Insoluble Dietary Fibers Market by Type (Cellulose, Hemicellulose, Chitin & Chitosan, Lignin, Fiber/Bran, and Resistant Starch), Source (Cereals & Grains, Legumes, and Fruits & Vegetables), Application, and Region - Global Forecast to 2022

[137 Pages Report] The insoluble dietary fiber market is projected to grow at a CAGR of 9.2% from 2017 to 2022, to reach USD 2.66 billion by 2022. Factors such as growth in demand for functional foods, rising consumer awareness through government health programs, and increase in health-consciousness among consumers are driving this market.

Request for Customization to get the global Insoluble Dietary Fiber Market forecasts to 2025

The years considered for the study are as follows:

- Base year – 2015

- Estimated year – 2016

- Projected year – 2022

- Forecast period – 2016 to 2022

See how this study impacted revenues for other players in Dietary Fibers Market

Client’s Problem Statement

Our client, a US manufacturer of dietary fiber, wanted to enter the APAC market and expand its current manufacturing facility. It also wanted to understand the value chain of the product and its customer base, with specific focus on the demand for these products in key application areas.

MnM Approach

MNM conducted a study to understand the prospects of dietary fiber in the region. We categorized the focus areas based on product type and identified the regional drivers that will likely impact the client in APAC.

Revenue Impact (RI)

Our findings helped the client identify application areas with the highest growth opportunities, such as fortified food & beverages and animal feed. Demand for fast-growing dietary fiber types, including soluble dietary fiber, was also identified. Moreover, the regulatory environment was studied and key active players in the market were examined to understand the best industry practices. The study allowed the client to analyze country-level trends in APAC and devise market penetration strategy in high-growth application areas to target potential revenue streams, with projected revenue of ~USD 150 million in three years.

Key Market Dynamics in Insoluble Dietary Fiber Market

Growth in demand for functional foods

Changes in lifestyles and lack of time have led to high consumption of functional foods in countries around the world, especially in Asia. With growth in workload, busy lifestyles, and increase in the number of working women (considering women play a predominant role in preparing meals in households), the time and means to intake healthy food have reduced. This has resulted in the growing demand for products that offer balanced nutrition. Thus, the consumer demand for functional foods, nutraceuticals, and supplements has been increasing. As insoluble dietary fibers form an essential ingredient in functional food products, their market is also increasing.

With changing consumer lifestyles, there is a need for intake of extra fiber. Insoluble dietary fiber content varies in different types of foods. Several key players such as Archer Daniels Midland Company (U.S.), Cargill (U.S.), and E. I. du Pont de Nemours and Company (U.S.), offer a range of insoluble dietary fibers obtained from different sources including wheat, oats, corn, peas, potato, legumes, and rice for their application in food, feed, and pharmaceutical products. Further, the products offered by these companies are also in accordance with consumer needs. This is projected to drive the market for insoluble dietary fibers.

Cost-intensiveness

Dietary fibers cannot be digested by humans due to lack of necessary enzymes in the digestive tract. More specifically, dietary fibers are resistant to hydrolysis. Since dietary fibers cannot be digested, they pass through the body almost unchanged and cannot be used as an energy source. These properties of fibers are useful in the physiological functions that they perform. However, the same characteristics become a hindrance while incorporating fibers as ingredients in food products. Blending of fibers into the product is of high importance for the chemical stability of the product across range of temperatures, and requires time. However, with taking up the volume of the overall product and not contributing to the energy, these fibers become a cost-intensive ingredient. Further, there would be an economic impact on the manufacturer due to the high price of dietary fibers and also the difference in the technology involved in obtaining them.

