Industrial Centrifuge Market by Type (Sediment, Clarifier, Decanter, Disc, Filter, Basket, Screen), Operation (Batch, Continuous), Design (Horizontal, Vertical), End User (Chemical, Power, Food, Wastewater, Pharmaceutical, Paper) & Region - Global Forecast to 2025

The global industrial centrifuge market in terms of revenue was estimated to be worth $7.2 billion in 2020 and is poised to reach $9.0 billion by 2025, growing at a CAGR of 4.4% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The increasing demand for centrifuges in process industries and the rising need for wastewater management solutions are the major factors driving the growth of this market. However, the high cost of centrifuges is expected to restrain the market growth during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Centrifuge Market Dynamics

Drivers: Increasing demand for centrifuge from process industries

Industrial centrifuges are used for the separation of two- or three-phase systems and have a range of industrial applications. Many process industries are increasingly using various types of centrifuge equipment for the separation of two or three immiscible phases. Some of these industries include chemical processing, food processing (including dairy and beverage industry), metal processing, mining and mineral processing, pharmaceutical and biotechnology industries, fuel and biofuel industries, wastewater processing, and pulp and paper industries.

Restraints: High cost of industrial centrifuge

The high cost of industrial centrifuges is a major factor restraining market growth, especially in developing countries. Industrial centrifuges are high-cost equipment, and the procedures involving the use of such equipment are generally expensive. This is mainly due to the requirement of special foundations to absorb vibrations, coupled with the high manufacturing and maintenance costs associated with parts rotating at high speeds. Moreover, centrifuges are not a one-size-fits-all type of equipment, and almost every centrifuge is manufactured by the OEM for a specific application depending on end-user requirements.

Challenge: Decresing oil prices

Crude oil prices have witnessed a consistent decline in recent years. The cost per barrel of oil dropped from USD 65.06 per barrel in 2018 to USD 37.55 per barrel in 2020 in the US. The Energy Information Administration (EIA) forecasted crude oil prices to reach USD 45.70 per barrel in 2021. Also, the retailprice of diesel fuel in the US averaged USD 3.06/gal in 2019, which was 13 cents/gal lower than in 2018. EIA forecasts that the diesel price will average USD 2.52/gal in 2020 and USD 2.59/gal in 2021 (Source: US Energy Information Administration). The decreasing oil prices are affecting the growth of capital equipment vendors, especially industrial centrifuge manufacturers. This is because centrifuges play an important role in oil and gas drilling activities

Opportunities: Growing demad for centrifuges in developing countries

Developing countries such as India, Malaysia, Indonesia, and China are witnessing rapid urbanization, with infrastructure improvements in several sectors, such as wastewater treatment, pharmaceutical & biotech industries, and food and beverage. The rapid economic growth in these countries has encouraged the establishment of various process industries, which in turn is expected to drive the demand for centrifugation equipment.

Power industry accounted for the largest share of the global industrial centrifuge market in 2019

On the basis of end users, the global market is segmented into the chemicals industry, food and beverage industry, metal industry, mining industry, pharmaceutical and biotechnology industries, power plants, pulp and paper industry, wastewater treatment plants, and water purification plants. In 2019, the power industry segment accounted for the largest share of the global market. Growing oil and gas exploration activities, the establishment of new power plants to cater to the rising energy needs in developing countries, and upgradation of existing power plants to make them more efficient and reliable are some of the factors that are expected to drive the growth of this segment.

Vertical Centrifuge dominated the industrial centrifuge market in 2019

On the basis of design, the market is segmented into vertical and horizontal centrifuges. In 2019, the vertical centrifuge segment accounted for the largest share of the market. Growth in this segment can be attributed to factors such as the ability of these centrifuges to attain high speeds and the high efficiency of separation.

