Integrated Traffic Systems Market by Function (traffic monitoring, traffic control, information Provision), Sensors, Hardware Type (display boards, sensors, radars, interface boards, surveillance cameras), and Region – Global Forecast to 2025

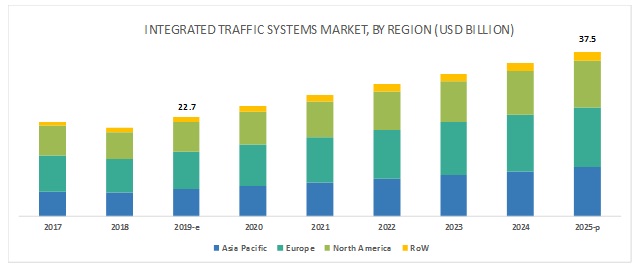

[130 Pages Report] The global integrated traffic systems market is projected to grow from USD 22.7 billion in 2019 to USD 37.5 billion by 2025, at a CAGR of 8.7%. Increase in vehicle ownership is projected to drive the demand for integrated traffic systems market.

The traffic control segment is expected to be the second largest contributor to the integrated traffic system market, by function, during the forecast period.

The current limitations of road infrastructure in developed as well as developing economies have fueled the development for new and existing technologies such as integrated traffic systems. Increasing traffic and growing population in urban areas have boosted the demand for smooth and congestion-free travel from commuters and governments. Moreover, vehicle ownership ratio has increased significantly across the globe, which has led to an increasing demand for traffic control functions. Due to the limited availability of land, usage of current road infrastructure needs to be optimum. For optimum usage of road infrastructure, traffic control systems such as parking management and intelligent traffic lightings are required. As a result of these factors, the traffic control system segment is estimated to be the second largest contributor in the integrated traffic systems market.

Surveillance camera is expected to be the fastest growing segment in the integrated traffic systems market, by hardware, during the forecast period.

The surveillance camera segment is expected to be the fastest growing market during the forecast period. The main factors driving the market include real-time traffic tracking and easily readable information. Moreover, decreasing the cost of camera systems is fueling the application of surveillance cameras in the integrated traffic systems market.

Asia Pacific is estimated to be the fastest growing market and Europe is estimated to account for the largest market share of integrated traffic systems market during the forecast period.

The Asia Pacific integrated traffic systems market is estimated to grow at the highest CAGR during the forecast period. The growth of the Asia Pacific region is due to increased urbanization and vehicle sales in the region in the last two decades. Europe is estimated to account for the largest market share as European countries have a strong focus on emission- and congestion-free traffic. Moreover, Europe has always been an early adopter of advanced technologies such as integrated traffic systems. Countries like Germany and the UK are estimated to drive the market share of Europe in the market.

Key Market Players

The key players in the integrated traffic systems market are Kapsch TrafficCom (Austria), Cubic (US), Swarco (Austria) , Siemens (Germany), Sumitomo (Japan), Flir Systems (US), Jenoptik AG (Germany), LG CNS (Korea), and Iteris (US). Swarco is anticipated to be a dominant player in the market. Swarco adopted the strategies of new product development, supply contracts, and mergers & acquisitions to retain its leading position in the market. The company strengthened its product portfolio and increased its global presence by building customer relationships. It has also started to increase its presence in emerging markets.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2025 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2025 |

|

Forecast Units |

Value (USD million) |

|

Segments Covered |

Function, Hardware, Sensors, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

Sumitomi electric (Japan), Kapsch TrafficCom (Austria), Cubic (US), Swarco (Austria), Siemens (Germany), and Iteris (US). |

This research report categorizes the integrated traffic systems market on the basis of hardware, Function type, sensors type, and region.

