High Pressure Seals Market by Material (Metal, TPU, HNBR, Fluoroelastomer, EPDM), End-Use Industry (Oil & Gas, Chemical & Petrochemical, Aerospace & Defense, Power Generation, Manufacturing, Mining, Pharmaceutical) - Global Forecast to 2026

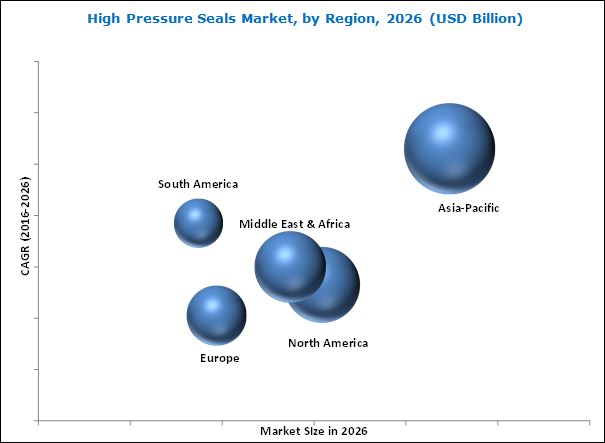

[170 Pages Report] The global high pressure seals market was valued at USD 3.45 Billion in 2015 and is projected to reach USD 4.84 Billion by 2021, at a CAGR of 6.6% between 2016 and 2021. The market is projected to reach USD 6.99 Billion by 2026, at a CAGR of 7.1% between 2016 and 2026.

Objectives of the report are as follows:

- To define and segment the market for high pressure seals

- To provide detailed information regarding major factors influencing growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market size, in terms of value

- To analyze the market segmentation and project the market size, in terms of value, for key regions, such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa

- To analyze competitive developments, such as new product launches, capacity expansions, mergers & acquisitions, and partnerships & agreements taking place in the market

- To strategically profile key players of the market

The base year considered for the study is 2015, while the forecast period is between 2016 & 2021 (mid-term) and between 2016 & 2026 (long term).

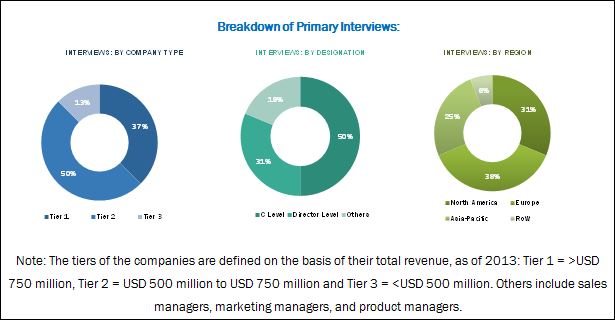

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global market and to estimate the sizes of various other dependent submarkets in the overall market. The research study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the global high pressure seals market.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the high pressure seals market includes sourcing of basic raw materials, manufacturing and supplying to intermediate product manufacturers, and usage in various end-use applications. The raw materials for high pressure seals are metal, fluoroelastomers, NBR, EPDM, PTFE, silicon carbide, and graphite. Suppliers for these raw materials include E. I. du Pont de Nemours and Company (U.S.), Solvay S.A. (Belgium), 3M Company (U.S.), Saint-Gobain S.A. (France), Lubrizol Corporation (U.S.), OMNOVA Solutions (U.S.), Zeon Chemicals L.P. (U.S.), PetroChina Co. Ltd. (China), and ExxonMobil (U.S.), among others.

Key Target Audience:

- Raw Material Suppliers

- High Pressure Seals Manufacturers

- Traders, Distributors, and Suppliers of High Pressure Seals

- Government & Regional Agencies, Research Organizations, and Investment Research Firms

Scope of the Report:

This research report categorizes the global high pressure seals market on the basis of material, end-use industry, and region.

