Top 10 High & Medium Voltage Products Market by HV (Switchgear, HV Cables, Power Transformer), MV (Ring Main Unit, Recloser, MV Cables, Voltage Regulator, Surge Protection Device, Disconnect Switch), Installation Type, End User - Global Forecast to 2028

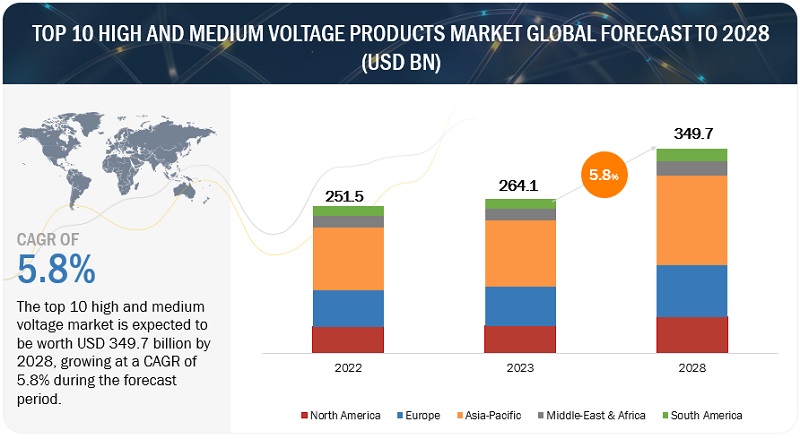

[239 Pages Report] The global top 10 high and medium voltage products market is estimated to grow from USD 264.1 billion in 2023 to USD 349.7 billion by 2028; it is expected to record a CAGR of 5.8% during the forecast period. The increasing demand for high and medium voltage products is driven by growing energy requirements, the incorporation of renewable energy sources, the electrification of sectors like transportation, and continuous grid modernization initiatives. These products play a critical role in the efficient transmission and distribution of electricity, addressing the needs of urbanization, industrial expansion, and emerging markets, all while adhering to environmental regulations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Top 10 high and medium voltage products Market Dynamics

Driver: Growing demand for reliable and continuous power supply

The growth in the demand for reliable and continuous power supply is driven by a confluence of factors, including increasing urbanization, industrialization, technological advancements, and the rising prevalence of electronic devices and data-driven systems. In an era where our lives are intricately connected to electricity, the importance of an uninterrupted power supply cannot be overstated. Industries depend on a constant energy source to maintain production and operations. Any power disruption can result in financial losses, delayed deliveries, and reduced competitiveness. The demand for continuous power supply is also amplified by the increasing integration of renewable energy sources into the power grid infrastructure, which can be intermittent.

Restraint: Implementation of stringent regulations to limit SF6 emissions from switchgears and ring main units

SF6, a potent greenhouse gas, has stringent emission restrictions worldwide. The US Environmental Protection Agency (EPA) initiated investigations in 1997, leading to mandatory reporting for equipment exceeding 17,820 pounds in 2012, resulting in notable emission reductions. The EU's F-Gas Regulation No. 517/2014 tightened SF6 usage limitations, and a 2022 revision aims to further evaluate its use. Notably, SF6 emissions are notably higher in the US compared to European nations, prompting California's Air Resources Board to decrease permissible annual emissions from 10% in 2010 to 1% in 2020, reflecting a global trend towards stricter regulations on SF6 usage.

Opportunities: Continuous increase in power generation capacity

The need for reliable and affordable energy sources to power various sectors has significantly increased power generation capacities worldwide. This growth is driven by rising energy demand, economic growth, and efforts to improve electricity access. Countries across the globe are actively investing in the expansion and modernization of power plants, as a result, there has been an increasing shift toward cleaner and more sustainable alternatives, including renewable energy sources like solar, wind, hydroelectric, geothermal, and biomass. Nuclear power is also a significant contributor to global power generation capacities, with its large-scale and low-carbon electricity production offering a reliable baseload power source. Moreover, there is a growing focus on energy efficiency and demand-side management measures to optimize the use of existing power generation capacities.

Challenges: Supply chain disruptions

The price variations of copper and aluminum can indeed pose a significant threat to the submarine power cable market. Due to their excellent electrical conductivity and corrosion resistance, copper and aluminum are commonly used as conductors in submarine power cables. Fluctuations in the prices of these materials can impact the overall cost and profitability of submarine cable projects. The prices of these raw materials are consistently varying and face multiple disruptions along the supply chain. Manufacturing disruptions in China and the US could contribute to the stagnant growth in the submarine power cable market over the next year or two. Due to the inflation and economic crisis, the local currencies of several countries have depreciated. A misalignment of supply and demand leads to financial losses for component/part manufacturers. Copper and aluminum make up a significant portion of the cost of submarine power cables. The supply disruption of these two commodities and the increasing raw material costs are anticipated to drive the price increase, disrupting the submarine power cable market. However, with careful planning, innovation, and investment, manufacturers can overcome these challenges and continue providing high-quality products essential to the global economy.

