Industrial Wastewater Treatment Chemicals Market by Type (Coagulants, Flocculants, Biocides & Disinfectants), End-Use Industry (Power Generation, Mining, Chemical) and Region (APAC, Europe, North America, MEA, South America) - Global Forecast to 2026

Updated on : September 02, 2025

Industrial Wastewater Treatment Chemicals Market

The global Industrial wastewater treatment chemicals market was valued at USD 12.8 billion in 2021 and is projected to reach USD 16.6 billion by 2026, growing at a cagr 5.3% from 2021 and 2026. Growing industrialization across the globe is a main factors that provide new growth opportunities for industrial wastewater treatment chemical manufacturers. Morerover, stringent government regulations, depleting freshwater resources, increasing industrial demand, and rising support for sustainable development support for the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global Industrial wastewater treatment chemicals market

During COVID-19 pandemic, several goverment imposed restriction owing to which several manufacturing activities were suspended which, in turn, resulted into declined in demand for oil & gas and other industrial products. Due to imbalanced in supply-demand of oil & gas and other petrochemicals products, the demand for industrial wastewater treatment chemcials were declined. Moreover, due to supply chain disruption, the price of raw materials were increased significantly which, in turn, resulted into increased in cost of water treatment chemcials.

Industrial Wastewater Treatment Chemicals Market Dynamics

Driver: Stringent regulatory and sustainability mandates concerning the environment

Several regulatory bodies such as Environmental Protection Agency (EPA), CWA, SDWA, and other bodies has imposed regulation pertaining to industrial discharge and wastewater treatments. Owing to this regulation, the demand for wastewater treatment chemicals has increased significantly. The heightened regulatory and sustainability mandates have increased the demand for water purification and industrial wastewater treatment, providing opportunities for water treatment chemical manufacturers such as Kemira OYJ (Finland) and BWA Water Additives (UK). The Wastewater Effluent Regulations established under the Fisheries Act include minimum effluent quality standards that can be achieved through wastewater treatment. The increasing concerns regarding environmental safety and the rising awareness regarding the improved quality of drinking water are expected to increase the demand for industrial wastewater treatment chemicals during the forecast period.

Restraints: Alternative water treatment technologies

Physical water treatment technologies, such as UV disinfection and RO filtration are preferred over water treatment chemicals in water treatment industry. With growing environmental concerns and government regulations, the water treatment chemicals market is gradually moving toward these sustainable alternatives. These technologies will minimize the usage of chemicals in water treatment processes. RO technology is a water purification technology using a semi-permeable membrane to remove large particles from water. It removes up to 99% of the dissolved pollutants in the water. UV disinfection technology has replaced chlorine as a disinfectant, extensively. EPA regulations promote the use of UV disinfection over chlorine-based biocides. Moreover, a number of nanotechnology-based technologies are utilized in the limiting the usage of chemicals in water treatment. These alternative technologies act as a restraint for the growth in industrial wastewater treatment chemicals market.

Opportunity: Adopting more sustainable approach through initiatives of reduce-recycle-reuse

These are referred to as the “three Rs” of sustainability—reduce, reuse, and recycle. The goal of the three Rs is to prevent wastage and conserve natural resources. The three Rs are referred to as:

- Reduce: To use fewer resources in the first place; resources are required to manufacture, transport, and dispose of products, so reduction minimizes the use of new resources

- Reuse: A practice of using materials more than once instead of discarding them .

- Recycle: Involves converting waste materials into new products by physical and chemical processes; although recycling uses energy, it helps prevent old materials from entering the waste stream

Water recycling is reusing treated wastewater for beneficial purposes such as agriculture and landscape irrigation, industrial processes, toilet flushing, and replenishing a groundwater basin (referred to as groundwater recharge). Water recycling offers resources and financial savings. Wastewater treatment can be tailored to meet the water quality requirements of a planned reuse. In any industry, water is a resource of critical importance. Thus, reusing the wastewater is of critical importance; these 3Rs will help any industry become more sustainable.

Challenges: Need for more eco-friendly formulations and vulnerability regarding copying of patents

Stringent environmental regulations made by various agencies such as the EPA suppress the growth of the industrial wastewater treatment chemicals market. Growing concern over the environmental impact of chemicals has led to strict regulatory restrictions for water treatment chemical manufacturers and are encouraged to choose green alternatives. Compared to standard formulations, green alternative formulations are not a reliable option for severe conditions. Moreover, these green alternative also poses the a risk of bio fouling which resulted in requirement of extra dosage of biocides, impacting cost efficiency of the installation. Additionally, once these patented water treatment chemicals are publically available, it becomes vulnerable to being copied. Some manufacturers in Asia are able to provide counterfeit products at lower prices, hence, posing a significant challenge for major water treatment chemical manufacturers.

