Hydrogen Detection Market Size, Share & Trends

Hydrogen Detection Market by Electrochemical, Metal Oxide Semiconductor (MOS), Catalytic, Thermal Conductivity, Micro-Electromechanical Systems (MEMS), Detection Range (0-1000 ppm, 0-5000 ppm, 0-20,000 ppm, >0-20,000 ppm - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The hydrogen detection market is projected to grow from USD 0.28 billion in 2025 to USD 0.50 billion in 2030, at a CAGR of 11.8%. High adoption of fuel cells globally, increased use of hydrogen in several applications and enforcement of stringent health and safety regulations worldwide are the major factors driving market growth. In addition, shifting the focus of OEMs to low-carbon energy systems, rising deployment of IoT-enabled gas detection systems to provide ample opportunities for the market players.

KEY TAKEAWAYS

- The Asia Pacific hydrogen detection market accounted for a 33.9% revenue share in 2024.

- By sensor technology, the electrochemical segment is expected to register the highest CAGR of 14.2%.

- By implementation type, the portable segment is projected to grow at the fastest rate from 2025 to 2030.

- By process stage, the generation segment is expected to dominate the market.

- By application, the automotive & transportation segment will grow the fastest during the forecast period.

- By detection range, the 0-5,000 PPM segment is expected to dominate the market, growing at the highest CAGR of 12.5%.

- Teledyne Technologies Incorporated, Honeywell International Inc., and Figaro Engineering Inc. were identified as some of the star players in the global hydrogen detection market, given their strong market share and product footprint.

- Prosense Gas and Flame Detectors, Senko International Inc., and Eltra GmbH, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The hydrogen detection market is projected to grow significantly in the coming years, driven by the increasing adoption of hydrogen as a clean energy source and the growing emphasis on safety across industrial, energy, and transportation sectors. Industries are increasingly deploying advanced hydrogen sensors, IoT-enabled monitoring systems, and real-time analytics to detect leaks, ensure operational safety, and comply with regulatory standards. Rising investments in hydrogen infrastructure, coupled with government initiatives promoting hydrogen adoption and safety, are further accelerating market growth. With its potential to enhance safety, optimize operations, and enable proactive decision-making, hydrogen detection technology is emerging as a critical enabler in the global transition toward a hydrogen-based energy ecosystem

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The hydrogen detection market is undergoing a substantial transformation as industries shift from conventional gas safety methods to advanced hydrogen-specific detection solutions. Growing investments in hydrogen infrastructure, increasing deployment of fuel cells in transportation and power sectors, and the global push toward low-emission energy sources are fueling the demand for reliable hydrogen sensors. Companies such as Teledyne Technologies Incorporated (US), Honeywell International (US), H2San (US), Figaro Engineering (Japan), and Nissha FIS (Japan) are at the forefront of this evolution, offering innovative sensor technologies, wireless detection systems, and IoT-enabled gas monitoring platforms. These solutions support diverse applications, from hydrogen generation and storage to transportation and industrial usage, enhancing safety, compliance, and operational efficiency. The transition also mirrors a broader trend toward smart industrial ecosystems, where digitalization, automation, and predictive maintenance tools are becoming critical. As hydrogen adoption accelerates across developed and emerging markets, this shift is unlocking new opportunities for detection technology providers and paving the way for a safer and more sustainable hydrogen economy.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High adoption of fuel cells globally

-

Increased use of hydrogen across industries

Level

-

Prolonged development timelines and technical/regulatory barriers

-

High cost of advanced hydrogen detection technologies

Level

-

Rising demand for portable and wearable hydrogen detectors in field operations

-

Advent of miniaturized, low-power sensors to detect hydrogen leaks in EVs and drones

Level

-

Lack of standardized performance metrics and globally harmonized calibration protocols

-

Cybersecurity issues associated with IoT-integrated hydrogen detection networks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High Adoption of Fuel Cells Globally

The hydrogen detection market is driven by the rapid adoption of fuel cell technologies across transportation, industrial, and stationary power sectors. Hydrogen, being highly flammable, requires precise monitoring in fuel cell stacks, storage tanks, and refueling stations to prevent leaks and explosions. Government support in countries like Japan, South Korea, China, and Germany, along with the growth of FCEVs and backup power applications, is accelerating demand for advanced hydrogen sensors and safety systems.