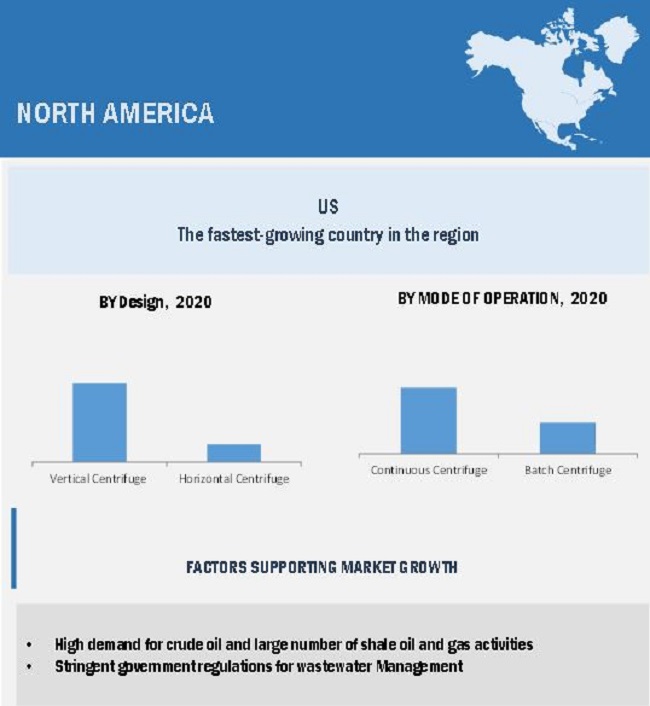

North America accounted for the largest share of the global industrial centrifuge market in 2019.

In 2019, North America accounted for the largest share of the global market, followed by Europe. The high demand for crude oil, a large number of shale oil and gas drilling activities, government initiatives to manage wastewater, flourishing food processing industry, technological advancements, and government support for the development of innovative centrifugation systems are the key factors driving the growth of the global market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Some of the key players include ANDRITZ AG (Austria), Alfa Laval Corporate AB (Sweden), GEA Group AG (Germany), Mitsubishi Kakoki Kaisha, Ltd. (Japan), Thomas Broadbent & Sons (UK), FLSmidth & Co. A/S (Denmark), Schlumberger Limited (US), Ferrum AG (Switzerland), Flottweg SE (Germany), SIEBTECHNIK TEMA (Germany), HEINKEL Drying & Separation Group (Germany), Gruppo Pieralisi - MAIP S.p.A. (Italy), SPX Flow Inc. (US), HAUS Centrifuge Technologies (Turkey), Elgin Separation Solutions (US), Comi Polaris Systems, Inc. (US), Dedert Corporation (US), US Centrifuge Systems (US), B&P Littleford (US), and Pneumatic Scale Angelus (US).

Industrial Centrifuge Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Method, Product, Application, End User, and Region |

|

Geographies Covered |

North America (US, Mexico, and Canada), Europe (Germany, France, UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, and RoAPAC), Latin America, and the Middle East & Africa |

|

Companies Covered |

ANDRITZ AG (Austria), Alfa Laval Corporate AB (Sweden), GEA Group AG (Germany), Mitsubishi Kakoki Kaisha, Ltd. (Japan), Thomas Broadbent & Sons (UK), FLSmidth & Co. A/S (Denmark), Schlumberger Limited (US), Ferrum AG (Switzerland), Flottweg SE (Germany), SIEBTECHNIK TEMA (Germany), HEINKEL Drying & Separation Group (Germany), Gruppo Pieralisi - MAIP S.p.A. (Italy), SPX Flow Inc. (US), HAUS Centrifuge Technologies (Turkey), Elgin Separation Solutions (US), Comi Polaris Systems, Inc. (US), Dedert Corporation (US), US Centrifuge Systems (US), B&P Littleford (US), and Pneumatic Scale Angelus (US). |

This research report categorizes the industrial centrifuge market into the following segments & sub-segments:

By type

-

Sedimentation Centrifuge

- Clarifier /Thickener

- Decanter Centrifuge

- Disc Stack Centrifuge

- Hydrocyclones

- Other Sedimentation Centrifuges

-

Filtering Centrifuge

- Basket Centrifuge

- Scroll Screen Centrifuge

- Peeler Centrifuge

- Pusher Centrifuge

- Inverting Basket Centrifuge

- Vibratory Centrifuge

By Mode of Operation

- Batch centrifuge

- Continuous centrifuge

By Design

- Horizontal centrifuge

- Vertical centrifuge

By End User

- Chemical Industry

- Food and Beverages Industry

- Metal Processing Industry

- Mining Industry

- Pharmaceuticals and Biotechnology Industry

- Power Industry

- Pulp and Paper Industry

- Wastewater Treatment Plants

- Water Purification Plants

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments:

- In 2017, FLSmidth and the University of Denmark extended their partnership for a four-year period to discover additional ways of working together in the global cement and mining industries.

- In 2020, GEA launched GEA sludge Decanter pro line

- In 2019, Alfa Laval launched ALDEC G3 VecFlow decanter

Frequently Asked Questions (FAQ):

What is the projected market of the global industrial centrifuge market in 2025?

