Industrial Ethernet Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Hardware, Software, Services), Protocol (PROFINET, EtherNet/IP), End-use Industry (Automotive & Transportation, Electrical & Electronics) and Region - Global Growth Driver and Industry Forecast to 2028

Industrial Ethernet Market Size and Share

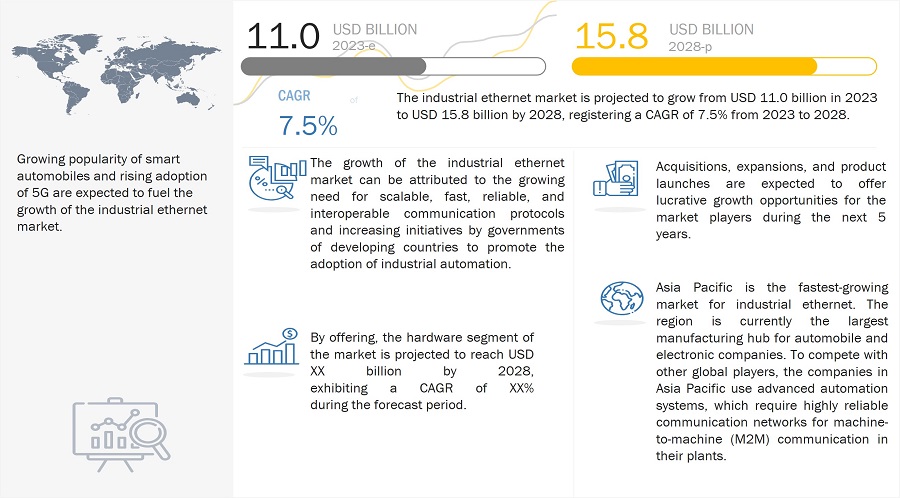

The global industrial ethernet market size is projected to grow from USD 11.0 billion in 2023 to USD 15.8 billion by 2028; it is expected to record atCAGR of 7.5% during the forecast period.

Growing popularity of smart automobiles and rising adoption of 5G are expected to fuel the growth of the industrial ethernet market.

Industrial Ethernet Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

By Offering Segment Analysis:

Service segment to account for the largest share of the industrial ethernet market by 2028

Rapid changes in network infrastructure and the growing adoption of IIoT have led to the adoption of cloud and virtualization. This has significantly increased the pressure on network administrators to manage the network infrastructure. Hence, manufacturing industries are outsourcing network services to ensure better network management quality and reduced operating costs. Companies are adopting remote network monitoring services, which are expected to boost the services market during the forecast period.

By Protocol Segment Analysis:

Industrial Ethernet Market for MODBUS–TCP protocol to grow with significant CAGR during the forecast period

MODBUS–TCP can interact with EtherNet/IP and other industrial Ethernet protocols (i.e., HTTP, FTP, and Telnet) without any non-standard network interface cards and/or switching infrastructure, and thus, offering a high level of interoperability for industrial communication network devices.

By Industry Segment Analysis:

Industrial Ethernet Market for Engineering/Fabrication to have significant CAGR during the forecast period

The industrial ethernet is mainly used in engineering design and fabrication of metal, steel, and other structural parts manufacturing. In the fabrication industry, different networking technologies can be implemented. For instance, the Industrial ethernet ensures consistent, uninterrupted mobile connectivity for workers, vehicles, and equipment while extending connectivity outside the plant (transportation yard and interconnected buildings). It also supports features such as data security and allows workers to coordinate workforce activities and communicate in real-time for better safety management and increasing productivity.

By Regional Growth Analysis:

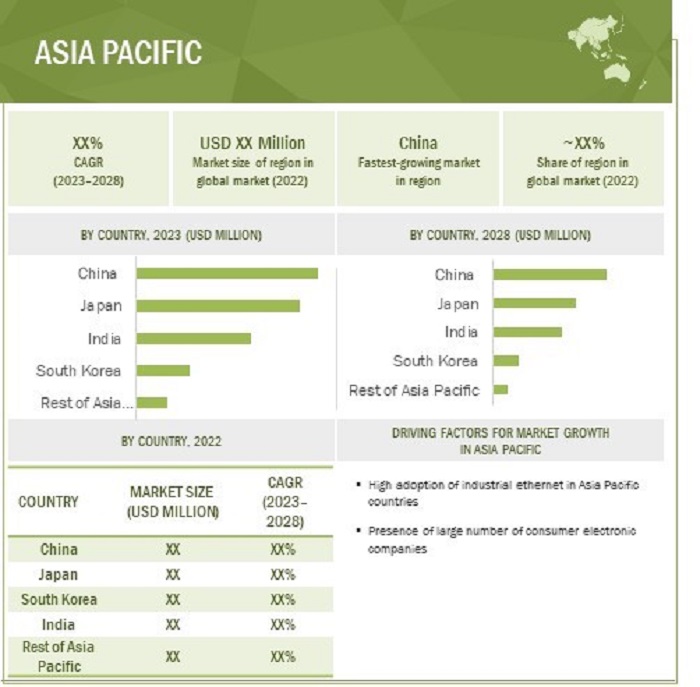

Asia Pacific to grow at the highest CAGR in the industrial ethernet market during the forecast period

