Industrial Cleaning Chemicals Market by Ingredient (Surfactants, Solvents, Chelating Agents), Product (General & Medical Cleaning), Application (Manufacturing & Commercial Offices, Healthcare, Retail & Food Service), and Region - Global Forecast to 2028

Updated on : August 21, 2025

Industrial Cleaning Chemicals Market

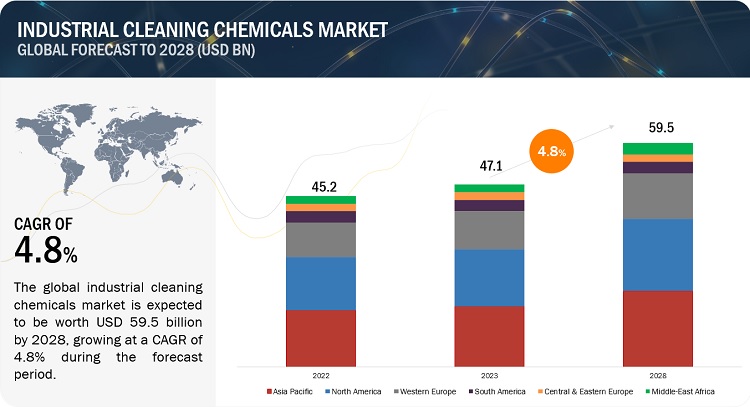

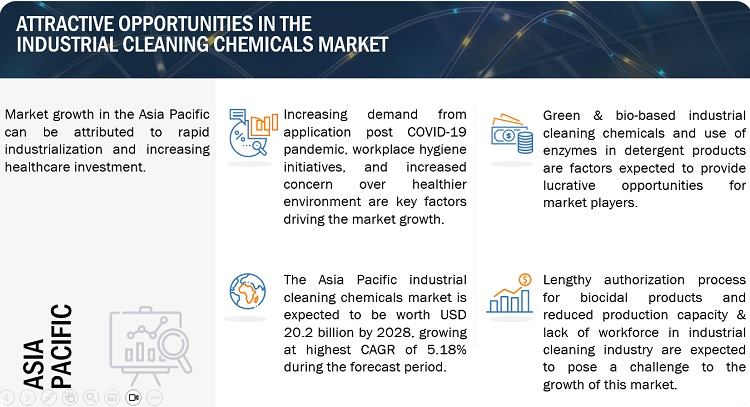

The global industrial cleaning chemicals market was valued at USD 47.1 billion in 2023, and is projected to reach USD 59.5 billion by 2028, growing at 4.8% cagr from 2023 to 2028. Over the world, the industrial cleaning chemicals market is expanding significantly, and during the forecast period, a similar trend is anticipated. The extensive use of industrial cleaning chemicals and growing concern about enabling healthier environment has raised the demand for industrial cleaning chemicals worldwide. Increasing demand from application post COVID-19 pandemic post-COVID-19, coupled with the rise in workplace hygiene initiatives, are key factors expected to drive the global industrial cleaning chemicals industry during the forecast period. Furthermore, demand for green & bio-based industrial cleaning chemicals and the role of enzymes in detergent products chemicals is an opportunity for market growth. However, lengthy authorization for biocidal products and reduced production capacity and lack of workforce in industrial cleaning industry are the major challenges in the industrial cleaning chemicals industry.

Industrial Cleaning Chemicals Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in Industrial Cleaning Chemicals Market

Industrial Cleaning Chemicals Market Dynamics

Driver: Increasing demand from end-use industries post COVID-19 pandemic

Industrial cleaning plays a very vital role in the performance and growth of manufacturing & commercial offices, healthcare, and retail & food service applications. In these applications, there is direct client interaction so, these industries aim on ensuring cleanliness. In manufacturing, food processing industries, and automotive industries, better hygiene is not only safe for workers but also results in quality products, which helps in improving productivity. All these applications are projected to grow at a positive rate, which is expected to drive the demand for industrial cleaning chemicals in these applications. Thus, the increasing demand from end-use industries post COVID-19 pandemic drives the market.

Restraints: Government & environmental regulations

Many industrial cleaning chemicals are subject to numerous regulations from government and environmental authorities because of their VOC content (usually in solvent-based cleaning products). Solvent cleaners consists of mineral spirits, a solvent commonly used for hard surface cleaning due to their ability to quickly dissolve grease, oil, grime, dirt, burnt-on carbon, and heavy lubricants. There are many other chemicals such as tetrachloroethylene and sodium hydroxide, that are toxic and result in various health risks. Sodium hydroxide is used to clean storage tanks and process tanks, tetrachloroethylene for dry cleaning, and triclosan is used in the healthcare industry—these chemicals have adverse effects on health when they get merged with the sources of drinking water. All these factors restrain the industrial cleaning chemicals market.

Opportunities: Use of enzymes in detergent products chemicals

An enzyme is a catalyst that can speed up biological processes. Enzymes, at lower temperatures, enable significant environmental savings by their ability to provide washing performance. Employing enzymes, which at low concentrations have high performance in compact cleaning products, is an alternative technology to replace phosphates. Enzymes are used in consumer detergent applications such as laundry & dishwashing and are used for professional cleaning in floor cleaning, medical devices, and ware washing applications. Thus, the use of enzymes in detergent products chemicals is a major opportunity for the manufacturers of industrial cleaning chemicals.

Challenges: Lengthy authorization for biocidal products

The Biocidal Products Regulation (BPR, Regulation (EU) 528/2012) concerns the placing on the market and use of biocidal products, which are used to protect animals, humans, materials, or articles against harmful organisms such as bacteria or pests, by the action of the active substances contained in the biocidal product. All biocidal products must be authorized before they can be made available in the market. Companies can choose between many alternative processes, depending on the number of countries and their product where they wish to sell it. The advocacy for regulatory flexibility for fast availability and approval of biocidal products is a major challenge for industrial cleaning chemical manufacturers in Europe.