Integrated traffic systems market, by function

- Traffic Monitoring

- Traffic Control

- Information Provision

Traffic monitoring market, by System

- Automatic vehicle Detection

- Number Plate Recognition System

- Journey Time Measurement System

Traffic control market, by System

- Intelligent Traffic Lightings

- Parking Management

- Incident Detection

Information Provision market, by System

- Information Communication System

- Multifunctional system

Integrated traffic systems market, by Hardware

- Surveillance Cameras

- Display Boards

- Radars

- Sensors

- Smart Traffic Lights

- Interface Boards

- Others

Integrated Traffic Systems Market, by Region

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In January 2019, Cubic acquired GRIDSMART Technologies, a market-leading, technology-driven business with a differentiated video tracking offering in the intelligent traffic systems market to enhance its surface transport management solution offerings.

Key questions addressed in the report

- How will the increasing technological advancements impact the integrated traffic systems market?

- What are the important functions and which function will account for the largest market share in the integrated traffic systems market?

- Who are the key players in the market and how intense is the competition?

- How will advancements in the hardware of integrated traffic systems impact the market?

- Which region will account for the largest market share during the forecast period and why?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources for Vehicle Production

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 As sumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Integrated Traffic Systems Market

4.2 Market: Major Countries

4.3 Market, By Hardware

4.4 Market, By Function Type

4.5 Market for Traffic Monitoring Function, By System Type

4.6 Market for Traffic Control Function, By System Type

4.7 Market for Information Provision, By System Type

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Urbanization and Car Ownership

5.2.1.2 Increasing Concerns Related to Public Safety

5.2.1.3 Advent of Digital and Advanced Technologies in Transportation Infrastructure

5.2.1.4 Regulatory Frameworks and Government Policies to Reduce Carbon Emissions

5.2.2 Restraints

5.2.2.1 Lack of Standardized and Uniform Technologies

5.2.2.2 Huge Capital Investments in Old Road Infrastructure

5.2.3 Opportunities

5.2.3.1 Increasing Public-Private Partnerships (Ppps)

5.2.3.2 Increasing Number of Mega Cities in Developing Countries

5.2.4 Challenges

5.2.4.1 Vulnerability to Digital Attacks

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Use Cases: Integrated Traffic Management System

6.2.1 Cavite-Laguna Expressway (Calax), Philippines

6.2.2 Vilnius Traffic Management System, Lithuania

6.2.3 Thompsons Roadways Project, Melbourne, Australia

6.2.4 Smart City Bhubaneswar, India

6.3 Integrated Traffic Ecosystem

6.4 Protocols Related to Integrated Traffic System

6.4.1 Short Range

6.4.2 Wave (Ieee 802.11)

6.4.3 Wimax (Ieee 802.11)

6.4.4 Ofdm

6.4.5 Ieee 1512

6.4.6 Traffic Management Data Dictionary (Tmdd)

6.4.7 Others

6.5 Porter’s 5 Forces Analysis

7 Integrated Traffic Systems Market, By Sensors Type (Page No. - 46)

7.1 Infrared Sensors

7.2 Weigh-In Motion Sensors (Force Sensor)

7.3 Acoustic Sensors

7.3.1 Road Condition Sensors

7.3.2 Visibility Sensors

7.3.3 thermal Mapping Sensors

7.3.4 Wind Speed Sensors

7.3.5 Inductive Loop Detectors

8 Integrated Traffic Systems Market, By Function (Page No. - 48)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are as ia Pacific, Europe, North America and RoW

8.1 Introduction

8.2 Traffic Monitoring

8.2.1 Automatic Vehicle Detection

8.2.1.1 Increasing Demand for Reducing Average Travelling Time is Estimated to Drive The Automatic Vehicle Detection System Market

8.2.2 Number Plate Recognition System

8.2.2.1 Increasing Demand for Reliable Journey Time Measurement Systems is Driving The Growth of the Number Plate Recognition Systems

8.2.3 Journey Time Measurement System

8.2.3.1 Increasing Demand for Reduction in Waiting Time During Traffic Congestion is Driving the Demand for Journey Time Measurement Systems

