Hydroxyapatite Market by Type (Nano-size, Micro-size, Greater than Micrometers) Application (Orthopedic, Dental Care, Plastic Surgery) Orthopedic (Synthetic and Natural Source) Dental Care (Toothpaste and Others) and Region - Global Forecast to 2025

Updated on : April 04, 2024

Hydroxyapatite Market

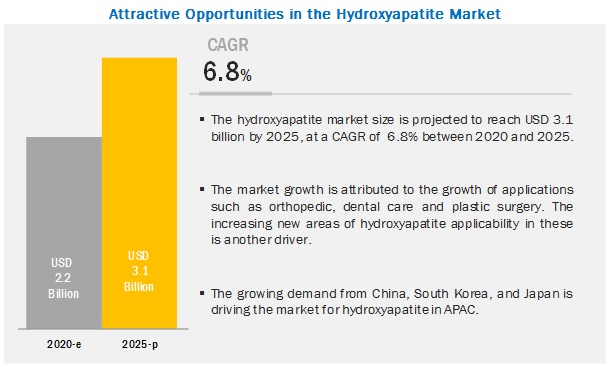

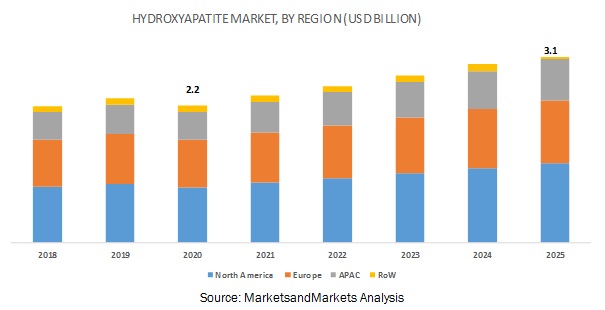

The Hydroxyapatite Market size was valued at USD 2.2 billion in 2020 and is projected to reach USD 3.1 billion by 2025, growing at 6.8% cagr from 2020 to 2025. The Hydroxyapatite (HAp) market is projected to grow at a significant rate during the forecast period due to the increasing consumer awareness about bioactive ceramics and growing healthcare expenditure across the globe.

Hydroxyapatite Market Dynamics

Based on type, the Hydroxyapatite market has been segmented into nano-size, micro-size, and greater than micrometers.

The nano-size segment accounted for the largest share of the Hydroxyapatite market in 2019. Nano-size Hydroxyapatite is synthetic in nature and is mostly used in orthopedic, dental care products, plastic surgery, food, and pharmaceutical applications. Hydroxyapatite with particle size in nanometers is attracting attention as a bioceramic due to its similarity with human hard tissue. Nano-size Hydroxyapatite is used in the food and dental care products to increase the strength of bones and teeth.

Based on the application, the Hydroxyapatite market has been segmented into orthopedic, dental care, plastic surgery, and others. The orthopedic segment led the Hydroxyapatite market in 2019.

This segment of the market is projected to lead the market during the forecast period as well. Hydroxyapatite is used as a coating for implants, bone grafts, and bone fillers. Due to its bioactivity, hydroxyapatite is used as an alternative to allogeneic and xenogeneic bone grafts, resulting in the reduced healing time required. The aging global population and growing demand for bioactive ceramics in the bone replacement surgeries are driving the demand for hydroxyapatite in the orthopedic applications.

The North American region accounted for the largest share of the Hydroxyapatite market in 2019.

It is projected to register significant growth in the Hydroxyapatite market during the forecast period as well. The Asia Pacific Hydroxyapatite market is projected to grow at the highest CAGR during the forecast period. The increased demand for hydroxyapatite from countries such as China, South Korea, and South Korea is driving the growth of the Asia Pacific Hydroxyapatite market. Moreover, the aging population, increasing disposable income of the middle-class population, and growing awareness among masses about the advantages of dental bone grafting and bone grafting over traditional treatments provide a huge growth opportunity for the manufacturers of hydroxyapatite in the Asia Pacific region.

