Influencer Marketing Platform Market by Offering, Application (Product Seeding, Influencer Relationship Management), Marketing Type (Content Marketing and Distribution, Event Promotion and Attendance), End User and Region - Global Forecast to 2028

Influencer Marketing Platform Market Growth & Trends

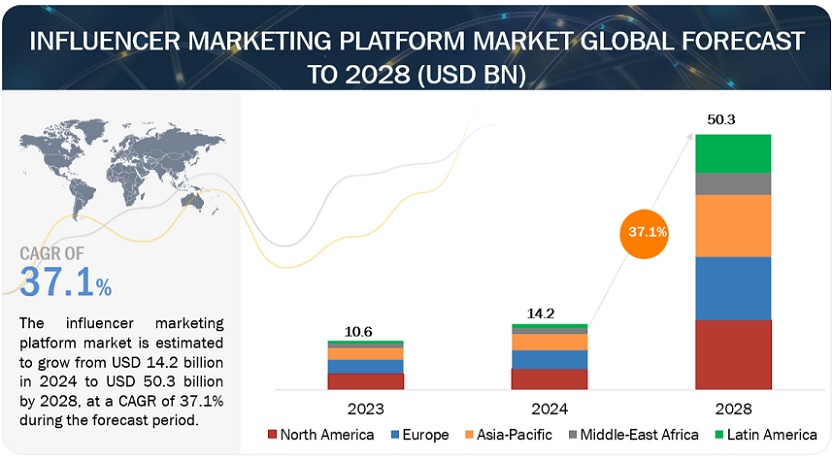

[329 Pages Report] The global influencer marketing platform market is estimated to grow from USD 10.6 billion in 2023 to USD 14.2 billion in 2024 and is forecasted to reach USD 50.3 billion by 2028, at a CAGR of 37.1% during 2024-2028 period. Influencer marketing has emerged as a powerful tool for brands facing challenges in reaching their target audience amidst the vast landscape of digital media. Leveraging the trust and credibility of influencers, brands can authentically connect with niche communities. By partnering with influencers whose values align with theirs, brands can create engaging content that resonates with consumers on a personal level. This approach cuts through the noise of traditional advertising, leading to higher levels of engagement and conversion. However, maintaining transparency and authenticity is crucial to the success of influencer marketing campaigns. Overall, influencer marketing offers brands a unique opportunity to build trust and connect with consumers in an era of unlimited content choices.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Rising adoption of AI driven solutions boost the growth of market

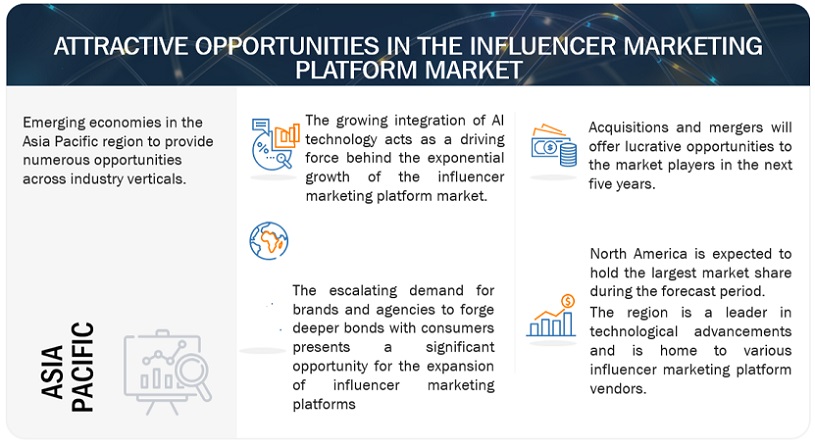

The growing integration of AI technology acts as a driving force behind the exponential growth of influencer marketing platforms. According to the IZEA Insights: Influencing AI report, a substantial 67% of influencers actively incorporate AI tools into their content creation process, indicative of widespread adoption and recognition of its benefits. Additionally, an Econsultancy report reveals that as of July 2023, 58% of marketers leverage generative AI for tasks such as written content creation and copywriting, with 43% utilizing it for SEO keyword research, underscoring AI's integral role in modern marketing strategies.

This reliance on AI-driven solutions is reshaping the influencer marketing landscape by streamlining tasks such as campaign planning, influencer selection, and content optimization. By automating these processes, AI not only boosts efficiency but also reduces resource expenditure. Moreover, AI's ability to combat influencer fraud and identify optimal partnerships, especially with micro-influencers, enhances campaign authenticity and effectiveness. Consequently, the symbiotic relationship between AI and influencer marketing is driving measurable ROI and fostering the rapid expansion of influencer marketing platforms, positioning them as indispensable tools for brands and influencers alike in today's digital ecosystem. Technologies plays a pivotal role in reshaping industries toward more technically advanced, sustainable, and environmentally resilient practices.