The projected market of the global industrial centrifuge market is expected to be 9.0 bilion in 2025.

Who are the leading players in the industrial centrifuge market?

Some of the leading players in the industrial centrifuge market include ANDRITZ AG (Austria), Alfa Laval Corporate AB (Sweden), GEA Group AG (Germany), Mitsubishi Kakoki Kaisha, Ltd. (Japan), Thomas Broadbent & Sons (UK), FLSmidth & Co. A/S (Denmark), Schlumberger Limited (US), Ferrum AG (Switzerland), Flottweg SE (Germany), SIEBTECHNIK TEMA (Germany), HEINKEL Drying & Separation Group (Germany), Gruppo Pieralisi - MAIP S.p.A. (Italy), SPX Flow Inc. (US), HAUS Centrifuge Technologies (Turkey), Elgin Separation Solutions (US)

Who are the major end-users of the industrial centrifuge market?

The end user of the industrial centrifuge market includes chemicals industry, food and beverage industry, metal industry, mining industry, pharmaceutical and biotechnology industries, power plants, pulp and paper industry, wastewater treatment plants, and water purification plants.power industry is the largest end-users in the industrial centrifuge market.

What are the major types in the industrial centrifuge market?

By type, the global industrial centrifuge market is segmented into sedimentation centrifuge and filtering centrifuge. The sedimentation centrifuge segment is expected to dominate the global market.

What are the major design in the industrial centrifuge market?

By design, the global industrial centrifuge market is segmented into vertical and horizontal centrifuge. The vertical centrifuge segment is expected to dominate the industrial centrifuge market during the forecast period.

What are the major mode of operation in the industrial centrifuge market?

By mode of operation, the global industrial centrifuge market is segmented into batch and continuous centrifuge. The continuous centrifuge segment is expected to dominate the industrial centrifuge market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 INDUSTRIAL CENTRIFUGE MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key industry insights

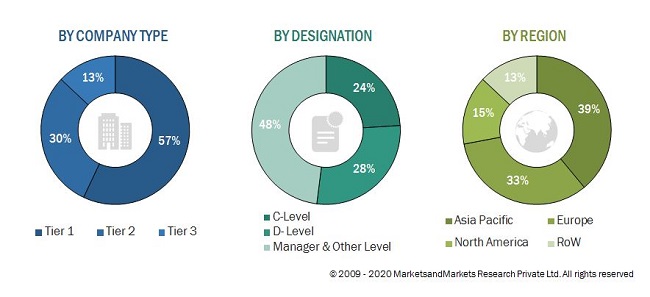

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY DESIGNATION AND REGION 43

2.2 MARKET SIZE ESTIMATION

FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (1)

FIGURE 7 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2)

FIGURE 8 TOP-DOWN APPROACH

2.2.1 GROWTH FORECAST

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 10 INDUSTRIAL CENTRIFUGE MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 11 SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 12 FILTERING CENTRIFUGE MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 13 GLOBAL MARKET, BY MODE OF OPERATION, 2020 VS. 2025 (USD MILLION)

FIGURE 14 GLOBAL MARKET, BY DESIGN, 2020 VS. 2025 (USD MILLION)

FIGURE 15 GLOBAL MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 16 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 INDUSTRIAL CENTRIFUGE MARKET OVERVIEW

FIGURE 17 INCREASING DEMAND FOR CENTRIFUGES IN PROCESS INDUSTRIES IS A MAJOR FACTOR DRIVING MARKET GROWTH

4.2 GLOBAL MARKET, BY TYPE

FIGURE 18 SEDIMENTATION CENTRIFUGES ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4.3 NORTH AMERICAN MARKET, BY TYPE & COUNTRY (2019)

FIGURE 19 US ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2019

4.4 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

FIGURE 20 ASIA PACIFIC MARKET TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 INDUSTRIAL CENTRIFUGE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand for centrifuges from process industries

5.2.1.2 Growing need for wastewater management solutions

TABLE 1 INVESTMENTS IN WATER UTILITIES AND WASTEWATER TREATMENT

5.2.2 RESTRAINTS

5.2.2.1 High cost of industrial centrifuges

5.2.2.2 Slow replacement of equipment due to longer life span

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for centrifuges in developing countries