Hydroxyapatite Market Players

The major restraints for the Hydroxyapatite market are unfavorable healthcare reforms in the US and unmet performance benchmark by hydroxyapatite such as its low fracture toughness. The key players operating in the Hydroxyapatite market are FLUIDINOVA (Portugal), SofSera Corporation (Japan), Berkeley Advanced Biomaterials (US), Taihei Chemical Industrial Co. Ltd. (Japan), SigmaGraft (US) and CAM Bioceramics (Netherlands)

Hydroxyapatite Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 2.2 billion |

|

Revenue Forecast in 2025 |

USD 3.1 billion |

|

CAGR |

6.8% |

|

Market Size available for years |

2018-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value(USD million) |

|

Segments covered |

Type, Application, Orthopedic sub-segment, Dental care sub-segment and Region |

|

Geographies covered |

North America, Europe, APAC and RoW |

|

Companies covered |

FLUIDINOVA (Portugal), SofSera Corporation (Japan), Berkeley Advanced Biomaterials (US), Taihei Chemical Industrial Co. Ltd. (Japan), SigmaGraft (US), CAM Bioceramics (Netherlands) and 9 other companies |

This research report categorizes the HAp market based on type, application, and region.

Hydroxyapatite Market by Type:

- Nano-size

- Micro-size

- Greater than Micrometers

Hydroxyapatite Market by Application:

-

Orthopedic

- Synthetic

- Natural Source

-

Dental Care

- Toothpaste

- Others

- Plastic Surgery

- Others

Hydroxyapatite Market by Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

The market has been further analyzed for the key countries in each of these regions.

Key Questions addressed by the report

- The report also helps to understand the HAp market in terms of orthopedic sub-segments (synthetic ands natural source) and dental care sub-segments (toothpaste and others) in the global and regional level.

- The report is expected to help the stakeholders understand the pulse of the HAp market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

- The report helps to identify the new revenue streams in the HAp market and the reasons behind it.

- The impact of COVID-19 on the HAp market has been studied in the report.

- This report is expected to help the stakeholders obtain information about the major competitors in the market and gain insights to enhance their position in the HAp market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

FIGURE 1 HYDROXYAPATITE IN A NUTSHELL

1.3 MARKET SCOPE

FIGURE 2 HYDROXYAPATITE MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 LIMITATIONS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 3 HYDROXYAPATITE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BASED ON ORTHOPEDIC MARKET

FIGURE 4 MARKET SIZE ESTIMATION: BASED ON ORTHOPEDIC MARKET

2.2.2 BASED ON NANO-SIZE PARTICULATE MARKET OF CALCIUM PHOSPHATE

FIGURE 5 MARKET SIZE ESTIMATION: BASED ON NANO-SIZE PARTICULATE MARKET OF CALCIUM PHOSPHATE

2.3 DATA TRIANGULATION

FIGURE 6 HYDROXYAPATITE MARKET: DATA TRIANGULATION

2.3.1 HYDROXYAPATITE MARKET INSIGHTS THROUGH PRIMARY INTERVIEWS

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 7 MICRO-SIZE SEGMENT HAD THE LARGEST SHARE IN 2019

FIGURE 8 ORTHOPEDIC APPLICATION HAD THE LARGEST MARKET SHARE IN 2019

FIGURE 9 APAC TO REGISTER FASTEST GROWTH DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 ATTRACTIVE GROWTH OPPORTUNITY FOR HYDROXYAPATITE MARKET

