Hydrogen Tank Material Market by Material Type (Metal, Carbon Fiber, Glass Fiber), Tank Type (Tank 1, Tank 2, Tank 3, Tank 4), End-use Industry (Automotive & Transportation, Industrial, Chemicals, Medical & Pharmaceuticals), Region – Global Forecast to 2030

Hydrogen Tank Material Market

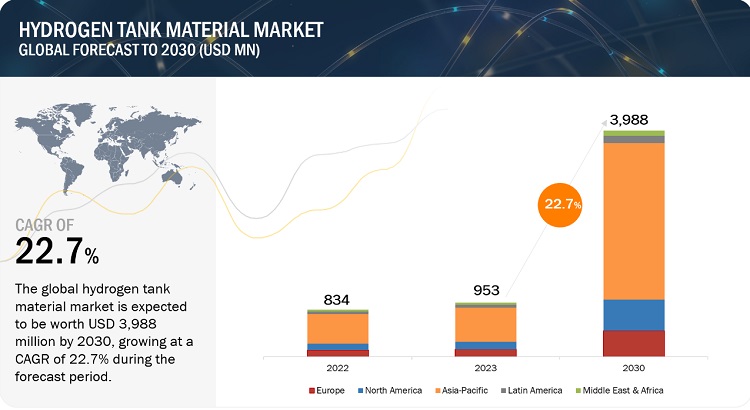

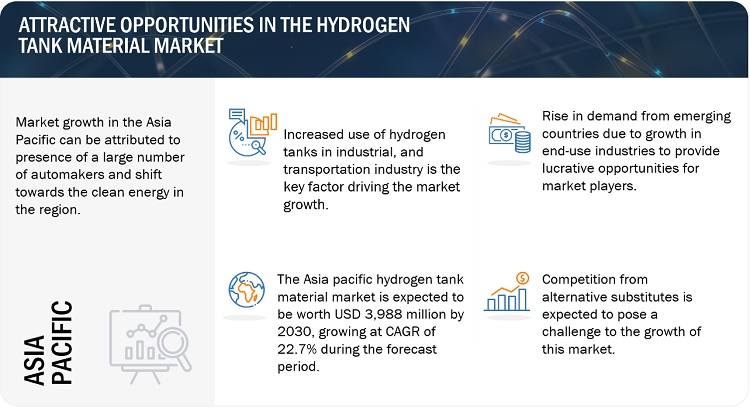

Hydrogen Tank Material Market was valued at USD 953 million in 2023 and is projected to reach USD 3,988 million by 2030, growing at a cagr 22.7% from 2023 to 2030. Significant growth of hydrogen and hydrogen tanks in industrial applications, chemical industry, automotive & transportation, and many other end-use industries is driving the growth of the market globally.

Attractive Opportunities in the Hydrogen Tank Material Market

To know about the assumptions considered for the study, Request for Free Sample Report

Hydrogen Tank Material Market Dynamics

Drivers: Rising environmental awareness to increase hydrogen tank materials demand

Stringent environmental norms and regulations are other factors boosting the demand for hydrogen vehicles across the globe. The most important energy fuel sources prevailing globally are gasoline, diesel, petroleum products, and natural gas. The exploration and production of these fuels are harmful and pose a risk to the environment, but natural gas is considered as the alternative fuel for the enhancement of welfare and sustainable development as it reduces carbon emissions, slows down global warming, and lessens GHG emissions. In order to protect against and minimize the risks associated with the usage of gasoline or diesel as a fuel and promote the usage of natural gas, the US government has set up various rules and regulations for environmental conservation. Countries with major natural gas reserves are looking at the advantages of using hydrogen as an alternative fuel; its use results in lower CO2 emissions as compared to the use of petrol or diesel.

Restraints: High cost of composite material-based tanks and regulatory approvals

The market for composites and end-use industries is competitive. A manufacturer needs to have a composite cylinder type-approved by a regulatory body or an independent inspection authority. For instance, in most Asia Pacific countries, such as India and Pakistan, Type 2, Type 3, and Type 4 cylinders are not permissible for commercial purposes. These processes and procedures may discourage the use of hydrogen tanks. There are also certain standards that need to be conformed to, pertaining to the safety measures, to avoid human or property loss from blast accidents. However, such incidents occur mainly due to the use of substandard hydrogen cylinders and hydrogen kits in vehicles, which may hamper the demand and limit the growth of the hydrogen tank material market. These factors may impact the market, eventually.

Opportunities: Emergence of lightweight composite material-based hydrogen tanks

Hydrogen tanks are available in a variety of types, sizes, and weights to suit various applications. The emergence of lightweight cylinders has given rise to a new phase in the hydrogen tanks industry. Composite cylinders, which include Type 3, and Type 4 cylinders are basically, the lightweight cylinders, with Type 4 being the lightest., A cylinder’s cost increases with a reduction in its weight. Over the years, Type 1 has been the most dominant type of cylinder, but in recent years, there has been a shift in the demand toward composite cylinders. The Type 3 cylinders are metal-lined composite cylinders, whereas Type 4 cylinders are plastic-lined composite cylinders, due to which Type 4 is the costliest cylinder. These composite cylinders are lighter than the steel cylinders, safe, reliable, and have an increased life span, owing to their advantageous properties and increasing demand from OEMs.

Challenges: Impact of fluctuating oil prices

The oil price volatility has a significant impact on the natural gas markets. As witnessed in recent years, oil prices were relatively stable, but they fell sharply in 2014, due to which many energy companies were forced to reconsider their investments, business models, and cost structures. Over the years, the wide gap between oil and natural gas prices has led to fuel conversions. Gas prices in some markets are related to oil prices; there are also substitution effects, which means users switch between oil and gas in response to changes in pricing dynamics. Hydrogen is considered economical options and have a cost advantage over oil prices. Even a small reduction in the price differential between natural gas and oil can undermine the viability of hydrogen as transportation fuels. On the other hand, when the prices of oil are at their peak, the demand for natural gas accelerates, ultimately pushing the demand for hydrogen tanks and its material. The uncertain nature of oil prices is expected to impact the growth of the hydrogen tank material industry in the future.

