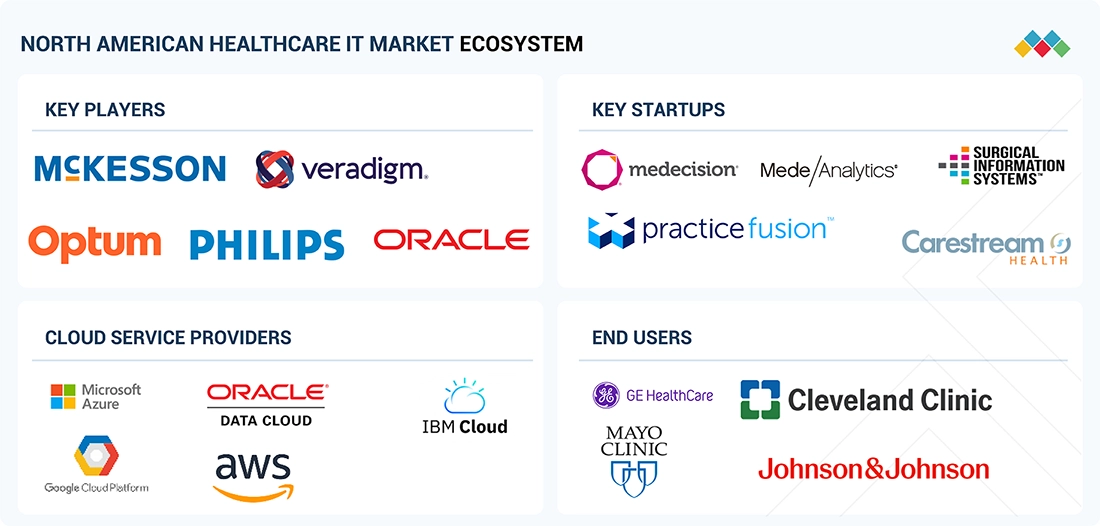

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Orcale (US), Veradigm Inc. (US), and McKesson Corporation (US) have entered into a number of agreements and partnerships to cater to the growing demand for North American Healthcare IT across innovative applications.

The growth of North American Healthcare IT market can be attributed to increasing awareness about digital health, government mandates, financial incentives for adopting healthcare IT solutions, and a shift toward value-based care. The rising use of big data, high returns on IT investments, and the growing incidence of chronic diseases further drive demand. Additionally, the adoption of cloud-based solutions and advanced technologies like AI and IoT create new opportunities for market expansion.

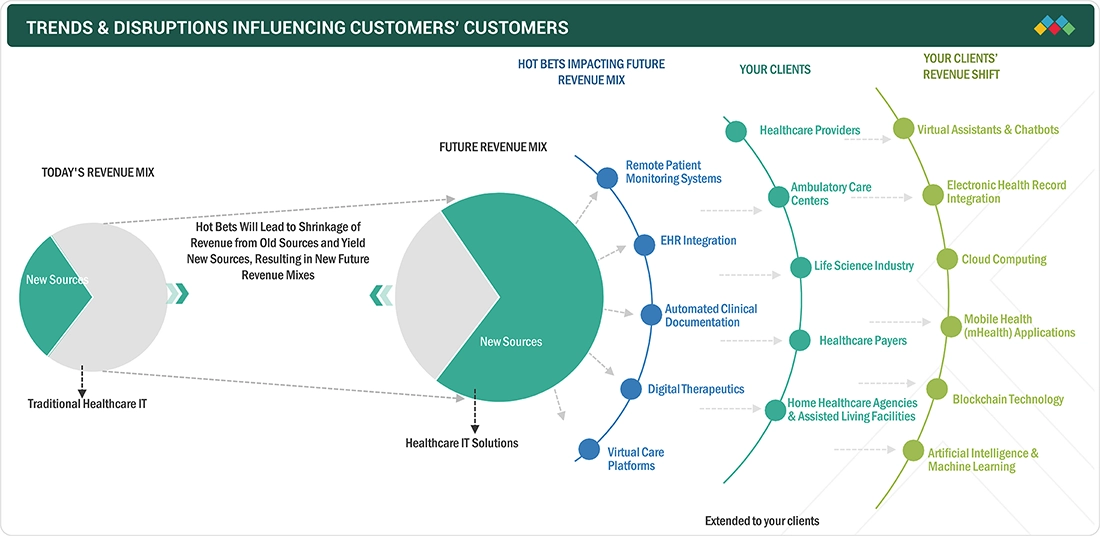

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of North America Healthcare vendors, and target applications are clients of North America Healthcare vendors. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of aerospace materials manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing need to curtail escalating healthcare costs

