Intelligent Flow Meter Market by Type (Magnetic, Coriolis, Ultrasonic, Vortex, Multiphase, Thermal, Turbine, Variable Area, & Differential Pressure), Offering, Communication Protocol, Industry, and Region - Global Forecast to 2025

Intelligent Flow Meter Market

Intelligent Flow Meter Market and Top Companies

- Emerson Electric - Emerson Electric offers flow measurement systems under its Automations Solutions segment. This segment majorly caters to process, discrete, and hybrid industries, supporting them to magnify production and protect plant personnel as well as the environment while minimizing their energy and operating costs. The company provides a range of flow meters such as Coriolis, magnetic, differential pressure, vortex, ultrasonic, multiphase, watercut, and turbine types.

- Endress+Houser - Endress+Hauser offers a diverse range of intelligent flow meters such as Coriolis, electromagnetic, differential pressure, ultrasonic, vortex, and thermal types under its Process Instrumentation and Automation segment. The company’s flow meters are majorly used in process industries such as chemicals, oil & gas, and food & beverages for acquiring accurate measurement results of the liquid and gas processed in these industries to analyze this data for further decisions.

- Yokogawa Electric - Yokogawa Electric is engaged in designing, developing, and manufacturing intelligent flow meters. The company’s Industrial Automation and Control Business comprises the intelligent flow meter portfolio that includes magnetic flow meters, vortex flow meters, Coriolis flow meters, and variable area flow meters. It serves various industries such as oil, chemicals, natural gas, electric power, iron and steel, pulp & paper, pharmaceutical, and food.

- ABB - ABB provides flow meters and other measurement and analytics products under its industrial automation segment. The company offers a diverse range of flow meters such as Coriolis mass flow meters, electromagnetic flow meters, multiphase flow meters, primary flow differential pressure products, thermal mass flow meters, variable area flow meters, vortex flow meters, and swirl flow meters. Moreover, the company caters to a variety of industries such as oil & gas, marine, metals, chemicals and pharmaceuticals, power, metals & and mining, and pulp & paper.

- Siemens - Siemens offers industrial automation products and solutions, including flow measurement products, under its Digital Industries segment. The company’s flow meter portfolio consists of flow meter types such as electromagnetic, Coriolis, ultrasonic, vortex, variable area, and differential pressure. These flow meters are offered under the brand SITRANS F. The intelligent flow meters offered by the company are used for the accurate measurement of the flow of liquids, gas, and steam. The SITRANS F product family not only has simple flow indicators but also advanced bus-compatible electronic systems with multifaceted and reliable metering solutions suitable for multiple industry requirements.

Intelligent Flow Meter Market and Top Industries

- Water & wastewater - The water & wastewater industry is one of the largest industrial areas for intelligent flow meters. The accuracy of intelligent flow meters varies with industry and the water & wastewater industry requires maximum accuracy to avoid water wastage. Major intelligent flow meter types such as magnetic, ultrasonic, coriolis, vortex, thermal, and turbine are widely used in this industry for accurate water flow measurement for the safe disposal of wastewater and the provision of clean water. However, ultrasonic and magnetic flow meters contributing to the major share of the market, are significantly used in the water & wastewater industry.

- Oil & gas - The oil & gas industry is one of the significant industry areas for intelligent flow meters. The oil & gas industry comprises processes such as the extraction, processing, and refining of oil and natural gas. Intelligent flow meters are widely used in this industry since the new-generation flow meters can be installed easily and require low maintenance as there are no moving parts in intelligent flow meters. Turbine, thermal, differential pressure, Coriolis, multiphase, and ultrasonic flow meters are mostly used for the flow measurement of oil & gas. Flexible and reliable intelligent flow meters can be deployed in the wide areas of the oil & gas industry such as oilfield services, upstream production, pipeline detection, gas processing, distribution and utilization, and refining.

- Chemicals - The chemicals industry is one of the prominent end-user industries of intelligent flow meters. These flow meters are predominantly used in the chemicals industry for the measurement of chemical fluids in manufacturing and processing plants as well as their disposal. A huge amount of waste chemical fluids is required to be handled at the chemical plants. These chemical plants employ their treatment facilities with the help of intelligent flow meters before these waste chemicals are destroyed.

Intelligent Flow Meter Market and Top Types

- Magnetic - A magnetic flow meter is also known as an electromagnetic flow meter or magmeter. It is a volumetric flow meter mostly suitable for wastewater applications. These flow meters do not have any moving parts and are preferably used for any kind of conductive or water-based dirty liquid. The operation of a magnetic flow meter is based on Faraday’s law of electromagnetic induction. A magnetic flow meter can handle almost all liquids and slurries only if the material being metered is electrically conductive. One of the advantages of magnetic flow meters is that they can measure forward as well as reverse flow with equal accuracy. These flow meters also provide minimum obstructions in the flow path, thereby yielding minimum pressure drop. Since magnetic flow meters do not have any moving parts, the maintenance cost is considerably low.

- Coriolis - The development of mass flow meters is a result of the high demand for more accurate flow measurements in mass-related processes such as chemical reactions and heat transfers. Coriolis flow meters are one of the most commonly used mass flow meters for liquid flow applications. The operation of these flow meters is based on the principle of a natural phenomenon called Coriolis force. They measure the mass rate of the flow directly as opposed to volumetric flow. Though coriolis meters have high accuracy, they can also cause a high-pressure drop.