Carbon Fiber to account for the largest market share in terms of both value and volume by 2030

In high-value applications and for higher performance, carbon fiber materials are used to produce hydrogen tanks. Carbon fiber reinforcement is mainly used to prevent galvanic corrosion of the metallic components of the cylinder for long life. These carbon fiber composite materials are majorly used in manufacturing Type 3 and Type 4 hydrogen tanks. The use of carbon fiber material in Type 3 and Type 4 hydrogen tanks, is driving the market due to the reduction in weight of fuel systems and vehicles.

Tank 4 type to be the fastest growing tank type of hydrogen tank material market

Type 4 hydrogen tanks are manufactured with a gas-tight thick rubber membrane, and metal is not used in their structural design. In the Type 4 hydrogen tanks, the plastic liner is reinforced with either woven glass fiber or a woven carbon fiber material, by which the entire tank is wrapped. These composite wrappers offer strength to the cylinder. Type 4 hydrogen tanks are very light and can contain more volumes of gas compared to other types of tanks available in related dimensions due to the very thin wall of the tanks. Also, because of the lesser load in the vehicle, the overall mileage of the vehicles improves. However, these tanks are the most expensive type, since they are made of composites.

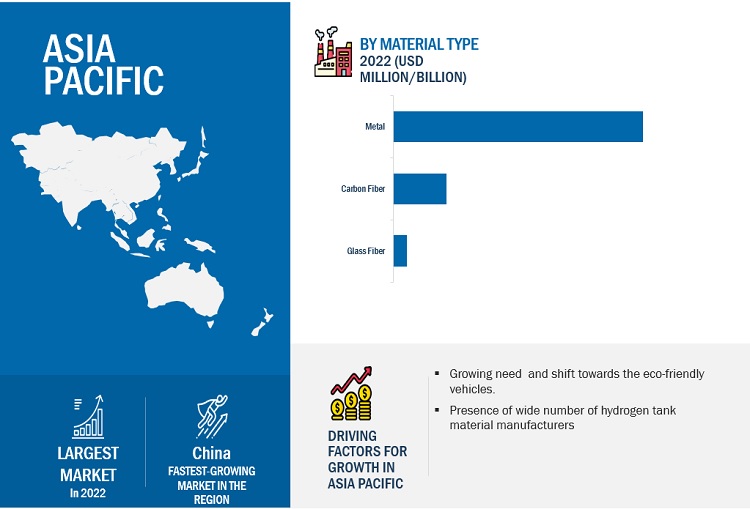

Asia Pacific held the largest market share and is expected to witness the highest CAGR in the hydrogen tank material market

Asia Pacific is the dominating region in the hydrogen tank material market, and it is expected to witness high growth in the next five years. Asia Pacific is one of the leading markets for green technology adoption in order to meet government targets for lowering greenhouse gas (GHG) emissions. Because of the commercial deployment of Japanese fuel cell micro-CHP products, Japan and South Korea have invested heavily in fuel cell adoption since 2009. FCEVs are zero-emission vehicles that use an on-board hydrogen fuel cell to power an electric motor. To combat climate change and meet decarbonization targets, governments in the region are encouraging the use of EVs and FCEVs and are funding, either fully or partially, the construction of hydrogen refueling stations to enable the deployment of FCEVs such as public buses and municipal trucks as well as cars. the deployment of fuel cell rail applications in this region can help decarbonize the sector while also propelling the growth of the hydrogen tank material market.

To know about the assumptions considered for the study, download the pdf brochure

Hydrogen Tank Material Market Players

The key players in the global hydrogen tank material market are:

- Worthington Industries, Inc. (US)

- Luxfer Group (England)

- Hexagon Composites ASA (Norway)

- Quantum Fuel Systems LLC (US)

- Faber Industrie SPA (Italy)

- Everest Kanto Cylinders Ltd. (India)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the hydrogen tank material industry. The study includes an in-depth competitive analysis of these key players in the hydrogen tank material market, with their company profiles, recent developments, and key market strategies.

Hydrogen Tank Material Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 953 million |

|

Revenue Forecast in 2030 |

USD 3,988 million |

|

CAGR |

22.7% |

|

Years considered for the study |

2021–2030 |

|

Base year |

2022 |

|

Forecast period |

2023–2030 |

|

Units considered |

Value (USD Million/Billion), Volume (Units) |

|

Segments |

Material Type, Tank Type, End-use Industry, and Region |

|

Regions |

Asia Pacific, North America, Europe, Latin America, and Middle East & Africa |

|

Companies |

Worthington Industries, Inc. (US), Luxfer Group (England), Hexagon Composites ASA (Norway), Quantum Fuel Systems LLC (US), Faber Industrie SPA (Italy), Everest Kanto Cylinders Ltd. (India), Avanco Group (Germany), Praxair Technologies, Inc. (US), and others. |

This research report categorizes the hydrogen tank material market based on material type, tank type, end-use industry, and region.

By Material Type:

- Metal

- Carbon Fiber

- Glass Fiber

By Tank Type:

- Tank 1

- Tank 2

- Tank 3

- Tank 4

By End-use Industry:

- Automotive & Transportation

- Industrial

- Chemicals

- Medical & Pharmaceuticals

- Others

By Region:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In October 2022, Worthington Industries entered into a Partnership with Innovair Group to bring the best quality cylinders to Canada.