5.2.4 CHALLENGES

5.2.4.1 Decreasing oil prices

5.2.4.2 Competition from low-cost vendors

5.3 COVID-19 IMPACT ON THE GLOBAL MARKET

5.3.1 COVID-19 HEALTH ASSESSMENT

TABLE 2 COVID-19 CASES IN DIFFERENT REGIONS

5.3.2 IMPACT ON THE GLOBAL MARKET

FIGURE 22 IMPACT OF COVID-19 ON THE GLOBAL MARKET

6 REGULATORY STANDARDS (Page No. - 64)

6.1 INTRODUCTION

6.2 STANDARDS AND CERTIFICATIONS

TABLE 3 LIST OF STANDARDS REFERENCED DIRECTLY BY BS.EN12547

6.3 GOOD MANUFACTURING PRACTICE (GMP) GUIDELINES

7 INDUSTRIAL CENTRIFUGE MARKET, BY TYPE (Page No. - 67)

7.1 INTRODUCTION

TABLE 4 GLOBAL MARKET, BY TYPE, 2018-2025 (USD MILLION)

7.2 SEDIMENTATION CENTRIFUGE

TABLE 5 GLOBAL SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 6 GLOBAL SEDIMENTATION CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 7 NORTH AMERICA: SEDIMENTATION CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 8 EUROPE: SEDIMENTATION CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 9 ASIA PACIFIC: SEDIMENTATION CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.2.1 CLARIFIER/THICKENER

7.2.1.1 Clarifiers are used in a large variety of industries for removing effluents?a key factor driving market growth

TABLE 10 GLOBAL CLARIFIER/THICKENER MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 11 NORTH AMERICA: CLARIFIER/THICKENER MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 12 EUROPE: CLARIFIER/THICKENER MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 13 ASIA PACIFIC: CLARIFIER/THICKENER MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.2.2 DECANTER CENTRIFUGE

7.2.2.1 Decanter centrifuge segment is expected to grow at the highest CAGR in the sedimentation centrifuge market

TABLE 14 GLOBAL DECANTER CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 15 NORTH AMERICA: DECANTER CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 16 EUROPE: DECANTER CENTRIFUGE MARKET, BY COUNTRY,2018-2025 (USD MILLION)

TABLE 17 ASIA PACIFIC: DECANTER CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 18 GLOBAL HORIZONTAL DECANTER CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (UNITS)

TABLE 19 GLOBAL HORIZONTAL DECANTER CENTRIFUGE MARKET, BY END USER, 2018-2025 (UNITS)

7.2.3 DISC STACK CENTRIFUGE

7.2.3.1 Disc stack centrifuges work at a higher rotation speed as compared to other centrifuges owing to their sophisticated design

TABLE 20 GLOBAL DISC STACK CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 21 NORTH AMERICA: DISC STACK CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 22 EUROPE: DISC STACK CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 23 ASIA PACIFIC: DISC STACK CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.2.4 HYDROCYCLONES

7.2.4.1 The degree of separation obtained in hydrocyclones is generally coarse, thus finding extensive applications in mineral processing and production of food powders

TABLE 24 GLOBAL HYDROCYCLONES MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 25 NORTH AMERICA: HYDROCYCLONES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 26 EUROPE: HYDROCYCLONES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 27 ASIA PACIFIC: HYDROCYCLONES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.2.5 OTHER SEDIMENTATION CENTRIFUGES

TABLE 28 GLOBAL OTHER SEDIMENTATION CENTRIFUGES MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 29 NORTH AMERICA: OTHER SEDIMENTATION CENTRIFUGES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 30 EUROPE: OTHER SEDIMENTATION CENTRIFUGES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 31 ASIA PACIFIC: OTHER SEDIMENTATION CENTRIFUGES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3 FILTERING CENTRIFUGE

TABLE 32 GLOBAL FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 33 GLOBAL FILTERING CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 34 NORTH AMERICA: FILTERING CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 35 EUROPE: FILTERING CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 36 ASIA PACIFIC: FILTERING CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.1 BASKET CENTRIFUGE

7.3.1.1 Basket centrifuges form the largest segment of the filtering centrifuge market

TABLE 37 GLOBAL BASKET CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 38 NORTH AMERICA: BASKET CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 39 EUROPE: BASKET CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 40 ASIA PACIFIC: BASKET CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.2 SCROLL SCREEN CENTRIFUGE

7.3.2.1 One of the major applications of scroll screen centrifuges is in the coal preparation industry

TABLE 41 GLOBAL SCROLL SCREEN CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 42 NORTH AMERICA: SCROLL SCREEN CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 43 EUROPE: SCROLL SCREEN CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 44 ASIA PACIFIC: SCROLL SCREEN CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.3 PEELER CENTRIFUGE

