Food Processing Seals Market by Material Type (Metals, Face Materials, Elastomers), Application (Bakery & Confectionery, Meat, Poultry & Seafood, Dairy Products, Non-Alcoholic Beverage, Alcoholic Beverage), and Region - Global Forecast to 2023

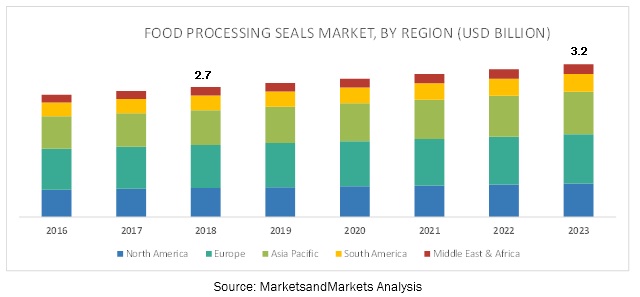

[126 Pages Report] The food processing seals market is projected to grow from USD 2.7 billion in 2018 to USD 3.2 billion by 2023, at a CAGR of 3.3%, during the forecast period. Food processing seals are seals that are used in the food processing industry to prevent leakage. In addition, seals used in food processing prevents food contamination by preventing microbial growth. The sealing materials used in the food processing industry must be corrosive-resistant and also comply with an increasing number of regulations, such as FDA, 3-A, and NSF standards. The growing production of processed and packaged food in countries, such as the US, Germany, UK, France, Spain, China, Japan, and Russia drive the demand for food processing seals. Furthermore, the presence of stringent regulations regarding the use of food grade seals and seal material is projected to drive the demand for food processing seals.

Metal material type to lead the food processing seals material market during the forecast period.

The food processing seals market has been segmented on the basis of material type into metals, face materials, elastomers, and others. The metal material type is expected to lead the market during the forecast period, in terms of value. Its usage in different elements in a seal drives its demand in various applications. In addition, metals offer considerable freedom of design since they are not restricted by the temperature and chemical limitations unlike other materials.

The bakery & confectionery application segment is expected to be the largest contributor to the overall food processing seals market during the forecast period.

Based on application, the food processing seals market has been segmented into bakery & confectionery, meat, poultry & seafood, dairy products, non-alcoholic beverage, alcoholic beverage, and others. The bakery & confectionery application segment accounted for the largest market share, in terms of value, followed by the meat, poultry & seafood segment, in 2017. This is due to huge production and demand for baked products and chocolates, globally. In addition, rapid urbanization and changing pattern in the consumption of food in regions, such as APAC and South America, are expected to drive the market in the industrial segment during the forecast period.

Europe is expected to account for the largest share of the food processing seals market during the forecast period.

Europe is estimated to be the largest food processing seals market in 2018 and to continue to lead the market till 2023 owing to the growing food processing and production. In addition, the presence of stringent regulations regarding the use of seals in various food & beverage applications drives the demand for food processing seals in the region.

Key Market Players

The key players in this market are Freudenberg Group (Germany), AESSEAL Plc (UK), Smiths Group Plc (UK), Flowserve Corporation (US), A.W. Chesterton Company (US), SKF (US), Parker Hannifin (US), Trelleborg AB (Sweden), IDEX Corporation (US), EnPro Industries, Inc. (US), James Walker (UK), and Meccanotecnica Umbra S.p.A. (Italy).

Recent Developments

- In November 2018, Freudenberg launched two elastomers, namely, 75 EPDM 386 and 85 EPDM 387. These elastomers can be used as a material for O-rings and machined formed parts in the food industry equipment.

- In July, 2018, Garlock, a subsidiary of EnPro Industries, launched a new product called PUR-GARD. It is a dynamic seal, which is used in the food processing equipment.

- In April 2017, Parker Hannifin launched NBR and FKM sealing materials, namely, NBR N9400 and FKM V9196, which can be used in the food processing equipment.

- In January 2016, EagleBurgmann, a part of Freudenberg, launched a shaft seal called SeccoMix1 for agitators, which can be used in mixers, agitators, dryers, and suction filters used for food processing.

Key questions addressed by the report

- What are the major developments impacting the market?

- Where will all these developments take the industry in the mid- to long-term?

- What are the upcoming types of food processing seals?

- What are the emerging applications for food processing seals?

- What are the major factors impacting market growth during the forecast period?

Frequently Asked Questions (FAQ):

Why is food processing seal important for food processing industry?

What are the factors driving the food processing seals market?