-

Favorable government mandates and support for healthcare IT solutions

Level

-

High cost of deployment of healthcare IT solutions for small and mid-sized organizations

Level

-

Increasing use of healthcare IT solutions in outpatient care facilities

-

Growing inclination towards home healthcare

Level

-

Lack of integration of healthcare IT solutions

-

Increased data security concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing need to curtail escalating healthcare costs

The overall cost of healthcare delivery in North America has continued to climb significantly, driven by rising insurance premiums, increasing demand for advanced and quality healthcare services, an aging population, and the growing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and obesity. According to the Centers for Medicare & Medicaid Services (CMS), US health spending reached approximately USD 4.9 trillion in 2023, up 7.5% from the previous year, accounting for about 17.6% of the national GDP. This growth outpaced overall economic expansion and underscores systemic challenges such as high administrative overheads, frequent patient readmissions, and inefficiencies in medical billing and records management.

Restraint: High cost of deployment of healthcare IT solutions for small and mid-sized organizations

The cost of various healthcare IT solutions is considerably high, making it difficult for small and medium-sized healthcare organizations to implement them. This is mainly due to difficulties in implementing multiple networks with health setups, a lack of wireless connectivity options, and the need to install subsequent security layers to avoid data breaches. Moreover, support and maintenance services, which include modifying and upgrading software as per changing user requirements, represent a recurring expenditure that accounts for a large share of the total cost of ownership.

Opportunity: Increasing use of healthcare IT solutions in outpatient care facilities

In response to the rising pressures on health systems to lower the cost of care, the industry is shifting towards outpatient settings to reduce care costs. It is estimated that a procedure performed in an outpatient surgery center costs 30–60% less than in inpatient hospital settings. In addition, convenience is another important factor driving the rise of ambulatory care. With the increase in outpatient settings and patient influx, the demand and usage of HCIT solutions in outpatient settings will increase.

Challenge: Lack of integration of healthcare IT solutions

A key challenge in the North American healthcare IT market is the lack of integration across disparate IT systems. Many healthcare providers operate multiple platforms for electronic health records, telemedicine, and patient management, which often do not communicate seamlessly. This fragmentation leads to inefficiencies, data silos, and difficulties in delivering coordinated care, slowing the overall digital transformation of the healthcare ecosystem.

: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cloud-based healthcare solutions for policy administration, claims, analytics, and cloud computing. | Improves interoperability, automates workflows, and enhances patient and member experiences. |

|

Integrated EHR, real-world data, and payer-provider analytics platforms. | Strengthens decision-making, streamlines workflows, and supports cost-efficient, data-driven care. |

|

Pharmacy and specialty practice solutions, including Drug Spend Analysis, MyHealthMart, and iKnowMed EHR. | Optimizes medication management, financial control, and oncology operations. |

|

Imaging and telehealth systems like IntelliSpace PACS and Enterprise Telehealth programs. | Enhances remote monitoring, diagnostic accuracy, and care coordination. |

|

Data analytics, IT performance, and pharmacy benefit management platforms. | Boosts efficiency, improves access to medications, and supports population health outcomes. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The North American healthcare IT market is rapidly evolving as healthcare providers, payers, and technology vendors adopt advanced digital solutions to enhance care delivery, operational efficiency, and patient outcomes. The ecosystem encompasses electronic health records (EHRs), telehealth platforms, health information exchange (HIE) systems, analytics and business intelligence tools, and AI-driven clinical decision support solutions. Integration with emerging technologies such as artificial intelligence, cloud computing, and remote patient monitoring is enabling real-time data access, predictive insights, and improved care coordination across healthcare settings. Simultaneously, regulatory support and interoperability initiatives are fostering connected systems that streamline information sharing, enhance collaboration, and enable patient-centered care. Together, these elements are shaping a dynamic North American healthcare IT ecosystem that supports efficient, data-driven, and high-quality healthcare delivery.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aerospace Materials Market, By Solution & Service