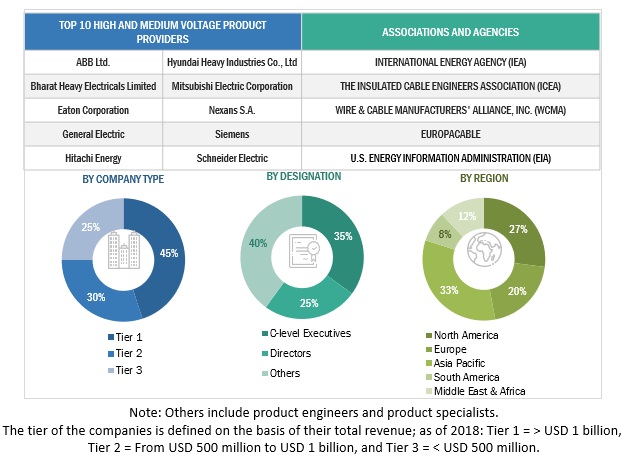

Top 10 high and medium voltage products Market Ecosystem

Leading companies in this market include well-established, financially secure producers of High and Medium voltage products. These corporations have been long operating in the market and have a differentiated product portfolio, modern manufacturing technologies, and robust sales and marketing networks. Major companies in this market include ABB (Switzerland), Prysmian SpA (Italy), Schneider Electric (France), Hitachi Global (Japan), and Siemens (Germany).

The medium voltage cables and accessories segment, is expected to be the largest market by medium voltage, by product during the forecast period.

By product, the top 10 high and medium voltage products market is divided into high voltage and medium voltage. Medium voltage cables and accessories segment by medium voltage is the largest segment in the market. Specifically, this segment benefits from the expansion of renewable energy sources, grid modernization, and urbanization efforts. Medium voltage cables are crucial for transmitting electricity efficiently from renewable generation sites to load centers, while accessories, such as connectors and insulation, ensure reliability and safety. Additionally, as industries and urban areas grow, the demand for these products in medium voltage applications escalates, making it the dominant segment in the market.

By end user, the residential segment is expected to be the third largest segment during the forecast period.

This report segments the refinery and petrochemical filtration market based on end user into two segments: Transmission and distribution, residential, industrial, and commercial. The residential segment is expected to be the largest segment during the forecast period. This is owing to the reason that residential areas require reliable power distribution to meet the increasing demand for electricity due to population growth and higher per capita consumption. Secondly, urbanization and housing development projects drive the need for high and medium voltage products to deliver electricity to homes. Lastly, the integration of smart grid technologies and the growing focus on energy efficiency in residential areas contribute to the prominence of this segment in the market.

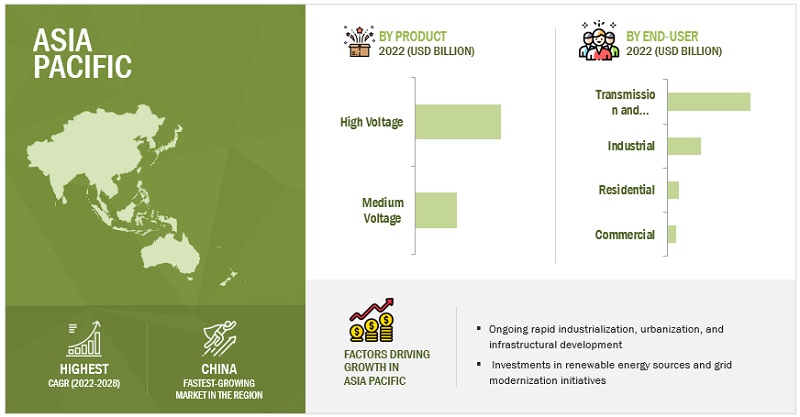

“Asia Pacific”: The largest in the Top 10 high and medium voltage products market.

Asia Pacific is expected to be the largest Top 10 high and medium voltage products market during the forecast period. As nations in this region are undergoing rapid industrialization, urbanization, and infrastructural development, necessitating extensive electrical networks. Additionally, the growing demand for electricity, especially in populous countries like China and India, fuels the need for high and medium voltage products to ensure reliable power distribution. Furthermore, investments in renewable energy sources and grid modernization initiatives contribute to the region's prominence in this market.

