High-Performance Insulation Materials Market by Type (Aerogel, Ceramic Fiber, Glass Bubble, EPS, XPS), Application (Oil & Gas, Industrial, Construction, Transportation and Power Generation, Automotive, and Paints & Coatings) - Global Forecast to 2021

[138 Pages Report] The global market size of high-performance insulation materials market was USD 5.79 Billion in 2015 and is estimated to reach USD 10.93 Billion by 2021, at a CAGR of 11.2% between 2016 and 2021. In this report, 2015 is considered as the base year and the forecast period is between 2016 and 2021.

The Objectives of this study are:

- To analyze and forecast the market size of high-performance insulation material market, in terms of value and volume

- To define, describe, and segment the global high performance insulation materials market by material type and applications

- To forecast the sizes of the market segments based on regions such as Asia-Pacific, North America, Europe, South America, and the Middle East & Africa.

- To provide detailed information regarding the important factors influencing the growth of the market (drivers, restraints, and opportunities)

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, alliances, joint ventures, mergers & acquisitions, and new product developments in the global high-performance insulation materials market

- To strategically profile key players and comprehensively analyze their core competencies

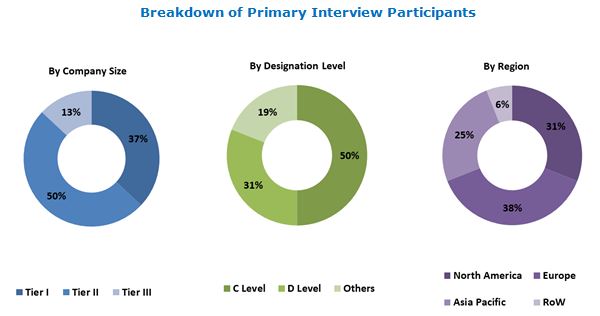

This research study involves the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg BusinessWeek, and Factiva) to identify and collect information useful for this technical, market-oriented, and commercial study of the high performance insulation materials market. The primary sources mainly include several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industrys supply chain. The total market has been split into several segments and sub-segments. The figure below illustrates the breakdown of the primary interviews based on company type, designation, and region conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The value chain for the market consists of various stages; raw material procurement and manufacturing/production are the two stages which accounts for the maximum value addition. For aerogels and ceramic fibers; silica, transition oxides, and alumina are the major raw materials used. Aerogel producers such as Aspen Aerogels Inc. (U.S.), Cabot Corporation (U.S.), and Aerogel Technologies LLC (U.S.) conduct extensive R&D to develop a distinct manufacturing process, pilot study of the product, and commercialize the product. The key players such as Aspen and Cabot have patent protection for their manufacturing configuration and products. In view of this, it is important for emerging companies to develop a distinctive method to manufacture aerogel materials. Companies have to be continuously involved in R&D to develop innovative manufacturing processes and products.

Target Audience:

- High-performance insulation materials manufacturers

- High-performance insulation materials dealers

- High-performance insulation materials suppliers

- End users, raw material suppliers, and others

Scope of the Report

This report categorizes the global high-performance insulation materials market on the basis of material type, application, and region.

Market Segmentation, by Material Type:

The high performance insulation materials market has been segmented based on material type:

- Ceramic Fibers

- Aerogels

- Others (Glass Bubble, EPS, XPS)

Market Segmentation, by Application:

The high-performance insulation materials market has been segmented based on application:

- Oil & gas

- Industrial

- Construction, Transportation and Power Generation

- Others (Automotive, Paints & Coatings)

Market Segmentation, by Region:

The regional analysis covers:

- Asia-Pacific

- North America

- Europe

- South America

- Middle East & Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix that gives a detailed comparison of product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