In 2024, the Healthcare Provider Solutions segment dominated the North American healthcare IT market, driven by the growing adoption of electronic health records (EHRs), telehealth platforms, and integrated care management systems across hospitals and clinics. EHR systems remain central for patient data management and care coordination, while telemedicine solutions are expanding access to remote care and improving patient engagement. Analytics and clinical decision support tools enhance operational efficiency and inform evidence-based treatment, while cybersecurity and IT infrastructure services ensure data protection and system reliability. Collectively, these solutions and services are enabling healthcare providers to deliver more efficient, patient-centered, and compliant care.

Aerospace Materials Market, By Component

In 2024, the Services segment held the largest share of the North American healthcare IT market, driven by the growing need for professional expertise to manage complex healthcare technologies. Healthcare organizations increasingly rely on advisory, implementation, and maintenance services to optimize the deployment of electronic health records (EHRs), telemedicine platforms, and data analytics systems. These services support workflow standardization, compliance with regulations, and ongoing system upgrades, enabling providers to focus on delivering high-quality care while ensuring their IT infrastructure remains secure, efficient, and scalable.

Aerospace Materials Market, By End User

In 2024, healthcare providers led the North American healthcare IT market, reflecting their critical role in driving technology adoption. Hospitals, specialty clinics, and outpatient facilities are investing heavily in IT infrastructure to streamline clinical workflows, improve patient outcomes, and support population health initiatives. The emphasis on interoperability, real-time data access, and secure information exchange has made providers the primary consumers of healthcare IT solutions and services in the region.

REGION

US to be fastest-growing Country in North American healthcare IT market during forecast period

The US is expected to register the highest CAGR in the North American healthcare IT market during the forecast period, driven by rapid adoption of digital health solutions, increasing investments in AI-driven healthcare technologies, and government initiatives promoting interoperability and value-based care. Leading hospitals, health systems, and technology vendors in the US are implementing electronic health records (EHRs), telehealth platforms, and advanced analytics to improve patient outcomes, streamline operations, and ensure regulatory compliance. Growing demand for remote patient monitoring, predictive analytics, and personalized care is further accelerating the adoption of healthcare IT solutions across the country.

