In-Dash Navigation System Market by Technology (2D & 3D maps), by Components (Display Unit, Control Module, Antenna Module, & Wiring Harness), by Connected Navigation Services (TDI & FMS), by Vehicle Type (PC, LCV & Electric Vehicle) & by Region - Global Forecast to 2022

The In-Dash Navigation System Market, by value, is projected to grow at a CAGR of 12.74% during the forecast period, to reach $17.53 billion by 2022. In this study, 2016 has been considered the base year, and 2017 to 2022 the forecast period, for estimating the size of the market.

The automotive industry is at a phase where various electronic devices such as lane departure warning system, adaptive cruise control, and navigation system are being installed in vehicles. The versatility and flexibility offered by automotive embedded systems have taken the electrification of automobiles to a new level. The in-dash navigation system is one of the embedded devices offered by automotive OEMs in most of their vehicle models. The in-dash navigation system uses the global positioning system (GPS) to provide accurate location and directions. Along with the route information, navigation systems can also provide real-time traffic information and weather forecast. The major components of in-dash navigation system are display unit, antenna module, control module, and wiring harness.

Market Dynamics

Drivers

- Increasing customer preference for in-dash navigation system

- Government regulations pertaining to in-vehicle navigation system

- Increasing application area of navigation services

Restraints

- High system cost and lack of supporting infrastructure in developing countries

- Concerns regarding cyber and data security

Opportunities

- Increasing adaption by insurance industry

- Trend of connected car devices

Challenges

- Use of other connectivity type and PND for navigation

The market for the vehicle in-navigation systems is growing at a significant rate in the emerging economies such as Asia-pacific, owing to a rise in the GDP and population in these regions, resulting in improvement in lifestyles, increased purchasing power of consumers, and development in road connectivity and infrastructure.

The following are the major objectives of the study.

- To describe and forecast the market, in terms of volume (thousand units) and value (USD million/billion), by component, connected navigation services, technology, vehicle, electric vehicle.

- To describe and forecast the market, in terms of value, by region–Asia Pacific, Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of in-dash navigation system

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the in-dash navigation system ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the market

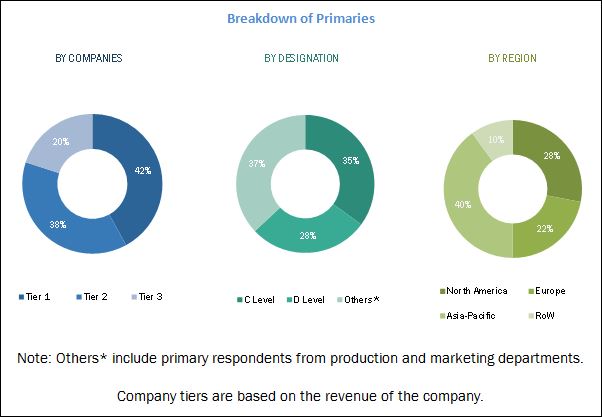

During this research study, major players operating in the market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries based on the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the in-dash navigation system market consists of top tier-1 suppliers like Continental AG (Germany), Aptiv (UK), Robert Bosch GmbH. (Germany), and Denso Corporation (Japan), and research institutes such as Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (EAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA).

Major Developments

- In April 2017, Continental AG developed electronic horizon (e-horizon). It gives exact weather information for short-term forecasts and integrate real-time, location-specific weather data used in critical weather conditions. By using advanced navigation data for driver can drive vehicle safely.

- In May 2017, TomTom launched TomTom VIA 53 that offers connected navigation with Wi-Fi updates and smartphone notifications. Drivers can connect their smartphones and can get notifications from SMS, iMessege and offers voice activation compatibility with Siri and Google Now.

- In June 2017, Bosch and TomTom developed high-resolution maps for automated driving. By using Bosch’s “radar road signature”, automated vehicles can determine their exact location in a lane down to a few centimeters. This radar road signature only transmits five kilobytes of data to a cloud per kilometer. This will enable automated vehicles to determine their locations all the time.

