High Temperature Insulation Materials Market

High Temperature Insulation Materials Market by Material Type (Ceramic Fibers, Insulating Firebricks, Calcium Silicate), End-use Industry (Petrochemical, Ceramic, Glass, Iron & Steel, Cement), Temperature Range, and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The high temperature insulation materials market is projected to reach USD 5.23 billion by 2030 from USD 4.32 billion in 2025, at a CAGR of 3.9% during the forecast period. The steady growth of high-heat, energy-intensive industries is the key driver of increased market demand for high-temperature insulation materials. The need to reduce energy losses, enhance efficiency, and ensure compliance with stringent emission standards has put pressure on manufacturers to adopt advanced insulation solutions across various industries, including petrochemical, steel, cement, and power generation. Petrochemical feedstock accounts for approximately 12% of the world's oil demand; this share is expected to increase in the future due to rising consumption of plastics and fertilizers. Furthermore, China's petrochemical industry accounted for 14% of global oil demand, with ethylene production exceeding 70 million metric tons per year. The steel industry supports this same dynamic: the production of crude steel worldwide reached 1,886 million tonnes in 2024, underscoring the need for high-temperature durability. Advances in ceramic fibers, insulating firebricks, and calcium silicate are improving thermal stability, energy efficiency, and durability of equipment in refineries, steel mills, cement plants, and power plants. As firms operate at higher temperatures and new, more stringent energy and emission policies are implemented, high-temperature insulating materials will become increasingly invaluable for enhanced performance, safety assurance, and reduced overall operational costs.

KEY TAKEAWAYS

-

By RegionAsia Pacific high temperature insulation materials market dominated, with a share of 58.0% in 2024.

-

By Material TypeBy material type, the ceramic fibers segment is expected to register the highest CAGR of 4.4% from 2025 to 2030, in terms of value.

-

By Temperature RangeBy temperature range, the 1,700°C (3,092°F) and above segment is expected to dominate the market, growing at the highest CAGR of 5.1%.

-

By End-use IndustryBy end-use industry, the cement segment is projected to grow at the fastest rate from 2025 to 2030.

-

Competitive Landscape - Key Players3M, Morgan Advanced Materials plc, RHI Magnesita GmbH, Luyang Energy-saving Materials Co., Ltd., and Alkegen were identified as Star players in the high temperature insulation materials market, as they have focused on innovation and have broad industry coverage, and strong operational & financial strength.

-

Competitive Landscape- StartupsPyrotek, Rath-Group, and MAFTEC Co., Ltd., among others have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy.

The high-temperature insulation materials market is expected to experience growth primarily influenced by a surge in industrial activity in the sectors of steel, cement, petrochemicals, and power generation that require reliable thermal protection at temperatures exceeding 600°C. The rise in energy costs and more stringent emission regulations are factors leading to the implementation of advanced insulation solutions, which result in reduced heat loss and increased operational efficiency. Furthermore, the market is opening up due to improvements in technological products, such as low-biopersistence fibers, microporous insulation, and high-strength refractory modules, which are substantially used in furnaces, kilns, turbines, and reactors. There are other factors, such as the large-scale retrofitting of aging industrial assets, the growth of high-temperature processing capacity in emerging economies, and the industry’s stronger focus on sustainability and decarbonization; all these factors together are pushing the market for a sustained period.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The influence on end-use industries in the high temperature insulation materials market is shaped by rapid industrial expansion, rising energy-efficiency requirements, and the need to reduce heat loss in high-temperature operations. Key end-use segments include steel, petrochemicals, power generation, glass, cement, and ceramics, where insulation materials support furnace linings, reactors, kilns, and thermal processing equipment. Demand is driven by stricter emission regulations, the push for operational efficiency, and the modernization of industrial infrastructure. Fluctuations in production output, maintenance cycles, and capacity expansions directly impact the revenues of insulation manufacturers and suppliers, thereby shaping overall market growth and investment patterns.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expanding demand from high-heat and heavy industries

-

Stringent energy efficiency and emission regulations

Level

-

Health, safety, and environmental regulations increasing compliance costs

-

Supply chain volatility and high capital costs limiting market expansion

Level

-

Industrial expansion in emerging economies

-

Rising demand from decarbonization, retrofit, and energy-efficiency projects

Level

-

Performance degradation and technical complexity in extreme multi-hazard environments