8.3 Traffic Control

8.3.1 Intelligent Traffic Lightings

8.3.1.1 Increasing Demand for Reduced Waiting Time is Expected to Drive the Intelligent Traffic Lightings Market

8.3.2 Parking Management

8.3.2.1 Limited Availability of Parking Spaces in Urban Areas is Expected to Drive the Demand for Parking Management

8.3.3 Incident Detection System

8.3.3.1 Increasing Urbanization in as ia Pacific is Estimated to Drive the Incident Detection System Market

8.4 Information Provision

8.4.1 Multifunctional System

8.4.1.1 Increasing Number of Components in Integrated Traffic Systems is Estimated to Drive the Demand for Multifunction Systems

8.4.2 Information Communication System

8.4.2.1 Europe is Estimated to Account for the Largest Market Share in the Information Communication System Market

9 Integrated Traffic Systems Market, By Hardware (Page No. - 59)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are as ia Pacific, Europe, North America and RoW

9.1 Introduction

9.2 Display Boards

9.2.1 Increasing Need to Help Drivers in Receiving Updated Traffic Information is Expected to Drive the Deployment of Display Boards

9.3 Sensors

9.3.1 Increase in Number of Sensors Required Per Traffic System is Driving the Growth of the Sensors Market

9.4 Surveillance Cameras

9.4.1 Increasing Demand for Real-Time Superior Quality Data is Driving the Demand for Surveillance Cameras

9.5 Radars

9.5.1 Increasing Demand for Vehicle Detection System is Expected to Increase the Demand for Radars

9.6 Smart Traffic Lights

9.6.1 Increasing Demand for Lowering Waiting Periods at Traffic Signals is Estimated to Drive the Demand for Smart Traffic Lights

9.7 Interface Boards

9.7.1 Increasing Demand for Integrated Traffic Systems is Expected to Drive the Interface Boards Market

9.8 Others

10 Integrated Traffic Systems Market, By Region (Page No. - 68)

Note - The Chapter is Further Segmented at Regional and Country Level By Function Type: Traffic Monitoring, Traffic Control and Information Provision

