Industrial Gaskets Market

Industrial Gaskets Market by Material Type (Semi-metallic, Non-metallic, Metallic), Product Type (Soft Gaskets, Spiral Wound Gaskets), End-use Industry (Refineries, Power Generation, Chemical Processing, Pulp & Paper), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The industrial gasket market is projected to reach USD 16.84 billion by 2030 from USD 12.77 billion in 2025, at a CAGR of 5.7% during the forecast period. Industrial gasket market is growing at a rapid rate due to various factors that are reflective of global industrial, environmental, and technological advancements. Essentially, the growth arises from the growing need for leak-free, durable sealing applications in numerous sectors that manufacture goods under severe conditions involving high pressure, intense temperatures, and harsh chemicals.

KEY TAKEAWAYS

-

BY MATERIAL TYPENon-metallic gaskets include those made of rubber, compressed fiber, PTFE, ePTFE, graphite, and cork. They are very softer and more flexible than metallic gaskets which makes them versatile for many end-use applications, although they do work best in conditions of low to moderate pressure and temperature. Non-metallic gaskets are commonly used in oil & gas, chemical processing, water treatment, food & beverage, and pharmaceutical industries because they are economical, easy to install, and resistant to chemicals.

-

BY PRDUCT TYPEUsed across different industries, soft gaskets are non-metallic sealing components that can be relied on for their flexibility and cost-effectiveness. Moreover, they are easily made from rubber, graphite, cork, PTFE as well as compressed non-asbestos fiber (CNAF). These gaskets are specifically built to tightly compress to flange surfaces and fill gaps to prevent fluid movement the so-called seal— even with a low bolt load. This makes them perfect for systems using soft gaskets, as opposed to metallic gaskets, which would require sealed systems.

-

BY END-USE INDUSTRYIn refinery pipelines and flange connections, spiral wound gaskets are frequently used due to their ability to handle high pressures and temperatures while maintaining a seal during thermal cycling. These gaskets are often installed in the flanges of crude oil transfer lines, gas pipelines, and product delivery systems, where they prevent leaks of flammable hydrocarbons or hydrogen-rich gases

-

BY REGIONThe industrial gaskets market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. The dynamic industrial environment of the Asia Pacific region, combined with its rising energy requirements and infrastructural growth, makes it the fastest-growing market for industrial gaskets. As companies aim at efficiency, safety, and environmental regulations, the need for quality gasket solutions will increase further

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including mergers & acquisition. For instance, Klinger Goup (Austria) have entered into a number of acquisition deals to cater to the growing demand for industrial gaskets across innovative applications. Klinger Spain has announced the acquisition of two well-established sealing solution providers, Productos Salinas and Juntas Besma. This strategic expansion significantly boosts Klinger's footprint in the Spanish market and broadens its product portfolio

The main drivers of growth is the growth of the oil & gas, power generation, and chemical processing industries, especially in emerging markets like India, China, Brazil, and parts of Southeast Asia. All these industries make extensive use of pipelines, refineries, reactors, boilers, and pressure vessels, all of which need gaskets for safe, efficient, and reliable operation. As energy needs expand and industrial processes gather momentum, the demand for high-performance gaskets expands ever more urgently

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The industrial gasket market is witnessing significant trends & disruptions, reshaping customer businesses across various industries. New formulations and innovative manufacturing techniques drive the development of products with improved efficiency. The increasing focus on sustainability and environmental regulations is prompting companies to adopt eco-friendly solutions, enhancing their operational efficiency and reducing their carbon footprint.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demad from oil & gas and power generation

-

Increasing focus on plant safety and reliability

Level

-

Fluctuating raw material prices

-

Availability of alternate sealing solutions

Level

-

Emerging markets and industrial zones

-

Technological advancement & digitaization

Level

-

Stringent quality and certification standards

-

Competition from low-cost manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand from oil & gas and power generation

