Hydraulic Dosing Pump Market by Type (Diaphragm, Piston), End-user (Agriculture, Livestock, Industry (Water, Oil & Gas, Chemical, Power)), Discharge Pressure (Up to 25 Bar, 25-100, Above 100 Bar), and Region - Global Forecast to 2023

[129 Pages Report] The global hydraulic dosing pump market was valued at USD 742.6 million in 2017 and is projected to reach USD 949.3 million by 2023, at a CAGR of 4.23% during the forecast period. The increasing implementation of smart dosing technologies coupled with refining capacity additions in the Asia Pacific and the Middle East are the major opportunities for the hydraulic dosing pump market.

Years considered for the study are as follows:

- Base year: 2017

- Estimated year: 2018

- Projected year: 2023

- Forecast period: 20182023

The base year for company profiles is 2017. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, describe, and forecast the global hydraulic dosing pump market on the basis of type, discharge pressure, end-user, and region

- To provide detailed information on major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contributions to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to major regions (Asia Pacific, Europe, North America, South America, and Middle East & Africa)

- To profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as mergers & acquisitions, expansions, new product developments, and contracts & agreements in the hydraulic dosing pump market

Research Methodology

This research study involved the use of extensive secondary sources, directories, and databases such as Bloomberg Businessweek and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the overall hydraulic dosing pump market. Primary sources include industry experts from core and related industries such as preferred suppliers, manufacturers, distributors, technology developers, standards and certification organizations of companies, and organizations related to all the segments of this industrys value chain. The points below explain the research methodology.

- Study of annual revenues and market developments of major players that provide hydraulic dosing pumps

- Analyses of major end-users of hydraulic dosing pump

- Assessment of future trends and growth of the hydraulic dosing pump market

- Assessment of the market on the basis of types of dosing pumps

- Study of the contracts & developments related to the market by key players across different regions

- Finalization of the overall market sizes by triangulating the supply-side data, which includes product developments, supply chains, and annual revenues of companies providing hydraulic dosing pump across the globe

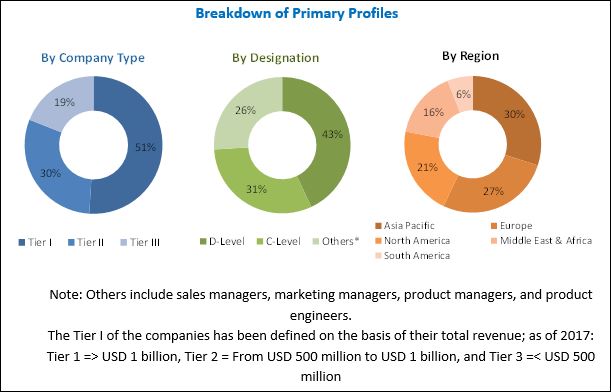

After arriving at the overall market size, the overall market has been split into several segments and subsegments. The figure given below illustrates the breakdown of primaries conducted during the research study on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Major manufacturers in the hydraulic dosing pump market include Dover Corporation (US), Grundfos (Denmark), SPX Flow (US), IDEX Corporation (US), and LEWA (Germany). Manufacturers such as ProMinent (Germany), Milton Roy (US), Lutz-Jesco (Germany), SEKO (US), Iwaki (Japan), Verder (Netherlands), Tacmina (Japan), and Tefen (Israel) either participate in the supply of raw materials/auxiliary components or directly sell hydraulic dosing pumps through authorized distribution channels.

Target Audience:

The reports target audience includes:

- Hydraulic dosing pump manufacturing company

- Industry and consulting firms

- State and national regulatory authorities

- Government and industry associations

- Manufacturing & process industries

- Pump associations

Scope of the Report:

By Type

- Diaphragm

- Piston

- Others

By Discharge Pressure

- UP to 25 bar

- 25100 bar

- Above 100 bar

By End-User

- Agriculture

- Livestock

- Industry

- Chemical

- Water & wastewater treatment

- Oil & gas

- Power

- Others

By Region

- Asia Pacific

- North America

- Europe

- South America

- Middle East & Africa

Others in type include peristaltic, solenoid, and digital doing pumps

Others in end-user include food & beverage, pharmaceutical, metal processing, automotive, and mining

