Chilled Beam System Market Size, Share, Statistics, Industry Growth Analysis by Design (Active, Passive, Multi-Service), Business (New Construction, Renovation), Application (Commercial Offices, Educational Institutions, Healthcare, Hotels), Geography and Forecast - 2025

Updated on : November 04, 2024

The Global Chilled Beam System Market size is experiencing significant demand and growth, driven by the increasing need for energy-efficient cooling solutions in commercial and residential buildings. Key trends shaping this market include the rising adoption of sustainable building practices and advancements in HVAC technology, which enhance the performance and efficiency of chilled beam systems. As more architects and builders prioritize environmental considerations, the future of the chilled beam system market looks promising, with innovations aimed at improving comfort and reducing energy consumption. This trend is expected to fuel further growth, making chilled beam systems a viable option for modern climate control solutions.

Chilled Beam System Market Size

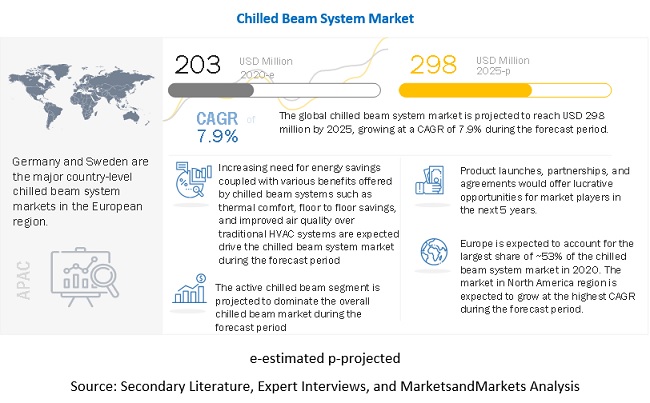

The global Chilled Beam System Market size in terms of revenue was estimated to be USD 203 million in 2020 and is poised to reach USD 298 million by 2025 , growing at a CAGR of 7.9% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. Increasing need for energy savings coupled with various benefits offered by chilled beam systems such as thermal comfort, floor to floor savings, and improved air quality over tradiational HVAC systems are expected drive the chilled beam system industry during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Chilled Beam System Market

COVID-19 has affected the production capacities and financial condition of chilled beam providers. The pandemic has resulted in a widespread health crisis, which is adversely affecting the financial markets and economies of countries and end-users. This is expected to lead to an economic downturn and negatively affect the demand for chilled beams in short term. The overall long-term impact of COVID-19 on the chilled beam system market is expected to depend upon various factors, such as the global spread and duration of the pandemic, the actions taken by various government authorities worldwide in response to the pandemic, and the severity of the disease.

The current COVID-19 pandemic presents many challenges to the HVAC industry. Chilled beam system market is an intrinsic sub-vertical of global HVAC and construction business space. Indoor Air Quality (IAQ) has become a top concern for every building owner during the pandemic. HVAC systems impact the distribution and bioburden of infectious aerosols. The building owners are likely to implement enhanced air filtration and cleaning technologies such as Bipolar Ionization (BPI) and Ultraviolet Germicidal Irradiation (UVGI) that show promise for the abatement of airborne transmission of the virus. The pandemic is likely to incentivize building owners and designers to look for solutions that offer augmented local abatement or contaminant removal with notably raising the energy and maintenance costs. This will allow chilled beams, coupled with DOAS systems, to be at forefront.

Chilled Beam System Market Trends & Dynamics

Driver : Several advantages offered by chilled beam systems over traditional HVAC system is likely increase its adoption

The various benefits of chilled beam systems compared with that of traditional HVAC system have resulted in the increasing adoption of chilled beams in many applications, especially commercial offices, and educational institutions. Chilled beam provide building owners a significant savings in number of ways. Chilled beam uses water to transfer sensible heat to and from a room. Water provide the transport medium for the bulk of the thermal energy rather than just air due to the ability of water to store significantly more thermal energy per unit volume than the same volume of air. Chilled beams save floor-to-floor space (height) as they do not need as much interstitial space for ductwork and have smaller mechanical room footprint requirements. Chilled beams have no internal moving parts and have negligible maintenance requirements compared to the traditional HVAC system.

Restraint: Lack of consumer awareness and high initial cost

The potential applications of the chilled beam technology are increasing at a considerable pace; however, the lack of consumer awareness and high cost of ownership pertaining to the installation of chilled beams are acting as barriers in the adoption of these solutions. Initial costs for chilled beam systems are typically higher as compared to all air systems. Even though chilled beam systems save money on ductwork, fans, controls, Variable Air Volume systems (VAVs), and Air Handling Units (AHUs) but add money for the chilled beam themselves, pipe insulation, water piping, and pumps. Moreover, the high initial costs are related to various factors which include installation, maintenance, and separate handling of condensation issues in chilled beams.