On the basis of Material:

- Metal

- TPU

- HNBR

- Fluoroelastomers

- EPDM

- Others

On the basis of End-Use Industry:

- Oil & gas

- Chemical & petrochemical

- Aerospace & defense

- Power generation

- Manufacturing

- Mining

- Pharmaceutical

- Others

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Geographic Analysis:

- Country-level analysis of the high pressure seals market by end-use industry

Company Information:

- Detailed analysis and profiling of additional market players

Product Analysis

- Product Matrix, which gives a detailed comparison of product portfolio of each company

The global high pressure seals market is projected to reach USD 4.84 Billion by 2021, at a CAGR of 6.6% from 2016 to 2021; and USD 6.99 Billion by 2026, at a CAGR of 7.1% from 2016 to 2026. High pressure seals are designed to provide long service life and low friction for extreme pressure applications over a wide temperature range. These seals are mostly used in heavy industry, helical shafts, working rolls for cold and hot rolling mills, machinery for paper, pumps, marine shafts, and gearboxes. These applications drive the high pressure seals market globally.

High pressure seals find usage in industries, such as oil & gas, chemical & petrochemical, mining, pharmaceutical, and manufacturing. The oil & gas industry accounted for the largest share of the overall market and is expected to continue doing so throughout the forecast period. High pressure seals serve the oil & gas industry in upstream, midstream, and downstream segments. Seals in oil & gas industry are used in pipe couplings, valves, compressors, and hydraulic pumps.

The EPDM (ethylene propylene diene monomer rubber) segment is projected to be the fastest-growing material segment of the market between 2016 and 2021. EPDM-based high pressure seals are used in the power generation industry. These seals provide better weather resistance, good low-temperature flexibility, and good heat resistance. Increasing electricity demand from growing economies, such as China, India, and Southeast Asian countries will drive the demand for EPDM-based high pressure seals during the next few years.

Growth in the pharmaceutical and manufacturing industries have increased the demand for high pressure seals. In 2015, Asia-Pacific accounted for the largest share of the global high pressure seals market and is also projected to be the fastest-growing market till 2021. China is expected to account for the largest share of the Asia-Pacific market till 2026, with India registering the fastest-growth rate during the forecast period.

Use of renewable sources for power generation and increasing use of gland packing & seal-less pumps restrains the growth of the market globally.

Companies have adopted strategies such as new product development, expansion, partnership, agreement, and collaboration to expand their market share and distribution network in the global high pressure seals market. They engage in intensive research & development activities to innovate and develop new products which can open new avenues of applications. For instance, John Crane has launched the O-ring pusher seal 48VBF for high temperature pumps. This seal helps in reducing costs as it does not need a cooling water system to operate. The company, along with improving R&D, also focuses on increasing the number of its manufacturing facilities around the globe.

EagleBurgmann launched high pressure seals, such as PDGS compressor seal, HRC N mechanical seal, cartridge 9984, DF (P) DGS6, Cartex cartridge and SeccoMix1. The company strategically aims to cater the specific needs of its clients by producing high-quality products and processing orders efficiently.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 High Pressure Seals

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Market Size

2.2.2 Bottom-Up Approach

2.2.3 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the High Pressure Seals Market

