Heat Pump Water Heater Market by Type (Air-to-Air, Air-to-Water, Water Source, Geothermal, Hybrid), Storage Tank (Up to 500 L, 500-1,000 L, Above 1,000 L), Refrigerant Type (R410A, R407C, R744), Rated Capacity, End User Region - Global Forecast to 2028

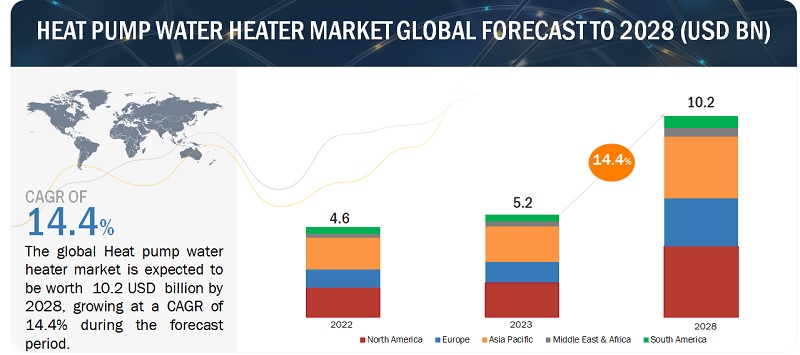

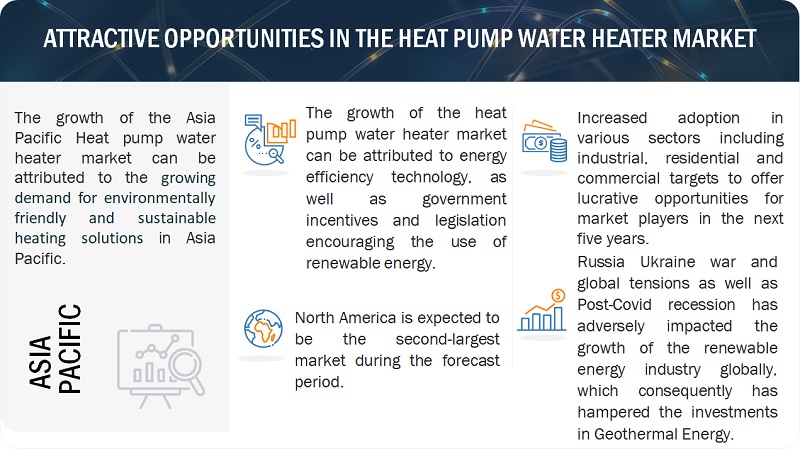

The global heat pump water heater market is estimated to grow from USD 5.2 billion in 2023 to USD 10.2 billion by 2028; it is expected to record a CAGR of 14.4% during the forecast period. Heat pump water heaters are distinguished by their ability to harness air, water, or geothermal heat for hot water production, establishing them as a compelling option for energy-efficient water heating solutions. The global market for these systems has experienced consistent growth, propelled by rising demand and favorable regulatory environments. The incorporation of heat pump water heaters with renewable energy sources, including solar panels, plays a pivotal role in their widespread adoption. This integration facilitates the effective utilization of surplus renewable energy to heat water, diminishing dependence on fossil fuels. This strategic alignment with the worldwide objective of transitioning to cleaner and more sustainable energy solutions serves as a driving force behind the continued expansion of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Heat Pump Water Heater Market Dynamics

Driver: Rising demand for residential and commercial water heating solutions

The increasing demand for residential and commercial water heating solutions is a transformative force shaping the global heating industry. This upsurge reflects broader societal changes driven by factors such as population growth, urbanization, and heightened expectations for comfort and convenience. Specifically within the heat pump water heater market, this trend acts as a significant catalyst, influencing product development, market strategies, and the overall trajectory of the industry. Governments and regulatory bodies are increasingly recognizing the environmental impact of energy-intensive systems and are incentivizing the adoption of eco-friendly technologies. This regulatory support, manifesting through energy efficiency standards, subsidies, and incentives, further propels the demand for heat pump water heaters. The market's response to these regulatory measures indicates a broader societal shift towards sustainable living and responsible consumption.

Technological advancements play a pivotal role in meeting the escalating demand for water heating solutions. The heat pump water heater market is witnessing continuous innovation in terms of system efficiency, integration with smart technologies, and adaptability to various climatic conditions. Enhanced compressor technologies, advanced heat exchanger designs, and improved control systems contribute to higher performance standards, making heat pump water heaters more versatile and appealing to a broader consumer base. The increasing demand for water heating solutions also presents an opportunity for market players to engage in strategic partnerships and collaborations. Collaborations between manufacturers, energy providers, and construction companies can lead to integrated solutions addressing not only the heating needs of consumers but also broader energy efficiency goals. Partnerships with technology companies can facilitate the incorporation of smart features, enhancing the usability and control of water heating systems.

Restraint: Variability in performance based on climate conditions

Heat pump water heaters excel in extracting ambient heat from the surrounding air, making them highly efficient in moderate and warmer climates. However, their effectiveness is significantly impacted by colder temperatures, presenting a climatic sensitivity that poses challenges for regions enduring extended periods of low temperatures. This challenge may result in diminished efficiency and increased energy consumption. Climate variability's impact on heat pump water heater performance extends beyond operational efficiency; it also affects the overall system lifespan. In regions with frequent temperature drops below freezing, components such as the compressor and heat exchanger may experience additional stress and wear. This can result in increased maintenance requirements and potentially shorten the lifespan of the equipment, leading to higher long-term costs for consumers and reduced system reliability.