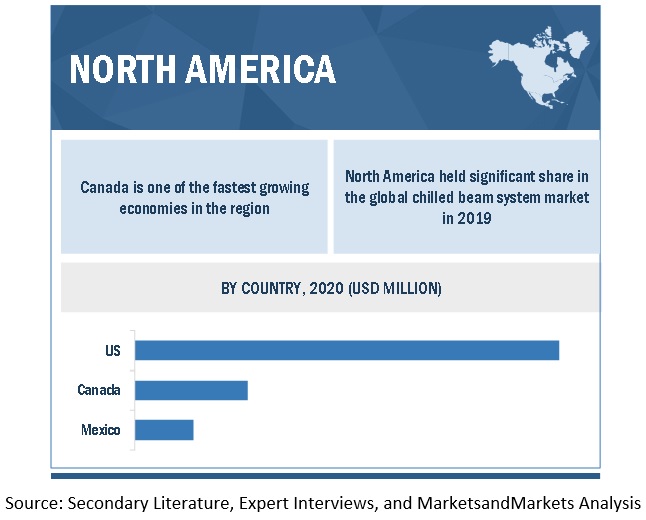

Opportunity : Expected growth of chilled beam applications in North America

The chilled beam technology is not much popular in North America as comparted to that in Europe. With the increasing awareness about the benefits of chilled beams and tightening of building codes pertaining to energy conservation, the demand for chilled beam systems has been increasing at a significant pace in North America. The major factors driving the demand for chilled beams in North America include the increasing commercial floor space, rising energy consumption in the commercial sector for applications such as space cooling and heating, ventilation, water heating, refrigeration, cooking, office equipment, lighting, and others.

Challenge: Rick of water leaks and lack of filters used in chilled beams

Piping and control valves must be field-installed to distribute chilled water to multiple beams in every space of the building as chilled beams are water-based systems. This not only impacts installed cost but also increases the risk of water leaks due to the increased piping and pipe connections. Unlike to commercial HVAC solutions chilled beams are typically not equipped with particulate air filters. This means that the chilled beam are not equipped with any protection against dust or other particles floating around the air of the indoor space. There is a chance that these dust or other particles that are generated within the space or brought into the space (for example on clothing or shoes) are recirculated back into the air after cooling or heating.

Chilled Beam System Market Segmentation

The market for multi-service chilled beam to grow at the highest CAGR from 2020 to 2025

Multi-Service Chilled Beam (MSCB) offers an alternative to suspended ceilings for ventilation, cooling, and heating, thereby fulfilling most needs for indoor climate. These chilled beams provide very economic cooling, acoustic baffling, as well as modern lighting and are incorporated with a variety of other services such as sprinkler systems, public address systems, smoke detectors, Passive Infrared (PIR) sensors, Building Management System (BMS), voice and data cables, Closed-Circuit Television (CCTV), and energy control. The market for multi-service chilled beam is expected to grow at the highest CAGR during the forecast period. This growth is expected to be driven by the use of such products in commercial offices, hotels, and other applications.

Chilled beam system market in hotel application to exhibit high growth during the forecast period

The market for the chilled beam systems used in hotels is expected to grow at the highest CAGR during the forecast period. Hotels aim to provide the utmost comfort to every individual as their cash flows largely depends on repeat business. Chilled beams are the most suitable systems for hotels as they can be easily setup, improve indoor air quality, low noise level, and thermal comfort at every guest room. Chilled beam systems offer energy efficient thermal comfort to occupants. These solutions provide the desired comfort to guests and react to changes in occupancy by quickly changing the room temperature. They also provide comfort features such as guest room air heating and cooling control, adjustment of individual room temperature set-point, reduced airflow, heating and cooling when not required, occupancy control with network connection, and room keycard reader.

To know about the assumptions considered for the study, download the pdf brochure

The chilled beam system market in APAC to grow at the highest CAGR during the forecast period

The increasing commercial floor space (both existing and new additions) along with the need for energy efficient equipment is expected to fuel the market for chilled beam systems in North America. The market for chilled beam system in North America is in the growth stage and many companies in this region are increasingly adopting chilled beam technology which is replacing traditional systems such as fan coil units and variable air volume systems. The various attributes of chilled beam systems make them suitable for application in healthcare facilities, hotels, research laboratories, airports, retail, residential, and data centers.