FIGURE 10 GROWING DEMAND FROM ORTHOPEDIC AND DENTAL CARE PRODUCTS TO DRIVE MARKET

4.2 HYDROXYAPATITE MARKET, BY TYPE

FIGURE 11 NANO-SIZE SEGMENT IS PROJECTED TO BE FASTEST-GROWING TYPE DURING FORECAST PERIOD

4.3 HYDROXYAPATITE MARKET, BY APPLICATION

FIGURE 12 ORTHOPEDIC SEGMENT IS FASTEST-GROWING APPLICATION HYDROXYAPATITE

4.4 HYDROXYAPATITE MARKET IN ORTHOPEDIC

FIGURE 13 SYNTHETIC SUB-SEGMENT TO WITNESS HIGHER GROWTH DURING THE FORECAST PERIOD

4.5 HYDROXYAPATITE MARKET IN DENTAL CARE

FIGURE 14 TOOTHPASTE SUB-SEGMENT IN DENTAL CARE PROJECTED TO REGISTER HIGHER GROWTH

4.6 HYDROXYAPATITE MARKET, BY REGION

FIGURE 15 APAC TO BE THE FASTEST-GROWING HYDROXYAPATITE MARKET

4.7 APAC HYDROXYAPATITE MARKET

FIGURE 16 CHINA HAD THE LARGEST SHARE IN 2019

4.8 HYDROXYAPATITE MARKET, BY COUNTRY

FIGURE 17 CHINA EXPECTED TO REGISTER FASTEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 OVERVIEW OF FACTORS GOVERNING THE HYDROXYAPATITE MARKET

5.2.1 DRIVERS

5.2.1.1 Continuous R&D activities to increase applicability of hydroxyapatite in medical industry

5.2.1.2 Growing demand for medical implants

5.2.1.3 Growing plastic surgery and dental care industry in APAC

5.2.2 RESTRAINTS

5.2.2.1 Unfavorable healthcare reforms in the US

5.2.3 OPPORTUNITIES

5.2.3.1 Growing healthcare industry and easy availability of raw materials in APAC

5.2.3.2 Growing hydroxyapatite based oral care products

5.2.4 CHALLENGES

5.2.4.1 Unmet performance benchmark and increasing popularity of bioresorbable composites

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 HYDROXYAPATITE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 HYDROXYAPATITE PATENT ANALYSIS

FIGURE 20 PUBLICATION TRENDS - LAST 5 YEARS

TABLE 1 LIST OF PATENTS BY SHANGHAI INST CERAMICS CAS

TABLE 2 LIST OF PATENTS BY ANTEIS SA

TABLE 3 LIST OF PATENTS BY MATHYS AG BETTLACH

TABLE 4 LIST OF PATENTS BY GEISTLICH PHARMA AG

5.5 YC, YCC SHIFT

5.6 MANUFACTURING PROCESS & RAW MATERIALS

TABLE 5 TRADITIONAL METHODS OF MANUFACTURING HYDROXYAPATITE

5.7 IMPACT FACTORS FOR GROWTH

5.8 IMPACT OF COVID-19

FIGURE 21 PRE-COVID VS POST-COVID SCENARIO

5.9 MACROECONOMIC INDICATORS

TABLE 6 HEALTHCARE EXPENDITURE, BY COUNTRY (USD MILLION)

TABLE 7 GDP PER CAPITA, BY COUNTRY (USD MILLION)

TABLE 8 HEALTHCARE EXPENDITURE, PER CAPITA, 2018, (USD)

TABLE 9 OLD AGE POPULATION, BY COUNTRY, 2019 (IN MILLION)

6 HYDROXYAPATITE MARKET, BY TYPE (Page No. - 56)

6.1 INTRODUCTION

FIGURE 22 MICRO-SIZE HYDROXYAPATITE ACCOUNTED FOR MAJORITY SHARE OF THE MARKET IN 2019

TABLE 10 HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

6.2 NANO-SIZE

FIGURE 23 NORTH AMERICA IS LARGEST MARKET FOR NANO-SIZE HYDROXYAPATITE BETWEEN 2020 AND 2025

TABLE 11 NANO-SIZE HYDROXYAPATITE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.3 MICRO-SIZE

FIGURE 24 APAC TO BE FASTEST-GROWING MICRO-SIZE HYDROXYAPATITE MARKET BETWEEN 2020 AND 2025

TABLE 12 MICRO-SIZE HYDROXYAPATITE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.4 GREATER THAN MICROMETERS

FIGURE 25 EUROPE IS LARGEST MARKET FOR HYDROXYAPATITE WITH PARTICLE SIZE GREATER THAN MICROMETERS

TABLE 13 GREATER THAN MICROMETERS HYDROXYAPATITE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7 HYDROXYAPATITE MARKET, BY APPLICATION (Page No. - 61)