Opportunities: Integration of IoT with heat pump water heaters

It is anticipated that heat pump water heaters equipped with Internet of Things (IoT) capabilities will provide remote diagnostics, predictive maintenance, and real-time monitoring. Smart thermostats that monitor environmental changes and communicate with the heat pump water heater equipment are a component of Internet of Things (IoT)-enabled heat pump water heater systems. Heat pump water heater systems can use data to continuously enhance performance and save energy thanks to sophisticated software. For example, the installation of sensors, software, a network, and a cloud-based data store is part of building management systems (BMS). Among the things they oversee are boilers, chillers, pumps, rooftop units, heat pumps, VAV boxes, radiators, fan coil units, exhaust fans, and security and safety procedures. Facility managers can maintain heat pump water heater systems more quickly and affordably thanks to these systems. Integration with IoT reduces system failure by tracking abnormalities in heat pump water heaters. Consequently, given the integration of IoT with heat pump water heaters, there are numerous opportunities for market expansion. Among the things they oversee are boilers, chillers, pumps, rooftop units, heat pumps, VAV boxes, radiators, fan coil units, exhaust fans, and security and safety procedures. These systems save time and money by making it easier for facility managers to maintain heat pump water heater systems. By tracking anomalies in heat pump water heaters, integration with IoT helps to lower system failure. Therefore, there are a lot of prospects for market expansion given the integration of IoT with heat pump water heaters.

Challenges: High installation costs

Heat pump water heater systems play a pivotal role in enhancing energy efficiency, cutting energy expenses, and mitigating carbon emissions across residential, commercial, and industrial settings. These systems come in two main types: aerothermal heat pumps (air source heat pumps) and geothermal heat pumps (ground source heat pumps). Air source heat pump water heaters are more prevalent, offering cost-effectiveness and efficiency suitable for most homes and small commercial structures. On the other hand, geothermal heat pump water heaters tend to be pricier due to their underground installation, involving the placement of high-density polyethylene pipes. Despite the longer installation period, geothermal systems boast enhanced efficiency and are ideal for larger buildings.

The installation expenses for heat pump water heater equipment in residential, commercial, and industrial contexts hinge on various factors. In residential applications, costs are influenced by home size, additional ductwork, equipment type, and the British Thermal Unit (BTU) value of the system. The installation cost of a heat pump water heater is also contingent on factors such as complexity, type, brand, and size of the heat pump. Consequently, the higher installation costs pose a challenge that may impede the growth of the heat pump market.

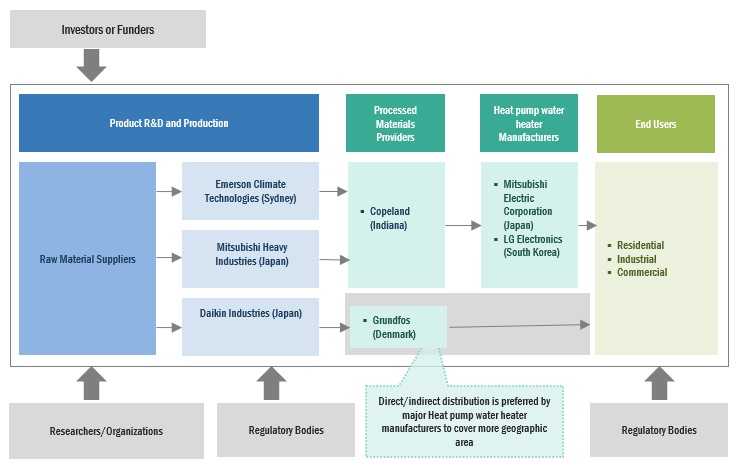

Heat pump water heater market Ecosystem

In the heat pump water heater market, leading enterprises distinguish themselves as established and financially sound providers of products and services. Boasting extensive experience, these companies showcase a diverse product range, cutting-edge technologies, and robust global sales and marketing networks. Their proven track record in the industry establishes them as dependable and trusted partners for customers seeking heat pump water heater solutions. Demonstrating adaptability to market dynamics, these companies consistently deliver high-quality products and services, positioning them as leaders in addressing the energy and power sector's demands. Notable players in this market include Panasonic Corporation (Japan), LG Electronics (South Korea), Johnson Controls-Hitachi Air Conditioning (Japan), Mitsubishi Electric Corporation (Japan), and Trane Technologies plc (Ireland).

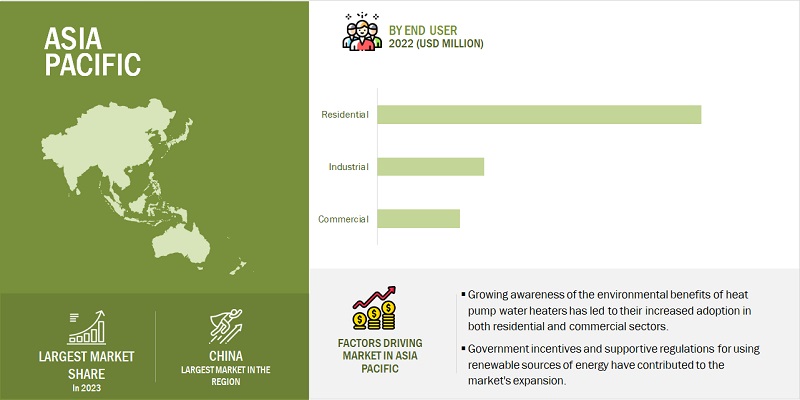

By End user industry, the residential segment is expected to be the largest segment in the market during the forecast period.

Based on the end user segment, the heat pump water heater market is segmented into three categories: residential, commercial, and industrial. The Residential segment is expected to be the largest segment during the forecast period. Heat pump water heaters are more cost-effective in the long run than standard water heaters since they use less energy and require less maintenance. Heat pump water heaters are becoming increasingly popular among homes looking for energy-efficient, cost-effective, and ecologically friendly water heating options. Governments throughout the world are offering incentives and subsidies to encourage the use of energy-efficient devices such as heat pump water heaters. These incentives have reduced the cost of heat pump water heaters for homeowners.

By storage tank capacity, up to 500 liters is expected to be the fastest-growing segment during the forecast period.

Based on the storage tank capacity segment the heat pump water heater market is categorized into three categories: up to 500 liters, 500–1,000 liters, and above 1,000 liters. Up to 500 liters segment is expected to be the fastest growing segment during the forecast period. Heat pumps with up to 500 liters capacity are widely used for water heating due to their compact size, ease of installation, and suitability for small commercial and residential applications. These heat pumps are suitable for less hot water requirement applications in small individual heat pump water heaters of up to 500 liters capacity, such as in hospitality, personal laundry, and other similar applications. Additionally, government subsidies for residential heat pumps are driving the market for heat pump water heaters with up to 500 liters capacity.

Asia Pacific: The largest in the heat pump water heater market.