Top Chilled Beam System Companies - Key Market Players:

- As of 2019, Climate Technologies (Australia),

- FläktGroup Holding GmbH (Germany),

- FTF Group (UK) ,

- Halton Group (Finland),

- Lindab (Sweden),

- Price Industries (Canada),

- Swegon Group AB (Sweden),

- Systemair AB (Sweden),

- TROX GmbH (Germany), and

- Johnson Controls International plc (Ireland) were the major Chilled Beam System Companies in the chilled beam system market. The study includes an in-depth competitive analysis of these key players in the chilled beam system market with their company profiles, recent developments, and key market strategies.

Chilled Beam System Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 203 million |

| Projected Market Size | USD 298 million |

| Growth Rate | 7.9% at a CAGR |

|

Forecast period |

2020–2025 |

|

Base year considered |

2019 |

| Years considered | 2016–2025 |

|

Forecast units |

Value (USD million/Thousand USD) |

|

Segments covered |

|

|

Regions covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Several advantages offered by chilled beam systems over traditional HVAC system is likely increase its adoption |

| Key Market Opportunity | Expected growth of chilled beam applications in North America |

| Largest Growing Region | North America |

| Highest CAGR Segment | Multi-service chilled beam |

| Largest Application Market Share | Hotel application |

In this report, the overall chilled beam system market has been segmented based on design, business, application and region.

Chilled Beam System Market , By Design:

- Active Chilled Beam

- Passive Chilled Beam

- Multi-service Chilled Beam

Chilled Beam System Market, By Business:

- New Construction

- Renovation

Chilled Beam System Market, By Application:

- Commercial Offices

- Educational Institutions

- Healthcare Facilities

- Hotels

- Others

Chilled Beam System Market, By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Sweden

- Norway

- Rest of Europe

-

Asia Pacific (APAC)

- Australia

- China

- Japan

- India

- Rest of APAC

-

Rest of the World (RoW)

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

Which region is expected to generate the highest revenues during the forecast period?

The European region is expected to generate the highest revenue during the forecast period

Does this report include the impact of COVID-19 on the chilled beam system market?

Yes, the report includes the impact of COVID-19 on the chilled beam system market. It illustrates the post- COVID-19 market scenario.

Who are the top ten players in the chilled beam system market?

The major vendors operating in the chilled beam system market include , Climate Technologies (Australia), FläktGroup Holding GmbH (Germany), FTF Group (UK) , Halton Group (Finland), Lindab (Sweden), Price Industries (Canada), Swegon Group AB (Sweden), Systemair AB (Sweden), TROX GmbH (Germany), and Johnson Controls International plc (Ireland)

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Sweden, Norway, and the rest of European countries.

Which is the highest revenue-generating end-use application during the forecast period?

The commercial offices is expected to generate the highest revenue during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 CHILLED BEAM SYSTEM MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up approach (demand side):

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR CHILLED BEAM SYSTEMS THROUGH SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

FIGURE 8 ASSUMPTIONS OF RESEARCH STUDY

2.4.2 LIMITATIONS

FIGURE 9 LIMITATIONS OF RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 10 IMPACT OF COVID-19 ON CHILLED BEAM SYSTEM MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 11 ACTIVE CHILLED BEAM SYSTEMS EXPECTED TO CAPTURE LARGEST MARKET SHARE BY 2025

FIGURE 12 NEW CONSTRUCTION SEGMENT EXPECTED TO CAPTURE LARGER MARKET SHARE BY 2025

FIGURE 13 COMMERCIAL OFFICES SEGMENT TO DOMINATE CHILLED BEAM SYSTEM MARKET, IN TERMS OF SIZE, DURING FORECAST PERIOD

FIGURE 14 EUROPE TO HOLD LARGEST SHARE OF MARKET BY 2025

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN GLOBAL CHILLED BEAM SYSTEM MARKET

FIGURE 15 INCREASING NEED FOR ENERGY SAVINGS TO DRIVE GROWTH OF MARKET, 2020–2025

4.2 CHILLED BEAM SYSTEM MARKET, BY DESIGN

FIGURE 16 MULTI-SERVICE MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY BUSINESS

FIGURE 17 CHILLED BEAM SYSTEMS FOR NEW CONSTRUCTION BUSINESS TO ACCOUNT FOR LARGER SHARE BY 2025

4.4 MARKET, BY APPLICATION

FIGURE 18 MARKET FOR HOTELS IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.5 MARKET, BY GEOGRAPHY

FIGURE 19 SWEDEN HELD LARGEST SHARE OF GLOBAL CHILLED BEAM SYSTEM MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 EVOLUTION