Anti-foaming agents is projected to register healthy growth during the forecast period

In terms of demand, anti-foaming agents is expected to register highest CAGR growth during the forecast period. Anti-foaming agents or defoamers are chemical additives that reduce and hinder the formation of foam in industrial processes. In these processes, foam causes defects on surface coatings. Generally, a defoamer is insoluble in a foaming medium and has surface-active properties. Defoamers have low viscosity and can quickly spread throughout foamy surfaces. The chemicals have an affinity with air-liquid surfaces, where they destabilize the foam formations. Defoamers can be broadly classified into oil-based, powder, water-based, silicone-based, EO-/PO-based, and alkyl polyacrylates. The commonly used agents are insoluble oils, polydimethylsiloxanes, and other silicones, alcohols, stearates, and glycols.

By end-use industry, Food & beverage industry is the fastest growing segment in the Industrial wastewater treatment chemicals market.

The Food & beverage industry is estimated to register healthy CAGR growth during the forecast period. It requires large quality water for its processes, as it is directly related to public health. Water is required for various applications such as cleaning & washing of food items and in heat exchange processes. Industrial wastewater treatment chemicals are used to remove suspended solids, colloidal, organics, iron, and manganese from surface and groundwater. Recycled water is also increasingly preferred owing to increased environmental regulations and water scarcity. Various types of industrial wastewater treatment chemicals are used for activities carried out in boilers, coolers, and single & multiple effect evaporators, where there are possibilities of corrosion, scaling, fouling, and microbial contaminations.

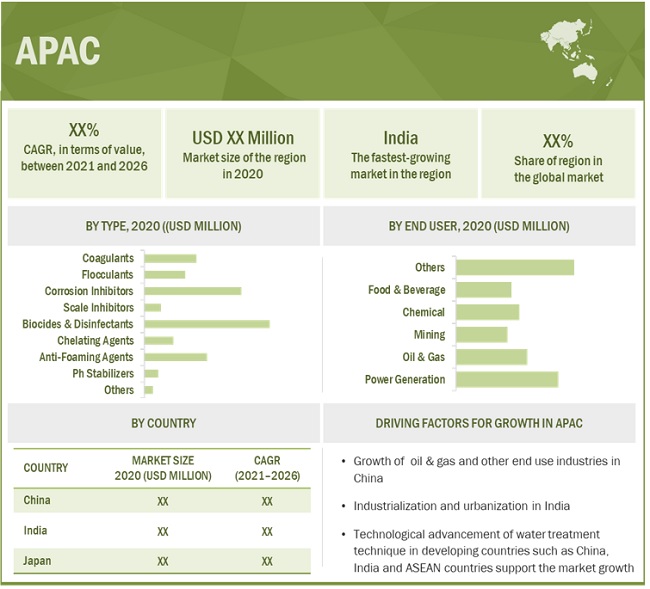

Asia Pacific market expects to register highest CAGR during forecast period

APAC is the fastest-growing market. This is mainly attributed to significant growth of manufacturing sector, increasing FDI investment, shifting of manufacturing facilities toward ASEAN and India, growing stringency of regulation, and rising awareness pertaining to wastewater treatment, which support for the growth of the market. The developing economy such as China, India, Malaysia, and Indonesia, are projected to be a leading market for industrial wastewater treatment chemicals in the next five years. Growing demand from end-use segments such as municipal water treatment, power generation, chemicals, oil & gas, and mining industry supports for the growth of the industrial wastewater treatment chemicals market.

To know about the assumptions considered for the study, download the pdf brochure

Industrial Wastewater Treatment Chemicals Market Players

The leading players in the Industrial wastewater treatment chemicals market are Thermax Limited (India), Ecolab Inc. (US), Kemira Oyj (Finland), BASF SE (Germany), Suez SA (France), Lonza Group Ltd. (Switzerland), Veolia Group (France), Kurita Water Industries Ltd. (Japan), AkzoNobel N.V. (Netherlands), Baker Hughes Inc. (US), SNF Floerger (France) and Dow Inc. (US).

Read More: Industrial Wastewater Treatment Chemicals Companies

Industrial Wastewater Treatment Chemicals Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Unit considered |

Value (USD Million), Volume (Kilotons) |

|

Segments |

Type, End-use industry and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa and South America |

|

Companies |

The major players are BASF SE (Germany), Ecolab Inc. (US), Kemira Oyj (Finland), Suez SA (France), Veolia Group (France), Lonza Group Ltd. (Switzerland), Kurita Water Industries Ltd. (Japan), Thermax Limited (India), Baker Hughes Inc. (US), Akzo Nobel N.V. (Netherlands), Dow Inc. (US), SNF Floerger (France), and others are covered in the Industrial wastewater treatment chemicals market. |

This research report categorizes the global Industrial wastewater treatment chemicals market on the basis of Type, End-use industry, and Region.