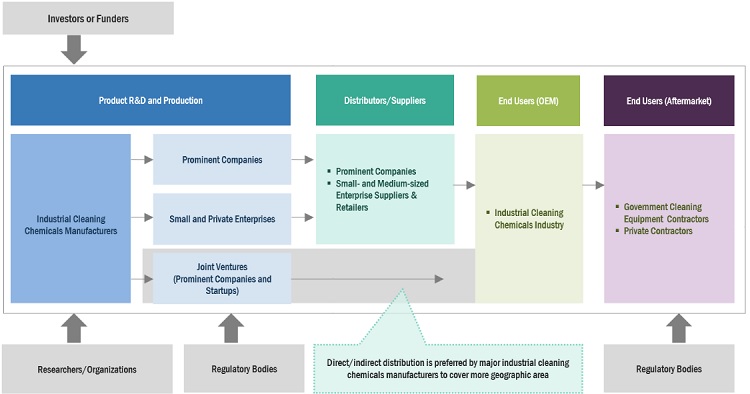

Industrial Cleaning Chemicals Market Ecosystem

Prominent companies in industrial cleaning chemicals market include financially stable and well-established manufacturers of industrial cleaning chemicals. These key players have been operating in the market for several years and possess state-of-the-art technologies, a diversified product portfolio, and strong worldwide marketing and sales networks. Prominent companies in this market include BASF SE (Germany), Dow Inc. (US), Clariant AG (Switzerland), Evonik Industries AG (Germany), and Solvay SA (Belgium).

Based on ingredient type, the surfactants segment is estimated to account for the largest market share of the industrial cleaning chemicals market

Based on ingredient type, the surfactants segment is estimated to account for the largest market share. This is attributed to the widespread usage of surfactants as an ingredient with many different formulations in the industrial cleaning chemicals. Moreover, the surfactants segment is anticipated to grow at the second highest CAGR during the forecast period because of its superior qualities.

Based on product type, the general & medical device cleaning segment is anticipated to dominate the market

General & medical device cleaning segment dominated the global industrial cleaning chemicals market. This high growth is mainly driven by its extensive application in the sanitary wares, cleaning of floors, medical equipment, carpets, glass surfaces, and for maintaining basic hygiene in work and healthcare premises. Moreover, the general & medical device cleaning segment is also anticipated to grow at the highest CAGR during the forecast period.

Based on application, the healthcare segment is estimated to account for the largest market share of the industrial cleaning chemicals market

Based on application, the healthcare segment is estimated to account for the largest market share. This is attributed to its increasing demand for usage of the industrial cleaning chemicals in healthcare centers such as hospitals, clinics, and medical institutions. Moreover, the healthcare segment is anticipated to grow at the highest CAGR during the forecast period.

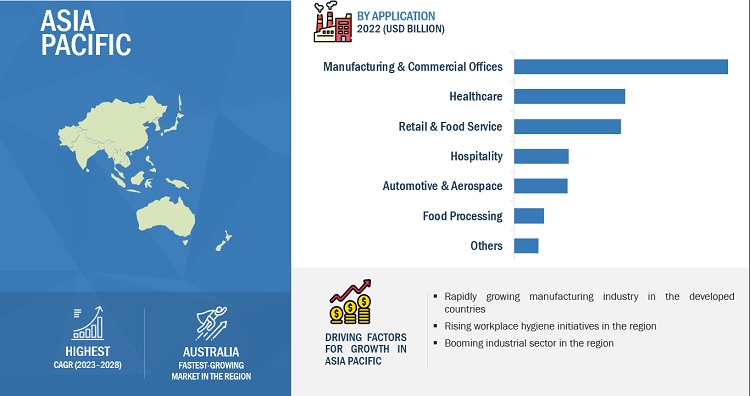

The Asia Pacific market is projected to contribute the largest share of the industrial cleaning chemicals market

Asia Pacific is projected to hold the largest share of the global industrial cleaning chemicals market throughout the forecast period, in terms of value. According to projections, the region will be a prime location for the industrial cleaning chemicals business attributed to the rising concern about healthier environment in healthcare and increasing healthcare expenditure, and increasing demand from industrial, food processing and automotive industry.

To know about the assumptions considered for the study, download the pdf brochure

Industrial Cleaning Chemicals Market Players

The key market players profiled in the Report include BASF SE (Germany), Dow Inc. (US), Clariant AG (Switzerland), Evonik Industries AG (Germany), Solvay SA (Belgium), Diversey Holdings Ltd. (US), Stepan Company (US), Ecolab Inc. (US), Pilot Chemical Corp. (US), and DuPont de Nemours, Inc. (US), among others.

Read More: Industrial Cleaning Chemicals Companies

Industrial Cleaning Chemicals Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2017-2028 |

|

Base Year Considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion), Volume (Kiloton) |

|

Segments Covered |

Ingredient Type, Product Type, Application, and Region |

|

Geographies covered |

Asia Pacific, North America, Western Europe, Central & Eastern Europe, Middle East & Africa, and South America |

|

Companies covered |

BASF SE (Germany), Dow Inc. (US), Clariant AG (Switzerland), Evonik Industries AG (Germany), Solvay SA (Belgium), Diversey Holdings Ltd. (US), Stepan Company (US), Ecolab Inc. (US), Pilot Chemical Corp. (US), DuPont de Nemours, Inc. (US), and others |

The study categorizes the industrial cleaning chemicals market based on Ingredient Type, Product Type, Application, and Region.

By Ingredient Type

-

Surfactants

- Anionic

- Nonionic

- Cationic

- Amphoteric

- Solvents

- Chelating Agents

- pH Regulators

- Solubilizers/Hydrotropes

- Enzymes

- Others

By Product Type

- Oven & Grill Cleaners

- Metal Cleaners

- Dish Washing

-

General & Medical Device Cleaning

- Floor Care

- Carpet Care

- Food Cleaners

- Dairy Cleaners

-

Disinfectants

- Commercial Laundry

By Application

- Manufacturing & Commercial Offices

- Healthcare

- Retail & Food Service

- Hospitality

- Automotive & Aerospace

- Food Processing

- Others

By Region

- Asia Pacific

- North America

- Western Europe

- Central & Eastern Europe

- Middle East & Arica

- South America

Recent Development

- In December 2022, Clariant AG announced an expansion of its business by new investments to enhance Chinese ethoxylation plant. An investment of USD 87.5 million is made for increasing capacity for existing products as well as the introduction of new products by the end of 2024.