-

Certification and testing bottlenecks hindering material adoption

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expanding demand from high-heat and heavy industries

The rapid growth of high-heat and heavy industries drives the demand for high temperature insulation materials. Increasing production in steel, cement, glass, petrochemicals, and ceramics requires robust insulation for furnaces, kilns, reactors, and pipelines operating at temperatures above 800–1,400°C. In this regard, it is observed that, from a manufacturing perspective, petrochemicals remain central, providing inputs for 95% of finished goods and accounting for 12% of global oil demand-a share that keeps growing with new integrated complexes in China and the Middle East. For efficiency in extremely hot conditions, facilities like the Yulong refinery and CNOOC's Daxie mainly rely on ceramic fibers and high-alumina insulation. In 2024, 1,886 million tonnes of crude steel were produced worldwide, meeting a significant demand for insulation. With petrochemicals and specialty chemicals accounting for 57% of EU chemical sales in 2023, ongoing additions to global capacity continue to drive the adoption of advanced high-temperature insulation solutions.

Restraint: Health, safety, and environmental regulations increasing compliance costs

Stringent global health, safety, and environmental regulations have become a significant challenge for the high temperature insulation materials market, significantly raising compliance costs and operational burdens. Ceramic?????? fibers and refractory ceramic wool have been identified as Category 1B carcinogens according to the EU CLP Regulation. In contrast, RCF has been placed in Group 2B as a potential carcinogen by IARC due to the inhalation of hazardous substances and the formation of crystalline silica at high temperatures. RCF has been designated as an SVHC and has been subject to stringent control and authorization measures in the EU since 2011. In the US, OSHA's 2024 Hazard Communication Standard revision requires stricter SDS criteria and enhanced worker training, whilst the EPA implements emission regulations for fine mineral fibers. The UK HSE has further tightened operational standards regarding exposure limits. As authorities intensify scrutiny, producers face increasing pressure to shift to low-biopersistence, biosoluble fibers, which are safer but 15–30% more expensive, rendering regulatory compliance a significant challenge that impacts manufacturing, product design, and industry profitability.

Opportunity: Industrial expansion in emerging economies

The rapid industrial growth in the Asia Pacific, the Middle East & Africa, as well as Latin America, offers opportunities for suppliers of high-temperature insulation materials. The expansion of the steel, cement, petrochemical, and mining sectors, in addition to extensive rehabilitation of obsolete facilities, is driving the demand for enhanced insulation to reduce heat loss and comply with global efficiency standards. In December 2024, crude steel production in Asia and Oceania increased by 9.0% to 106.3 million tons, driven by the introduction of new blast and electric arc furnaces, which necessitated the use of ceramic fibers, insulating fire bricks, and calcium silicate boards. Significant energy initiatives, including Saudi Arabia's Jafurah gas development, enhance the need for high-temperature pipe and cracker insulation. UNIDO's efforts to achieve a 26% reduction in energy intensity through kiln and furnace retrofits in emerging economies are expected to enhance market growth. With the increasing industrial supremacy, China, India, and other Asian nations today account for 73.6% of global steel production; these developments present significant prospects for domestic manufacturing, collaborative partnerships, and advanced insulating solutions.

Challenge: Performance degradation and technical complexity in extreme multi-hazard environments

Ceramic fiber, insulating firebricks (IFBs), and calcium silicate exhibit expedited disintegration in conditions characterized by moisture, chemical exposure, abrasion, and thermal cycling exceeding 1,000°C. These stressors induce microcracking, shrinkage, devitrification, and structural degradation, compromising the reliability of turbines, kilns, and furnaces operating at 1,500°C. Ceramic fiber blankets exhibit a 30–50% reduction in strength after 100 cycles at 1,200°C, accompanied by up to 4% shrinkage, which results in the formation of brittle, tear-sensitive areas. IFBs exhibit fissures and 0.2-inch degradation due to high-temperature shock. Hydration cracking occurs after absorption of 200–300% water by calcium silicate, whereas a 25% loss in strength and promotion of corrosion under insulation are also observed. To be stable in the long run, such multi-hazard exposures require the use of hydrophobic aerogel-silicate composites, phosphate-bonded IFBs, and zirconia-reinforced ??????fibers.

high-temperature-insulation-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