- In October 2022, Hexagon Purus and Lhyfe companies has got into a collaboration project for production of green and renewable hydrogen for transportation and industrial applications.

- In July 2022, Rev1 Ventures Partners with Worthington Industries to accelerate advancements in sustainability technology, smart manufacturing. Worthington to provide individual investments, up to $10 million, to propel emerging technologies that align with Worthington’s vision and enable the company to better serve current and future markets.

- In July 2021, Luxfer Gas Cylinders partnered with Octopus Hydrogen to make heavy goods transportation and the aviation industries cleaner and greener by delivering green hydrogen to the sectors which cannot be decarbonized by batteries alone, mainly aviation and heavy-duty road vehicles.

- In March 2021, The Worthington Industries subsidiary SCI was acquired by Luxfer Group in full. The goal of this transaction is to strengthen Luxfer Group's capacity for expanding hydrogen and CNG gas potential.

Frequently Asked Questions (FAQ):

Which are the key players of hydrogen tank material market and what are their strategies to strengthen their market presence/shares?

Some of the key players of hydrogen tank material market Worthington Industries, Inc. (US), Luxfer Group (England), Hexagon Composites ASA (Norway), Quantum Fuel Systems LLC (US), Faber Industrie SPA (Italy), Everest Kanto Cylinders Ltd. (India) among others, are the key manufacturers that secured contracts, deals in the last few years. Agreements, expansions, technological developments, contracts, and deals was the key strategies adopted by these companies to strengthen their hydrogen tank material market presence.

What are the drivers for the hydrogen tank material market?

Increased use of hydrogen and clean energy in automotive & transportation and industrial industries is expected to drive the market globally.

Which type of material holds the largest market share?

Metal segment holds the largest share in terms of both, value and volume in the hydrogen tank material market.

What is the major factor on which the final price of hydrogen tank relies?

Price and availability of raw material along with the type of manufacturing process used plays an important role in determining the costs of the hydrogen tanks.

Which region is expected to hold the highest market share?

Asia Pacific will dominate the market share in forecasted period i.e. between 2023 to 2030, due to the huge demand coming from the countries like China, India and South Korea. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for clean energy- Government investments and initiatives- Increasing demand from automotive, industrial, and other end-use industries- Rising environmental awarenessRESTRAINTS- High cost of composite material and regulatory approvals- Lack of standardization in manufacturing technologies of compositesOPPORTUNITIES- Development of lightweight fuel tanks- Emergence of composite material-based hydrogen tanksCHALLENGES- Issues related to recycling of hydrogen tank materials- Capital-intensive production and complex manufacturing process

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMICS OUTLOOKINTRODUCTIONGDP TRENDS AND FORECASTTRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 SUPPLY CHAIN ANALYSISRAW MATERIAL ANALYSISFINAL PRODUCT ANALYSIS

- 5.8 VALUE CHAIN ANALYSIS

-

5.9 ECOSYSTEM

-

5.10 PRICING ANALYSISAVERGAE PRICING OF HYDROGEN TANK MATERIAL OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2021–2023 (USD/KG)AVERAGE SELLING PRICE TREND, BY MATERIAL TYPE, 2021–2024AVERAGE SELLING PRICE TREND, BY TANK TYPE, 2021–2024AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY, 2021–2024AVERAGE SELLING PRICE TREND, BY REGION, 2021–2024

-

5.11 TRADE ANALYSISEXPORT SCENARIO FOR HS CODE 7019IMPORT SCENARIO FOR HS CODE 7019EXPORT SCENARIO FOR HS CODE 681511IMPORT SCENARIO FOR HS CODE 681511

-

5.12 TECHNOLOGY ANALYSISKEY TECHNOLOGIESCOMPLEMENTARY TECHNOLOGY

-

5.13 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTS' ANALYSESPATENTS BY CHINA PETROLEUM & CHEMICAL CORPORATIONPATENTS BY SINOPEC ENGINEERING GROUP CORPORATION- REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES & EVENTS

-

5.15 CASE STUDY ANALYSISCASE STUDY 1: TORAY INDUSTRIES LAUNCHED TORAYCA CARBON FIBERCASE STUDY 2: ARKEMA DEVELOPED ELIUM RESIN TO BE USED IN HYDROGEN TANKSCASE STUDY 3: ARKEMA DEVELOPED ELIUM RESIN TO BE USED IN HYDROGEN TANKS

- 5.16 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.17 INVESTMENT AND FUNDING SCENARIO

-

5.18 IMPACT OF AI/GEN AITOP USE CASES AND MARKET POTENTIALCASE STUDIES OF AI IMPLEMENTATION IN HYDROGEN TANK MATERIAL MARKET

- 6.1 INTRODUCTION

-

6.2 METALCHEAPEST AND MOST WIDELY USED RAW MATERIAL

-

6.3 FIBERAPPLICATIONS IN HIGH-END APPLICATIONS

-

6.4 RESINGROWING DEMAND FOR COMPOSITES IN TYPE 3 & TYPE 4 TANKS

- 7.1 INTRODUCTION

-

7.2 TYPE 1COST-EFFECTIVENESS TO BOOST ITS DEMAND FOR HYDROGEN STORAGE

-

7.3 TYPE 2LIGHTWEIGHT PROPERTY DRIVING DEMAND FROM END-USE INDUSTRIES

-

7.4 TYPE 3HIGH STRENGTH AND EXTRA IMPACT RESISTANCE

-

7.5 TYPE 4APPLICATION IN FUEL CELL ELECTRIC VEHICLES TO DRIVE THE DEMAND

- 8.1 INTRODUCTION

-

8.2 AUTOMOTIVE & TRANSPORTATIONGROWING ADOPTION OF HYDROGEN FUELED VEHICLES

-

8.3 INDUSTRIALHIGH USAGE OF TYPE 1 AND TYPE 2 HYDROGEN TANKS

-

8.4 CHEMICALSINCREASING USE OF HYDROGEN IN CHEMICAL INDUSTRY TO DRIVE THE DEMAND

-

8.5 REFUELING STATIONGROWING NUMBER OF REFUELING STATION TO DRIVE THE DEMAND

- 8.6 OTHER END-USE INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Ongoing hydrogen storage projects to boost the marketCANADA- Improving demand from industrial and automobile industries to boost market