Asia Pacific is expected to be the largest region in the heat pump water heater market in 2023. Asia Pacific has been leading the heat pump water heater market. The regional heat pump water heater market is experiencing growth due to the presence of leading heat pump water heater providers Panasonic Corporation (Japan), LG Electronics (South Korea), Johnson Controls–Hitachi Air Conditioning (Japan), Mitsubishi Electric Corporation (Japan). China, India, New Zealand, and Malaysia are among the region's rising economies. The development in urbanization and economic growth has resulted in an increase in commercial building construction, such as retail malls, hospitals, hotels, and manufacturing facilities, driving demand for heat pump water heaters.

Key Market Players

The heat pump water heater market is dominated by a few major players that have a wide regional presence. The major players in the heat pump water heater market include Panasonic Corporation (Japan), LG Electronics (South Korea), Johnson Controls–Hitachi Air Conditioning (Japan), Mitsubishi Electric Corporation (Japan), and Trane Technologies plc (Ireland). Between 2018 and 2023, Strategies such as new product launches, contracts, agreements, partnerships, collaborations, acquisitions, and expansions are followed by these companies to capture a larger share of the heat pump water heater market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion), Volume (MW/KW) |

|

Segments Covered |

Heat pump water heater market by Type, End user industry, by Rated capacity, by Refrigerant type, by Storage tank capacity and Region. |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, South America |

|

Companies covered |

Panasonic Holdings Corporation (Japan), LG Electronics (South Korea), Johnson Controls-Hitachi Air Conditioning (Japan), Midea Group (China), RHEEM Manufacturing Company (US), Daikin (Japan), A. O. Smith Corporation (US), Bosch Industries (Germany), and Ingersoll Rand (US), Viessmann Group (Germany), NIBE Energy Systems (Sweden), Valliant Group (Germany), Mitsubishi Electric (Japan), Glen Dimplex (Ireland), Stiebel Eltron (Germany), Trane Technologies plc (Ireland), Haier (China), Fujitsu General (Japan), Emerson (US), Gree Electric Appliances (China), Ariston Holding N.V. (Italy), EVO Energy Technologies (Austria) Namma Swadeshi (India), Ecotech Solutions, Guangzhou SPRSUN New Energy Technology Development (China), Electrify my home (US). |

This research report categorizes the heat pump water heater market based on by Type, End user industry, by Rated capacity, by Refrigerant type, by Storage tank capacity and Region.

On the basis of type:

- Air-to-Air heat pump water heater

- Air-to-Water heat pump water heater

- Water source heat pump water heater

- Ground source (geothermal) heat pump water heater

- Hybrid heat pump water heater

On the basis of End user industry:

- Residential

- Commercial

- Industrial

On the basis of refrigerant type:

- R410A

- R407C

- R744

- Others

On the basis of storage tank capacity:

- Upto 500 liters

- 500–1,000 liters

- Above 1,000 liters

On the basis of rated capacity:

- UP TO 10 KW

- 10–20 KW

- 20–30 KW

- 30–100 KW

- 100–150 KW

On the basis of region:

- Europe

- North America

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In January 2023, Fujitsu General established a joint venture with FGAHP, a manufacturer of heat pump and water solutions, for the manufacture of heat pump water heating systems known as ATW within Europe.

- In December 2022, Fujitsu General Limited and Groupe Atlantic established a joint venture for the manufacture of heat pump water heating systems ATW within Europe.

- In October 2022, The expansion plan for Panasonic Corporation's air-to-water (A2W) heat pump business in Europe was revealed. The company intends to introduce three new eco-friendly models with varying heating capacities for homes in Europe that use natural refrigerants.

- In August 2020, Johnson Controls-Hitachi Air Conditioning acquired McDowall Air Conditioning, which provides specialist design, manufacture, installation, and servicing of HVAC systems. The acquisition will help the company to increase its customer base for heat pump water heaters and market share for HVAC equipment.

- In June 2020, Johnson Controls-Hitachi Air Conditioning acquired East Lancashire Refrigeration, which provides specialist design, manufacture, installation, and servicing of HVAC systems. The acquisition will help the company enhance its customer base for heat pump water heaters and market share for HVAC equipment.

Frequently Asked Questions (FAQ):

What is the current size of the heat pump water heater market?

The current market size of the heat pump water heater market is USD 5.2 billion in 2023.

What are the major drivers for the heat pump water heater market?

Growing demand for sustainable development and supportive government policies to decarbonize various sectors are some of the major drivers for the heat pump water heater market.

Which is the largest region during the forecasted period in the heat pump water heater market?

Asia Pacific is expected to dominate the heat pump water heater market between 2023–2030, followed by North America & Europe.

Which is the largest segment, by rated capacity, during the forecasted period in the heat pump water heater market?

The 10-20 kw heat pump water heater segment is expected to be the largest market during the forecast period owing to the relatively mature and cost-effective technology.

Which is the fastest segment, by end-user industry, during the forecasted period in the heat pump water heater market?

Residential is expected to be the fastest market during the forecast period by application. The growth is attributed to the penetration of renewables in the energy system. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing installation of heat pump water heaters in residential, commercial, and industrial sectors to reduce carbon dioxide (CO2) emissions- Government-led incentives and regulations to enhance energy efficiencyRESTRAINTS- Variability in performance of heat pump water heaters based on climatic conditions- Complexities associated with installation and maintenance of heat pump water heatersOPPORTUNITIES- Expansion of MARKET in emerging economies and untapped regions- Integration of Internet of Things (IoT) with heat pump water heaters- Increased sales of heat pumps in EuropeCHALLENGES- Lack of awareness regarding benefits of heat pump water heaters in developing and underdeveloped countries- High installation cost

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 PRICING ANALYSISINDICATIVE PRICE TREND OF HEAT PUMP WATER HEATERS, BY REGIONINDICATIVE PRICE TREND OF HEAT PUMP WATER HEATERS, BY END USER

-

5.5 SUPPLY CHAIN ANALYSISRAW MATERIAL SUPPLIERSORIGINAL EQUIPMENT MANUFACTURERS (OEMS)DISTRIBUTORSEND USERS

-

5.6 ECOSYSTEM/MARKET MAP

-

5.7 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORK RELATED TO HEAT PUMP WATER HEATERS- Regulatory framework in North America- Regulatory framework in Europe- Regulatory framework in Asia Pacific- Regulatory framework in RoW