Key Market Players

The Top 10 high and medium voltage products market is dominated by a few major players that have a wide regional presence. The major players in the Top 10 high and medium voltage products market are ABB (Switzerland), Prysmian SpA (Italy), Schneider Electric (France), Hitachi Global (Japan), and Siemens (Germany). Between 2019 and 2023, strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the Top 10 high and medium voltage products market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Product, Installation Type, End User, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

ABB Ltd. (Switzerland), Bharat Heavy Electricals Limited (India), Eaton (Ireland), General Electric (US), Hitachi (Japan), Hyndai Heavy Electrical (South Korea), Mitsubishi Electric Corporation (Japan), Sumitomo Electric Industries (Japan), Prysmian S.p.A (Italy), Nexans (France), Siemens (Germany), Schneider Electric (France), Anchor Electricals (India), KEI Industries Limited (India), G&W Electric (US), NKT Cables (Denmark), Lucy Electric (UK), ORECCO Electric (China), Toshiba Corporation (Japan) |

This research report categorizes the Top 10 high and medium voltage products market by product, installation type, end user, and region

On the basis of installation type:

- Indoor

- Outdoor

On the basis of end user:

- Transmission and Distribution Utilities

- Industrial

- Residential

- Commercial

On the basis of by Product:

-

High voltage products

- Power Transformers

- Switchgears

- High voltage cables and accessories

-

Medium voltage products

- Disconnect Switches

- Surge Protection Devices

- Fault Current Limiters

- Voltage Regulators

- Reclosers

- Ring Main Units

- Medium voltage cables and accessories

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2023, Prysmian Group secured a contract for a power interconnection project between France and Spain. The project developed for the joint venture INELFE aims to enhance power supply reliability, facilitate the integration of renewable energy, and contribute to an efficient system, aligning with the European Commission's Projects of Common Interest.

- In May 2022, Enel has started providing electricity across their networks using ABB's 24 kV SF6-Free Ring Main Units. Enel has installed 20 ABB SafePlus AirPlus Medium Voltage RMUs in their secondary substations across Italy and Spain.

- In September 2021, Sumitomo Electric Industries, Ltd. and Siemens Energy AG partnered to secure a contract from Greenlink Interconnector Limited. The company was responsible for the design, engineering, procurement, production, construction, and commissioning of a 500MW HVDC subsea/underground electricity interconnector cable, connecting Ireland and the United Kingdom.

Frequently Asked Questions (FAQ):

What is the current size of the top 10 high and medium voltage products market?

The current market size of the top 10 high and medium voltage products market is USD 264.1 billion in 2023.

What are the major drivers for the top 10 high and medium voltage products market?

Growing demand for reliable and continuous power supply and rise in grid investments to improve transmission and distribution infrastructure are the major driving factors for the top 10 high and medium voltage products market.

Which is the largest region during the forecasted period in the top 10 high and medium voltage products market?

Asia Pacific is expected to dominate the top 10 high and medium voltage products market between 2023–2028, followed by North America and Europe.

Which is the largest segment, by product during the forecasted period in the top 10 high and medium voltage products market?

The medium voltage cables and accessories segment is expected to be the largest market during the forecast period because these are essential for efficient power distribution networks, including renewable energy integration and grid modernization efforts, which are driving significant demand.

Which is the third largest segment, by the end user during the forecasted period in the top 10 high and medium voltage products market?

The residential segment is expected to be the third largest growing market during the forecast period due to increasing electricity demand driven by urbanization and housing development, as well as the adoption of smart grid technologies for enhanced energy efficiency in residential areas.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rise in grid investments to improve transmission and distribution infrastructure- Growing demand for reliable and continuous power supply with increasing urbanization and industrializationRESTRAINTS- Delays in procurement and installation of electrical equipment attributed to complex regulatory and environmental authorization procedures- Implementation of stringent regulations to limit SF6 emissions from switchgears and ring main unitsOPPORTUNITIES- Continuous increase in power generation capacity- Increasing development of smart grids and growing digitalizationCHALLENGES- Requirement for high technical expertise to develop and install power cables- Supply chain disruptions

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 ECOSYSTEM MAPPING

-

5.5 VALUE CHAIN ANALYSISRAW MATERIAL/COMPONENT PROVIDERSTOP 10 HIGH AND MEDIUM VOLTAGE PRODUCT MANUFACTURERS/ASSEMBLERS/INSTALLATION AND MAINTENANCE SERVICE PROVIDERSEND USERS/OPERATORS