Target Audience

- Automobile manufacturers

- In-dash navigation system manufacturers

- Automotive component manufacturers

- Automobile organizations/associations

- In-dash navigation system component suppliers

- Raw material suppliers for navigation systems

- Traders and distributors of in-dash navigation system

- Tier 1, Tier 2, and Tier 3 suppliers

- Distributors and suppliers of automotive components/parts

Scope of the Report

Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of The World (RoW)

Market, By Component type

- Display Unit

- Control Module

- Antenna Module

- Wiring Harness

Market, By Connected Navigation Services type

- Real Time Traffic And Direction Information Services

- Fleet Management Services

- Others (Weather Forecast And Concierge)

Market, By Technology Type

- 2D Maps

- 3D Maps

Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Market, By Electric vehicle type

- BEV

- HEV

- PHEV

Critical Questions:

- Many OEMs are commercializing their level 3 autonomy vehicle globally. How the ecosystem of in-dash navigation system revolves around level of autonomy? What strategies will stakeholder implement to take this as a revenue generating opportunity?

- The ecosystem of the market is dominated by few key players. How competitors and new entrants will strategize their growth?

- Where will all these developments take the industry in the mid to long term?

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of automotive maps technology market

- Detailed analysis of in-dash navigation market for electric vehicle

The In-Dash Navigation System Market, by value, is projected to grow at a CAGR of 12.74% during the forecast period, to reach USD 17.53 billion by 2022. The market is segmented by region, component type, technology type, connected navigation services type, vehicle type, and electric vehicle type.

The market, by technology type, is dominated by the 2D maps technology in 2017, followed by 3D maps. The market for 2D maps is expected to have the maximum share in the market in the next five years. This can be attributed to the higher costs and complexity in terms of technical expertise of 3D maps technology.

The display units are estimated to have highest market share followed by control modules, antenna modules and wiring harness. Whereas by volume the wiring harness is expected to capture the largest market followed by other components. The in-dash navigation systems market is expected to have highest growth in the emerging markets due to increased adoption rate and high production of vehicles in these regions. By component type, the market is segmented into display units, antenna module, control module and wiring harness.

The market, by vehicle type, is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger car segment accounts for the largest share of this market, followed by light commercial vehicles (LCV) and heavy commercial vehicles (HCV).

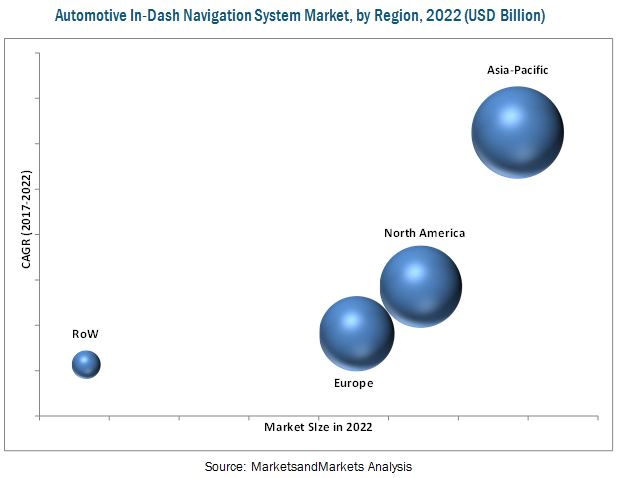

Asia Pacific is estimated to account for the largest share, by value and volume, of the market in 2017. In terms of growth, Asia Pacific is projected to exhibit the highest CAGR as compared to other regions. Developing economies like China and India are expected to play a major role on the backdrop of increasing vehicle production. Also, increasing number of vehicles on road in the developing economies will also lead to increase in demand real time traffic and weather information, which will further boost the demand for in-dash navigation systems.