TMT bar plants in Jalna, India; 15–55 ton induction furnaces melting at 1,640–1,655°C; replaced ceramic fiber with WDS LambdaFlex Super Microporous + SS 800 Board as ladle back-up insulation | Shell temperature reduced to 80–100°C, saving 150–160 kWh per heat with only 1°C/min drop vs. >2°C/min, yielding 1,800–1,920 kWh daily savings (12 heats) while maintaining high durability and corrosion resistance |

|

KLAY EnerSol used prefabricated 3M Nextel high-temperature textiles to shield PDH process heater tubes in Selangor, Malaysia, from excessive radiant heat flux and secondary cracking | Improved heat-flux control reduced secondary cracking, while prefabricated Nextel insulation shortened turnaround from 3–4 weeks to a few days and minimized operational downtime and supply chain disruptions |

|

A European aluminum producer operating an anode baking furnace at 1,100–1,240°C replaced its existing 13 mm, 128 kg/m³ magnesium-silicate blanket in 20–25 mm expansion joints with Superwool Prime Blanket of identical specifications to improve thermal performance and durability during the furnace’s demanding 880-hour baking cycle | Superior resilience and tear-free handling enabled reuse for a second baking cycle in good-condition joints, while its lower thermal conductivity (0.28 vs. 0.43 W/m•K at 1,000°C) improved insulation efficiency and supported a full transition to Superwool® Prime in H2 2022 |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

An ecosystem map for the high temperature insulation materials market highlights the interconnected network of stakeholders across its industrial value chain. It includes raw material suppliers (alumina, silica, kaolin, zirconia, alkaline earth silicates, and refractory binders), manufacturers of ceramic fibers, insulating firebricks, calcium silicate boards, microporous panels, and refractory modules, as well as distributors, fabricators, and installation contractors. The ecosystem further extends to end-use industries, including steel, petrochemicals, power generation, glass, cement, ceramics, and industrial furnace manufacturers, all of which rely on these materials to ensure thermal efficiency, equipment durability, and safe high-temperature operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

High Temperature Insulation Materials Market, By Material Type

In 2024, the ceramic fibers segment dominated the high temperature insulation materials market, led by its outstanding thermal resistance, lightweight characteristics, and appropriateness for prolonged exposure to intense heat. Ceramic fibers are extensively utilized in steel manufacturing facilities, petrochemical heaters, power generation systems, and industrial furnaces, where it is essential to uphold high energy efficiency and minimize heat loss. Their low thermal conductivity, adaptability, and simple installation make them ideal for furnace linings, expansion joints, and high-temperature sealing applications. The increasing demand for lightweight, high-performance insulation and the necessity to comply with stringent energy-efficiency and emission regulations are bolstering the adoption of ceramic fibers in both established and developing industrial sectors.

High Temperature Insulation Materials Market, By Temperature Range

In 2024, the high temperature insulation materials market was dominated by the temperature range segment of 1,100°C–1,500°C (2,012°F–2,732°F), driven by its critical role in heavy industrial operations in which intense thermal loads are routine. This range is quite extensively needed in steel reheating furnaces, petrochemical reformers, rotary kilns, glass melting tanks, and high-temperature processing units for maintaining the structural integrity and minimizing heat losses to keep operational efficiency to a maximum. Increased industrial production, advanced furnace technologies, and stringent energy-efficiency regulations have significantly increased the demand for insulation materials that can withstand extreme temperatures. Continuous improvements in advanced fiber compositions and lightweight refractory systems have played a significant role in driving market growth in this sector, making it the largest and fastest-growing temperature classification globally.

High Temperature Insulation Materials Market, By End-use Industry

In 2024, the petrochemicals sector was the largest end-use segment of the high temperature insulation materials market, led by the industry's dependence on high-heat operations like steam crackers, reformers, ethylene furnaces, and catalytic reactors. These units operate regularly at temperatures above 1,200°C, making advanced insulation necessary to maintain process efficiency, reduce heat loss, and ensure equipment longevity. High-performance ceramic fibers, insulating firebricks, and calcium silicate systems are extensively applied to enhance thermal stability, reduce energy consumption, and meet stringent emission and safety standards. The swift growth of capacity in Asia and the Middle East, along with continuous furnace enhancements and maintenance cycles driven by turnarounds in global petrochemical centers, has further stimulated demand. As producers emphasize energy efficiency and reliability in high-temperature settings, the petrochemical industry remains a significant catalyst for growth in high temperature insulation materials.