5.3 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MARKET

5.3.1 DRIVERS

5.3.1.1 Rising need for energy savings

5.3.1.2 Several advantages offered by chilled beam systems over traditional HVAC systems

5.3.2 RESTRAINT

5.3.2.1 Lack of consumer awareness and high initial costs

5.3.3 OPPORTUNITY

5.3.3.1 Expected growth in adoption of chilled beam systems in North America

FIGURE 21 COMMERCIAL SECTOR DELIVERED ENERGY CONSUMPTION, 2010-2050

FIGURE 22 COMMERCIAL FLOOR SPACE GROWTH, 2019-2050

FIGURE 23 US COMMERCIAL ELECTRICITY CONSUMPTION, BY END USE, 2019 & 2050

5.3.4 CHALLENGES

5.3.4.1 Risk of condensation over chilled beam coil

5.3.4.2 Risk of water leaks and lack of filters used in chilled beams

5.4 VALUE CHAIN ANALYSIS

FIGURE 24 MARKET: VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM

FIGURE 25 CHILLED BEAMS: ECOSYSTEM ANALYSIS

5.6 PORTER’S FIVE FORCES MODEL

TABLE 1 IMPACT OF EACH FORCE ON MARKET

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 DEGREE OF COMPETITION

5.7 CASE STUDIES

5.7.1 CASE STUDY: 250 S. WACKER – RENOVATION OF INDUCTION SYSTEM WITH ACTIVE CHILLED BEAMS

5.7.2 CASE STUDY: MEMORIAL HOSPITAL AND HEALTH CARE CENTER

5.7.3 CASE STUDY: MARSTON HALL AT IOWA STATE UNIVERSITY IN AMES

5.8 TECHNOLOGY TRENDS

5.8.1 USE OF CONTROL SENSORS TO AVOID FORMATION OF CONDENSATE ON CHILLED BEAM SURFACES

5.8.2 VIRTUAL REALITY PLATFORM

5.9 PRICING ANALYSIS

TABLE 2 AVERAGE SELLING PRICE RANGE OF CHILLED BEAMS

TABLE 3 AVERAGE SELLING PRICE RANGE OF CHILLERS

5.10 TRADE ANALYSIS

TABLE 4 EXPORT DATA, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 5 IMPORT DATA, BY COUNTRY, 2015–2019 (USD MILLION)

5.11 PATENT ANALYSIS

5.11.1 PATENTS PERTAINING TO MARKET

5.12 REGULATORY LANDSCAPE

6 CHILLED BEAM SYSTEM MARKET, BY FUNCTION (Page No. - 74)

6.1 INTRODUCTION

FIGURE 26 GLOBAL CHILLED BEAM SYSTEM MARKET, BY FUNCTION

6.2 COOLING

6.3 COOLING AND HEATING

7 CHILLED BEAM SYSTEM MARKET, BY BUSINESS (Page No. - 75)

7.1 INTRODUCTION

FIGURE 27 MARKET, BY BUSINESS

TABLE 6 MARKET, BY BUSINESS, 2016–2019 (USD MILLION)

TABLE 7 MARKET, BY BUSINESS, 2020–2025 (USD MILLION)

7.2 NEW CONSTRUCTIONS

7.2.1 SIGNIFICANT LONG-TERM COST SAVINGS AND HIGH ENERGY EFFICIENCY OFFERED BY CHILLED BEAM SYSTEMS TO DRIVE THEIR DEMAND IN NEW CONSTRUCTIONS

7.3 RENOVATIONS

7.3.1 ENERGY SAVING POTENTIAL OF CHILLED BEAM SYSTEMS IS BOOSTING THEIR DEMAND IN RENOVATION BUSINESS

8 CHILLED BEAM SYSTEM MARKET, BY DESIGN (Page No. - 78)

8.1 INTRODUCTION

FIGURE 28 ACTIVE CHILLED BEAM SYSTEMS TO LEAD OVERALL MARKET BY 2025

TABLE 8 MARKET, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 9 CHILLED BEAM SYSTEM MARKET, BY DESIGN, 2020–2025 (USD MILLION)

FIGURE 29 MARKET, BY DESIGN

8.2 ACTIVE CHILLED BEAMS

8.2.1 STRINGENT REGULATIONS REGARDING ENERGY-EFFICIENT BUILDINGS IN US ARE LIKELY TO FUEL DEMAND FOR ACTIVE CHILLED BEAMS

TABLE 10 ACTIVE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 ACTIVE MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 12 NORTH AMERICAN ACTIVE MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 13 NORTH AMERICAN ACTIVE CHILLED BEAM MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 14 EUROPEAN ACTIVE MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 15 EUROPEAN ACTIVE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 16 ACTIVE CHILLED BEAM MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 17 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 18 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 19 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD THOUSAND)