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

Further breakdown of regional or country-specific analyses

Company Information

Detailed analyses and profiling of additional market players (up to 5)

The overall hydraulic dosing pump market is estimated to grow from USD 771.8 million in 2018 to USD 949.3 million by 2023, at a CAGR of 4.23%. The market is driven by factors such as the growing demand from the chemical industry and rising investments in the water & wastewater treatment industry. Growth in demand from the oil & gas sector is expected to boost the demand for hydraulic dosing pumps. The increasing implementation of smart dosing technologies coupled with refining capacity additions in the Asia Pacific and the Middle East present great opportunities for the market.

The report segments the hydraulic dosing pump market, by type, into diaphragm, piston, and others. The diaphragm pump segment is estimated to lead the market in 2018. The diaphragm pump segment is also projected to grow at the fastest rate during the forecast period because of its higher efficiency and ability to handle hazardous, toxic, or corrosive chemicals. In the Asia Pacific, the demand for diaphragm hydraulic dosing pumps is from the chemical and manufacturing sectors. This is likely to boost the overall diaphragm hydraulic dosing pump market.

Based on the end user, the industry segment accounted for the largest market size in 2017. The major users of hydraulic dosing pumps include water & wastewater treatment, pharmaceutical, chemical processing, oil & gas, food & beverage, power plant, mining, and automotive industries. Driven by an increased focus on digitalization led by rapid industrialization in countries such as China and India is expected to drive the industry segment of the hydraulic dosing pump market by the end user. Additionally, the demand from agricultural applications including horticulture, irrigation, liquid metering, chemical injection, and dairy farms, especially from the Asia Pacific would accelerate the demand for hydraulic dosing pumps during the forecast period.

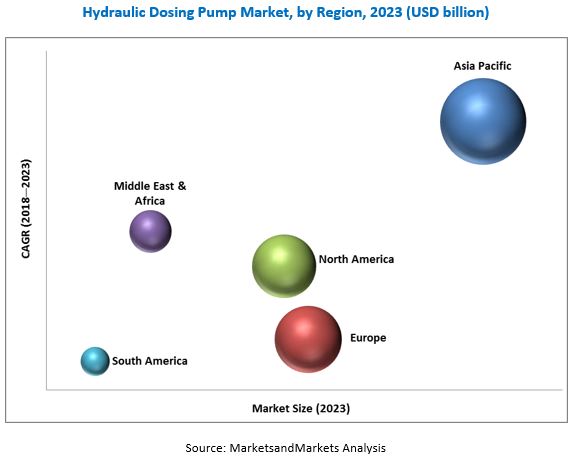

The hydraulic dosing pump market has been analyzed on the basis of 5 regions: Asia Pacific, North America, Europe, the Middle East & Africa, and South America. The market in the Asia Pacific is expected to lead the global market by 2023. The market size in this region can be attributed to the rising demand from chemical and the booming manufacturing industries in the region. China and India are the key markets for hydraulic dosing pumps in the Asia Pacific.

The availability of low-cost and inferior quality products have adversely affected the demand for hydraulic dosing pumps. In developing countries such as India and China, cost is a major parameter during procurement, which provides opportunities for local players to offer substitutes and similar products at a comparatively lower cost. This restricts the entry of global players in the local market and presents a challenge in the hydraulic dosing pump market.

Key players in the hydraulic dosing pump market include Dover Corporation (US), Grundfos (Denmark), SPX Flow (US), IDEX Corporation (US), and LEWA (Germany). Investments & expansions was the most commonly adopted strategy by the top players in the market from 2015 to 2018 (July). It was followed by new product launches, contracts & agreements and collaborations & partnerships.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Hydraulic Dosing Pump Market, By Region

4.2 Hydraulic Dosing Pump Market, By Type

4.3 Hydraulic Dosing Pump Market, By Discharge Pressure

4.4 Hydraulic Dosing Pump Market, By End-User

4.5 Asia Pacific Hydraulic Dosing Pump Market

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Investments in the Water & Wastewater Treatment Industry