The objectives of the report

- To define, segment, and estimated the size of the insoluble dietary fibers market, with respect to its sources, applications, types, and key regional markets

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To project the size of the market in terms of value and volume, with respect to four regions (along with their respective countries), namely, North America, Europe, Asia-Pacific, and Rest of the World (RoW)

- To strategically profile the key players and comprehensively analyze their product portfolios and core competencies

- To analyze the competitive developments such as new product launches, acquisitions, expansions & investments, agreements, collaborations and joint ventures in the insoluble dietary fibers market

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share

- Secondary research was conducted to find the value of food thickeners for regions such as North America, Europe, Asia-Pacific, and RoW

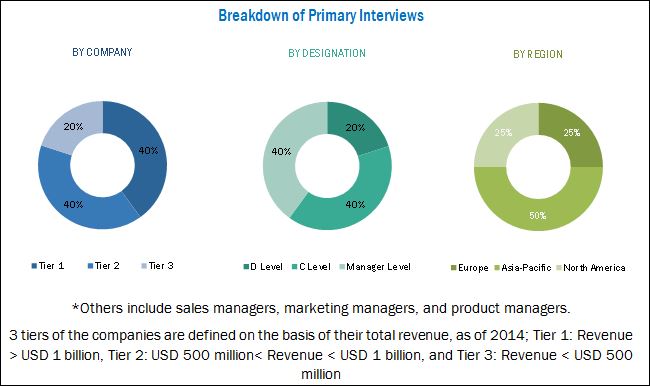

- The key players have been identified through secondary sources such as the Food & Drug Administration (FDA), the United States Department of Agriculture (USDA), and the Canadian Food Inspection Agency (CFIA), while their market shares in respective regions have been determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the insoluble dietary fibers market.

To know about the assumptions considered for the study, download the pdf brochure

Target Audience

The stakeholders for the report are as follows:

- Insoluble dietary fiber manufacturers/distributors

- Insoluble fiber importers and exporters

-

Suppliers

- Farmers

- Agriculture institutes

- R&D institutes

- Technology providers

-

Consumers

- Food & beverage manufacturers/suppliers

- Retailers

- Farmers (livestock farmers)

- Associations and industry bodies such as the Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and other food & safety associations

Scope Of The Report

The insoluble dietary fiber market has been segmented into,

On the basis of the type,

- Cellulose

- Hemicellulose

- Chitin & chitosan

- Lignin

- Fiber/bran

- Resistant starch

- Others include husk and grasses

On the basis of the source,

- Cereals & grains

- Legumes

- Fruits & vegetable

- Others include nuts and seeds

On the basis of the application,

- Functional food & beverages

- Pharmaceuticals

- Feed

- Pet food

On the basis of the region,

- North America

- Europe

- Asia-Pacific

- RoW (Africa and the Middle East)

“The study answers several questions for stakeholders, primarily which market segments to focus on in next two to five years for prioritizing efforts and investments.”

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Application Analysis

- Further breakdown of functional food and beverage applications

Regional Analysis

- Further breakdown of the Rest of Europe insoluble dietary fiber into Russia, and Italy

- Further breakdown of the Rest of Asia-Pacific insoluble dietary fiber into Australia, New Zealand, and Vietnam

- Further breakdown of the RoW insoluble dietary fiber into Paraguay, Uruguay, Chile, and Cuba

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The insoluble dietary fiber market is projected to grow at a CAGR of 9.2% from 2017 to 2022, to reach a projected value of USD 2.66 billion by 2022. Factors such as growth in demand for functional food, rising consumer awareness through government health programs, and increase in health-consciousness among consumers are driving this market.

The insoluble dietary fiber market, based on type, has been segmented into cellulose, hemicellulose, chitin & chitosan, lignin, fiber/bran, resistant starch, and others. The cellulose segment dominated this market in 2016. Cellulose is insoluble dietary fiber used in a wide range of food applications such as meat products, poultry products, and bakery items. Cellulose fibers with low water absorption capacity are mainly used for providing fiber enrichment in different types of bakery products such as bread and tortillas. Cellulose with high water- and oil-holding capacity is used in processed meat to manage the moisture level. The fiber/bran segment is projected to be the fastest-growing due to the growing technological advancements in extraction processes and the investment by the key companies in sourcing fiber/bran from grains, fruits, and vegetable.

The insoluble dietary fiber, based on application, is segmented into functional food & beverages, pharmaceutical, animal feed, and pet food. The functional food and beverage segment is projected to be the largest application segment during the forecast period. Consumption of extra insoluble dietary fibers with food leads to the prevention of health disorders such as constipation, hyperglycemia, obesity, and high cholesterol. Due to the changing diet patterns and the increasing health concerns, insoluble dietary fibers have begun to form an integral part of processed and packaged food in a bid to meet nutritive requirements.