8.3 PASSIVE CHILLED BEAMS

8.3.1 PASSIVE CHILLED BEAMS ARE INCREASINGLY BEING PREFERRED IN COMMERCIAL OFFICE SPACES DUE TO THEIR LOW RUNNING COSTS AND ENERGY CONSUMPTION

TABLE 20 PASSIVE CHILLED BEAM MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 PASSIVE CHILLED BEAM MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 22 NORTH AMERICAN PASSIVE CHILLED BEAM MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 23 NORTH AMERICAN PASSIVE CHILLED BEAM MARKET, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 24 EUROPEAN PASSIVE CHILLED BEAM MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 25 EUROPEAN PASSIVE CHILLED BEAM MARKET, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 26 MARKET IN APAC, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 27 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 28 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 29 PASSIVE CHILLED BEAM MARKET IN ROW, BY APPLICATION, 2020–2025 (USD THOUSAND)

8.4 MULTI-SERVICE CHILLED BEAMS

8.4.1 MULTI-SERVICE CHILLED BEAM MARKET TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 30 MULTI-SERVICE CHILLED BEAM MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 MULTI-SERVICE CHILLED BEAM MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 32 MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 33 MARKET, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 34 EUROPEAN MULTI-SERVICE CHILLED BEAM MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 35 EUROPEAN MULTI-SERVICE CHILLED BEAM MARKET, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 36 MULTI-SERVICE CHILLED BEAM MARKET IN APAC, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 37 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 38 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 39 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD THOUSAND)

8.5 CHILLED BEAM SYSTEM ADOPTION BY INSTALLATION TYPE

FIGURE 30 CHILLED BEAM SYSTEM ADOPTION, BY INSTALLATION TYPE

8.5.1 EXPOSED CHILLED BEAMS

8.5.2 RECESSED CHILLED BEAMS

9 CHILLED BEAM SYSTEM MARKET, BY APPLICATION (Page No. - 93)

9.1 INTRODUCTION

FIGURE 31 MARKET, BY APPLICATION

FIGURE 32 COMMERCIAL OFFICES TO LEAD CHILLED BEAM SYSTEM MARKET BY 2025

TABLE 40 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 41 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

9.2 COMMERCIAL OFFICES

9.2.1 CHILLED BEAM SYSTEMS ARE BROADLY ADOPTED IN COMMERCIAL OFFICES AS THEY OFFER INCREASED USABLE FLOOR SPACE

TABLE 42MARKET FOR COMMERCIAL OFFICES, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 43 MARKET FOR COMMERCIAL OFFICES, BY DESIGN, 2020–2025 (USD MILLION)

TABLE 44 MARKET FOR COMMERCIAL OFFICES, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 BEAM SYSTEM MARKET FOR COMMERCIAL OFFICES, BY REGION, 2020–2025 (USD MILLION)

9.3 EDUCATIONAL INSTITUTIONS

9.3.1 CHILLED BEAMS PROVIDE ENVIRONMENT WITH LOW NOISE AND IMPROVED VENTILATION, WHICH IS ESSENTIAL IN CASE OF EDUCATION SETUP

TABLE 46 MARKET FOR EDUCATIONAL INSTITUTIONS, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 47 CHILLED BEAM SYSTEM MARKET FOR EDUCATIONAL INSTITUTIONS, BY DESIGN, 2020–2025 (USD MILLION)

TABLE 48 MARKET FOR EDUCATIONAL INSTITUTIONS, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 49 MARKET FOR EDUCATIONAL INSTITUTIONS, BY REGION, 2020–2025 (USD THOUSAND)

9.4 HEALTHCARE FACILITIES

9.4.1 CHILLED BEAMS’ ENERGY-SAVING POTENTIAL, EASE OF USE, LOW MAINTENANCE, AND MINIMAL SPACE REQUIREMENTS DRIVE THEIR DEMAND IN HEALTHCARE FACILITIES

TABLE 50 MARKET FOR HEALTHCARE FACILITIES, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 51 CHILLED BEAM SYSTEM MARKET FOR HEALTHCARE FACILITIES, BY DESIGN, 2020–2025 (USD MILLION)

TABLE 52 MARKET FOR HEALTHCARE FACILITIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 MARKET FOR HEALTHCARE FACILITIES, BY REGION, 2020–2025 (USD MILLION)

9.5 HOTELS

9.5.1 CHILLED BEAM SYSTEMS ARE GAINING POPULARITY IN HOTELS PRIMARILY FOR THEIR LOW SOUND AND MAINTENANCE

TABLE 54 MARKET FOR HOTELS, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 55 MARKET FOR HOTELS, BY DESIGN, 2020–2025 (USD MILLION)

TABLE 56 MARKET FOR HOTELS, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 MARKET FOR HOTELS, BY REGION, 2020–2025 (USD MILLION)