- Ultrasonic - Ultrasonic flow meters (UFM) are the most widely used non-contact type flow meters for measuring the flow in pipes. The use of these flow meters is preferred due to their advantages such as high resolutions with less interference of noise on the output. This category of smart flow meters possesses the ability to measure the custody transfer of natural gas. This feature has benefited the UFM in gaining a huge demand over the years. UFMs are extensively used to measure liquid flow as well, which is not just limited to clean liquids. The intelligent flow meter industry has also introduced a special type of UFM that can accurately measure the flow of slurries and impure liquids.

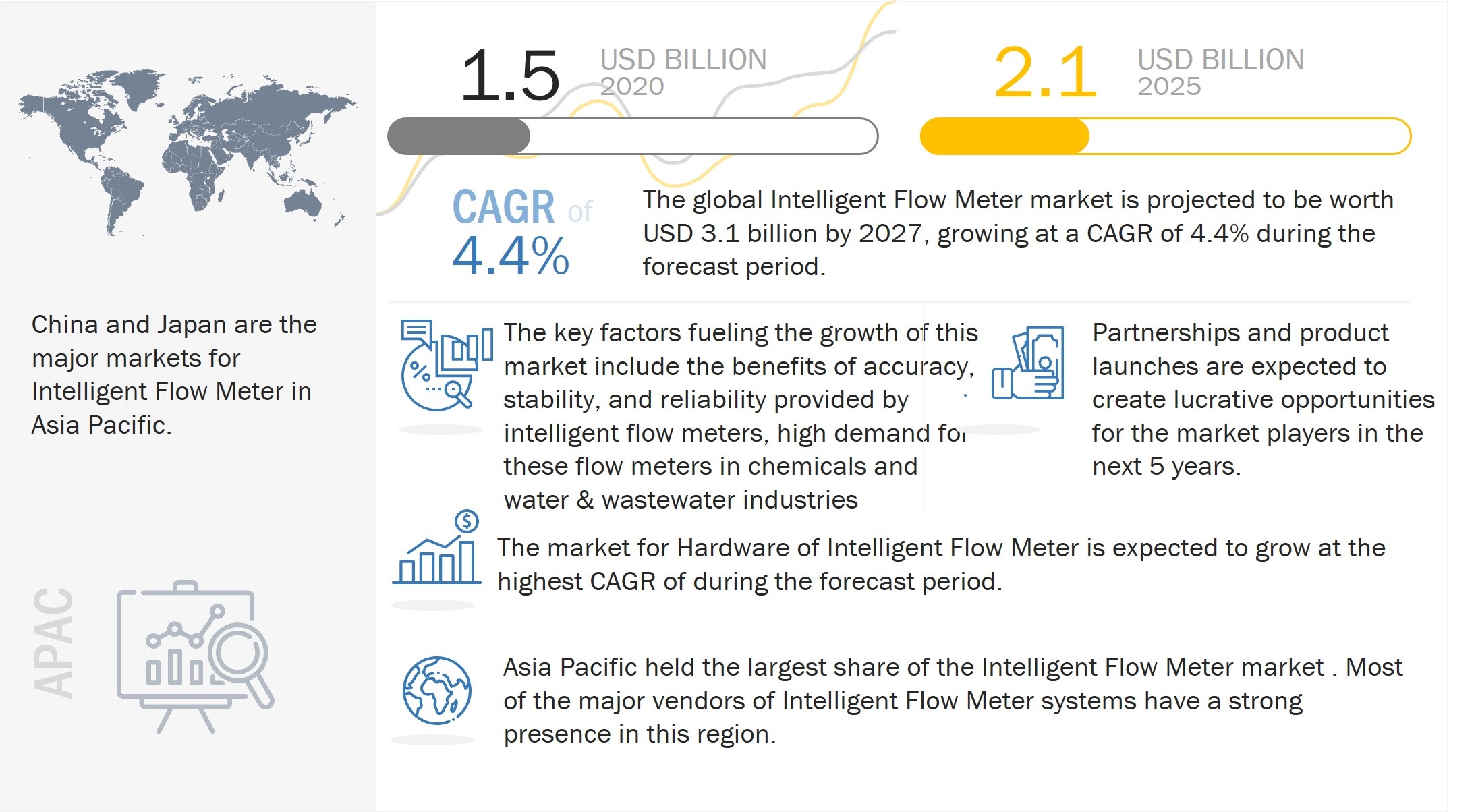

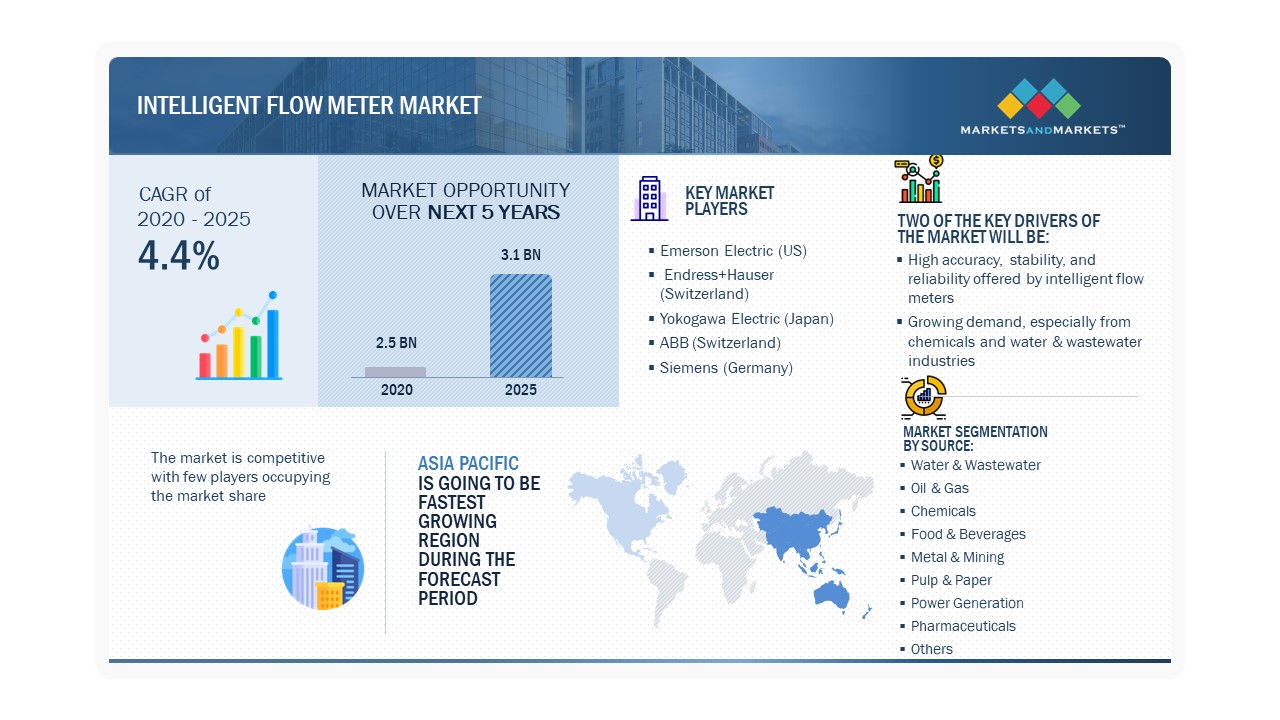

The global intelligent flow meter market size is projected to grow from USD 2.5 billion in 2020 to USD 3.1 Billion by 2025, at a CAGR of 4.4% between 2020-2025. A flow meter is a device used to measure and monitor the flow of liquids and gases, be it linear, non-linear, mass, or volumetric. An intelligent flow meter is a smart flow measurement device used to measure and monitor the flow rate of a liquid or gas in real time. An intelligent flow meter comprises primary devices, sensors, transducers, and transmitters that help in the precise functioning of the same.

These flow meters are used in various applications, such as water & wastewater, oil & gas, food & beverages, chemicals, and pulp & paper, with different engineering requirements.

Intelligent Flow Meter Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

Intelligent Flow Meter Market Dynamics:

Driver: Growing demand, especially from chemicals and water & wastewater industries

The chemicals industry is one of the major application areas for intelligent flow meters since various flow meters, such as magnetic, differential pressure, and ultrasonic flow meters, are employed in this industry.

Using these flow meters in the chemicals industry helps provide safety from flammable and toxic substances. Intelligent flow meters make industrial processes more efficient by properly measuring the quantity and flow of the chemicals used. Hence, there is an increasing trend of the deployment of flow meters in chemical plants, which is largely encouraging the market.

Restraint: High initial cost required for coriolis and magnetic flow meters