10.1 Introduction

10.2 As ia Pacific

10.2.1 China

10.2.1.1 China Will Account for the Second Largest Market Share Owing to Its Highest Urban Population

10.2.2 India

10.2.2.1 India is Estimated to Grow at the Highest Cagr Because of Smart City Projects

10.2.3 Japan

10.2.3.1 Japan is Estimated to Account for the Highest Market Share

10.2.4 South Korea

10.2.4.1 Developed Economy of South Korea to Drive the Market

10.2.5 Australia

10.2.5.1 Growing Traffic Congestion is Estimated to Drive the Need for the Integrated Traffic Systems

10.2.6 Rest of as ia Pacific

10.2.6.1 Rest of as ia Pacific is Estimated to Witness Relatively Slow Growth

10.3 Europe

10.3.1 France

10.3.1.1 France Will Be One of the Early Adopters of Integrated Traffic Systems

10.3.2 Germany

10.3.2.1 Germany is Estimated to Account for the Largest Market Share

10.3.3 Italy

10.3.3.1 Traffic Control is Estimated to Grow at the Highest Cagr

10.3.4 Spain

10.3.4.1 Increasing Car Ownership Will Drive the Demand for Integrated Traffic Systems

10.3.5 Switzerland

10.3.5.1 Swiss Market is Estimated to Grow Because of Increasing Focus on Road Safety

10.3.6 Russia

10.3.6.1 Traffic Monitoring to Be the Largest Segment

10.3.7 UK

10.3.7.1 UK is Estimated to Grow at the Highest Cagr

10.3.8 Rest of Europe

10.3.8.1 Rest of Europe is Estimated to Account for A Significant Market Share

10.4 North America

10.4.1 Canada

10.4.1.1 Traffic Monitoring is Estimated to Account for the Highest Market Share

10.4.2 Mexico

10.4.2.1 Mexico is Estimated to Be the Second Fastest Growing Market

10.4.3 US

10.4.3.1 Increasing Traffic Congestion in US Cities is Estimated to Drive the Market

10.5 RoW

10.5.1 Brazil

10.5.1.1 Traffic Monitoring is Estimated to Grow at the Highest Cagr

10.5.2 Argentina

10.5.2.1 Highest Urbanized Population Percentage Will Drive the Market

10.5.3 Rest of RoW

10.5.3.1 Traffic Monitoring to Grow at the Highest Cagr

11 Competitive Landscape (Page No. - 88)

11.1 Overview

11.2 Competitive Leadership Mapping

11.2.1 Introduction

11.2.2 Visionary Leaders

11.2.3 Innovators

11.2.4 Dynamic Differentiators

11.2.5 Emerging Companies

11.3 Competitive Situation & Trends

11.3.1 Supply Contract

11.3.2 Acquisition

11.3.3 New Product Launch

11.3.4 Expansions

11.3.5 Joint Venture/Partnership

12 Company Profile (Page No. - 96)

(Business Overview, Products & Services, Solutions Offered, Recent Developments & SWOT Analysis View)*

12.1 Sumitomo Electric

12.2 Siemens

12.3 Cisco

12.4 SWARCO

12.5 Kapsch Trafficcom

12.6 LG CNS

12.7 Cubic

12.8 Iteris

12.9 Jenoptik

12.10 FLIR

12.11 Additional Companies

12.11.1 GTT

12.11.2 Atkins

12.11.3 Savari

12.11.4 PTV Group

12.11.5 Intelvision Technologies

12.11.6 Transcore

12.11.7 Imtac

12.11.8 EFKON

12.11.9 Citilog

12.11.10 Q-Free

*Details on Business Overview, Products & Services, Solutions Offered, Recent Developments & SWOT Analysis View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 120)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.4.1 Integrated Traffic Systems Market, By Traffic Monitoring System

13.4.1.1 Vehicle Detection System

13.4.1.1.1 As ia Pacific Vehicle Detection System, By Country

13.4.1.1.2 Europe Vehicle Detection System, By Country

13.4.1.1.3 North America Vehicle Detection System, By Country

13.4.1.1.4 RoW Vehicle Detection System, By Country

13.4.1.2 Automatic Number Plate Detection System

13.4.1.2.1 As ia Pacific Automatic Number Plate Detection System, By Country

13.4.1.2.2 Europe Automatic Number Plate Detection System, By Country

13.4.1.2.3 North America Automatic Number Plate Detection System, By Country

13.4.1.2.4 RoW Automatic Number Plate Detection System, By Country

13.4.1.3 Journey Time Measurement System

13.4.1.3.1 As ia Pacific Automatic Number Plate Detection System, By Country

13.4.1.3.2 Europe Automatic Number Plate Detection System, By Country

13.4.1.3.3 North America Automatic Number Plate Detection System, By Country

13.4.1.3.4 RoW Automatic Number Plate Detection System, By Country

13.4.2 Integrated Traffic Systems Market, By Traffic Control System

13.4.2.1 Intelligent Traffic Signal System

13.4.2.1.1 As ia Pacific Intelligent Traffic Signal System, By Country

13.4.2.1.2 Europe Intelligent Traffic Signal System, By Country

13.4.2.1.3 North America Intelligent Traffic Signal System, By Country

13.4.2.1.4 RoW Intelligent Traffic Signal System, By Country

13.4.2.2 Incident Detection System

13.4.2.2.1 As ia Pacific Incident Detection System, By Country

13.4.2.2.2 Europe Automatic Incident Detection System, By Country

13.4.2.2.3 North America Incident Detection System, By Country

13.4.2.2.4 RoW Incident Detection System, By Country

13.4.2.3 Journey Time Measuring System

13.4.2.3.1 As ia Pacific Parking Management, By Country

13.4.2.3.2 Europe Parking Management, By Country

13.4.2.3.3 North America Parking Management, By Country

13.4.2.3.4 RoW Parking Management, By Country

13.4.3 Additional Company Profiles

13.5 Related Reports

13.6 Author Details

List of Tables (57 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Public Private Partnership (Ppp) Model Highlights (2010–2018)

Table 3 Comparison of Different Traffic Management Techniques

Table 4 Integrated Traffic Systems Market, By Function, 2017–2025 (USD Million)

Table 5 Traffic Monitoring: Market, By Region, 2017–2025 (USD Million)