Restraint: Complexity in ROI measurement impedes the growth of market

The complexities surrounding the measurement of return on investment (ROI) in influencer marketing pose a significant restraint on the growth of influencer marketing platforms. As highlighted in the 2021 Linqia report, widespread concerns among marketers, with 65% emphasizing the importance of measuring performance and ROI, underscore this issue. Moreover, the time-intensive nature of managing influencer campaigns, as indicated by 51% of respondents, exacerbates these challenges. The primary hurdle lies in aligning measurement strategies with campaign objectives, particularly in accurately tracking engagement rates and conversion rates. Additionally, monitoring fluctuations in follower counts during campaigns provides insights into brand awareness and influence levels. Brands must establish realistic goals and actively track progress to comprehend campaign outcomes and make necessary adjustments for future success. Collaboration with influencers to develop targeted messaging aligned with campaign goals is paramount. Overall, overcoming these measurement challenges is crucial for influencer marketing platforms to drive growth and demonstrate tangible value to brands in the evolving market landscape.

Opportunity: Rising shift towards OTT platforms and social media channels

The burgeoning consumer shift towards Over-the-Top (OTT) platforms and social media channels presents a prime opportunity for influencer marketing platforms to thrive. With more individuals gravitating towards digital streaming services and spending increased time on social media platforms, there is a vast and highly engaged audience ripe for targeted marketing efforts. Influencer marketing platforms serve as a bridge between brands and this digitally-savvy audience, offering a curated network of influencers who command substantial followings and influence within specific niches or demographics. Leveraging these platforms, brands can effectively tap into the diverse and attentive audiences that frequent OTT platforms and social media channels. By collaborating with influencers to create authentic and engaging content, brands can organically integrate their messaging into the online spaces where consumers are actively seeking entertainment and information, thus maximizing brand visibility, engagement, and ultimately driving business growth in the digital landscape.

Challenge: Issues in managing influencer relationships

Managing influencer relationships poses significant challenges to the growth of influencer marketing platforms. As influencer marketing becomes increasingly integral to digital marketing strategies, brands encounter hurdles in identifying suitable influencers and nurturing long-term relationships with them. The process demands personalized communication and meticulous attention to each influencer's preferences and audience dynamics. Managing influencer relationships helps in alleviating these challenges by centralizing essential information and facilitating seamless communication. It empower brands to pinpoint the most relevant influencers, track campaign performance, and offers actionable insights for optimization. Despite the efficiencies offered by such platforms, building and sustaining authentic influencer relationships remains labor-intensive. Brands must invest time and resources to cultivate trust and loyalty among influencers, fostering genuine advocacy for their products or services over time.

Influencer Marketing Platform Market Ecosystem

By end user, retail & ecommerce holds the highest CAGR during the forecast period.

In retail & ecommerce, influencer marketing platforms play a pivotal role in harnessing the expansive reach and influence of social media personalities. These platforms facilitate the strategic identification of influencers whose audiences closely align with target demographics, enabling the creation of authentic content that boosts brand visibility and fosters consumer trust. Leveraging influencer collaborations proves cost-effective and grants access to niche markets, making them indispensable tools for businesses aiming to optimize their marketing endeavors. Additionally, the robust analytics and feedback mechanisms offered by these platforms empower retailers & ecommerce brands to refine their strategies and continually enhance product offerings and campaign efficacy.

Based on the application, influencer relationship management holds the highest CAGR during the forecast period.

The growth of influencer relationship management within influencer platform markets is remarkable. As brands increasingly recognize the value of authentic influencer partnerships, influencer relationship management are becoming indispensable. These applications streamline influencer discovery, communication, and collaboration processes, optimizing campaign execution. With features such as contract management, payment processing, and performance analytics, influencer relationship management platforms empower brands to build and nurture long-term relationships with influencers. This trend underscores the industry's evolution toward more strategic and sustainable influencer marketing practices, where cultivating genuine connections and maximizing mutual value are paramount. Consequently, influencer relationship management is poised to continue its upward trajectory as a cornerstone of influencer marketing strategies.

By marketing type, the leads generation and sales enablement accounts for the largest market size during the forecast period.

