High Temperature Grease Market by Type (Soap Thickener, Non-Soap Thickener, lubricants), Application (Industrial, Automotive), and Region (APAC, EU, NA, MEA, LA) - Global Forecast to 2021

[185 Pages Report] The high temperature grease market is estimated to have been USD 19.48 Billion in 2015 and is projected to reach USD 26.49 Billion by 2021, at a CAGR of 5.3% between 2016 and 2021. In this report, 2015 is considered as the base year and forecast period is between 2016 and 2021. The market has been segmented on the basis of type, application, and region. Industrial application is expected to play a key role in fueling the growth of the overall high temperature grease market owing to the rapid industrialization in the Asia-Pacific region. It accounted for the largest market share in the global high temperature grease market in 2015. Soap thickener is the major type of high temperature grease owing to its improved oxidative stability and high operational temperature range.

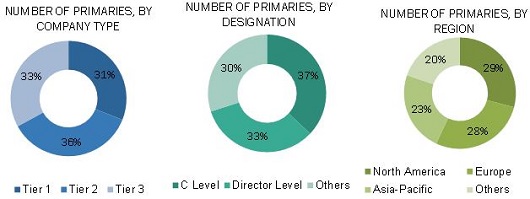

In this report, market sizes have been derived using both bottom-up and top-down approaches. First, the market size for each application (Industrial and Automotive) for various regions (Asia-Pacific, Europe, North America, Middle East & Africa, and Latin America) and countries have been identified using secondary and primary research. The overall high temperature grease market sizes for various regions and countries have been calculated by adding these individual markets. Regional level high temperature grease market sizes have been further broken down on the basis of type using percentage split gathered during the research. For future growth (CAGR) trends of the high temperature grease market, the application–industrial and automotive have been analyzed. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, Directors, and executives. The breakdown of profiles of primary interviewees is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

As the high temperature grease market is vertically integrated, the raw material suppliers itself are the manufacturers. The major high temperature grease manufacturers are Royal Dutch Shell Plc. (the Netherlands), Exxon Mobil Corporation (U.S.), Sinopec Limited (China), Total S.A. (France), BP Plc. (U.K.), Chevron Corporation (U.S.), Fuchs Petrolub AG (Germany), Lubrizol Corporation (U.S.), and others.

The target audiences for the high temperature grease market report are as follows:

- High temperature grease manufacturers

- High temperature grease suppliers

- Government and research organizations

- High temperature grease traders, distributors, and suppliers

- Investment banks and private equity firms

- Raw material suppliers

- Service providers

- End users such as automobile, marine, and manufacturing companies

Scope of the Report:

This report categorizes the global market for high temperature grease on the basis of thickener type, application, and region.

High Temperature Greases Market, by Type:

- Soap Thickener:

- Lithium complex

- Aluminum Complex

- Calcium sulphonate

- Others

- Non-soap Thickener

- Polyurea

- Clay

- Silica

- Lubricants

High Temperature Greases Market, by Application:

- Industrial

- Steel

- Mining

- Marine

- Others

- Automotive

- Commercial Vehicle

- Passenger Vehicle

High Temperature Greases Market, by Geography:

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options (not limited to) are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country, additional application, and/or type

Country Information

- Additional country information (Up to 3)

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The industrial application dominated the high temperature grease market. The growth in the steel, mining, and marine industries is expected to drive the rising demand for the high temperature grease across the globe. Additionally, the improved living standards in emerging economies are contributing to the growth of the global high temperature grease market is projected to be worth USD 26.49 Billion by 2021, registering a CAGR of 5.3% between 2016 and 2021. The rapid growth in the industrial sector in Asia-Pacific is a key factor driving the high temperature grease market. More than 70% of high temperature grease was consumed by the industrial application segment in 2015. Also, the rapid growth of the automotive industry in Asia-Pacific is one of the factors driving the market.he global high temperature grease market.

The high temperature grease market is classified on the basis of type into soap thickener, non-soap thickener, and lubricants. The high temperature grease market is dominated by soap thickener because of its improved oxidative stability and high operational temperature range. However, non-soap thickener is also estimated to register a high CAGR between 2016 and 2020. Non-soap thickeners are in the form of very fine powders and have enough porosity and surface area to absorb oil with a high melting point. Because of which, they are mainly used in electric motors, bearings, and oven conveyers.