- In November 2022, BASF SE has announced a collaboration with Inditex to develop the first detergent designed to reduce microfiber release from textiles during washing.

- In June 2022, Evonik Industries AG celebrated the start of construction of the world’s first commercial rhamnolipid production facility with a groundbreaking ceremony. The new biosurfactant plant is a triple-digit million-euro investment in Evonik’s biotech hub in Slovakia.

- In April 2022, Solvay SA announced its production of biodegradable solvent Rhodiasolv IRIS. Previously manufactured in China, this solvent will now be produced at Solvay's Melle site (France).

- In January 2022, Dow Inc. signed an exclusive agreement with Locus Performance Ingredients to expand biosurfactant offerings in the global home care and personal care markets.

Frequently Asked Questions (FAQ):

What are the drivers and opportunities for the industrial cleaning chemicals market?

Factors such as increasing demand from application post COVID-19 pandemic, workplace hygiene initiatives, and increased concern about enabling healthier environment drives the market growth. Moreover, the green & bio-based industrial cleaning chemicals and role of enzymes in detergent products chemicals creates an opportunity for the industrial cleaning chemicals market.

Who are the major players in the industrial cleaning chemicals market?

The key market players are BASF SE (Germany), Dow Inc. (US), Clariant AG (Switzerland), Evonik Industries AG (Germany), and Solvay SA (Belgium).

What is the emerging ingredient type of industrial cleaning chemicals?

The enzymes segment is the emerging ingredient type of industrial cleaning chemicals during the forecast period.

What are the major factors restraining market growth during the forecast period?

Government & environmental regulations is the major restraint for the industrial cleaning chemicals market growth.

What will be the impact of Climate Control Change and other initiatives on the growth of the global industry?

Due to rising environmental concerns, the industrial cleaning chemicals industry is closely monitored by environmental regulatory bodies. This has resulted in its slow growth, specifically in developed regions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand from end-use industries post-COVID-19 pandemic- Workplace hygiene initiatives- Efforts for a healthier indoor environment in commercial and industrial facilitiesRESTRAINTS- Government and environmental regulationsOPPORTUNITIES- Green & bio-based industrial cleaning chemicals- Use of enzymes in detergent productsCHALLENGES- Lengthy authorization process for biocidal products- Reduced production capacity and lack of workforce for industrial cleaning

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALSMANUFACTURING OF INDUSTRIAL CLEANING CHEMICALSDISTRIBUTION NETWORKEND-USE INDUSTRIES

-

6.2 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.3 PRICING ANALYSISAVERAGE SELLING PRICE FOR TOP 3 APPLICATIONS OFFERED BY KEY PLAYERSAVERAGE SELLING PRICE, BY REGION

-

6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS IN INDUSTRIAL CLEANING CHEMICALS MARKET

-

6.5 ECOSYSTEM ANALYSIS

-

6.6 TECHNOLOGY ANALYSISCLEANING TECHNOLOGIES

-

6.7 CASE STUDY ANALYSISEUROSTARS HOTELS AND DIVERSEYSOFITEL MUMBAI BKC AND DIVERSEY

-

6.8 TRADE DATA STATISTICSIMPORT SCENARIO OF INDUSTRIAL CLEANING CHEMICALSEXPORT SCENARIO OF INDUSTRIAL CLEANING CHEMICALS

-

6.9 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS FOR INDUSTRIAL CLEANING CHEMICALS, BY COUNTRY/REGION

- 6.10 KEY CONFERENCES AND EVENTS IN 2023–2024

-

6.11 PATENT ANALYSISAPPROACHDOCUMENT TYPEJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 SURFACTANTSWIDELY USED IN GENERAL CLEANERSANIONIC SURFACTANTSNONIONIC SURFACTANTSCATIONIC SURFACTANTSAMPHOTERIC SURFACTANTS