One of the major factors limiting the growth of the intelligent flow meter market is a high capital investment for coriolis and magnetic flow meters. These flow meters are used in various applications and possess various features, making them suitable for these applications and providing an accurate measurement.

The high initial investment, including the cost of meter and wiring, is required for coriolis and magnetic flow meters. All other related costs are lesser than the initial cost. Also, the cost of ownership is less expensive than the initial investment required for these flow meters, which acts as a major restraint for the growth of the intelligent flow meter market.

Opportunity: Growing awareness about the advantages of intelligent flow meters

With continuous technological developments in process automation, it is important to make users aware of the benefits of new products.

In the case of intelligent flow meters, there is awareness regarding the cost- and environment-related benefits of intelligent flow meters. Intelligent flow meters analyze the flow measurement data in real time and provide feedback control per the process requirements, which upgrades them when compared with traditional flow meters.

Challenge: Lower adoption rate compared to conventional flow meters

Even though the benefits of intelligent flow meters are numerous compared to traditional flow meters, the adoption rate of intelligent flow meters is low. The high capital and installation cost requirement reduces consumer interest in their implementation.

The process performed by traditional and modern intelligent flow meters is the same, but the major difference between them is the ability of modern intelligent flow meters to provide information from analog to digital, signal processing, sound reduction, and a diagnostic approach. The adoption rate is low due to their high cost and time-consuming process of implementation.

Intelligent Flow Meter Market Segment Insights:

Based on type, the magnetic flow meter segment held the largest share of the market in 2019.

Based on type, Magnetic flow meters contributed the largest share in the intelligent flow meter market. Magnetic flow meters are considered more accurate and reliable than other flow meters with no moving parts. They can measure the flow of water in both forward and backward directions.

The growth can be attributed to the increasing water & wastewater applications such as correct billing & accurate water consumption monitoring, optimization of water usage, monitoring of water flow between reservoirs, irrigation water measurement, reverse osmosis water treatment, and high-purity water plants.