On the basis of Type

- Corrosion inhibitors

- Scale inhibitors

- Coagulants & flocculants

- Biocides & disinfectants

- Chelating agents

- Anti-foaming agents

- pH adjusters and stabilizers

- Others

On the basis of End-use industry

- Power Generation

- Oil & Gas

- Mining

- Chemical

- Food & Beverage

- Others

On the basis of region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In September 2021, Kemira opened its new Asia Pacific R&D center in Pujiang Town, Shanghai, China.

- In September 2021, Ecolab launches flotation 360 under the Nalco water segment, especially for mining and mineral processing.

- In October 2021, Ecolab had acquired Purolite, a separation and purification life science solution provider.

- In April 2021, Suez had joint ventured with Dijon Metropole to form multi-service company, named Odivea, which is a public wastewater service in France.

- In March 2021, Suez had joint ventured with Schneider Electric to form a unique software solution for the optimization of water treatment infrastructure.

Frequently Asked Questions (FAQ):

What are driving factor for the Industrial wastewater treatment chemicals market?

Stringent regulatory & sustainability mandates concerning the environment and growth of several end-use industry supports for the growth of Industrial wastewater treatment chemicals market.

Which type of the Industrial wastewater treatment chemicals used across industrial application?

Based on type, the Industrial wastewater treatment chemicals market includes Corrosion Inhibitors, Coagulants, Flocculants, Biocides & Disinfectants, pH Stabilizers, Chelating Agents, Scale Inhibitors, Anti-foaming Agents, and Others.

What is challenge for the Industrial wastewater treatment chemicals market?

Development of eco-friendly chemicals and vulnerability pertaining to patented products iis a big challenge for the market.

In terms of demand, which region holds largest market share?

In terms of demand, North America has largest market share, especially, the US accounts lion’s share of the market.

What is wastewater treatment chemicals?

These chemicals are used to remove impurities from water. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 1 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.1.2.4 List of participated industry experts

2.2 MARKET SIZE ESTIMATION

2.2.1 ESTIMATING THE MARKET SIZE FROM THE KEY SUPPLIERS’ MARKET SHARE

FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

2.2.2 TOP-DOWN APPROACH

FIGURE 3 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 5 POWER GENERATION END-USE INDUSTRY TO LEAD THE MARKET DURING THE FORECAST PERIOD

FIGURE 6 BIOCIDES AND DISINFECTANTS ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2020

FIGURE 7 NORTH AMERICA LEADS THE GLOBAL INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES IN THE INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET

FIGURE 8 GROWING INDUSTRIALIZATION IN THE EMERGING ECONOMIES TO DRIVE THE MARKET

4.2 ASIA PACIFIC INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET, BY TYPE AND COUNTRY, 2020

FIGURE 9 COAGULANTS SEGMENT AND CHINA ACCOUNTED FOR THE LARGEST MARKET SHARES

4.3 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET, BY TYPE

FIGURE 10 ANTI-FOAMING AGENTS TO REGISTER THE HIGHEST CAGR

4.4 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY

FIGURE 11 FOOD & BEVERAGE SEGMENT TO REGISTER THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET

5.1.1 DRIVERS

5.1.1.1 Increasing demand for chemically treated water in various end-use segments

5.1.1.2 Stringent regulatory and sustainability mandates concerning the environment

5.1.2 RESTRAINTS

5.1.2.1 Alternative water treatment technologies

5.1.3 OPPORTUNITIES

5.1.3.1 Increase in the demand for specific formulations

5.1.3.2 Adopting a more sustainable approach through initiatives of reduce-recycle-reuse

5.1.3.3 Increasing demand for biocides and disinfectant water treatment chemicals from various applications

5.1.4 CHALLENGES

5.1.4.1 Need for more eco-friendly formulations and vulnerability regarding the copying of patents

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 PORTER’S FIVE FORCES ANALYSIS OF INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET

5.2.1 THREAT OF NEW ENTRANTS

5.2.2 THREAT OF SUBSTITUTES

5.2.3 BARGAINING POWER OF SUPPLIERS

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 1 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3 VALUE CHAIN ANALYSIS

FIGURE 14 VALUE CHAIN OF INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET

5.3.1 RAW MATERIAL SUPPLIERS

5.3.2 MANUFACTURERS

5.3.3 DISTRIBUTORS

5.3.4 END-CONSUMERS

5.4 PRICING ANALYSIS

TABLE 2 GLOBAL AVERAGE PRICES OF WATER TREATMENT CHEMICALS (USD/TON)