Restraints of the Market:

The in-dash navigation system market is highly dependent on the supporting infrastructure such as connectivity, roadways and other infrastructure. The cheap availability of other substitutes such as personal navigation devices, and mobile phones might affect negatively to in-dash navigation systems market. The cyber security of vehicle is also one of the concerns as the navigation system is connected via internet, hackers can hack into the system, which can lead to disastrous situations specially in case of connected vehicles.

The market is dominated by key players such as Continental AG (Germany), Robert Bosch GmbH (Germany), Denso Corporation (Japan), and Delphi Automotive (UK) among others.

The increasing awareness and use of in-vehicle connected services are expected to create tremendous growth opportunities for supply-side players.

Real Time Traffic And Directions Information (TDI) Services

Real time traffic and directions information (TDI) services enable driver to drive the vehicle using real time data from sources about the traffic and routes to take, so that vehicle driver can make proper decision regarding optimum route to take. This technology uses data from different sources in real-time and processes information to take immediate decisions that is the key to successful traffic management. Traffic data comes from a traffic data collection system that analyzes traffic flow, data collected from data observation points collected after regular interval of time.

Fleet Management Services

Fleet management services provides cheap and reliable communications link to track location of a fleet vehicle, finding out optimal routes, minimize idle time, monitor driving pattern/driver behavior and ensure vehicle safety. Advantages of having fleet management services in a vehicle includes fuel consumption monitoring, enhanced driver and vehicle safety, evaluation of driver’s and vehicle’s performance and improved customer service. Instantaneous location targeting using global positioning system (GPS), online monitoring program are some of technologies used for fleet management services. The market for the vehicle in-navigation systems is growing at a significant rate in the emerging economies such as Asia Pacific, owing to a rise in the GDP and population in these regions, resulting in improvement in lifestyles, increased purchasing power of consumers, and development in road connectivity and infrastructure.

Others (Parking, Weather Info, Etc)

This segment covers other services such as parking, weather information, etc. Parking services shows the availability of parking spot and count of free spaces in registered area. The main function of the weather information system includes issuing disaster warnings and conducting climate studies. Whereas concierge enables user to get premiere services such as notifications regarding various alerts on screen boards of a GPS system.

For availability of parking services, a central server maintains database about registered parking area. So, a driver can make a judgment based on nearby vacant parking thus by using navigation method, the user can get the shortest path to the chosen parking region. A typical weather information system is the collection of components such as sensors, communication, software, and computers. The system helps to capture information of important weather parameters, transmit information, and run forecast models.

Critical Questions would be:

- Regular traffic updates and updates of road environments are the basic information for connected vehicles. How it is creating opportunities for the supply side?

- How the development in road logistics and supply chain will help in-dash navigation system manufacturers to grab new revenue opportunities?

- In which regions, companies can create new revenue pockets for short as well as long term?

High system cost and lack of supporting infrastructure in developing countries are major factors restraining the growth of the in-dash navigation system market. In developing countries, there is enormous difference in income level; hence affordability and buyers purchasing power is less. This create situation where less number of customers buy premium cars and mass number of customers prefer buying economic cars. In-vehicle navigation system cost is comparatively high than that of other navigation devices or systems, which is major restrain of in-vehicle navigation system market.

Another restrain is lack of supporting infrastructure, navigation infrastructure includes road connectivity, space and ground base connectivity, database for navigation, telecom support and more. In most of the developing region connectivity issue is more prominent as required bandwidth for navigation systems is supported in most of the rural areas. If we consider connectivity in rural areas of India 4G connectivity is not available which is required for smooth operations of in-vehicle navigation systems. In addition, government initiatives are less supportive to improve infrastructure. In India, there is no rule for the use of navigation systems which could hamper public safety.

