Industrial Agitators Market by Model Type (Large Tank, Portable, Drum, Pail, Tote), Mounting (Top, Side, Bottom Mounted), Component (Head, Impeller, Seal, Propeller, Turbines, Disperser), Form (Solid-Solid, Liquid-Gas), Region - Global Forecast to 2028

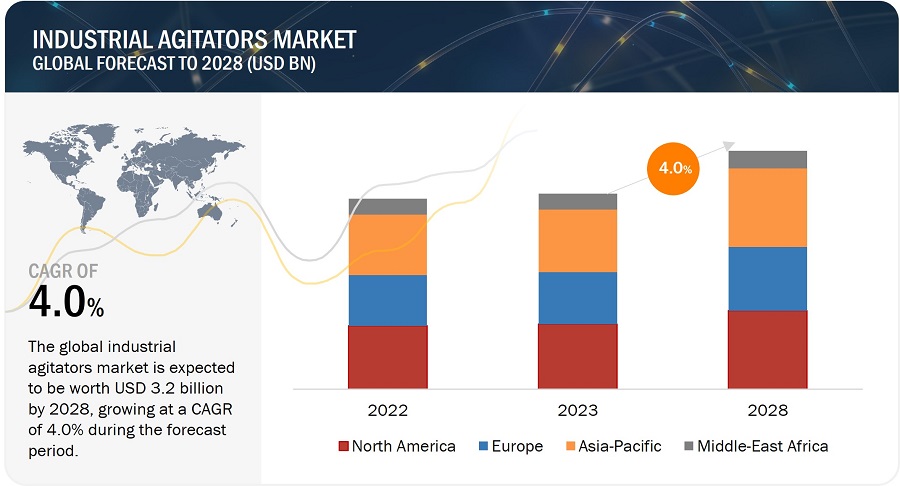

[195 Pages Report] The global industrial agitators market size is estimated to be worth USD 2.6 billion in 2023 and is projected to reach USD 3.2 billion by 2028, at a CAGR of 4.0% during the forecast period. Increasing demand for homogeneous mixing, growing need for energy efficient mixing equipment or industrial mixer in pharmaceutical, chemical and food & beverage industries, and growing adoption of customized industrial agitators are some of the major factors driving the industrial agitators market growth globally.

Industrial Agitators Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Agitators Market Trends

Driver: Growing need for energy efficiency, flow maximization, rapid mixing, waste reduction, and other advancements

The increasing requirement of optimizing mixing processes is pushing industrial agitator companies to develop industrial mixer that helps achieve low power consumption, flow maximization, rapid mixing, and other advancements. Mixing, blending, fluid handling, separation, thermal heat transfer, and other processes are integral to companies for production and manufacturing across various industries, such as chemical, food & beverage, pharmaceutical, and other industrial markets. Rapid innovations and emerging trends in industrial mixer application are driving the need for more energy-efficient, speedy mixing and low costs mixing/agitation technologies in the said market. For instance, in 2022, SPX FLOW launched a new APV Flex-Mix Pilot industrial Mixer for the food & beverage industry to test small-scale pilot batches of low to high-viscosity product samples using a single unit. This pilot industrial mixer is useful for companies focusing on small-scale production or craft producers producing a variety of products in small batches. This helps cut costs and reduce waste during the testing phase due to small batch production.

Restraint: High costs for maintenance and repairs of industrial agitators

Industrial agitators require significant upfront investment by agitator companies. This might create a barrier for some agitator companies, especially smaller ones. The cost of industrial mixer can vary depending on their size, materials, and complexity. Furthermore, the maintenance process for industrial mixer consists of replacing worn parts and changing the lubricant, bearings, seals, and other components. Any wear and tear or fault in a component of the industrial agitators can lead to an expense to the client. The maintenance activity applies to various factors in an industrial mixer, including simple adjustments in components of the industrial mixer, troubleshooting by standard exchanges, fault identification and diagnostics, repairs, mechanical corrections, renovation, reconstruction, or complete exchange of the rotating part, and so on. However, the impact of this restraint is expected to reduce with time due to the growing advancements in agitation technology and the subsequently increasing opportunities for industrial agitators market.