-

9.3 EUROPEGERMANY- German automotive industry to drive the marketITALY- Efforts to reduce carbon emissions from automobile & transportation industries to boost marketFRANCE- Fuel and energy efficiency plan to boost marketUK- Changes in climate change regulations to boost marketNETHERLANDS- Plans to improve hydrogen-based vehicles and refueling infrastructure to boost marketREST OF EUROPE

-

9.4 ASIA PACIFICSOUTH KOREA- Development of hydrogen and fuel cell-based vehicles to boost marketCHINA- Carbon neutrality targets to drive hydrogen as major energy sourceINDIA- Changes in regulations in favor of hydrogen as fuel to boost marketJAPAN- National hydrogen strategies to achieve emission reduction targets to boost marketREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICASOUTH AFRICA- Net-zero emission target by 2050 to influence marketGCC COUNTRIES- Use of hydrogen as energy source to drive marketREST OF MIDDLE EAST & AFRICA

-

9.6 LATIN AMERICABRAZIL- Need for cleaner transportation fuels to drive marketMEXICO- Changing energy dependence to greener alternatives to drive marketREST OF LATIN AMERICA

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES

- 10.3 REVENUE ANALYSIS, 2019–2023

- 10.4 MARKET SHARE ANALYSIS

-

10.5 BRAND/PRODUCT COMPARISONBRAND/PRODUCT COMPARISON, BY COMPOSITE HYDROGEN TANK MATERIAL PRODUCTS

-

10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT- Company footprint- Material type footprint- Tank type footprint- End-use industry footprint- Region footprint

-

10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES- Detailed list of key startups/SMEs- Competitive benchmarking of Key Startups/SMES

-

10.8 VALUATION AND FINANCIAL METRICS OF COMPOSITE HYDROGEN TANK MATERIAL MANUFACTURERS

-

10.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSEXPANSIONSOTHER DEVELOPMENTS

-

11.1 KEY COMPANIESTORAY INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSGL CARBON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTEIJIN LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARKEMA- Business overview- Products/Solutions/Services offered- MnM viewOUTOKUMPU- Business overview- Products/Solutions/Services offered- MnM viewACCIAIERIE VALBRUNA S.P.A.- Business overview- Products/Solutions/Services offered- MnM viewHUNTSMAN INTERNATIONAL LLC.- Business overview- Products/Solutions/Services Offered- MnM viewMITSUBISHI CHEMICAL GROUP CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAPERAM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJAPAN STEEL WORKS, LTD.- Business overview- Products/Solutions/Services offered- MnM viewSYENSQO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHS HYOSUNG ADVANCED MATERIALS- Business overview- Products/Solutions/Services Offered- Recent developments- MnM viewHEXCEL CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewJINDAL STAINLESS LIMITED- Business overview- Products/Solutions/Services Offered- Recent developments- MnM viewNIPPON STEEL CORPORATION- Business overview- Products/Solutions/Services Offered- Recent developments- MnM viewJILIN CHEMICAL FIBER GROUP CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewZHONGFU SHENYING CARBON FIBER CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

11.2 OTHER PLAYERSCHINA BEIHAI FIBERGLASS CO.,LTD.HENGRUI GROUPTCR COMPOSITESGMS COMPOSITESKORDSAWESTLAKE CORPORATIONSIKA AGJIANGSU AOSHENG COMPOSITE MATERIAL TECHNOLOGY CO., LTD.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GOVERNMENT INITIATIVES AND STRATEGIES TO PROMOTE USAGE OF HYDROGEN

- TABLE 2 GLOBAL SALES OF NG VEHICLES, BY REGION, 2021

- TABLE 3 HYDROGEN TANK MATERIAL MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRY

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRY

- TABLE 6 GDP PERCENTAGE (%) CHANGE, KEY COUNTRY, 2020–2029

- TABLE 7 TRENDS OF GLOBAL AUTOMOTIVE INDUSTRY

- TABLE 8 HYDROGEN TANK MATERIAL MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 9 AVERAGE SELLING PRICE TREND OF HYDROGEN TANK MATERIAL, BY MATERIAL TYPE, 2021–2029 (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE TREND OF HYDROGEN TANK MATERIAL, BY REGION, 2021–2029 (USD/KG)

- TABLE 11 TOP 10 EXPORTING COUNTRIES OF GLASS FIBERS IN 2023

- TABLE 12 TOP 10 IMPORTING COUNTRIES OF GLASS FIBERS IN 2023

- TABLE 13 TOP 10 EXPORTING COUNTRIES OF CARBON FIBERS IN 2023

- TABLE 14 TOP 10 IMPORTING COUNTRIES OF CARBON FIBERS IN 2023

- TABLE 15 HYDROGEN TANK MATERIAL MARKET: GLOBAL PATENTS

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 DETAILED LIST OF CONFERENCES & EVENTS RELATED TO HYDROGEN TANK MATERIAL MARKET, 2023–2024

- TABLE 21 TOP USE CASES AND MARKET POTENTIAL

- TABLE 22 CASE STUDIES OF GEN AI IMPLEMENTATION IN HYDROGEN TANK MATERIAL MARKET

- TABLE 23 HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (TONS)