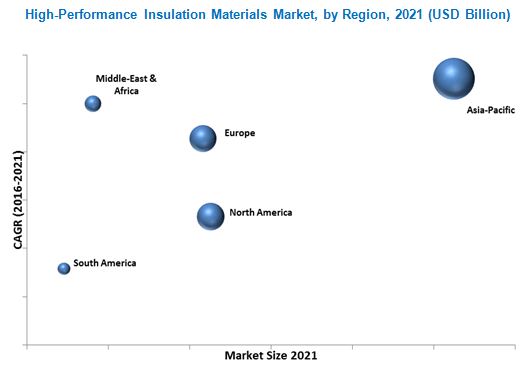

The high-performance insulation materials market is projected to reach USD 10.93 Billion by 2021, registering a CAGR of 11.2% between 2016 and 2021. The market is driven by the increased demand form the end-use applications such as oil & gas, industrial, construction, transportation, and paints & coatings, among others. Asia-Pacific region, with its growing economy and rapidly expanding commercial and industrial base is projected to experience the highest growth in the high-performance insulation material market between 2016 and 2021.

The high performance insulation material market is segmented on the basis of material type, application, and region. On the basis of material type, it is segmented as aerogel, ceramic fiber, and others.

The aerogel segment is projected to be the fastest-growing high-performance insulation material type between 2016 and 2021, in terms of volume. The high growth for this segment is attributed to its superior thermal resistance properties, water repellent characteristics, light-weight, and tensile strength.

The high performance insulation materials market segmented on the basis of application as, oil & gas; industrial; construction, transportation and power generation; and others. The oil & gas segment is the largest market for high-performance insulation materials due to growing demand for advanced insulation materials, especially, for subsea pipelines applications. This dominance is expected to continue during the forecast period due to increasing demand of advanced insulation materials and capability of this segment to absorb the high cost of insulation materials. Unique properties such as superlative thermal resistance, enhanced acoustic insulation, lightweight, reduced thickness, and fire & water resistance are required for usage in the oil & gas sector.

The Asia-Pacific market is projected to register the highest growth in the global high-performance insulation material market between 2016 and 2021. The high performance insulation material market in Europe and North America is consolidated, whereas, the market in Asia-Pacific has a fragmented structure. High-performance insulation materials manufacturers are significantly expanding their production capacities in China, Japan, and South Korea.

The major restraints in the high-performance insulation materials market are high production cost of aerogels and carcinogenic nature of ceramic fibers. Expansion and new product launch are the most preferred strategies adopted by the key market players to sustain in this highly competitive market. Major opportunities in the market are growing applications of aerogels in day-lighting segment and others. The company profiled in this report includes Aspen Aerogels Inc. (U.S.), Cabot Corporation (U.S.), 3M Company (U.S.), Aerogel Technologies LLC (U.S.), Nano High-Tech Co. Ltd. (China), Morgan Thermal Ceramics (U.K.), and Unifrax Corporation (U.S.), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.3.2 Currency

1.3.3 Package Size

1.4 Stakeholders

1.5 Limitations

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Growth Opportunities for High Performance Insulation Materials Manufacturers in Long Term

4.2 High Performance Insulation Materials Market to Grow at A High Rate

4.3 Asia-Pacific High Insulation Materials Market Scenario By Country and Type

4.4 Leading Countries in High Performance Insulation Materials Market, 2015

4.5 High Performance Insulation Materials Market, By Application

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Application

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Superior Thermal Resistance of Aerogels and Ceramic Fibers

5.3.1.2 Growth of End-Use Industries

5.3.1.3 Stringent Regulation Against Traditional Insulation Materials

5.3.2 Restraints

5.3.2.1 High Manufacturing Cost of Aerogels

5.3.2.2 Carcinogenic Nature of Ceramic Fibers

5.3.3 Opportunities

5.3.3.1 Growing Applications of Aerogels in the Day-Lighting Segment

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Regulatory Framework

7 High-Performance Insulation Materials Market, By Type (Page No. - 47)

7.1 Introduction

7.2 Ceramic Fiber

7.2.1 Refractory Ceramic Fiber

7.2.2 Low Bio-Persistence Fibers

7.2.3 Polycrystalline Ceramic Fibers

7.3 Aerogel

7.3.1 Silica Aerogel

7.3.2 Polymer Aerogel

7.3.3 Carbon Aerogel

7.4 Others

8 High Performance Insulation Materials Market, By Application (Page No. - 54)

8.1 Introduction

8.2 Oil & Gas

8.3 Industrial

8.4 Construction, Transportation, and Power Generation

8.5 Others

9 High-Performance Insulation Material Market, Regional Analysis (Page No. - 62)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 South Korea