Restraint: Complexities in Developing Industry-Specific Hydrogen Detection Sensors

Designing and developing industry-specific hydrogen detection systems remains a key restraint for the market. Diverse applications across oil & gas, chemicals, automotive, energy, and semiconductors demand sensors with unique specifications, high chemical resistance, high-temperature tolerance, lightweight design, and fast response. Compliance with strict regulations such as ATEX and IECEX further complicates development, increases R&D costs, and limits scalability. Additionally, universal sensors often lack the accuracy or robustness required for niche applications, constraining widespread adoption and infrastructure expansion.

Opportunity: Shifting Focus of OEMs to Low-Carbon Energy Systems

The global push for decarbonization and net-zero emissions is encouraging OEMs to invest in green hydrogen and low-carbon energy systems, creating growth opportunities for hydrogen detection. Hydrogen is emerging as a key alternative fuel in transport, power generation, and industrial processes, including fuel cell vehicles, hydrogen trains, and backup power systems. Hydrogen detection sensors ensure safety, regulatory compliance, and operational efficiency, driving OEM investments by companies like Toyota, Hyundai, and Cummins in hydrogen infrastructure and technology deployment

Challenge: Production and Revenue Losses from Unplanned Downtime of Detection Equipment

Unplanned downtime of hydrogen detection systems poses a major challenge, leading to production losses and revenue instability in hydrogen-intensive processes. Failures in sensors can force shutdowns of production lines, refineries, or fueling stations to prevent safety hazards, given hydrogen’s high flammability. Legacy systems often lack real-time diagnostics and predictive maintenance, making fault detection slow and costly. Adoption of AI-enabled, self-monitoring hydrogen sensors is critical to minimize downtime, enhance operational efficiency, and ensure continuous, safe operations

Hydrogen Detection Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of hydrogen leak detectors across fuel cell vehicle R&D labs and production lines, as well as in after-sales service centers. | Enables early leak detection| Improves worker and vehicle safety| Reduces downtime| Ensures compliance with safety regulations |

|

Installation of hydrogen detection systems at refueling stations and hydrogen hubs to monitor storage tanks, pipelines, and dispensers. | Enhances operational safety| Reduces accident risks| iIproves public confidence in hydrogen refuelling infrastructure| Ensures regulatory compliance |

|

Integration of advanced hydrogen detection technologies in production plants, storage facilities, and distribution terminals. | Prevents product losses| Enhances asset protection| Supports safe large-scale hydrogen handling| Improves profitability |

|

Use of hydrogen detection solutions in maintenance depots and refuelling facilities for hydrogen-powered trains in Europe. | Enables safe depot operations| Reduces risk of fire/explosions| Ensures smooth train operations| Supports sustainable rail transport |

|

Application of cryogenic hydrogen leak detectors at launch pads, storage tanks, and fueling systems for space missions. | Provides real-time monitoring| Prevents catastrophic failures| Improves crew safety| Ensures mission success |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The major players operating in the hydrogen detection market with a significant global presence include Teledyne Technologies Incorporated (US), Honeywell International (US), H2San (Canada), Figaro Engineering (Japan), Nissha FIS (Japan), MSA Safety (US), H2Sense (France), SGX Sensortech (Switzerland), Drägerwerk AG & Co. KGaA (Germany), and Alphasense (UK). The hydrogen detection ecosystem comprises of raw material providers, hydrogen detection device providers, and end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hydrogen Detection Market, By Sensor Technology

The electrochemical sensor segment accounted for a significant share in 2024. Its growth is driven by high sensitivity, reliability, and cost-effectiveness, making it widely adopted across industrial safety, energy, and transportation applications. Emerging technologies such as MEMS and MOS sensors are gaining traction for compact, IoT-enabled hydrogen monitoring, enabling real-time data collection and integration with predictive maintenance systems.

Hydrogen Detection Market, By Implementation Type

The fixed detector segment held the largest share in 2024. Growth is driven by its critical deployment in industrial plants, refineries, and storage facilities where continuous monitoring ensures compliance with stringent safety standards. Portable detection systems are increasingly used for inspections, maintenance, and field applications, offering flexibility and mobility in hydrogen safety management.

Hydrogen Detection Market, By Detection Range

The 0–5,000 ppm detection range accounted for the largest share in 2024. This range balances sensitivity and scalability, making it suitable for automotive fuel cells, industrial processes, and energy storage applications. Sensors in this range are widely preferred for both safety compliance and operational efficiency across diverse hydrogen-utilizing sectors.

Hydrogen Detection Market, By Process Stage

The hydrogen generation segment dominated the market in 2024. Growth is driven by the critical need for accurate monitoring during production to prevent leaks, ensure process safety, and optimize operational efficiency. Storage, transportation, and end-use stages also require advanced detection systems, especially for large-scale infrastructure and fuel cell applications.