4.2 Asia-Pacific High Pressure Seals Market, By Material and Countries, 2015

4.3 Global High Pressure Seals Market Attractiveness

4.4 Market Share of Regions By Application of High Pressure Seals

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Segmentation

5.2.1 High Pressure Seals Market, By Material Type

5.2.2 High Pressure Seals Market, By End-Use Industry

5.2.3 High Pressure Seals Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Efficiency in Oil Production in Offshore

5.3.1.2 Expected Recovery in Oil Prices

5.3.2 Restraints

5.3.2.1 Increasing Interest in Renewable Or Alternative Energy

5.3.2.2 Gland Packing and Seal-Less Pumps

5.3.3 Opportunity

5.3.3.1 Opportunities in Nuclear Power Generation

5.3.4 Challenges

5.3.4.1 Degradation of Elastomeric Or Polymer Based Seals

5.3.4.2 Lowering the Operating Pressure of Pumps to Reduce the Energy Consumption

5.3.4.3 Specific Requirements of End-Use Industries

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value-Chain Analysis

6.2.1 Raw Material Suppliers

6.2.2 Manufacturers

6.2.3 End-Users

6.3 Porters Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Patent Analysis

6.5 Industry Standards and Regulatory Standards

6.6 Price-Performance Analysis of Materials Used in High Pressure Seals

6.7 Macro Economic Overview and Key Drivers

6.7.1 Introduction

6.7.2 Manufacturing Industry Trends and Forecast, By Country

6.7.3 Aerospace Industry Trends

6.7.4 Oil & Gas Industry Trends

6.7.5 Chemicals & Petrochemcials Industry Trends

6.7.6 Cost & Profit Margin Analysis of High Pressure Seals Industry

7 Global High Pressure Seals Market, By Material (Page No. - 60)

7.1 Introduction

7.1.1 Metal

7.1.2 Thermoplastic Polyurethane

7.1.3 Hydrogenated Nitrile Butadiene Rubber (HNBR)

7.1.4 Fluoroelastomers

7.1.5 Ethylene Propylene Diene Monomer

7.1.6 Others

7.1.6.1 Perfluoroelastomer

7.1.6.2 Graphite

7.1.6.3 Ptfe

8 Global High Pressure Seals Market, By End-Use Industry (Page No. - 70)

8.1 Introduction

8.2 Oil & Gas

8.2.1 Upstream

8.2.2 Midstream

8.3 Chemicals & Petrochemicals

8.4 Power Generation

8.4.1 Thermal Power

8.4.1.1 Gas Turbine

8.4.1.2 Steam Turbine

8.4.1.3 Hydropower

8.5 Aerospace & Defense

8.6 Mining

8.7 Manufacturing Industry

8.8 Pharmaceuticals

8.9 Other End-Use Industries

9 High Pressure Seal Market, By Region (Page No. - 84)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.2.5 Taiwan

9.2.6 Indonesia

9.2.7 Thailand

9.2.8 Rest of the Asia Pacific

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 France

9.4.3 U.K.

9.4.4 Russia

9.4.5 Rest of the Europe

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of the South America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.2 Uae

9.6.3 Rest of the Middle East & Africa

10 Competitive Landscape (Page No. - 131)

10.1 Overview

10.2 Competitive Situations and Trends

10.3 New Product Launches: Most Popular Growth Strategy Between 2012 and 2016

10.3.1 New Product Launches

10.3.2 Expansions

10.3.3 Agreements & Contracts

10.4 Market Share Analysis

11 Company Profiles (Page No. - 138)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 SKF AB

11.2 Dupont

11.3 Flowserve Corporation

11.4 John Crane

11.5 Eagle Burgmann

11.6 Aesseal

11.7 Ekato Holding GmbH

11.8 American High Performance Seals

11.9 Jet Seal

11.10 FP Paris

11.11 James Walker

11.12 Seal House

11.13 Other Key Players in the Market

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 162)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (91 Tables)

Table 1 Market Segmentation, By Material Type

Table 2 Market Segmentation, By End-Use Industry

Table 3 Expected Increase in Oil Production and Emergence of Newer Technologies is Driving the Market

Table 4 Increasing Interest in Renewable Or Alternative Energy Market is Restraining the Demand for High Pressure Seals

Table 5 Nuclear Power Generation to Create Opportunities for High Pressure Seals

Table 6 High Energy Consumption and Degradation of Polymer Based Seals to Pose A Challenge in the Market

Table 7 Regulatory Standards Applicable to High Pressure Seals

Table 8 Contribution of Manufacturing Industry to GDP, By Country, USD Billion (20152021)

Table 9 Market of New Airplanes, 2014

Table 10 Oil Production, Million Tonnes (20142015)

Table 11 Oil Refinery Capacity, Thousand Barrels Per Day (20132014)

Table 12 Global High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 13 Global Metal High Pressure Seals Market Size, By Region, 20142026 (USD Million)

Table 14 Global Thermoplastic Polyurethane High Pressure Seals Market Size, By Region, 20142026 (USD Million)

Table 15 Global HNBR High Pressure Seals Market Size, By Region, 20142026 (USD Million)

Table 16 Global Fluoroelastomer Based High Pressure Seals Market Size, By Region, 20142026 (USD Million)

Table 17 Global Epdm Based High Pressure Seals Market Size, By Region, 20142026 (USD Million)

Table 18 Global Other High Pressure Seals Market Size, By Region, 20142026 (USD Million)

Table 19 Global High Pressure Seals Market Size, By End User Industries, 20142026 (USD Million)

Table 20 Global High Pressure Seals Market Size in Oil & Gas, By Region, 20142026 (USD Million)