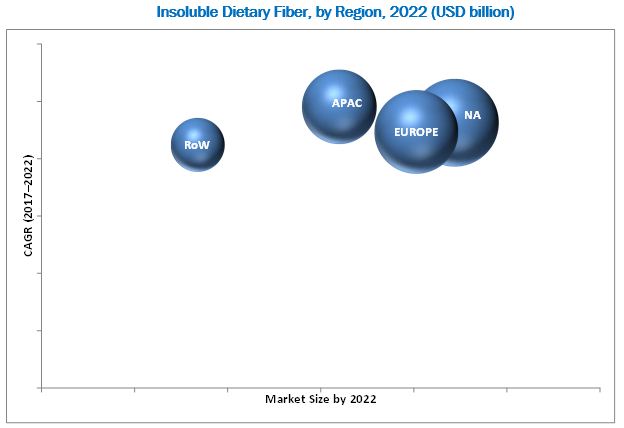

North America accounted for the largest market share for insoluble dietary fiber in 2016. The significant increase in a number of health-conscious consumers is driving the production of insoluble dietary fibers in the region. Consumers in North America are gradually becoming aware of the health benefits provided by insoluble dietary fibers their significance in enhancing immunity. Increasing occurrences of obesity and cardiac diseases have led consumers to demand natural and low-calorie food products. Food manufacturers are therefore concentrating on different applications of insoluble dietary fiber and products. Asia Pacific is projected to be the fastest-growing market during the forecast period. Also, key markets in the Asia Pacific region include China, India, Japan, and Australia. These countries have vast areas under agriculture and produce high-fiber grains & cereals such as oats and barley, which are the primary raw materials for dietary fiber ingredients

The major restraining factor for the insoluble dietary fiber is time and investment required for the regulatory approval. The dietary fiber content has to be declared in the nutrition labeling, and health claims on the packaging of these contents are also strictly regulated. The procedures such as clinical trials are lengthy and require heavy investments, which may limit the number of new entrants in the market.

Companies such as E. I. du Pont de Nemours and Company (U.S.), Cargill, Inc. (U.S.), J. RETTENMAIER & SÖHNE GmbH Co (U.S.), Grain Processing Corporation (U.S.), Ingredion Incorporated (U.S.), and Roquette Frères (France) have acquired leading market position through the provision of a broad portfolio, catering to the varied requirements of the market, along with a focus on the diverse end-user segments. They are also focused on innovation and are geographically diversified.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Periodization Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Market Share Estimation

2.2.1 Secondary Data

2.2.2 Primary Data

2.2.2.1 Key Industry Insights

2.2.2.2 Breakdown of Primaries

2.3 Macroeconomic Indicators

2.3.1 Introduction

2.3.1.1 Aging of Population

2.3.1.2 Developing Economies

2.3.1.3 Occurrence of Nutritional Deficiencies

2.4 Market Size Estimation

2.5 Market Breakdown & Data Triangulation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Insoluble Dietary Fibers Market

4.2 Functional Food & Beverages Segment Holds Maximum Share of Insoluble Dietary Fibers Market

4.3 Cereals & Grains Segment is Projected to Account for the Largest Share, By Source, Through 2022

4.4 Asia-Pacific is the Fastest Growing Region for Insoluble Dietary Fibers Market

4.5 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in Demand for Functional Foods