The evolution of influencer marketing platforms has seen a notable surge in solutions catering to lead generation and sales enablement. These platforms offer sophisticated tools to identify, engage, and convert leads through strategic influencer collaborations. By harnessing the power of trusted personalities, brands can effectively amplify their message and drive targeted traffic towards conversion. Through data-driven insights and seamless integration with sales pipelines, these platforms facilitate a holistic approach to marketing, optimizing ROI and enhancing brand visibility. As businesses increasingly prioritize performance-driven strategies, the convergence of influencer marketing with lead generation and sales enablement emerges as a pivotal force in shaping modern marketing landscapes.

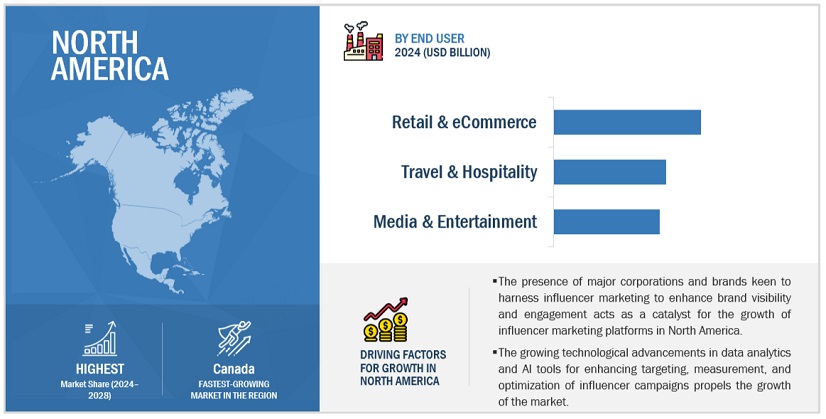

North America to account for the largest market size during the forecast period.

In North America, the influencer marketing platform landscape has experienced exponential growth, fueled by several key factors. The integration of AI technologies has revolutionized the industry, enabling precise audience targeting, content optimization, and campaign performance analysis. Simultaneously, the region's widespread adoption of social media has provided fertile ground for influencer collaboration, with platforms such as Instagram, TikTok, and YouTube becoming indispensable channels for brand promotion. Moreover, North America serves as the home base for numerous influential vendors in the market, fostering innovation and competition. This convergence of technological advancement, social media proliferation, and market leadership underscores North America's pivotal role in driving the evolution of influencer marketing platforms.

Key Market Players

The Influencer marketing platform vendors have implemented various types of organic and inorganic growth strategies, such as partnerships and agreements, new product launches, product upgrades, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market for influencer marketing platform are Izea Worldwide (US), Launchmetrics (US), Triller (US), Traackr (US), Upfluence (US), Meltwater (US), Aspire.io (US), CreatorIQ (US), Later (US), Impact.com (US), Linqia (US), Onalytica (UK), Social Beat (India), GRIN (US), BazaarVoice (US), Pattern (US), Lefty (France), Sprout Social (US), Intellifluence (US), Insense (US), Captiv8 (US), InBeat (Canada), Heepsy (Spain), LTK (US), TRIBE Influencer (Australia), Skeepers (France), Influencity (Spain), Zefmo (India), Afluencer (US), HypeAuditor (US), MagicLinks (US), SocialBook (US), Creator.co (Canada), Glewee (US), and ArabyAds (UAE).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2028 |

|

Forecast units |

USD Billion |

|

Segments Covered |

Offering, Application, Marketing Type, End User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Izea Worldwide (US), Launchmetrics (US), Triller (US), Traackr (US), Upfluence (US), Meltwater (US), Aspire.io (US), CreatorIQ (US), Later (US), Impact.com (US), Linqia (US), Onalytica (UK), Social Beat (India), GRIN (US), BazaarVoice (US), Pattern (US), Lefty (France), Sprout Social (US), Intellifluence (US), Insense (US), Captiv8 (US), InBeat (Canada), Heepsy (Spain), LTK (US), TRIBE Influencer (Australia), Skeepers (France), Influencity (Spain), Zefmo (India), Afluencer (US), HypeAuditor (US), MagicLinks (US), SocialBook (US), Creator.co (Canada), Glewee (US), and ArabyAds (UAE) |

This research report categorizes the Influencer marketing platform market based on Offering, Application, Marketing Type, End User, and Region.