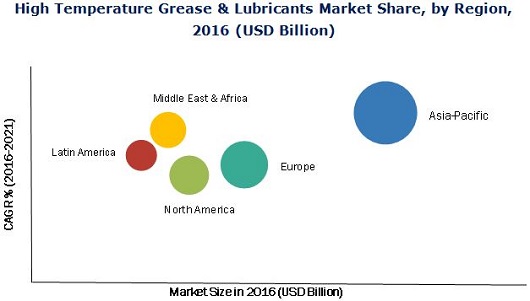

Currently, Asia-Pacific is the largest market for high temperature grease. The growing automotive and the manufacturing industry in the region are expected to drive the increasing demand for high temperature grease. On the other hand, Middle East & Africa is projected to be the second-fastest growing region between 2016 and 2021. This high growth is attributed to the growing industrial sector in the region.

The major factor restraining the growth of the high temperature grease market is unstable economic situation. The 2008 global economic turmoil hit almost all the sectors in developed nations of North America and Western Europe. There have been no significant investments in the key end-use sectors such as manufacturing, energy, and automotive. As a result, the demand for high temperature grease has dropped significantly in the past five years.

Some of the important high temperature grease companies are Royal Dutch Shell Plc. (the Netherlands), Exxon Mobil Corporation (U.S.), The Dow Chemical Company (U.S.), Sinopec Limited (China), Total S.A. (France), BP Plc. (U.K.), Chevron Corporation (U.S.), Fuchs Petrolub AG (Germany), Indian Oil Corporation (India), Lubrizol Corporation (U.S.), and E.I. DuPont de Nemours and Company (U.S.). The players in this market need to compete with each other with respect to prices and offering wide product range to meet the market requirements.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stake Holders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Significant Opportunities in the High Temperature Grease & Lubricants Market (2016-2021)

4.2 High Temperature Grease & Lubricants Market to Grow at A High Rate

4.3 Asia-Pacific High Temperature Grease & Lubricants Market Scenario, By Country and Type

4.4 High Temperature Grease & Lubricants Market Attractiveness, 2016-2021

4.5 High Temperature Grease & Lubricants Market, By Application and By Region, 2015

4.6 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rapid Industrialization in Asia-Pacific & Africa

5.3.1.2 Growing Automotive Industry in Asia-Pacific Region

5.3.1.3 Soaring Demand for Lithium Complex Soap-Thickener

5.3.2 Restraints

5.3.2.1 Effect of Economic Crisis in North America and Western Europe

5.3.3 Opportunities

5.3.3.1 Industrial Growth in the Middle East & Africa Region

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Raw Material

6.2.2 Blending

6.2.3 Distribution

6.2.4 End User

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 High Temperature Grease & Lubricants Market, By Type (Page No. - 50)

7.1 Introduction

7.2 Soap Thickener

7.2.1 Lithium Complex

7.2.2 Aluminium Complex

7.2.3 Calcium Sulphonate

7.3 Non-Soap Thickener

7.3.1 Polyurea

7.3.2 Clay

7.3.3 Silica

7.4 High Temperature Lubricants

8 High Temperature Grease & Lubricants Market, By Application (Page No. - 64)

8.1 Introduction

8.2 Industrial

8.2.1 Steel

8.2.2 Mining

8.2.3 Marine

8.3 Automotive

8.3.1 Commercial Vehicle

8.3.2 Passenger Vehicle

9 High Temperature Grease & Lubricants Market, By Region (Page No. - 76)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 Asia-Pacific High Temperature Grease & Lubricants Market, By Type