5.2.1.2 Rise in Consumer Awareness Through Government Health Programs

5.2.1.3 Increase in Health Consciousness Among Consumers Due to Rising Prevalence of Health Disorders

5.2.2 Restraints

5.2.2.1 Time and Investment Required for Regulatory Approval

5.2.2.2 Cost-Intensiveness

5.2.3 Opportunities

5.2.3.1 Growth in Consumer Preference for Weight Management Products

5.2.3.2 New Food Applications of Insoluble Dietary Fibers

5.2.4 Challenges

5.2.4.1 Growth of Soluble Dietary Fibers as Alternatives

5.3 Value Chain Analysis

5.4 Supply Chain Analysis

5.5 Regulatory Framework

5.5.1 Determination of Total Dietary Fibers

5.5.1.1 Prosky Method (AOAC 985.29)

5.5.1.2 Mccleary Method (AOAC 2009.01)

5.5.2 North America

5.5.2.1 U.S.

5.5.2.1.1 U.S. FDA Approved Dietary Fiber Nutrient Content Claims

5.5.2.1.2 U.S. FDA Approved Dietary Fiber Health Claims

5.5.2.2 Canada

5.5.2.2.1 Feeds Act (R.S.C., 1985, C. F-9)

5.5.2.2.2 Labeling and Claims

5.5.3 European Union

5.5.3.1 Dietary Fiber Nutrient Content Claims

5.5.3.2 Dietary Fiber Health Claims

5.5.3.3 Code of Practice of Labeling

5.5.4 Asia-Pacific

5.5.4.1 Qualifying Criteria for Nutrition Content Claims About Dietary Fiber in Australia/New Zealand

5.5.4.2 Biosafety Regulations of Asia-Pacific Countries By Apaari, APCOAB & FAO

6 Insoluble Dietary Fibers Market, By Type (Page No. - 51)

6.1 Introduction

6.2 Cellulose

6.3 Hemicellulose

6.4 Chitin & Chitosan

6.5 Lignin

6.6 Fiber/Bran

6.6.1 Wheat

6.6.2 OAT

6.7 Resistant Starch

6.8 Others

7 Insoluble Dietary Fibers Market, By Source (Page No. - 60)

7.1 Introduction

7.2 Cereals & Grains

7.3 Legumes

7.4 Fruits & Vegetables

7.5 Other Sources

8 Insoluble Dietary Fibers Market, By Application (Page No. - 65)

8.1 Introduction

8.2 Functional Food & Beverages

8.2.1 Beverages

8.2.2 Dairy

8.2.3 Bakery & Confectionery

8.2.4 Breakfast Cereals & Snack Bars

8.2.5 Meat Products

8.2.6 Savory Snacks

8.3 Pharmaceuticals

8.4 Animal Feed

8.5 Pet Food

9 Insoluble Dietary Fibers Market, By Region (Page No. - 71)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 U.K.

9.3.2 France

9.3.3 Germany

9.3.4 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Australia

9.4.5 Rest of Asia-Pacific

9.5 Rest of the World (RoW)

9.5.1 Brazil

9.5.2 Others in RoW

10 Competitive Landscape (Page No. - 100)

10.1 Introduction

10.2 Vendor Dive Overview

10.2.1 Vanguard

10.2.2 Innovator

10.2.3 Dynamic

10.2.4 Emerging

10.3 Competitive Benchmarking

10.3.1 Product Offering (For 25 Companies)

10.3.2 Business Strategy (For 25 Companies)

Top 25 Companies Analyzed for This Study are - Cargill; Archer Daniels Midland Company; Roquette Frères; E. I. Du Pont De Nemours and Company; Ingredion Incorporated; Sunopta, Inc.; Interfiber; Solvaira Specialties; Unipektin Ingredients AG; Advocare Internatinal, L.P.; J. Rettenmaier & Söhne GmbH Co Kg; Grain Processing Corporation; Barndad Nutrition; CJ Cheiljedang; Nexira; General Mills Inc.; Royal Ingredients Group; Emsland Group; Fiberstar; A&B Ingredients; Robinson Pharma, Inc.; Jelu-Werk; Now Foods; Cosucra Groupe Warcoing S.A.; Douglas Laboratories

11 Company Profiles (Page No. - 104)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

11.1 Cargill

11.2 E. I. Dupont De Nemours and Company

11.3 Grain Processing Corporation

11.4 Ingredion Incorporated

11.5 J. Rettenmaier & Söhne GmbH & Co. Kg

11.6 Roquette Frères

11.7 Sunopta, Inc.

11.8 Nexira

11.9 Advocare International, L.P.

11.10 Unipektin Ingredients AG

11.11 Barndad Innovative Nutrition

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 130)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (69 Tables)

Table 1 Dietary Fibers: Functional Properties in Dairy & Beverage Products

Table 2 List of Regulatory Bodies Active in Various Countries for Food, Feed, and Pharmaceutical Products

Table 3 Requirements for Health Claims on Labeling

Table 4 FDAMA (FDA Modernization Act) Health Claims Authorized Based on an Authoritative Statement By Federal Scientific Bodies

