Immersive Simulator Market by Simulation Environment (Console Operator, Field Operator), Offering (Hardware, Software & Services), Application (Training, Product Development, Emergency Services), Industry, and Geography - Global Forecast to 2022

[143 Pages Report] The immersive simulator market is estimated to reach USD 11.44 Billion by 2022, at a CAGR of 35.13% between 2016 and 2022. The base year considered for the study is 2015 and the forecast period is between 2016 and 2022.

The objective of the report is to provide a detailed analysis of the immersive simulator market based on simulation environment, offering, application, industry, and geography. The report provides detailed information regarding the major factors influencing the growth of the market. The report also gives a detailed overview of the value chain in the immersive simulator market and analyzes the market trends through the Porter's five forces analysis.

Immersive simulator-based emergency services help in improving safety in industrial performance by preventing catastrophes, reducing maintenance costs, and decreasing the release of waste material in the environment, thereby increasing the production throughout. As emergency situations such as oil spills, fire breakout, or any other disaster can occur in a process plant, field operating training is provided to plant operators to prevent or address such situations. The use of immersive simulators for training helps operators to make better decisions in emergency scenarios, ensures more stability, and lowers the risk of accidents and hazardous impact on the environment.

With the growing industry automation and process control, operators may lack the knowledge required to operate a plant safely and proficiently. The process and discrete industries are equipped with different machineries working on different platforms. It would be difficult for a new user to operate those machines. On-field training enables users to interact with the machineries, but immersive simulator training helps prevent untoward incidents and enables users to respond quickly and appropriately in case of emergencies. Simulator technologies are more advanced than on-field training and provide a collaborative training environment. The operators can learn more quickly when they are allowed to work in a fully immersed environment.

The immersive simulator market is estimated to be worth USD 11.44 Billion by 2022, at a CAGR of 35.13% between 2016 and 2022. The growth of this market is majorly driven by the increasing applications in the medical industry, risk mitigation in oil and gas industries through training in immersive simulator, and ability to transfer knowledge quickly through training in immersive simulator

The immersive simulator market has been segmented on the basis of offering, simulation environment, application, industry, and geography. The market for immersive simulator hardware is expected to grow at a high CAGR on the basis of offering. The technological advancements in hardware components and the increasing number of new product launches and developments are expected to boost the adoption of hardware in industries such as automotive, food and beverages, oil and gas, chemicals, medicals, and entertainment, among others. The immersive simulator market for the training application held the largest market share among all the applications. With the rising concern toward safety, training in various industries has been increased. This, in turn, is expected to drive the market for immersive simulator for training purposes. Training using immersive simulators helps create a platform and development suite for better understanding and simplification of ideas before putting them into action on the site.

The immersive simulator market used in console operator training held the largest market share owing to its training application in process industries and product development in discrete industries. The rapid advancements in process control, along with the training in factories and plants to enhance the production process drive the growth of the market. Immersive training ensures risk mitigation in the process industries during handling or coming in contact with hazardous substances. This is expected to stimulate the demand for immersive console operations.

The immersive simulator market for the oil and gas industry held the largest market share among all industries. Immersive simulator offers the capability to see through solid structures for maintenance and inspection requirements in the oil and gas industry. Moreover, for the safety of the people working in a refinery, proper training in the operations of the assets in the plant has to be provided. This is driving the growth of the market for immersive simulators.

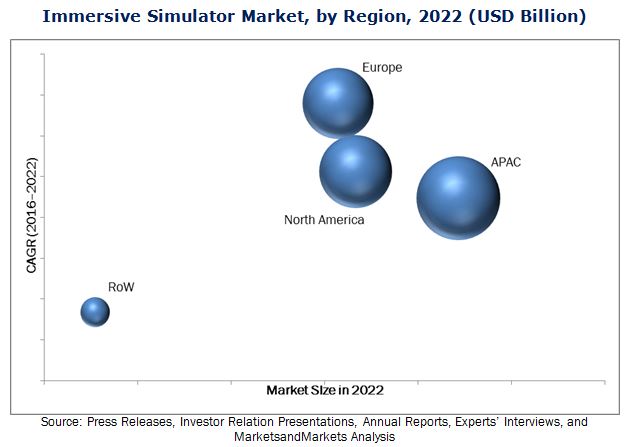

The immersive simulator market in APAC held the largest market share in 2015 owing to the huge demand for immersive simulators in metal and mining, oil and gas, aerospace and defense, and medical and biotech industries. Australia has added the functional use of immersive simulator in metal and mining industry, while China, Japan, and India have contributed to the market growth in the aerospace and defense sector along with the medical and biotech sector.