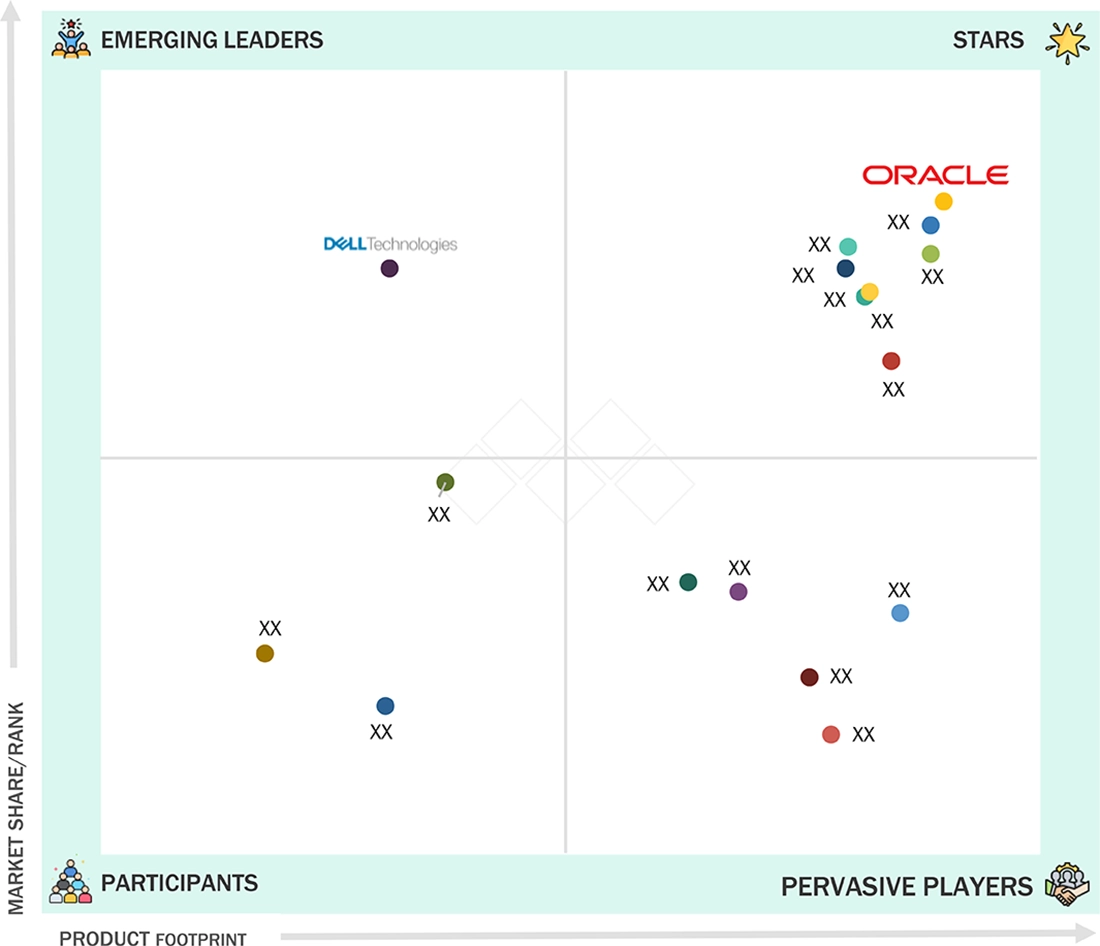

: COMPANY EVALUATION MATRIX

In the North American healthcare IT market matrix, Oracle (Star) leads with a strong market presence and comprehensive suite of healthcare IT solutions, driven by its robust electronic health records (EHR) systems, analytics platforms, and cloud-based offerings widely adopted across hospitals and health systems. Dell Inc. (Emerging Leader) is gaining visibility with its specialized IT infrastructure, data management solutions, and healthcare-focused services, strengthening its position through innovation and targeted offerings for providers. While Oracle dominates through scale and a diversified portfolio, Dell Inc. shows significant potential to move toward the leaders’ quadrant as demand for secure, integrated, and high-performance healthcare IT infrastructure continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 202.12 Billion |

| Market Forecast in 2030 (Value) | USD 439.09 Billion |

| Growth Rate | CAGR of 13.9% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | US, Canada |

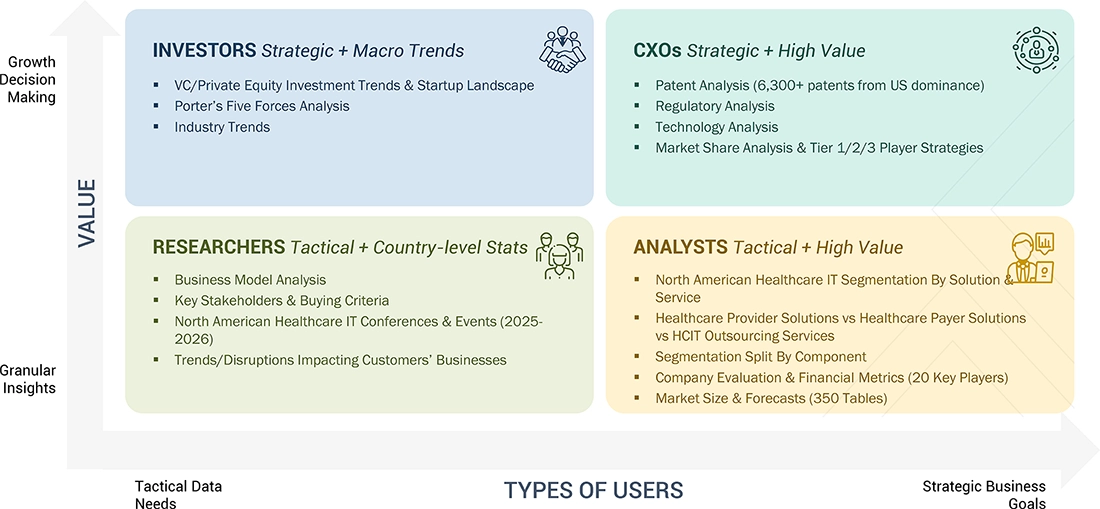

WHAT IS IN IT FOR YOU: REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Healthcare IT Players | Competitive profiling of healthcare IT vendors (EHR, ERP, telehealth, analytics), Market share of top players, 2*2 matrix | Benchmarking of vendor capabilities across large hospital networks |