5.5 ECOSYSTEM MAPPING

TABLE 3 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS ECOSYSTEM

5.6 YC-YCC DRIVERS

5.7 TARIFF POLICIES & REGULATIONS

5.7.1 NORTH AMERICA

5.7.1.1 Clean Water Act (CWA)

5.7.1.2 Safe Drinking Water Act (SDWA)

5.7.2 EUROPE

5.7.2.1 The Urban Wastewater Treatment Directive (1991)

5.7.2.2 The Drinking Water Directive (1998)

5.7.2.3 The Water Framework Directive (2000)

5.7.3 ASIA (CHINA)

5.7.3.1 Environmental Protection Law (EPL)

5.7.3.2 The Water Resources Law

5.7.3.3 Water Pollution Prevention & Control Law (WPL)

5.8 TRADE ANALYSIS

5.8.1 CHEMICAL EXPORTS: BY COUNTRY, 2019 AND 2020 (USD BILLION)

5.8.2 CHEMICAL IMPORTS: BY COUNTRY, 2019 AND 2020 (USD BILLION)

TABLE 4 WATER TREATMENT CHEMICALS, YEAR-WISE EXPORT DATA,2009-2019 (USD MILLION)

5.9 TECHNOLOGY ANALYSIS

5.10 CASE STUDY ANALYSIS

5.10.1 CASE STUDY BY THERMAX GLOBAL

5.10.1.1 Tulsion Resins for Ultra-pure Water in Solar Cell Manufacturing

5.11 FORECASTING FACTORS AND COVID-19 IMPACT FACTOR ANALYSIS

5.12 ADJACENT/RELATED MARKET

5.12.1 INTRODUCTION

5.12.2 LIMITATIONS

5.12.3 WATER TREATMENT CHEMICALS MARKET

5.12.4 WATER TREATMENT CHEMICALS MARKET OVERVIEW

TABLE 5 WATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 6 WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2019-2026 (USD MILLION)

TABLE 7 WATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

5.12.5 BOILER WATER TREATMENT CHEMICALS MARKET

5.12.6 BOILER WATER TREATMENT CHEMICALS MARKET, BY TYPE

TABLE 8 BWTC MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 9 BWTC MARKET SIZE, BY END-USE INDUSTRY, 2015–2022 (USD MILLION)

TABLE 10 BWTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

6 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET, BY TYPE (Page No. - 82)

6.1 INTRODUCTION

FIGURE 15 ANTI-FOAMING AGENTS TO BE THE FASTEST-GROWING TYPE DURING THE FORECAST PERIOD

TABLE 11 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 12 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 13 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 14 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

6.2 COAGULANTS

6.2.1 ORGANIC COAGULANTS

6.2.1.1 Polyamine

6.2.1.2 PolyDADMAC

6.2.2 INORGANIC COAGULANTS

6.2.2.1 Aluminum sulfate

6.2.2.2 Polyaluminum chloride (PAC)

6.2.2.3 Ferric chloride

6.2.2.4 Others

TABLE 15 COAGULANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 16 COAGULANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 17 COAGULANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 18 COAGULANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.3 FLOCCULANTS

6.3.1.1 Anionic flocculants

6.3.1.2 Cationic flocculants

6.3.1.3 Non-ionic flocculants

6.3.1.4 Amphoteric flocculants

TABLE 19 FLOCCULANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 20 FLOCCULANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 21 FLOCCULANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 22 FLOCCULANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.4 CORROSION INHIBITORS

6.4.1 ANODIC INHIBITORS

6.4.2 CATHODIC INHIBITORS

TABLE 23 CORROSION INHIBITORS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 24 CORROSION INHIBITORS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 25 CORROSION INHIBITORS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 26 CORROSION INHIBITORS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.5 SCALE INHIBITORS

6.5.1 PHOSPHONATES

6.5.2 CARBOXYLATES/ACRYLIC

6.5.3 OTHERS

TABLE 27 SCALE INHIBITORS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 28 SCALE INHIBITORS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 29 SCALE INHIBITORS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 30 SCALE INHIBITORS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.6 BIOCIDES & DISINFECTANTS

6.6.1 OXIDIZING

6.6.2 NON-OXIDIZING

6.6.3 DISINFECTANTS

TABLE 31 BIOCIDES & DISINFECTANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 32 BIOCIDES & DISINFECTANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 33 BIOCIDES & DISINFECTANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 34 BIOCIDES & DISINFECTANTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.7 CHELATING AGENTS

TABLE 35 CHELATING AGENTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 36 CHELATING AGENTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 37 CHELATING AGENTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 38 CHELATING AGENTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.8 ANTI-FOAMING AGENTS

TABLE 39 ANTI-FOAMING AGENTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 40 ANTI-FOAMING AGENTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 41 ANTI-FOAMING AGENTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 42 ANTI-FOAMING AGENTS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.9 PH STABILIZERS

TABLE 43 PH STABILIZERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 44 PH STABILIZERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 45 PH STABILIZERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 46 PH STABILIZERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.10 OTHERS

TABLE 47 OTHERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 48 OTHERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 49 OTHERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 50 OTHERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

7 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY (Page No. - 103)

7.1 INTRODUCTION

FIGURE 16 POWER GENERATION SEGMENT TO MAINTAIN THE LEADING POSITION DURING THE FORECAST PERIOD

TABLE 51 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 52 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 53 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 54 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