Hydrogen Detection Market, By Application

The oil & gas sector accounted for the largest share in 2024. This is driven by strict safety regulations and the widespread use of hydrogen in refining, chemical processing, and industrial operations. Rapid growth is also observed in automotive fuel cells, energy storage, and power generation applications due to the increasing adoption of low-carbon and hydrogen-based technologies.

REGION

Asia Pacific to be fastest-growing region in global hydrogen detection market during forecast period

Asia Pacific is expected to lead growth in the hydrogen detection industry during the forecast period. Rapid industrialization, increasing environmental awareness, and investments in hydrogen infrastructure are driving demand. Countries like Japan, South Korea, China, and India are advancing clean energy transitions, with hydrogen central to decarbonizing transportation, energy, and manufacturing. Japan and South Korea are advancing hydrogen adoption through large-scale deployment of fuel cell vehicles and refueling stations, whereas China is emphasizing hydrogen production, with a strong focus on scaling green hydrogen capacity. This creates strong demand for hydrogen sensors and leak detection systems. Local players such as Figaro Engineering, Nissha FIS, and SGX Sensortech further support regional adoption.

Hydrogen Detection Market: COMPANY EVALUATION MATRIX

In the hydrogen detection companies matrix, Teledyne Technologies (Star) leads with a strong market presence and a comprehensive portfolio of hydrogen sensing solutions, driving large-scale adoption through advanced sensors, real-time monitoring systems, and industrial safety platforms. Drägerwerk AG & Co. KGaA (Emerging Leader) is gaining traction with innovative, IoT-enabled hydrogen detection solutions that enhance safety, operational efficiency, and compliance. While Teledyne dominates with scale and established industrial networks, Drägerwerk shows strong growth potential to advance toward the leaders’ quadrant by expanding its sensor technologies and broadening adoption across industrial, automotive, and energy sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.26 Billion |

| Market Forecast in 2030 (Value) | USD 0.50 Billion |

| Growth Rate | CAGR of 11.8% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Middle East, Latin America, and Africa |

WHAT IS IN IT FOR YOU: Hydrogen Detection Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hydrogen Equipment & Safety Solutions Manufacturer | Competitor benchmarking of fixed and portable hydrogen detection solutions End-user segmentation by industry (oil & gas, automotive, energy, chemical) Analysis of sensor technology adoption trends (electrochemical, MOS, MEMS) | Identify gaps in product portfolio Highlight emerging market opportunities and safety trends Support R&D and expansion strategies |

| Fuel Cell Vehicle OEM | Profiling of hydrogen sensor suppliers for automotive applications Mapping integration of sensors into FCEVs Insights into global hydrogen refueling infrastructure | Optimize sensor selection for vehicle safety Identify supplier gaps and partnerships Align technology with regulations and incentives |

| Industrial Hydrogen Producer | Competitive analysis of sensors for production and storage Risk assessment for leakage and explosion hazards Review of predictive maintenance and IoT-enabled monitoring trends | Enhance operational safety and compliance Support process optimization and downtime reduction Guide investments in high-risk areas |

| Hydrogen Refueling Station Operator | Analysis of fixed and portable detection systems Benchmarking sensor performance under extreme conditions Insights into IoT integration for real-time leak detection | Improve station safety and reliability Facilitate regulatory compliance Enable predictive maintenance and smart monitoring |

| Hydrogen-Powered Rail / Public Transport Operator | Assessment of hydrogen detection needs in trains and depots Benchmarking sensors for mobile applications Study of integration with onboard safety systems | Enhance passenger and operational safety Reduce risk of hydrogen leaks Support compliance with transport safety regulations |

RECENT DEVELOPMENTS

- July 2025 : Figaro launched the TGS 2616 hydrogen gas sensor in the Asia Pacific region, targeting hydrogen safety applications. The sensor is designed to detect low concentrations of hydrogen with improved sensitivity and reliability, particularly in industrial and automotive environments.

- May 2025 : Honeywell launched a maintenance-free Hydrogen Leak Detector (HLD) that utilizes thermal conductivity technology to detect hydrogen leaks as low as 50 ppm in real time. The solution is engineered to support hydrogen-powered systems with improved safety and operational efficiency.