9.6 OTHERS

TABLE 58 MARKET FOR OTHER APPLICATIONS, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 59 MARKET FOR OTHER APPLICATIONS, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 60 CHILLED BEAM SYSTEM MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 61 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD THOUSAND)

10 GEOGRAPHIC ANALYSIS (Page No. - 105)

10.1 INTRODUCTION

FIGURE 33 MARKET, BY REGION

FIGURE 34 CANADA IS EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 35 ACTIVE MARKET IN EUROPE TO LEAD OVERALL MARKET BY 2025

TABLE 62 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 CHILLED BEAM SYSTEM MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 36 SNAPSHOT: MARKET IN NORTH AMERICA

TABLE 64 NORTH AMERICAN MARKET, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 65 NORTH AMERICAN MARKET, BY DESIGN, 2020–2025 (USD MILLION)

FIGURE 37 EDUCATIONAL INSTITUTIONS TO HOLD LARGEST SIZE OF MARKET IN NORTH AMERICA BY 2025

TABLE 66 NORTH AMERICAN MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 67 NORTH AMERICAN MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 68 NORTH AMERICAN MARKET FOR COMMERCIAL OFFICES, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 69 NORTH AMERICAN CHILLED BEAM SYSTEM MARKET FOR COMMERCIAL OFFICES, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 70 MARKET FOR EDUCATIONAL INSTITUTIONS, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 71 MARKET FOR EDUCATIONAL INSTITUTIONS, BY DESIGN, 2020–2025 (USD MILLION)

TABLE 72 MARKET FOR HEALTHCARE FACILITIES, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 73 MARKET FOR HEALTHCARE FACILITIES, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 74 MARKET FOR HOTELS, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 75 MARKET FOR HOTELS, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 76 MARKET FOR OTHER APPLICATIONS, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 77 MARKET FOR OTHER APPLICATIONS, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 78 MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 79 MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

10.2.1 US

10.2.1.1 Chilled beams are becoming popular as unique cost- and-energy-saving alternative to traditional air conditioning

10.2.2 CANADA

10.2.2.1 Market to grow at highest CAGR in North America

10.2.3 MEXICO

10.2.3.1 Growth in construction industry and increasing number of luxury offices to drive market

10.3 EUROPE

FIGURE 38 SNAPSHOT:MARKET IN EUROPE

TABLE 80 EUROPEAN MARKET, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 81 EUROPEAN MARKET, BY DESIGN, 2020–2025 (USD MILLION)

FIGURE 39 COMMERCIAL OFFICES TO HOLD LARGEST SIZE OF CHILLED BEAM SYSTEM MARKET IN EUROPE BY 2025

TABLE 82 EUROPEAN MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 83 EUROPEAN MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 84 EUROPEAN MARKET FOR COMMERCIAL OFFICES, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 85 EUROPEAN MARKET FOR COMMERCIAL OFFICES, BY DESIGN, 2020–2025 (USD MILLION)

TABLE 86 EUROPEAN MARKET FOR EDUCATIONAL INSTITUTIONS, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 87 EUROPEAN CHILLED BEAM SYSTEM MARKET FOR EDUCATIONAL INSTITUTIONS, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 88 EUROPEAN MARKET FOR HEALTHCARE FACILITIES, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 89 EUROPEAN MARKET FOR HEALTHCARE FACILITIES, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 90 EUROPEAN MARKET FOR HOTELS, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 91 EUROPEAN MARKET FOR HOTELS, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 92 EUROPEAN MARKET FOR OTHER APPLICATIONS, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 93 EUROPEAN MARKET FOR OTHER APPLICATIONS, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 94 EUROPEAN MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 95 EUROPEAN MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

10.3.1 SWEDEN

10.3.1.1 Market to grow at highest rate in Europe

10.3.2 GERMANY

10.3.2.1 Cool and dry climate favorable for market growth

10.3.3 UK

10.3.3.1 Stringent building laws to propel market growth

10.3.4 FRANCE

10.3.4.1 Growth in commercial offices sector to drive market for chilled beam systems

10.3.5 NORWAY

10.3.5.1 Stringent building energy performance standards to drive market

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 40 SNAPSHOT: MARKET IN ASIA PACIFIC

TABLE 96 MARKET IN ASIA PACIFIC, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 97 MARKET IN ASIA PACIFIC, BY DESIGN, 2020–2025 (USD MILLION)