7.1 INTRODUCTION

FIGURE 26 ORTHOPEDIC APPLICATION ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

TABLE 14 HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 15 HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, 2018–2025 (USD MILLION)

TABLE 16 HYDROXYAPATITE MARKET SIZE IN DENTAL CARE, 2018–2025 (USD MILLION)

7.2 ORTHOPEDIC

7.2.1 IMPACT OF MEGATRENDS IN ORTHOPEDIC

FIGURE 27 NORTH AMERICA TO BE LARGEST HYDROXYAPATITE MARKET IN ORTHOPEDIC APPLICATION

TABLE 17 HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, BY REGION, 2018–2025 (USD MILLION)

7.2.2 SYNTHETIC

TABLE 18 SYNTHETIC HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, BY REGION, 2018–2025 (USD MILLION)

7.2.3 NATURAL SOURCE

TABLE 19 NATURAL SOURCE HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, BY REGION, 2018–2025 (USD MILLION)

7.3 DENTAL CARE

7.3.1 IMPACT OF MEGATRENDS IN DENTAL CARE

FIGURE 28 APAC TO BE FASTEST-GROWING HYDROXYAPATITE MARKET IN DENTAL CARE

TABLE 20 HYDROXYAPATITE MARKET SIZE IN DENTAL CARE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 DENTAL IMPLANTS MARKET, BY COUNTRY/ REGION, 2016–2023 (USD MILLION)

TABLE 22 PREMIUM DENTAL IMPLANTS MARKET, BY COUNTRY/ REGION, 2016–2023 (USD MILLION)

TABLE 23 DENTAL PROSTHETICS MARKET, BY TYPE, 2016–2023 (USD MILLION)

7.3.2 TOOTHPASTE

TABLE 24 HYDROXYAPATITE TOOTHPASTE MARKET SIZE IN DENTAL CARE, BY REGION, 2018–2025 (USD MILLION)

7.3.3 OTHERS

TABLE 25 OTHERS MARKET SIZE IN DENTAL CARE, BY REGION, 2018–2025 (USD MILLION)

7.4 PLASTIC SURGERY

7.4.1 IMPACT OF MEGATRENDS IN PLASTIC SURGERY

FIGURE 29 APAC TO BE LARGEST HYDROXYAPATITE MARKET IN PLASTIC SURGERY BY 2025

TABLE 26 HYDROXYAPATITE MARKET SIZE IN PLASTIC SURGERY, BY REGION, 2018–2025 (USD MILLION)

7.5 OTHERS

FIGURE 30 NORTH AMERICA TO BE FASTEST-GROWING HAP MARKET IN OTHER APPLICATIONS

TABLE 27 HYDROXYAPATITE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

8 HYDROXYAPATITE MARKET, BY REGION (Page No. - 74)

8.1 INTRODUCTION

TABLE 28 HYDROXYAPATITE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 DENTAL IMPLANTS AND PROSTHETICS MARKET, BY REGION, 2016–2023 (USD MILLION)

TABLE 30 DENTAL IMPLANTS AND PROSTHETICS MARKET, BY COUNTRY/REGION, 2016–2023 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: HYDROXYAPATITE MARKET SNAPSHOT

TABLE 31 NORTH AMERICA: HYDROXYAPATITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 32 NORTH AMERICA: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, 2018–2025 (USD MILLION)

TABLE 35 NORTH AMERICA: HYDROXYAPATITE MARKET SIZE IN DENTAL CARE, 2018–2025 (USD MILLION)

TABLE 36 NORTH AMERICA: HYDROXYAPATITE MARKET SIZE, BY COUNTRY AND TYPE, 2018–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: HYDROXYAPATITE MARKET SIZE, BY COUNTRY AND APPLICATION, 2018–2025 (USD MILLION)