9.2.4 India

9.2.5 Rest of Asia-Pacific

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Italy

9.3.5 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 Kuwait

9.5.4 Qatar

9.5.5 Iran

9.5.6 Rest of Middle East & Africa (Including South Africa)

9.6 South America

9.6.1 Brazil

9.6.2 Rest of South America

10 Competitive Landscape (Page No. - 103)

10.1 Overview

10.2 New Product Launches: the Most Popular Growth Strategy

10.3 Maximum Developments Recorded Between 2012 and 2015

10.4 Competitive Situations and Trends

10.4.1 New Product Launches

10.4.2 Partnerships/Agreements/Collaborations

10.4.3 Mergers & Acquisitions

10.4.4 Expansions

10.4.5 R&D

11 Company Profiles (Page No. - 110)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Ibiden Co. Ltd.

11.2 The 3M Company

11.3 Morgan Thermal Ceramics

11.4 Aspen Aerogels, Inc.

11.5 Cabot Corporation

11.6 Unifrax Corporation

11.7 Shandong Luyang Share Co., Ltd.

11.8 Isolite Insulating Products Co., Ltd.

11.9 Aerogel Technologies, LLC

11.10 Nano High-Tech Co., Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 129)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Knowledge Store: Marketsandmarkets Subscription Portal

12.6 Related Reports

List of Tables (97 Tables)

Table 1 Iron & Steel Production for 2013 & 2014

Table 2 Global Oil Production 2013-2015

Table 3 Government Regulations on Ceramic Fibers (Refractory Ceramic Fiber)

Table 4 Exposure Limitations of Rcf By Local Jurisdictions

Table 5 Properties of Different Types of Aerogels

Table 6 High-Performance Insulation Materials Market Size, By Type, 20142021 (Kiloton)

Table 7 High Performance Insulation Material Market Size, By Type, 20142021 (USD Million)

Table 8 Properties of Silica Aerogel

Table 9 High Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 10 High-Performance Insulation Material Market Size, By Application, 20142021 (USD Million)

Table 11 High-Performance Insulation Materials Market Size in Oil & Gas, By Region, 20142021 (Kiloton)

Table 12 High Performance Insulation Material Market Size in Oil & Gas, By Region, 20142021 (USD Million)

Table 13 High Performance Insulation Materials Market Size in Industrial, By Region, 20142021 (Kiloton)

Table 14 High-Performance Insulation Material Market Size in Industrial, By Region, 20142021 (USD Million)

Table 15 High-Performance Insulation Materials Market Size in Construction, Transportation, and Power Generation, By Region 20142021 (Kiloton)

Table 16 High-Performance Insulation Material Market Size in Construction, Transportation, and Power Generation, By Region, 20142021 (USD Million)

Table 17 High-Performance Insulation Material Market Size in Other Applications, By Region, 20142021 (Kiloton)

Table 18 High-Performance Insulation Material Market Size in Other Applications, By Region, 20142021 (USD Million)

Table 19 High-Performance Insulation Materials Market Size, By Region, 20142021 (Kiloton)

Table 20 High Performance Insulation Material Market Size, By Region, 20142021 (USD Million)

Table 21 Asia-Pacific: High-Performance Insulation Materials Market Size, By Country, 20142021 (Kiloton)

Table 22 Asia-Pacific: Market Size, By Country, 20142021 (USD Million)

Table 23 Asia-Pacific: Market Size, By Type, 20142021 (Kiloton)

Table 24 Asia-Pacific: Market Size, By Type, 20142021 (USD Million)

Table 25 Asia-Pacific: Market Size, By Application, 20142021 (Kiloton)

Table 26 Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 27 China: High-Performance Insulation Material Market Size, By Application, 20142021 (Kiloton)

Table 28 China: Market Size, By Application, 20142021 (USD Million)

Table 29 South Korea: High Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 30 South Korea: Market Size, By Application, 20142021 (USD Million)

Table 31 Japan: High Performance Insulation Material Market Size, By Application, 20142021 (Kiloton)

Table 32 Japan: Market Size, By Application, 20142021 (USD Million)

