High Voltage Cables and Accessories Market by Product Type (Cables (XLPE, EPR, HEPR, MI), Accessories (Joints, Termination, Fittings & Fixtures), Conductor Type (Aluminum, Copper), Installation, Voltage, End User & Region - Global Forecast to 2028

High Voltage Cables and Accessories Market Size, Share, Growth Report & Forecast

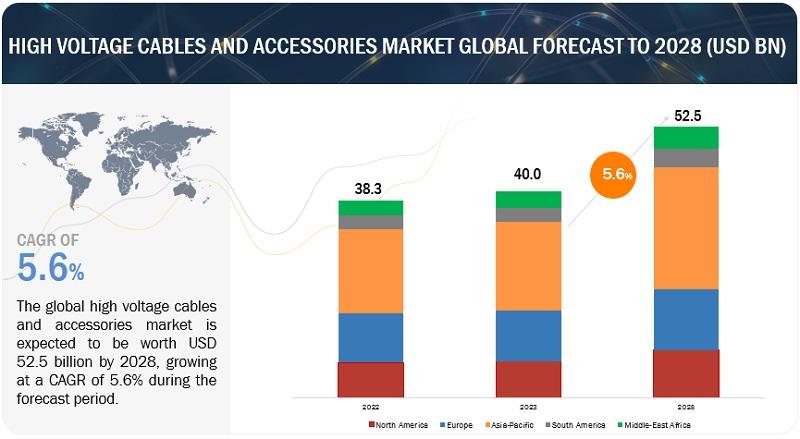

[248 Pages Report] The global high voltage cables and accessories market is estimated to grow from USD 40.0 billion in 2023 to USD 52.5 billion by 2028; it is expected to record a CAGR of 5.6% during the forecast period.

Power utilities is one of the major end user of high voltage cables and accessories. Power utilities utilize high voltage cables to transmit electricity over long distances while minimizing power losses during transmission. This is anticipated to enhance the high voltage cables and accessories market size.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

High Voltage Cables and Accessories Market Growth Dynamics

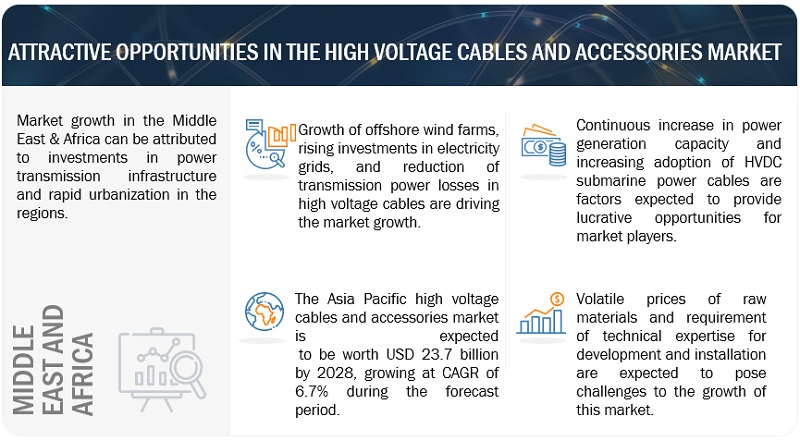

Driver: Rising Investments in Electricity Grids

Investments in electricity grids have been on the rise in recent years as governments and energy companies recognize the need to modernize and upgrade their infrastructure to meet the increasing demand for electricity and support the transition to cleaner energy sources. High voltage cables accessories play a crucial role in the expansion and enhancement of electricity grids. These cables are responsible for transmitting electricity at high voltages over long distances, connecting power generation sources, substations, and distribution networks. They also facilitate the interconnection of regional and national power grids, enabling the exchange of electricity across borders. Interconnections enhance grid stability, support energy trading, and contribute to a more reliable and resilient electricity supply. Moreover, governments are providing fiscal support to bolster spending on electricity networks as part of their response to the economic crisis triggered by the pandemic. This additional support is further contributing to the increased investment in electricity grids.

Restraint: High Cost of Installation and Repair of Underground and Submarine Cables

The installation and repair of underground and submarine cables can be quite costly, posing financial challenges for power transmission projects. This is primarily due to the complex nature of the installation process, the specialized equipment required, and the need for skilled personnel. The installation of underground cables involves excavation, trenching, and cable laying, requiring significant manpower and machinery. Special care must be taken to ensure the cables are properly protected and insulated, which adds to the overall cost. Submarine cable installation is an even more intricate and expensive process. It involves specialized vessels and equipment capable of laying cables on the seabed, often in challenging marine conditions. The cables need to be carefully routed and secured, considering factors such as water depth, seabed conditions, and potential hazards like shipping routes or marine wildlife habitats. The high costs associated with underground and submarine cable installations and repairs are primarily driven by the need for advanced technology, specialized materials, and skilled labor. These factors contribute to the overall project budget and can pose financial constraints for power transmission initiatives, especially for long-distance or large-scale projects.