Based on offerings, the hardware segment held the market share in 2019

The hardware segment led the intelligent flow meter market in 2019, holding the largest share of the intelligent flow meter market. Hardware is the most important component of an intelligent flow meter system.

These mainly include sensors such as flow sensors, temperature sensors, pressure sensors, and velocity sensors, and components also include transmitters, switches, and accessories. These devices enable the flow measurement of fluids or gases with high accuracy, which humans cannot differentiate.

Based on Industry, Oil & Gas segment is expected to grow at the highest CAGR in the forecast period

The intelligent flow meter market for the water & wastewater industry is expected to grow at the highest CAGR during the forecast period.

The major reasons behind the growth of this market include the increasing need for accurate water flow measurement to avoid wastage and favorable government regulations on installing intelligent flow meters for the safe discharge of wastewater and proper water distribution.

Intelligent Flow Meter Market Regional Insights:

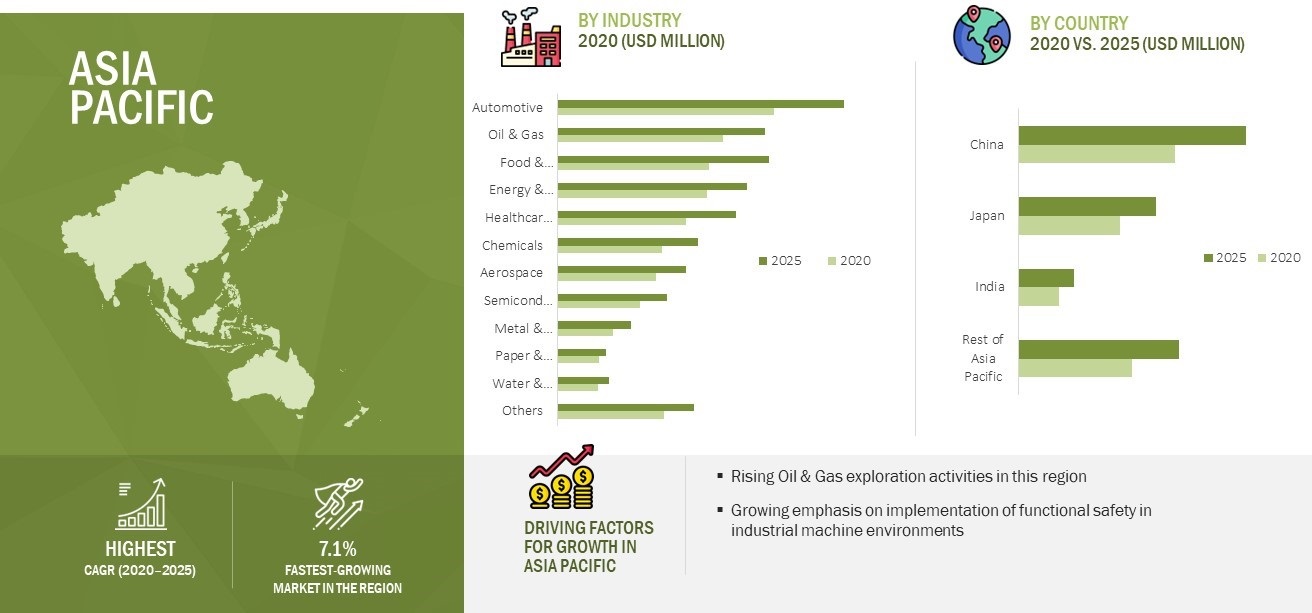

The Asia Pacific region is projected to Grow at the highest CAGR during the forecast period

APAC is to grow at the highest growth rate during the forecast period. The adoption of industrial automation in China is increasing rapidly due to the country's growing industrial sector and rising per capita income.

This leads to the increasing adoption of advanced manufacturing technologies, digital platforms, and smart measurement solutions, consequently leading to more adoption of intelligent flow meters in the country. The presence of prominent players in the intelligent flow meter market, such as Yokogawa Electric (Japan), Azbil (Japan), and Fuji Electric (Japan), supports the growth of the region to a large extent.

Industrial Services Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Intelligent Flow Meter Industry

Some of the Major players in the Intelligent Flow Meter Market are Emerson Electric (US), Endress+Hauser (Switzerland), Yokogawa Electric (Japan), ABB (Switzerland), and Siemens (Germany). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to expand their presence in the Intelligent Flow Meter Market.

Emerson Electric is engaged in the manufacturing and developing process control equipment, valves, and measurement & analytical instruments. Its offers products and solutions to commercial, industrial, and residential markets. Emerson Electric offers flow measurement systems under its Automations Solutions segment. This segment caters to process, discrete, and hybrid industries, supporting them to magnify production and protect plant personnel and the environment while minimizing their energy and operating costs. The company provides a range of flow meters such as Coriolis, magnetic, differential pressure, vortex, ultrasonic, multiphase, and turbine types. Emerson Electric also offers control valves, accessories, configuration, and diagnostic software required for flow measurement.

Endress+Hauser provides instruments for temperature, pressure, level, and flow measurement for industrial processes and measurement-related services and software. The company also offers liquid analysis instruments. Endress+Hauser provides a diverse range of intelligent flow meters such as Coriolis, electromagnetic, differential pressure, ultrasonic, vortex, and thermal types under its Process Instrumentation and Automation segment. The company’s flow meters are used in process industries such as chemicals, oil & gas, and food & beverages to acquire accurate measurement results of the liquid and gas processing in these industries to analyze this data for further decisions.