Key players in the in-dash navigation system market include Robert Bosch GmbH (Germany), Continental AG (Germany), Denso Corporation (Japan), and Delphi Automotive Plc. (UK), TomTom (Netherlands), Garmin(Switzerland), Harman international (US) These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce modern technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Assumptions

1.8 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Sources

2.1.1.2 Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increasing Sales of Luxurious Cars

2.2.2.2 Rising Trend of Semiautonomous Vehicle

2.2.2.3 Cost Containment

2.2.3 Supply-Side Analysis

2.2.3.1 Technological Advancement

2.2.3.2 Influence of Other Factors

2.3 Market Size Estimation

2.4 Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in In-Dash Navigation System Market

4.2 Market, By Region, 2017

4.3 Market, By Technology

4.4 Market, By Vehicle Type

4.5 Market, By Component

4.6 Market, By Electric Vehicle Type

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market Segmentation

5.2.2 Market, Vehicle Type

5.2.3 Market, By Region

5.2.4 Market, By Connected Navigation Services Type

5.2.5 Market, By Component Type

5.2.6 Market, By Technology Type

5.2.7 Market, By Electric Vehicle Type

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Customer Preference for In-Dash Navigation System

5.3.1.2 Government Regulation About In-Dash Navigation System

5.3.1.3 Increasing Application Area of Navigation Services

5.3.2 Restraints

5.3.2.1 High System Cost and Lack of Supporting Infrastructure in Developing Countries

5.3.2.2 Concerns Regarding Cyber and Data Security

5.3.3 Opportunities

5.3.3.1 Increasing Adoption By the Insurance Industry

5.3.3.2 Trend of Connected Car Devices

5.3.4 Challenges

5.3.4.1 Use of Other Connectivity Types and Pnd for Navigation

5.4 Porter’s Five Forces Analysis

5.4.1 Bargaining Power of Suppliers

5.4.2 Bargaining Power of Buyers

5.4.3 Threat From New Entrants

5.4.4 Threat From Substitutes

5.4.5 Intensity of Competitive Rivalry

6 In-Dash Navigation System Market, By Technology Type (Page No. - 54)

6.1 Introduction

6.1.1 2D Maps

6.1.2 3D Maps

7 In-Dash Navigation System Market, By Component Type (Page No. - 61)

7.1 Introduction

7.2 Antenna Module

7.3 Control Module

7.4 Display Unit

7.5 Wiring Harness

8 In-Dash Navigation System Market, By Connected Navigation Services (Page No. - 69)

8.1 Introduction

8.2 Real Time Traffic, Directions and Information (TDI) Services

8.3 Fleet Management Services

8.4 Others (Parking, Weather Info, Etc.)

9 In-Dash Navigation System Market, By Vehicle Type (Page No. - 73)

9.1 Introduction

9.2 Passenger Car

9.3 Commercial Vehicle (CV)

9.3.1 Light Commercial Vehicle

9.3.2 Heavy Commercial Vehicle

10 In-Dash Navigation System Market, By Electric Vehicle Type (Page No. - 81)

10.1 Introduction

10.2 BEV

10.3 PHEV

10.4 HEV

11 In-Dash Navigation System Market, By Region (Page No. - 87)

11.1 Introduction

11.2 Asia-Pacific

11.3 Europe

11.4 North America

11.5 RoW

12 Competitive Landscape (Page No. - 104)

12.1 Introduction

12.2 Competitive Leadership Mapping

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.3 Competitive Benchmarking

12.3.1 Strength of Product Portfolio (For All 25 Companies)

12.3.2 Business Strategy Excellence (For All 25 Companies)

*Top 25 Companies Analyzed for This Study are – Alpine Electronics, Inc., Aisin AW Co. Ltd., Clarion Co. Ltd., Continental AG, Delphi Automotive PLC, Denso Corporation, Luxoft Holding Inc., Garmin Ltd., Here International B.V., Pioneer Corporation, Tomtom NV, Mitsubishi Electric Corporation, Harman International Industries, Nng Global Infotainment Technologies, Robert Bosch GmbH, Telenav, Inc., Jvc Kenwood Holdings Inc., Visteon Corporation, Panasonic Corporation, Fujitsu Ten Ltd., Trimble Inc., Magellan Navigation Inc., Kimball Electronics Inc., Sierra Wireless Inc., Magneti Marelli S.P.A