-

5.8 PATENT ANALYSIS

-

5.9 CASE STUDY ANALYSISCOMMERCIAL FACILITY USED DAIKIN INDUSTRIES’ HEAT PUMP WATER HEATER TO REVOLUTIONIZE WATER HEATING EFFICIENCYINDUSTRIAL PLANT IMPLEMENTED CARRIER AQUAEDGE 19DV WATER-COOLED CHILLER WITH HEAT RECOVERY TO REDUCE ENERGY COSTS, INCREASE OPERATIONAL EFFICIENCY, AND MINIMIZE ENVIRONMENTAL IMPACTHOTEL DEPLOYED A. O. SMITH VOLTEX HYBRID ELECTRIC HEAT PUMP WATER HEATER TO ENHANCE HOSPITALITY WITH SUSTAINABLE HOT WATER SOLUTIONS

-

5.10 TECHNOLOGY ANALYSISHYBRID HEAT PUMP SYSTEMSENERGY RECOVERY SYSTEMSVARIABLE SPEED COMPRESSORS

- 5.11 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.12 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

-

5.13 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 UP TO 500 LITERSGOVERNMENT SUBSIDIES FOR RESIDENTIAL HEAT PUMPS TO DRIVE DEMAND

-

6.3 500–1,000 LITERSCAPABILITY TO PROVIDE HEATING TO SMALL COMMERCIAL BUSINESSES TO FUEL DEMAND

-

6.4 ABOVE 1,000 LITERSNEED TO REPLACE CONVENTIONAL HEATING METHODS WITH ENERGY-EFFICIENT ONES AND TECHNOLOGICAL ADVANCEMENTS IN HEAT PUMP WATER HEATERS TO FUEL DEMAND

- 7.1 INTRODUCTION

-

7.2 RESIDENTIALGOVERNMENT PROGRAMMES AIMED AT ENHANCING ENERGY EFFICIENCY TO INCREASE DEMAND

-

7.3 COMMERCIALGROWING FOCUS ON USING RENEWABLE ENERGY SOURCES FOR COMMERCIAL OPERATIONS TO DRIVE MARKET

-

7.4 INDUSTRIALENERGY-EFFICIENT DESIGN TO FUEL DEMAND

- 8.1 INTRODUCTION

-

8.2 UP TO 10 KWSUITABILITY FOR SINGLE-FAMILY HOUSES TO DRIVE DEMAND

-

8.3 10–20 KWGROWING DEMAND IN RESIDENTIAL SECTOR TO FUEL MARKET GROWTH

-

8.4 20–30 KWABILITY TO MEET HEATING REQUIREMENTS OF COMMERCIAL SECTOR TO FUEL DEMAND

-

8.5 30–100 KWGROWING DEMAND FROM SMALL AND MEDIUM-SIZED COMMERCIAL BUILDINGS TO DRIVE MARKET

-

8.6 100–150 KWINCREASING HEATING DEMAND FROM LARGE COMMERCIAL OPERATORS TO DRIVE MARKET

-

8.7 ABOVE 150 KWRISING HIGH-VOLUME HOT WATER DEMAND IN VARIOUS INDUSTRIES TO BOOST INSTALLATION

- 9.1 INTRODUCTION

-

9.2 AIR-TO-AIR HEAT PUMP WATER HEATERSLOW INSTALLATION COST TO BOOST DEMAND

-

9.3 AIR-TO-WATER HEAT PUMP WATER HEATERSINCREASING INCLINATION TOWARD SUSTAINABLE ALTERNATIVES TO MINIMIZE ENERGY CONSUMPTION TO FUEL DEMAND

-

9.4 WATER-SOURCE HEAT PUMP WATER HEATERSGROWING AWARENESS REGARDING REDUCING CARBON FOOTPRINT TO DRIVE DEMAND

-

9.5 GROUND-SOURCE (GEOTHERMAL) HEAT PUMP WATER HEATERHIGH EFFICIENCY AND EMERGENCE AS SUSTAINABLE ALTERNATIVE TO TRADITIONAL HEAT PUMPS TO DRIVE MARKET

-

9.6 HYBRID HEAT PUMP WATER HEATERGOVERNMENT-LED SUPPORT AND VERSATILITY FOR USE IN ALL SEASONS TO DRIVE DEMAND

- 10.1 INTRODUCTION

-

10.2 R410ARISING DEMAND IN VARIOUS SECTORS DUE TO VERSATILITY AND EFFECTIVENESS TO DRIVE MARKET

-

10.3 R407CGROWING DEMAND FOR HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEMS WITH RAPID URBANIZATION AND RISING DISPOSABLE INCOME TO DRIVE MARKET

-

10.4 R744ECO-FRIENDLY OPERATIONAL FEATURES TO PROPEL DEMAND

- 10.5 OTHERS

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICASIA PACIFIC HEAT PUMP WATER HEATER MARKET: RECESSION IMPACTBY TYPEBY STORAGE TANK CAPACITYBY RATED CAPACITYBY REFRIGERANT TYPEBY END USERBY COUNTRY- India- China- Australia- Japan- South Korea- Rest of Asia Pacific

-

11.3 EUROPEEUROPEAN HEAT PUMP WATER HEATER MARKET: RECESSION IMPACTBY TYPEBY STORAGE TANK CAPACITYBY RATED CAPACITYBY REFRIGERANT TYPEBY END USERBY COUNTRY- UK- Italy- Germany- France- Rest of Europe

-

11.4 NORTH AMERICANORTH AMERICAN HEAT PUMP WATER HEATER MARKET: RECESSION IMPACTBY TYPEBY RATED CAPACITYBY REFRIGERANT TYPEBY STORAGE TANK CAPACITYBY END USERBY COUNTRY- US- Canada- Mexico

-

11.5 MIDDLE EAST & AFRICAMIDDLE EASTERN & AFRICAN HEAT PUMP WATER HEATER MARKET: RECESSION IMPACTBY TYPEBY RATED CAPACITYBY REFRIGERANT TYPEBY STORAGE TANK CAPACITYBY END USERBY COUNTRY- GCC- South Africa- Rest of Middle East & Africa