- March 2023 : H2scan launched its HY-ALERTA 5021 Solid-State Area Hydrogen Monitor product which protects battery rooms from explosive hydrogen build up and is maintenance free for more than 10 years. The HY-ALERTA 5021 is capable of detecting low levels of hydrogen even in the presence of other gases that can cause false alarms with other sensor technologies.

Table of Contents

Methodology

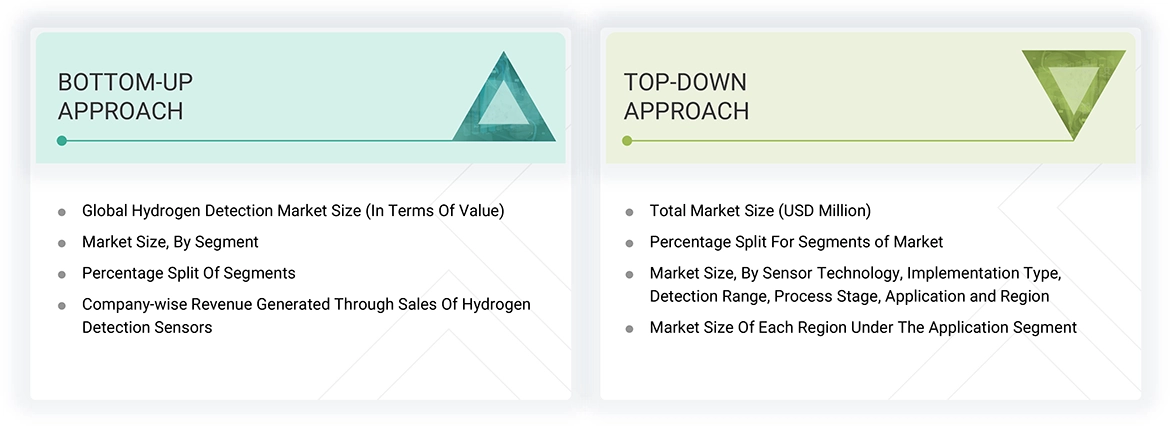

The research study involved four major activities in estimating the size of the hydrogen detection market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the hydrogen detection market report, the global market size has been estimated using both top-down and bottom-up approaches and several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

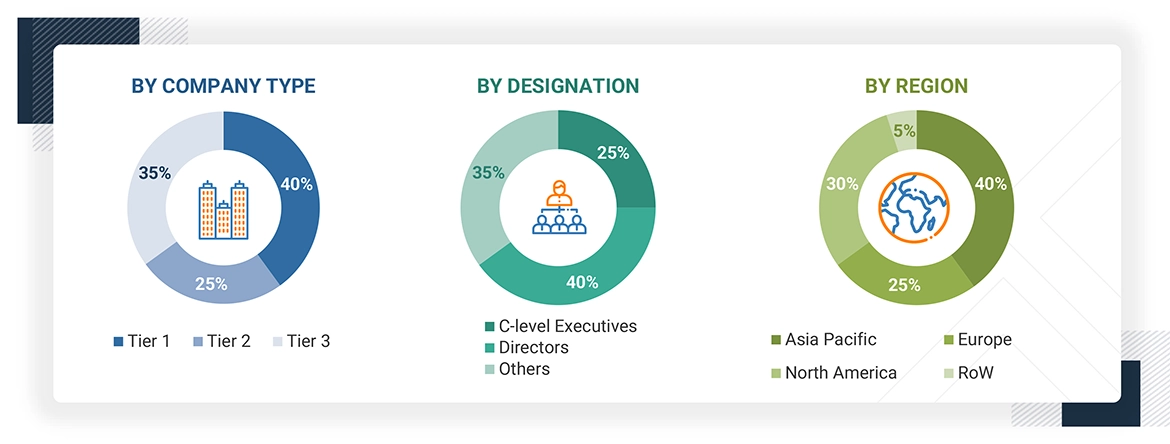

Primary Research

After understanding the hydrogen detection market scenario through secondary research, extensive primary research has been conducted. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the RoW. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data was collected mainly through telephonic interviews, which comprised 80% of the total primary interviews; questionnaires and emails were also used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce our primary research findings. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the hydrogen detection market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying top-line investments and spending in the ecosystem, and considering segment-level splits and major market developments

- Identifying different stakeholders in the hydrogen detection market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers in the hydrogen detection market and studying their product portfolio

- Analyzing trends related to the adoption of hydrogen detection products

- Tracking recent and upcoming market developments, including investments, R&D activities, product launches, expansions, acquisitions, partnerships, collaborations, agreements, and investments, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of hydrogen sensors