9.2.2 Asia-Pacific Market Analysis, By Application

9.2.3 Asia-Pacific Market Analysis, By Country

9.2.3.1 China

9.2.3.2 Japan

9.2.3.3 India

9.2.3.4 South Korea

9.3 Europe

9.3.1 European High Temperature Grease & Lubricants, By Type

9.3.2 European High Temperature Grease & Lubricants Market, By Application

9.3.3 European High Temperature Grease & Lubricants Market, By Country

9.3.3.1 Germany

9.3.3.2 Russia

9.3.3.3 France

9.3.3.4 Turkey

9.4 North America

9.4.1 North American High Temperature Grease & Lubricants Market, By Type

9.4.2 North American High Temperature Grease & Lubricants Market, By Application

9.4.3 North American High Temperature Graese & Lubricants Market, By Country

9.4.3.1 U.S.

9.4.3.2 Canada

9.4.3.3 Mexico

9.5 Middle East & Africa

9.5.1 Middle East & Africa High Temperature Grease & Lubricants Market, By Type

9.5.2 Middle East & Africa High Temperature Grease & Lubricants Market, By Application

9.5.3 Middle East & Africa High Temperature Grease & Lubricants Market, By Country

9.5.3.1 UAE

9.5.3.2 Saudi Arabia

9.5.3.3 South Africa

9.6 Latin America

9.6.1 Latin America High Temperature Grease & Lubricants Market, By Type

9.6.2 Latin America High Temperature Grease & Lubricants Market, By Application

9.6.3 Latin America High Temperature Grease & Lubricants Market, By Country

9.6.3.1 Brazil

9.6.3.2 Argentina

10 Competitive Landscape (Page No. - 117)

10.1 Overview

10.2 Strategic Benchmarking

10.2.1 New Product Launch

10.3 Competitive Situation and Trends

10.3.1 New Product Launch

10.3.2 Expansions

11 Company Profiles (Page No. - 122)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Introduction

11.2 Exxonmobil Corporation

11.3 Royal Dutch Shell PLC.

11.4 The DOW Chemical Company

11.5 Fuchs Petolub SE

11.6 Total S.A.

11.7 BP PLC

11.8 Petroliam Nasional Berhad (Petronas)

11.9 Lubrizol Corporation

11.10 Chevron Corporation

11.11 E.I. Du Pont De Nemours and Co.

11.12 Sinopec Limited

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 149)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (93 Tables)

Table 1 High Temperature Grease Market & Lubricants Market, By Type

Table 2 High Temperature Grease Market & Lubricants Market, By Application

Table 3 High Temperature Grease Market & Lubricants Market Size, By Type, 2014–2021 (USD Million)

Table 4 High Temperature Grease Market & Lubricants Market Size, By Type, 2014–2021 (Kiloton)

Table 5 Soap Thickener Market Size, By Region, 2014–2021 (USD Million)

Table 6 Soap Thickener Market Size, By Region, 2014–2021 (Kiloton)

Table 7 Non-Soap Thickners Market Size, By Region, 2014 - 2021 (USD Million)

Table 8 Non-Soap Thickners Market Size, By Region, 2014–2021 (Kiloton)

Table 9 High Temperature Lubricants Market Size, By Region, 2014–2021 (USD Million)

Table 10 High Temperature Lubricants Market Size, By Region, 2014–2021 (Kilotons)

Table 11 High Temperature Grease Market & Lubricants Market Size, By Application, 2014–2021 (USD Million)

Table 12 High Temperature Grease Market & Lubricants Market Size, By Application, 2014–2021 (Kiloton)

Table 13 High Temperature Grease Market & Lubricants Market Size in Industrial Application, By Region, 2015–2021 (USD Million)

Table 14 High Temperature Grease Market & Lubricants Market Size in Industrial Application, By Region, 2014–2021 (Kiloton)

Table 15 High Temperature Grease Market & Lubricants Market Size in Automotive Application, By Region, 2014–2021 (USD Million)

Table 16 High Temperature Grease Market & Lubricants Market Size in Automotive Application, By Region, 2014–2021 (Kiloton)

Table 17 High Temperature Grease Market & Lubricants Market Size, By Region, 2014–2021 (USD Million)

Table 18 High Temperature Grease Market & Lubricants Market Size, By Region, 2014–2021 (Kiloton)

Table 19 Asia-Pacific: High Temperature Grease Market & Lubricants Market Size, By Type, 2014-2021 (USD Million)

Table 20 Asia-Pacific: High Temperature Grease Market & Lubricants Market Size, By Type, 2014-2021 (Kiloton)

Table 21 Asia-Pacific: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (USD Million)

Table 22 Asia-Pacific: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 23 Asia-Pacific: High Temperature Grease Market & Lubricants Market Size , By Country, 2014-2021 (USD Million)

Table 24 Asia-Pacific: High Temperature Grease Market & Lubricants Market Size, By Country, 2014-2021 (Kiloton)

Table 25 China: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 26 China: High Temperature Grease Market & Lubricants Market Size, By Application, 2013-2020 (Kiloton)

Table 27 Japan: High Temperature Gresae Market & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 28 Japan: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 29 India: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 30 India: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 31 South Korea: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 32 South Korea: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 33 Europe: High Temperature Grease Market & Lubricants Market Size, By Type, 2014-2021 (USD Million)