Intelligent Flow Meter Market Report Scope:

|

Report Metric |

Details |

| Market Size Value in 2020 | USD 2.5 billion |

| Revenue Forecast in 2025 | USD 3.1 Billion |

| Growth Rate | 4.4% |

|

Years considered |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD million) |

|

Segments covered |

Type, Offering, Communication Protocol, Industry, and Region |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

ABB (Switzerland), Emerson Electric (US), Siemens (Germany), Endress+Houser (Switzerland), Honeywell International, Yokogawa Electric (Japan), Baker Hughes (US), and Azbil (Japan) |

In this report, the overall intelligent flow meter market has been segmented based on type, Offering, Communication Protocol, Industry, and Region

By Type

- Coriolis

- Magnetic

- Vortex

- Multiphase

- Ultrasonic

- Variable Area

- Differential Pressure

- Thermal

- Turbine

By Offering

- Hardware

- Software

- Services

By Communication Protocol

- PROFIBUS

- Modbus

- HART

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World

- Middle East & Africa

- South America

Intelligent Flow Meter Industry Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts.

The Intelligent Flow Meter industry has witnessed numerous technological advancements in terms of type, offering and communication protocol over the years. Substantial investments have been made in the research & development and upgrades of the Intelligent Flow Meter. The value chain of the linear motion ecosystem starts with research and development (R&D), which comprises system requirements analysis, comparison of electronics specifications, and prototype development, followed by manufacturing and system integration phases.

- Addition/refinement in segmentation–Increase in depth or width of segmentation of the market

-

Intelligent Flow Meter Market, by Type

- Coriolis

- Magnetic

- Vortex

- Multiphase

- Ultrasonic

- Variable Area

- Differential Pressure

- Thermal

- Turbine

-

Intelligent Flow Meter Market, by Offerings

- Hardware

- Software

- Services

-

Intelligent Flow Meter Market, by Communication Protocol

- PROFIBUS

- Modbus

- HART

- Others

-

Intelligent Flow Meter Market, by Industry

- Water & Wastewater

- Oil & Gas

- Chemicals

- Food & Beverages

- Metal & Mining

- Pulp & Paper

- Power Generation

- Pharmaceuticals

- Others

- Coverage of new market players and change in the market share of existing players of the Intelligent Flow Meter Market

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have a total of 25 players (15 major, 10 Startups/SME). Moreover, the share of companies operating in the Intelligent Flow Meter Market and start-up matrix have also been provided in the report.

- Updated financial information and product portfolios of players operating in the Intelligent Flow Meter Market

Newer and improved representation of financial information: The new edition of the report provides updated financial information in the Intelligent Flow Meter Market till 2021/2022 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to quickly analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities.

- We have updated the market developments of the profiled players

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new service launches, new product launches, investments, funding, and certification have been mapped for the years 2019 to 2022.

- New data points/analysis (frameworks) which was not present in the previous version of the report

- Competitive benchmarking of startups /SMEs covers employee details, financial status, the latest funding round, and total funding.

- Technology analysis and case studies are added in this report edition to give the technological perspective and the significance of the advancements in the Intelligent Flow Meter Market.

- We have included details of patent registrations to overview R&D activities in the Intelligent Flow Meter Market.

- The startup evaluation matrix is added in this report, covering drone startups.

The new edition of the report consists of trends/disruptions in customer business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to better understand the market dynamics for Intelligent Flow Meter.

Recent Developments in Intelligent Flow Meter Industry

- In September 2022, Yokogawa Electric Corporation announced the release of the OpreXTM Magnetic Flowmeter CA Series. The products in this new series are all capacitance-type magnetic flowmeters that can measure the flow of conductive fluids through a measurement tube without the fluids encountering the device's electrodes.

- In December 2021, ABB introduced an electromagnetic flowmeter with bidirectional connectivity to power intelligent water loss management. ABB’s AquaMaster4 Mobile Comms flowmeter is the latest wireless solution for continuous flow measurement, the logging of accurate data, and the communication of information critical for today’s water management.

Frequently Asked Questions (FAQ’s)

What is the current size of the Intelligent Flow Meter Market?

The Intelligent Flow Meter Market is projected to grow from USD 2.5 billion in 2020 to USD 3.1 Billion by 2025, at a CAGR of 4.4% between 2020-2025.

Who are the winners in the Intelligent Flow Meter Market?

>Emerson Electric (US), Endress+Hauser (Switzerland), Yokogawa Electric (Japan), ABB (Switzerland), and Siemens (Germany).

What are some of the technological advancements in the market?

One of the major areas of development in flow meter technology is the role of computer processing. With cheaper memory and higher processing speeds now available, the era of big data is upon us, and this is being used to perform an increasingly complex operation.

Self-Clean System: - Another direction of development has seen products created with the ability to self-clean and maintain an effective level of operation. Without needing constant attention from technicians, these designs save money from reduced engineer costs and maintenance costs.

What are the factors driving the growth of the market?