| Digital Health Startups | Top startups in Norht America region, analysis of offerings mHealth apps, remote patient monitoring, and digital therapeutics | Evaluation of switching costs between platforms |

| Payers & Insurance Providers | Economic and technical assessment of cloud-based claims management, policy administration, and analytics platforms | Forecast adoption of AI-driven automation and predictive analytics |

| Medical Device Vendors | Benchmarking of connected medical device integration and interoperability with hospital systems | Mapping of adoption trends for IoT-enabled devices |

| Government & Regulatory Agencies | Policy impact analysis and regulatory compliance benchmarking across EHR and health IT systems | Assessment of data privacy, cybersecurity, and reporting requirements |

RECENT DEVELOPMENTS

- May 2025 : Oracle, the Cleveland Clinic, and G42 formed a partnership to create an AI-based healthcare delivery platform. This platform will utilize Oracle’s cloud and AI technologies, Cleveland Clinic’s clinical expertise, and G42’s sovereign AI infrastructure. The goal is to improve patient outcomes, facilitate precision medicine, and transition healthcare from a reactive to a proactive approach, initially focusing on populations in the US and UAE.

- February 2025 : Athenahealth formed a partnership with Abridge AI, Inc. to enhance the Ambient Notes feature within the athenahealth athenaOne platform by integrating Abridge's AI-powered ambient listening and documentation capabilities.

- December 2024 : Koninklijke Philips N.V. expanded its partnership with Sim&Cure to enhance treatments for brain aneurysms by integrating the Sim&Size software into its Azurion platform, making the procedures more efficient and precise.

- October 2024 : GE HealthCare partnered with Blackford to integrate AI solutions into its imaging systems. This will help radiologists manage workloads more effectively and improve patient diagnosis.

- September 2024 : Mecwacare partnered with Cognizant to achieve digital transformation aimed at improving healthcare services and enhancing experiences for clients, families, and staff in the aged care sector.

Table of Contents

Methodology

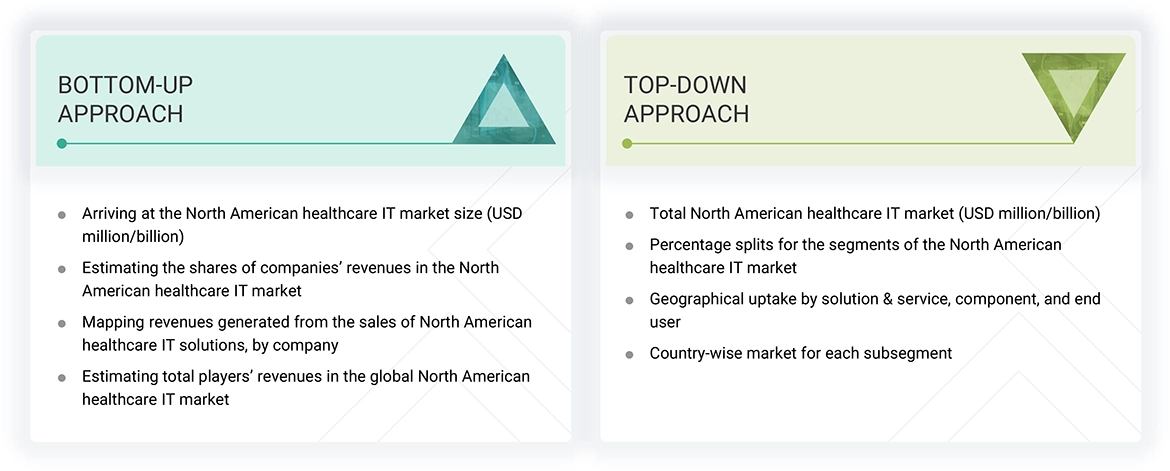

The study involved five major activities to estimate the current size of the North America Healthcare IT market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and market sizes with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources were utilized, including annual reports, press releases, and investor presentations from companies, as well as white papers, certified publications, and articles authored by recognized experts. Additionally, reputable websites, regulatory bodies, and databases such as D&B Hoovers, Bloomberg Business, and Factiva were referenced. This comprehensive approach aimed to gather information for the study of the North America healthcare IT market.