How are the regulations helping the food processing seals market to grow?

- FDA- Under FDA, there are two most commonly referred standards for sealing products. These are found in the Code of Federal Regulations under Title 21 (Food and Drugs) and part 177 (Indirect Food Additives: Polymers).

- 3-A formulates sanitary standards and practices for the design, installation, fabrication, and cleaning of equipment in the food processing industry.

- Food Contact Material Regulation (EC) No 1935/2004- The material used in food processing industry has to comply with Regulation (EC) No 1935/2004, so that materials do not transfer their constituents when they come in direct contact with food.

- Commission Regulation (EC) No. 2023/2006 - This is a European regulation which ensures conformity that materials and articles intended to be brought into contact with food or already in contact with food should be manufactured in compliance with Good Manufacture Practice (GMP).

- Regulations EU No 10/2011 - This European regulation is for the plastic materials and articles intended to be brought into contact with food. This regulation covers specific provisions for plastic multi-layer materials and articles and for multi-material multilayers, such as that the material or article does not induce an unacceptable change in the composition of the food and the company is operating under good manufacturing practice.

What is the major restraint for food processing seals market?

What was the market size of food processing seals in 2017 and how is it estimated to grow?

Which are the top players which exist in food processing seals market?

Which are the major application areas of Food Processing Seals Market? Which application led the market and why?

Which are the materials are used to make food processing seals?

Which region leads the food processing seals market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Food Processing Seals Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Food Processing Seals Market

4.2 Food Processing Seals Market, By Region

4.3 Europe Food Processing Seals Market, By Application and Country

4.4 Food Processing Seals Market, By Country

4.5 Food Processing Seals Market, By Application

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Standards & Regulations

5.2.1 FDA

5.2.2 3-A

5.2.3 Food Contact Materials Regulations (EC) 1935/2004

5.2.4 Commission Regulation (EC) No. 2023/2006

5.2.5 Regulations EU No 10/2011

5.2.6 Wras

5.2.7 NSF

5.2.8 ATEX

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Poultry, Dairy, Bakery, and Confectionery Products

5.3.1.2 Growing Demand for Processed and Convenience Food

5.3.1.3 Presence of Stringent Standards and Regulations

5.3.2 Restraints

5.3.2.1 Volatile Raw Material Prices

5.3.2.2 Presence of Sealless Equipment

5.3.2.3 Growing Demand for Fresh and Organic Food Products

5.3.3 Opportunities

5.3.3.1 Emerging Regional Markets

5.3.3.2 Growing Investment in the Development of New Food & Beverage Processing Seals

5.3.4 Challenges

5.3.4.1 Risk of Seal Failure

5.4 Porters Five Forces Analysis

5.4.1 Threat of Substitutes

5.4.2 Threat of New Entrants

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

5.5 Macroeconomic Indicators

5.5.1 GDP Trends and Forecast of Major Economies

5.5.2 Population Statistics

5.5.3 Dairy Industry Trend

5.5.4 Cheese Production Outlook

6 Food Processing Seals Market, By Material Type (Page No. - 45)

6.1 Introduction

6.2 Metals

6.2.1 Chromium-Nickel-Molybdenum Steel is the Most Common Metal Used in Food Processing Seals

6.3 Face Materials

6.3.1 Silicon Carbide Drives the Demand for Face Materials in Food Processing Seals

6.4 Elastomers

6.4.1 FKM is Suitable to A Wide Range of Temperature, Making It the Preferred Type of Elastomer for Use in Seals

6.5 Others

7 Food Processing Seals Market, By Application (Page No. - 49)

7.1 Introduction

7.2 Bakery & Confectionery

7.2.1 Exposure to Extreme Temperatures and Conditions During the Production of Bakery Products and Confectioneries to Drive the Demand for Food Processing Seals

7.3 Meat, Poultry & Seafood

7.3.1 Prevention of Leakage of Blended Meat, Poultry, and Seafood Increases the Demand for Food Processing Seals

7.4 Dairy Products

7.4.1 Change in Operating Temperatures During the Processing of Dairy Products to Boost the Demand for Food Processing Seals

7.5 Alcoholic Beverage

7.5.1 Organic and Inorganic Deposits During the Production of Alcoholic Beverage to Augment the Demand for Food Processing Seals