The immersive simulator market has been driven by the increasing applications in the medical industry, risk mitigation in the oil and gas industries through training in immersive simulator, and ability to transfer knowledge quickly through training in immersive simulator. However, the major restraining factors for the growth of this market are lack of integration between providers of immersive simulator hardware, software, and services as well as the low adoption and acceptance due to lack of awareness.

The key players in immersive simulator market such as Applied Research Associate Inc., (U.S.), Aveva Group Plc, (U.K.), ESI Group (France), Immerse Learning (U.S.), Schneider Electric SE (France), and Siemens AG, (Germany), among others are focusing on new product launches and developments, acquisitions, and collaborations strategies to enhance their product offerings and expand their business.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

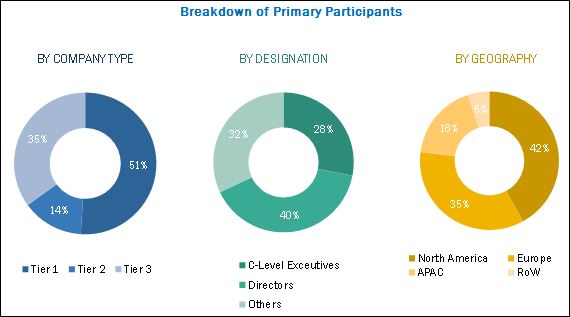

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share Top-Down Analysis (Supply Side)

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights – Immersive Simulator Market (Page No. - 32)

4.1 Immersive Simulator Market, 2016–2022 (USD Million)

4.2 Market, By Simulation Environment (2016–2022)

4.3 Immersive Simulator Market, By Application (2016)

4.4 Market, By Industry and Region (2016)

4.5 Market, By Geography (2016)

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Immersive Simulation Market, By Simulation Environment

5.2.2 Immersive Simulation Market, By Offering

5.2.3 Immersive Simulation Market, By Application

5.2.4 Immersive Simulation Market, By Industry

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Applications in the Medical Industry

5.3.1.2 Risk Mitigation in Oil & Gas Industries Through Training in Immersive Simulator

5.3.1.3 Ability to Transfer Knowledge Quickly Through Training in Immersive Simulator

5.3.2 Restraints

5.3.2.1 Lack of Integration Between Providers of Immersive Simulator Hardware, Software, and Services

5.3.2.2 Low Adoption and Acceptance Due to Lack of Awareness

5.3.3 Opportunities

5.3.3.1 High Demand for Immersive Simulation in the Tourism Sector

5.3.3.2 Use of Complete Immersive Training in Defense

5.3.4 Challenges

5.3.4.1 Technical Challenges Related to Configuration of Immersive Simulator Applications for Different Industrial Platforms

5.3.4.2 Head and Eye Tracking Difficulties in Head-Mounted Display During Immersive Simulation

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Model

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Market, By Offering (Page No. - 51)