- TABLE 24 HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (USD THOUSAND)

- TABLE 25 METAL HYDROGEN TANKS MARKET, BY REGION, 2022–2030 (TONS)

- TABLE 26 METAL HYDROGEN TANKS MARKET, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 27 FIBER HYDROGEN TANKS MARKET, BY REGION, 2022–2030 (TONS)

- TABLE 28 FIBER HYDROGEN TANKS MARKET, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 29 RESIN HYDROGEN TANKS MARKET, BY REGION, 2022–2030 (TONS)

- TABLE 30 RESIN HYDROGEN TANKS MARKET, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 31 HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (TONS)

- TABLE 32 HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (USD THOUSAND)

- TABLE 33 TYPE 1: HYDROGEN TANK MATERIAL MARKET, BY REGION, 2022–2030 (TONS)

- TABLE 34 TYPE 1: HYDROGEN TANK MATERIAL MARKET, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 35 TYPE 2: HYDROGEN TANK MATERIAL MARKET, BY REGION, 2022–2030 (TONS)

- TABLE 36 TYPE 2: HYDROGEN TANK MATERIAL MARKET, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 37 TYPE 3: HYDROGEN TANK MATERIAL MARKET, BY REGION, 2022–2030 (TONS)

- TABLE 38 TYPE 3: HYDROGEN TANK MATERIAL MARKET, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 39 TYPE 4: HYDROGEN TANK MATERIAL MARKET, BY REGION, 2022–2030 (TONS)

- TABLE 40 TYPE 4: HYDROGEN TANK MATERIAL MARKET, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 41 HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 42 HYDROGEN TANK MATERIAL MARKET, BYEND-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 43 HYDROGEN TANK MATERIAL MARKET AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY, BY REGION, 2022–2030 (TONS)

- TABLE 44 HYDROGEN TANK MATERIAL MARKET AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 45 HYDROGEN TANK MATERIAL MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2022–2030 (TONS)

- TABLE 46 HYDROGEN TANK MATERIAL MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 47 HYDROGEN TANK MATERIAL MARKET IN CHEMICALS END-USE INDUSTRY, BY REGION, 2022–2030 (TONS)

- TABLE 48 HYDROGEN TANK MATERIAL MARKET IN CHEMICALS END-USE INDUSTRY, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 49 HYDROGEN TANK MATERIAL MARKET IN REFUELING STATION END-USE INDUSTRY, BY REGION, 2022–2030 (TONS)

- TABLE 50 HYDROGEN TANK MATERIAL MARKET IN REFUELING STATION END-USE INDUSTRY, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 51 HYDROGEN TANK MATERIAL MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2030 (TONS)

- TABLE 52 HYDROGEN TANK MATERIAL MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 53 HYDROGEN TANK MATERIAL MARKET, BY REGION, 2022–2030 (TONS)

- TABLE 54 HYDROGEN TANK MATERIAL MARKET, BY REGION, 2022–2030 (USD THOUSAND)

- TABLE 55 NORTH AMERICA: HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (TONS)

- TABLE 56 NORTH AMERICA: HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (USD THOUSAND)

- TABLE 57 NORTH AMERICA: HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (TONS)

- TABLE 58 NORTH AMERICA: HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (USD THOUSAND)

- TABLE 59 NORTH AMERICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 60 NORTH AMERICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 61 NORTH AMERICA: HYDROGEN TANK MATERIAL MARKET, BY COUNTRY, 2022–2030 (TONS)

- TABLE 62 NORTH AMERICA: HYDROGEN TANK MATERIAL MARKET, BY COUNTRY, 2022–2030 (USD THOUSAND)

- TABLE 63 US: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 64 US: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 65 CANADA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 66 CANADA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 67 EUROPE: HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (TONS)

- TABLE 68 EUROPE: HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (USD THOUSAND)

- TABLE 69 EUROPE: HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (TONS)

- TABLE 70 EUROPE: HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (USD THOUSAND)

- TABLE 71 EUROPE: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 72 EUROPE: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 73 EUROPE: HYDROGEN TANK MATERIAL MARKET, BY COUNTRY, 2022–2030 (TONS)

- TABLE 74 EUROPE: HYDROGEN TANK MATERIAL MARKET, BY COUNTRY, 2022–2030 (USD THOUSAND)

- TABLE 75 GERMANY: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 76 GERMANY: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 77 ITALY: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 78 ITALY: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 79 FRANCE: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 80 FRANCE: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 81 UK: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 82 UK: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 83 NETHERLANDS: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 84 NETHERLANDS: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 85 REST OF EUROPE: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 86 REST OF EUROPE: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 87 ASIA PACIFIC: HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (TONS)

- TABLE 88 ASIA PACIFIC: HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (USD THOUSAND)

- TABLE 89 ASIA PACIFIC: HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (TONS)

- TABLE 90 ASIA PACIFIC: HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (USD THOUSAND)

- TABLE 91 ASIA PACIFIC: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 92 ASIA PACIFIC: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 93 ASIA PACIFIC: HYDROGEN TANK MATERIAL MARKET, BY COUNTRY, 2022–2030 (TONS)

- TABLE 94 ASIA PACIFIC: HYDROGEN TANK MATERIAL MARKET, BY COUNTRY, 2022–2030 (USD THOUSAND)

- TABLE 95 SOUTH KOREA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 96 SOUTH KOREA: HYDROGEN TANK MATERIAL, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 97 CHINA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 98 CHINA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 99 INDIA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 100 INDIA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 101 JAPAN: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 102 JAPAN: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 103 REST OF ASIA PACIFIC: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 104 REST OF ASIA PACIFIC: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 105 MIDDLE EAST & AFRICA: HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (TONS)