7.6 Non-Alcoholic Beverage

7.6.1 Aggressive Operating Conditions During Production of Non-Alcoholic to Fules the Demand for Food Processing Seals

7.7 Others

8 Food Processing Seals Market, By Region (Page No. - 59)

8.1 Introduction

8.2 Europe

8.2.1 Germany

8.2.1.1 Presence of Stringent Regulatory Environment to the Drive the Demand for Food Processing Seals

8.2.2 UK

8.2.2.1 Strong Food & Beverage Industry Increases the Demand for Food Processing Seals

8.2.3 France

8.2.3.1 Well-Established Food & Beverage Sector Drives the Market

8.2.4 Italy

8.2.4.1 Presence of Various Food Processing Seals Manufacturers to Boost the Demand

8.2.5 Spain

8.2.5.1 Increasing Demand for Processed Food to Augment Market Growth

8.2.6 Russia

8.2.6.1 Huge Food Production and Processing Impact the Growth of the Market

8.2.7 Rest of Europe

8.3 APAC

8.3.1 China

8.3.1.1 Rapid Urbanization, Increase in Spending Pattern, and Demand for Convenience Food Fuels the Growth of the Food Processing Seals Market

8.3.2 Japan

8.3.2.1 Growing Demand for Processed Food to Drive the Food Processing Seals Market

8.3.3 India

8.3.3.1 Government Initiative and Changing Lifestyle Increases the Demand for Food Processing Seals

8.3.4 Australia

8.3.4.1 Export Dynamism and Domestic Demand for Processed Food Boosts the Demand

8.3.5 South Korea

8.3.5.1 Manufacture of A Wide Variety of Processed Food to Increase the Demand for Food Processing Seals

8.3.6 Rest of APAC

8.4 North America

8.4.1 US

8.4.1.1 Presence of Major Food Processing Seals Manufacturers to Drive the Demand

8.4.2 Canada

8.4.2.1 Increasing Demand for Food & Beverage Among the Growing Population to Drive the Market

8.4.3 Mexico

8.4.3.1 Presence of Established Food Manufacturers Drives the Demand for Food Processing Seals

8.5 South America

8.5.1 Brazil

8.5.1.1 Huge Production of Meat, Poultry, and Seafood to Drive the Food Processing Seals Market

8.5.2 Argentina

8.5.2.1 Development of New Food Processing Facilities to Drive the Demand for Food Processing Seals

8.5.3 Rest of South America

8.6 Middle East & Africa

8.6.1 South Africa

8.6.1.1 Growing Income of the Middle-Class Population and Rising Demand for Processed Food to Augment the Market Growth

8.6.2 Turkey

8.6.2.1 Investment By the Government in the Food & Beverage Industry to Drive the Demand for Food Processing Seals

8.6.3 Iran

8.6.3.1 Growing Demand for Processed Food Among the Rising Population to Drive the Demand for Food Processing Seals

8.6.4 Rest of the Middle East & Africa

9 Competitive Landscape (Page No. - 88)

9.1 Overview

9.2 Ranking of Key Players

9.3 Competitive Scenario

9.3.1 Expansions

9.3.2 New Product Launches

9.3.3 Acquisitions

9.3.4 Agreements

10 Company Profiles (Page No. - 93)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Freudenberg Group (Eagleburgmann)

10.2 Aesseal

10.3 Smiths Group (John Crane)

10.4 Flowserve

10.5 A.W. Chesterton

10.6 SKF

10.7 Parker Hannifin

10.8 Trelleborg

10.9 IDEX Corporation (FTL Technology and Precision Polymer Engineering)

10.10 Enpro Industries (Garlock)

10.11 James Walker

10.12 Meccanotecnica Umbra (Huhnseal AB)

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.13 Other Market Players

10.13.1 Precision Associates, Inc

10.13.2 Klinger Group

10.13.3 Kismet Rubber Products

10.13.4 Spareage Sealing Solutions

10.13.5 Teknikum OY

10.13.6 Fmi Sichem SRL.

10.13.7 Northern Engineering (Sheffield) Ltd

10.13.8 Lidering Safe Industry

10.13.9 CDK Seals

10.13.10 Cinch Seal

11 Appendix (Page No. - 120)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (60 Tables)

Table 1 Trends and Forecast of GDP, By Major Economies, 20182023 (USD Billion)

Table 2 Population Statistics, 20122017 (Million)

Table 3 Dairy Production, By Region, 20092013 (Kiloton)

Table 4 Europe: Dairy Production, By Country, 20092013 (Kiloton)

Table 5 APAC: Dairy Production, By Country, 20092013 (Kiloton)