Table 34 Europe: High Temperature Grease Market & Lubricants Market Size, By Type, 2014-2021 (Kiloton)

Table 35 Europe: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (USD Million)

Table 36 Europe: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 37 Europe: High Temperature Grease Market & Lubricants Market Size, By Country, 2014-2021 (USD Million)

Table 38 Europe: High Temperature Grease Market & Lubricants Market Size, By Country, 2014-2021 (Kiloton)

Table 39 Germany: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 40 Germany: High Tempearture Grease Market & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 41 Russia: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 42 Russia: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 43 France: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 44 France: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 45 Turkey: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 46 Turkey: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 47 North America: High Temperature Grease Market & Lubricants Market Size, By Type, 2014-2021 (USD Million)

Table 48 North America: High Temperature Grease Market & Lubricants Market Size, By Type, 2014-2021 (Kiloton)

Table 49 North America: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (USD Million)

Table 50 North America: High Temperature Grease Market & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 51 North America: High Temperature Grease Market & Lubricants Market Size, By Country, 2014-2021 (USD Million)

Table 52 North America: High Temperature Grease Market & Lubricants Market Size, By Country, 2014-2021 (Kiloton)

Table 53 U.S.: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 54 U.S.: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 55 Canada: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 56 Canada: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 57 Mexico: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 58 Mexico: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 59 Middle East & Africa: High Temperature Grease & Lubricants Market Size, By Type, 2014-2021 (USD Million)

Table 60 Middle East & Africa: High Temperature Grease & Lubricants Market Size, By Type, 2014-2021 (Kiloton)

Table 61 Middle East & Africa: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (USD Million)

Table 62 Middle East & Africa: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 63 Middle East & Africa: High Temperature Grease & Lubricants Market Size, By Country, 2014-2021 (USD Million)

Table 64 Middle East & Africa: High Temperature Grease & Lubricants Market Size, By Country, 2014-2021 (Kiloton)

Table 65 UAE: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 66 UAE: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 67 Saudi Arabia: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 68 Saudi Arabia: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 69 South Africa: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 70 South Africa: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 71 Latin America: High Temperature Grease & Lubricants Market Size, By Type, 2014-2021 (USD Million)

Table 72 Latin America: High Temperature Grease & Lubricants Market Size, By Type, 2014-2021 (Kiloton)

Table 73 Latin America: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (USD Million)

Table 74 Latin America: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 75 Latin America: High Temperature Grease & Lubricants Market Size, By Country, 2014-2021 (USD Million)

Table 76 Latin America: High Temperature Grease & Lubricants Market Size, By Country, 2014-2021 (Kiloton)

Table 77 Brazil: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 78 Brazil: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 79 Argentina: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (USD Millon)

Table 80 Argentina: High Temperature Grease & Lubricants Market Size, By Application, 2014-2021 (Kiloton)

Table 81 New Product Launch, 2011–2016

Table 82 Expansions, 2011–2016

Table 83 Exxonmobil Corporation: Products and Their Description

Table 84 Royal Dutch Shell PLC.: Products and Their Descriptions

Table 85 The DOW Chemical Comapany : Products and Their Descriptions

Table 86 Fuchs Petrolub SE : Products and Their Descriptions

Table 87 Total S.A. : Products and Their Descriptions

Table 88 BP PLC. : Products and Their Descriptions

Table 89 Petronas: Products and Their Descriptions

Table 90 Lubrizol Corporation: Products and Their Descriptions

Table 91 Chevron Corporation: Products and Their Descriptions

Table 92 E. I. De Pont De Numeours and Co.: Products and Their Descriptions

Table 93 Sinopec Limited: Products and Their Descriptions

List of Figures (61 Figures)

Figure 1 High Temperature Grease & Lubricants: Market Segmentation

Figure 2 High Temperature Grease & Lubricants Market, Research Design

Figure 3 Key Data From Secondary Sources

Figure 4 Key Data From Primary Sources

Figure 5 Key Industry Insights

Figure 6 Breakdown of Primary Interviews

Figure 7 Market Size Estimation: Bottom-Up Approach

Figure 8 Market Size Estimation: Top-Down Approach

Figure 9 Market Breakdown and Data Triangulation

Figure 10 High Temperature Grease & Lubricants Market, 2016-2021

Figure 11 Industrial Sector Expected to Be Fastest-Growing Application for High Temperature Grease & Lubricants