Opportunities: Increasing Adoption of HVDC Submarine Power Cables

The utilization of HVDC (High Voltage Direct Current) submarine power cables is witnessing a notable surge due to their multitude of advantages in transmitting electricity over long distances across bodies of water. HVDC submarine cables offer a dependable and efficient solution for large-scale power transmission, presenting several benefits when compared to traditional HVAC (High Voltage Alternating Current) cables. HVDC systems exhibit lower electrical losses compared to HVAC systems, resulting in improved energy efficiency. By employing HVDC technology, transmission losses are reduced, leading to enhanced efficiency and cost savings. HVDC submarine power cables also boast an augmented power transmission capacity. They have the capability to handle higher power loads compared to HVAC cables, making them well-suited for efficiently transmitting large quantities of electricity over significant distances. Furthermore, HVDC submarine cables contribute to improved grid stability and control. In addition to their technical benefits, HVDC submarine power cables also exhibit a reduced environmental impact compared to HVAC cables. HVDC submarine cables have a smaller physical footprint as they are laid on the seabed. This reduces conflicts related to land use and preserves sensitive ecosystems.

Challenges: Requirement of Technical Expertise for Development and installation

The development of efficient transmission and distribution (T&D) infrastructure is crucial to address energy security concerns and the need to expand power generation capacity in developing nations. The specific types of cables and accessories used in the high voltage cables and accessories market present unique challenges for utilities, wire and cable manufacturers, and material suppliers. The cable industry demands continuous technical innovations to improve system performance, optimize costs, and enhance power delivery. Considering all these factors, the power cable sector aims to ensure long-lasting performance of high voltage cables. This places pressure on supply chain participants to meet the high-quality requirements of high voltage cables and accessories for power and utility applications. Therefore, suppliers must allocate more resources to in-house research and development (R&D) in order to meet customer demands. This presents a challenge for suppliers operating in the high voltage cables and accessories market.

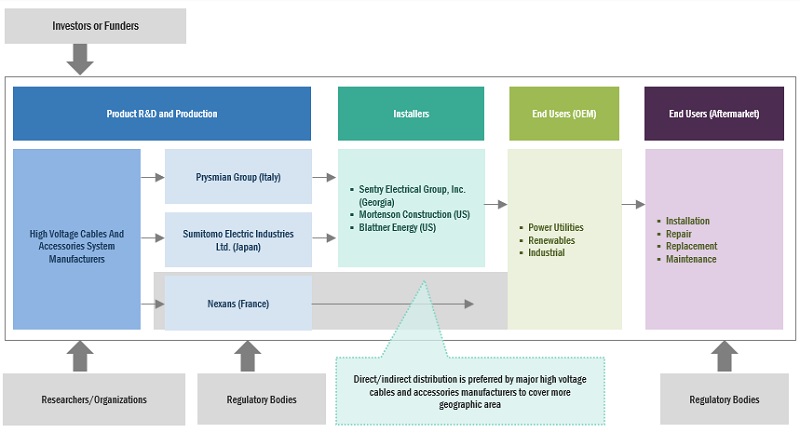

High Voltage Cables And Accessories Market Ecosystem

Leading companies in this market include well-established, financially secure producers of high voltage cables and accessories. These corporations have been long operating in the market and have a differentiated product portfolio, modern manufacturing technologies, and robust sales and marketing networks. Major companies in this market include Prysmian Group (Italy), Sumitomo Electric Industries Ltd. (Japan), Nexans (France), LS Cable & System Ltd. (South Korea), and NKT A/S (Denmark).

The 400 kV and above segment, is expected to be the fastest market by voltage during the forecast period.

By voltage, the high voltage cables and accessories market is divided into 72.5 kV, 123 kV, 145 kV, 170 kV, 245 kV, 400 kV and above. Bag filter is the fastest segment in the high voltage cables and accessories market. The adoption of 400kV and higher voltage cables is on the rise due to their ability to cater to the demands of major transmission projects and large-scale power generation initiatives. Additionally, the use of these high voltage cables proves cost-effective and allows for future scalability, accommodating expansions and upgrades in power infrastructure.

By industrial end user, the oil & gas segment is expected to be the largest segment during the forecast period

This report segments the high voltage cables and accessories market based on industrial end user into four segments: oil & gas, petrochemicals and chemicals, metals and mining, and others. The oil & gas segment is expected to be the largest segment during the forecast period. The adoption of high voltage cables has witnessed a significant increase in the oil and gas due to the industry's growing power demand requires efficient and reliable transmission of electricity over long distances. Subsea operations have increased the demand for high voltage cables that can withstand harsh underwater environments.