TABLE 38 COMPARISON BETWEEN NORTH AMERICA AND EUROPE HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 39 COMPARISON BETWEEN NORTH AMERICA AND APAC HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 40 COMPARISON BETWEEN NORTH AMERICA AND REST OF WORLD HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 41 COMPARISON BETWEEN NORTH AMERICA AND EUROPE HYDROXYAPATITE MARKET SIZE, BY APPLICATION 2018–2025 (USD MILLION)

TABLE 42 COMPARISON BETWEEN NORTH AMERICA AND APAC HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 43 COMPARISON BETWEEN NORTH AMERICA AND REST OF WORLD HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 44 COMPARISON BETWEEN NORTH AMERICA AND EUROPE HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, 2018–2025 (USD MILLION)

TABLE 45 COMPARISON BETWEEN NORTH AMERICA AND APAC HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, 2018–2025 (USD MILLION)

TABLE 46 COMPARISON BETWEEN NORTH AMERICA AND REST OF WORLD HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, 2018–2025 (USD MILLION)

TABLE 47 COMPARISON BETWEEN NORTH AMERICA AND EUROPE HYDROXYAPATITE MARKET SIZE IN DENTAL CARE, 2018–2025 (USD MILLION)

TABLE 48 COMPARISON BETWEEN NORTH AMERICA AND APAC HYDROXYAPATITE MARKET SIZE IN DENTAL CARE, 2018–2025 (USD MILLION)

TABLE 49 COMPARISON BETWEEN NORTH AMERICA AND REST OF WORLD HYDROXYAPATITE MARKET SIZE IN DENTAL CARE, 2018–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: DENTAL IMPLANTS AND PROSTHETICS MARKET, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 51 NORTH AMERICA: DENTAL IMPLANTS MARKET, BY COUNTRY, 2016–2023 (USD MILLION)

8.2.1 US

8.2.1.1 Increasingly aging population to significantly impact the market

TABLE 52 US MACROECONOMIC INDICATORS: NATIONAL HEALTH EXPENDITURES AND ECONOMIC INDICATORS

(USD BILLION)

TABLE 53 US MACROECONOMIC INDICATORS: DENTAL SERVICES EXPENDITURES (USD BILLION)

TABLE 54 US: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 55 US: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.2 REST OF NORTH AMERICA

TABLE 56 REST OF NORTH AMERICA: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 REST OF NORTH AMERICA: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3 EUROPE

FIGURE 32 EUROPE: HYDROXYAPATITE MARKET SNAPSHOT

TABLE 58 EUROPE: HYDROXYAPATITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 59 EUROPE: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 60 EUROPE: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 61 EUROPE: HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, 2018–2025 (USD MILLION)

TABLE 62 EUROPE: HYDROXYAPATITE MARKET SIZE IN DENTAL CARE, 2018–2025 (USD MILLION)

TABLE 63 EUROPE: NANO-SIZE HYDROXYAPATITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 64 EUROPE: MICRO-SIZE HYDROXYAPATITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 EUROPE: GREATER THAN MICROMETERS HYDROXYAPATITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 66 EUROPE: HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 67 EUROPE: HYDROXYAPATITE MARKET SIZE IN DENTAL CARE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 68 EUROPE: HYDROXYAPATITE MARKET SIZE IN PLASTIC SURGERY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 EUROPE: HYDROXYAPATITE MARKET SIZE IN OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 70 EUROPE: DENTAL IMPLANTS AND PROSTHETICS MARKET, BY COUNTRY/ REGION, 2016–2023 (USD MILLION)

TABLE 71 EUROPE: DENTAL IMPLANTS MARKET, BY COUNTRY/ REGION, 2016–2023 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 High percentage of aging population and strong public healthcare insurance system are key drivers

TABLE 72 GERMANY: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 GERMANY: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.2 FRANCE

8.3.2.1 Increasing awareness about dental care and strong healthcare insurance driving the market

TABLE 74 FRANCE: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 FRANCE: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.3 ITALY