7.3.3.1 High speed of rotation and high efficiency of separation are the key factors driving market growth

TABLE 45 GLOBAL PEELER CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 46 NORTH AMERICA: PEELER CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 47 EUROPE: PEELER CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 48 ASIA PACIFIC: PEELER CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.4 PUSHER CENTRIFUGE

7.3.4.1 Pusher centrifuges are highly effective for feed slurries containing a wide range of solid content, thus finding applications in the chemical and mineral industry

TABLE 49 GLOBAL PUSHER CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 50 NORTH AMERICA: PUSHER CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 51 EUROPE: PUSHER CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 52 ASIA PACIFIC: PUSHER CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.5 INVERTING BASKET CENTRIFUGE

7.3.5.1 Inverting basket centrifuges are designed for typical pharmaceutical applications

TABLE 53 GLOBAL INVERTING BASKET CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 54 NORTH AMERICA: INVERTING BASKET CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 55 EUROPE: INVERTING BASKET CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 56 ASIA PACIFIC: INVERTING BASKET CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.6 VIBRATORY CENTRIFUGE

7.3.6.1 Vibratory centrifuges are suitable for processing mass products

TABLE 57 GLOBAL VIBRATORY CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 58 NORTH AMERICA: VIBRATORY CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 59 EUROPE: VIBRATORY CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 60 ASIA PACIFIC: VIBRATORY CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

8 INDUSTRIAL CENTRIFUGE MARKET, BY MODE OF OPERATION (Page No. - 94)

8.1 INTRODUCTION

TABLE 61 GLOBAL MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

8.2 CONTINUOUS CENTRIFUGE

8.2.1 THE CONTINUOUS CENTRIFUGE SEGMENT IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 62 CONTINUOUS CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 63 NORTH AMERICA: CONTINUOUS CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 64 EUROPE: CONTINUOUS CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 65 ASIA PACIFIC: CONTINUOUS CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

8.3 BATCH CENTRIFUGE

8.3.1 BATCH-TYPE CENTRIFUGAL FILTERS ARE SIMPLE IN DESIGN AND VERSATILE IN APPLICATION

TABLE 66 BATCH CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 67 NORTH AMERICA: BATCH CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 68 EUROPE: BATCH CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 69 ASIA PACIFIC: BATCH CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

9 INDUSTRIAL CENTRIFUGE MARKET, BY DESIGN (Page No. - 99)

9.1 INTRODUCTION

TABLE 70 GLOBAL MARKET, BY DESIGN, 2018-2025 (USD MILLION)

9.2 HORIZONTAL CENTRIFUGE

9.2.1 HORIZONTAL ORIENTATION OFFERS ADVANTAGES LIKE IMPROVED WASHING CAPABILITIES AND UNIFORM SOLID SIZE DISTRIBUTION FOR ENHANCED SOLID OUTPUT QUALITY

TABLE 71 HORIZONTAL INDUSTRIAL CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

9.3 VERTICAL CENTRIFUGE

9.3.1 VERTICAL CENTRIFUGE SEGMENT IS THE LARGEST SEGMENT IN THIS MARKET

TABLE 75 VERTICAL INDUSTRIAL CENTRIFUGE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 77 EUROPE: VERTICAL , BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 78 ASIA PACIFIC: VERTICAL MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

10 INDUSTRIAL CENTRIFUGE MARKET, BY END USER (Page No. - 104)

10.1 INTRODUCTION

TABLE 79 GLOBAL MARKET, BY END USER, 2018-2025 (USD MILLION)

10.2 POWER INDUSTRY

10.2.1 THE POWER INDUSTRY IS THE LARGEST END USER OF INDUSTRIAL CENTRIFUGES

TABLE 80 GLOBAL MARKET FOR THE POWER INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET FOR THE POWER INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 82 EUROPE: MARKET FOR THE POWER INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION) 107

TABLE 83 ASIA PACIFIC: MARKET FOR THE POWER INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

10.3 WASTEWATER TREATMENT PLANTS

10.3.1 INCREASING POPULATION LEVELS, ENVIRONMENTAL DEGRADATION, AND ECONOMIC DEVELOPMENT ARE THE KEY FACTORS DRIVING THE MARKET GROWTH