7.1 Introduction

7.2 Software and Services

7.2.1 Graphics Interface

7.2.2 Haptics Control

7.2.3 Performance Tracker

7.3 Hardware

7.3.1 Head-Mounted Display

7.3.2 Monitor/Display

7.3.3 Audio Hardware

7.3.4 Interaction Devices

7.3.4.1 Exoskeleton

7.3.4.2 Data Glove

7.3.4.3 3d Mouse

7.3.4.4 Haptic Technology

7.3.4.4.1 Locomotion Interface

7.3.4.4.2 Tactile Feedback

7.3.4.4.3 Force Feedback

8 Market, By Simulation Environment (Page No. - 57)

8.1 Introduction

8.2 Field Operator Training

8.2.1 Industrial Outlook of Field Operator Training

8.2.2 Advantages of Field Operator Training

8.2.3 Disadvantages of Field Operator Training

8.3 Console Operator Training

8.3.1 Industrial Outlook of Console Operator Training

8.3.2 Advantages of Console Operator Training

8.3.3 Disadvantages of Console Operator Training

9 Market, By Application (Page No. - 61)

9.1 Introduction

9.2 Training

9.3 Emergency Services

9.4 Product Development

9.4.1 Product Design

9.4.2 Error Detection

10 Market, By Industry (Page No. - 66)

10.1 Introduction

10.2 Oil and Gas

10.3 Metals and Mining

10.4 Power and Energy

10.5 Medical and Biotech

10.6 Aerospace and Defense

10.7 Automotive and Marine

10.8 Chemicals

10.9 Water and Wastewater

10.10 Pulp and Paper

10.11 Food and Beverages

10.12 Others

11 Geographical Analysis (Page No. - 87)

11.1 Introduction

11.2 North America

11.2.1 U.S

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 U.K.

11.3.3 France

11.3.4 Italy

11.3.5 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Rest of Asia-Pacific

11.5 Rest of the World

11.5.1 Middle East & Africa

11.5.2 South America

12 Competitive Landscape (Page No. - 103)

12.1 Overview

12.2 Market Ranking Analysis of Immersive Simulator

12.3 Competitive Situation and Trends

12.3.1 New Product Developments

12.3.2 Partnerships and Agreements

12.3.3 Acquisitions

13 Company Profiles (Page No. - 109)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 Aveva Group PLC

13.3 ESI Group

13.4 Schneider Electric SE

13.5 Siemens AG

13.6 Applied Research Associate, Inc.

13.7 Designing Digitally, Inc.

13.8 Immerse Learning

13.9 Mass Virtual Inc.

13.10 Samahnzi (Pty) Ltd.

13.11 Talent Swarm

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 135)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (43 Tables)

Table 1 Immersive Simulation Market, By Simulation Environment

Table 2 Immersive Simulation Market, By Offering

Table 3 Immersive Simulation Market, By Application

Table 4 Immersive Simulation Market, By Industry

Table 5 Immersive Simulator Market, By Offering, 2013–2022 (USD Million)

Table 6 Market, By Simulation Environment, 2013–2022 (USD Million)

Table 7 Market, By Application, 2013–2022 (USD Million)

Table 8 Market, By Industry, 2013–2022 (USD Million)

Table 9 Immersive Simulator Market for the Oil and Gas Industry, By Application, 2013–2022 (USD Million)

Table 10 Market for the Oil and Gas Industry, By Region, 2013–2022 (USD Million)

Table 11 Market for the Metal and Mining Industry, By Application, 2013–2022 (USD Million)

Table 12 Market for the Metals and Mining Industry, By Region, 2013–2022 (USD Million)

Table 13 Market for the Power and Energy Industry, By Application, 2013–2022 (USD Million)

Table 14 Market for the Power and Energy Industry, By Region, 2013–2022 (USD Million)

Table 15 Immersive Simulator Market for the Medical and Biotech Industry, By Application, 2013–2022 (USD Million)

Table 16 Immersive Simulator Market for the Medical and Biotech Industry, By Region, 2013–2022 (USD Million)

Table 17 Market for the Aerospace and Defense Industry, By Application, 2013–2022 (USD Million)

Table 18 Market for the Aerospace and Defense Industry, By Region, 2013–2022 (USD Million)

Table 19 Market for the Automotive and Marine Industry, By Application, 2013–2022 (USD Million)

Table 20 Market for the Automotive and Marine Industry, By Region, 2013–2022 (USD Million)

Table 21 Immersive Simulator Market for the Chemical Industry, By Application, 2013–2022 (USD Million)

Table 22 Market for the Chemical Industry, By Region, 2013–2022 (USD Million)

Table 23 Immersive Simulator Market for the Water and Wastewater Industry, By Application, 2013–2022 (USD Million)

Table 24 Market for the Water and Wastewater Industry, By Region, 2013–2022 (USD Million)