Opportunity: Rising usage of industrial mixing technologies in several applications

Advancements in technology have led to the development of more efficient and effective industrial mixer that can offer greater control and precision in mixing. As more industries seek to improve their manufacturing processes and achieve greater product consistency, the demand for industrial mixer is increasing. This presents an opportunity for agitator companies to offer new and improved mixing equipment that can meet the needs of industries looking to optimize their manufacturing processes. Furthermore, there is a growing need for customized mixing solutions that can meet specific requirements. This presents an opportunity for agitator companies to offer specialized products that can be tailored to meet specific needs of different industries such as pharmaceutical, chemical and food & beverage. In June 2022, considering the increasing importance of using industrial agitators and industrial mixer in different industrial processes, Sulzer launched its latest addition to the SALOMIX industrial agitator family, the SSF150.

Challenge: Emerging trend of renting industrial mixer due to high costs or shorter time span usage

Users or purchasers of industrial agitators or industrial mixer may look for options other than capital purchases. If a client is not able to afford the industrial mixer or needs the industrial mixer for a shorter time, then renting industrial mixer can be considered the most reliable option. This is one of the suitable alternatives garnering attention in the industrial agitators market for rental industrial agitators/industrial mixer. Rental industrial mixer offers a fast and cost-effective way of fulfilling the need without the high cost of a capital purchase, allowing purchasers to fulfill their mixing needs at a fraction of the original industrial mixer cost. This would largely benefit the buyers at a time when most of the end-user industries are considering or have already slashed their capital expenditure budgets.

Industrial Agitators Market: Key Trends

The prominent players in the industrial agitators market are SPX Flow, Inc. (US), Xylem Inc. (US),Ekato Group (Germany), Sulzer Ltd. (Switzerland) and NOV Inc (US). These agitator companies boast mixing trends with comprehensive product portfolio and strong geographic footprint.

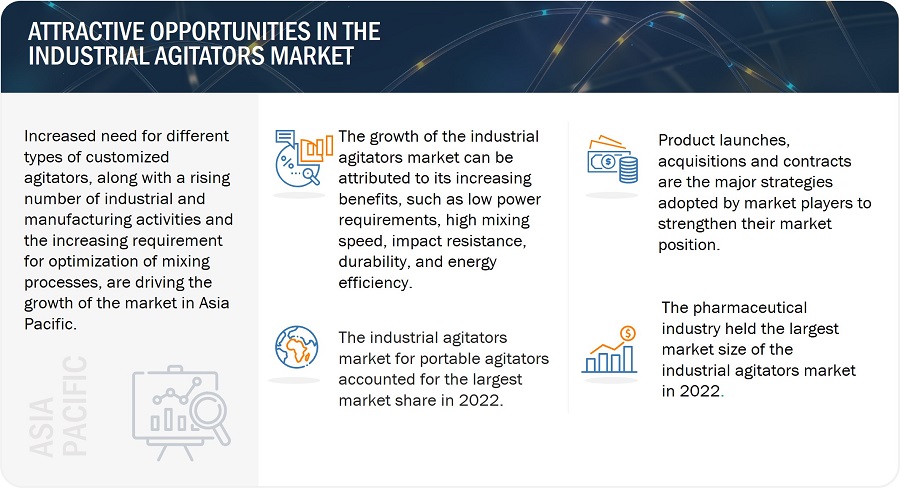

Portable agitators accounted for the largest share of the industrial agitators market in 2022

Portable agitators can be used for a variety of industrial mixing applications, including mixing liquids, suspending solids, and blending different materials. This type of industrial mixer is widely used in industries such as food & beverage, where they are used in wine cellars in the production of wine and sparkling wine. As the mixing process in portable industrial mixer takes less time, and such industrial agitators are simple and quick to install and uninstall for tank fittings and threads, they are gaining popularity. Portable industrial agitators also provide high torque, offer a wide range of gear reduction, and can endure shock loads that are greater than their rating. All these factors are expected to surge the industrial agitators market for portable industrial agitators during the forecast period.

Top-mounted agitators to register highest CAGR in the industrial agitators market during forecast period.

Top-mounted industrial agitators are widely used in a variety of industries such as chemical, pharmaceutical and food & beverage for mixing and blending applications. They are often preferred due to their vertical design, which allows for efficient mixing and blending of materials, and their ability to handle high viscosity materials. Top-mounted industrial agitators can be customized to meet the specific needs of different industries and applications. For instance, in pharmaceutical industry, top-mounted agitators are used for mixing and blending of medications, such as creams, ointments, and suspensions. All these factors are expected to provide a significant surge for top-mounted agitators in the industrial agitators market.