7.1.1 POWER GENERATION

7.1.1.1 The development of new power plants to boost the demand

FIGURE 17 DEVELOPMENT OF NEW COAL PLANTS, BY COUNTRY, 2020

TABLE 55 POWER GENERATION: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 56 POWER GENERATION: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 57 POWER GENERATION: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 58 POWER GENERATION: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

7.1.2 OIL & GAS

7.1.2.1 Recovery of the oil & gas industry to drive the market

FIGURE 18 GLOBAL CRUDE OIL PRODUCTION (MILLION BARRELS PER DAY), 2018 – 2021

FIGURE 19 CRUDE OIL PRICE ANALYSIS AND TREND (TILL AUGUST 2020)

TABLE 59 OIL & GAS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 60 OIL & GAS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 61 OIL & GAS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 62 OIL & GAS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

7.1.3 MINING

7.1.3.1 Growth of the mining industry in developing countries to support market growth

TABLE 63 MINING: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 64 MINING: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 65 MINING: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 66 MINING: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

7.1.4 CHEMICAL

7.1.4.1 The steady growth of the chemical industry in developing regions to drive the market

TABLE 67 CHEMICAL: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 68 CHEMICAL: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 69 CHEMICAL: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 70 CHEMICAL: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

7.1.5 FOOD & BEVERAGE

7.1.5.1 Growing concern about the quality of products to drive the market

TABLE 71 FOOD & BEVERAGE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 72 FOOD & BEVERAGE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 73 FOOD & BEVERAGE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 74 FOOD & BEVERAGE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

7.1.6 OTHERS

TABLE 75 OTHERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (USD MILLION)

TABLE 76 OTHERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 77 OTHERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2016-2018 (KILOTON)

TABLE 78 OTHERS: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

8 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET, BY REGION (Page No. - 118)

8.1 INTRODUCTION

FIGURE 20 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SNAPSHOT

8.2 NORTH AMERICA

FIGURE 21 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SNAPSHOT

TABLE 83 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 84 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 85 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 86 NORTH AMERICA: INDUSTRIAL WASTE INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 88 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 89 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 90 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 92 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 93 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 94 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

8.2.1 US

8.2.1.1 Stringent government rules and regulations to drive the market throughout the forecast period

TABLE 95 US: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 96 US: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 97 US: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 98 US: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Government initiatives for the water treatment sector to drive the market

TABLE 99 CANADA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 100 CANADA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 101 CANADA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 102 CANADA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

8.2.3 MEXICO

8.2.3.1 Company partnerships and improved regulations to propel the market growth

TABLE 103 MEXICO: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 104 MEXICO: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 105 MEXICO: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 106 MEXICO: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

8.3 ASIA PACIFIC

FIGURE 22 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SNAPSHOT

TABLE 107 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 108 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 109 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 110 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 111 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 112 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 113 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 114 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 116 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 117 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 118 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.1 CHINA

8.3.1.1 Growing power, oil, and chemical industries, along with increasing stringency of regulation, to support market growth

TABLE 119 CHINA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 120 CHINA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 121 CHINA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 122 CHINA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.2 INDIA

8.3.2.1 Industrialization and urbanization to drive the market

TABLE 123 INDIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 124 INDIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 125 INDIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 126 INDIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

8.3.3 JAPAN

8.3.3.1 Government initiative to boost the economy, coupled with stringent government norms, to drive the market

TABLE 127 JAPAN: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 128 JAPAN: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 129 JAPAN: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 130 JAPAN: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

8.3.4 SOUTH KOREA

8.3.4.1 The increasing quantity of domestic wastewater to propel the water treatment industry

TABLE 131 SOUTH KOREA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 132 SOUTH KOREA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 133 SOUTH KOREA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 134 SOUTH KOREA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

8.3.5 AUSTRALIA & NEW ZEALAND (ANZ)

8.3.5.1 Strong mining industry boosting the demand for industrial wastewater treatment chemicals

TABLE 135 AUSTRALIA & NEW ZEALAND: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 136 AUSTRALIA & NEW ZEALAND: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 137 AUSTRALIA & NEW ZEALAND: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 138 AUSTRALIA & NEW ZEALAND: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

8.3.6 REST OF ASIA PACIFIC

TABLE 139 REST OF ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 140 REST OF ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 141 REST OF ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 142 REST OF ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

8.4 EUROPE

TABLE 143 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 144 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 145 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 146 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 147 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 148 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 149 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 150 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 152 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 153 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 154 EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Significant recovery of the economy and healthy growth of end-use industries to support market growth

TABLE 155 GERMANY: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 156 GERMANY: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 157 GERMANY: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 158 GERMANY: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.2 UK

8.4.2.1 Rapid urbanization and industrialization in the country result in the growth in demand for treated water

TABLE 159 UK: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 160 UK: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 161 UK: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 162 UK: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.3 FRANCE