Table 25 Immersive Simulator Market for the Pulp and Paper Industry, By Application, 2013–2022 (USD Million)

Table 26 Market for the Pulp and Paper Industry, By Region, 2013–2022 (USD Million)

Table 27 Market for the Food and Beverages Industry, By Application, 2013–2022 (USD Million)

Table 28 Market for the Food and Beverages Industry, By Region, 2013–2022 (USD Million)

Table 29 Market for the Other Industries, By Application, 2013–2022 (USD Million)

Table 30 Market for the Other Industries, By Region, 2013–2022 (USD Million)

Table 31 Immersive Simulator Market, By Region, 2013–2022 (USD Million)

Table 32 Market in North America, By Country, 2013–2022 (USD Million)

Table 33 Market in North America, By Industry, 2013–2022 (USD Million)

Table 34 Market in Europe, By Country, 2013–2022 (USD Million)

Table 35 Market in Europe, By Industry, 2013–2022 (USD Million)

Table 36 Market in Asia-Pacific, By Country, 2013–2022 (USD Million)

Table 37 Immersive Simulator Market in Asia-Pacific, By Industry, 2013–2022 (USD Million)

Table 38 Market in RoW, By Region, 2013–2022 (USD Million)

Table 39 Immersive Simulator Market in RoW, By Industry, 2013–2022 (USD Million)

Table 40 Ranking of Key Players in the Immersive Simulator Market, 2015

Table 41 New Product Launches and Developments, 2014–2016

Table 42 Partnerships and Agreements, 2015–2016

Table 43 Acquisitions, 2014–2016

List of Figures (61 Figures)

Figure 1 Markets Covered in the Market

Figure 2 Immersive Simulator Market: Research Design

Figure 3 Immersive Simulator Market: Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Immersive Simulator Market Segmentation

Figure 8 Software & Services Segment Expected to Hold A Major Share of the Market During the Forecast Period

Figure 9 Console Operator Expected to Hold A Major Share of the Market During the Forecast Period

Figure 10 Immersive Simulator Market for Training Application Expected to Grow at the Highest Rate During the Forecast Period

Figure 11 Oil & Gas Industry to Hold the Largest Size of the Market During the Forecast Period

Figure 12 Immersive Simulator Market, By Geography, 2016

Figure 13 Attractive Growth Opportunities in the Immersive Simulator Market

Figure 14 Console Operator Training Market Expected to Grow at A Higher CAGR Between 2016 and 2022

Figure 15 Training Application Expected to Lead the Market in 2016

Figure 16 Oil & Gas Industry Expected to Hold the Largest Share of the Immersive Simulator Market in 2016

Figure 17 The U.S. to Hold the Largest Share of the Market in 2016

Figure 18 Immersive Simulation Market, By Region

Figure 19 Drivers, Restraints, Opportunities, and Challenges in the Market

Figure 20 Value Chain Analysis: Major Value Addition Done During the Manufacturing & Assembly Phase

Figure 21 Porter’s Five Forces Analysis - 2015

Figure 22 Impact Analysis: Immersive Simulator Market

Figure 23 Medium Impact of Threat of New Entrants on the Market

Figure 24 Medium Impact of Threat of Substitutes in the Immersive Simulator Market

Figure 25 Medium Impact of Bargaining Power of Suppliers in the Market

Figure 26 Low Impact of Bargaining Power of Buyers in the Immersive Simulator Market

Figure 27 High Impact of Intensity of Competitive Rivalry in the Market

Figure 28 Immersive Simulator Market, By Offering

Figure 29 Market for Hardware Expected to Grow at A Higher Rate Between 2016 and 2022

Figure 30 Market, By Simulation Environment

Figure 31 Market for Console Operator Training Expected to Grow at A Higher Rate Between 2016 and 2022

Figure 32 Immersive Simulator Market, By Application

Figure 33 Market for Training Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 34 Market, By Industry

Figure 35 Oil and Gas Industry Expected to Hold the Largest Size of the Market Between 2016 and 2022

Figure 36 North America to Hold the Largest Size of the Immersive Simulator Market for the Oil and Gas Industry in 2016