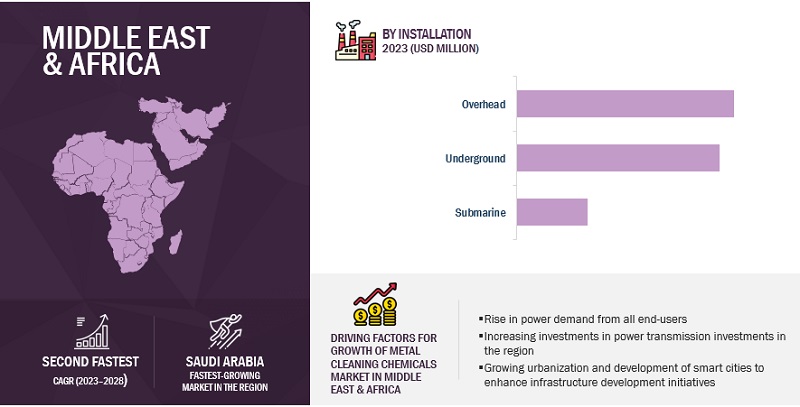

“Middle East & Africa”: The second-fastest in the high voltage cables and accessories market”

Middle East & Africa is expected to be the second-fastest high voltage cables and accessories market during the forecast period. As nations in this region are undergoing massive urbanization, there is a greater demand for reliable power transmission, which is enhancing the investment in development of high voltage transmission grids, further driving the high voltage cables and accessories market in Middle East & Africa.

Key Market Players

The high voltage cables and accessories market is dominated by a few major players that have a wide regional presence. The major players in the high voltage cables and accessories market are Prysmian Group (Italy), Sumitomo Electric Industries Ltd. (Japan), Nexans (France), LS Cable & System Ltd. (South Korea), and NKT A/S (Denmark). Between 2019 and 2023, strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the high voltage cables and accessories market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

High voltage cables and accessories market by product type, voltage, conductor type, installation, and end user |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies covered |

Prysmian Group (Italy), Sumitomo Electric Industries Ltd. (Japan), Nexans (France), LS Cable & System Ltd. (Korea), NKT A/S (Denmark), Furukawa Electric (Japan), Taihan Cable & Solution Co., Ltd. (South Korea), ZTT (China), Elsewedy Electric Company (Egypt), Wuxi Jiangnan Cable (China), Riyadh Cables (Saudi Arabia), PFISTERER Holding AG (Germany), DUCAB (UAE), TE Connectivity (Switzerland), Brugg Kabel AG (Switzerland), KEI Industries Ltd. (India), Tratos (Italy), Southwire Company, LLC (US), Tele-Fonika Kable SA (Poland), and Synergy Cables (US). |

This research report categorizes the high voltage cables and accessories market by component, power source, application, and region.

On the basis of by product type:

-

Cables

- XLPE Cables (Cross-linked Polyethylene)

- EPR Cables (Ethylene-Propylene Rubber)

- HEPR Cables (High Modulus Ethylene-Propylene)

- MI Cables (Mass Impregnated)

-

Accessories

- Cable Joints

- Cable Terminations

- Fittings & Fixtures

- Others

On the basis of voltage:

- 72.5 kV

- 123 kV

- 145 kV

- 170 kV

- 245 kV

- 400 kV and above

On the basis of installation:

- Overhead

- Underground

- Submarine

On the basis of conductor type:

- Copper

- Aluminum

On the basis of end user:

- Power Utilities

- Renewables

-

Industrial

- Oil & Gas

- Chemicals & Petrochemicals

- Metals & Mining

- Others

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2023, Prysmian Group made an announcement regarding the successful acquisition of a contract valued at over USD 864.9 million. This contract pertains to the development of a new power interconnection project between France and Spain, which will be executed for INELFE. INELFE is a joint venture equally owned by Red Electrica, the Spanish grid operator, and Réseau de Transport d’Électricité (RTE), the French grid operator.

- In April 2023, Nexans finalized the purchase of Reka Kaapeli Oy, for a total of USD 57.29 million. The integration of Reka Cables into Nexans' Distribution & Usage business group was included in the acquisition. Being a part of Nexans presents Reka Cables with the chance to enhance its growth and development, while also enabling increased investments in renewable energy solutions.

- In April 2023, Sumitomo Electric Industries, Ltd. revealed its plans to construct a fresh Power Cable facility in the Scottish Highlands, UK. This initiative aims to make a substantial impact on fostering local supply chains and advancing technologies in the UK within the renewable energy sector.

- In March 2023, Prysmian Group made an announcement regarding the acquisition of contracts from the Dutch transmission system operator TenneT. These contracts, with a total value of around USD 1.94 billion, are for two grid connection projects that aim to connect two upcoming offshore wind farms situated in the Dutch North Sea to the province of Zeeland in the Netherlands. The scope of the project includes various tasks such as design, engineering, manufacturing, installation, testing, and commissioning of two 525 kV HVDC submarine and land cable systems, along with all associated accessories.

Frequently Asked Questions (FAQ):

What is the current size of the high voltage cables and accessories market?