8.4.3.1 Increasing focus of the French chemical sector to drive the market in the country

TABLE 163 FRANCE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 164 FRANCE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 165 FRANCE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 166 FRANCE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.4 SPAIN

8.4.4.1 Steady growth in demand is expected throughout the forecast period

TABLE 167 SPAIN: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 168 SPAIN: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 169 SPAIN: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 170 SPAIN: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.5 ITALY

8.4.5.1 Use of advanced water treatment procedures and chemicals is a market driver

TABLE 171 ITALY: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 172 ITALY: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 173 ITALY: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 174 ITALY: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.6 RUSSIA

8.4.6.1 The steady growth of the power and oil & gas sectors to boost the demand throughout the forecast period

TABLE 175 RUSSIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 176 RUSSIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 177 RUSSIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 178 RUSSIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.7 REST OF EUROPE

TABLE 179 REST OF EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 180 REST OF EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 181 REST OF EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 182 REST OF EUROPE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 183 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 184 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 185 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 188 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 189 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 192 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 193 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 194 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 Growing industrialization and water scarcity to spur the demand

TABLE 195 SAUDI ARABIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 196 SAUDI ARABIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 197 SAUDI ARABIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 198 SAUDI ARABIA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5.2 UAE

8.5.2.1 Growing production of chemicals and oil to drive the market

TABLE 199 UAE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 200 UAE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 201 UAE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 202 UAE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5.3 SOUTH AFRICA

8.5.3.1 Growing demand for freshwater to drive the market

TABLE 203 SOUTH AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 204 SOUTH AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 205 SOUTH AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 206 SOUTH AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5.4 QATAR

8.5.4.1 Oil & gas industry in the country driving the demand for water treatment chemicals

TABLE 207 QATAR: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 208 QATAR: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 209 QATAR: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 210 QATAR: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 211 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (KILOTON)

TABLE 212 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 213 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 214 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 215 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019-2026 (KILOTON)

TABLE 216 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019-2026 (KILOTON)

TABLE 217 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019-2026 (USD MILLION)

TABLE 218 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2019-2026 (USD MILLION)

TABLE 219 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016-2018 (KILOTON)

TABLE 220 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019-2026 (KILOTON)

TABLE 221 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2016-2018 (USD MILLION)

TABLE 222 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019-2026 (USD MILLION)

TABLE 223 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 224 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 225 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 226 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 Strong industrial base in the country to drive the market

TABLE 227 BRAZIL: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 228 BRAZIL: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 229 BRAZIL: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 230 BRAZIL: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

8.6.2 CHILE

8.6.2.1 The growth of the mining industry to fuel the industrial wastewater treatment chemicals market

TABLE 231 CHILE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 232 CHILE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 233 CHILE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 234 CHILE: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

8.6.3 REST OF SOUTH AMERICA

TABLE 235 REST OF SOUTH AMERICA: GDP GROWTH RATE, 2019-2021

TABLE 236 REST OF SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (KILOTON)

TABLE 237 REST OF SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (KILOTON)

TABLE 238 REST OF SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2016–2018 (USD MILLION)

TABLE 239 REST OF SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET SIZE, BY END-USE INDUSTRY , 2019–2026 (USD MILLION)

9 COMPETETIVE LANDSCAPE (Page No. - 195)

9.1 INTRODUCTION

FIGURE 23 NEW PRODUCT LAUNCH WAS THE KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2018 AND 2021

9.2 MARKET SHARE ANALYSIS

FIGURE 24 MARKET SHARE OF KEY PLAYERS, 2020

TABLE 240 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET: DEGREE OF COMPETITION

TABLE 241 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2021

9.3 MARKET EVALUATION MATRIX

TABLE 242 MARKET EVALUATION MATRIX

9.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 25 TOP 5 PLAYERS DOMINATED THE MARKET IN THE LAST 3 YEARS

9.5 COMPANY EVALUATION QUADRANT

9.5.1 STAR

9.5.2 EMERGING LEADERS

9.5.3 PERVASIVE

9.5.4 PARTICIPANTS

FIGURE 26 COMPETITIVE LEADERSHIP MAPPING: INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET, 2020

TABLE 243 COMPANY PRODUCT FOOTPRINT

TABLE 244 COMPANY END-USE INDUSTRY FOOTPRINT

TABLE 245 COMPANY REGION FOOTPRINT

9.6 COMPETITIVE LEADERSHIP MAPPING OF START-UPS

9.6.1 PROGRESSIVE COMPANIES

9.6.2 RESPONSIVE COMPANIES

9.6.3 STARTING BLOCKS

9.6.4 DYNAMIC COMPANIES

FIGURE 27 COMPETITIVE LEADERSHIP MAPPING OF START-UPS, 2020

9.7 COMPETITIVE SITUATION & TRENDS

TABLE 246 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET: EXPANSIONS, 2018-2021