FIGURE 41 MARKET FOR HOTELS TO GROW AT HIGHEST RATE IN APAC FROM 2020 TO 2025

TABLE 98 MARKET IN ASIA PACIFIC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 99 MARKET IN ASIA PACIFIC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 100 MARKET IN ASIA PACIFIC FOR COMMERCIAL OFFICES, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 101 CHILLED BEAM SYSTEM MARKET IN ASIA PACIFIC FOR COMMERCIAL OFFICES, BY DESIGN, 2020–2025 (USD MILLION)

TABLE 102 MARKET IN ASIA PACIFIC FOR EDUCATIONAL INSTITUTIONS, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 103 MARKET IN ASIA PACIFIC FOR EDUCATIONAL INSTITUTIONS, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 104 MARKET IN ASIA PACIFIC FOR HEALTHCARE FACILITIES, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 105 MARKET IN ASIA PACIFIC FOR HEALTHCARE FACILITIES, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 106 MARKET IN ASIA PACIFIC FOR HOTELS, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 107 MARKET IN ASIA PACIFIC FOR HOTELS, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 108 MARKET IN ASIA PACIFIC FOR OTHER APPLICATIONS, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 109 MARKET IN ASIA PACIFIC FOR OTHER APPLICATIONS, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 110 CHILLED BEAM SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 111 MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2025 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Replacement of traditional air condition and ventilation systems to reduce energy consumption is expected to create demand

10.4.2 AUSTRALIA

10.4.2.1 market in Australia to dominate market in APAC during forecast period

10.4.3 INDIA

10.4.3.1 Booming construction industry, emerging smart building criteria, and growing consumer concerns toward energy savings to drive market

10.4.4 CHINA

10.4.4.1 Green construction initiatives to boost market growth

10.4.5 REST OF ASIA PACIFIC

10.5 REST OF THE WORLD (ROW)

FIGURE 42 ACTIVE CHILLED BEAMS TO HOLD LARGEST SIZE OF MARKET IN ROW BY 2025

TABLE 112 MARKET IN ROW, BY DESIGN, 2016–2019 (USD THOUSAND)

TABLE 113 MARKET IN ROW, BY DESIGN, 2020–2025 (USD THOUSAND)

TABLE 114 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 115 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 116 MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 117 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Increasing focus on energy-efficient HVAC systems to drive market

10.5.2 SOUTH AMERICA

10.5.2.1 Development in commercial sector to contribute to market growth

11 COMPETITIVE LANDSCAPE (Page No. - 137)

11.1 INTRODUCTION

11.2 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 43 MARKET: REVENUE ANALYSIS (2019)

11.3 MARKET SHARE ANALYSIS, 2019

TABLE 118 MARKET: MARKET SHARE ANALYSIS (2019)

11.4 COMPANY EVALUATION MATRIX

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 EMERGING LEADER

11.4.4 PARTICIPANT

FIGURE 44 MARKET COMPANY EVALUATION MATRIX, 2019

11.5 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION QUADRANT, 2019

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 45 CHILLED BEAM SYSTEM MARKET, SME EVALUATION QUADRANT, 2019

11.6 MARKET: PRODUCT FOOTPRINT

TABLE 119 PRODUCT FOOTPRINT OF COMPANIES

TABLE 120 APPLICATION FOOTPRINT OF COMPANIES

TABLE 121 REGIONAL FOOTPRINT OF COMPANIES

11.7 COMPETITIVE SITUATIONS AND TRENDS

TABLE 122 MARKET: PRODUCT LAUNCHES

TABLE 123 MARKET: DEALS

TABLE 124 MARKET: OTHER RECENT DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 148)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 HALTON GROUP