The market for industrial gaskets is growing drastically, led by the increasing demand from the oil & gas and power generation industries. These segments depend heavily upon gaskets to ensure leak-proof operations in high-temperature and high-pressure applications, with gaskets being essential in ensuring safety and efficiency. In the oil & gas industry, world consumption hit an all-time high in 2023, with oil demand rising 2% to above 100 million barrels per day. This growth can be traced to post-COVID economic recovery and rising industrial activity, led by non-OECD countries. The growth in refining capacity and new pipelines and storage units call for sophisticated gasket solutions to manage aggressive chemicals and harsh operating conditions. Furthermore, increased liquefied natural gas (LNG) projects and offshore drilling operations further propagate the demand for long-lasting and consistent gaskets. The power generation industry also plays a very crucial role in propelling the market. This increase is fueled by the electrification of transport and residential heating as well as by the spread of data centers and digital technologies. Electricity consumption in Asia Pacific and the Middle East grew by about 5%, reflecting the fast-paced industrialization and urbanization of these two regions. Power plants, particularly fossil fuel-fired power plants, need high-performance gaskets to maintain boiler, turbine, and heat exchanger integrity under varying thermal and pressure conditions

Restraint: Fluctuating raw material prices

Unstable raw material prices strongly limit the growth of the industrial gasket business. Gaskets are produced using various materials such as rubber, graphite, PTFE, ePTFE and metals such as stainless steel and copper, all of which are subject to unstable pricing from global market trends. Geopolitical tensions, supply chain disruption, inflation, and energy price fluctuation are some reasons that can cause high material cost swings. A rise in the cost of steel or rubber can cause the cost of production of gaskets to rise considerably. This volatility also discourages manufacturers from maintaining stable pricing strategies and maintaining profit margins. While the volume players can swallow a bit of cost fluctuations or hedge against the price fluctuation, small manufacturers can take in smaller margins or must pass the burden to customers, potentially losing customers to competitors. Other than that, long-term projects as well as large industrial projects can be delayed or renegotiated due to price volatility. Repeatable variation in material prices also impacts research and development expenditure, budgeting, and inventory planning. Therefore, volatile raw material prices introduce uncertainty across the supply chain and reduce the overall market predictability, constraining short-run expansion as well as long-run innovation for the industrial gasket industry

Opportunity: Emerging markets and industrial zones

Growing markets and fast-developing industrial regions are a major growth prospect for the industrial gasket market. With countries in Asia Pacific, Middle East & Africa, Latin America, and parts of Eastern Europe industrializing, demand is sharp for infrastructure, energy, and manufacturing facilities. This growth is directly contributing to the demand for industrial gaskets, which form a very critical part of pipelines, power plants, refineries, chemical plants, and heavy machinery. In countries such as India, China, Indonesia, and Vietnam, government-driven initiatives like "Make in India," "Belt and Road," and "Indonesia Vision 2045" are driving high-value investments in industrial corridors, energy parks, and transport infrastructure. All these projects involve oil plants, LNG terminals, power generation plants, and water treatment plants, all of which need gaskets to carry out operations safely, efficiently and smoothly. For instance, India's upcoming refinery expansions and Southeast Asia's expanding chemical production capacity are generating steady demand for high-performance sealing solutions. Moreover, special economic zones (SEZs) and industrial parks are being established to capture foreign direct investment (FDI) and spur local manufacturing. Such zones tend to contain concentrations of heavy industries, auto plants, and electronics manufacturing facilities, all having specific gasket solutions designed for process machinery, compressors, heat exchangers, and pipelines. As these regions develop greater energy infrastructure and manufacturing capabilities, they establish long-term, scalable demand for gaskets, making them a prime target for international and regional manufacturers of gaskets.

Challenge: Stringent quality and certification standards

Stringent certification and quality standards pose a very significant problem to the industrial gasket industry, especially as end-use applications includes oil & gas, power generation, pharmaceutical, and chemical processing increasingly stress safety, reliability, and compliance. Gaskets serving these applications are required to satisfy stringent pressures, chemical tolerance, heat resistance, and wear-related standards, frequently certified by various global organizations like ASME, API, ISO, and DIN. These standards necessitate sophisticated material science, accurate manufacturing techniques, and ongoing quality assurance testing. For gasket manufacturers, particularly small and medium-sized companies, attaining and sustaining these certifications can prove both time-consuming and expensive. It generally entails considerable investment in specialized equipment, highly trained labor, and third-party verification. Failure to comply with these standards can lead to product rejections, delayed shipments, or loss of contracts, especially in export markets where conformity is unavoidable. Moreover, certification processes differ by industry and by geographical location, adding yet more complexity for businesses dealing internationally. The continuous revision of regulatory systems and the growing need for nature friendly, low-emissions sealing products put further pressure on. As the industries strive to reach zero-leakage standards and greener technology, the burden of compliance increases, rendering some manufacturers unable to keep up. The problem becomes a limitation of entry for new competitors, limits innovation cycles, and raises production cost, ultimately being a market-expansion and competitiveness barrier