12.4 Market Ranking Analysis : In-Dash Navigation System

13 Company Profiles (Page No. - 109)

(Company Overview, Strength of Product Portfolio, Product Offerings, Business Strategy Excellence, Recent Developments)*

13.1 Continental AG

13.2 Garmin Ltd.

13.3 Robert Bosch GmbH

13.4 Delphi Automotive PLC

13.5 Denso Corporation

13.6 Tomtom NV

13.7 Luxoft Holding Inc

13.8 Harman International

13.9 Alpine Electronics, Inc.

13.10 Pioneer Corporation

13.11 Mitsubishi Electric Corporation

13.12 Clarion Co. Ltd.

*Details on Company Overview, Strength of Product Portfolio, Product Offerings, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 150)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing Rt: Real Time Market Intelligence

14.4 Available Customizations

14.4.1 Additional Company Profiles

14.4.1.1 Business Overview

14.4.1.2 SWOT Analysis

14.4.1.3 Recent Developments

14.4.1.4 MnM View

14.4.2 Detaled Analysis of In-Dash Navigation System

14.4.3 Detaled Analysis of Electric Vehicle

14.4.4 Aftermarket for Automotive In-Dash Navigation System

14.5 Related Reports

14.6 Author Details

List of Tables (64 Tables)

Table 1 Average American Dollar Exchange Rates (Per 1 USD)

Table 2 Country-Wise Government Legislations Regarding the Use of Connectivity Services

Table 3 In-Dash Navigation System Market, By Technology Type, 2015–2022 (‘000 Units)

Table 4 Market, By Technology Type, 2015–2022 (USD Million)

Table 5 2D Maps Technology: Market, By Region, 2015–2022 (‘000 Units)

Table 6 2D Maps Technology: Market, By Region, 2015–2022 (USD Million)

Table 7 3D Maps Technology: Market, By Region, 2015–2022 (‘000 Units)

Table 8 3D Maps Technology: Market, By Region, 2015–2022 (USD Million)

Table 9 Market, By Component Type, 2015–2022 (Million Units)

Table 10 Market, By Component Type, 2015–2022 (USD Million)

Table 11 Antenna Module: Automotive Market, By Region, 2015–2022(Million Units)

Table 12 Antenna Module: Market, By Region, 2015–2022 (USD Million)

Table 13 Control Module: Automotive Market, By Region, 2015–2022 (Million Units)

Table 14 Control Module: Market, By Region, 2015–2022 (USD Million)

Table 15 Display Unit: Automotive Market, By Region, 2015–2022 (Million Units)

Table 16 Display Unit: Market, By Region, 2015–2022 (USD Million)

Table 17 Wiring Harness: Automotive Market, By Region, 2015–2022 (Million Units)

Table 18 Wiring Harness: Market, By Region, 2015–2022 (USD Million)

Table 19 Market, By Connected Navigation Services, 2015–2022 (USD Million)

Table 20 Real Time Traffic, Directions, and Information Services: Market, By Region, 2015–2022 (USD Million)

Table 21 Fleet Management Services: Market, By Region, 2015–2022 (USD Million)

Table 22 Others: Market, By Region, 2015–2022 (USD Million)

Table 23 Market, By Vehicle Type, 2015–2022 (‘000 Units)

Table 24 Market, By Vehicle Type, 2015–2022 (USD Million)

Table 25 Passenger Car (PC) In-Dash Navigation System Market, By Region, 2015–2022 (‘000 Units)

Table 26 Passenger Car (PC) Market, By Region, 2015–2022 (USD Million)