Table 5 Declaration for Feed Materials as Referred to in Article 16(1)B of the European Commission (Europa)

Table 6 Insoluble Dietary Fibers Market Size, By Type, 2015–2022 (USD Million)

Table 7 Cellulose Market Size, By Region, 2015–2022 (USD Million)

Table 8 Hemicellulose Market Size, By Region, 2015–2022 (USD Million)

Table 9 Chitin & Chitosan Market Size, By Region, 2015–2022 (USD Million)

Table 10 Lignin Market Size, By Region, 2015–2022 (USD Million)

Table 11 Fiber/Bran Market Size, By Region, 2015–2022 (USD Million)

Table 12 Resistant Starch Market Size, By Region, 2015–2022 (USD Million)

Table 13 Other Insoluble Dietary Fibers Market Size, By Region, 2015–2022 (USD Million)

Table 14 Market Size for Insoluble Dietary Fibers, By Source, 2015-2022 (USD Million)

Table 15 Cereals & Grains Market Size, By Region, 2015-2022 (USD Million)

Table 16 Legumes Market Size, By Region, 2015-2022 (USD Million)

Table 17 Fruits & Vegetables Market Size, By Region, 2015-2022 (USD Million)

Table 18 Other Sources Market Size, By Region, 2015-2022 (USD Million)

Table 19 Insoluble Dietary Fibers Market Size, By Application, 2015-2022 (USD Million)

Table 20 Functional Food & Beverages Market Size, By Region, 2015-2022 (USD Million)

Table 21 Pharmaceuticals Market Size, By Region, 2015-2022 (USD Million)

Table 22 Animal Feed Market Size, By Region, 2015-2022 (USD Million)

Table 23 Pet Food Market Size, By Region, 2015-2022 (USD Million)

Table 24 Market Size for Insoluble Dietary Fibers, By Region, 2015–2022 (USD Million)

Table 25 Insoluble Dietary Fiber Market Size, By Region 2015-2022 (KT)

Table 26 North America: Insoluble Dietary Fibers Market Size, By Application, 2015–2022 (USD Million)

Table 27 North America: Size, By Source, 2015–2022 (USD Million)

Table 28 North America: Market Size, By Type, 2015–2022 (USD Million)

Table 29 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 30 U.S.: Market Size, By Application, 2015–2022 (USD Million)

Table 31 U.S.: Market Size, By Source, 2015–2022 (USD Million)

Table 32 Canada: Market Size, By Application, 2015–2022 (USD Million)

Table 33 Canada: Market Size, By Source, 2015–2022 (USD Million)

Table 34 Mexico: Market Size, By Application, 2015–2022 (USD Million)

Table 35 Mexico: Market Size, By Source, 2015–2022 (USD Million)

Table 36 Europe: Insoluble Dietary Fibers Market Size, By Application, 2015–2022 (USD Million)

Table 37 Europe: Market Size, By Source, 2015–2022 (USD Million)

Table 38 Europe: Market Size, By Type, 2015–2022 (USD Million)

Table 39 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 40 U.K.: Market Size, By Application, 2015–2022 (USD Million)

Table 41 U.K.: Market Size, By Source, 2015–2022 (USD Million)

Table 42 France: Market Size, By Application, 2015–2022 (USD Million)

Table 43 France: Market Size, By Source, 2015–2022 (USD Million)

Table 44 Germany: Insoluble Dietary Fibers Market Size, By Application, 2015–2022 (USD Million)

Table 45 Germany: Market Size, By Source, 2015–2022 (USD Million)

Table 46 Rest of Europe: Market Size for Insoluble Dietary Fibers, By Application, 2015–2022 (USD Million)

Table 47 Rest of Europe: bers Market Size, By Source, 2015–2022 (USD Million)

Table 48 Asia-Pacific: Insoluble Dietary Fibers Market Size, By Application, 2015–2022 (USD Million)

Table 49 Asia-Pacific: Market Size, By Source, 2015–2022 (USD Million)

Table 50 Asia-Pacific: Market Size, By Type, 2015–2022 (USD Million)

Table 51 Asia-Pacific: Market Size, By Country, 2015–2022 (USD Million)