8.3.3.1 Recent recession and high impact of COVID-19 will weaken growth of hydroxyapatite

TABLE 76 ITALY: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 ITALY: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.4 RUSSIA

8.3.4.1 High ratio of aging population to drive orthopedic and dental care procedures

TABLE 78 RUSSIA: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 79 RUSSIA: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.5 UK

8.3.5.1 Growing medical tourism in UK is a major driver of HAp market

TABLE 80 UK: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 81 UK: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.6 PORTUGAL

8.3.6.1 Presence of hydroxyapatite manufacture in the country fueling demand

TABLE 82 PORTUGAL: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 83 PORTUGAL: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.7 REST OF EUROPE

TABLE 84 REST OF EUROPE: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 REST OF EUROPE: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4 APAC

FIGURE 33 APAC: HYDROXYAPATITE MARKET SNAPSHOT

TABLE 86 APAC: HYDROXYAPATITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 87 APAC: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 88 APAC: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 89 APAC: HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, 2018–2025 (USD MILLION)

TABLE 90 APAC: HYDROXYAPATITE MARKET SIZE IN DENTAL CARE, 2018–2025 (USD MILLION)

TABLE 91 APAC: NANO-SIZE HYDROXYAPATITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 92 APAC: MICRO-SIZE HYDROXYAPATITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 93 APAC: GREATER THAN MICROMETERS HYDROXYAPATITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 94 APAC: HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 95 APAC: HYDROXYAPATITE MARKET SIZE IN DENTAL CARE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 96 APAC: HYDROXYAPATITE MARKET SIZE IN PLASTIC SURGERY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 97 APAC: HYDROXYAPATITE MARKET SIZE IN OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 98 ASIA PACIFIC: DENTAL IMPLANTS AND PROSTHETICS MARKET, BY COUNTRY/ REGION, 2016–2023 (USD MILLION)

TABLE 99 ASIA PACIFIC: DENTAL IMPLANTS MARKET, BY COUNTRY/ REGION, 2016-2023 (USD MILLION)

8.4.1 CHINA

8.4.1.1 China witnessing increasing awareness about oral healthcare and growing beauty awareness

TABLE 100 CHINA: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 101 CHINA: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.2 JAPAN

8.4.2.1 High percentage of aging population to fuel the demand for hydroxyapatite

TABLE 102 JAPAN: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 JAPAN: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.3 SOUTH KOREA

8.4.3.1 Dental care and plastic surgery procedures increasing in the country

TABLE 104 SOUTH KOREA: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 SOUTH KOREA: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.4 REST OF APAC

TABLE 106 REST OF APAC: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 107 REST OF APAC: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.5 REST OF WORLD

8.5.1 BRAZIL WILL DRIVE HYDROXYAPATITE MARKET IN REST OF WORLD

TABLE 108 REST OF WORLD: HYDROXYAPATITE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 REST OF WORLD: HYDROXYAPATITE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 110 REST OF WORLD: HYDROXYAPATITE MARKET SIZE IN ORTHOPEDIC, 2018–2025 (USD MILLION)

TABLE 111 REST OF WORLD: HYDROXYAPATITE MARKET SIZE IN DENTAL CARE, 2018–2025 (USD MILLION)

TABLE 112 LATIN AMERICA: DENTAL IMPLANTS AND PROSTHETICS MARKET, BY COUNTRY/ REGION, 2016–2023 (USD MILLION)

TABLE 113 LATIN AMERICA: DENTAL IMPLANTS MARKET, BY COUNTRY/ REGION, 2016-2023 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 112)