The current market size of the high voltage cables and accessories market is USD 40.0 billion in 2023.

Rising investments in electricity grids and renewable energy adoption are the major driving factors for the high voltage cables and accessories market.

Rising investments in electricity grids and renewable energy adoption are the major driving factors for the high voltage cables and accessories market.

Which is the largest region during the forecasted period in the high voltage cables and accessories market?

Asia Pacific is expected to dominate the high voltage cables and accessories market between 2023–2028, followed by Europe and North America. Rising energy demand with increased power transmission infrastructure investments are driving the market for this region.

Which is the largest segment, by conductor type during the forecasted period in the high voltage cables and accessories market?

The copper segment is expected to be the largest market during the forecast period owing to their superior electrical conductivity, that allows for efficient and low-resistance transmission of electricity.

Which is the fastest segment, by the voltage during the forecasted period in the high voltage cables and accessories market?

The 400 kV and above segment is expected to be the fastest growing market during the forecast period due to the convenience of future scalability and cost-effectiveness of the voltage range.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing number offshore wind farms- Rising investments in electricity grids- Reduction of transmission power losses in high voltage cablesRESTRAINTS- Complex regulatory and environmental authorization procedures- High cost of installation and repair of underground and submarine cablesOPPORTUNITIES- Continuous increase in power generation capacity- Increasing adoption of HVDC submarine power cablesCHALLENGES- Volatile prices of raw materials- Requirement of technical expertise for development and installation

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS FOR HIGH VOLTAGE CABLES AND ACCESSORIES MANUFACTURERS

- 5.4 MARKET MAP

-

5.5 VALUE CHAIN ANALYSISRAW MATERIAL PROVIDERS/SUPPLIERSHIGH VOLTAGE CABLES AND ACCESSORIES MANUFACTURERSDISTRIBUTORS/END USERS

- 5.6 AVERAGE SELLING PRICE ANALYSIS

-

5.7 TECHNOLOGY ANALYSISTECHNOLOGY TRENDS RELATED TO HIGH VOLTAGE CABLES AND ACCESSORIES

-

5.8 TARIFF AND REGULATORY LANDSCAPETARIFF FOR HIGH VOLTAGE ACCESSORIES AND CABLESREGULATIONS RELATED TO HIGH VOLTAGE CABLES AND ACCESSORIESCODES AND REGULATIONS RELATED TO HIGH VOLTAGE CABLES AND ACCESSORIES

-

5.9 PATENT ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS, 2023–2024

- 5.11 TRADE ANALYSIS

-

5.12 CASE STUDY ANALYSIS345 KV TRANSMISSION RELIABILITY PROJECT ENHANCES ELECTRICAL CAPABILITIES OF BOSTON AND EASTERN MASSACHUSETTSBRUGG CABLES PROVIDES HIGH VOLTAGE CABLES AND COMPREHENSIVE RANGE OF ACCESSORIES FOR POWER SUPPLY PROJECTS DURING BEIJING OLYMPIC GAMES

-

5.13 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 ALUMINUMEXCELLENT THERMAL CONDUCTIVITY TO BOOST DEMAND

-

6.3 COPPERHOSPITALS, DATA CENTERS, AND AIRPORTS TO PRESENT SIGNIFICANT DEMAND

- 7.1 INTRODUCTION

-

7.2 72.5 KVADVANCEMENTS IN CABLE TECHNOLOGY AND INSULATION MATERIALS TO BOOST DEMAND

-

7.3 123 KVEXPANSION OF SMART GRID INITIATIVES TO DRIVE MARKET

-

7.4 145 KVGROWING NEED FOR LONG-DISTANCE POWER TRANSMISSION TO DRIVE MARKET

-

7.5 170 KVINITIATIVES TO MODERNIZE GRID TO DRIVE MARKET

-

7.6 245 KVREDUCED POWER LOSSES AND SUPERIOR EFFICIENCY TO BOOST MARKET

-

7.7 400KV AND ABOVERENEWABLE ENERGY PROJECTS AND INFRASTRUCTURE DEVELOPMENT TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 8.1 INTRODUCTION

-

8.2 CABLESABILITY TO CARRY LARGE AMOUNTS OF ELECTRICAL POWER AT HIGH VOLTAGES TO BOOST DEMANDCROSS-LINKED POLYETHYLENE- Excellent thermal endurance to drive marketETHYLENE-PROPYLENE RUBBER- Flexibility and ease of installation to drive marketHIGH MODULUS ETHYLENE-PROPYLENE- Improved resistance to electrical and thermal stresses to enhance demandMASS IMPREGNATED- High mechanical durability in challenging environments to drive market