-

7.3 SOLVENTSHUGE DEMAND FROM METAL CLEANING

-

7.4 CHELATING AGENTSHIGH PERFORMANCE OF CHELATING AGENTS IN HARD WATER

-

7.5 PH REGULATORSINCREASING DEMAND FROM COMMERCIAL LAUNDRY

-

7.6 SOLUBILIZERS/HYDROTROPESREQUIRE LOW LEVELS FOR SOLUBILIZATION OF SURFACTANTS

-

7.7 ENZYMESBETTER CLEANING PROPERTIES COMPARED TO SYNTHETIC CLEANING PRODUCTS

- 7.8 OTHERS

- 8.1 INTRODUCTION

-

8.2 GENERAL & MEDICAL DEVICE CLEANINGHIGH DEMAND FROM INDUSTRIAL AND INSTITUTIONAL SECTORSFLOOR CARECARPET CARE

-

8.3 METAL CLEANERSHIGH IN VOC CONTENT AND TOXICITY

-

8.4 DISINFECTANTSHIGH DEMAND FROM HEALTHCARE INDUSTRY

-

8.5 COMMERCIAL LAUNDRYINCREASING DEMAND FROM HEALTHCARE AND HOSPITALITY INDUSTRIES

-

8.6 DISH WASHINGRISE IN DEMAND FROM FOOD SERVICE AND HOTEL INDUSTRIES

-

8.7 OVEN & GRILL CLEANERSREPEATED USE OF PH REGULATORS IN FOOD INDUSTRY

-

8.8 FOOD CLEANERSEXTENSIVE USE OF WETTING AGENTS IN FOOD INDUSTRY

-

8.9 DAIRY CLEANERSNEED TO MAINTAIN HIGHEST QUALITY AND HYGIENE STANDARDS

- 9.1 INTRODUCTION

-

9.2 MANUFACTURING & COMMERCIAL OFFICESRISING INDUSTRIALIZATION IN EMERGING ECONOMIES

-

9.3 HEALTHCAREINCREASED HEALTHCARE EXPENDITURE TO REDUCE CROSS-CONTAMINATION

-

9.4 RETAIL & FOOD SERVICEENZYMATIC CLEANING PROCESSES IMPORTANT IN RETAIL & FOOD SERVICE APPLICATION

-

9.5 HOSPITALITYGROWTH IN TOURISM INDUSTRY POST-COVID-19 PANDEMIC

-

9.6 AUTOMOTIVE & AEROSPACEREGULAR INTERVALS OF CLEANING IN AEROSPACE INDUSTRY

-

9.7 FOOD PROCESSINGNEED FOR HYGIENE AND BIO-BASED PRODUCTS TO DRIVE THE MARKET

- 9.8 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICIMPACT OF RECESSIONASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET, BY APPLICATIONASIA PACIFIC INDUSTRIAL CLEANING CHEMICALS MARKET, BY COUNTRY- China- Japan- India- South Korea- Australia

-

10.3 NORTH AMERICAIMPACT OF RECESSIONNORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET, BY APPLICATIONNORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET, BY COUNTRY- US- Mexico- Canada

-

10.4 WESTERN EUROPEIMPACT OF RECESSIONWESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET, BY APPLICATIONWESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET, BY COUNTRY- Germany- France- UK- Italy- Spain

-

10.5 CENTRAL & EASTERN EUROPEIMPACT OF RECESSIONCENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET, BY APPLICATIONCENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET, BY COUNTRY- Russia- Poland

-

10.6 SOUTH AMERICAIMPACT OF RECESSIONSOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET, BY APPLICATIONSOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET, BY COUNTRY- Brazil- Argentina

-

10.7 MIDDLE EAST & AFRICAIMPACT OF RECESSIONMIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET, BY COUNTRY- Saudi Arabia- UAE

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY INDUSTRIAL CLEANING CHEMICAL MANUFACTURERS

- 11.3 RANKING OF KEY MARKET PLAYERS

-

11.4 MARKET SHARE ANALYSISDEGREE OF COMPETITION BETWEEN KEY PLAYERS

- 11.5 REVENUE ANALYSIS OF KEY MARKET PLAYERS

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.7 COMPANY EVALUATION QUADRANT (TIER-1 PLAYERS)STARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 11.8 COMPETITIVE BENCHMARKING

-

11.9 START-UP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

11.10 COMPETITIVE SITUATIONS AND TRENDSDEALSPRODUCT LAUNCHESOTHER DEVELOPMENTS

- 12.1 INTRODUCTION

-

12.2 MAJOR PLAYERSBASF SE- Business overview- BASF SE: Products offered- Recent developments- MnM viewDOW INC.- Business overview- Dow Inc.: Products offered- Recent developments- MnM viewCLARIANT AG- Business overview- Clariant AG: Products offered- Recent developments- MnM viewEVONIK INDUSTRIES AG- Business overview- Evonik Industries AG: Products offered- Recent developments- MnM viewSOLVAY SA- Business overview- Solvay SA: Products offered- Recent developments- MnM viewDIVERSEY HOLDINGS, LTD.- Business overview- Diversey Holdings, Ltd.: Products offered- Recent developments- MnM viewECOLAB INC.- Business overview- Ecolab Inc.: Products offered- Recent developments- MnM viewSTEPAN COMPANY- Business overview- Stepan Company: Products offered- Recent developments- MnM viewNOVOZYMES A/S- Business overview- Novozymes A/S: Products offered- Recent developments- MnM viewDUPONT DE NEMOURS, INC.- Business overview- Dupont De Nemours, Inc.: Products offeredPILOT CHEMICAL CORP.- Business overview- Pilot Chemical Corp.: Products offered- Recent developmentsNATIONAL CHEMICAL LABORATORIES, INC.- Business overview- National Chemical Laboratories, Inc.: Products offeredNYCO PRODUCTS COMPANY- Business overview- Nyco Products Company: Products offeredTRANS GULF INDUSTRIES- Business overview- Trans Gulf Industries: Products offeredPRO CHEM, INC.- Business overview- Pro Chem Inc.: Products offered

-

12.3 OTHER KEY PLAYERSCRODA INTERNATIONAL PLCENASPOL A.S.UNGER FABRIKKER A.S.AARTI INDUSTRIESEOC GROUPKLK OLEOSATOL CHEMICALSARROW PRODUCTSARCOT MANUFACTURING CORPORATIONCHELA LTDE-ZOILCELESTE INDUSTRIES CORPORATIONMEDALKANFRASERS AEROSPACEMULTI-CLEAN

- 13.1 INTRODUCTION

- 13.2 LIMITATION

-

13.3 SOLVENTS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.4 SOLVENTS MARKET, BY REGIONASIA PACIFICEUROPENORTH AMERICAMIDDLE EAST & AFRICASOUTH AMERICA

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 INDUSTRIAL CLEANING CHEMICALS MARKET: RISK ASSESSMENT

- TABLE 2 KEY APPLICATIONS OF INDUSTRIAL CLEANING CHEMICALS

- TABLE 3 REGULATIONS FOR INDUSTRIAL CLEANING CHEMICALS

- TABLE 4 INDUSTRIAL CLEANING CHEMICALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020–2027 (USD BILLION)

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 8 AVERAGE SELLING PRICE FOR TOP 3 APPLICATIONS OFFERED BY KEY PLAYERS (USD/KG)

- TABLE 9 AVERAGE SELLING PRICE OF INDUSTRIAL CLEANING CHEMICALS, BY REGION (USD/KG)

- TABLE 10 INDUSTRIAL CLEANING CHEMICALS MARKET: ROLE IN ECOSYSTEM

- TABLE 11 IMPORT OF INDUSTRIAL CLEANING CHEMICALS, BY REGION, 2016–2021 (USD MILLION)

- TABLE 12 EXPORT OF INDUSTRIAL CLEANING CHEMICALS, BY REGION, 2016–2021 (USD MILLION)

- TABLE 13 INDUSTRIAL CLEANING CHEMICALS MARKET: KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 14 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS

- TABLE 15 PATENTS BY FOSHAN SHUNDE MIDEA WASHING APPLIANCES MFG. CO., LTD.