Figure 12 Asia-Pacific to Register Highest CAGR Between 2016 and 2021

Figure 13 Asia-Pacific to Dominate High Temperature Grease & Lubricants Market Between 2016 and 2021

Figure 14 Long Term Sustainibility of the High Temperature Grease & Lubricants Market Between 2016 and 2021

Figure 15 Asia-Pacific Expected to Be the Key Market for High Temperature Grease & Lubricants Between 2016 and 2021

Figure 16 Asia-Pacific High Temperature Grease & Lubricants Market: Lubricants Accounted for the Largest Share 2015

Figure 17 Asia-Pacific Projected to Be the Fastest-Growing Market for High Temperature Grease & Lubricants Between 2016 and 2021

Figure 18 Industrial Sector is the Largest Application of High Temperature Grease & Lubricants Across All Regions

Figure 19 Asia-Pacific to Experience High Growth During Forecast Period

Figure 20 Overview of the Forces Governing the High Temperature Grease & Lubricants Market

Figure 21 Value Chain of High Temperature Grease & Lubricants Market

Figure 22 Porter’s Five Forces Analysis

Figure 23 Lubricants to Dominate High Temperature Grease & Lubricants Market Between 2016 and 2021

Figure 24 Asia-Pacific to Drive the Soap Thickener Demand in High Temperature Grease & Lubricants Market Between 2016 and 2021

Figure 25 Lithium Complex Market Size, 2014-2021

Figure 26 Aluminium Complex Market Size, 2014-2021

Figure 27 Calcium Sulphonate Market Size, 2014-2021

Figure 28 Asia-Pacific to Continue Dominating the Market for Non-Soap Thickener During Forecast Period

Figure 29 Polyurea Market Size, 2014-2021

Figure 30 Clay Market Size, 2014-2021

Figure 31 Silica Market Size, 2014-2021

Figure 32 Industrial Application to Dominate the High Temperature Grease & Lubricants Market Between 2016 and 2021

Figure 33 Asia-Pacific to Be the Largest High Temperature Grease & Lubricants Market in Industrial Application

Figure 34 High Temperature Grease & Lubricants Market Size in Steel Industry, 2014-2021

Figure 35 High Temperature Grease & Lubricants Market Size in Mining Industry, 2014-2021

Figure 36 High Temperature Grease & Lubricants Market Size in Mining Industry, 2014-2021

Figure 37 Asia-Pacific to Retain Its Dominance in High Temperature Grease & Lubricants Market in Automotive Application Till 2021

Figure 38 High Temperature Grease & Lubricants Market Size, in Commercial Vehicle, 2014-2021

Figure 39 High Temperature Grease & Lubricants Market Size in Passenger Vehicle, 2014-2021

Figure 40 Regional Snapshot (2016-2021): Asia-Pacific Countries to Drive the Market

Figure 41 Asia-Pacific High Temperature Grease & Lubricants Market Snapshot: China and Japan Leading the Asia-Pacific Market

Figure 42 Europe Market Snapshot: Germany is the Largest High Temperature Grease & Lubricants Market

Figure 43 North American Market Snapshot: Majority of Key Players Based in the U.S.

Figure 44 Companies Primarily Adopted Organic Growth Strategies Between 2011 and 2016

Figure 45 Strategic Benchmarking: Exxonmobil Corporation Focusing on New Product Launch to Capture Additional Market Share

Figure 46 Geographical Revenue Mix of Top Five Market Player

Figure 47 Exxonmobil Corporation: Company Snapshot

Figure 48 Exxonmobil Corporation: SWOT Analysis

Figure 49 Royal Dutch Shell PLC.: Company Snapshot

Figure 50 Royal Dutch Shell PLC.: SWOT Analysis

Figure 51 The DOW Chemical Company: Company Snapshot

Figure 52 The DOW Chemical Company: SWOT Analysis

Figure 53 Fuchs Petrolub SE: Company Snapshot

Figure 54 Fuchs Petrolob SE: SWOT Analysis

Figure 55 Total S.A.: Company Snapshot

Figure 56 Toatal S.A.: SWOT Analysis

Figure 57 BP PLC: Company Snapshot

Figure 58 Petronas: Company Snapshot

Figure 59 Chevron Corporation: Company Snapshot

Figure 60 E.I.Du Pont De Nemours and Co.: Company Snapshot

Figure 61 Sinopec Limited: Company Snapshot

Growth opportunities and latent adjacency in High Temperature Grease Market