This research study includes significant use of secondary sources, directories, and databases to discover and collect valuable information for analyzing the global cell isolation market. In-depth interviews were conducted with a variety of primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to gather and verify critical qualitative and quantitative data and assess the market's growth prospects. The global market size determined from secondary research was then triangulated with primary research inputs to calculate the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the cell isolation market. The secondary sources used for this study include World Health Organization (WHO), Centers for Disease Control and Prevention (CDC), National Center for Biotechnology Information (NCBI), Stem Cell Society Singapore (SCSS), International Society for Advancement of Cytometry (ISAC), and American Filtration and Separations Society (AFS), Food and Drug Administration (FDA), American Society for Cell Biology (ASCB), National Institutes of Health (NIH), International Society for Cell & Gene Therapy (ISCT), American Society for Gene and Cell Therapy (ASGCT), Pharmaceutical Research and Manufacturers of America (PhRMA), Japan Agency for Medical Research and Development, European Federation of Pharmaceutical Industries and Associations (EFPIA), and the Alliance for Regenerative Medicine (ARM), Statista; corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; press releases; trade, business, professional associations and among others. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

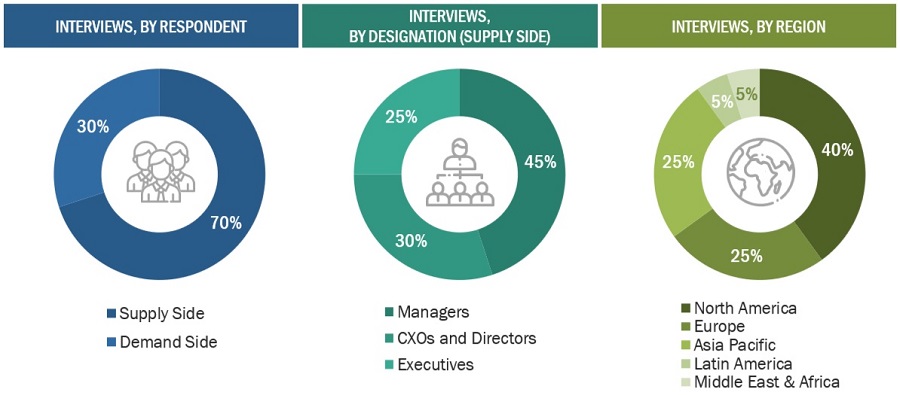

Extensive primary research was conducted after acquiring basic knowledge about the global cell isolation market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as pharmaceutical & biotechnology companies, academic & research institutes, hospitals & diagnostic laboratories, CROs, and CMOs, and experts from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were done in five key regions: Asia Pacific, North America, Europe, Latin America, and Middle East & Africa. About 70% and 30% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This data was gathered using questionnaires, e-mails, online surveys, in-person interviews, and telephone interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

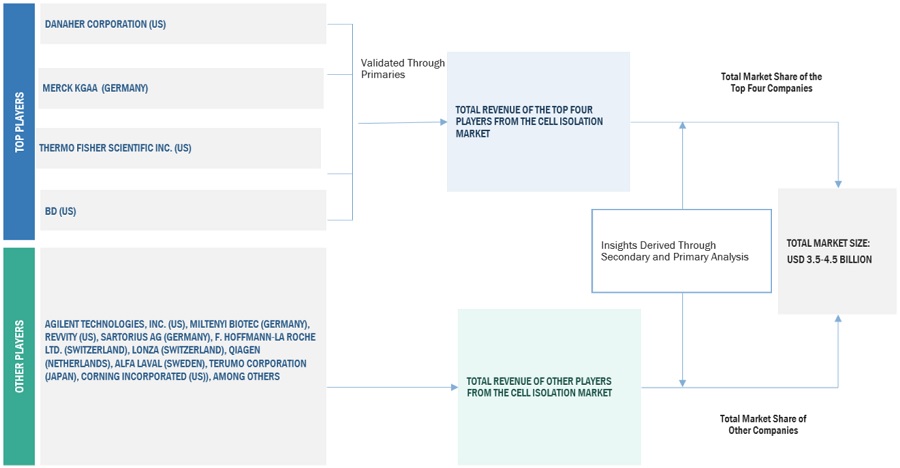

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cell isolation market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Bottom-up Approach

-

The key players in the industry and market have been identified through extensive secondary research

-

The revenues generated from the cell isolation business of leading players have been determined through primary and secondary research

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

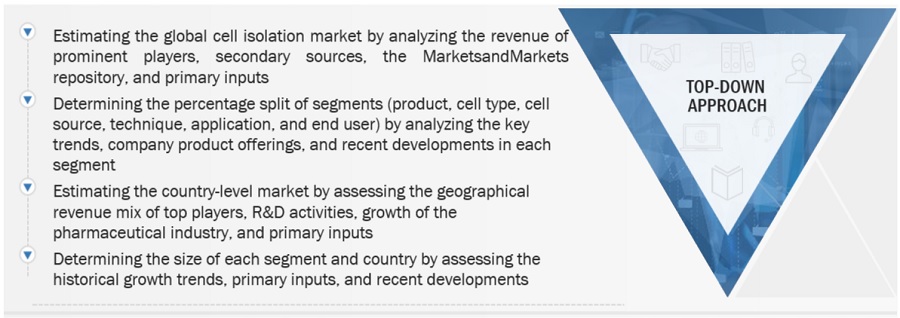

Top-down Approach

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments.

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Cell isolation/cell separation is the process used for separation of an individual cell type from heterogeneous cell populations without contamination from another cell type. Cell isolation instruments and consuambles are widely used for various application from biological research to production of vaccines, drugs, antibodies, enzymes, proteins, and other biotechnology products.

Stakeholders

-

Cell Isolation Product Manufacturers

-

Cell Biology Associations

-

Research & Consulting Firms

-

Distributors of Cell Isolation Products

-

Contract Manufacturers of Global Cell Isolation Products

-

Biotechnology, Biopharmaceutical, and Pharmaceutical Companies

-

Healthcare Institutes (Hospitals, Medical Schools, Diagnostic Centers, Cell Banks, and Outpatient Clinics)

-

Research Institutes and Clinical Research Organizations (CROs)

-

Venture Capitalists

-

Insurance Providers

-

Government Bodies

Report Objectives

-

To define, describe, and forecast the global cell isolation market by product, cell type, cell source, technique, application, end user, and region

-

To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets1 with respect to their individual growth trends, future prospects, and contributions to the total market

-

To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the revenue of the market segments with respect to six major regions:

-

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa

-

To profile the key players and comprehensively analyze their market shares and core competencies

-

To track and analyze competitive developments such as product launches, agreements, partnerships, collaborations, acquisitions, and expansions in the cell isolation market

-

To benchmark players within the cell isolation market using the Company Evaluation Matrix framework, which analyzes market players based on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Portfolio Assessment

-

Product Matrix, which gives a detailed comparison of the product portfolios of the top five companies.

Company Information

-

Detailed analysis and profiling of additional market players (up to five).

Geographical Analysis

-

A further breakdown of the Rest of Europe cell isolation market into countries

-

A further breakdown of the Rest of Asia Pacific cell isolation market into countries

-

A further breakdown of the Rest of Latin American cell isolation market into countries

-

A further breakdown of the Rest of Middle East cell isolation market into countries

Growth opportunities and latent adjacency in Cell Isolation Market