- TABLE 16 PATENTS BY QINGDAO HAIER DISHWASHER COMPANY

- TABLE 17 PATENTS BY L'OREAL

- TABLE 18 TOP 10 PATENT OWNERS IN US, 2012–2022

- TABLE 19 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (USD MILLION)

- TABLE 20 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (USD MILLION)

- TABLE 21 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (KILOTON)

- TABLE 22 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (KILOTON)

- TABLE 23 SURFACTANTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 24 SURFACTANTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 25 SURFACTANTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 26 SURFACTANTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 27 SOLVENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 28 SOLVENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 29 SOLVENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 30 SOLVENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 31 CHELATING AGENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 32 CHELATING AGENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 33 CHELATING AGENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 34 CHELATING AGENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 35 PH REGULATORS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 36 PH REGULATORS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 37 PH REGULATORS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 38 PH REGULATORS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 39 SOLUBILIZERS/HYDROTROPES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 40 SOLUBILIZERS/HYDROTROPES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 41 SOLUBILIZERS/HYDROTROPES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 42 SOLUBILIZERS/HYDROTROPES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 43 ENZYMES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 44 ENZYMES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 45 ENZYMES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 46 ENZYMES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 47 OTHER INGREDIENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 48 OTHER INGREDIENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 49 OTHER INGREDIENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 50 OTHER INGREDIENTS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 51 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

- TABLE 52 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY PRODUCT TYPE, 2022–2028 (USD MILLION)

- TABLE 53 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (KILOTON)

- TABLE 54 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY PRODUCT TYPE, 2022–2028 (KILOTON)

- TABLE 55 GENERAL & MEDICAL DEVICE CLEANING: PERCENTAGE SHARE OF INGREDIENT TYPE (2022)

- TABLE 56 FLOOR CARE: PERCENTAGE SHARE OF INGREDIENT TYPE (2022)

- TABLE 57 CARPET CARE: PERCENTAGE SHARE OF INGREDIENT TYPE (2022)

- TABLE 58 METAL CLEANERS: PERCENTAGE SHARE OF INGREDIENT TYPE (2022)

- TABLE 59 DISINFECTANTS: PERCENTAGE SHARE OF INGREDIENT TYPE (2022)

- TABLE 60 COMMERCIAL LAUNDRY: PERCENTAGE SHARE OF INGREDIENT TYPE (2022)

- TABLE 61 DISH WASHING: PERCENTAGE SHARE OF INGREDIENT TYPE (2022)

- TABLE 62 OVEN & GRILL CLEANERS: PERCENTAGE SHARE OF INGREDIENT TYPE (2022)

- TABLE 63 FOOD CLEANERS: PERCENTAGE SHARE OF INGREDIENT TYPE (2022)

- TABLE 64 DAIRY CLEANERS: PERCENTAGE SHARE OF INGREDIENT TYPE (2022)

- TABLE 65 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 66 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 67 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 68 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 69 MANUFACTURING & COMMERCIAL OFFICES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (USD MILLION)

- TABLE 70 MANUFACTURING & COMMERCIAL OFFICES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (USD MILLION)

- TABLE 71 MANUFACTURING & COMMERCIAL OFFICES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (KILOTON)

- TABLE 72 MANUFACTURING & COMMERCIAL OFFICES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (KILOTON)

- TABLE 73 MANUFACTURING & COMMERCIAL OFFICES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 74 MANUFACTURING & COMMERCIAL OFFICES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 75 MANUFACTURING & COMMERCIAL OFFICES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (KILOTON)

- TABLE 76 MANUFACTURING & COMMERCIAL OFFICES: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (KILOTON)

- TABLE 77 HEALTHCARE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (USD MILLION)

- TABLE 78 HEALTHCARE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (USD MILLION)

- TABLE 79 HEALTHCARE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (KILOTON)

- TABLE 80 HEALTHCARE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (KILOTON)

- TABLE 81 HEALTHCARE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 82 HEALTHCARE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 83 HEALTHCARE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (KILOTON)

- TABLE 84 HEALTHCARE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (KILOTON)

- TABLE 85 RETAIL & FOOD SERVICE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (USD MILLION)

- TABLE 86 RETAIL & FOOD SERVICE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (USD MILLION)

- TABLE 87 RETAIL & FOOD SERVICE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (KILOTON)

- TABLE 88 RETAIL & FOOD SERVICE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (KILOTON)

- TABLE 89 RETAIL FOOD & SERVICE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 90 RETAIL FOOD & SERVICE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 91 RETAIL FOOD & SERVICE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (KILOTON)

- TABLE 92 RETAIL FOOD & SERVICE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (KILOTON)

- TABLE 93 HOSPITALITY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (USD MILLION)

- TABLE 94 HOSPITALITY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (USD MILLION)

- TABLE 95 HOSPITALITY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (KILOTON)

- TABLE 96 HOSPITALITY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (KILOTON)

- TABLE 97 HOSPITALITY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 98 HOSPITALITY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 99 HOSPITALITY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (KILOTON)

- TABLE 100 HOSPITALITY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (KILOTON)

- TABLE 101 AUTOMOTIVE & AEROSPACE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (USD MILLION)

- TABLE 102 AUTOMOTIVE & AEROSPACE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (USD MILLION)

- TABLE 103 AUTOMOTIVE & AEROSPACE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (KILOTON)

- TABLE 104 AUTOMOTIVE & AEROSPACE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (KILOTON)

- TABLE 105 AUTOMOTIVE & AEROSPACE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 106 AUTOMOTIVE & AEROSPACE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 107 AUTOMOTIVE & AEROSPACE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (KILOTON)

- TABLE 108 AUTOMOTIVE & AEROSPACE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (KILOTON)

- TABLE 109 FOOD PROCESSING: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (USD MILLION)

- TABLE 110 FOOD PROCESSING: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (USD MILLION)

- TABLE 111 FOOD PROCESSING: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (KILOTON)