-

5.6 TECHNOLOGY ANALYSISSF6-FREE RING MAIN UNITINTELLIGENT SWITCHGEAR

- 5.7 PRICING ANALYSIS

-

5.8 TARIFF ANALYSISTARIFF RELATED TO HIGH AND MEDIUM VOLTAGE CABLE UNITSTARIFF RELATED TO RING MAIN UNITS

-

5.9 CODES AND REGULATORY LANDSCAPELIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSCODES RELATED TO HIGH VOLTAGE CABLES AND ACCESSORIES

-

5.10 PATENT ANALYSIS

-

5.11 TRADE ANALYSISHIGH VOLTAGE PRODUCTSMEDIUM VOLTAGE PRODUCTS- Import scenario- Export scenario

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.13 CASE STUDY ANALYSISAEGIS 36 RING MAIN UNIT WAS DEPLOYED IN RENEWABLE PROJECT TO ENSURE HASSLE-FREE OPERATION FOR EXTENDED PERIOD- Problem statement- SolutionAUSTRALIA-SINGAPORE INTERCONNECTOR PROJECT DEVELOPED VIABLE SOLUTION TO LINK RENEWABLE ENERGY FROM AUSTRALIA TO SINGAPORE’S POWER NETWORK- Problem statement- SolutionSÜC COBURG DEPLOYED ABB’S SAFERING AIRPLUS RING MAIN UNITS TO INCREASE RELIABILITY OF POWER SUPPLY IN POWER DISTRIBUTION GRID- Problem statement- Solution

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 INDOORINCREASING INVESTMENTS IN RENEWABLE ENERGY INDUSTRY TO FUEL DEMAND

-

6.3 OUTDOORINCREASING ELECTRIFICATION AND GROWING NEED FOR HIGH-LOAD, LONG-DISTANCE ELECTRICITY TRANSMISSION TO DRIVE DEMAND

- 7.1 INTRODUCTION

-

7.2 HIGH VOLTAGECAPABILITY OF HIGH VOLTAGE PRODUCTS TO TRANSMIT ELECTRICITY EFFICIENTLY AND SAFELY OVER LONG DISTANCES TO DRIVE DEMAND- Power transformers- Switchgears- High voltage cables and accessories

-

7.3 MEDIUM VOLTAGEPOTENTIAL OF MEDIUM VOLTAGE PRODUCTS TO EFFICIENTLY DISTRIBUTE ELECTRICITY WITH REDUCED POWER LOSSES TO FUEL DEMAND- Disconnect switches- Surge protection devices- Fault current limiters- Voltage regulators- Reclosers- Ring main units- Medium voltage cables and accessories

- 8.1 INTRODUCTION

-

8.2 TRANSMISSION AND DISTRIBUTIONGROWING NEED TO MAINTAIN STABLE FREQUENCY AND VOLTAGE AND DELIVER EFFICIENT POWER TO DRIVE MARKET

-

8.3 INDUSTRIALRISING USE OF HIGH AND MEDIUM VOLTAGE PRODUCTS TO ENSURE EFFICIENT POWER DISTRIBUTION WITHIN INDUSTRIAL FACILITIES AND EQUIPMENT PROTECTION TO DRIVE MARKET

-

8.4 COMMERCIALGROWING ADOPTION OF HIGH AND MEDIUM VOLTAGE PRODUCTS TO PROVIDE RELIABLE POWER SUPPLY TO VARIOUS CRITICAL EQUIPMENT TO FUEL SEGMENTAL GROWTH

-

8.5 RESIDENTIALRISING DEMAND FOR HIGH AND MEDIUM VOLTAGE PRODUCTS TO OFFER STABLE POWER SUPPLY AND REDUCE RISK OF ELECTRICAL FAULTS AND FIRES TO BOOST MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 EUROPEEUROPE: RECESSION IMPACT- UK- Germany- Italy- SPAIN- France- Rest of Europe

-

9.3 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT- Brazil- Argentina- Chile- Rest of South America

-

9.4 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Renewable energy development plans to generate demandCANADA- Increasing investments in wind energy sector to foster market growthMEXICO- Rising focus on renewable power generation to fuel market growth

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTSAUDI ARABIA- Government policies supporting utilization of renewables for power generation to drive marketUAE- Rising implementation of enhanced oil recovery (EOR) technique in oil fields to accelerate demandEGYPT- Increasing energy demand and transformation of power generation infrastructure to control carbon emissions to accelerate market growthSOUTH AFRICA- Rising adoption of renewable sources backed by government support to drive marketREST OF MIDDLE EAST & AFRICA