-

11.6 SOUTH AMERICASOUTH AMERICAN HEAT PUMP WATER HEATER MARKET: RECESSION IMPACTBY TYPEBY RATED CAPACITYBY REFRIGERANT TYPEBY STORAGE TANK CAPACITYBY END USERBY COUNTRY- Brazil- Argentina- Rest of South America

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2019–2023

- 12.3 MARKET SHARE ANALYSIS, 2022

- 12.4 MARKET EVALUATION FRAMEWORK, 2019–2023

- 12.5 REVENUE ANALYSIS, 2018–2022

-

12.6 COMPETITIVE SCENARIOS AND TRENDSDEALSOTHERS

-

12.7 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT (KEY PLAYERS)

-

12.8 COMPANY EVALUATION MATRIX (OTHER PLAYERS), 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT (OTHER PLAYERS)

-

13.1 KEY PLAYERSPANASONIC CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLG ELECTRONICS- Business overview- Products/Solutions/Services offered- MnM viewJOHNSON CONTROLS-HITACHI AIR CONDITIONING- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITSUBISHI ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTRANE TECHNOLOGIES PLC- Business overview- Products/Solutions/Services offered- MnM viewFUJITSU GENERAL- Business overview- Products/Solutions/Services offered- Recent developmentsHAIER INC.- Business overview- Products/Solutions/Services offeredCARRIER- Business overview- Products/Solutions/Services offered- Recent developmentsRHEEM MANUFACTURING COMPANY- Business overview- Products/Solutions/Services offered- Recent developmentsA.O. SMITH- Business overview- Products/Services/Solutions offered- Recent developmentsBOSCH THERMOTECHNOLOGY CORP.- Business overview- Products/Services/Solutions offered- Recent developmentsVAILLANT GROUP- Business overview- Products/Services/Solutions offered- Recent developmentsMIDEA- Business overview- Products/Services/Solutions offeredDAIKIN INDUSTRIES, LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsVIESSMANN GROUP- Business overview- Products/Services/Solutions offered- Recent developments

-

13.2 OTHER PLAYERSSTIEBEL ELTRON GMBH & CO. KG (DE)GLEN DIMPLEX GROUPNIBE ENERGY SYSTEMSGREE ELECTRIC APPLIANCES, INC. OF ZHUHAIEMERSON ELECTRIC CO.GUANGZHOU CANOVA HEATING & REFRIGERATION EQUIPMENT CO., LTD.ARISTON HOLDING N.V.EVO ENERGY TECHNOLOGIESNAMMA SWADESHIECO TECH SOLUTIONS

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 LIST OF MAJOR SECONDARY SOURCES

- TABLE 2 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 HEAT PUMP WATER HEATER MARKET SNAPSHOT

- TABLE 4 INDICATIVE PRICE TREND OF HEAT PUMP WATER HEATERS, BY REGION, 2022–2028 (USD)

- TABLE 5 INDICATIVE PRICE TREND OF HEAT PUMP WATER HEATERS, BY END USER, 2022–2028 (USD)

- TABLE 6 COMPANIES AND THEIR ROLES IN HEAT PUMP WATER HEATER ECOSYSTEM

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2018–2022

- TABLE 13 MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 14 EXPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 15 IMPORT SCENARIO FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 16 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 18 KEY BUYING CRITERIA, BY END USER

- TABLE 19 MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 20 MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 21 UP TO 500 LITERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 UP TO 500 LITERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 500–1,000 LITERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 500–1,000 LITERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 ABOVE 1,000 LITERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 ABOVE 1,000 LITERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 MARKET, BY END USER, 2019–2022 (THOUSAND UNITS)

- TABLE 28 MARKET, BY END USER, 2023–2028 (THOUSAND UNITS)