Table 6 North America: Dairy Production, By Country, 20092013 (Kiloton)

Table 7 South America: Dairy Production, By Country, 20092013 (Kiloton)

Table 8 Middle East & Africa: Dairy Production, By Country, 20092013 (Kiloton)

Table 9 Cheese Production, By Region, 20092013 (Kiloton)

Table 10 Europe: Cheese Production, By Country, 20092013 (Kiloton)

Table 11 APAC: Cheese Production, By Country, 20092013 (Kiloton)

Table 12 North America: Cheese Production, By Country, 20092013 (Kiloton)

Table 13 South America: Cheese Production, By Country, 20092013 (Kiloton)

Table 14 Middle East & Africa: Cheese Production, By Country, 20092013 (Kiloton)

Table 15 Food Processing Seals Market Size, By Material Type, 20162023 (USD Million)

Table 16 Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 17 Food Processing Seals Market Size in Bakery & Confectionery, By Region, 20162023 (USD Million)

Table 18 Food Processing Seals Market Size in Meat, Poultry & Seafood, By Region, 20162023 (USD Million)

Table 19 Food Processing Seals Market Size in Dairy Products, By Region, 20162023 (USD Million)

Table 20 Food Processing Seals Market Size in Alcoholic Beverage, By Region, 20162023 (USD Million)

Table 21 Food Processing Seals Market Size in Non-Alcoholic Beverage, By Region, 20162023 (USD Million)

Table 22 Food Processing Seals Market Size in Other Applications, By Region, 20162023 (USD Million)

Table 23 Food Processing Seals Market Size, By Region, 20162023 (USD Million)

Table 24 Europe: Food Processing Seals Market Size, By Country, 20162023 (USD Million)

Table 25 Europe: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 26 Germany: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 27 UK: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 28 France: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 29 Italy: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 30 Spain: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 31 Russia: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 32 Rest of Europe: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 33 APAC: Food Processing Seals Market Size, By Country, 20162023 (USD Million)

Table 34 APAC: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 35 China: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 36 Japan: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 37 India: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 38 Australia: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 39 South Korea: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 40 Rest of APAC: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 41 North America: Food Processing Seals Market Size, By Country, 20162023 (USD Million)

Table 42 North America: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 43 US: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 44 Canada: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 45 Mexico: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 46 South America: Food Processing Seals Market Size, By Country, 20162023 (USD Million)

Table 47 South America: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 48 Brazil: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 49 Argentina: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 50 Rest of South America: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 51 Middle East & Africa: Food Processing Seals Market Size, By Country, 20162023 (USD Million)

Table 52 Middle East & Africa: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 53 South Africa: Food Processing Seals Market Size, Application, 20162023 (USD Million)

Table 54 Turkey: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 55 Iran: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 56 Rest of the Middle East & Africa: Food Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 57 Expansions, 20152018

Table 58 New Product Launches, 20152018

Table 59 Acquisitions, 20152018

Table 60 Agreements, 20152018

List of Figures (41 Figures)

Figure 1 Food Processing Seals Market: Research Design

Figure 2 Food Processing Seals Market: Data Triangulation

Figure 3 Elastomers Segment to Witness the Highest Growth in the Food Processing Seals Market

Figure 4 Alcoholic Beverage Segment to Witness the Highest Growth in the Food Processing Seals Market

Figure 5 Europe Accounted for the Largest Share of the Food Processing Seals Market in 2017

Figure 6 Growing Demand for Processed Food Products to Drive the Market

Figure 7 Europe to Be the Largest Food Processing Seals Market

Figure 8 Bakery & Confectionery Segment and Germany Accounted for the Largest Market Share in 2017

Figure 9 India to Be the Fastest Growing Food Processing Seals Market

Figure 10 Bakery & Confectionery Was the Largest Application of Food Processing Seals in 2017

Figure 11 Overview of Factors Governing the Growth of the Food Processing Seals Market

Figure 12 Food Processing Seals Market: Porters Five Forces Analysis

Figure 13 Metals to Dominate the Food Processing Seals Market

Figure 14 Bakery & Confectionery Application to Lead the Food Processing Seals Market

Figure 15 Europe to Be the Largest Food Processing Seals Market in the Bakery & Confectionery Application

Figure 16 North America to Be the Largest Food Processing Seals Market in the Meat, Poultry & Seafood Application

Figure 17 Europe to Be the Largest Food Processing Seals Market in the Dairy Products Application