Table 33 India: High-Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 34 India: Market Size, By Application, 20142021 (USD Million)

Table 35 Rest of Asia-Pacific: High-Performance Insulation Material Market Size, By Application, 20142021 (Kiloton)

Table 36 Rest of Asia-Pacific: Market Size By Application, 20142021 (USD Million)

Table 37 Europe: High-Performance Insulation Materials Market Size, By Country, 20142021 (Kiloton)

Table 38 Europe: Market Size, By Country, 20142021 (USD Million)

Table 39 Europe: Market Size, By Type, 20142021 (Kiloton)

Table 40 Europe: Market Size, By Type, 20142021 (USD Million)

Table 41 Europe: Market Size, By Application, 20142021 (Kiloton)

Table 42 Europe: Market Size, By Application, 20142021 (USD Million)

Table 43 Germany: High Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 44 Germany: Market Size, By Application, 20142021 (USD Million)

Table 45 France: High Performance Insulation Material Market Size, By Application, 20142021 (Kiloton)

Table 46 France: Market Size, By Application, 20142021 (USD Million)

Table 47 U.K.: High-Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 48 U.K.: Market Size, By Application, 20142021 (USD Million)

Table 49 Italy: High-Performance Insulation Material Market Size, By Application, 20142021 (Kiloton)

Table 50 Italy: Market Size, By Application, 20142021 (USD Million)

Table 51 Rest of Europe: High-Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 52 Rest of Europe: Market Size, By Application, 20142021 (USD Million)

Table 53 North America: High Performance Insulation Material Market Size, By Country, 20142021 (Kiloton)

Table 54 North America: Market Size, By Country, 20142021 (USD Million)

Table 55 North America: Market Size, By Type, 20142021 (Kiloton)

Table 56 North America: Market Size, By Type, 20142021 (USD Million)

Table 57 North America: Market Size, By Application, 20142021 (Kiloton)

Table 58 North America: Market Size, By Application, 20142021 (USD Million)

Table 59 U.S.: High-Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 60 U.S.: Market Size, By Application, 20142021 (USD Million)

Table 61 Canada: High-Performance Insulation Material Market Size, By Application, 20142021 (Kiloton)

Table 62 Canada: Market Size, By Application, 20142021 (USD Million)

Table 63 Mexico: High Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 64 Mexico: Market Size, By Application, 20142021 (USD Million)

Table 65 Middle East & Africa: High-Performance Insulation Material Market Size, By Country, 20142021 (Kiloton)

Table 66 Middle East & Africa: Market Size, By Country, 20142021 (USD Million)

Table 67 Middle East & Africa: Market Size, By Type, 20142021 (Kiloton)

Table 68 Middle East & Africa: Market Size, By Type, 20142021 (USD Million)

Table 69 Middle East & Africa: Market Size, By Application, 20142021 (Kiloton)

Table 70 Middle East & Africa: Market Size, By Application, 20142021 (USD Million)

Table 71 Saudi Arabia: High-Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 72 Saudi Arabia: Market Size, By Application, 20142021 (USD Million)

Table 73 UAE: High Performance Insulation Material Market Size, By Application, 20142021 (Kiloton)

Table 74 UAE: Market Size, By Application, 20142021 (USD Million)

Table 75 Kuwait: High Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 76 Kuwait: Market Size, By Application, 20142021 (USD Million)

Table 77 Qatar: High-Performance Insulation Material Market Size, By Application, 20142021 (Kiloton)

Table 78 Qatar: Market Size, By Application, 20142021 (USD Million)

Table 79 Iran: High-Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 80 Iran: Market Size, By Application, 20142021 (USD Million)

Table 81 Rest of Middle East & Africa: High Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 82 Rest of Middle East & Africa: Market Size, By Application, 20142021 (USD Million)

Table 83 South America: High-Performance Insulation Material Market Size, By Country, 20142021 (Kiloton)

Table 84 South America: Market Size, By Country, 20142021 (USD Million)

Table 85 South America: Market Size, By Type, 20142021 (Kiloton)

Table 86 South America: Market Size, By Type, 20142021 (USD Million)

Table 87 South America: Market Size, By Application, 20142021 (Kiloton)