TABLE 247 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET: NEW PRODUCT LAUNCHES, 2018-2021

TABLE 248 INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET: DEALS, JANUARY 2018–JANUARY 2021

10 COMPANY PROFILES (Page No. - 208)

(Business overview, Products offered, Recent Developments, Winning imperatives, MNM view)*

10.1 MAJOR PLAYERS

10.1.1 ECOLAB INC.

TABLE 249 ECOLAB INC.: BUSINESS OVERVIEW

FIGURE 28 ECOLAB INC.: COMPANY SNAPSHOT

TABLE 250 ECOLAB INC.: PRODUCT OFFERINGS

TABLE 251 ECOLAB INC: DEALS

TABLE 252 ECOLAB INC.: OTHERS

FIGURE 29 ECOLAB’S CAPABILITY IN INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET

10.1.2 SUEZ S.A.

TABLE 253 SUEZ S.A.: BUSINESS OVERVIEW

FIGURE 30 SUEZ S.A.: COMPANY SNAPSHOT

TABLE 254 SUEZ S.A. PRODUCT OFFERING

TABLE 255 SUEZ S.A.: DEALS

TABLE 256 SUEZ S.A.: OTHER DEVELOPMENTS

FIGURE 31 SUEZ’S CAPABILITY IN THE INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET

10.1.3 KEMIRA OYJ

TABLE 257 KEMIRA OYJ: BUSINESS OVERVIEW

FIGURE 32 KEMIRA OYJ: COMPANY SNAPSHOT

TABLE 258 KEMIRA OYJ: PRODUCT OFFERING

TABLE 259 KEMIRA OYJ: DEALS

TABLE 260 KEMIRA OYJ: OTHERS

FIGURE 33 KEMIRA’S CAPABILITY IN THE INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET

10.1.4 KURITA WATER INDUSTRIES

TABLE 261 KURITA WATER INDUSTRIES: BUSINESS OVERVIEW

FIGURE 34 KURITA WATER INDUSTRIES: COMPANY SNAPSHOT

TABLE 262 KURITA WATER INDUSTRIES: PRODUCT OFFERING

FIGURE 35 KURITAS’ CAPABILITY IN THE INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET

10.1.5 BASF SE

TABLE 263 BASF SE: BUSINESS OVERVIEW

FIGURE 36 BASF SE: COMPANY SNAPSHOT

TABLE 264 BASF SE: PRODUCT OFFERING

FIGURE 37 BASF’S CAPABILITY IN THE INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET

10.1.6 VEOLIA GROUP

TABLE 265 VEOLIA GROUP: BUSINESS OVERVIEW

FIGURE 38 VEOLIA GROUP: COMPANY SNAPSHOT

TABLE 266 VEOLIA GROUP: PRODUCT OFFERING

FIGURE 39 VEOLIA’S CAPABILITY IN INDUSTRIAL WASTEWATER TREATMENT CHEMICALS MARKET

10.1.7 THERMAX LIMITED

TABLE 267 THERMAX LIMITED: BUSINESS OVERVIEW

.FIGURE 40 THERMAX LIMITED: COMPANY SNAPSHOT

TABLE 268 THERMAX LIMITED: PRODUCT OFFERING

10.1.8 LONZA GROUP LTD.

TABLE 269 LONZA GROUP LTD.: BUSINESS OVERVIEW

FIGURE 41 LONZA GROUP LTD.: COMPANY SNAPSHOT

TABLE 270 LONZA GROUP LTD.: PRODUCT OFFERING

10.1.9 BAKER HUGHES INCORPORATED

TABLE 271 BAKER HUGHES INCORPORATED: BUSINESS OVERVIEW

FIGURE 42 BAKER HUGHES INCORPORATED: COMPANY SNAPSHOT

TABLE 272 BAKER HUGHES INCORPORATED: PRODUCT OFFERING

10.1.10 AKZO NOBEL N.V.

TABLE 273 AKZO NOBEL N.V.: BUSINESS OVERVIEW

TABLE 274 AKZO NOBEL N.V.: PRODUCT OFFERING

10.1.11 THE DOW CHEMICAL COMPANY

TABLE 275 THE DOW CHEMICAL COMPANY: BUSINESS OVERVIEW

TABLE 276 THE DOW CHEMICAL COMPANY: PRODUCT OFFERING

10.1.12 SNF FLOERGER

TABLE 277 SNF FLOERGER: BUSINESS OVERVIEW

TABLE 278 SNF FLOERGER: PRODUCT OFFERING

10.1.13 ARIES CHEMICAL

TABLE 279 ARIES CHEMICAL: BUSINESS OVERVIEW

TABLE 280 ARIES CHEMICAL: PRODUCT OFFERING

10.1.14 BUCKMAN LABORATORIES

TABLE 281 BUCKMAN LABORATORIES: BUSINESS OVERVIEW

10.1.15 FERALCO AB

TABLE 282 FERALCO AB: PRODUCT OFFERING

10.1.16 BAUMINAS QUIMICA

TABLE 283 BAUMINAS QUIMICA: BUSINESS OVERVIEW

TABLE 284 BAUMINAS QUIMICA: PRODUCT OFFERING

10.1.17 HYDRITE CHEMICAL CO.

TABLE 285 HYDRITE CHEMICAL CO.: BUSINESS OVERVIEW

TABLE 286 HYDRITE CHEMICAL: PRODUCT OFFERING

10.1.18 INNOSPEC INC.

TABLE 287 INNOSPEC INC.: BUSINESS OVERVIEW

TABLE 288 INNOSPEC INC.: PRODUCT OFFERING

10.1.19 IXOM OPERATIONS PTY LTD

TABLE 289 IXOM OPERATIONS PTY LTD.: BUSINESS OVERVIEW

TABLE 290 IXOM OPERATIONS PTY LTD.: PRODUCT OFFERING

10.1.20 DORF KETAL

TABLE 291 DORF KETAL: BUSINESS OVERVIEW

TABLE 292 DORF KETAL: PRODUCT OFFERING

10.1.21 GEO SPECIALTY CHEMICALS., INC

TABLE 293 GEO SPECIALTY CHEMICALS: BUSINESS OVERVIEW

TABLE 294 GEO SPECIALTY CHEMICALS: PRODUCT OFFERING

10.2 START UPS

10.2.1 AQUATECH INTERNATIONAL

10.2.2 BWA WATER ADDITIVES UK LIMITED

10.2.3 CORTEC CORPORATION

10.2.4 EVOQUA WATER TECHNOLOGIES CORPORATION

10.2.5 ACCEPTA LTD

10.2.6 MCC CHEMICALS, INC.

10.2.7 PENTAIR PLC.

10.2.8 ROEMEX LIMITED

10.2.9 XYLEM, INC.

*Details on Business overview, Products offered, Recent Developments, Winning imperatives, MNM view might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 261)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

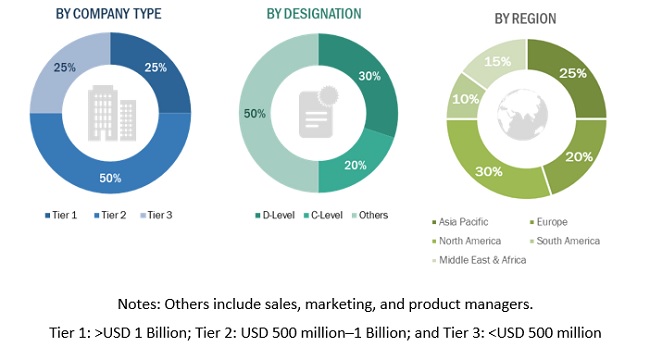

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, ICIS articles, Factiva, and Bloomberg Businessweek, to identify and gather information for a technical, market-oriented, and commercial study of the industrial wastewater treatment chemicals market. The primary sources include industry experts from core and related industries and preferred suppliers, regulatory bodies, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with different primary respondents such as key industry participants, subject matter experts (SMEs), C-Level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects

Secondary Research

In the secondary research process, sources such as annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Primary Research

After the complete market estimation process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research has been conducted to gather information and to verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, industry trends, Porter’s Five Forces analysis, key players, competitive landscape, industry trends, strategies of key players, and key market dynamics such as drivers, restraints, opportunities, and challenges.

In the primary research process, different primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information. The primary sources included industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the Industrial wastewater treatment chemicals market.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this approach, the information pertaining to the global industrial wastewater treatment chemical industry structure has been ascertained to assess the presence of the global key players and small-to-medium-sized manufacturers in the market. Then, the share of the key players involved in the Industrial wastewater treatment chemicals market has been ascertained. The information about the company’s sales from the Industrial wastewater treatment chemicals market by type, either in terms of value or volume, has been assessed for the historical and estimated years. This information collection has been done through secondary research, such as from the companies’ annual reports, investor presentations, contract documents, or through the interaction with industry experts. Based on the collected insights, the share of the key players in the Industrial wastewater treatment chemicals market has been assessed, which has led to quantifying the global industrial wastewater treatment chemicals market size in terms of supply.

Data Triangulation

After arriving at the overall market size from the process explained above, the total market has been split into several segments and sub-segments. To complete the overall market size estimation process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. In addition, the market size has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the industrial wastewater treatment chemicals market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market size by type and end-use industry

- To forecast the market size with respect to five regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as acquisition, new product launch, and investment & expansion, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC industrial wastewater treatment chemicals market

- Further breakdown of Rest of Europe industrial wastewater treatment chemicals market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Wastewater Treatment Chemicals Market