Table 21 Global High Pressure Seals Market Size in Chemicals & Petrochemicals, By Region, 20142026 (USD Million)

Table 22 Global High Pressure Seals Market Size in Power Generation, By Region, 20142026 (USD Million)

Table 23 Global High Pressure Seals Market Size in Aerospace & Defense, By Region, 20142026 (USD Million)

Table 24 Global High Pressure Seals Market Size in Mining, By Region, 20142026 (USD Million)

Table 25 Global High Pressure Seals Market Size in Manufacturing Industry, By Region, 20142026 (USD Million)

Table 26 Global High Pressure Seals Market Size in Pharmaceuticals, By Region, 20142026 (USD Million)

Table 27 Global High Pressure Seals Market Size in Other End User Industries, By Region, 20142026 (USD Million)

Table 28 High Pressure Seals Market Size, By Region, 20142026 (USD Million)

Table 29 Asia-Pacific: High Pressure Seals Market Size, By Country, 20142026 (USD Million)

Table 30 Asia-Pacific: Market Size, By Material, 20142026 (USD Million)

Table 31 Asia-Pacific: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 32 China: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 33 China: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 34 Japan: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 35 Japan: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 36 India: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 37 India: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 38 South Korea: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 39 Korea: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 40 Taiwan: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 41 Taiwan: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 42 Indonesia: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 43 Indonesia: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 44 Thailand: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 45 Thailand: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 46 Rest of Asia-Pacific: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 47 Rest of the Asia-Pacific: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 48 North America: High Pressure Seals Market Size, By Country, 20142026 (USD Million)

Table 49 North America: Market Size, By Material, 20142026 (USD Million)

Table 50 North America: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 51 U.S.: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 52 U.S.: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 53 Canada: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 54 Canada: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 55 Mexico: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 56 Mexico: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 57 Europe: High Pressure Seals Market Size, By Country, 20142026 (USD Million)

Table 58 Europe: Market Size, By Material, 20142026 (USD Million)

Table 59 Europe: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 60 Germany: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 61 Germany: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 62 France: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 63 France: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 64 U.K.: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 65 U.K.: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 66 Russia: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 67 Russia: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 68 Rest of the Europe: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 69 Rest of the Europe: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 70 South America: High Pressure Seals Market Size, By Country, 20142026 (USD Million)

Table 71 South America: Market Size, By Material, 20142026 (USD Million)

Table 72 South America: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 73 Brazil: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 74 Brazil: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 75 Argentina: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 76 Argentina: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 77 Rest of the South America: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 78 Rest of the South America: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 79 Middle East & Africa: High Pressure Seals Market Size, By Country, 20142026 (USD Million)

Table 80 Middle East & Africa: Market Size, By Material, 20142026 (USD Million)

Table 81 Middle East & Africa: High Pressure Seals Market Size, By End-Use Industry, 20142026 (USD Million)

Table 82 Saudi Arabia: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 83 Saudi Arabia: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 84 Uae: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 85 Uae.: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 86 Rest of the Middle East & Africa: High Pressure Seals Market Size, By Material, 20142026 (USD Million)

Table 87 Rest of the Middle East & Africa: Market Size, By End-Use Industry, 20142026 (USD Million)

Table 88 New Product Launches, 20122016

Table 89 Expansions, 20122016

Table 90 Agreements & Contracts, 20122016

Table 91 Products Offered

List of Figures (59 Figures)

Figure 1 High Pressure Seals: Market Segmentation

Figure 2 High Pressure Seals Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 High Pressure Seals Market: Data Triangulation

Figure 6 Metal-Based High Pressure Seals to Remain the Dominant Material Till 2021

Figure 7 Oil & Gas Segment is Projected to Dominate the Market

Figure 8 Asia-Pacific to Witness Significant Growth During the Forecast Period

Figure 9 Growing Oil & Gas Production From Deep Water to Drive the Market

Figure 10 Metal High Pressure Seals Accounted for the Largest Share Inasia-Pacific Market

Figure 11 Global High Pressure Seals Market is Expected to Witness Highest CAGR in Asia-Pacific Between 2016 and 2021

Figure 12 Oil & Gas Application is Dominated By North America and Middle East & Africa