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operations managers, and finally with the domain experts at MarketsandMarkets

Hydrogen Detection Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall hydrogen detection market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Hydrogen detection refers to the process of detecting the presence or concentration of hydrogen gas as a fuel, as well as non-fuel (inclusive gas or as an ingredient) in the environment. Hydrogen is an odorless and colorless gas, making it difficult to detect with conventional sensing technologies alone. Hydrogen above a certain concentration level is explosive and can cause potential hazards; hence, precise detection of hydrogen becomes a key task in different industrial settings. Various hydrogen detection methods and technologies have been developed to accurately identify and quantify the presence of hydrogen. Several hydrogen detection technologies include electrochemical, catalytic, metal-oxide-semiconductors (MOS), micro-electromechanical systems (MEMS), and thermal conductivity.

The hydrogen detection market is segmented based on sensor technology, implementation type, detection range, process stage, application, and region. The market comprises electrochemical, catalytic, metal-oxide-semiconductor (MOS), thermal conductivity, and micro-electromechanical systems (MEMS) by sensor technology. Each sensor type offers unique advantages, such as fast response time, high sensitivity, and cost-efficiency, making them suitable for various industrial requirements. In terms of implementation type, hydrogen detectors are available as fixed and portable systems, with fixed systems deployed in industrial plants and portable units used for field inspections or emergency response. The market is also categorized by detection range, including 0–1,000 ppm, 0–5,000 ppm, 0–20,000 ppm, and beyond 20,000 ppm, based on the safety threshold and detection needs of different environments. The hydrogen lifecycle is addressed across four process stages: generation, storage, transportation, and usage, each requiring real-time leak monitoring and safety assurance. Key application areas include oil & gas, automotive & transportation, chemicals, metals & mining, power & energy, and other sectors such as semiconductors, food & beverage, and medical industries. Each segment demands tailored detection technologies to meet compliance, safety, and operational efficiency standards.

Key Stakeholders

- Original Equipment Manufacturers (OEMs)

- Industrial Machinery Manufacturers

- Industrial Chemical Manufacturers

- Hydrogen Detection Equipment Manufacturers and Vendors

- Components Suppliers

- Hydrogen Detection Equipment Distributors and Traders

- Research Organizations and Consulting Companies

- Government Bodies, Regulating Authorities, and Policymakers

- Venture Capitalists, Private Equity Firms, and Startup Companies

- Forums, Alliances, and Associations Related to Sensing Equipment

- Governments and Financial Institutions

- Analysts and Strategic Business Planners

- Existing End Users and Prospective Ones

Report Objectives

- To describe and forecast the hydrogen detection market size, in terms of value, based on sensor technology, implementation type, detection range, process stage and application

- To assess the hydrogen detection market size, in terms of value, with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the hydrogen detection market

- To give a detailed overview of the supply chain of the hydrogen detection market ecosystem

- To strategically analyze the ecosystem, porter’s five forces, key stakeholders & buying criteria, technology analysis, key conferences & events, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To estimate impact of AI/Gen AI, impact of 2025 US tariff on the hydrogen detection market.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with a detailed competitive landscape of the market.

- To analyze competitive developments such as acquisitions, product launches, partnerships, expansions, and collaborations undertaken in the hydrogen detection market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Who are the key players in the global hydrogen detection market?

Teledyne Technologies Incorporated (US), Honeywell International (US), H2San (Canada), Figaro Engineering (Japan), and Nissha FIS (Japan) are the key market players.

Which region is expected to hold the largest market share and why?

Asia Pacific is expected to hold the largest share in the hydrogen detection market owing to rapid industrialization, expanding hydrogen infrastructure, and strong governmental support for clean energy transitions.

What are the primary forces fueling growth and the significant opportunities within the hydrogen detection market?

The hydrogen detection market is expanding due to stringent safety norms, rising hydrogen usage in energy and transportation, and increased adoption of fuel cells.

What are the prominent strategies adopted by market players?

The key players have adopted product launches, acquisitions, collaborations, partnerships, investments, agreements, and expansions to strengthen their position in the hydrogen detection market.

What is the impact of Gen AI/AI on the hydrogen detection market on a scale of 1–10 (1 - least impactful and 10 - most impactful)?

The impact is as follows:

|

Real-time Data Processing and Leak Prediction |

9 |

|

Sensor Calibration and Optimization |

8 |

|

Edge AI Integration |

7 |

|

Regulatory and Safety Compliance Support |

6 |

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hydrogen Detection Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hydrogen Detection Market