TABLE 125 HALTON GROUP: BUSINESS OVERVIEW

12.1.2 LINDAB

FIGURE 46 LINDAB: COMPANY SNAPSHOT

12.1.3 SWEGON GROUP AB

TABLE 126 SWEGON GROUP AB: BUSINESS OVERVIEW

12.1.4 CLIMATE TECHNOLOGIES

TABLE 127 CLIMATE TECHNOLOGIES: BUSINESS OVERVIEW

12.1.5 FLÄKTGROUP HOLDING GMBH

TABLE 128 FLÄKTGROUP HOLDING GMBH: BUSINESS OVERVIEW

12.1.6 FTF GROUP (FRENGER SYSTEMS)

TABLE 129 FTF GROUP: BUSINESS OVERVIEW

12.1.7 PRICE INDUSTRIES

TABLE 130 PRICE INDUSTRIES: BUSINESS OVERVIEW

12.1.8 SYSTEMAIR AB

FIGURE 47 SYSTEMAIR AB: COMPANY SNAPSHOT

12.1.9 TROX GMBH

TABLE 131 TROX GMBH BUSINESS OVERVIEW

12.1.10 JOHNSON CONTROLS INTERNATIONAL PLC

FIGURE 48 JOHNSON CONTROLS INTERNATIONAL PLC: COMPANY SNAPSHOT

12.2 OTHER PLAYERS

12.2.1 TITUS

12.2.2 KRANTZ LIMITED

12.2.3 KIEFER KLIMATECHNIK GMBH

12.2.4 BARCOL-AIR GROUP AG

12.2.5 EB AIR CONTROL INC.

12.2.6 TWA PANEL SYSTEMS, INC.

12.2.7 CARRIER

12.2.8 AIRFIXTURE, LLC

12.2.9 AIRVENT

12.2.10 NUCLIMATE AIR QUALITY SYSTEMS, INC.

12.2.11 MADEL AIR TECHNICAL DIFFUSION

12.2.12 GRADA INTERNATIONAL INC.

12.2.13 SOLID AIR INTERNATIONAL

12.2.14 ROCCHEGGIANI SPA

12.2.15 CAVERION CORPORATION

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT & RELATED REPORTS (Page No. - 177)

13.1 INTRODUCTION

13.2 HVAC SYSTEM MARKET, BY COOLING EQUIPMENT

TABLE 132 HVAC SYSTEM MARKET, BY COOLING EQUIPMENT, 2017–2025 (USD BILLION)

TABLE 133 HVAC SYSTEM MARKET FOR COOLING EQUIPMENT, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 134 HVAC SYSTEM MARKET FOR COOLING EQUIPMENT, BY REGION, 2017–2025 (USD BILLION)

13.2.1 UNITARY AIR CONDITIONERS

TABLE 135 COOLING EQUIPMENT MARKET FOR UNITARY AIR CONDITIONERS, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 136 COOLING EQUIPMENT MARKET FOR UNITARY AIR CONDITIONERS, BY REGION, 2017–2025 (USD BILLION)

13.2.2 VRF SYSTEMS

TABLE 137 COOLING EQUIPMENT MARKET FOR VRF SYSTEMS, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 138 COOLING EQUIPMENT MARKET FOR VRF SYSTEMS, BY REGION, 2017–2025 (USD BILLION)

13.2.3 CHILLERS

TABLE 139 COOLING EQUIPMENT MARKET FOR CHILLERS, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 140 COOLING EQUIPMENT MARKET FOR CHILLERS, BY REGION, 2017–2025 (USD BILLION)

13.2.4 ROOM AIR CONDITIONERS

TABLE 141 COOLING EQUIPMENT MARKET FOR ROOM AIR CONDITIONERS, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 142 COOLING EQUIPMENT MARKET FOR ROOM AIR CONDITIONERS, BY REGION, 2017–2025 (USD MILLION)

13.2.5 COOLERS

TABLE 143 COOLING EQUIPMENT MARKET FOR COOLERS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 144 COOLING EQUIPMENT MARKET FOR COOLERS, BY REGION, 2017–2025 (USD MILLION)

13.2.6 COOLING TOWERS

TABLE 145 COOLING EQUIPMENT MARKET FOR COOLING TOWERS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 146 COOLING EQUIPMENT MARKET FOR COOLING TOWERS, BY REGION, 2017–2025 (USD MILLION)

14 APPENDIX (Page No. - 187)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

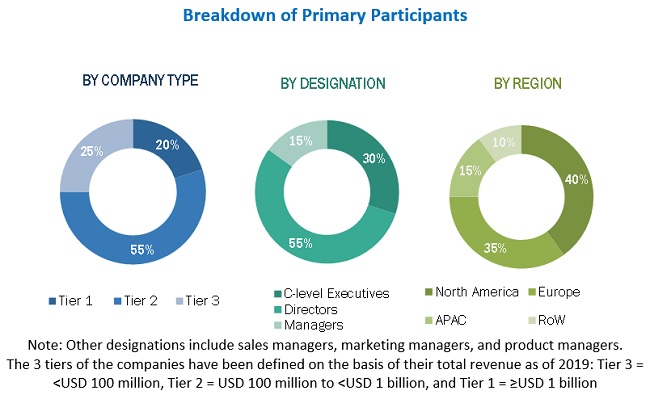

The study involves four major activities for estimating the size of the chilled beam system market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the chilled beam system market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, databases, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, & professional associations have been used to identify and collect information for an extensive technical and commercial study of the chilled beam system market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the chilled beam system market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the chilled beam system market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To define, describe, segment, and forecast the chilled beam system market size, by design type, business, and application, in terms of value

- To describe and forecast the market size, in terms of value, for four key regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the COVID-19 impact on the chilled beam system market

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide details about the chilled beam system market value chain

- To strategically analyze micro markets concerning individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Chilled Beam System Market