-

8.3 ACCESSORIESENHANCES SAFETY AND PERFORMANCE WITH LOWER MAINTENANCE COSTCABLE JOINTS- Lesser downtime and cost-saving attributes to boost demandCABLE TERMINATION- Safety features, improved performance, and durability to strengthen marketFITTINGS AND FIXTURES- Reduction of power loss and maintenance of optimal electrical characteristics to drive marketOTHERS- Maintains critical safety as per regulations set by regulatory bodies

- 9.1 INTRODUCTION

-

9.2 POWER UTILITIESTRANSMISSION OF ELECTRICITY OVER LONG DISTANCES WITH MINIMAL LOSSES TO BOOST DEMAND

-

9.3 RENEWABLESREDUCED RELIANCE ON FOSSIL FUELS AND PROMOTION OF ECO-FRIENDLY SOLUTIONS TO BOOST DEMAND

-

9.4 INDUSTRIALABILITY TO WITHSTAND HARSH INDUSTRIAL CONDITIONS TO DRIVE MARKETOIL & GAS- Cost savings by minimizing power losses during transmission to strengthen marketCHEMICALS & PETROCHEMICALS- Safety features to counter electrical risks to boost marketMINING & METALS- Ability to handle high-power needs of mining equipment to drive marketOTHERS

- 10.1 INTRODUCTION

-

10.2 OVERHEADHIGHWAYS, TRANSPORTATION NETWORKS, AND RAILWAYS TO OFFER LUCRATIVE OPPORTUNITIES

-

10.3 UNDERGROUNDRESIDENTIAL AREAS AND COMMERCIAL AND INDUSTRIAL ZONES TO PRESENT SIGNIFICANT DEMAND

-

10.4 SUBMARINENEED TO ENSURE STABLE AND RESILIENT ELECTRICITY SUPPLY TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICARECESSION IMPACT: NORTH AMERICABY PRODUCT TYPEBY INSTALLATIONBY CONDUCTOR TYPEBY VOLTAGE RATING TYPEBY END USERBY COUNTRY- US- CANADA- Mexico

-

11.3 EUROPERECESSION IMPACT: EUROPEBY INSTALLATIONBY PRODUCT TYPEBY VOLTAGEBY END USERBY CONDUCTOR TYPEBY COUNTRY- Germany- UK- France- Italy- Spain- Denmark- Netherlands- Switzerland- Belgium- Ireland- Russia- Poland- Romania- Rest of EUROPE

-

11.4 ASIA PACIFICRECESSION IMPACT: ASIA PACIFICBY INSTALLATIONBY PRODUCT TYPEBY VOLTAGEBY END USERBY CONDUCTOR TYPEBY COUNTRY- China- India- Japan- Australia- South Korea- Indonesia- Malaysia- Rest of Asia Pacific

-

11.5 SOUTH AMERICARECESSION IMPACT: SOUTH AMERICABY INSTALLATIONBY PRODUCT TYPEBY VOLTAGEBY END USERBY CONDUCTOR TYPEBY COUNTRY- Brazil- Argentina- Colombia- Rest of South America

-

11.6 MIDDLE EAST AND AFRICARECESSION IMPACT: MIDDLE EAST AND AFRICABY PRODUCT TYPEBY INSTALLATIONBY CONDUCTOR TYPEBY VOLTAGEBY END USERBY COUNTRY- Saudi Arabia- UAE- Egypt- South Africa- Rest of Middle East & Africa

- 12.1 KEY PLAYERS STRATEGIES

- 12.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- 12.3 REVENUE SHARE ANALYSIS OF TOP FIVE MARKET PLAYERS

-

12.4 COMPANY EVALUATION MATRIX, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 12.5 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: COMPANY FOOTPRINT

- 12.6 COMPETITIVE SCENARIO

-

13.1 KEY PLAYERSSUMITOMO ELECTRIC INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPRYSMIAN GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEXANS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNKT A/S- Business overview- Products/Solutions/Services offered- Product launches- Recent developments- MnM viewLS CABLE & SYSTEM LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTE CONNECTIVITY- Business overview- Products/Solutions/Services offeredEL SEWEDY ELECTRIC COMPANY- Business overview- Products/Solutions/Services offered- Recent developmentsWUXI JIANGNAN CABLE CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsZTT- Business overview- Products/Solutions/Services offered- Recent developmentsFURUKAWA ELECTRIC CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsKEI INDUSTRIES LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsTAIHAN CABLE & SOLUTION CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsTELE-FONIKA KABLE SA- Business overview- Products/Solutions/Services offeredRIYADH CABLES- Business overview- Products/Solutions/Services offeredTRATOS- Business overview- Products/Solutions/Services offered

-

13.2 OTHER PLAYERSSYNERGY CABLESPFISTERER HOLDING AGDUCAB HVSOUTHWIRE COMPANY, LLCBRUGG KABEL AG

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET SNAPSHOT

- TABLE 2 T&D INFRASTRUCTURE EXPANSION PLANS

- TABLE 3 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: ECOSYSTEM ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE OF HIGH VOLTAGE CABLES AND ACCESSORIES, BY CABLES (USD MILLION PER KILOMETER)