High accuracy, stability, and reliability are offered by intelligent flow meters, growing demand, especially from chemicals and water & wastewater industries, increasing investments in industrial infrastructure, and rising use for gaining diagnostic information along with standard flow measurement data.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 INTELLIGENT FLOW METER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

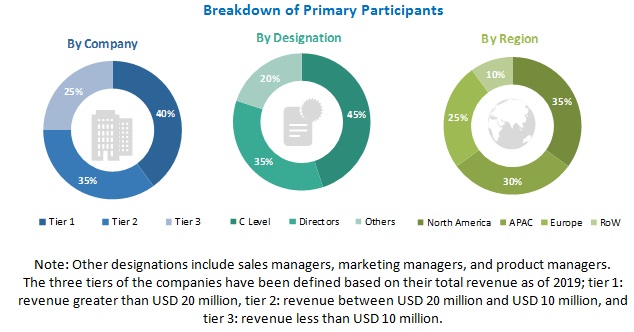

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up approach (demand side)

FIGURE 3 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size by top-down analysis (supply side)

FIGURE 4 MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR INTELLIGENT FLOW METER MARKET THROUGH SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 7 ASSUMPTIONS OF RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 8 SNAPSHOT: INTELLIGENT FLOW METER MARKET, 2017–2025 (USD MILLION)

FIGURE 9 MARKET: SCENARIOS

3.1 REALISTIC SCENARIO

TABLE 1 MARKET: REALISTIC SCENARIO, 2020–2025 (USD MILLION)

3.2 PESSIMISTIC SCENARIO

TABLE 2 MARKET: PESSIMISTIC SCENARIO, 2017–2025 (USD MILLION)

3.3 OPTIMISTIC SCENARIO

TABLE 3 MARKET: OPTIMISTIC SCENARIO, 2017–2025 (USD MILLION)

FIGURE 10 HARDWARE EXPECTED TO HOLD MAJOR SHARE OF MARKET IN 2020

FIGURE 11 OIL & GAS INDUSTRY ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2019

FIGURE 12 MAGNETIC FLOW METERS EXPECTED TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 13 APAC IS EXPECTED TO HOLD POTENTIAL GROWTH FOR MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 INTELLIGENT FLOW METER MARKET EXPECTED TO HAVE HUGE GROWTH OPPORTUNITIES IN APAC

FIGURE 14 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

4.2 MARKET, BY OFFERING (2017–2025)

FIGURE 15 MARKET FOR SOFTWARE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 INTELLIGENT FLOW METER MARKET, BY COMMUNICATION PROTOCOL (2020–2025)

FIGURE 16 PROFIBUS TO HOLD LARGEST SHARE OF MARKET IN 2020

4.4 MARKET IN APAC, BY COUNTRY

FIGURE 17 CHINA ACCOUNTED FOR LARGEST SHARE OF MARKET IN APAC IN 2019

4.5 MARKET, BY REGION

FIGURE 18 INTELLIGENT FLOW METER MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING 2020–2025

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High accuracy, stability, and reliability offered by intelligent flow meters

5.2.1.2 Growing demand, especially from chemicals and water & wastewater industries

5.2.1.3 Increasing investments in industrial infrastructure

5.2.1.4 Rising use for gaining diagnostic information along with standard flow measurement data

FIGURE 20 IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High initial cost required for coriolis and magnetic flow meters

TABLE 4 COST COMPARISON OF FLOW METERS

5.2.2.2 Deteriorating oil prices

FIGURE 21 DECLINING OIL PRICES ADVERSELY AFFECT INVESTMENTS

5.2.2.3 Decline in demand for intelligent flow meters owing to COVID-19 outbreak

FIGURE 22 IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing emphasis on real-time data analysis and enhanced visibility

5.2.3.2 Rising growth opportunities in emerging countries in APAC

5.2.3.3 Growing awareness about advantages of intelligent flow meters

FIGURE 23 IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 High cost of intelligent flow meters

5.2.4.2 Lower adoption rate compared to conventional flow meters

FIGURE 24 IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING MANUFACTURING AND ASSEMBLY STAGES

5.4 IMPACT OF COVID-19 ON INTELLIGENT FLOW METER MARKET

6 INTELLIGENT FLOW METER MARKET, BY TYPE (Page No. - 57)

6.1 INTRODUCTION

FIGURE 26 MARKET, BY TYPE

FIGURE 27 MAGNETIC FLOW METERS EXPECTED TO DOMINATE MARKET IN 2025

TABLE 5 MARKET, BY TYPE, 2017–2025 (USD MILLION)

6.2 MAGNETIC FLOW METERS

TABLE 6 MAGNETIC FLOW METER MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 7 MAGNETIC FLOW METER MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

6.2.1 BY TYPE

FIGURE 28 IN-LINE MAGNETIC FLOW METERS TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 8 MAGNETIC FLOW METER MARKET, BY TYPE, 2017–2025 (USD MILLION)

6.2.1.1 In-line magnetic flow meters

6.2.1.1.1 In-line magnetic flow meters offer higher accuracy of flow measurement than other types

6.2.1.2 Insertion magnetic flow meters

6.2.1.2.1 Insertion magnetic flow meters are suitable for straight pipes

6.2.1.3 Low-flow magnetic flow meters

6.2.1.3.1 Low-flow magnetic flow meters are suitable for measuring low-flow fluid applications

6.2.2 BY COMPONENT

TABLE 9 MAGNETIC FLOW METER MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