- TABLE 112 FOOD PROCESSING: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (KILOTON)

- TABLE 113 FOOD PROCESSING: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 114 FOOD PROCESSING: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 115 FOOD PROCESSING: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (KILOTON)

- TABLE 116 FOOD PROCESSING: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (KILOTON)

- TABLE 117 OTHER APPLICATIONS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (USD MILLION)

- TABLE 118 OTHER APPLICATIONS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (USD MILLION)

- TABLE 119 OTHER APPLICATIONS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2017–2021 (KILOTON)

- TABLE 120 OTHER APPLICATIONS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY INGREDIENT TYPE, 2022–2028 (KILOTON)

- TABLE 121 OTHER APPLICATIONS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 122 OTHER APPLICATIONS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 123 OTHER APPLICATIONS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (KILOTON)

- TABLE 124 OTHER APPLICATIONS: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (KILOTON)

- TABLE 125 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 126 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 127 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2021 (KILOTON)

- TABLE 128 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2022–2028 (KILOTON)

- TABLE 129 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 130 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 132 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 133 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 134 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 136 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 137 CHINA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 138 CHINA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 139 CHINA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 140 CHINA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 141 JAPAN: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 142 JAPAN: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 143 JAPAN: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 144 JAPAN: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 145 INDIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 146 INDIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 147 INDIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 148 INDIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 149 SOUTH KOREA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 150 SOUTH KOREA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 151 SOUTH KOREA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 152 SOUTH KOREA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 153 AUSTRALIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 154 AUSTRALIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 155 AUSTRALIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 156 AUSTRALIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 157 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 158 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 159 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 160 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 161 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 162 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 163 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 164 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 165 US: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 166 US: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 167 US: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 168 US: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 169 MEXICO: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 170 MEXICO: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 171 MEXICO: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 172 MEXICO: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 173 CANADA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 174 CANADA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 175 CANADA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 176 CANADA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 177 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 178 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 179 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 180 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 181 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 182 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 183 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 184 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 185 GERMANY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 186 GERMANY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 187 GERMANY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 188 GERMANY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 189 FRANCE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 190 FRANCE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 191 FRANCE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 192 FRANCE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 193 UK: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 194 UK: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 195 UK: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 196 UK: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 197 ITALY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 198 ITALY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 199 ITALY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 200 ITALY: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 201 SPAIN: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 202 SPAIN: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 203 SPAIN: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 204 SPAIN: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 205 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 206 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 207 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 208 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 209 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 210 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 211 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 212 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 213 RUSSIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 214 RUSSIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 215 RUSSIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 216 RUSSIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 217 POLAND: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 218 POLAND: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 219 POLAND: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 220 POLAND: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 221 SOUTH AMERICA: SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 222 SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 223 SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 224 SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 225 SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 226 SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 227 SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 228 SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 229 BRAZIL: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 230 BRAZIL: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 231 BRAZIL: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 232 BRAZIL: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 233 ARGENTINA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 234 ARGENTINA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 235 ARGENTINA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 236 ARGENTINA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 237 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 240 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 241 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 244 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 245 SAUDI ARABIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 246 SAUDI ARABIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 247 SAUDI ARABIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 248 SAUDI ARABIA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 249 UAE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 250 UAE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 251 UAE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 252 UAE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 253 INDUSTRIAL CLEANING CHEMICALS MARKET: DEGREE OF COMPETITION

- TABLE 254 INDUSTRIAL CLEANING CHEMICALS MARKET: INGREDIENT TYPE FOOTPRINT

- TABLE 255 INDUSTRIAL CLEANING CHEMICALS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 256 INDUSTRIAL CLEANING CHEMICALS MARKET: APPLICATION FOOTPRINT

- TABLE 257 INDUSTRIAL CLEANING CHEMICALS MARKET: COMPANY REGION FOOTPRINT

- TABLE 258 INDUSTRIAL CLEANING CHEMICALS MARKET: KEY START-UPS/SMES

- TABLE 259 INDUSTRIAL CLEANING CHEMICALS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 260 INDUSTRIAL CLEANING CHEMICALS MARKET: DEALS (2019–2023)

- TABLE 261 INDUSTRIAL CLEANING CHEMICALS MARKET: PRODUCT LAUNCHES (2019–2023)

- TABLE 262 INDUSTRIAL CLEANING CHEMICALS MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2019–2023)

- TABLE 263 BASF SE: COMPANY OVERVIEW

- TABLE 264 DOW INC.: COMPANY OVERVIEW

- TABLE 265 CLARIANT AG: COMPANY OVERVIEW

- TABLE 266 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 267 SOLVAY SA: COMPANY OVERVIEW

- TABLE 268 DIVERSEY HOLDINGS, LTD.: COMPANY OVERVIEW

- TABLE 269 ECOLAB INC.: COMPANY OVERVIEW

- TABLE 270 STEPAN COMPANY: COMPANY OVERVIEW

- TABLE 271 NOVOZYMES A/S: COMPANY OVERVIEW

- TABLE 272 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

- TABLE 273 PILOT CHEMICAL CORP.: COMPANY OVERVIEW

- TABLE 274 NATIONAL CHEMICAL LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 275 NYCO PRODUCTS COMPANY: COMPANY OVERVIEW