Industrial Gaskets Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies press-in-place gaskets, edge-bonded gaskets, and over-molded gaskets for the chemical, pharmaceutical, and food & beverage industries. | Custom-shaped, ensuring reliable placement and optimized sealing performance. |

|

Provides CNAF gaskets, elastomer gaskets, graphite gaskets, and metal gaskets for chemical, pulp & paper, food & beverage, marine, and petrochemical industries. | Excellent sealing performance while being easy to cut, handle, and install. |

|

Offers specialized jacketed gasket, camprofile gasket, and solid metallic gasket for heat exchangers, valves, chemical industry, and power stations. | The specialized gaskets have superior sealing capabilities. Provides excellent resistance to mechanical wear and chemical attack |

|

Develops railcar manway gaskets, hygienic sanitary gaskets, and O-rings. | The gasket is specially designed to improve system performance, simplify assembly, and lower total cost. |

|

Manufactures spiral-wound metal gaskets, corrugated metal gaskets, kammprofile metal gaskets, jacketed metal gaskets, and solid metal gaskets. | Delivers exceptional mechanical strength, versatile, and cost-effective sealing solutions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The industrial gasket market has a complex ecosystem, including manufacturers (Freudenberg Sealing Technologies, Teadit, Klinger Group, Parker Hannifin, Garlock), raw material suppliers (BASF, DOW, Nippon Steel), distributors (Tenneco, Gasco Inc., Sealmax), governments, and end-user industries (ExxonMobil Corporation, Saudi Arabian Oil Co., Honeywell International Inc., General Electric Co.). Prominent companies in this market include well-established, financially stable manufacturers of industrial gasket products. These companies have been operating in the market for several years and possess diversified product portfolios and strong global sales and marketing networks

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Gaskets Market, By Material Type

Non-Metallic gasket is among the fastest growing in the gasket market because of the need for reliable sealing solutions in environmentally sensitive and safety-critical operations. Non-metallic gaskets have also seen an increase in the adoption rates due to the shift toward lightweight and energy-efficient systems. Innovations in material science, such as expanded PTFE, high-performance elastomers, are improving gasket performance and increasing their versatility. Furthermore, the major growth in renewable energy sector , growing industrial automation, and tighter environmental regulations are propelling the market

Industrial Gaskets Market, By Product Type

Soft gaskets exert exceptional sealing force withstanding moderate pressure. Furthermore, they are very effective in the prevention of leakage of liquids and gases in cases like water, steam, air, oil, and mild chemical applications. Widely used in the chemical, food and beverage, and even pharmaceutical industries, soft gaskets also come in handy during maintenance and repair procedures due to their ease of installation and ability to adjust to a variety of contours. Compared to metallic or semi-metallic gaskets, soft gaskets will also prove to be the better alternative as they do not require the same degree of surface machining or preparation for flange imperfections

Industrial Gaskets Market, By End-Use Industry

Industrial gaskets play a critical role in the safe and efficient operation of refineries, where they are used to seal joints and prevent leaks in a wide range of equipment handling high-pressure, high-temperature, and often corrosive fluids. Refineries process crude oil into valuable products like gasoline, diesel, and petrochemicals, involving complex systems such as pipelines, heat exchangers, reactors, and distillation columns. Gaskets ensure the integrity of flange connections, valve bonnets, and other joints, preventing the escape of hazardous substances like hydrocarbons, steam, or toxic gases, which could lead to safety hazards, environmental damage, or operational downtime

REGION

Asia Pacific to be fastest-growing region in global industrial gakets market during forecast period

The energy generation sector in Asia Pacific is a major contributor to the growth of the gasket market. In 2023, electricity generation in region grew by 5.3%. This expansion is driven by the development of new power plants and upgrading of existing ones, with the need for high efficient sealing solutions to ensure operational integrity . the dynamic industrial environment of the Asia Pacific region, combined with its rising energy requirements and infrastructural growth, makes it the fastest-growing market for industrial gaskets. As companies aim at efficiency, safety, and environmental regulations, the need for quality gasket solutions will increase further