- TABLE 5 AVERAGE SELLING PRICE ANALYSIS, BY REGION (USD MILLION PER KILOMETER), 2021 AND 2028

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: CODES AND REGULATIONS

- TABLE 11 SOUTH AMERICA: CODES AND REGULATIONS

- TABLE 12 GLOBAL: CODES AND REGULATIONS

- TABLE 13 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: PATENT REGISTRATIONS

- TABLE 14 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 15 TRADE DATA FOR HS CODE: 8544, 2018–2022 (USD THOUSAND)

- TABLE 16 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 18 KEY BUYING CRITERIA, BY END USER

- TABLE 19 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021–2028 (USD MILLION)

- TABLE 20 ALUMINUM: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 COPPER: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 23 72.5 KV: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 123KV: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 145KV: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 170KV: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 245KV: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 400KV AND ABOVE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 30 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE TYPE, 2021–2028 (USD MILLION)

- TABLE 31 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021–2028 (USD MILLION)

- TABLE 32 CABLES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 XLPE CABLES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 EPR CABLES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 HEPR CABLES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 MI CABLES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 ACCESSORIES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 CABLE JOINTS: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 CABLE TERMINATION: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 FITTINGS AND FIXTURES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 OTHERS: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 HIGH VOLTAGE CABLES AND ACCESSORIES, BY END USER, 2021–2028 (USD MILLION)

- TABLE 43 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER, 2021–2028 (USD MILLION)

- TABLE 44 POWER UTILITIES: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 RENEWABLES: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 46 INDUSTRIAL: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 OIL & GAS: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 48 CHEMICALS & PETROCHEMICALS: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 MINING & METALS: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 50 OTHERS: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 52 OVERHEAD: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 53 UNDERGROUND: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 54 SUBMARINE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 55 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 CABLE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021–2028 (KILOMETER)

- TABLE 57 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE TYPE, 2021–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE RATING TYPE, 2021–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 US: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 67 CANADA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 68 MEXICO: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 69 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 71 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE TYPE, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 75 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER TYPE, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021–2028 (USD MILLION)

- TABLE 77 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 GERMANY: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 79 UK: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 80 FRANCE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 81 ITALY: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 82 SPAIN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 83 DENMARK: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 84 NETHERLANDS: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 85 SWITZERLAND: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 86 BELGIUM: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 87 IRELAND: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 88 RUSSIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 89 POLAND: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 90 ROMANIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 91 REST OF EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE TYPE, 2021–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER, 2021–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 CHINA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 102 INDIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 103 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 104 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 105 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER, 2021–2028 (USD MILLION)

- TABLE 106 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 107 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 108 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLES PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 109 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021–2028 (USD MILLION)

- TABLE 111 AUSTRALIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 112 SOUTH KOREA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 113 INDONESIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 114 MALAYSIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 115 REST OF ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 116 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 117 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 118 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 119 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 121 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 122 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER, 2021–2028 (USD MILLION)

- TABLE 123 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021–2028 (USD MILLION)

- TABLE 124 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 125 BRAZIL: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 126 ARGENTINA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 127 COLOMBIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 128 REST OF SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE TYPE 2021–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, ACCESSORY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021–2028 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER 2021–2028 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER, 2021–2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 138 SAUDI ARABIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 139 UAE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 140 EGYPT: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 141 SOUTH AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 142 REST OF MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 143 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2022

- TABLE 144 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: DEGREE OF COMPETITION

- TABLE 145 PRODUCT TYPE FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 146 END USE FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 147 VOLTAGE FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 148 INSTALLATION FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 149 CONDUCTOR TYPE FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 150 REGION FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 151 COMPANY FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 152 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: NEW PRODUCT LAUNCHES, 2019–2023

- TABLE 153 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: DEALS, 2019–2023

- TABLE 154 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: OTHERS, 2019–2023

- TABLE 155 SUMITOMO ELECTRIC INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 156 SUMITOMO ELECTRIC INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 SUMITOMO ELECTRIC INDUSTRIES LTD.: DEALS

- TABLE 158 SUMITOMO ELECTRIC INDUSTRIES LTD.: OTHERS

- TABLE 159 PRYSMIAN GROUP: BUSINESS OVERVIEW

- TABLE 160 PRYSMIAN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 PRYSMIAN GROUP: PRODUCT LAUNCHES

- TABLE 162 PRYSMIAN GROUP: DEALS

- TABLE 163 PRYSMIAN GROUP: OTHERS

- TABLE 164 NEXANS: COMPANY OVERVIEW

- TABLE 165 NEXANS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 NEXANS: DEALS

- TABLE 167 NEXANS: OTHERS

- TABLE 168 NKT A/S: COMPANY OVERVIEW

- TABLE 169 NKT A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 NKT A/S : PRODUCT LAUNCHES