5.2.1.2 Growing Demand From Chemical Industry

5.2.2 Restraints

5.2.2.1 Availability of Low-Cost and Inferior-Quality Pump Products

5.2.2.2 Pressure Pulsation in Pumps

5.2.3 Opportunities

5.2.3.1 Implementation of Smart Digital Dosing Technology

5.2.3.2 Refining Capacity Additions in Developing Regions

5.2.4 Challenges

5.2.4.1 Growing Customized Demand From Consumers

5.2.4.2 Potential Substitutes Such as Mechanically Actuated Dosing Pumps

6 Hydraulic Dosing Pump Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Diaphragm Pumps

6.3 Piston Pumps

6.4 Others

7 Hydraulic Dosing Pump Market, By Discharge Pressure (Page No. - 44)

7.1 Introduction

7.2 Up to 25 Bar

7.3 25100 Bar

7.4 Above 100 Bar

8 Hydraulic Dosing Pump Market, By End-User (Page No. - 48)

8.1 Introduction

8.2 Agriculture

8.3 Livestock

8.4 Industry

8.4.1 Water & Wastewater Treatment

8.4.2 Chemical

8.4.3 Oil & Gas

8.4.4 Power

8.4.5 Others

9 Hydraulic Dosing Pump Market, By Region (Page No. - 55)

9.1 Introduction

9.2 Asia Pacific

9.2.1 By Type

9.2.2 By Discharge Pressure

9.2.3 By End-User

9.2.4 By Country

9.2.4.1 China

9.2.4.2 India

9.2.4.3 Japan

9.2.4.4 Australia

9.2.4.5 South Korea

9.2.4.6 Rest of Asia Pacific

9.3 Europe

9.3.1 By Type

9.3.2 By Discharge Pressure

9.3.3 By End-User

9.3.4 By Country

9.3.4.1 Germany

9.3.4.2 UK

9.3.4.3 France

9.3.4.4 Italy

9.3.4.5 Spain

9.3.4.6 Rest of Europe

9.4 North America

9.4.1 By Type

9.4.2 By Discharge Pressure

9.4.3 By End-User

9.4.4 By Country

9.4.4.1 US

9.4.4.2 Canada

9.4.4.3 Mexico

9.5 Middle East & Africa

9.5.1 By Type

9.5.2 By Discharge Pressure

9.5.3 By End-User

9.5.4 By Country

9.5.4.1 Saudi Arabia

9.5.4.2 South Africa

9.5.4.3 Israel

9.5.4.4 UAE

9.5.4.5 Rest of the Middle East & Africa

9.6 South America

9.6.1 By Type

9.6.2 By Discharge Pressure

9.6.3 By End-User

9.6.4 By Country

9.6.4.1 Brazil

9.6.4.2 Argentina

9.6.4.3 Colombia

9.6.4.4 Rest South America

10 Competitive Landscape (Page No. - 90)

10.1 Introduction

10.2 Market Share Analysis

10.3 Competitive Scenario

10.3.1 Contracts & Agreements

10.3.2 Expansions & Investments

10.3.3 New Product Launches

10.3.4 Collaborations & Partnerships

10.3.5 Mergers & Acquisitions

Competitive Benchmarking

11 Company Profiles (Page No. - 96)

11.1 Grundfos Holding

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Developments

11.1.4 MnM View

11.2 IDEX Corporation

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 MnM View

11.3 SPX Flow

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 MnM View

11.4 Dover Corporation

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 MnM View

11.5 Lewa

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 MnM View

11.6 Verder International

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.7 Prominent

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.8 Seko

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.9 Milton Roy

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.10 Lutz-Jesco

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.11 Iwaki

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Recent Developments

11.12 Tefen

11.12.1 Business Overview

11.12.2 Products Offered

11.12.3 Recent Developments

12 Appendix (Page No. - 122)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (66 Tables)

Table 1 Global Hydraulic Dosing Pump Market Snapshot

Table 2 Hydraulic Dosing Pump Market Size, By Type, USD Million, 20162023

Table 3 Comparison Between Hydraulically Actuated and Mechanically Actuated Diaphragm Pump Type