FIGURE 34 COMPANY EVALUATION MATRIX

10 CUSTOMER LANDSCAPE (Page No. - 113)

FIGURE 35 CUSTOMER LANDSCAPE OF ORTHOPEDIC AND DENTAL APPLICATION

11 COMPANY PROFILES (Page No. - 114)

(Business Overview, Products Offered)*

11.1 FLUIDINOVA

11.2 SOFSERA CORPORATION

11.3 BERKELEY ADVANCED BIOMATERIALS

11.4 TAIHEI CHEMICAL INDUSTRIAL CO. LTD.

11.5 SIGMAGRAFT

11.6 CAM BIOCERAMICS

11.7 GRANULAB (M) SDN BHD

11.8 MERZ NORTH AMERICA

11.9 EVONIK INDUSTRIES AG

11.10 BIONNOVATION

11.11 OTHER COMPANIES

11.11.1 APS MATERIALS

11.11.2 SANGI CO., LTD.

11.11.3 ALB TECHNOLOGY

11.11.4 MEDICOAT AG

11.11.5 PROMIMIC

*Details on Business Overview, Products Offered might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 126)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The Hydroxyapatite(HAp) study involved four major activities to estimate the current market size for algae products. Exhaustive secondary research was done to collect information on market, peer market and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources include annual reports and press releases & investor presentations of companies; white papers and certified publications of regulatory bodies and trade directories; bioceramics-related journals; certified publications and articles from recognized authors; and databases.

Primary Research

The hydroxyapatite (HAp) market comprises many stakeholders in the supply chain, which include manufacturers, suppliers, distributors, and end-product manufacturers. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary participants from the supply side include key opinion leaders, executives, vice presidents, and CEOs of companies involved in the HAp market. The primary sources from the demand side include experts from end-use industries, associations and institutions involved in the market, and key opinion leaders.

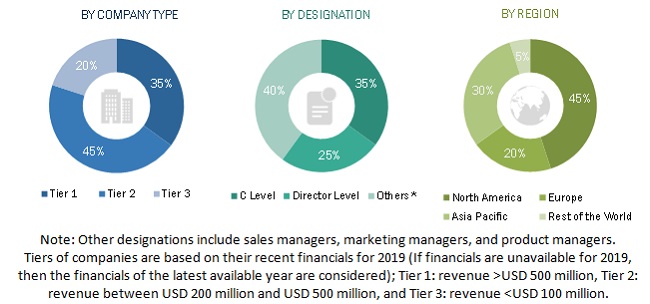

Breakdown of primary interviews:

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the HAp market and to estimate the sizes of its other dependent submarkets. The research study involves the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the HAp market.

Data Triangulaion

After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been then verified through primary research by conducting extensive interviews with key personnel such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives of the leading companies operating in the HAp market. Data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments of the HAp market. The breakdown of profiles of the primaries has been depicted in the below figure.

Objectives of the Report:

- To define and segment the Hydroxyapatite market based on type, application, orthopedic sub-segment, dental care sub-segment, and region

- To analyze and forecast the size of the Hydroxyapatite market, in terms of value

- To analyze the market segmentation and project the market size, in terms of value for the key regions such as North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the Hydroxyapatite market

- To strategically profile the key players operating in the Hydroxyapatite market

The value chain of the HAp market includes sourcing of the basic raw materials used for producing hydroxyapatite, manufacturing process of hydroxyapatite, and distributors, which supply hydroxyapatite to various end users for different applications.

Key Target Audience:

- Raw Material Suppliers

- Manufacturers of Hydroxyapatite

- End Users of Hydroxyapatite

- Government Agencies, Regional Agencies, and Research Organizations

- Investment Research Firms

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- A country-level analysis of the Hydroxyapatite market based on the type

- A country-level analysis of the Hydroxyapatite market based on application

- A regional-level analysis of Hydroxyapatite market based on orthopedic

- A regional-level analysis of Hydroxyapatite market based on dental care

Company Information:

- Detailed analysis and profiling of additional market players

- Company evaluation matrix with the companies being categorized into visionary leaders, innovators, emerging companies, and dynamic differentiators.

- The customer landscape includes analysis of major end-use companies in the orthopedic and dental care applications.

Product Analysis

- Product matrix, which gives a detailed comparison of product portfolios of each company

Growth opportunities and latent adjacency in Hydroxyapatite Market