- TABLE 29 MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 30 MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 31 RESIDENTIAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 RESIDENTIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 COMMERCIAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 COMMERCIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 INDUSTRIAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 INDUSTRIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 38 MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 39 UP TO 10 KW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 UP TO 10 KW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 10–20 KW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 10–20 KW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 20–30 KW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 20–30 KW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 30–100 KW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 30–100 KW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 100–150 KW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 100–150 KW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 ABOVE 150 KW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 ABOVE 150 KW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 52 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 53 AIR-TO-AIR HEAT PUMP WATER HEATERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 AIR-TO-AIR HEAT PUMP WATER HEATERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 AIR-TO-WATER HEAT PUMP WATER HEATERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 AIR-TO-WATER HEAT PUMP WATER HEATERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 WATER-SOURCE HEAT PUMP WATER HEATERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 WATER-SOURCE HEAT PUMP WATER HEATERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 GROUND-SOURCE (GEOTHERMAL) HEAT PUMP WATER HEATERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 GROUND-SOURCE (GEOTHERMAL) HEAT PUMP WATER HEATERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 HYBRID HEAT PUMP WATER HEATERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 HYBRID HEAT PUMP WATER HEATERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 64 MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 65 R410A: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 R410A: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 R407C: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 R407C: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 R744: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 R744: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 76 MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 77 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 INDIA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 90 INDIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 91 INDIA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 92 INDIA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 93 INDIA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 94 INDIA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 95 INDIA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 96 INDIA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 97 INDIA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 98 INDIA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 99 CHINA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 100 CHINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 101 CHINA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 102 CHINA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 103 CHINA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 104 CHINA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 105 CHINA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 106 CHINA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 107 CHINA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 108 CHINA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 109 AUSTRALIA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 110 AUSTRALIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 AUSTRALIA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 112 AUSTRALIA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 113 AUSTRALIA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 114 AUSTRALIA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 115 AUSTRALIA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 116 AUSTRALIA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 117 AUSTRALIA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 118 AUSTRALIA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 119 JAPAN: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 120 JAPAN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 121 JAPAN: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 122 JAPAN: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 123 JAPAN: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 124 JAPAN: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 125 JAPAN: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 126 JAPAN: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 127 JAPAN: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 128 JAPAN: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 129 SOUTH KOREA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 130 SOUTH KOREA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 131 SOUTH KOREA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 132 SOUTH KOREA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 133 SOUTH KOREA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 134 SOUTH KOREA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 135 SOUTH KOREA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 136 SOUTH KOREA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 137 SOUTH KOREA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 138 SOUTH KOREA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 149 EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 150 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 151 EUROPE: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 152 EUROPE: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 153 EUROPE: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 154 EUROPE: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 155 EUROPE: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 156 EUROPE: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 157 EUROPE: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 158 EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 159 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 160 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 161 UK: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 162 UK: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 163 UK: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 164 UK: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 165 UK: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 166 UK: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 167 UK: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 168 UK: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 169 UK: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 170 UK: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 171 ITALY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 172 ITALY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 173 ITALY: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 174 ITALY: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 175 ITALY: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 176 ITALY: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 177 ITALY: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 178 ITALY: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 179 ITALY: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 180 ITALY: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 181 GERMANY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 182 GERMANY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 183 GERMANY: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 184 GERMANY: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 185 GERMANY: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 186 GERMANY: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 187 GERMANY: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 188 GERMANY: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 189 GERMANY: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 190 GERMANY: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 191 FRANCE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 192 FRANCE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 193 FRANCE: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 194 FRANCE: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 195 FRANCE: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 196 FRANCE: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 197 FRANCE: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 198 FRANCE: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 199 FRANCE: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 200 FRANCE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 201 REST OF EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 202 REST OF EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 203 REST OF EUROPE: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 204 REST OF EUROPE: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 205 REST OF EUROPE: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 206 REST OF EUROPE: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 207 REST OF EUROPE: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 208 REST OF EUROPE: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 209 REST OF EUROPE: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 210 REST OF EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 211 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 212 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 213 NORTH AMERICA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 214 NORTH AMERICA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 215 NORTH AMERICA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 216 NORTH AMERICA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 217 NORTH AMERICA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 218 NORTH AMERICA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 219 NORTH AMERICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 220 NORTH AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 221 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 222 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 223 US: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 224 US: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 225 US: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 226 US: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 227 US: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 228 US: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 229 US: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 230 US: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 231 US: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 232 US: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 233 CANADA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 234 CANADA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 235 CANADA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 236 CANADA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 237 CANADA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 238 CANADA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 239 CANADA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 240 CANADA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 241 CANADA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 242 CANADA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 243 MEXICO: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 244 MEXICO: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 245 MEXICO: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 246 MEXICO: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 247 MEXICO: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 248 MEXICO: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 249 MEXICO: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 250 MEXICO: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 251 MEXICO: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 252 MEXICO: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 265 SAUDI ARABIA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 266 SAUDI ARABIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 267 SAUDI ARABIA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 268 SAUDI ARABIA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 269 SAUDI ARABIA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 270 SAUDI ARABIA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 271 SAUDI ARABIA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 272 SAUDI ARABIA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 273 SAUDI ARABIA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 274 SAUDI ARABIA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 275 UAE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 276 UAE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 277 UAE: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 278 UAE: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 279 UAE: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 280 UAE: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 281 UAE: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 282 UAE: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 283 UAE: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 284 UAE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 285 REST OF GCC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 286 REST OF GCC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 287 REST OF GCC: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 288 REST OF GCC: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 289 REST OF GCC: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 290 REST OF GCC: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 291 REST OF GCC: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 292 REST OF GCC: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 293 REST OF GCC: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 294 REST OF GCC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 295 SOUTH AFRICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 296 SOUTH AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 297 SOUTH AFRICA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 298 SOUTH AFRICA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 299 SOUTH AFRICA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 300 SOUTH AFRICA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 301 SOUTH AFRICA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 302 SOUTH AFRICA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 303 SOUTH AFRICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 304 SOUTH AFRICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 305 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 306 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 307 REST OF MIDDLE EAST & AFRICA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 308 REST OF MIDDLE EAST & AFRICA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 309 REST OF MIDDLE EAST & AFRICA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 310 REST OF MIDDLE EAST & AFRICA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 311 REST OF MIDDLE EAST & AFRICA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 312 REST OF MIDDLE EAST & AFRICA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 313 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 314 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 315 SOUTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 316 SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 317 SOUTH AMERICA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 318 SOUTH AMERICA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 319 SOUTH AMERICA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 320 SOUTH AMERICA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 321 SOUTH AMERICA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 322 SOUTH AMERICA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 323 SOUTH AMERICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 324 SOUTH AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 325 SOUTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 326 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 327 BRAZIL: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 328 BRAZIL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 329 BRAZIL: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 330 BRAZIL: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 331 BRAZIL: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 332 BRAZIL: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 333 BRAZIL: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 334 BRAZIL: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 335 BRAZIL: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 336 BRAZIL: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 337 ARGENTINA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 338 ARGENTINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 339 ARGENTINA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 340 ARGENTINA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 341 ARGENTINA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 342 ARGENTINA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 343 ARGENTINA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 344 ARGENTINA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 345 ARGENTINA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 346 ARGENTINA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 347 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 348 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 349 REST OF SOUTH AMERICA: MARKET, BY RATED CAPACITY, 2019–2022 (USD MILLION)

- TABLE 350 REST OF SOUTH AMERICA: MARKET, BY RATED CAPACITY, 2023–2028 (USD MILLION)

- TABLE 351 REST OF SOUTH AMERICA: MARKET, BY REFRIGERANT TYPE, 2019–2022 (USD MILLION)

- TABLE 352 REST OF SOUTH AMERICA: MARKET, BY REFRIGERANT TYPE, 2023–2028 (USD MILLION)

- TABLE 353 REST OF SOUTH AMERICA: MARKET, BY STORAGE TANK CAPACITY, 2019–2022 (USD MILLION)

- TABLE 354 REST OF SOUTH AMERICA: MARKET, BY STORAGE TANK CAPACITY, 2023–2028 (USD MILLION)

- TABLE 355 REST OF SOUTH AMERICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 356 REST OF SOUTH AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 357 MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019–2023