6.2.2.1 Non-magnetic flow tubes

6.2.2.1.1 Non-magnetic flow tube is essential component of magnetic flow meter as it lowers current losses

6.2.2.2 Magnetic coils

6.2.2.2.1 Magnetic coils are placed around pipes enabling accurate operation of magmeters

6.2.2.3 Sensing electrodes

6.2.2.3.1 Sensing electrodes enable precise sensing and measurement of flow rate

6.2.2.4 Transmitters

6.2.2.4.1 Transmitters play vital role in processing signals that determine flow rate of fluids

6.2.3 BY LINER MATERIAL

TABLE 10 MAGNETIC FLOW METER MARKET, BY LINER MATERIAL, 2017–2025 (USD MILLION)

6.2.3.1 Perfluoroalkoxy

6.2.3.1.1 PFA has excellent thermal resistance property

6.2.3.2 Polytetrafluoroethylen

6.2.3.2.1 PTFE liner material is largely used in food & beverages industry

6.2.3.3 Hard rubber

6.2.3.3.1 Hard rubber liners are sensitive to high temperatures

6.2.3.4 Others

TABLE 11 MAGNETIC FLOW METER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 12 MAGNETIC FLOW METER MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 13 MAGNETIC FLOW METER MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 14 MAGNETIC FLOW METER MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 15 MAGNETIC FLOW METER MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

6.3 CORIOLIS

6.3.1 CORIOLIS FLOW METERS ARE MAJOR CHOICE OF CHEMICALS AND OIL & GAS INDUSTRIES

FIGURE 29 HARDWARE SEGMENT OF CORIOLIS FLOW METER MARKET EXPECTED TO CONTRIBUTE LARGEST SHARE IN 2020

TABLE 16 CORIOLIS FLOW METER MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 17 CORIOLIS FLOW METER MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 18 CORIOLIS FLOW METER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 19 CORIOLIS FLOW METER MARKET IN NORTH AMERICA, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 20 CORIOLIS FLOW METER MARKET IN EUROPE, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 21 CORIOLIS FLOW METER MARKET IN APAC BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 22 CORIOLIS FLOW METER MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

6.4 ULTRASONIC

TABLE 23 ULTRASONIC FLOW METER MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 24 ULTRASONIC FLOW METER MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

6.4.1 BY TYPE

FIGURE 30 SPOOL PIECE ULTRASONIC FLOW METERS TO HOLD LARGEST MARKET SHARE IN 2025

TABLE 25 ULTRASONIC FLOW METER MARKET, BY TYPE, 2017–2025 (USD MILLION)

6.4.1.1 Spool piece ultrasonic flow meters

6.4.1.1.1 Spool piece flow meters require low maintenance

6.4.1.2 Clamp-on ultrasonic flow meters

6.4.1.2.1 Clamp-on type has effortless installation process

6.4.1.3 Insertion ultrasonic flow meters

6.4.1.3.1 Insertion flow meters are costlier than other types of ultrasonic flow meters

TABLE 26 ULTRASONIC FLOW METER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 27 ULTRASONIC FLOW METER MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 28 ULTRASONIC FLOW METER MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 29 ULTRASONIC FLOW METER MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 30 ULTRASONIC FLOW METER MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

6.5 VORTEX

FIGURE 31 VORTEX FLOW METER MARKET FOR CHEMICALS INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 31 VORTEX FLOW METER MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 32 VORTEX FLOW METER MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

6.5.1 BY MOUNTING TYPE

TABLE 33 VORTEX FLOW METER MARKET, BY MOUNTING TYPE, 2017–2025 (USD MILLION)

6.5.1.1 Wafer vortex flow meters

6.5.1.1.1 Wafer vortex flow meters are economic to install

6.5.1.2 Flanged vortex flow meters

6.5.1.2.1 Chemicals and oil & gas industries largely deploy flanged vortex flow meters

6.5.1.3 Insertion vortex flow meters

6.5.1.3.1 Flow measurement in large pipes requires insertion vortex flow meters

TABLE 34 VORTEX FLOW METER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 35 VORTEX FLOW METER MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 36 VORTEX FLOW METER MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 37 VORTEX FLOW METER MARKET IN APAC, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 38 VORTEX FLOW METER MARKET IN ROW, BY REGION 2017–2025 (USD MILLION)

6.6 MULTIPHASE

6.6.1 MULTIPHASE FLOW METERS HAVE MAJOR APPLICATIONS IN OIL & GAS INDUSTRY

TABLE 39 MULTIPHASE FLOW METER MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 40 MULTIPHASE FLOW METER MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 41 MULTIPHASE FLOW METER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 42 MULTIPHASE FLOW METER MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 43 MULTIPHASE FLOW METER MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 44 MULTIPHASE FLOW METER MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 45 MULTIPHASE FLOW METER MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

6.7 THERMAL

6.7.1 OIL & GAS INDUSTRY IS MAJOR END USER OF THERMAL FLOW METERS

FIGURE 32 THERMAL FLOW METER MARKET FOR SOFTWARE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 46 THERMAL FLOW METER MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 47 THERMAL FLOW METER MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 48 THERMAL FLOW METER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 49 THERMAL FLOW METER MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 50 THERMAL FLOW METER MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 51 THERMAL FLOW METER MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 52 THERMAL FLOW METER MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