By Offering:

-

Software

-

By Type

- Web-Based

- Mobile-Based

-

By Deployment Mode

- Cloud

- On-Premises

-

By Type

-

Services

-

Professional Services

- Consulting

- Integration & Deployment

- Support & Maintenance

- Managed Services

-

Professional Services

By Application:

- Search & Discovery

- Campaign Management

- Analytics & Reporting

- Content Creation

- Influencer Relationship Management

- Compliance Management

- Payment Processing

- Product Seeding

- Social Listening

- Other Applications

By Marketing Type:

- Thought Leadership & Industry Expertise

- Content Marketing & Distribution

- Event Promotion & Attendance

- Product Launches & Announcements

- Lead Generation& Sales Enablement

- Employee Advocacy & Brand Endorsement

- Other Marketing Types

By End User:

-

Retail & eCommerce

- Fashion & Lifestyle

- Health & Wellness

- Sports & Fitness

- Food & Beverages

- Others

- Travel & Hospitality

-

Media & Entertainment

- Gaming

- Advertising & Marketing Agencies, and PR

- Others

- BFSI

- Automotive & Transportation

- Education

- Healthcare & Life Sciences

- Other End Users

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- ANZ

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- Egypt

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- IZEA announced the acquisition of Zuberance, an advocate marketing software platform, to enrich its ecosystem. Zuberance's features, including customer referrals, reviews, stories, and social sharing, will integrate into IZEA's platform, empowering influencers, and customers to cultivate a network of advocates. This strategic move aligns with IZEA's vision of leveraging influencer presence and authentic customer advocacy in its integrated marketing ecosystem.

- Lectra announced the signing of an agreement to acquire a controlling stake in the American company Launchmetrics, securing a majority of its capital and voting rights.

- Triller announced the complete acquisition of Julius, a leading influencer marketing solution, to enhance its creator platform, offering deep insights and streamlined ROI for customers, aligning with its creator-centric services model.

- Impact.com acquired SaaSquatch to enrich its partnership management platform, allowing brands to harness customer referrals alongside influencer and affiliate partnerships. This acquisition enhances Impact.com's capabilities with automated referral campaigns, tracking, reporting, and rewarding customer advocates, amplifying its value proposition for brands seeking comprehensive partnership solutions.

- Meltwater announced the acquisition of Klear, a leading social influencer marketing company. The acquisition complements Meltwater's existing social listening and analytics offerings, creating a unique integrated product for social listening, analytics, social management, and influencer marketing

Frequently Asked Questions (FAQ):

What is influencer marketing platform?

An influencer marketing platform, often referred to as a marketplace, functions as a centralized solution for businesses to discover, connect with, contract, and remunerate influencers for tailored campaigns. By automating key processes such as influencer identification and payment logistics, these platforms enhance efficiency in campaign management. It enable brands to effectively coordinate with multiple influencers, optimizing resource allocation and maximizing campaign effectiveness within a unified framework.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Spain, and Italy in the European region.

Which are key end user adopting Influencer marketing platform?

Key end user adopting influencer marketing platform include retail & e-commerce (fashion & lifestyle, health & wellness, sports & fitness, food & beverages, and others), travel & hospitality, media & entertainment (gaming, advertising & marketing agencies, and PR, and others), BFSI, automotive & transportation, education, healthcare & life sciences, and other end users (government, real estate, telecommunication).

Which are the key drivers supporting the market growth for influencer marketing platform?

The key drivers supporting the market growth for the influencer marketing platform market include the growing landscape of social media platforms, rising adoption of AI driven solutions boost the growth of market, growth of micro-influencers.

Who are the key vendors in the market for Influencer marketing platform?

The key vendors in the global Influencer marketing platform market Izea Worldwide (US), Launchmetrics (US), Triller (US), Traackr (US), Upfluence (US), Meltwater (US), Aspire.io (US), CreatorIQ (US), Later (US), Impact.com (US), Linqia (US), Onalytica (UK), Social Beat (India), GRIN (US), BazaarVoice (US), Pattern (US), Lefty (France), Sprout Social (US), Intellifluence (US), Insense (US), Captiv8 (US), InBeat (Canada), Heepsy (Spain), LTK (US), TRIBE Influencer (Australia), Skeepers (France), Influencity (Spain), Zefmo (India), Afluencer (US), HypeAuditor (US), MagicLinks (US), SocialBook (US), Creator.co (Canada), Glewee (US), and ArabyAds (UAE). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