Asia Pacific is currently the largest manufacturing hub for automobile and electronic companies. To compete with other global players, the industrial ethernet companies in Asia Pacific use advanced automation systems, which require highly reliable communication networks that can help in machine-to-machine (M2M) communication in the plants. The manufacturing companies in Asia Pacific extensively adopt the smart factory concept for implementing advanced manufacturing technologies on the factory floor. This innovative concept has transformed the manufacturing sector in Asia Pacific and has increased the implementation of smart automation in factories. The growing acceptance of Industrial Revolution 4.0 in Asia Pacific is also a factor driving the growth of the regional market.

Industrial Ethernet Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Industrial Ethernet Companies - Key Market Players

Cisco (US), Siemens (Germany), Rockwell Automation (US), OMRON (Japan), Moxa (Taiwan), Belden( US), Huawei Technologies (China), SICK (Germany), Schneider Electric (France), and ABB (Switzerland) are few major industrial ethernet companies.

Recent Developments

- In November 2022, Siemens launched its new Industrial Edge Management System, an optimized license management solution, as well as new devices at the SPS trade fair in Nuremberg, Germany from November 8 to 10, 2022. The newly launched management systems will bring Operational Technology (OT) and IT closer together in industrial production, enabling a seamless flow of data from the field level to the cloud.

- In October 2022, OMRON signed a pan-European distribution agreement with Conrad Electronic, the Germany-based sourcing platform for technical supplies operating in 17 European countries.

Recession Impact

The market for industrial ethernet might experience slow down due to the coming recession in 2023 and 2024. The companies in the industrial ethernet market have a strong base in the North American and European regions. As the recession is expected to have a major impact in these regions, the overall market for industrial ethernet industry is expected to witness a slow growth rate during the years 2023 and 2024. Automotive & transportation, electrical & electronics, and oil & gas are some of the major industries in this market to be affected by the coming recession.

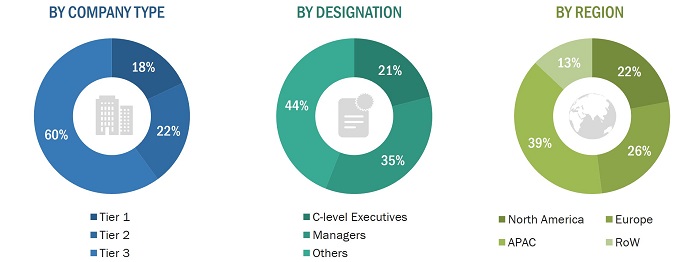

In-depth interviews have been conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the industrial ethernet marketplace.

- By Company Type: Tier 1 - 18%, Tier 2 – 22%, and Tier 3 - 60%

- By Designation: C-Level Executives - 21%, Managers - 35%, and Others – 44%

- By Region: North America - 22%, Europe - 26%, Asia Pacific (APAC)- 39%, and RoW - 13%

Industrial Ethernet Market Dynamics:

Driver: Increasing initiatives by governments of developing countries to promote adoption of industrial automation

The governments of developing countries worldwide are supporting the development of various industries to achieve holistic growth. This has led to an increase in the adoption of various automation and communication components and technologies for the structural development of industries. Governments are highly focused on the process and discrete industries. For instance, the Government of Singapore has partnered with various associations, such as the Singapore Food Manufacturing Association (SFMA) and the Food Innovation Resource Centre, to implement the latest automation solutions, including SCADA, PLC, DCS, robots, and cables, in the food & beverage industry.

The Government of Malaysia introduced a 200% automation capital allowance (ACA) in its 2015 budget to encourage labor-intensive manufacturing industries, such as textile, rubber, and plastics, to adopt the latest automation technologies to improve their overall productivity. Under ACA, the government writes off capital expenditure for manufacturing companies within 3 years (an initial allowance of 40% and an annual allowance of 20%).

India is one of the emerging countries with a fast-growing manufacturing sector. The formulation of the National Manufacturing Policy (NMP) by the central government has increased the development of its manufacturing sector. The government has also launched the Make in India policy to encourage companies to implement automation processes in their manufacturing plants. Thus, the measures taken by the governments to support the adoption of industrial control and factory automation are expected to fuel the growth of the market during the forecast period.