Table 52 China: Market Size for Insoluble Dietary Fibers, By Application, 2015–2022 (USD Million)

Table 53 China: Market Size, By Source, 2015–2022 (USD Million)

Table 54 Japan: Insoluble Dietary Fibers Market Size, By Application, 2015–2022 (USD Million)

Table 55 Japan: Market Size, By Source, 2015–2022 (USD Million)

Table 56 India: Market Size for Insoluble Dietary Fibers, By Application, 2015–2022 (USD Million)

Table 57 India: Market Size, By Source, 2015–2022 (USD Million)

Table 58 Australia: Insoluble Dietary Fibers Market Size, By Application, 2015–2022 (USD Million)

Table 59 Australia: Market Size, By Source, 2015–2022 (USD Million)

Table 60 Rest of Asia-Pacific: Market Size for Insoluble Dietary Fibers, By Application, 2015–2022 (USD Million)

Table 61 Rest of Asia: Market Size, By Source, 2015–2022 (USD Million)

Table 62 RoW: Insoluble Dietary Fibers Market Size, By Application, 2015–2022 (USD Million)

Table 63 RoW: Market Size, By Source, 2015–2022 (USD Million)

Table 64 RoW: Market Size, By Type, 2015–2022 (USD Million)

Table 65 RoW: Market Size, By Country, 2015–2022 (USD Million)

Table 66 Brazil: Market Size for Insoluble Dietary Fibers, By Application, 2015–2022 (USD Million)

Table 67 Brazil: Market Size, By Source, 2015–2022 (USD Million)

Table 68 Others in RoW: Insoluble Dietary Fibers Market Size, By Application, 2015–2022 (USD Million)

Table 69 Others in RoW: Market Size, By Source, 2015–2022 (USD Million)

List of Figures (32 Figures)

Figure 1 Market Segmentation

Figure 2 Insoluble Fibers Market Regional Segmentation

Figure 3 Insoluble Fibers Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Population Aged 65 and Above (% of Total Population)

Figure 6 Occurrence of Nutritional Deficiencies (Global)

Figure 7 Market Size Estimation: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Market Breakdown & Data Triangulation

Figure 10 Fiber/Bran Segment is Projected to Grow at the Highest Rate From 2017 to 2022 in Terms of Value

Figure 11 Functional Food & Beverages Segment is Projected to Dominate the Global Market Through 2022

Figure 12 Fruits & Vegetables Segment Projected to Grow the Fastest Through 2022

Figure 13 Insoluble Dietary Fibers Market Share (Value), By Region, 2016

Figure 14 Attractive Opportunities in this Market, 2017–2022

Figure 15 Pharmaceuticals Was the Second-Largest Application Segment in 2016

Figure 16 Cereals & Grains Segment to Dominate Through 2022

Figure 17 Cellulose Segment Accounted for the Largest Share in the Asia-Pacific Insoluble Dietary Fibers Market, By Type, 2016

Figure 18 North American Insoluble Dietary Fibers Market has Reached the Maturity Phase

Figure 19 Market Dynamics: Insoluble Dietary Fibers

Figure 20 Value Chain Analysis: Insoluble Dietary Fibers Market

Figure 21 Supply Chain Analysis: Insoluble Dietary Fibers Market

Figure 22 Cellulose Accounted for the Largest Share in 2016 and is Projected to Dominate Through 2022

Figure 23 Asia-Pacific is Projected to Grow at the Highest Rate From 2017 to 2022 for Cellulose Insoluble Dietary Fibers

Figure 24 Cereals & Grains as A Source of Insoluble Dietary Fibers Will Hold the Largest Market Share During the Forecast Period

Figure 25 Insoluble Dietary Fibers Market Share, By Application, 2017 vs 2022

Figure 26 North American Insoluble Dietary Fibers Market: A Snapshot

Figure 27 Asia-Pacific: Insoluble Dietary Fibers Market Snapshot

Figure 28 Dive Chart

Figure 29 Cargill.: Company Snapshot

Figure 30 E. I. Dupont De Nemours & Company: Company Snapshot

Figure 31 Ingredion Incorporated: Company Snapshot

Figure 32 Sunopta, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Insoluble Dietary Fibers Market