Figure 18 APAC to Be the Largest Food Processing Seals Market in the Alcoholic Beverage Application

Figure 19 Europe to Be the Largest Food Processing Seals Market in the Non-Alcoholic Beverage Application

Figure 20 APAC to Be the Largest Food Processing Seals Market in Other Applications

Figure 21 Europe to Be the Largest Food Processing Seals Market

Figure 22 Europe: Food Processing Seals Market Snapshot

Figure 23 APAC: Food Processing Seals Market Snapshot

Figure 24 North America: Food Processing Seals Market Snapshot

Figure 25 South America: Food Processing Seals Market Snapshot

Figure 26 Middle East & Africa: Food Processing Seals Market Snapshot

Figure 27 Expansion Was the Key Growth Strategy Adopted By the Market Players Between 2015 and 2018

Figure 28 Freudenberg Group Led the Food Processing Seals Market in 2017

Figure 29 Freudenberg Group: Company Snapshot

Figure 30 Freudenberg Group: SWOT Analysis

Figure 31 Asseal: SWOT Analysis

Figure 32 Smiths Group (John Crane): Company Snapshot

Figure 33 Smiths Group: SWOT Analysis

Figure 34 Flowserve: Company Snapshot

Figure 35 Flowserve: SWOT Analysis

Figure 36 A.W. Chesterton: SWOT Analysis

Figure 37 SKF: Company Snapshot

Figure 38 Parker Hannifin: Company Snapshot

Figure 39 Trelleborg: Company Snapshot

Figure 40 IDEX Corporation: Company Snapshot

Figure 41 Enpro Industries (Garlock): Company Snapshot

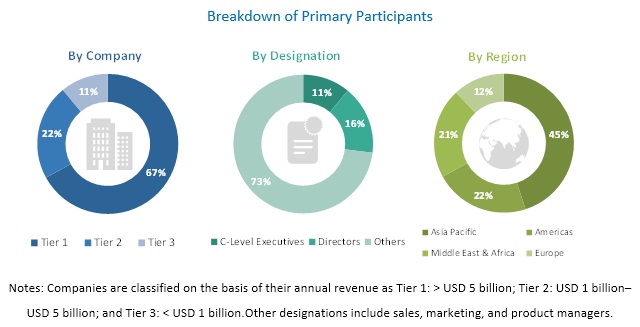

The study involves four major activities to estimate the size of the food processing seals market. Firstly, exhaustive secondary research was done to collect information regarding the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Later, both top-down and bottom-up approaches were employed to estimate the complete market size. Finally, the market breakdown and data triangulation procedures were used to estimate the market sizes of the segments and subsegments.

Secondary Research

Secondary sources used in this study are annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites, such as Factiva, ICIS, Bloomberg, Fluid Sealing Association (FSA), and European Sealing Association (ESA). The findings of this study were verified through primary research by conducting extensive interviews with key officials, such as CEOs, vice presidents, directors, and other executives.

Primary Research

The food processing seals market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the bakery & confectionery, meat, poultry & seafood, dairy products, non-alcoholic beverage, and alcoholic beverage applications. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the food processing seals market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation process explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides in the bakery & confectionery, meat, poultry & seafood, dairy products, non-alcoholic beverage, and alcoholic beverage applications.

Report Objectives

- To define, describe, and forecast the food processing seals market size, in terms of value

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the market growth

- To estimate and forecast the market size by material type, application, and region

- To forecast the size of the market with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To track and analyze recent developments, such as expansions, acquisitions, new product launches, and agreements, in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

Scope Of The Report

|

Report Metric |

Details | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

The report categorizes the global food processing seals market based on material type, application, and region.

On the basis of material type, the food processing seals market has been segmented as:

- Metals

- Face Materials

- Elastomers

- Others

- Polyurethane (PU)

- Polyether ether ketone (PEEK)

- Polytetrafluoroethylene (PTFE)

On the basis of application, the food processing seals market has been segmented as:

- Bakery & confectionery

- Meat, poultry & seafood

- Dairy products

- Non-alcoholic beverage

- Alcoholic beverage

- Others

- Sauces

- Ready-to-eat meals

- Dressings

- Vegetables

On the basis of region, the food processing seals market has been segmented as:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Available Customizations

MarketsandMarkets offers customizations with the given market data according to client-specific needs.

- Further breakdown of Rest of Asia Pacific, Rest of Europe, Rest of South America, and Rest of the Middle East & Africa food processing seals markets

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Food Processing Seals Market