-

9.6 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Increasing investments in reducing carbon footprint to support market growthJAPAN- Rising government-led initiatives to meet power demand to fuel market growthINDIA- Rising electrification initiatives supported by government schemes in remote areas to propel market growthSOUTH KOREA- Increasing developments in offshore wind sector to fuel market growthAUSTRALIA- Rising electrification of railway network to drive demandREST OF ASIA PACIFIC

- 10.1 OVERVIEW

- 10.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- 10.3 MARKET SHARE ANALYSIS, 2022

- 10.4 REVENUE ANALYSIS, 2018–2022

-

10.5 COMPANY EVALUATION MATRIX, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.6 STARTUPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.7 COMPETITIVE BENCHMARKING

- 10.8 COMPANY FOOTPRINT

-

10.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

11.1 KEY PLAYERSSIEMENS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewABB LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHITACHI ENERGY LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSCHNEIDER ELECTRIC- Business overview- Products/Solutions/Services offered- MnM viewPRYSMIAN GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBHARAT HEAVY ELECTRICALS LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsGE- Business overview- Products/Solutions/Services offeredLUCY ELECTRIC- Business overview- Products/Solutions/Services offeredNEXANS- Business overview- Products/Solutions/Services offered- Recent developmentsSUMITOMO ELECTRIC INDUSTRIES, LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsORECCO- Business overview- Products/Solutions/Services offeredMITSUBISHI ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsG&W ELECTRIC- Business overview- Products/Solutions/Services offeredTOSHIBA CORPORATION- Business overview- Products/Solutions/Services offeredHD HYUNDAI ELECTRIC- Business overview- Products/Solutions/Services offeredANCHOR ELECTRICALS PRIVATE LIMITED- Business overview- Products/Solutions/Services offeredEATON- Business overview- Recent developmentsNKT A/S- Business overview- Recent developmentsKEI INDUSTRIES LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsHAVELLS INDIA LTD.- Business overview- Products/Solutions/Services offered- Recent developments

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: SNAPSHOT

- TABLE 2 T&D INFRASTRUCTURE EXPANSION PLAN, BY REGION

- TABLE 3 GLOBAL WARMING POTENTIAL OF GREENHOUSE GASES (100-YEAR TIME PERIOD)

- TABLE 4 COMPANIES AND THEIR ROLE IN TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE POWER TRANSFORMERS, 2021, 2022, 2023, AND 2028 (USD MILLION/UNIT)

- TABLE 6 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE SWITCHGEARS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 7 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE CABLES, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- TABLE 8 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE DISCONNECT SWITCHES, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 9 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE SURGE PROTECTION DEVICES, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 10 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE FAULT CURRENT LIMITERS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 11 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE REGULATORS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 12 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RECLOSERS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 13 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RING MAIN UNITS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 14 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE CABLES, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- TABLE 15 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE POWER TRANSFORMERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/UNIT)

- TABLE 16 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE SWITCHGEARS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 17 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE CABLES, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- TABLE 18 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE DISCONNECT SWITCHES, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 19 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE SURGE PROTECTION DEVICES, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 20 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE FAULT CURRENT LIMITERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 21 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE REGULATORS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 22 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RECLOSERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 23 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RING MAIN UNITS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 24 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE CABLES, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- TABLE 25 TARIFF RELATED TO HIGH AND MEDIUM VOLTAGE CABLE UNITS

- TABLE 26 TARIFF RELATED TO RING MAIN UNITS

- TABLE 27 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 32 NORTH AMERICA: CODES

- TABLE 33 SOUTH AMERICA: CODES

- TABLE 34 GLOBAL: CODES

- TABLE 35 INNOVATIONS AND PATENT REGISTRATIONS, FEBRUARY 2021–JULY 2023

- TABLE 36 TRADE DATA FOR HIGH VOLTAGE PRODUCTS UNDER HS CODE 8544, 2018–2022 (USD THOUSAND)

- TABLE 37 IMPORT DATA FOR MEDIUM VOLTAGE PRODUCTS UNDER HS CODE 853590, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 38 EXPORT DATA FOR MEDIUM VOLTAGE PRODUCTS UNDER HS CODE 853590, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 39 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 40 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 41 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 42 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 43 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021–2028 (USD BILLION)

- TABLE 44 INDOOR: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 OUTDOOR: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 46 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021–2028 (USD BILLION)