- TABLE 106 MIDDLE EAST & AFRICA: HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (USD THOUSAND)

- TABLE 107 MIDDLE EAST & AFRICA: HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (TONS)

- TABLE 108 MIDDLE EAST & AFRICA: HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (USD THOUSAND)

- TABLE 109 MIDDLE EAST & AFRICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 110 MIDDLE EAST & AFRICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 111 MIDDLE EAST & AFRICA: HYDROGEN TANK MATERIAL MARKET, BY COUNTRY, 2022–2030 (TONS)

- TABLE 112 MIDDLE EAST & AFRICA: HYDROGEN TANK MATERIAL MARKET, BY COUNTRY, 2022–2030 (USD THOUSAND)

- TABLE 113 SOUTH AFRICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 114 SOUTH AFRICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 115 GCC COUNTRIES: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 116 GCC COUNTRIES: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDSUTRY, 2022–2030 (USD THOUSAND)

- TABLE 117 REST OF MIDDLE EAST & AFRICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 118 REST OF MIDDLE EAST & AFRICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 119 LATIN AMERICA: HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (TONS)

- TABLE 120 LATIN AMERICA: HYDROGEN TANK MATERIAL MARKET, BY MATERIAL TYPE, 2022–2030 (USD THOUSAND)

- TABLE 121 LATIN AMERICA: HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (TONS)

- TABLE 122 LATIN AMERICA: HYDROGEN TANK MATERIAL MARKET, BY TANK TYPE, 2022–2030 (USD THOUSAND)

- TABLE 123 LATIN AMERICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 124 LATIN AMERICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 125 LATIN AMERICA: HYDROGEN TANK MATERIAL MARKET, BY COUNTRY, 2022–2030 (TONS)

- TABLE 126 LATIN AMERICA: HYDROGEN TANK MATERIAL MARKET, BY COUNTRY, 2022–2030 (USD THOUSAND)

- TABLE 127 BRAZIL: HYDROGEN TANK MATERIAL MARKET, BY APPLICATION, 2022–2030 (TONS)

- TABLE 128 BRAZIL: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDSUTRY, 2022–2030 (USD THOUSAND)

- TABLE 129 MEXICO: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 130 MEXICO: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 131 REST OF LATIN AMERICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (TONS)

- TABLE 132 REST OF LATIN AMERICA: HYDROGEN TANK MATERIAL MARKET, BY END-USE INDUSTRY, 2022–2030 (USD THOUSAND)

- TABLE 133 STRATEGIES ADOPTED BY COMPOSITE HYDROGEN TANK MATERIAL MANUFACTURERS

- TABLE 134 DEGREE OF COMPETITION: COMPOSITE HYDROGEN TANK MATERIAL MARKET

- TABLE 135 MATERIAL TYPE FOOTPRINT

- TABLE 136 TANK TYPE FOOTPRINT

- TABLE 137 END-USE INDUSTRY FOOTPRINT

- TABLE 138 REGION FOOTPRINT

- TABLE 139 HYDROGEN TANK MATERIAL MARKET: KEY STARTUPS/SMES

- TABLE 140 HYDROGEN TANK MATERIAL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 141 HYDROGEN TANK MATERIAL MARKET: PRODUCT LAUNCHES, JANUARY 2018–AUGUST 2024

- TABLE 142 HYDROGEN TANK MATERIAL MARKET: DEALS, JANUARY 2018–AUGUST 2024

- TABLE 143 HYDROGEN TANK MATERIAL MARKET: EXPANSIONS, JANUARY 2018–AUGUST 2024

- TABLE 144 HYDROGEN TANK MATERIAL MARKET: OTHER DEVELOPMENTS, JANUARY 2018–AUGUST 2024

- TABLE 145 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 146 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES, JANUARY 2018–AUGUST 2024

- TABLE 148 TORAY INDUSTRIES, INC.: DEALS, JANUARY 2018–AUGUST 2024

- TABLE 149 TORAY INDUSTRIES, INC.: EXPANSIONS, JANUARY 2018–AUGUST 2024

- TABLE 150 SGL CARBON: COMPANY OVERVIEW

- TABLE 151 SGL CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 SGL CARBON: PRODUCT LAUNCHES, JANUARY 2018–AUGUST 2024

- TABLE 153 SGL CARBON: OTHER DEVELOPMENTS, JANUARY 2018–AUGUST 2024

- TABLE 154 TEIJIN LIMITED: COMPANY OVERVIEW

- TABLE 155 TEIJIN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 TEIJIN LIMITED: DEALS, JANUARY 2018–AUGUST 2024

- TABLE 157 ARKEMA: COMPANY OVERVIEW

- TABLE 158 ARKEMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 ARKEMA: DEALS, JANUARY 2018–AUGUST 2024

- TABLE 160 OUTOKUMPU: COMPANY OVERVIEW

- TABLE 161 OUTOKUMPU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 OUTOKUMPU: DEALS, JANUARY 2018–AUGUST 2024

- TABLE 163 ACCIAIERIE VALBRUNA S.P.A.: COMPANY OVERVIEW

- TABLE 164 ACCIAIERIE VALBRUNA S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 HUNTSMAN INTERNATIONAL LLC.: COMPANY OVERVIEW

- TABLE 166 HUNTSMAN INTERNATIONAL LLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 HUNTSMAN INTERNATIONAL LLC.: DEALS, JANUARY 2018–AUGUST 2024

- TABLE 168 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 169 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 170 MITSUBISHI CHEMICAL GROUP CORPORATION: DEALS, JANUARY 2018–AUGUST 2024