Industrial Gaskets Market: COMPANY EVALUATION MATRIX

In the industrial gaskets market matrix, Freudenberg Sealing Technologies (Star) leads with a strong market share and extensive product footprint, due to its broad portfolio of high-performance gaskets, finding appliations in transmissions, differentials, cooling systems, filtering, piping, etc.. Flexitallic (Emerging Leader) has advanced product that offers high performance. Their strategic expansions, underscores its dedication to enhance product availability and customer service across global market. While Freudenberg Sealing Technologies dominates through scale and a diverse portfolio, Flexitallic shows significant potential to move toward the leaders’ quadrant as demand for high performance gaskets continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.1 Billion |

| Market Forecast in 2030 (value) | USD 16.8 Billion |

| Growth Rate | CAGR of 5.7% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Industrial Gaskets Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Power Generation Organization |

|

|

| Distributor |

|

Insights on demand growth in high-potential segments, Support product targeting and faster adoption, Minimize substitution risks through innovation |

| Raw Material Supplier |

|

|

| Gasket Manufacturer |

|

|

RECENT DEVELOPMENTS

- September 2024 : Klinger Spain has announced the acquisition of two well-established sealing solution providers—Productos Salinas and Juntas Besma. This strategic expansion significantly boosts KLINGER’s footprint in the Spanish market and broadens its product portfolio. The integration brings a wider array of offerings, including industrial gaskets, sealing products, specialized rubbers, precision-engineered profiles, and the exclusive Vulkollan polyurethane. With these additions, KLINGER Spain is well-positioned to deliver greater value across a diverse range of industries

- April 2024 : The Klinger Group has announced the acquisition of DIUNIS Wilhelm Gärtner GmbH Stanztechnik, a specialized volume-cutting company based in Wuppertal, Germany. Known for its expertise in producing small, non-metallic gaskets, DIUNIS adds valuable capabilities that align with KLINGER’s strategic focus. This acquisition broadens KLINGER’s product offering and represents a meaningful step in its ongoing expansion and diversification within market

- April 2024 : Freudenberg has expanded its operations in southeast Europe. It has unveiled its new warehouse in Turkey, which ensures much faster deliveries of key products and parts to local customers. Also, this expansion marks another step forward in enhancing sustainability, as transport routes to the customers will now be much more efficient.

Table of Contents

Methodology

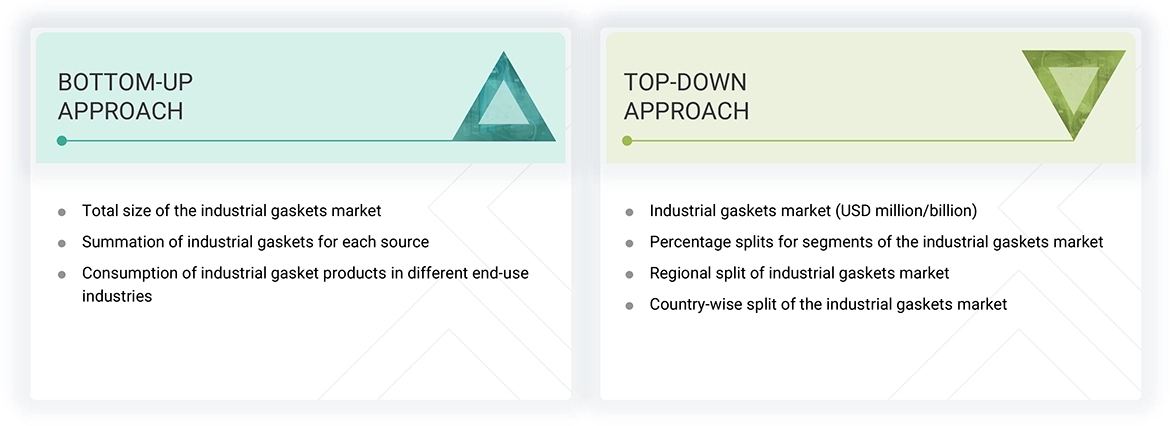

The study involved four major activities to estimate the current size of the global industrial gaskets market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of industrial gaskets through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the industrial gaskets market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study on the industrial gaskets market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

The industrial gaskets market comprises several stakeholders in the supply chain, which include raw material suppliers, equipment suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the industrial gaskets market. Primary sources from the supply side include associations and institutes involved in the industrial gaskets market, key opinion leaders, and processing players.