Table 4 Diaphragm Pump: Market, By Region, 20162023 (USD Million)

Table 5 Piston Pump: Market, By Region, 20162023 (USD Million)

Table 6 Others: Market, By Region, 20162023 (USD Million)

Table 7 Hydraulic Dosing Pump Market, By Discharge Pressure, 20162023 (USD Million)

Table 8 Up to 25 Bar: Market, By Region, 20162023 (USD Million)

Table 9 25100 Bar: Market, By Region, 20162023 (USD Million)

Table 10 Above 100 Bar: Market, By Region, 20162023 (USD Million)

Table 11 Hydraulic Dosing Pump Market, By End-User, 20162023 (USD Million)

Table 12 Agriculture: Market, By Region, 20162023 (USD Million)

Table 13 Livestock: Market, By Region, 20162023 (USD Million)

Table 14 Industry: Market, By Region, 20162023 (USD Million)

Table 15 Water & Wastewater Treatment: Market, By Region, 20162023 (USD Million)

Table 16 Chemical: Market, By Region, 20162023 (USD Million)

Table 17 Oil & Gas: Market, By Region, 20162023 (USD Million)

Table 18 Power: Market, By Region, 20162023 (USD Million)

Table 19 Others: Market, By Region, 20162023 (USD Million)

Table 20 Hydraulic Dosing Pump Market Size, By Region, 20162023 (USD Million)

Table 21 Asia Pacific: Market Size, By Type, 20162023 (USD Million)

Table 22 Asia Pacific: Market Size, By Discharge Pressure, 20162023 (USD Million)

Table 23 Asia Pacific: Market Size, By End-User, 20162023 (USD Million)

Table 24 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 25 China: Market Size, By End-User, 20162023 (USD Million)

Table 26 India: Market Size, By End-User, 20162023 (USD Million)

Table 27 Japan: Market Size, By End-User, 20162023 (USD Million)

Table 28 Australia: Market Size, By End-User, 20162023 (USD Million)

Table 29 South Korea: Market Size, By End-User, 20162023 (USD Million)

Table 30 Rest of Asia Pacific: Market Size, By End-User, 20162023 (USD Million)

Table 31 Europe: Market Size, By Type, 20162023 (USD Million)

Table 32 Europe: Market Size, By Discharge Pressure, 20162023 (USD Million)

Table 33 Europe: Market Size, By End-User, 20162023 (USD Million)

Table 34 Europe: Market Size, By Country, 20162023 (USD Million)

Table 35 Germany: Market Size, By End-User, 20162023 (USD Million)

Table 36 UK: Market Size, By End-User, 20162023 (USD Million)

Table 37 France: Market Size, By End-User, 20162023 (USD Million)

Table 38 Italy: Market Size, By End-User, 20162023 (USD Million)

Table 39 Spain: Market Size, By End-User, 20162023 (USD Million)

Table 40 Rest of Europe: Market Size, By End-User, 20162023 (USD Million)

Table 41 North America: Market Size, By Type, 20162023 (USD Million)

Table 42 North America: Market Size, By Discharge Pressure, 20162023 (USD Million)

Table 43 North America: Market Size, By End-User, 20162023 (USD Million)

Table 44 North America: Market Size, By Country, 20162023 (USD Million)

Table 45 US: Market Size, By End-User, 20162023 (USD Million)

Table 46 Canada: Market Size, By End-User, 20162023 (USD Million)

Table 47 Mexico: Market Size, By End-User, 20162023 (USD Million)

Table 48 Middle East & Africa: Market Size, By Type, 20162023 (USD Million)

Table 49 Middle East & Africa: Market Size, By Discharge Pressure, 20162023 (USD Million)

Table 50 Middle East and Africa: Market Size, By End-User, 20162023 (USD Million)

Table 51 Middle East and Africa: Market Size, By Country, 20162023 (USD Million)

Table 52 Saudi Arabia: Market Size, By End-User, 20162023 (USD Million)