- TABLE 47 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 48 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 49 HIGH VOLTAGE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 50 MEDIUM VOLTAGE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 51 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 52 TRANSMISSION AND DISTRIBUTION: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 53 INDUSTRIAL: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 54 COMMERCIAL: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 55 RESIDENTIAL: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 56 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 57 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021–2028 (THOUSAND UNITS/THOUSAND MILES)

- TABLE 58 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021–2028 (USD BILLION)

- TABLE 59 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT TYPE, 2021–2028 (USD BILLION)

- TABLE 60 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 61 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 62 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 63 UK: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 64 GERMANY: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 65 ITALY: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 66 SPAIN: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 FRANCE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 68 REST OF EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 69 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021–2028 (USD BILLION)

- TABLE 70 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021–2028 (USD BILLION)

- TABLE 71 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 72 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 73 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 74 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 BRAZIL: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 76 ARGENTINA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 77 CHILE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 78 REST OF SOUTH AMERICA: TOP 10 HIGH & MEDIUM VOLTAGE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021–2028 (USD BILLION)

- TABLE 80 NORTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021–2028 (USD BILLION)

- TABLE 81 NORTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 82 NORTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 83 NORTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 84 US: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 85 CANADA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 86 MEXICO: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 87 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021–2028 (USD BILLION)

- TABLE 88 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021–2028 (USD BILLION)

- TABLE 89 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 90 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 91 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 92 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 93 SAUDI ARABIA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 94 UAE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 95 EGYPT: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 96 SOUTH AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 97 REST OF MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021–2028 (USD BILLION)

- TABLE 99 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021–2028 (USD BILLION)

- TABLE 100 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 101 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021–2028 (USD BILLION)

- TABLE 102 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 103 CHINA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 104 JAPAN: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 105 INDIA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 106 SOUTH KOREA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 107 AUSTRALIA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 108 REST OF ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021–2028 (USD BILLION)

- TABLE 109 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 110 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: DEGREE OF COMPETITION

- TABLE 111 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 112 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 113 PRODUCT: COMPANY FOOTPRINT

- TABLE 114 END USER: COMPANY FOOTPRINT

- TABLE 115 REGION: COMPANY FOOTPRINT

- TABLE 116 OVERALL COMPANY FOOTPRINT

- TABLE 117 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: PRODUCT LAUNCHES, 2021–2023

- TABLE 118 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: DEALS, 2021–2023

- TABLE 119 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: OTHERS, 2021–2023

- TABLE 120 SIEMENS: COMPANY OVERVIEW

- TABLE 121 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 122 SIEMENS: DEALS

- TABLE 123 ABB LTD.: COMPANY OVERVIEW

- TABLE 124 ABB LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 125 ABB LTD.: PRODUCT LAUNCHES

- TABLE 126 ABB LTD.: DEALS

- TABLE 127 HITACHI ENERGY LTD.: COMPANY OVERVIEW

- TABLE 128 HITACHI ENERGY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 HITACHI ENERGY LTD.: DEALS

- TABLE 130 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 131 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 PRYSMIAN GROUP: COMPANY OVERVIEW

- TABLE 133 PRYSMIAN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 PRYSMIAN GROUP: PRODUCT LAUNCHES

- TABLE 135 PRYSMIAN GROUP: DEALS

- TABLE 136 PRYSMIAN GROUP: OTHERS

- TABLE 137 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY OVERVIEW

- TABLE 138 BHARAT HEAVY ELECTRICALS LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 139 BHARAT HEAVY ELECTRICALS LIMITED.: PRODUCT LAUNCHES

- TABLE 140 GE: COMPANY OVERVIEW

- TABLE 141 GE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 LUCY ELECTRIC: COMPANY OVERVIEW

- TABLE 143 LUCY ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 NEXANS: COMPANY OVERVIEW

- TABLE 145 NEXANS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 NEXANS: DEALS

- TABLE 147 NEXANS: OTHERS

- TABLE 148 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 149 SUMITOMO ELECTRIC INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 150 SUMITOMO ELECTRIC INDUSTRIES LTD.: DEALS

- TABLE 151 SUMITOMO ELECTRIC INDUSTRIES LTD.: OTHERS

- TABLE 152 ORECCO: COMPANY OVERVIEW

- TABLE 153 ORECCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 155 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 156 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 157 G&W ELECTRIC: COMPANY OVERVIEW

- TABLE 158 G&W ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 160 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 HD HYUNDAI ELECTRIC: COMPANY OVERVIEW

- TABLE 162 HD HYUNDAI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 ANCHOR ELECTRICALS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 164 ANCHOR ELECTRICALS PRIVATE LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 165 EATON: COMPANY OVERVIEW