The research facilitated the collection of crucial data regarding the sector's leading companies, as well as market classification and segmentation based on industry trends, geographic regions, and significant market developments. Furthermore, a database of key industry leaders was created using the findings from this secondary research.

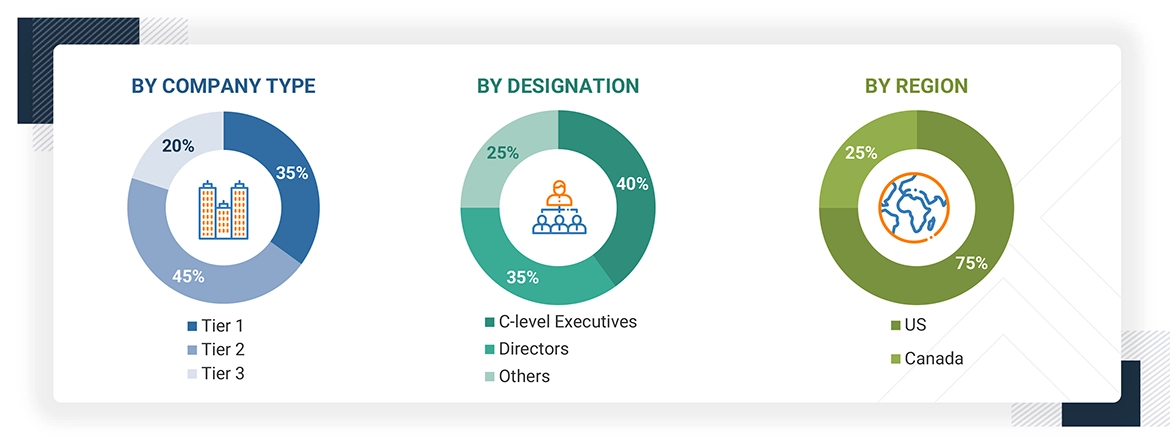

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the North America healthcare IT market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of healthcare IT solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

A breakdown of the primary respondents is provided below:

Note 1: Others include sales, marketing, and product managers.

Note 2: Tiers are defined based on a company’s total revenue. As of 2025: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the North America healthcare IT market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size, using the market size estimation processes, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the North America healthcare IT market.

Market Definition

Healthcare information technology (HCIT) involves designing, developing, creating, using, and maintaining information systems related to the healthcare industry. Healthcare IT digitizes existing paper-based healthcare systems, ensuring effective care and patient safety. The solutions encompass the use of software, or infrastructure to record, store, protect, and retrieve clinical, administrative, or financial information by healthcare providers, payers, or other end users.

Stakeholders

- Healthcare IT solution providers

- Healthcare IT vendors

- Healthcare IT service providers

- Healthcare payers

- Academic research institutes

- Government institutes

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the North America healthcare IT market based on solution & service, component, end user, and region

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall North America healthcare IT market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze the market structure profile of the key players of the North America healthcare IT market and comprehensively analyze their core competencies

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, agreements, and sales contracts in the North America healthcare IT market during the forecast period

Key Questions Addressed by the Report

Which are the top industry players in the global North American healthcare IT market?

Top players include Oracle (US), Veradigm, Inc. (US), McKesson Corporation (US), Koninklijke Philips N.V. (Netherlands), Optum, Inc. (US), Cognizant (US), and GE Healthcare (US).

Which solutions & services have been included in the North American healthcare IT market report?

The report includes:

- Healthcare provider solutions

- Healthcare payer solutions

- Healthcare outsourcing services

Which country dominates the global North American healthcare IT market?

The United States holds the largest share of the market during the forecast period.

Which end-user segments have been included in the North American healthcare IT market report?

The report includes:

- Healthcare Providers

- Healthcare Payers

- Life Science Industry

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Healthcare IT Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Healthcare IT Market