- TABLE 276 TRANS GULF INDUSTRIES: COMPANY OVERVIEW

- TABLE 277 PRO CHEM, INC.: COMPANY OVERVIEW

- TABLE 278 CRODA INTERNATIONAL PLC: COMPANY OVERVIEW

- TABLE 279 ENASPOL A.S.: COMPANY OVERVIEW

- TABLE 280 UNGER FABRIKKER A.S.: COMPANY OVERVIEW

- TABLE 281 AARTI INDUSTRIES: COMPANY OVERVIEW

- TABLE 282 EOC GROUP: COMPANY OVERVIEW

- TABLE 283 KLK OLEO: COMPANY OVERVIEW

- TABLE 284 SATOL CHEMICALS.: COMPANY OVERVIEW

- TABLE 285 ARROW PRODUCTS: COMPANY OVERVIEW

- TABLE 286 ARCOT MANUFACTURING CORPORATION: COMPANY OVERVIEW

- TABLE 287 CHELA LTD: COMPANY OVERVIEW

- TABLE 288 E-ZOIL: COMPANY OVERVIEW

- TABLE 289 CELESTE INDUSTRIES CORPORATION: COMPANY OVERVIEW

- TABLE 290 MEDALKAN: COMPANY OVERVIEW

- TABLE 291 FRASERS AEROSPACE: COMPANY OVERVIEW

- TABLE 292 MULTI-CLEAN: COMPANY OVERVIEW

- TABLE 293 SOLVENTS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

- TABLE 294 SOLVENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

- TABLE 295 ASIA PACIFIC: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

- TABLE 296 ASIA PACIFIC: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

- TABLE 297 EUROPE: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

- TABLE 298 EUROPE: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

- TABLE 299 NORTH AMERICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

- TABLE 300 NORTH AMERICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

- TABLE 302 MIDDLE EAST & AFRICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

- TABLE 303 SOUTH AMERICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

- TABLE 304 SOUTH AMERICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

- FIGURE 1 INDUSTRIAL CLEANING CHEMICALS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – BOTTOM-UP (DEMAND SIDE)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 – TOP-DOWN

- FIGURE 6 INDUSTRIAL CLEANING CHEMICALS MARKET: DATA TRIANGULATION

- FIGURE 7 SUPPLY-SIDE MARKET CAGR PROJECTIONS

- FIGURE 8 DEMAND-SIDE MARKET GROWTH PROJECTIONS: DRIVERS AND OPPORTUNITIES

- FIGURE 9 SURFACTANTS TO BE LARGEST INGREDIENT TYPE FOR INDUSTRIAL CLEANING CHEMICALS DURING FORECAST PERIOD

- FIGURE 10 GENERAL & MEDICAL DEVICE CLEANING TO BE LARGEST PRODUCT TYPE OF INDUSTRIAL CLEANING CHEMICALS DURING THE FORECAST PERIOD

- FIGURE 11 HEALTHCARE TO BE LARGEST APPLICATION OF INDUSTRIAL CLEANING CHEMICALS DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA LED INDUSTRIAL CLEANING CHEMICALS MARKET IN 2022

- FIGURE 13 NORTH AMERICA TO LEAD INDUSTRIAL CLEANING CHEMICALS MARKET DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 MANUFACTURING & COMMERCIAL OFFICES AND CHINA SEGMENTS ACCOUNTED FOR LARGEST SHARES IN 2022

- FIGURE 16 HEALTHCARE APPLICATION DOMINATED MOST REGIONS IN 2022

- FIGURE 17 INDIA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INDUSTRIAL CLEANING CHEMICALS MARKET

- FIGURE 19 INDUSTRIAL CLEANING CHEMICALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 INDUSTRIAL CLEANING CHEMICALS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 23 AVERAGE SELLING PRICES BY KEY PLAYERS FOR TOP 3 APPLICATIONS

- FIGURE 24 AVERAGE SELLING PRICE OF INDUSTRIAL CLEANING CHEMICALS, BY REGION (USD/KG)

- FIGURE 25 REVENUE SHIFT FOR INDUSTRIAL CLEANING CHEMICALS MARKET

- FIGURE 26 INDUSTRIAL CLEANING CHEMICALS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 IMPORT OF INDUSTRIAL CLEANING CHEMICALS, BY KEY COUNTRIES (2016– 2021)

- FIGURE 28 EXPORT OF INDUSTRIAL CLEANING CHEMICALS, BY KEY COUNTRIES (2016-2021)

- FIGURE 29 PATENTS REGISTERED IN INDUSTRIAL CLEANING CHEMICALS MARKET, 2012–2022

- FIGURE 30 PATENT PUBLICATION TRENDS, 2012–2022

- FIGURE 31 LEGAL STATUS OF PATENTS FILED IN INDUSTRIAL CLEANING CHEMICALS MARKET

- FIGURE 32 MAXIMUM PATENTS FILED IN JURISDICTION OF CHINA

- FIGURE 33 FOSHAN SHUNDE MIDEA WASHING APPLIANCES MFG. CO., LTD. REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2012 AND 2022

- FIGURE 34 ENZYMES SEGMENT TO WITNESS HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 35 HEALTHCARE TO BE LARGEST APPLICATION OF SURFACTANTS DURING FORECAST PERIOD

- FIGURE 36 MANUFACTURING & COMMERCIAL OFFICES TO LARGEST CONSUMER OF SOLVENTS DURING FORECAST PERIOD

- FIGURE 37 HEALTHCARE TO BE SECOND-LARGEST APPLICATION OF CHELATING AGENTS DURING THE FORECAST PERIOD

- FIGURE 38 HEALTHCARE TO BE LARGEST APPLICATION OF PH REGULATORS DURING FORECAST PERIOD

- FIGURE 39 HEALTHCARE TO BE LARGEST APPLICATION OF SOLUBILIZERS/HYDROTROPES IN INDUSTRIAL CLEANING CHEMICALS MARKET

- FIGURE 40 HEALTHCARE TO BE THE LARGEST APPLICATION OF ENZYMES IN INDUSTRIAL CLEANING CHEMICALS MARKET

- FIGURE 41 HEALTHCARE TO BE LARGEST APPLICATION OF OTHER INGREDIENTS DURING FORECAST PERIOD

- FIGURE 42 GENERAL & MEDICAL DEVICE CLEANING TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 43 HEALTHCARE APPLICATION TO LEAD INDUSTRIAL CLEANING CHEMICALS MARKET DURING FORECAST PERIOD

- FIGURE 44 SURFACTANT TO BE LARGEST INGREDIENT TYPE FOR MANUFACTURING & COMMERCIAL OFFICES APPLICATION DURING FORECAST PERIOD