Restraint: Absence of standardization in industrial communication protocols and interfaces

Industrial equipment or devices communicate through various interfaces, technologies, and protocols. The absence of standardization in these communication interfaces and protocols might result in the misrepresentation of data. It also can complicate the integration of systems and hinder the use of plug-and-play features for unrelated systems. This is one of the major restraints for the industrial ethernet market in coming years.

Opportunity: Emergence of 5G to create lucrative opportunities for market players

Industrial communication is a vital element of Industry 4.0. The demand for 5G technology is growing in the manufacturing industry, as 5G helps to overcome the shortcomings of other wireless systems. With the onset of 5G technology, the manufacturing industry will experience a major transformation. With the increasing demand of 5G the demand for industrial ethernet will also increase.

Challenge: Harsh field site conditions-high-voltage transients, severe shocks and vibrations, and extremely high temperatures

Industrial Ethernet devices are deployed in remote field locations which are prone to the effects of unfavorable and harsh conditions, such as high-voltage transients, shocks and vibrations, and extremely high temperatures. High voltage transients result from electrostatic discharge (ESD), bursts, electrical fast transients (EFT), and lightning strikes. These are a few challenges faced in industrial ethernet technology deployment. Therefore, there is a requirement for robust industrial communication equipment to withstand harsh conditions.

Industrial Ethernet Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

11.0 billion |

|

Projected Market Size |

15.8 billion |

|

Growth Rate |

7.5% |

|

Market Size Available for Years |

2023–2028 |

|

Estimated Year |

2023 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

USD Million/USD Billion |

|

Segments Covered |

By offering, protocol, and end-use industry and Region |

|

Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Siemens (Germany), Rockwell Automation (US), Cisco (US), Belden (US), Omron (Japan), Moxa (Taiwan), Huawei Technologies (Sweden), SICK (Germany), Schneider Electric (France), and ABB (Switzerland). |

Industrial Ethernet Market Highlights

This research report categorizes the industrial ethernet market based on by offering, protocol, and end-use industry and Region

|

Aspect |

Details |

|

Based on Offering: |

|

|

Based on Protocol: |

|

|

Based on End-use Industry: |

|

|

Based on the Region: |

|

Frequently Asked Questions (FAQ):

What are the key strategies adopted by the major companies in the industrial ethernet market?

Partnerships and collaborations have been and continue to be the major strategies adopted by the key players to grow in the industrial ethernet market.

Which region will dominate the industrial ethernet market?

Asia Pacific will dominate the industrial ethernet market.

Which are the major companies in the industrial ethernet market?

Cisco (US), Siemens (Germany), Rockwell Automation (US), OMRON (Japan), Moxa (Taiwan), are the key companies in this market.

What are the drivers for new market entrants?

The emergence of the Industrial Internet of Things (IIoT) has opened new growth avenues for the expansion of the industrial ethernet market.

Which end user industry is expected to drive the growth of the market in the next five years?

Water and wastewater is expected to lead the market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study has involved four major activities in estimating the size of the industrial ethernet market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods have been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the industrial ethernet market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand-side and supply-side vendors across four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows-

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the industrial ethernet market. These methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- Revenue of various industrial ethernet hardware, software, and services providers is considered to arrive at global numbers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the industrial ethernet market has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the industrial ethernet market, by offering, protocol, and end-use industry, in terms of value

- To describe and forecast the market size, by region, for North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze Micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To describe the value chain of the industrial ethernet market

- To analyze opportunities in the market for stakeholders and describe the competitive landscape of the market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as product developments/launches, expansion, and acquisitions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Ethernet Market

I have interest in Li-Fi technology, Industrial Automation, Industrial Ethernet, and Industrie 4.0 in India and China. Does the report include information about these parameters?

What all information the report provides specific to major industrial protocols (ProfiNet, EtherCat, PowerLink, Ethernet/IP, etc)? Please response at the earliest. Thank you.

I am looking for information on industrial network connectivity products, such as industrial Ethernet, cellular routers & gateways, other industrial wireless. Network edge devices such as industrial wireless sensors and platforms.

Could you please send me a sample and brochure of this report? What is the best price you can offer? Thanks!

Looking for the market information on Industrial Ethernet Market by Offering (Hardware, Software, and Services) and Protocol (EtherNet/IP, PROFINET, Modbus TCP, POWERLINK, CC-Link IE, EtherCAT, and Sercos III) in North America and Europe regions.

I am writing a short article for online Media about industrial automation trends worldwide, so need a bit more detailed information about the markets and forecast. Thank you.

We are industrial ethernet switch providers. We are intrested in market volume an market share information of these switches. When will be an updated version of this study with updated forecast period available?