Table 6 Traffic Monitoring: Integrated Traffic Monitoring Systems Market, By System, 2017–2025 (USD Million)

Table 7 Automatic Vehicle Detection: Market, By Region, 2017–2025 (USD Million)

Table 8 Number Plate Recognition System: Market, By Region, 2017–2025 (USD Million)

Table 9 Journey Time Measurement System: Market, By Region, 2017–2025 (USD Million)

Table 10 Traffic Control: Market, By Region, 2017–2025 (USD Million)

Table 11 Traffic Control: Market, By System, 2017–2025 (USD Million)

Table 12 Intelligent Traffic Lightings System: Market, By Region, 2017–2025 (USD Million)

Table 13 Parking Management: Market, By Region, 2017–2025 (USD Million)

Table 14 Incident Detection System: Market, By Region, 2017–2025 (USD Million)

Table 15 Information Provision: Market, By Region, 2017–2025 (USD Million)

Table 16 Information Provision: Market, By System, 2017–2025 (USD Million)

Table 17 Multifunctional System: Market, By Region, 2017–2025 (USD Million)

Table 18 Information Communication System: Market, By Region, 2017–2025 (USD Million)

Table 19 Integrated Traffic Systems Market, By Hardware, 2017–2025 (USD Million)

Table 20 Hardware: Integrated Traffic Systems Market, By Region, 2017–2025 (USD Million)

Table 21 Display Boards: Integrated Traffic Systems Market, By Region, 2017–2025 (USD Million)

Table 22 Sensors: Integrated Traffic Systems Market, By Region, 2017–2025 (USD Million)

Table 23 Surveillance Cameras: Integrated Traffic Systems Market, By Region, 2017–2025 (USD Million)

Table 24 Radars: Integrated Traffic Systems Market, By Region, 2017–2025 (USD Million)

Table 25 Smart Traffic Lights: Integrated Traffic Systems Market, By Region, 2017–2025 (USD Million)

Table 26 Interface Boards: Integrated Traffic Systems Market, By Region, 2017–2025 (USD Million)

Table 27 Others: Integrated Traffic Systems Market, By Region, 2017–2025 (USD Million)

Table 28 Integrated Traffic Systems Market, By Region, 2017–2025 (USD Million)

Table 29 as ia Pacific: Market, By Country, 2017–2025 (USD Million)

Table 30 China: Market, By Function, 2017–2025 (USD Million)

Table 31 India: Market, By Function, 2017–2025 (USD Million)

Table 32 Japan: Market, By Function, 2017–2025 (USD Million)

Table 33 South Korea: Market, By Function, 2017–2025 (USD Million)

Table 34 Australia: Market, By Function, 2017–2025 (USD Million)

Table 35 Rest of as ia Pacific: Market, By Function, 2017–2025 (USD Million)

Table 36 Europe: Market, By Country, 2017–2025 (USD Million)

Table 37 France: Market, By Function, 2017–2025 (USD Million)

Table 38 Germany: Market, By Function, 2017–2025 (USD Million)

Table 39 Italy: Market, By Function, 2017–2025 (USD Million)

Table 40 Spain: Market, By Function, 2017–2025 (USD Million)

Table 41 Switzerland: Market, By Function, 2017–2025 (USD Million)

Table 42 Russia: Market, By Function, 2017–2025 (USD Million)

Table 43 UK: Market, By Function, 2017–2025 (USD Million)

Table 44 Rest of Europe: Market, By Function, 2017–2025 (USD Million)

Table 45 North America: Market, By Country, 2017–2025 (USD Million)

Table 46 Canada: Market, By Function, 2017–2025 (USD Million)

Table 47 Mexico: Market, By Function, 2017–2025 (USD Million)

Table 48 US: Market, By Function, 2017–2025 (USD Million)

Table 49 RoW: Market, By Country, 2017–2025 (USD Million)

Table 50 Brazil: Market, By Function, 2017–2025 (USD Million)

Table 51 Argentina: Market, By Function, 2017–2025 (USD Million)