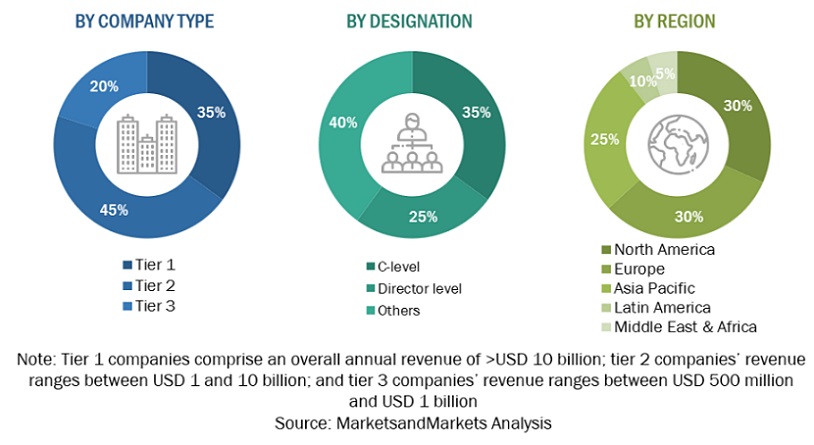

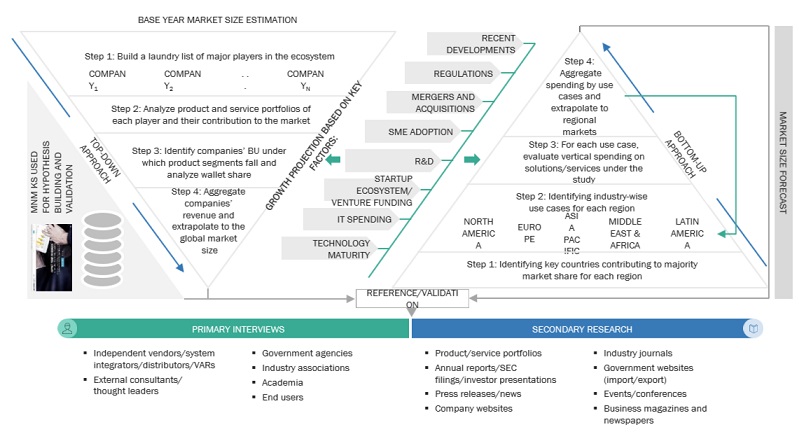

The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the global influencer marketing platform market. The primary sources were mainly industry experts from the core and related industries, preferred software providers, distributors, service providers, technology developers, alliances, and organizations related to all the segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the market’s prospects.

Secondary Research

The market size of companies offering influencer marketing platform software and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites. Additionally, influencer marketing platform software and services spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, functionality, applications, verticals, and regions, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and influencer marketing platform software experts; related key executives from influencer marketing platform software vendors, system integrators, professional service providers, and industry associations, and key opinion leaders.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the top-down approach, an exhaustive list of all the vendors offering software and services in the influencer marketing platform market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each offering of various vendors was evaluated based on the breadth of services, deployment modes, marketing types, applications, and end users. The aggregate revenue of all companies was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of influencer marketing platform software and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of influencer marketing platform software and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the regional penetration of influencer marketing platform software and services. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major influencer marketing platform solutions and services providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall influencer marketing platform market and its segments were determined and confirmed using the study.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on influencer marketing platform software and services based on some of the key use cases. These factors for the Influencer marketing platform tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Market Size Estimation: Top Down And Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

An influencer marketing platform, often referred to as a marketplace, functions as a centralized solution for businesses to discover, connect with, contract, and remunerate influencers for tailored campaigns. By automating key processes such as influencer identification and payment logistics, these platforms enhance efficiency in campaign management. It enable brands to effectively coordinate with multiple influencers, optimizing resource allocation and maximizing campaign effectiveness within a unified framework.

According to Later, an influencer marketing platform is specialized software tailored for enterprise businesses. It facilitates the identification of suitable creators, campaign creation aligned with specific objectives, and comprehensive performance monitoring. This technology streamlines influencer collaboration, ensuring efficient campaign execution and insightful analytics for informed decision-making and optimized results.

Key Stakeholders

- Influencer marketing platform software providers

- Influencer marketing platform service providers

- End-user enterprises

- System Integrators (SIs)

- Managed Service Providers (MSPs)

- Brand/ Marketing Agencies

- Technology providers

- Value-added resellers (VARs)

- Government and regulatory bodies

Report Objectives

- To define, describe, and predict the influencer marketing platform market by offering (software, and services), application, marketing type, end user, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the influencer marketing platform market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for Influencer marketing platform

- Further breakup of the European market for Influencer marketing platform

- Further breakup of the Asia Pacific market for Influencer marketing platform

- Further breakup of the Latin American market for Influencer marketing platform

- Further breakup of the Middle East & Africa market for Influencer marketing platform

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Influencer Marketing Platform Market