Table 53 South Africa: Market Size, By End-User, 20162023 (USD Million)

Table 54 Israel: Market Size, By End-User, 20162023 (USD Million)

Table 55 UAE: Market Size, By End-User, 20162023 (USD Million)

Table 56 Rest of the Middle East & Africa: Market Size, By End-User, 20162023 (USD Million)

Table 57 South America: Market Size, By Type, 20162023 (USD Million)

Table 58 South America: Market Size, By Discharge Pressure, 20162023 (USD Million)

Table 59 South America: Market Size, By End-User, 20162023 (USD Million)

Table 60 South America: Market Size, By Country, 20162023 (USD Million)

Table 61 Brazil: Market Size, By End-User, 20162023 (USD Million)

Table 62 Argentina: Market Size, By End-User, 20162023 (USD Million)

Table 63 Colombia: Market Size, By End-User, 20162023 (USD Million)

Table 64 Rest of South America: Market Size, By End-User, 20162023 (USD Million)

Table 65 Market Share Analysis, 2017

Table 66 Developments By Key Players in the Market, 20152018

List of Figures (42 Figures)

Figure 1 Hydraulic Dosing Pumps Market Segmentation

Figure 2 Hydraulic Dosing Pumps Market Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Assumptions of Research Study

Figure 7 Asia Pacific Held the Largest Share in the Hydraulic Dosing Pumps Market in 2017

Figure 8 Diaphragm Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Up to 25 Bar Segment Dominated the Hydraulic Dosing Pumps Market in 2017

Figure 10 Industry Segment is Expected to Dominate the Hydraulic Dosing Pumps Market From 2018 to 2023

Figure 11 Attractive Opportunities in the Hydraulic Dosing Pumps Market, 20182023

Figure 12 China to Grow at the Fastest Rate in the Global Hydraulic Dosing Pumps Market During the Forecast Period

Figure 13 Diaphragm Segment is Expected to Grow at the Fastest Rate During the Forecast Period

Figure 14 Up to 25 Bar Segment is Expected to Dominate the Hydraulic Dosing Pumps Market During the Forecast Period

Figure 15 Industry Segment Dominated the Hydraulic Dosing Pumps Market in 2017, and the Oil & Gas Subsegment Dominated the Industry Segment

Figure 16 China Accounted for the Largest Share of the Asia Pacific Hydraulic Dosing Pumps Market in 2017

Figure 17 Market Dynamics: Hydraulic Dosing Pumps Market

Figure 18 Water & Wastewater Capital Expenditure By Region, 20132020

Figure 19 Production Growth in the Chemical Industry, 20182020

Figure 20 Crude Distillation Capacity Additions, 20172040

Figure 21 Refining Capacity in the Middle East Region, 2016 & 20172021

Figure 22 Diaphragm Type Pump Segment Dominated the Hydraulic Dosing Pumps Market in 2017

Figure 23 Up to 25 Bar Segment is Expected to Lead the Hydraulic Dosing Pumps Market During the Forecast Period

Figure 24 Industry Segment Dominated the Hydraulic Dosing Pumps Market in 2018

Figure 25 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Asia Pacific Led the Hydraulic Dosing Pumps Market in 2017

Figure 27 Refining Capacity Additions, 20122017

Figure 28 Asia Pacific: Market Snapshot

Figure 29 Europe: Market Snapshot

Figure 30 Key Developments in the Hydraulic Dosing Pumps Market During 20152018

Figure 31 Grundfos: Company Snapshot

Figure 32 IDEX Corporation: Company Snapshot

Figure 33 SPX Flow: Company Snapshot

Figure 34 Dover Corporation: Company Snapshot

Figure 35 Lewa: Company Snapshot

Figure 36 Verder International: Company Snapshot

Figure 37 Prominent: Company Snapshot

Figure 38 Seko: Company Snapshot

Figure 39 Milton Roy: Company Snapshot

Figure 40 Lutz-Jesco: Company Snapshot

Figure 41 Iwaki: Company Snapshot

Figure 42 Tefen: Company Snapshot

Growth opportunities and latent adjacency in Hydraulic Dosing Pump Market