Table 52 Rest of RoW: Market, By Function, 2017–2025 (USD Million)

Table 53 Supply Contract, 2015–2018

Table 54 Acquisition, 2016–2018

Table 55 New Product Launch, 2015–2018

Table 56 Expansions, 2016–2017

Table 57 Joint Venture/Partnership, 2018–2019

List of Figures (42 Figures)

Figure 1 Integrated Traffic Systems Market: Market Segmentation

Figure 2 Research Design: Market

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Market: Market Outlook

Figure 8 Market, By Region, 2019 vs. 2025 (USD Million)

Figure 9 Increased Vehicle Ownership is Expected to Drive the Demand for Market

Figure 10 India to Grow at the Highest Rate During the Forecast Period

Figure 11 Surveillance Camera is Estimated to Account for the Largest Share of Market, 2019 vs. 2025 (USD Million)

Figure 12 Traffic Control Segment is Estimated to Be the Fastest Growing Market During the Forecast Period

Figure 13 Automatic Vehicle Detection is Estimated to Lead the ystems Market, 2019 vs. 2025 (USD Million)

Figure 14 Demand for Lowering the Average Waiting Time of the Vehicle at Signal is Estimated to Drive the Demand for Intelligent Traffic Lighting Systems, 2019 vs. 2025 (USD Million)

Figure 15 Information Communication System is Estimated to Lead the Market for Information Provision,

2019 vs. 2025 (USD Million) 34

Figure 16 Market Dynamics: Integrated Traffic System Market

Figure 17 Vehicle Ownership Per 1000 People (2004 vs. 2014)

Figure 18 Integrated Traffic System Ecosystem

Figure 19 High Cost of Integrated Traffic System is Hampering Mass Adoption of Technology

Figure 20 Traffic Monitoring Segment is Expected to Account for the Largest Market Share of the Integrated Traffic Systems Market

Figure 21 Surveillance Cameras Segment is Expected to Account for the Largest Market Size By 2025

Figure 22 Market, By Region: as ia Pacific to Grow at the Fastest Cagr, 2019 vs. 2025 (USD Million)

Figure 23 as ia Pacific: Market Snapshot

Figure 24 Europe: Market Snapshot

Figure 25 North America: US is Projected to Be the Largest Market, 2019 vs. 2025 (USD Million)

Figure 26 RoW: Brazil is Projected to Be the Largest Market, 2019 vs. 2025 (USD Million)

Figure 27 Integrated Traffic Systems Providers: Competitive Leadership Mapping

Figure 28 Companies Adopted Supply Contract as the Key Growth Strategy, 2015–2018

Figure 29 Sumitomo Electric: Company Snapshot

Figure 30 Sumitomo Electric: SWOT Analysis

Figure 31 Siemens: Company Snapshot

Figure 32 Siemens: SWOT Analysis

Figure 33 Cisco: Company Snapshot

Figure 34 Cisco: SWOT Analysis

Figure 35 SWARCO: SWOT Analysis

Figure 36 Kapsch Trafficcom: Company Snapshot

Figure 37 Kapsch Trafficcom: SWOT Analysis

Figure 38 LG CNS: Company Snapshot

Figure 39 Cubic: Company Snapshot

Figure 40 Iteris: Company Snapshot

Figure 41 Jenoptik: Company Snapshot

Figure 42 FLIR: Company Snapshot

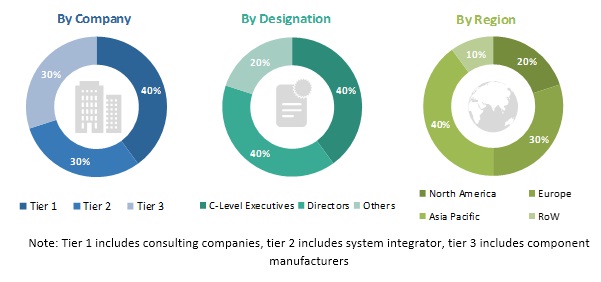

The study involves four main activities to estimate the current size of the integrated traffic systems market. Exhaustive secondary research was done to collect information on the market such as the use of various systems in various applications and transit types. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. A top-down approach was employed to estimate the complete market size of different segments considered in this study.