TABLE 84 GLOBAL MARKET FOR WASTEWATER TREATMENT PLANTS, BY REGION, 2018-2025 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET FOR WASTEWATER TREATMENT PLANTS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 86 EUROPE: MARKET FOR WASTEWATER TREATMENT PLANTS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET FOR WASTEWATER TREATMENT PLANTS, BY COUNTRY, 2018-2025 (USD MILLION)

10.4 FOOD AND BEVERAGE INDUSTRY

10.4.1 THE CENTRIFUGE SEPARATION PROCESS HAS IMPORTANT APPLICATIONS IN THE PROCESSING OF FOOD AND BEVERAGES

TABLE 88 GLOBAL MARKET FOR THE FOOD AND BEVERAGE INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET FOR THE FOOD AND BEVERAGE INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 90 EUROPE: MARKET FOR THE FOOD AND BEVERAGE INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET FOR THE FOOD AND BEVERAGE INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 92 GLOBAL MARKET FOR THE FOOD AND BEVERAGE INDUSTRY, BY TYPE, 2018-2025 (USD MILLION)

TABLE 93 GLOBAL MARKET FOR THE OLIVE OIL INDUSTRY, BY REGION, 2018-2025 (USD THOUSAND)

10.5 MINING INDUSTRY

10.5.1 INDUSTRIAL CENTRIFUGES ARE USED FOR MINERAL RECOVERY AND DRYING OF ORES IN THE MINING INDUSTRY

TABLE 94 GLOBAL MARKET FOR THE MINING INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET FOR THE MINING INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 96 EUROPE: MARKET FOR THE MINING INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION) 114

TABLE 97 ASIA PACIFIC: MARKET FOR THE MINING INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

10.6 CHEMICALS INDUSTRY

10.6.1 INCREASING DEMAND FOR RENEWABLE AND BIO-BASED CHEMICAL MATERIALS TO DRIVE THIS SEGMENT

TABLE 98 GLOBAL MARKET FOR THE CHEMICALS INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET FOR THE CHEMICALS INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 100 EUROPE: MARKET FOR THE CHEMICALS INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET FOR THE CHEMICALS INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 102 GLOBAL MARKET FOR THE CHEMICALS INDUSTRY, BY TYPE, 2018-2025 (USD MILLION)

10.7 WATER PURIFICATION PLANTS

10.7.1 CENTRIFUGES ARE USED FOR THE REMOVAL OF CHEMICALS AND BIOLOGICAL CONTAMINANTS IN THE WATER PURIFICATION PROCESS

TABLE 103 GLOBAL MARKET FOR WATER PURIFICATION PLANTS,BY REGION, 2018-2025 (USD MILLION) 117

TABLE 104 NORTH AMERICA: MARKET FOR WATER PURIFICATION PLANTS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 105 EUROPE: MARKET FOR WATER PURIFICATION PLANTS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET FOR WATER PURIFICATION PLANTS, BY COUNTRY, 2018-2025 (USD MILLION)

10.8 PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES

10.8.1 THE INCREASING GLOBAL DEMAND FOR DRUGS DURING COVID-19 HAS LED TO INCREASED PRODUCTION

TABLE 107 GLOBAL MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES, BY REGION, 2018-2025 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 109 EUROPE: MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 111 GLOBAL MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES, BY TYPE, 2018-2025 (USD MILLION)

10.9 METAL PROCESSING INDUSTRY

10.9.1 THE GROWING DEMAND FOR METALS IN TRANSPORTATION, CONSTRUCTION, AND MECHANICAL ENGINEERING ARE FACTORS DRIVING MARKET GROWTH

TABLE 112 GLOBAL MARKET FOR THE METAL PROCESSING INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET FOR THE METAL PROCESSING INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 114 EUROPE: MARKET FOR THE METAL PROCESSING INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET FOR THE METAL PROCESSING INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

10.1 PULP AND PAPER INDUSTRY

10.10.1 GROWING DEMAND FOR PAPER USED IN PACKAGING MATERIALS AND THE INCREASING DEMAND FOR SANITARY PRODUCTS ARE FACTORS DRIVING MARKET GROWTH

TABLE 116 GLOBAL MARKET FOR THE PULP AND PAPER INDUSTRY, BY REGION, 2018-2025 (USD MILLION) 123

TABLE 117 NORTH AMERICA: MARKET FOR PULP AND PAPER INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 118 EUROPE: MARKET FOR THE PULP AND PAPER INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET FOR THE PULP AND PAPER INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