REGION

Asia Pacific to be the fastest-growing region in the global high temperature insulation materials market during the forecast period

Asia Pacific will see the fastest growth in the high temperature insulation material market due to rapid industrialization and the proliferation of energy-intensive industries. High and continuous growth of steel production, increase in petrochemical capacity, and rise in ceramics manufacturing continue in the region, and it accounts for over 70% of the global steel output, hence escalating demand for reliable high-temperature refractory and insulation solutions. Power generation, including coal-based, waste-to-energy, and renewable thermal systems, increases the need for advanced insulation with the aim of efficiency and the reduction of heat loss. The surge in environmental regulations, energy efficiency mandates, and modernization of industrial furnaces and kilns accelerates material upgrades across factories. The expansion of manufacturing facilities in China, India, Japan, and Southeast Asia, along with increasing governmental incentives for environmentally friendly industrial practices, is enhancing the utilization of ceramic fibers, insulating firebricks, and calcium silicate insulation in heavy industries.

high-temperature-insulation-market: COMPANY EVALUATION MATRIX

3M (Star) maintains a leading position in the high temperature insulation materials market through its global reach, advanced ceramic fiber and microporous insulation technologies, and strong R&D capabilities, driving widespread adoption across steel, petrochemical, power, and high-performance industrial applications. Etex Group (Emerging Leader), through its Promat division, is rapidly strengthening its market presence by offering innovative calcium silicate and microporous insulation solutions tailored for industrial equipment, construction, and fire protection systems. This enables the company to capture the growing demand for energy-efficient, compliant, and application-specific high-temperature insulation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- 3M

- Morgan Advanced Materials plc

- RHI Magnesita GmbH

- Luyang Energy-saving Materials Co., Ltd.

- Etex Group

- Calderys

- Alkegen

- SHINAGAWA REFRA Co., Ltd.

- IBIDEN

- Grupo NUTEC

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.16 BN |

| Market Size in 2030 (Value) | USD 5.23 BN |

| CAGR | 3.9% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN) Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: high-temperature-insulation-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based high temperature insulation material manufacturers |

|

|

| Ceramic fiber–based high temperature insulation material manufacturers |

|

|

| Insulating Firebricks (IFB) based high temperature insulation material manufacturers |

|

|

RECENT DEVELOPMENTS

- January 2025 : RHI Magnesita completed the USD 410 million acquisition of Resco Group. This strategic move significantly strengthens RHI Magnesita’s North American footprint.

- November 2024 : Calderys announced the launch of HWI’s advanced copper refractory product range in the EMEA region.

- July 2023 : Morgan Advanced Materials expanded its Yixing plant in China, boosting the production capacity of TJM Insulating Firebricks (IFBs) by over 50%.

- May 2023 : Luyang Energy-saving Materials Co., Ltd. commenced trial production of its 1,500-ton-per-year wide-width ceramic fiber paper line.

- May 2023 : Etex completed the acquisition of Skamol, a Danish specialist in fire protection and high-temperature insulation materials, further strengthening its sustainable building solutions portfolio.