Secondary Research

The secondary sources referred to in this research study include traffic industry organizations such as the Intelligent Transportation Society of America (ITS America), Intelligent Transport Systems of UK (ITS UK); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and advance traffic management associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the scenario of the integrated traffic systems market through secondary research. Several primary interviews were conducted with market experts from both, demand- (in terms of component supply, country-level government associations, and trade associations) and supply-side (component manufacturers) across 4 major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). Primary data was collected through questionnaires, emails, and telephonic interviews. In our canvassing of primaries, we strived to cover various departments within organizations, which included sales, operations, and administration, to provide a holistic viewpoint of the market in our report.

After interacting with industry participants, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of the in-house subject-matter experts, led us to the findings as described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The integrated traffic systems market, by function, has been calculated using the top-down approach. Extensive secondary and primary researches have been carried out to understand the global market scenario for functions in integrated traffic systems. Several primary interviews were conducted with key opinion leaders involved in the development of the integrated traffic systems including component manufacturers, system integrators, and component manufacturers. Various qualitative aspects such as drivers, restraints, opportunities, and challenges influencing the growth of the market were taken into consideration while calculating and forecasting the size of the market.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying various factors and trends in the demand and supply sides of the integrated traffic systems market.

Report Objectives

- To define the integrated traffic systems market and segment it by functions

- To analyze and forecast the market size, in terms of value (USD million), for the market

- To identify and understand the market dynamics (drivers, restraints, opportunities, and challenges) and their impact on the market

- To segment the market and forecast market size, by value, based on functions (traffic monitoring, traffic control, and information provision)

- To segment the market and forecast market size for traffic monitoring function, by value, based on type (automatic vehicle detection, number plate recognition systems, and journey time measurement systems)

- To segment the market and forecast market size for traffic controlling function, by value, based on type (intelligent traffic management, parking management, and incident detection system)

- To segment the market and forecast market size for information provision function, by value, based on type (multifunctional system and information communication board)

- To segment the market and forecast market size, by value, based on hardware type (display boards, sensors, surveillance cameras, radars, interface boards, and others)

- To segment the market and forecast market size, by value, based on region [Asia Pacific, North America, Europe, and Rest of the World (RoW)]

- To provide an analysis of the recent developments, alliances, joint ventures, and mergers & acquisitions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Integrated traffic systems market, By traffic monitoring system

-

Vehicle detection System

- 1.2.1 Asia Pacific Vehicle detection system, By country

- 1.2.2 Europe Vehicle detection system, By country

- 1.2.3 North America Vehicle detection system, By country

- 1.2.4 RoW Vehicle detection system, By country

-

Automatic number plate detection System

- Asia Pacific Automatic number plate detection System, By country

- Europe Automatic number plate detection System, By country

- North America Automatic number plate detection System, By country

- RoW Automatic number plate detection System, By country

-

Journey time measuring system

- Asia Pacific Automatic Number Plate Detection System, By Country

- Europe Automatic Number Plate Detection System, By Country

- North America Automatic Number Plate Detection System, By Country

- Row Automatic Number Plate Detection System, By Country

Integrated traffic systems market, By traffic control system

-

Intelligent traffic signal System

- Asia Pacific Intelligent traffic signal System, By country

- Europe Intelligent traffic signal System, By country

- North America Intelligent traffic signal System, By country

- RoW Intelligent traffic signal System, By country

-

Incident detection system

- Asia Pacific Incident detection system, By country

- Europe Automatic Incident detection system, By country

- North America Incident detection system, By country

- RoW Incident detection system, By country

-

Journey time measuring system

- Asia Pacific Parking Management System, By country

- Europe Parking Management System, By country

- North America Parking Management System, By country

- RoW Parking Management System, By country

Additional Company Profiles

- Business Overview

- SWOT Analysis

- Recent Developments

- MnM View

Growth opportunities and latent adjacency in Integrated Traffic Systems Market