11 INDUSTRIAL CENTRIFUGE MARKET, BY REGION (Page No. - 125)

11.1 INTRODUCTION

TABLE 120 GLOBAL MARKET, BY REGION, 2018-2025 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 23 NORTH AMERICA: INDUSTRIAL CENTRIFUGE MARKET SNAPSHOT

TABLE 121 NORTH AMERICA: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 123 NORTH AMERICA: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 124 NORTH AMERICA: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 127 NORTH AMERICA: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.2.1 US

11.2.1.1 The US dominates the North American market

TABLE 128 US: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 129 US: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 130 US: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 131 US: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 132 US: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 133 US: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.2.2 CANADA

11.2.2.1 The Canadian market for industrial centrifuges is majorly driven by growing oil sand exploration activities

TABLE 134 CANADA: INDUSTRIAL CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 135 CANADA: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 136 CANADA: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 137 CANADA: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 138 CANADA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 139 CANADA: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Rising government investments to drive market growth

TABLE 140 MEXICO: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 141 MEXICO: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 142 MEXICO: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 143 MEXICO: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 144 MEXICO: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 145 MEXICO: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3 EUROPE

TABLE 146 EUROPE: INDUSTRIAL CENTRIFUGE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 147 EUROPE: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 148 EUROPE: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 149 EUROPE: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 150 EUROPE: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 151 EUROPE: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 152 EUROPE: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany is the largest European market for industrial wastewater treatment

TABLE 153 GERMANY: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 154 GERMANY: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 155 GERMANY: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 156 GERMANY: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 157 GERMANY: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 158 GERMANY: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 The market for industrial centrifuges in France is majorly driven by the well-established infrastructure for water and waste management

TABLE 159 FRANCE: INDUSTRIAL CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 160 FRANCE: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 161 FRANCE: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 162 FRANCE: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 163 FRANCE: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 164 FRANCE: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.3 UK

11.3.3.1 The UK is the fourth-largest chemicals producer in the EU?a key factor driving the adoption of industrial centrifuges

TABLE 165 UK: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 166 UK: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 167 UK: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 168 UK: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 169 UK: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 170 UK: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.4 SPAIN

11.3.4.1 Spain is the world's leading source of olive oil?a key driver for the adoption of industrial centrifuges in this market

TABLE 171 SPAIN: INDUSTRIAL CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 172 SPAIN: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 173 SPAIN: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 174 SPAIN: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 175 SPAIN: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 176 SPAIN: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.5 ITALY

11.3.5.1 Water scarcity in Italy has led to increased use of industrial centrifuges in the country

TABLE 177 ITALY: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 178 ITALY: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 179 ITALY: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 180 ITALY: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 181 ITALY: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 182 ITALY: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 183 CRUDE OIL PRODUCTION, 2017

TABLE 184 ROE: INDUSTRIAL CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 185 ROE: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 186 ROE: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 187 ROE: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 188 ROE: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 189 ROE: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 24 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 190 ASIA PACIFIC: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 191 ASIA PACIFIC: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 192 ASIA PACIFIC: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 193 ASIA PACIFIC: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 194 ASIA PACIFIC: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 195 ASIA PACIFIC: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 196 ASIA PACIFIC: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 High adoption and use of wastewater management is a key driver for the growth of this market

TABLE 197 JAPAN: INDUSTRIAL CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 198 JAPAN: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 199 JAPAN: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 200 JAPAN: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 201 JAPAN: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 202 JAPAN: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.2 CHINA

11.4.2.1 China is the second-largest pharmaceutical market in the world

TABLE 203 CHINA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 204 CHINA: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 205 CHINA: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 206 CHINA: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 207 CHINA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 208 CHINA: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Growing food & beverage industry and a flourishing pharmaceutical industry are the key drivers for market growth in India

TABLE 209 INDIA: INDUSTRIAL CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 210 INDIA: SEDIMENTATION CENTRIFUGE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 211 INDIA: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 212 INDIA: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 213 INDIA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 214 INDIA: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.4 REST OF ASIA PACIFIC

TABLE 215 ROAPAC: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 216 ROAPAC: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 217 ROAPAC: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 218 ROAPAC: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 219 ROAPAC: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 220 ROAPAC: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.5 LATIN AMERICA

11.5.1 FLOURISHING OIL AND GAS INDUSTRY IN LATIN AMERICA IS LIKELY TO BOOST MARKET GROWTH FOR INDUSTRIAL CENTRIFUGES

TABLE 221 LATIN AMERICA: INDUSTRIAL CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 222 LATIN AMERICA: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 223 LATIN AMERICA: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 225 LATIN AMERICA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 226 LATIN AMERICA: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.6 MIDDLE EAST AND AFRICA