- TABLE 358 MARKET: DEGREE OF COMPETITION

- TABLE 359 MARKET EVALUATION FRAMEWORK, 2019–2023

- TABLE 360 MARKET: DEALS, 2019–2023

- TABLE 361 MARKET: OTHERS, 2019–2023

- TABLE 362 TYPE: COMPANY FOOTPRINT

- TABLE 363 STORAGE TANK CAPACITY: COMPANY FOOTPRINT

- TABLE 364 RATED CAPACITY: COMPANY FOOTPRINT

- TABLE 365 REFRIGERANT TYPE: COMPANY FOOTPRINT

- TABLE 366 END USER: COMPANY FOOTPRINT

- TABLE 367 REGION: COMPANY FOOTPRINT

- TABLE 368 COMPANY OVERALL FOOTPRINT

- TABLE 369 TYPE: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 370 STORAGE TANK CAPACITY: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 371 RATED CAPACITY: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 372 REFRIGERANT TYPE: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 373 END USER: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 374 REGION: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 375 COMPANY OVERALL FOOTPRINT (OTHER PLAYERS)

- TABLE 376 PANASONIC CORPORATION: COMPANY OVERVIEW

- TABLE 377 PANASONIC CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 378 PANASONIC CORPORATION: PRODUCT LAUNCHES

- TABLE 379 PANASONIC CORPORATION: DEALS

- TABLE 380 PANASONIC CORPORATION: OTHERS

- TABLE 381 LG ELECTRONICS: COMPANY OVERVIEW

- TABLE 382 LG ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 383 JOHNSON CONTROLS-HITACHI AIR CONDITIONING: COMPANY OVERVIEW

- TABLE 384 JOHNSON CONTROLS-HITACHI AIR CONDITIONING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 385 JOHNSON CONTROLS-HITACHI AIR CONDITIONING: PRODUCT LAUNCHES

- TABLE 386 JOHNSON CONTROLS-HITACHI AIR CONDITIONING: DEALS

- TABLE 387 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 388 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 390 TRANE TECHNOLOGIES PLC: COMPANY OVERVIEW

- TABLE 391 TRANE TECHNOLOGIES PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 392 FUJITSU GENERAL: COMPANY OVERVIEW

- TABLE 393 FUJITSU GENERAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 394 FUJITSU GENERAL: DEALS

- TABLE 395 FUJITSU GENERAL: OTHERS

- TABLE 396 HAIER INC.: COMPANY OVERVIEW

- TABLE 397 HAIER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 398 CARRIER: COMPANY OVERVIEW

- TABLE 399 CARRIER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 400 CARRIER: PRODUCT LAUNCHES

- TABLE 401 RHEEM MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 402 RHEEM MANUFACTURING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 403 RHEEM MANUFACTURING COMPANY: DEALS

- TABLE 404 A.O. SMITH: COMPANY OVERVIEW

- TABLE 405 A.O. SMITH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 406 A.O. SMITH: PRODUCT LAUNCHES

- TABLE 407 BOSCH THERMOTECHNOLOGY CORP.: COMPANY OVERVIEW

- TABLE 408 BOSCH THERMOTECHNOLOGY CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 409 BOSCH THERMOTECHNOLOGY CORP.: PRODUCT LAUNCHES

- TABLE 410 VAILLANT GROUP: COMPANY OVERVIEW

- TABLE 411 VAILLANT GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 412 VAILLANT GROUP: PRODUCT LAUNCHES

- TABLE 413 MIDEA: COMPANY OVERVIEW

- TABLE 414 MIDEA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 415 DAIKIN INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 416 DAIKIN INDUSTRIES, LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 417 DAIKIN INDUSTRIES, LTD.: PRODUCT LAUNCHES

- TABLE 418 DAIKIN INDUSTRIES, LTD.: OTHERS

- TABLE 419 VIESSMANN GROUP: COMPANY OVERVIEW

- TABLE 420 VIESSMANN GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 421 VIESSMANN GROUP: PRODUCT LAUNCHES

- TABLE 422 STIEBEL ELTRON GMBH & CO. KG (DE): COMPANY OVERVIEW

- TABLE 423 GLEN DIMPLEX GROUP: COMPANY OVERVIEW

- TABLE 424 NIBE ENERGY SYSTEMS: COMPANY OVERVIEW

- TABLE 425 GREE ELECTRIC APPLIANCES, INC. OF ZHUHAI: COMPANY OVERVIEW

- TABLE 426 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 427 GUANGZHOU CANOVA HEATING & REFRIGERATION EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 428 ARISTON HOLDING N.V.: COMPANY OVERVIEW

- TABLE 429 EVO ENERGY TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 430 NAMMA SWADESHI: COMPANY OVERVIEW

- TABLE 431 ECO TECH SOLUTIONS: COMPANY OVERVIEW

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARIES

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET: TOP-DOWN APPROACH

- FIGURE 6 MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 7 METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR HEAT PUMP WATER HEATERS

- FIGURE 8 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF HEAT PUMP WATER HEATERS

- FIGURE 9 MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 10 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2022

- FIGURE 11 UP TO 10 KW SEGMENT TO LEAD MARKET IN 2028

- FIGURE 12 AIR-TO-AIR HEAT PUMP WATER HEATERS SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2028

- FIGURE 13 R410A SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 14 UP TO 500 LITERS SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 15 RESIDENTIAL SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 16 RISING DEMAND FOR RESIDENTIAL AND COMMERCIAL WATER HEATING SOLUTIONS

- FIGURE 17 EUROPEAN MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 RESIDENTIAL SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC MARKET IN 2022

- FIGURE 19 AIR-TO-AIR HEAT PUMP WATER HEATERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 20 10–20 KW SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2028

- FIGURE 21 RESIDENTIAL SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 22 UP TO 500 LITERS SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 23 R410A SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 24 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 ANNUAL SALES GROWTH OF HEAT PUMPS WORLDWIDE AND SELECTED MARKETS BETWEEN 2021 AND 2022

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 27 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 MARKET MAP

- FIGURE 29 MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2012–2022

- FIGURE 30 EXPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 31 IMPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 32 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 34 KEY BUYING CRITERIA, BY END USER

- FIGURE 35 MARKET, BY STORAGE TANK CAPACITY, 2022

- FIGURE 36 MARKET, BY END USER, 2022

- FIGURE 37 MARKET, BY RATED CAPACITY, 2022

- FIGURE 38 MARKET, BY TYPE, 2022

- FIGURE 39 MARKET, BY REFRIGERANT TYPE, 2022

- FIGURE 40 EUROPEAN MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 MARKET, BY REGION, 2022