- TABLE 166 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 EATON: DEALS

- TABLE 168 NKT A/S: COMPANY OVERVIEW

- TABLE 169 NKT A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 NKT A/S: PRODUCT LAUNCHES

- TABLE 171 NKT A/S: DEALS

- TABLE 172 NKT A/S: OTHERS

- TABLE 173 KEI INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 174 KEI INDUSTRIES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 KEI INDUSTRIES LIMITED: DEALS

- TABLE 176 HAVELLS INDIA LTD.: COMPANY OVERVIEW

- TABLE 177 HAVELLS INDIA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 HAVELLS INDIA LTD.: DEALS

- FIGURE 1 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: RESEARCH DESIGN

- FIGURE 2 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 3 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF HIGH AND MEDIUM VOLTAGE PRODUCTS

- FIGURE 7 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 COMPANY REVENUE ANALYSIS, 2022

- FIGURE 9 INDOOR SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- FIGURE 10 HIGH VOLTAGE SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 11 TRANSMISSION AND DISTRIBUTION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET IN 2022

- FIGURE 13 GROWING DEPLOYMENT OF SMART GRIDS AND INCREASING DIGITALIZATION

- FIGURE 14 TRANSMISSION AND DISTRIBUTION SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET IN 2022

- FIGURE 15 INDOOR SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2028

- FIGURE 16 HIGH VOLTAGE SEGMENT TO HOLD LARGER MARKET SHARE IN 2028

- FIGURE 17 TRANSMISSION AND DISTRIBUTION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 18 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 INVESTMENTS IN ELECTRICITY NETWORKS, BY REGION, 2015–2021

- FIGURE 20 ELECTRICITY DEMAND, BY REGION, 2020 VS. 2021

- FIGURE 21 GLOBAL ANNUAL RENEWABLE ELECTRICITY CAPACITY ADDITIONS, 2015–2026 (GW)

- FIGURE 22 GLOBAL NOMINAL PRICE OF ALUMINUM (USD/MT) AND COPPER (USD/MT), 2019–2022

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 24 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: ECOSYSTEM MAPPING

- FIGURE 25 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE POWER TRANSFORMERS, 2021, 2022, 2023, AND 2028 (USD MILLION/UNIT)

- FIGURE 27 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE SWITCHGEARS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 28 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE CABLES, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- FIGURE 29 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE PRODUCTS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 30 AVERAGE SELLING PRICE (ASP) OF HIGH AND MEDIUM VOLTAGE FAULT-CURRENT LIMITERS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 31 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE CABLES, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- FIGURE 32 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE POWER TRANSFORMERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/UNIT)

- FIGURE 33 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE SWITCHGEARS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 34 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE CABLES, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- FIGURE 35 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE DISCONNECT SWITCHES, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 36 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE FAULT CURRENT LIMITERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 37 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE REGULATORS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 38 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RECLOSERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 39 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RING MAIN UNITS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 40 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE CABLES, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- FIGURE 41 TRADE DATA FOR HIGH VOLTAGE PRODUCTS UNDER HS CODE 8544, 2018–2022 (USD THOUSAND)

- FIGURE 42 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 43 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 44 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 45 INDOOR SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2022

- FIGURE 46 HIGH VOLTAGE SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2022

- FIGURE 47 TRANSMISSION AND DISTRIBUTION SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 48 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC DOMINATED TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET IN 2022

- FIGURE 50 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET SNAPSHOT

- FIGURE 52 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET SHARE ANALYSIS, 2022

- FIGURE 53 INDUSTRY CONCENTRATION, 2022

- FIGURE 54 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 55 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 56 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 57 SIEMENS: COMPANY SNAPSHOT

- FIGURE 58 ABB LTD.: COMPANY SNAPSHOT

- FIGURE 59 HITACHI ENERGY LTD.: COMPANY SNAPSHOT

- FIGURE 60 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 61 PRYSMIAN GROUP: COMPANY SNAPSHOT

- FIGURE 62 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY SNAPSHOT

- FIGURE 63 GE: COMPANY SNAPSHOT

- FIGURE 64 NEXANS: COMPANY SNAPSHOT

- FIGURE 65 SUMITOMO ELECTRIC INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 66 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 HD HYUNDAI ELECTRIC: COMPANY SNAPSHOT