- TABLE 171 NKT A/S: DEALS

- TABLE 172 NKT A/S: OTHERS

- TABLE 173 LS CABLE & SYSTEM LTD.: COMPANY OVERVIEW

- TABLE 174 LS CABLE & SYSTEM LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 LS CABLE & SYSTEM LTD: DEALS

- TABLE 176 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 177 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 EL SEWEDY ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 179 EL SEWEDY ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 EL SEWEDY ELECTRIC COMPANY: OTHERS

- TABLE 181 WUXI JIANGNAN CABLE CO., LTD.: BUSINESS OVERVIEW

- TABLE 182 WUXI JIANGNAN CABLE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 WUXI JIANGNAN CABLE CO., LTD.: OTHERS

- TABLE 184 ZTT: COMPANY OVERVIEW

- TABLE 185 ZTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 ZTT: OTHERS

- TABLE 187 FURUKAWA ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 188 FURUKAWA ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 FURUKAWA ELECTRIC CO., LTD.: OTHER DEVELOPMENT

- TABLE 190 KEI INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 191 KEI INDUSTRIES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 KEI INDUSTRIES LIMITED: DEALS

- TABLE 193 TAIHAN CABLE & SOLUTION CO., LTD.: COMPANY OVERVIEW

- TABLE 194 TAIHAN CABLE & SOLUTION CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 TAIHAN CABLE & SOLUTION CO., LTD.: OTHER DEVELOPMENT

- TABLE 196 TELE-FONIKA KABLE SA: COMPANY OVERVIEW

- TABLE 197 TELE-FONIKA KABLE SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 RIYADH CABLES: COMPANY OVERVIEW

- TABLE 199 RIYADH CABLES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 TRATOS: COMPANY OVERVIEW

- TABLE 201 TRATOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR HIGH VOLTAGE CABLES AND ACCESSORIES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF HIGH VOLTAGE CABLES AND ACCESSORIES

- FIGURE 8 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 9 COMPANY REVENUE ANALYSIS, 2022

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 11 OVERHEAD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 CABLE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 POWER UTILITIES SEGMENT TO CLAIM LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 400 KV AND ABOVE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 COPPER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 RISING POWER CONSUMPTION TO DRIVE HIGH VOLTAGE CABLES AND ACCESSORIES MARKET

- FIGURE 17 ASIA PACIFIC MARKET TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 POWER UTILITIES AND US DOMINATED NORTH AMERICA IN 2022

- FIGURE 19 OVERHEAD SEGMENT TO LEAD MARKET IN 2028

- FIGURE 20 POWER UTILITIES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2028

- FIGURE 21 CABLE SEGMENT TO SECURE LARGER MARKET SHARE IN 2028

- FIGURE 22 COPPER SEGMENT TO PROCURE LARGER MARKET SHARE IN 2028

- FIGURE 23 400 KV AND ABOVE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2028

- FIGURE 24 HIGH VOLTAGE CABLES & ACCESSORIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 GLOBAL OFFSHORE WIND INSTALLATIONS, 2012–2021

- FIGURE 26 INVESTMENTS IN ELECTRICITY NETWORKS, BY REGION (2015–2021)

- FIGURE 27 ANNUAL RENEWABLE ELECTRICITY CAPACITY ADDITIONS WORLDWIDE (GW) (2015–2026)

- FIGURE 28 REVENUE SHIFTS FOR HIGH VOLTAGE CABLES AND ACCESSORIES MANUFACTURERS

- FIGURE 29 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: MARKET MAP/ECOSYSTEM ANALYSIS

- FIGURE 30 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE OF HIGH VOLTAGE CABLES AND ACCESSORIES, BY CABLE TYPE (USD MILLION PER KILOMETER)

- FIGURE 32 AVERAGE SELLING PRICE ANALYSIS, BY REGION (USD MILLION PER KILOMETER), 2021 AND 2028

- FIGURE 33 IMPORT AND EXPORT SCENARIO FOR HS CODE: 8544, 2018–2022 (USD THOUSAND)

- FIGURE 34 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 36 KEY BUYING CRITERIA, BY END USER

- FIGURE 37 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2022

- FIGURE 38 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2022

- FIGURE 39 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2022

- FIGURE 40 HIGH VOLTAGE CABLES AND ACCESSORIES SHARE, BY END USER, 2022

- FIGURE 41 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2022

- FIGURE 42 ASIA PACIFIC HIGH VOLTAGE CABLES AND ACCESSORIES MARKET TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 43 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2022 (%)

- FIGURE 44 NORTH AMERICA: SNAPSHOT OF HIGH VOLTAGE CABLES AND ACCESSORIES MARKET

- FIGURE 45 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET SNAPSHOT

- FIGURE 47 HIGH VOLTAGE CABLES & ACCESSORIES MARKET SHARE ANALYSIS, 2022

- FIGURE 48 TOP PLAYERS IN HIGH VOLTAGE CABLES & ACCESSORIES MARKET FROM 2018 TO 2022

- FIGURE 49 COMPANY EVALUATION MATRIX, 2022

- FIGURE 50 SUMITOMO ELECTRIC INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 51 PRYSMIAN GROUP: COMPANY SNAPSHOT