- TABLE 171 MITSUBISHI CHEMICAL GROUP CORPORATION: EXPANSIONS, JANUARY 2018–AUGUST 2024

- TABLE 172 APERAM: COMPANY OVERVIEW

- TABLE 173 APERAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 APERAM: DEALS, JANUARY 2018–AUGUST 2024

- TABLE 175 JAPAN STEEL WORKS, LTD.: COMPANY OVERVIEW

- TABLE 176 JAPAN STEEL WORKS, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 SYENSQO: COMPANY OVERVIEW

- TABLE 178 SYENSQO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 SYENSQO: OTHER DEVELOPMENTS, JANUARY 2018–AUGUST 2024

- TABLE 180 HS HYOSUNG ADVANCED MATERIALS: COMPANY OVERVIEW

- TABLE 181 HS HYOSUNG ADVANCED MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 HYOSUNG ADVANCED MATERIALS: DEALS

- TABLE 183 HS HYOSUNG ADVANCED MATERIALS: EXPANSIONS, JANUARY 2018–AUGUST 2024

- TABLE 184 HEXCEL CORPORATION: COMPANY OVERVIEW

- TABLE 185 HEXCEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 JINDAL STAINLESS LIMITED: COMPANY OVERVIEW

- TABLE 187 JINDAL STAINLESS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 JINDAL STAINLESS LIMITED: DEALS

- TABLE 189 JINDAL STAINLESS LIMITED: EXPANSIONS

- TABLE 190 NIPPON STEEL CORPORATION: COMPANY OVERVIEW

- TABLE 191 NIPPON STEEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 NIPPON STEEL CORPORATION: DEALS

- TABLE 193 JILIN CHEMICAL FIBER GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 194 JILIN CHEMICAL FIBER GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ZHONGFU SHENYING CARBON FIBER CO., LTD.: COMPANY OVERVIEW

- TABLE 196 ZHONGFU SHENYING CARBON FIBER CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 197 ZHONGFU SHENYING CARBON FIBER CO., LTD. : EXPANSIONS, JANUARY 2018- AUGUST 2024

- FIGURE 1 HYDROGEN TANK MATERIAL MARKET SEGMENTATION

- FIGURE 2 HYDROGEN TANK MATERIAL MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 HYDROGEN TANK MATERIAL MARKET: DATA TRIANGULATION

- FIGURE 6 METAL ACCOUNTED FOR HIGHEST MARKET SHARE IN 2023

- FIGURE 7 TANK 4 SEGMENT REGISTERED HIGH MARKET SHARE IN 2023

- FIGURE 8 INDUSTRIAL SEGMENT ACCOUNTED FOR LARGEST SHARE OF HYDROGEN TANK MATERIAL MARKET IN 2023

- FIGURE 9 ASIA PACIFIC LEADING HYDROGEN TANK MATERIAL MARKET

- FIGURE 10 GROWING INVESTMENTS IN HYDROGEN PROJECTS TO BOOST THE DEMAND FOR HYDROGEN TANK MATERILA MARKET

- FIGURE 11 TANK 1 & ASIA PACIFIC HELD LARGEST SHARE IN 2023

- FIGURE 12 METAL SEGMENT HELD LARGEST SHARE IN 2023

- FIGURE 13 METAL SEGMENT HELD LARGEST SHARE IN 2023

- FIGURE 14 CHINA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HYDROGEN TANK MATERIAL MARKET

- FIGURE 16 GLOBAL INVESTMENTS IN CLEAN ENERGY, 2020-2023

- FIGURE 17 HYDROGEN TANK MATERIAL MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDSUTRY

- FIGURE 19 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRY

- FIGURE 20 HYDROGEN TANK MATERIAL MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS: HYDROGEN TANK MATERIAL MARKET

- FIGURE 22 HYDROGEN TANK MATERIAL MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- FIGURE 23 HYDROGEN TANK MATERIAL MARKET: ECOSYSTEM

- FIGURE 24 AVERAGE PRICING OF HYDROGEN TANK MATERIAL OFFERED BY KEY PLAYERS, BY MATERIAL TYPE, 2021–2023 (USD/KG)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF HYDROGEN TANK MATERIAL, BY MATERIAL TYPE, 2021–2024

- FIGURE 26 AVERAGE SELLING PRICE TREND OF HYDROGEN TANK MATERIAL, BY TANK TYPE, 2021–2024

- FIGURE 27 AVERAGE SELLING PRICE OF HYDROGEN TANK MATERIAL, BY END-USE INDUSTRY, 2021–2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF HYDROGEN TANK MATERIAL, BY REGION, 2021–2024

- FIGURE 29 EXPORT OF GLASS FIBERS, BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 30 IMPORT OF GLASS FIBERS, BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 31 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 32 GLOBAL PATENT PUBLICATION TREND: 2014–2024

- FIGURE 33 HYDROGEN TANK MATERIAL MARKET: LEGAL STATUS OF PATENTS

- FIGURE 34 GLOBAL JURISDICTION ANALYSIS

- FIGURE 35 CHINA PETROLEUM & CHEMICAL CORPORATION REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 36 DEALS AND FUNDING IN HYDROGEN TANK MATERIAL MARKET SOARED IN 2024

- FIGURE 37 PROMINENT HYDROGEN TANK MATERIAL MANUFACTURING FIRMS IN 2024 (USD BILLION)

- FIGURE 38 METAL MATERIAL TYPE TO DOMINATE HYDROGEN TANK MATERIAL MARKET

- FIGURE 39 TYPE 4 TANK TYPE DOMINATED HYDROGEN TANK MATERIAL MARKET

- FIGURE 40 AUTOMOTIVE & TRANSPORTATION TO DOMINATE HYDROGEN TANK MATERIAL MARKET DURING FORECAST PERIOD

- FIGURE 41 CHINA TO BE FASTEST-GROWING HYDROGEN TANK MATERIAL MARKET DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: HYDROGEN TANK MATERIAL MARKET SNAPSHOT