Table 88 South America: Market Size, By Application, 20142021 (USD Million)

Table 89 Brazil: High Performance Insulation Materials Market Size, By Application, 20142021 (Kiloton)

Table 90 Brazil: Market Size, By Application, 20142021 (USD Million)

Table 91 Rest of South America: High Performance Insulation Material Market Size, By Application, 20142021 (Kiloton)

Table 92 Rest of South America: Market Size, By Application, 20142021 (USD Million)

Table 93 New Product Launch, 20112016

Table 94 Partnerships/Agreements/Collaborations, 20112016

Table 95 Mergers & Acquisitions, 20112016

Table 96 Expansions, 20112016

Table 97 R&D, 20112016

List of Figures (38 Figures)

Figure 1 High-Performance Insulation Materials Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 High-Performance Insulation Material Market: Data Triangulation

Figure 5 Ceramic Fiber to Dominate High-Performance Insulation Materials Market During 20162021

Figure 6 Oil & Gas to Register the Highest CAGR for High-Performance Insulation Material During the Forecast Period

Figure 7 Asia-Pacific to Be the Largest Market for High Performance Insulation Materials, (20162021)

Figure 8 High Performance Insulation Market Expected to Register A Double Digit Growth During Forecast Period

Figure 9 Moderate Growth Expected in High Performance Insulation Materials Market Between 2016 and 2021

Figure 10 Ceramic Accounts for Maximum Share in Asia-Pacific Market

Figure 11 Saudi Arabia to Be Fastest-Growing Market in Middle Eastern Region

Figure 12 Oil & Gas Dominated the High Performance Insulation Materials Market in 2015

Figure 13 Factors Affecting High-Performance Insulation Materials Market

Figure 14 Growth in Automobile Industry for Various Regions

Figure 15 Raw Material Accounts for Major Value Addition

Figure 16 Porters Five Forces Analysis

Figure 17 Ceramic Fiber to Dominate High-Performance Insulation Material Market Between 2016 and 2021

Figure 18 Asia-Pacific Will Dominate the Market for Aerogel During the Forecast Period 2016-2021

Figure 19 Asia-Pacific to Register the Highest CAGR for Others, During Forecast Period 2016-2021

Figure 20 Oil & Gas to Dominate the High-Performance Insulation Materials Market During 2016-2021

Figure 21 Asia-Pacific to Drive Oil & Gas High Performance Insulation Market Between 2016 and 2021

Figure 22 Regional Snapshot: China and India are Emerging as the New Hotspots

Figure 23 China, India, and Saudi Arabia to Be the Fastest-Growing Markets

Figure 24 Asia-Pacific Snapshot: China to Continue Dominating the High-Performance Insulation Materials Market

Figure 25 Germany: the Most Dominant High-Performance Insulation Material Market in the Region

Figure 26 North America Market Snapshot: Mexico is the Fastest-Growing Market

Figure 27 South Africa to Register the Highest CAGR During the Forecast Period

Figure 28 Brazil and Argentina: Two Key Hotspots in South America

Figure 29 Companies Adopted New Product Launches as the Key Growth Strategy, 20112016

Figure 30 Major Growth Strategies in the High-Performance Insulation Materials Market, 20112016

Figure 31 Developments in the Global High-Performance Insulation Material Market, 20112016

Figure 32 Ibiden Co. Ltd.: Company Snapshot

Figure 33 Ibiden Co. Ltd.: SWOT Analysis

Figure 34 The 3M Company: Company Snapshot

Figure 35 Aspen Aerogels, Inc.: Company Snapshot

Figure 36 Aspen Aerogels Inc.: SWOT Analysis

Figure 37 Cabot Corporation: Company Snapshot

Figure 38 Cabot Corporation.: SWOT Analysis

Growth opportunities and latent adjacency in High-Performance Insulation Materials Market

Sample of high performance insulation market report

General information on High Performance Insulation in manufacturing and automotive industry

Information on Pressure Sensitive adhesive tapes in attaching, mounting, manufacturing of high performance insualltion materials in construction, transportation, automotive, medical device markets.

High performance insulation application into subsea pipes made of stainless steel