The pharmaceutical industry to register highest CAGR as well as market size in the industrial agitators market during forecast period.

The pharmaceutical industry dominated the industrial agitators market with the highest market size in 2022 and is expected to grow at significant CAGR during the forecast period. Different industrial procedures are carried out in the pharmaceutical industry for tablet manufacturing and syrup production. These industrial procedures require industrial agitators and mixing equipment to improve their performance while reducing the manufacturing costs of medicines. These factors are fueling the growth of the pharmaceutical industry, positively influencing the industrial agitators market growth.

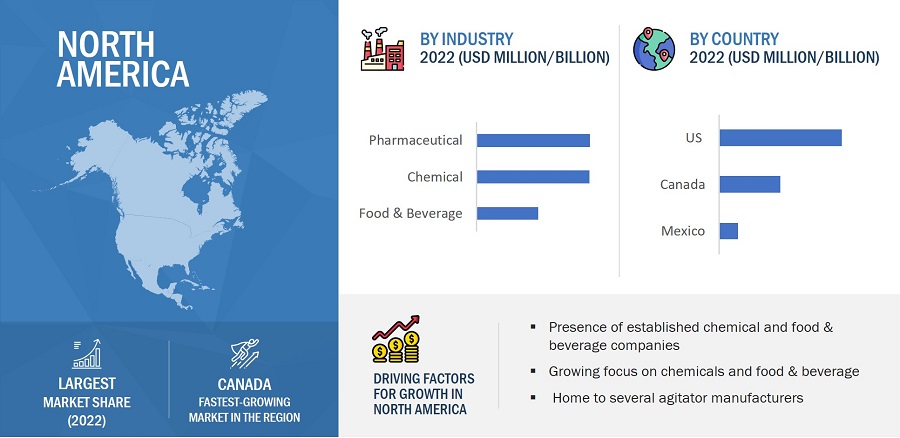

North America held for the largest share of the industrial agitators market in 2022

North America accounted for the largest share of the industrial agitators market in 2022. North America is home to many key agitator companies in the industrial agitators market, including SPX Flows, NOV Inc and Xylem Inc among others. This strong presence of these agitator companies drives innovation and competition, further driving the growth of the industrial agitators market in the region.

Industrial Agitators Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major agitator companies in the industrial agitators market include SPX Flow, Inc. (US), Xylem Inc. (US),Ekato Group (Germany), Sulzer Ltd. (Switzerland) and NOV Inc (US). These industrial agitator companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the industrial agitators market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million), Volume (Thousand Units) |

|

Segments covered |

By Model Type, Mounting, Form, Component, Industry and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The major players in the industrial agitators market are SPX Flow, Inc. (US), Xylem Inc. (US),Ekato Group (Germany), Sulzer Ltd. (Switzerland) and NOV Inc (US). |

Industrial Agitators Market Highlights

The study of segments in industrial agitator market based on model type, mounting, component, form, industry and region at the regional and global level.

|

Segment |

Subsegment |

|

By Model Type |

|

|

By Mounting |

|

|

By Component |

|

|

By Form |

|

|

By Industry |

|

|

By Region |

|

Recent Developments

- In September 2022, SPX Flow announced the launch of its new APV Flex-Mix™ Pilot Mixer, which enables food and beverage customers to test small-scale pilot batches of low to high-viscosity product samples using just a single unit.

- In November 2021, Statiflo International announced a new partnership with Spray Nozzle offering the company distributorship of its products that will expand Statiflo’s market presence into 18 more African countries.

- In January 2020, Ekato Group announced that it had been chosen as the plant supplier for the production of dermo- and nano-cosmetic products in the newly opened headquarters of Sesderma company in Spain.

Frequently Asked Questions (FAQ):

What is the current size of the global industrial agitators market?

The industrial agitators market is estimated to be worth USD 2.6 billion in 2023 and is projected to reach USD 3.2 billion by 2028, at a CAGR of 4.0% during the forecast period. Rising need for energy-efficient and customized mixing equipment in several industries such as chemical, pharmaceutical, etc are the major factors driving the industrial agitators market growth.

Who are the winners in the global industrial agitators market?

Agitator companies such as SPX Flow, Inc. (US), Xylem Inc. (US),Ekato Group (Germany), Sulzer Ltd. (Switzerland) and NOV Inc (US) fall under the winners category.