Figure 37 Training Applications to Lead the Immersive Simulator Market for the Metal and Mining Industry Between 2016 and 2022

Figure 38 North America Expected to Hold the Largest Size of the Market for the Power and Energy By 2022

Figure 39 Immersive Simulator Market for the Aerospace and Defense Industry in North America Expected to Grow at A Highest Rate Between 2016 and 2022

Figure 40 Training Applications Likely to Dominate the Market for the Chemical Industry During the Forecast Period

Figure 41 North America Expected to Dominate the Immersive Simulator for the Pulp and Paper Industry During the Forecast Period

Figure 42 Training Expected to Lead the Immersive Stimulator Market for the Food and Beverages Industry During the Forecast Period

Figure 43 Immersive Simulator Market in Europe to Grow at the Highest Rate During the Forecast Period

Figure 44 Snapshot of Immersive Simulator Market in North America

Figure 45 Snapshot of Market in Europe

Figure 46 Germany Likely to Dominate the European Market During the Forecast Period

Figure 47 Snapshot of Immersive Simulator Market in Asia-Pacific

Figure 48 Immersive Simulator Market in South America to Grow at the Highest Rate During the Forecast Period

Figure 49 New Product Development as the Key Growth Strategy Adopted By the Companies Between 2014 and 2016

Figure 50 Market Evolution Framework: New Product Developments Fuelled the Growth of the Market

Figure 51 Battle for Market Share: New Product Launches & Developments—The Key Strategies Adopted By Players Between 2014 and 2016

Figure 52 Geographic Revenue Mix of Top Immersive Simulator Market Players

Figure 53 Aveva Group PLC: Company Snapshot

Figure 54 Aveva Group PLC: SWOT Analysis

Figure 55 ESI Group: Company Snapshot

Figure 56 ESI Group: SWOT Analysis

Figure 57 Schneider Electric SE: Company Snapshot

Figure 58 Schneider Electric SE: SWOT Analysis

Figure 59 Siemens AG: Company Snapshot

Figure 60 Siemens AG: SWOT Analysis

Figure 61 Applied Research Associate, Inc.: SWOT Analysis

The research methodology used to estimate and forecast the immersive simulator market begins with capturing data on key vendor revenue through the secondary research such as BP Energy Outlook 2035, Current Market Outlook 2016–2035 Boeing, International Association of Medical Science Educators (IAMSE), International Energy Agency (IEA), North American Simulation and Gaming Association, Organisation Internationale des Constructeurs d'Automobiles (OICA), Simulation Australasia, Stockholm International Peace Research Institute, U.S. Energy Information Administration, press releases, investor relation presentations, and annual reports. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global immersive simulator market from the revenue of key players. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews of people holding key positions such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The immersive simulator ecosystem comprises component providers, system integrators, software providers, and distributors. The players involved in the development of immersive simulator include Applied Research Associate Inc. (U.S.), Aveva Group Plc, (U.K.), ESI Group (France), Immerse Learning, (U.S.), Schneider Electric SE. (France), and Siemens AG (Germany), among others.

Target Audience of the Report:

- Associations, organizations, forums, and alliances

- Component manufacturers

- Distributors and traders

- Original equipment manufacturers

- Process industries such as oil and gas, power, chemical, and entertainment, among others

- Research organizations and consulting companies

- Software and service providers

- System integrators

- Technology investors

- Technology solution providers

“This study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report:

This research report categorizes the global immersive simulation market on the basis of simulation environment, offering, application, industry, and geography.

Immersive Simulator Market, by Simulation Environment

- Console Operator Training

- Field Operator Training

Immersive Simulator Market, by Offering:

- Hardware

- Software & Services

Immersive Simulator Market, by Application:

- Training

- Emergency Services

- Product Development

Immersive Simulator Market, by Industry:

- Oil & Gas

- Metals & Mining

- Power & Energy

- Medical & Biotech

- Aerospace & Defense

- Automotive & Marine

- Chemicals

- Water & Wastewater

- Pulp & Paper

- Food & Beverages

- Others (Cement and Textile, Education, Tourism, and Entertainment)

Immersive Simulator Market, by Geography:

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companies’ specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Immersive Simulator Market