Table 27 Light Commercial Vehicle (LCV) Market, By Region, 2015–2022 (‘000 Units)

Table 28 Market for Light Commercial Vehicle (LCV), By Region, 2015–2022 (USD Million)

Table 29 Heavy Commercial Vehicle (HCV) Market, By Region, 2015–2022 (‘000 Units)

Table 30 Market for Heavy Commercial Vehicle (HCV), By Region, 2015–2022 (USD Million)

Table 31 Market, By Electric Vehicle Type, 2015–2022 (Units)

Table 32 Market, By Electric Vehicle Type, 2015–2022 (USD Thousand)

Table 33 BEV: Market, By Region, 2015–2022 (Units)

Table 34 BEV: Market, By Region, 2015–2022 (USD Thousand)

Table 35 PHEV: Market, By Region, 2015–2022 (Units)

Table 36 PHEV: Market, By Region, 2015–2022 (USD Thousand)

Table 37 HEV: Market, By Region, 2015–2022 (Units)

Table 38 HEV: Market, By Region, 2015–2022 (USD Thousand)

Table 39 Global In-Dash Navigation System Market, By Region, 2015–2022(‘000 Units)

Table 40 Global Market, By Region, 2015–2022 (USD Million)

Table 41 Asia-Pacific: Market, By Country, 2015–2022 ('000 Units)

Table 42 Asia-Pacific: Market, By Country, 2015–2022 (USD Million)

Table 43 Asia-Pacific: Market, By Vehicle Type, 2015–2022 ('000 Units)

Table 44 Asia-Pacific: Market, By Vehicle Type, 2015–2022 (USD Million)

Table 45 Asia Pacific: Market, By Technology, 2015–2022 (‘000 Units)

Table 46 Asia Pacific: Market, By Technology, 2015–2022 (USD Million)

Table 47 Europe: Market, By Country, 2015–2022 (‘000 Units)

Table 48 Europe: Market, By Country, 2015–2022 (USD Million)

Table 49 Europe: Market, By Vehicle Type, 2015–2022 ('000 Units)

Table 50 Europe: Market, By Vehicle Type, 2015–2022 (USD Million)

Table 51 Europe: Market, By Technology, 2015–2022 (‘000 Units)

Table 52 Europe: Market, By Technology, 2015–2022 (USD Million)

Table 53 North America: Market, By Country, 2015–2022 (‘000 Units)

Table 54 North America: Market, By Country, 2015–2022 (USD Million)

Table 55 North America: Market, By Vehicle Type, 2015–2022 (‘000 Units)

Table 56 North America: Market, By Vehicle Type, 2015–2022 (USD Million)

Table 57 North America: Market, By Technology, 2015–2022 (‘000 Units)

Table 58 North America: Market, By Technology, 2015–2022 (USD Million)

Table 59 RoW: Market, By Country, 2015–2022 ('000 Units)

Table 60 RoW: Market, By Country, 2015–2022 (USD Million)

Table 61 RoW: Market, By Vehicle Type, 2015–2022 (‘000 Units)

Table 62 RoW: Market, By Vehicle Type, 2015–2022 (USD Million)

Table 63 RoW: Market, By Technology, 2015–2022 (‘000 Units)

Table 64 RoW: Market, By Technology, 2015–2022 (USD Million)

List of Figures (60 figures)

Figure 1 In-Dash Navigation System Market

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Asia-Pacific is Estimated to Be the Largest Market for In-Dash Navigation Systems, 2017 vs 2022 (USD Million)

Figure 6 Passenger Car Segment is Estimated to Have Fastest Growth Rate for the Market

Figure 7 Hybrid Electric Vehicle Segment is Estimated to Hold the Largest Size of the In-Dash Navigation Market (USD Thousand), 2017–2022

Figure 8 Antenna Module Segment is Estimated to Have Fastest Growing CAGR the Market (USD Million), 2017–2022