Which region is expected to hold the highest share in industrial agitators market?

Asia Pacific is expected to dominate the industrial agitators market in 2028. Countries in Asia Pacific are showing growth in the chemical and pharmaceutical industries, which are proposed to be the main industries for industrial agitators and mixing equipment which are some of the major factors driving the industrial agitators market growth in the region.

What are the major drivers and opportunities related to the industrial agitators market?

Surging demand for customized industrial agitators, as well as rising usage of mixing equipment for uniform mixture production are some of the major drivers and opportunities for agitator companies as well as for industrial agitators market.

What are the major strategies adopted by market players?

The agitator companies have adopted product launches, acquisitions, and contracts to strengthen their position in the industrial agitators market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

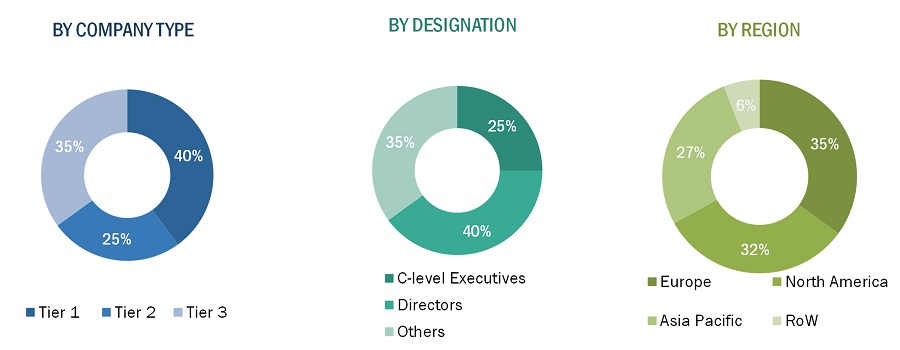

The research study involved 4 major activities in estimating the size of the industrial gaitators market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research was mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, and regional outlook and developments from both market and technology perspectives.

Primary Research

In the primary research, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, equipment manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the industrial agitators market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches along with data triangulation methods have been used to estimate and validate the size of the industrial agitators market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top line investments and spending in the ecosystems. Further, major developments in the key market area have been considered

- Analyzing major original equipment manufacturers (OEMs) and studying their product portfolios and understanding different applications of the solutions offered by them

- Analyzing the trends related to the adoption of different types of mixing equipment

- Tracking the recent and upcoming developments in the industrial agitators market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Conducting multiple discussions with key opinion leaders to know about different types of industrial agitators used and the applications for which they are used to analyze the breakup of the scope of work carried out by major companies

- Segmenting the market based on types with respect to applications wherein the types are to be used and deriving the size of the global industry market

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall industrial agitators market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The industrial agitators market size has been validated using both top-down and bottom-up approaches.

Market Definition

Industrial agitators are mechanical devices used in various manufacturing and industrial processes to mix, blend, or stir liquids, slurries, or other materials in tanks, reactors, and other containers. They come in various designs, sizes, and configurations and use different types of impellers, blades, or paddles to generate fluid motion and homogenize the contents of the vessel. Industrial agitators are used in a wide range of applications, including chemical processing, food and beverage production, pharmaceuticals, and wastewater treatment, among others. They can also help to maintain uniformity of temperature, pressure, and other process parameters, and can facilitate heat and mass transfer in various process operations

Stakeholders

- Original Equipment Manufacturers (OEMs)

- Industrial Machinery Manufacturers

- Industrial Chemical Manufacturers

- Pharmaceutical Manufacturers

- Industrial Agitators Manufacturers and Vendors

- Components Suppliers

- Industrial Agitators Distributors and Traders

- Government Bodies Such as Regulating Authorities and Policymakers

- Venture Capitalists, Private Equity Firms, and Startup Companies

The main objectives of this study are as follows:

- To describe and forecast the industrial agitators market, in terms of value, based on model type, component, form, mounting , and industry

- To describe and forecast the industrial agitators market size, in terms of value, with respect to 4 main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the industrial agitators market

- To provide a detailed overview of the supply chain of the industrial agitators market ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To analyze the probable impact of the recession on the market in future

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze the competitive landscape of the market

- To track and analyze competitive developments, such as partnerships, contracts, acquisitions, expansions, product launches, and other developments in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Agitators Market