- FIGURE 52 NEXANS: COMPANY SNAPSHOT

- FIGURE 53 NKT A/S: COMPANY SNAPSHOT

- FIGURE 54 LS CABLE & SYSTEM LTD.: COMPANY SNAPSHOT

- FIGURE 55 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 56 EL SEWEDY ELECTRIC COMPANY: COMPANY SNAPSHOT

- FIGURE 57 WUXI JIANGNAN CABLE CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 ZTT: COMPANY SNAPSHOT

- FIGURE 59 FURUKAWA ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 60 KEI INDUSTRIES LIMITED: COMPANY SNAPSHOT

- FIGURE 61 TAIHAN CABLE & SOLUTION CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 RIYADH CABLES: COMPANY SNAPSHOT

The study involved major activities in estimating the current size of the high voltage cables and accessories market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the high voltage cables and accessories market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the high voltage cables and accessories market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

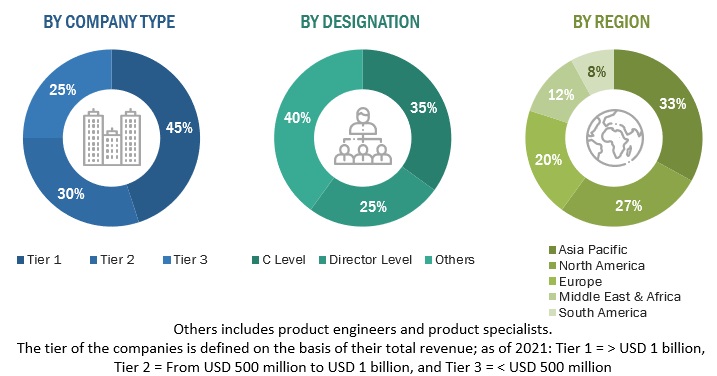

Primary Research

The high voltage cables and accessories market comprises several stakeholders such as high voltage cables and accessories manufacturers, manufacturing technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for high voltage cables and accessories in power utilities, renewable and industrial end-user. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

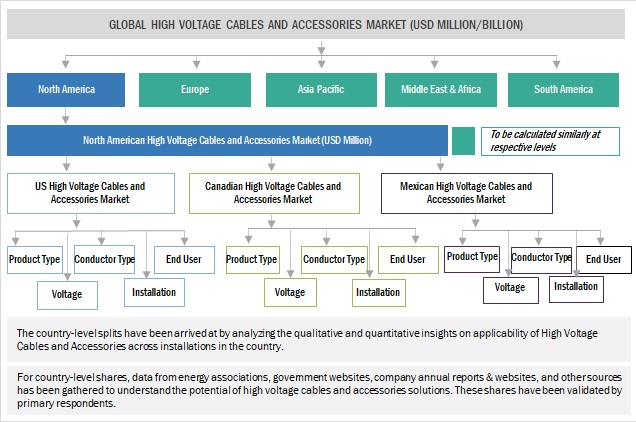

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the high voltage cables and accessories market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

High Voltage Cables and Accessories Market Size: Tow-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

High voltage cables and accessories are electrical components designed for transmitting electricity at high voltages. These components are used in various applications that require efficient and reliable power delivery over long distances. High voltage cables are specially constructed with multiple layers of insulation and shielding to handle increased electrical stress and insulation requirements. They have copper or aluminum conductors at their core, while insulation layers provide electrical insulation and protection against environmental factors. Accessories such as cable joints, terminations, insulators, surge arresters, and cable markers enhance performance and ensure safe operation of high voltage cable systems.

The growth of the high voltage cables and accessories market can be attributed to the transmission and distribution investments across major countries in North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Key Stakeholders

- Associations, forums, and alliances related to high voltage cables and accessories.

- High voltage cables and accessories manufacturing companies.

- Consulting companies in the energy sector

- Government and research organizations

- Power utilities

- State and national regulatory authorities

- Energy Management Companies

- Investment banks

- Original Equipment Manufacturers (OEMs)

Objectives of the Study

- To define, describe, and forecast the high voltage cables and accessories market based on product type, voltage, conductor type, installation, end user, and region, in terms of value and volume.

- To describe and forecast the high voltage cables and accessories market for various segments with respect to five main regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the high voltage cables and accessories value chain, along with industry trends, use cases, security standards, and Porter’s five forces analysis

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments in the high voltage cables and accessories market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape of the market.

- To analyze growth strategies adopted by market players such as partnerships, mergers and acquisitions, agreements, and product launches in the high voltage cables and accessories market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in High Voltage Cables and Accessories Market