- FIGURE 45 SOLVENT TO BE SECOND-LARGEST INGREDIENT TYPE FOR HEALTHCARE APPLICATION DURING FORECAST PERIOD

- FIGURE 46 ENZYMES INGREDIENT TYPE PROJECTED TO BE FASTEST GROWING SEGMENT FOR RETAIL & FOOD SERVICE APPLICATION DURING FORECAST PERIOD

- FIGURE 47 PH REGULATORS SEGMENT TO BE THE LARGEST INGREDIENT TYPE FOR HOSPITALITY APPLICATION DURING FORECAST PERIOD

- FIGURE 48 CHELATING AGENT TO BE LARGEST INGREDIENT TYPE FOR AUTOMOTIVE & AEROSPACE APPLICATION DURING FORECAST PERIOD

- FIGURE 49 SURFACTANTS SEGMENT TO BE THE LARGEST INGREDIENT TYPE FOR FOOD PROCESSING APPLICATION DURING FORECAST PERIOD

- FIGURE 50 SOLVENTS SEGMENT WAS THE SECOND-LARGEST INGREDIENT TYPE FOR OTHER APPLICATIONS DURING FORECAST PERIOD

- FIGURE 51 ASIA PACIFIC TO BE FASTEST-GROWING INDUSTRIAL CLEANING CHEMICALS MARKET BETWEEN 2023 AND 2028

- FIGURE 52 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SNAPSHOT

- FIGURE 53 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SNAPSHOT

- FIGURE 54 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SNAPSHOT

- FIGURE 55 RANKING OF TOP 5 PLAYERS IN INDUSTRIAL CLEANING CHEMICALS MARKET, 2022

- FIGURE 56 BASF SE LED INDUSTRIAL CLEANING CHEMICALS MARKET IN 2022

- FIGURE 57 DIVERSEY HOLDINGS, LTD. IS LEADING PLAYER IN INDUSTRIAL CLEANERS MARKET

- FIGURE 58 REVENUE ANALYSIS OF KEY COMPANIES IN LAST 5 YEARS

- FIGURE 59 INDUSTRIAL CLEANING CHEMICALS MARKET: COMPANY FOOTPRINT

- FIGURE 60 COMPANY EVALUATION QUADRANT FOR TIER-1 PLAYERS IN INDUSTRIAL CLEANING CHEMICALS MARKET

- FIGURE 61 START-UP/SME EVALUATION QUADRANT FOR INDUSTRIAL CLEANING CHEMICALS MARKET

- FIGURE 62 BASF SE: COMPANY SNAPSHOT

- FIGURE 63 DOW INC.: COMPANY SNAPSHOT

- FIGURE 64 CLARIANT AG: COMPANY SNAPSHOT

- FIGURE 65 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 66 SOLVAY SA: COMPANY SNAPSHOT

- FIGURE 67 DIVERSEY HOLDINGS, LTD.: COMPANY SNAPSHOT

- FIGURE 68 ECOLAB INC.: COMPANY SNAPSHOT

- FIGURE 69 STEPAN COMPANY: COMPANY SNAPSHOT

- FIGURE 70 NOVOZYMES A/S: COMPANY SNAPSHOT

- FIGURE 71 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the industrial cleaning chemicals market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering industrial cleaning chemicals and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the industrial cleaning chemicals industry, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the industrial cleaning chemicals market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Western Europe, Central & Eastern Europe, Asia Pacific, the Middle East & Africa and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from industrial cleaning chemicals vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using industrial cleaning chemicals, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of industrial cleaning chemicals and future outlook of their business which will affect the overall market.

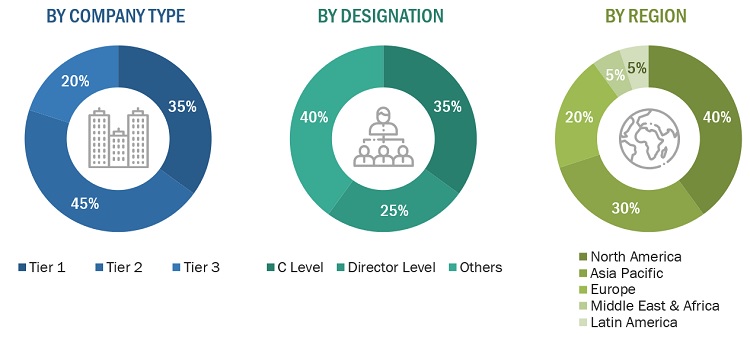

The Breakdown of Primary Research

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Report Metric |

Details |

|

BASF SE |

Vice-President |

|

Dow Inc. |

Director |

|

Clariant AG |

Project Manager |

|

Evonik Industries AG |

Sales Manager |

Market Size Estimation

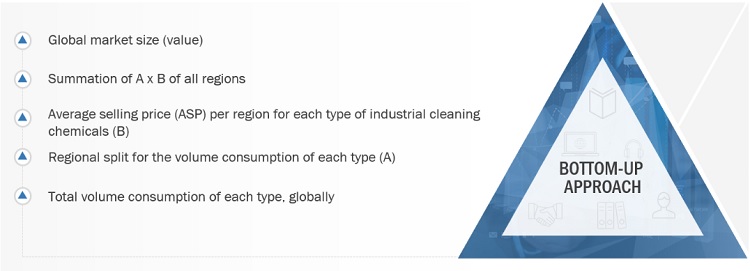

The top-down and bottom-up approaches have been used to estimate and validate the size of the industrial cleaning chemicals market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Global Industrial Cleaning Chemicals Market Size: Bottum Up Approach

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of industrial cleaning chemicals.

Market Definition

Industrial cleaning is the act of cleaning of impurities/unwanted particles in industrial facilities such as warehouses, factories, power plants, and other types of industrial production sites. Industrial cleaners are chemical solutions which are specially developed to remove or clean dust,oil, dirt, anti-seize, grease, gear oils contaminants, and other impurities from the surface.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the size of the industrial cleaning chemicals market based on ingredient type, product type, application, and region

- To forecast the market size of segments with respect to various regions, including North America, Western Europe, Central & Eastern Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the industrial cleaning chemicals market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the industrial cleaning chemicals market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the industrial cleaning chemicals market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Cleaning Chemicals Market