- FIGURE 69 EATON: COMPANY SNAPSHOT

- FIGURE 70 NKT A/S: COMPANY SNAPSHOT

- FIGURE 71 KEI INDUSTRIES LIMITED: COMPANY SNAPSHOT

- FIGURE 72 HAVELLS INDIA LTD.: COMPANY SNAPSHOT

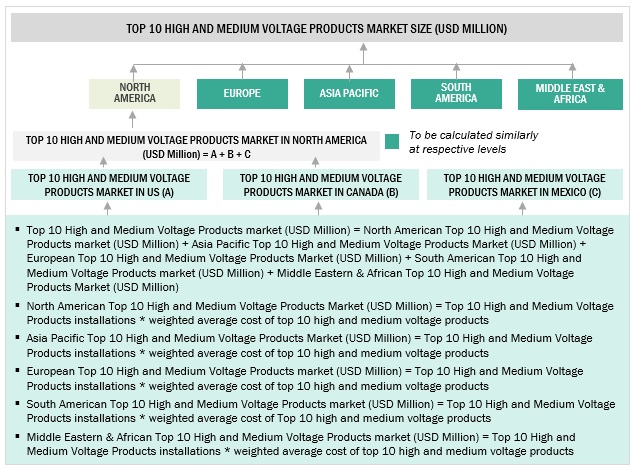

The study involved major activities in estimating the current size of the Top 10 high and medium voltage products market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the Top 10 high and medium voltage products market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global Top 10 high and medium voltage products market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The Top 10 high and medium voltage products market comprises several stakeholders such as generator manufacturers, manufacturers of subcomponents of Top 10 high and medium voltage products, manufacturing technology providers, and technology support providers in the supply chain. The demand side of this market is characterized by the rising offshore wind energy installations. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

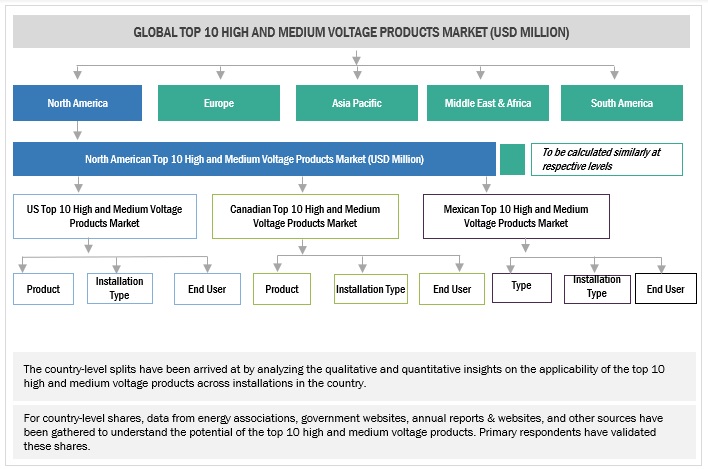

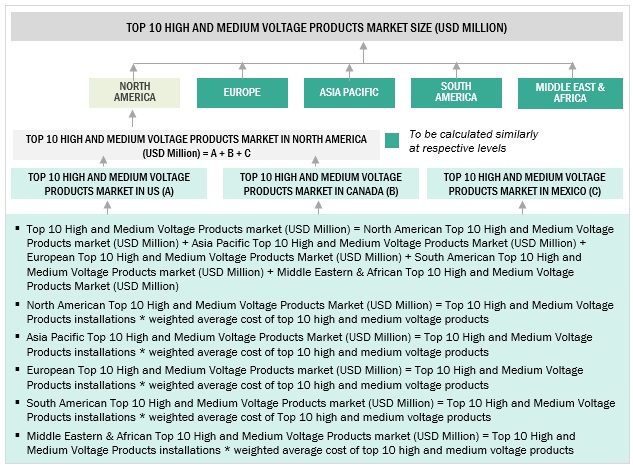

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Top 10 high and medium voltage products market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Top 10 high and medium voltage products Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Top 10 high and medium voltage products Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A hybrid power solution refers to a unit that combines multiple sources of energy generation to produce electricity. It typically integrates renewable energy sources, such as solar, and wind, with conventional power technologies like diesel generators. The combination of these sources allows for increased efficiency, reliability, and flexibility in electricity production.

Key Stakeholders

- Government & research organizations

- Institutional investors and investment banks

- Investors/shareholders

- Environmental research institutes

Objectives of the Study

- To define, describe, segment, and forecast the Top 10 high and medium voltage products market, in terms of value and volume, on the basis of system type, end user, grid connectivity, power rating, and region

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and Middle East & Africa, along with their key countries

- To provide detailed information about the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as sales contracts, agreements, investments, expansions, new product launches, mergers, partnerships, collaborations, and acquisitions, in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Top 10 High & Medium Voltage Products Market