11.6.1 PRESENCE OF LARGE OIL RESERVES TO DRIVE MARKET GROWTH

TABLE 227 MEA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 228 MEA: SEDIMENTATION CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 229 MEA: FILTERING CENTRIFUGE MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 230 MEA: MARKET, BY MODE OF OPERATION, 2018-2025 (USD MILLION)

TABLE 231 MEA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 232 MEA: MARKET, BY END USER, 2018-2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 177)

12.1 OVERVIEW

FIGURE 25 KEY PLAYERS ADOPTED ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN 2017 AND 2020

FIGURE 26 MARKET EVOLUTION FRAMEWORK

12.2 MARKET RANKING ANALYSIS, 2019

FIGURE 27 DECANTER AND SEPARATOR CENTRIFUGES MARKET RANKING ANALYSIS, 2019

12.3 COMPETITIVE SCENARIO

12.3.1 PARTNERSHIPS

12.3.2 PRODUCT LAUNCHES

12.3.3 EXPANSIONS

12.3.4 ACQUISITIONS

12.4 COMPETITIVE LEADERSHIP MAPPING

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE

12.4.4 EMERGING COMPANIES

FIGURE 28 MNM VENDOR DIVE COMPARISON MATRIX: INDUSTRIAL CENTRIFUGE MARKET

13 COMPANY PROFILES (Page No. - 183)

(Business Overview, Products Offered, Recent Developments, MnM View)*

13.1 ANDRITZ AG

FIGURE 29 ANDRITZ AG: COMPANY SNAPSHOT (2019)

13.2 ALFA LAVAL CORPORATE AB

FIGURE 30 ALFA LAVAL CORPORATE AB: COMPANY SNAPSHOT (2019)

13.3 GEA GROUP AG

FIGURE 31 GEA GROUP AG: COMPANY SNAPSHOT (2019)

13.4 THOMAS BROADBENT & SONS, LTD.

13.5 FLSMIDTH & CO. A/S

FIGURE 32 FLSMIDTH: COMPANY SNAPSHOT (2019)

13.6 SCHLUMBERGER LIMITED

FIGURE 33 SCHLUMBERGER LIMITED: COMPANY SNAPSHOT (2019)

13.7 SPX FLOW, INC.

FIGURE 34 SPX FLOW, INC.: COMPANY SNAPSHOT (2019)

13.8 MITSUBISHI KAKOKI KAISHA, LTD.

FIGURE 35 MITSUBISHI KAKOKI KAISHA, LTD.: COMPANY SNAPSHOT (2019)

13.9 FLOTTWEG SE

13.10 DEDERT CORPORATION

13.11 FERRUM LTD.

13.12 SIEBTECHNIK TEMA (A SUBSIDIARY OF SIEBTECHNIK GMBH)

13.13 HEINKEL DRYING AND SEPARATION GROUP

13.14 GRUPPO PIERALISI - MAIP S.P.A.

13.15 HAUS CENTRIFUGE TECHNOLOGIES

13.16 COMI POLARIS SYSTEMS

13.17 US CENTRIFUGE SYSTEMS

13.18 B&P LITTLEFORD

13.19 PNEUMATIC SCALE ANGELUS

13.20 ELGIN SEPARATION SOLUTIONS

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 220)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the global blood collection devices market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the blood collection devices market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as WHO, PEMA, IOGP, and WWEMA. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global industrial centrifuge market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global industrial centrifuge market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as personnel from the equipment planning & procurement manager, heavy equipment operator and technicians) and supply-side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East and the Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

BREAKDOWN OF PRIMARY PARTICIPANTS

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The global size of the industrial centrifuge market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the global industrial centrifuge market and other adjucent submarkets. The research methodology and the market numbers were then validated from primaries.

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the industrial centrifuge market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the industrial centrifuge market

Report Objectives

- To define, describe, segment, and forecast the industrial centrifuge market based on type, design, mode of operation, end user and region

- To provide detailed information about the factors influencing market growth, such as drivers, opportunities, restraints and challenges

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall in industrial centrifuge market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific (APAC), Middle East and Africa

- To profile the key players in the global industrial centrifuge market and comprehensively analyze their core competencies3 and market shares

- To track and analyze competitive developments, such as product launches, expansions, acquisition and partnerships in the industrial centrifuge market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Centrifuge Market