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 43 EUROPE: MARKET SNAPSHOT

- FIGURE 44 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2022

- FIGURE 45 MARKET: SEGMENTAL REVENUE ANALYSIS, 2018–2022

- FIGURE 46 MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- FIGURE 47 MARKET: COMPANY EVALUATION MATRIX (OTHER PLAYERS), 2022

- FIGURE 48 PANASONIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 LG ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 50 JOHNSON CONTROLS-HITACHI AIR CONDITIONING: COMPANY SNAPSHOT

- FIGURE 51 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 TRANE TECHNOLOGIES PLC: COMPANY SNAPSHOT

- FIGURE 53 FUJITSU GENERAL: COMPANY SNAPSHOT

- FIGURE 54 HAIER INC.: COMPANY SNAPSHOT

- FIGURE 55 CARRIER: COMPANY SNAPSHOT

- FIGURE 56 A.O. SMITH: COMPANY SNAPSHOT

- FIGURE 57 MIDEA: COMPANY SNAPSHOT

- FIGURE 58 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT

The study involved major activities in estimating the current size of the heat pump water heater market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the heat pump water heater market involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify information useful for a technical, market-oriented, and commercial study of the heat pump water heater market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

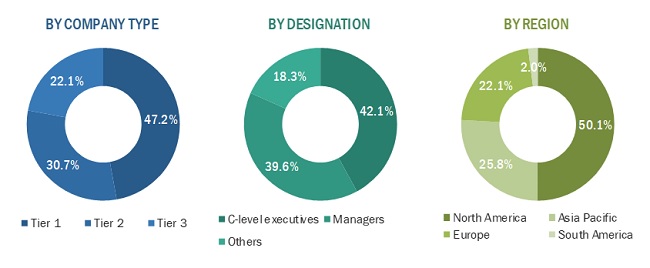

The heat pump water heater market comprises several stakeholders, such as heat pump water heater manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for heat pump water heaters in various applications such as energy, mobility, industrial, and grid injection. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

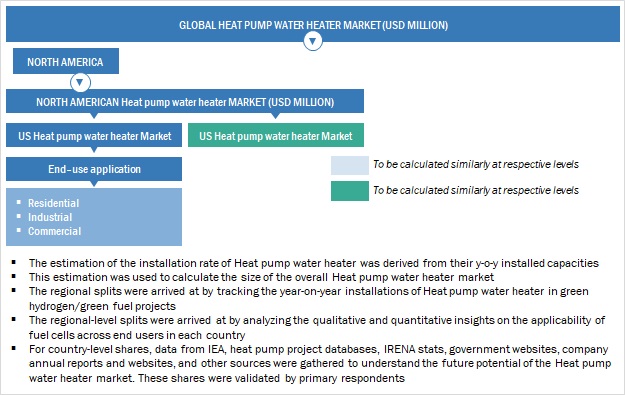

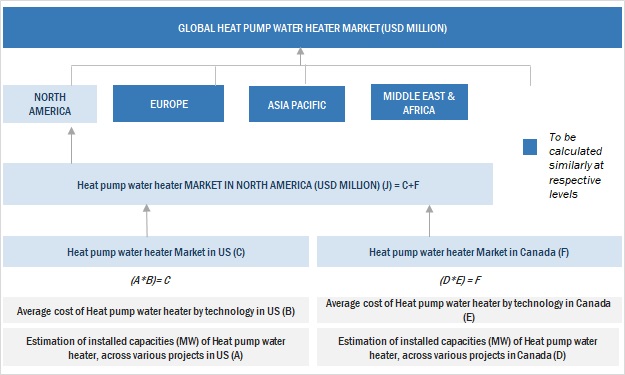

Both top-down and bottom-up approaches were used to estimate and validate the total size of the heat pump water heater market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Heat pump water heater market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Heat pump water heater market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A heat pump water heater (HPWH) is a type of water heater that uses a heat pump to efficiently heat water. Unlike traditional water heaters that generate heat directly, such as electric or gas water heaters, a heat pump water heater moves heat from the surrounding air or ground to heat the water.

The market for heat pump water heaters is defined as the sum of revenues generated by global companies from the sale of heat pump water heaters. Two different types of heat pump water heaters are available—geothermal heat pump water heaters and air source heat pump water heaters. These heaters are available with different rated capacities, including up to 10 kW, 10–20 kW, 20–30 kW, 30–100 kW, 100–150 kW, and above 150 kW. These devices come with different storage tank capacities, namely, up to 500 liters, 500–1,000 liters, and above 1,000 liters. Heat pump water heaters are used by residential, commercial, and industrial end users. The regions considered for this market study include North America, Europe, Asia Pacific, and South America.

Key Stakeholders

- Companies manufacturing heat pump water heaters

- T&D utilities

- Industrial end users

- Commercial end users

- Power and energy associations

- Government and research organizations

- Manufacturers of heat pump water heater components

- Distributors and suppliers of heat pump water heaters

- Heating, ventilation, and air conditioning (HVAC) industry and environmental associations

- National and local government organizations

- Technology standard organizations, forums, alliances, and associations

- Heat pump water heater associations

- Heat pump water heater survey companies

Objectives of the Study

- To define, describe, segment, and forecast the heat pump water heater market on the basis of type, rated capacity, refrigerant type, storage tank capacity, end user, and region in terms of value.

- To forecast the global heat pump water heater market in terms of volume.

- To describe and forecast the market for five key regions: North America, Europe, Asia Pacific, South America, and Middle East & Africa, along with their country-level market sizes in terms of value.

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide the supply chain analysis, trends/disruptions impacting the customer’s business, market map, pricing analysis, and regulatory analysis of the heat pump water heater.

- To analyze opportunities for stakeholders in the heat pump water heater and draw a competitive landscape of the market.

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, Porter’s five forces, and case studies pertaining to the market under study.

- To benchmark market players using the company evaluation quadrant, which analyzes market players on broad categories of business and product strategies adopted by them.

- To compare key market players with respect to the product specifications and applications.

- To strategically profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, new product launches, partnerships, joint ventures & collaborations, in the heat pump water heater.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Heat Pump Water Heater Market