Table of Contents

Methodology

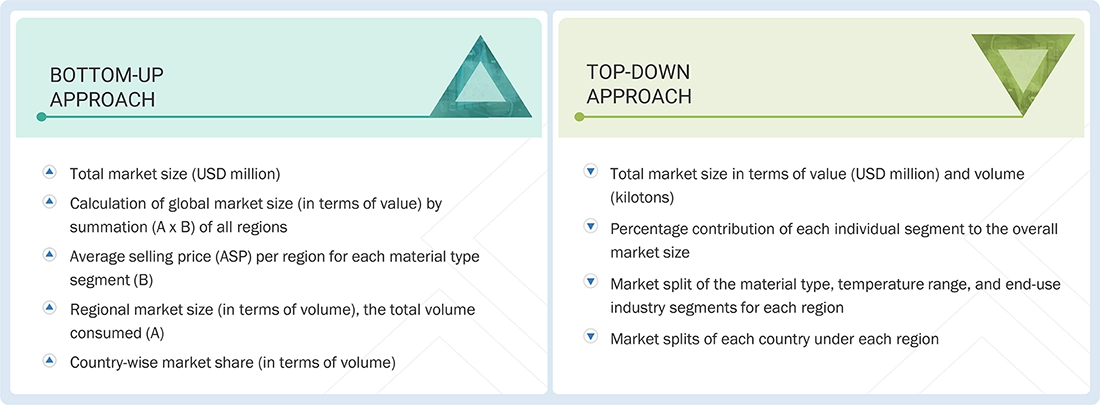

The study involved four major activities to estimate the current size of the global high temperature insulation materials market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of high temperature insulation materials through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the high temperature insulation materials market. Following this, market breakdown and data triangulation procedures were employed to determine the size of various market segments and sub-segments.

Secondary Research

The market for companies offering high temperature insulation materials is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to for identifying and collecting information for this study on the high temperature insulation materials market. Secondary sources also included annual reports, press releases, and investor presentations from door vendors, as well as forums, certified publications, and whitepapers. The secondary research was utilized to gather critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from both market- and technology-oriented perspectives

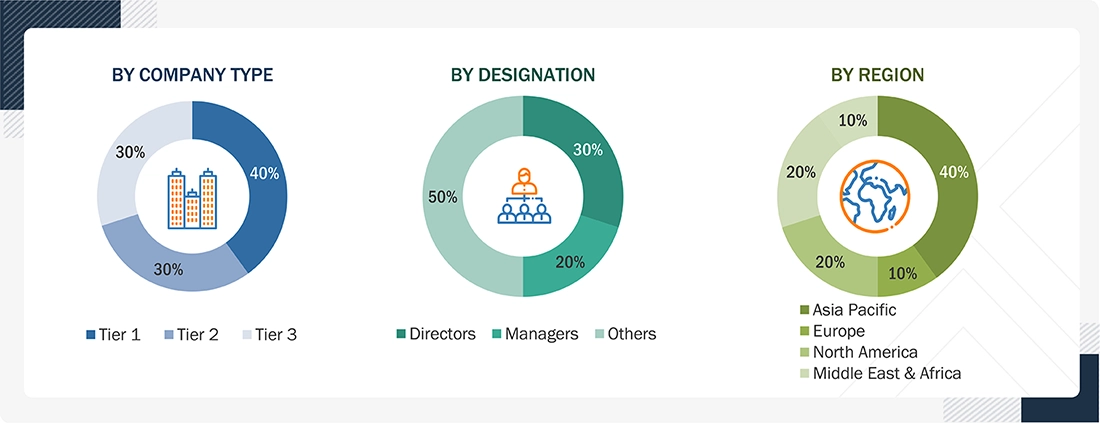

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the high temperature insulation materials market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of high temperature insulation materials offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Notes: Other designations include sales, marketing, and product managers. Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global high temperature insulation materials market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

High Temperature Insulation Materials Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

High temperature insulation materials are sophisticated thermal protection solutions engineered to function over 600°C (1,112°F), providing remarkable resistance to heat transfer and energy dissipation in harsh industrial environments. Prevalent varieties include ceramic fibers, insulating fire bricks, calcium silicate, aerogels, and microporous insulation, which are esteemed for their robustness, low thermal conductivity, and longevity. These materials are valued for their strength, low conductivity, and durability, and are widely utilized in such industries as petrochemical, steel, cement, glass, and nonferrous metals for precise temperature control, equipment protection, and energy efficiency. Adhering to ASTM, ISO, and national energy requirements, they facilitate emission reduction and process optimization. Continuous improvements in lightweight and eco-friendly formulations render HTIMs essential for improving sustainability and upgrading high-temperature industrial operations globally.

Key Stakeholders

- High temperature insulation materials manufacturers

- Raw material suppliers

- Converters & processors

- Distributors and traders

- Industry associations and regulatory bodies

- End users

Report Objectives

- To define, describe, and forecast the size of the global high temperature insulation materials market, based on material type, temperature range, end-use industry, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as acquisitions, expansions, partnerships, and agreements in the high temperature insulation materials market

- To provide the impact of AI/Gen AI on the market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the high temperature insulation materials market report:

Product Analysis

- A product matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the high temperature insulation materials market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the High Temperature Insulation Materials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in High Temperature Insulation Materials Market

Louis

Jul, 2022

Specific information on insulation material for high temperature.