- FIGURE 43 EUROPE: HYDROGEN TANK MATERIAL MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: HYDROGEN TANK MATERIAL MARKET SNAPSHOT

- FIGURE 45 COMPOSITE HYDROGEN TANK MATERIAL MARKET: REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- FIGURE 46 SHARES OF TOP COMPANIES IN COMPOSITE HYDROGEN TANK MATERIAL MARKET

- FIGURE 47 COMPOSITE HYDROGEN TANK MATERIAL MARKET: TOP TRENDING BRAND/PRODUCTS

- FIGURE 48 BRAND/PRODUCT COMPARISON, BY COMPOSITE HYDROGEN TANK MATERIAL PRODUCTS

- FIGURE 49 COMPOSITE HYDROGEN TANK MATERIAL MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 50 COMPANY FOOTPRINT

- FIGURE 51 COMPOSITE HYDROGEN TANK MATERIAL MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 52 EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 53 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 54 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 55 SGL CARBON: COMPANY SNAPSHOT

- FIGURE 56 TEIJIN LIMITED: COMPANY SNAPSHOT

- FIGURE 57 ARKEMA: COMPANY SNAPSHOT

- FIGURE 58 OUTOKUMPU: COMPANY SNAPSHOT

- FIGURE 59 HUNTSMAN INTERNATIONAL LLC.: COMPANY SNAPSHOT

- FIGURE 60 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 APERAM: COMPANY SNAPSHOT

- FIGURE 62 JAPAN STEEL WORKS, LTD.: COMPANY SNAPSHOT

- FIGURE 63 SYENSQO: COMPANY SNAPSHOT

- FIGURE 64 HS HYOSUNG ADVANCED MATERIALS: COMPANY SNAPSHOT

- FIGURE 65 HEXCEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 JINDAL STAINLESS LIMITED: COMPANY SNAPSHOT

- FIGURE 67 NIPPON STEEL CORPORATION: COMPANY SNAPSHOT

The study involved two major activities in estimating the current size of the hydrogen tank material market. Exhaustive secondary research was performed to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

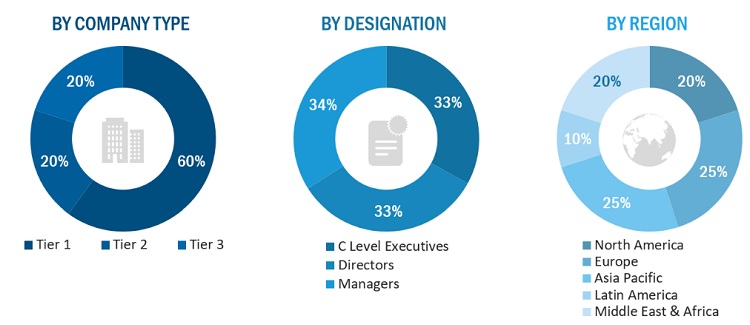

Primary Research

The hydrogen tank material market comprises several stakeholders, such as material suppliers, manufacturers, end-product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the automotive & transportation, industrial, chemicals, medical & pharmaceuticals, and other end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2022.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the hydrogen tank material market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall hydrogen tank material market size, using the market size estimation processes explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the automotive & transportation, industrial, chemicals, medical & pharmaceuticals.

Market Definition

The Office of Energy Efficiency and Renewable Energy has defined that hydrogen can be stored physically as either a gas or a liquid. Storage of hydrogen as a gas typically requires high-pressure tanks [350–700 bar (5,000–10,000 psi) tank pressure]. Storage of hydrogen as a liquid requires cryogenic temperatures because its boiling point at one atmosphere pressure is -423.04°F (−252.8°C).

Hydrogen tank can be considered as a storage vessel designed for holding or storing hydrogen gas wither at low or high temperature. Hydrogen tank materials mainly consist of carbon fiber, glass fiber, metal or composite materials. Overall, the choice and preference of the materials depends on the applications and required properties and characteristics including weight, capacity, pressure, and cost. The market covers hydrogen storage tanks used to store hydrogen in gaseous form for stationary and mobile applications. Stationary hydrogen storage tanks in the form of bundles and cascades are used to store hydrogen gas in hydrogen refueling stations, chemical, industrial, medical & pharmaceutical, and other industries. The mobile applications include hydrogen storage tanks in the form of bundles and cascades for transporting hydrogen at shorter distances. The mobile applications also include on-board (fuel tanks) hydrogen tanks and those transported through tube trailers over a distance of 300 Km. The scope of this report is restricted to tanks used to store hydrogen in gaseous form and doesn’t include those used to store cryogenic, cryo-compressed or material-based hydrogen tanks. The cost of gaseous hydrogen tanks is considered for the revenue estimation and depends on various factors such as material, industry, and tank volume.

Key Stakeholders

- Hydrogen tank manufacturers

- Raw material suppliers

- Distributors and suppliers

- Industry associations

- Universities, governments & research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environmental support agencies

- Investment banks and private equity firms

Objectives of the Report

- To define, describe, and forecast the size of the hydrogen tank material industry, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide detailed information about the technological advancements influencing the growth of the market

- To forecast the market based on the material type, tank type, and end-use industry

- To define, describe, and forecast the market based on five regions, namely, North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze recent developments such as expansions and joint ventures in the market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Europe hydrogen tank material market

- Further breakdown of Rest of North America hydrogen tank material market

- Further breakdown of Rest of Asia Pacific hydrogen tank material market

- Further breakdown of Rest of Middle East & Africa hydrogen tank material market

- Further breakdown of Rest of Latin America hydrogen tank material markets

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Hydrogen Tank Material Market