Figure 9 2D Technology Segment is Estimated to Hold the Largest Size of the In-Dash Navigation Market (USD Million), 2017–2022

Figure 10 Government Regulations & Changing Preferences of Buyers Expected to Drive the Demand for Market

Figure 11 Asia Pacific Estimated to Dominate this Market in 2017

Figure 12 2D Maps to Lead the Market, 2017 vs 2022

Figure 13 Passenger Car Segment to Hold the Largest Share in the In-Dash Navigation System , 2017 vs 2022

Figure 14 Display Units to Hold the Largest Market Share, 2017

Figure 15 Hybrid Electric Vehicle to Dominate the In-Dash Navigation System , 2017 vs 2022

Figure 16 Global Market Segmentation

Figure 17 In-Dash Navigation System Market By Vehicle Type,

Figure 18 Market By Region,

Figure 19 Market By Connected Navigation Services Type,

Figure 20 Market By Component Type,

Figure 21 Market By Technology Type,

Figure 22 Market By Electric Vehicle Type,

Figure 23 In-Dash Navigation System :Dynamics

Figure 24 In-Dash Navigation System : Market Dynamics

Figure 25 PND Units Sold (2007–2016)

Figure 26 Market: Porter’s Five Forces Analysis

Figure 27 Threat From New Entrants in the Market is Low

Figure 28 Government Regulation & Technology Factors Make the Bargaining Power of Suppliers High

Figure 29 Bargaining Power of Buyers is Moderate Due to the High Degree of Dependency on Suppliers

Figure 30 Threat From New Entrants is Low Due to High Degree of Process Complexity and Technical Expertise

Figure 31 Threat From Substitutes is High Due to the Easily Available Alternatives

Figure 32 Moderate Competitions Between Market Leaders Lead to Medium Intensity of Competitive Rivalry

Figure 33 Market, By Technology Type (2017–2022)

Figure 34 Asia-Pacific to Hold the Largest Share of 2D Maps Market for In-Dash Navigation System

Figure 35 North America to Hold the Largest Share of 3D Maps Market for In-Dash Navigation System in 2017

Figure 36 Wiring Harness to Capture the Largest Market for In-Dash Navigation Systems Market

Figure 37 In-Dash Navigation System Market, By Component Type, 2017–2022 (USD Million)

Figure 38 Market, By Connected Services (2017 vs 2022)

Figure 39 Passenger Car to Account for the Largest Share for Market

Figure 40 Asia-Pacific to Hold the Largest Share for Passenger Car Market (2017–2022)

Figure 41 North America to Hold the Largest Share for Light Commercial Vehicle Market, (2017 vs 2022)

Figure 42 Asia-Pacific to Hold the Largest Share for Heavy Commercial Vehicle Market, (2017–2022)

Figure 43 Market, By Electric Vehicle Type, 2017 vs 2022 (USD Thousand)

Figure 44 Market Outlook, By Region (USD Billion)

Figure 45 Asia-Pacific: Market Snapshot

Figure 46 Europe: Market Snapshot

Figure 47 North America: Market Snapshot

Figure 48 Market, Competitive Leadership Mapping, 2017

Figure 49 Continental AG: Company Snapshot

Figure 50 Garmin Ltd.: Company Snapshot

Figure 51 Robert Bosch GmbH: Company Snapshot

Figure 52 Delphi Automotive PLC: Company Snapshot

Figure 53 Denso Corporation: Company Snapshot

Figure 54 Tomtom: Company Snapshot

Figure 55 Luxoft Holding Inc.: Company Snapshot

Figure 56 Harman International: Company Snapshot

Figure 57 Alpine Electronics, Inc: Company Snapshot

Figure 58 Pioneer Corporation: Company Snapshot

Figure 59 Mitsubishi Electric Corporation: Company Snapshot

Figure 60 Clarion Co. Ltd.: Company Snapshot

Growth opportunities and latent adjacency in In-Dash Navigation System Market