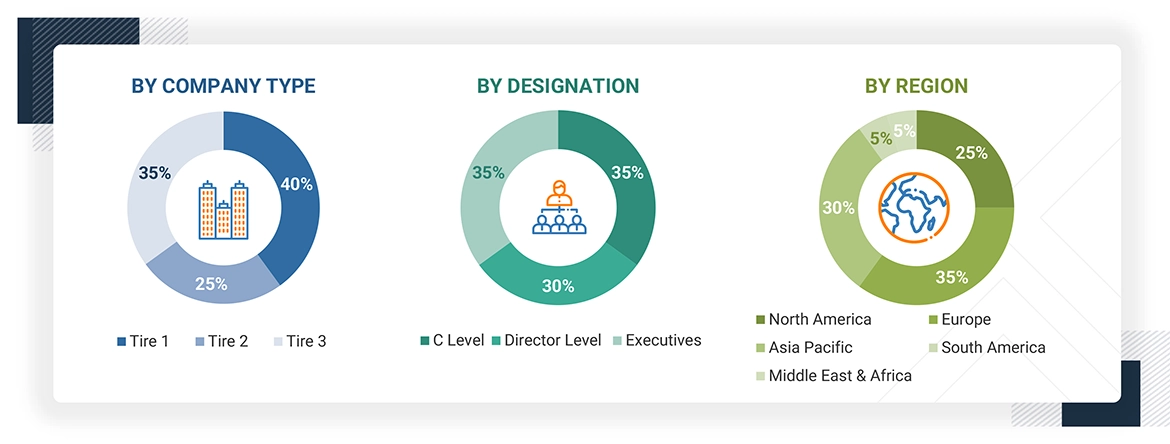

The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the industrial gaskets market by material type, product type, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders, such as directors and marketing executives, to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the industrial gaskets market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Industrial gaskets are essential sealing components designed to fill the space between two mating surfaces, preventing the leakage of fluids or gases under compression. Used across a wide range of applications, from pipelines and pressure vessels to pumps, engines, and industrial machinery, these gaskets play a vital role in ensuring the integrity, efficiency, and safety of mechanical systems.

By creating a reliable seal, industrial gaskets help maintain pressure, prevent contamination, reduce emissions, and protect equipment from wear or failure. Depending on the application, industrial gaskets can be made from metallic, non-metallic, or composite materials, each selected for its ability to withstand specific temperature, pressure, and chemical conditions.

Stakeholders

- Industrial Gasket Manufacturers

- Raw Material Suppliers

- Equipment Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-use Industries

- Associations and Industrial Bodies

Report Objectives

- To define, describe, and forecast the size of the industrial gaskets market in terms of value and volume

- To provide detailed information regarding the key factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To forecast the market size based on material type, product type, end-use industry, and region

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa (MEA), along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To strategically profile leading players and comprehensively analyze their key developments, such as product launches, expansions, and deals in the industrial gasket market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook

Key Questions Addressed by the Report

What primary factor is propelling the growth of the industrial gaskets market?

Industrial growth and rising demand from the oil & gas and power industries are the primary drivers.

How is the industrial gaskets market segmented?

The market is segmented by material type, product type, end-use industry, and region.

What are the major challenges in the industrial gaskets market?

Stringent quality and certification standards pose significant challenges.

What are the major opportunities in the industrial gaskets market?

Expansion in renewable energy and hydrogen energy represents a key opportunity.

Which region has the largest demand?

The Asia Pacific region has the highest demand for industrial gasket products.

Who are the major manufacturers of industrial gaskets?

Key manufacturers include Klinger Group (Austria), W.L. Gore & Associates (US), Garlock (US), Goodrich Gasket (India), James Walker Group (UK), Freudenberg Sealing Technologies (Germany), Donit Tesnit (Slovenia), Datwyler Holdings (Switzerland), Teadit (Brazil), and Parker Hannifin Corp. (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Gaskets Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Gaskets Market