Figure 13 High Pressure Seals: Market Dynamics

Figure 14 Crude Oil Price (USD/Barrel) Forecast: 2016-2021

Figure 15 High Pressure Seals Market: Value-Chain Analysis

Figure 16 Porters Five Forces Analysis

Figure 17 Highest Number of Patents Were Filed in Europe From January 2013 to December 2015

Figure 18 Price-Performance Analysis of Common Materials Used in Secondary Seals

Figure 19 Contribution of Manufacturing Industry to GDP, 2015 (USD Billion)

Figure 20 Market of New Airplanes, By Region, 2014

Figure 21 Oil Production, Million Tonnes (2015)

Figure 22 Oil Refinery Capacity, Thousand Barrels Per Day (2014)

Figure 23 John Crane Registered the Highest Ebitda in 2015

Figure 24 Metal Based High Pressure Seals Accounted for Major Share of the High Pressure Seals Market, 2015 (USD Million)

Figure 25 Asia-Pacific to Register the Highest CAGR in Metal Based High Pressure Seals Market Between 2016 and 2021

Figure 26 Asia-Pacific to Lead the Thermoplastic Polyurethane Based High Pressure Seals Market By 2021

Figure 27 Asia-Pacific to Register the Highest CAGR for HNBR-Based High Pressure Seals Market Between 2016 and 2021

Figure 28 North America to Lead the Fluoroelastomers-Based High Pressure Seals Market By 2021

Figure 29 South America to Register the Second-Highest CAGR Between 2016 and 2021

Figure 30 Asia-Pacific Will Continue to Lead the Others Segment in Terms of CAGR Between 2016 and 2021

Figure 31 Oil & Gas is the Largest End-Use Industry in the Global High Pressure Seals Market

Figure 32 Asia-Pacific is the Fastest-Growing Market for High Pressure Seals in Oil & Gas Segment: 2016-2021

Figure 33 Asia-Pacific is Expected to Remain the Largest Consumer of High Pressure Seals in Chemicals & Petrochemicals: 2016-2021

Figure 34 Asia-Pacific is the Fastest-Growing Market for High Pressure Seals in Power Generation (USD Million)

Figure 35 North America is Expected to Lead the High Pressure Seals Market in Aerospace & Defense: 2016-2021

Figure 36 Asia-Pacific is Expected to Be the Fastest-Growing Markets for High Pressure Seals in Mining

Figure 37 Asia-Pacific is the Fastest-Growing Market for High Pressure Seals in Manufcaturing Sector

Figure 38 North America Acoounted for Largest Market for High Pressure Seals in Pharmaceuticals Segment

Figure 39 Middle East & Africa Accounted for Largest Market Size for High Pressure Seals in Other End-Use Industries

Figure 40 Regional Snapshot: Rapid Growth Markets are Emerging as New Hotspots

Figure 41 Asia-Pacific Snapshot: Thailand to Be the Fastest Growing Market in the Region

Figure 42 Asia-Pacific Market Snapshot: Country-Wise Market Share of High Pressure Seals in Oil & Gas, Chemical & Petrochemical, and Aerospace & Defense-2015 (USD Million)

Figure 43 North America Snapshot: Mexico to Be the Fastest Growing Market in the Region

Figure 44 U.S. Market Snapshot: 2016 vs 2021

Figure 45 European Market Snapshot: U.K. to Be the Fastest Growing Market

Figure 46 Companies Adopted New Product Launches as the Key Growth Strategy Between 2012 and 2016

Figure 47 Market Evaluation Framework: New Product Launches Fueled Growth Between 2012 and 2016

Figure 48 John Crane Dominated the Global High Pressure Seals Market in 2015

Figure 49 SKF AB: Company Snapshot

Figure 50 SKF AB: Company Snapshot

Figure 51 Dupont: Company Snapshot

Figure 52 Dupont: SWOT Analysis

Figure 53 Flowserve Corpration: Company Snapshot

Figure 54 Flowserve Corporation: Company Snapshot

Figure 55 John Crane: Company Snapshot

Figure 56 John Crane: Company Snapshot

Figure 57 Eagle Burgmann: SWOT Analysis

Figure 58 Aseseal: Company Snapshot

Figure 59 American High Performance Seals: SWOT Analysis

Growth opportunities and latent adjacency in High Pressure Seals Market