6.8 VARIABLE AREA

6.8.1 VARIABLE AREA FLOW METERS ARE MOST SUITABLE FOR WATER & WASTEWATER INDUSTRY DUE TO THEIR SIMPLE CONSTRUCTION

TABLE 53 VARIABLE AREA FLOW METER MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 54 VARIABLE AREA FLOW METER MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 55 VARIABLE FLOW METER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 56 VARIABLE FLOW METER MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 57 VARIABLE FLOW METER MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 58 VARIABLE FLOW METER MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 59 VARIABLE FLOW METER MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

6.9 DIFFERENTIAL PRESSURE

6.9.1 SIMPLE YET ROBUST CONSTRUCTION OF DIFFERENTIAL PRESSURE FLOW METERS MAKES THEM WIDELY ADOPTED ACROSS INDUSTRIES

TABLE 60 DIFFERENTIAL PRESSURE FLOW METER MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 61 DIFFERENTIAL PRESSURE FLOW METER MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

FIGURE 33 APAC TO DOMINATE DIFFERENTIAL PRESSURE FLOW METER MARKET DURING FORECAST PERIOD

TABLE 62 DIFFERENTIAL PRESSURE FLOW METER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 63 DIFFERENTIAL PRESSURE FLOW METER MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 64 DIFFERENTIAL PRESSURE FLOW METER MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 65 DIFFERENTIAL PRESSURE FLOW METER MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 66 DIFFERENTIAL PRESSURE FLOW METER MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

6.10 TURBINE

6.10.1 TURBINE FLOW METERS DETERMINE FLOW RATE FROM PULSES GENERATED FROM ROTATING TURBINES

TABLE 67 TURBINE FLOW METER MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 68 TURBINE FLOW METER MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 69 TURBINE FLOW METER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 70 TURBINE FLOW METER MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 71 TURBINE FLOW METER MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 72 TURBINE FLOW METER MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 73 TURBINE FLOW METER MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

7 INTELLIGENT FLOW METER MARKET, BY OFFERING (Page No. - 99)

7.1 INTRODUCTION

FIGURE 34 MARKET, BY OFFERING

FIGURE 35 HARDWARE SEGMENT TO HOLD LARGEST SHARE OF INTELLIGENT FLOW METER MARKET IN 2020

TABLE 74 MARKET, BY OFFERING, 2017–2025 (USD MILLION)

7.2 HARDWARE

7.2.1 HARDWARE COMPONENTS ARE CORE OF INTELLIGENT FLOW METERS

7.3 SOFTWARE

7.3.1 DATA INTEGRATION, DATA REPORTING, AND ANALYSIS OF PARAMETERS ARE KEY FUNCTIONS OF SOFTWARE

7.4 SERVICES

7.4.1 SOFTWARE INTEGRATION AND INSTALLATION SERVICES ARE MAJOR PART OF MARKET

8 INTELLIGENT FLOW METER MARKET, BY COMMUNICATION PROTOCOL (Page No. - 103)

8.1 INTRODUCTION

FIGURE 36 MARKET, BY COMMUNICATION PROTOCOL

FIGURE 37 PROFIBUS EXPECTED TO HOLD LARGEST SHARE OF MARKET IN 2025

TABLE 75 MARKET, BY COMMUNICATION PROTOCOL, 2017–2025 (USD MILLION)

8.2 PROFIBUS

8.2.1 PROFIBUS ENABLES EFFECTIVE AND RAPID DIGITAL COMMUNICATION

8.3 MODBUS

8.3.1 MODBUS HAS SIMPLE DEPLOYMENT AND MAINTENANCE

8.4 HART

8.4.1 HART ENABLES BI-DIRECTIONAL COMMUNICATION MAKING IT DISTINCTIVE TO USE

8.5 OTHERS

9 INTELLIGENT FLOW METER MARKET, BY INDUSTRY (Page No. - 108)

9.1 INTRODUCTION

FIGURE 38 MARKET, BY INDUSTRY

FIGURE 39 MARKET FOR WATER & WASTEWATER INDUSTRY TO GROW AT HIGHEST CAGR DURING 2020-2025

TABLE 76 MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

9.2 WATER & WASTEWATER

9.2.1 MAGNETIC AND ULTRASONIC FLOW METERS ARE SIGNIFICANTLY USED IN WATER & WASTEWATER INDUSTRY

TABLE 77 INTELLIGENT FLOW METER MARKET FOR WATER & WASTEWATER INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 78 MARKET FOR WATER & WASTEWATER INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

9.3 OIL & GAS

9.3.1 ADOPTION OF INTELLIGENT FLOW METERS IN OIL & GAS INDUSTRY MIGHT BE ADVERSELY IMPACTED BY COVID-19 PANDEMIC

FIGURE 40 OIL & GAS INDUSTRY IN ROW EXPECTED TO CONTRIBUTE LARGEST SHARE OF MARKET IN 2020

TABLE 79 MARKET FOR OIL& GAS INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 80 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

9.4 CHEMICALS

9.4.1 INTELLIGENT FLOW METERS ENABLE PRECISE FLOW MEASUREMENT OF CHEMICALS UNDER HIGH TEMPERATURE AND PRESSURE

TABLE 81 INTELLIGENT FLOW METER MARKET FOR CHEMICALS INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 82 MARKET FOR CHEMICALS INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

9.5 FOOD & BEVERAGES

9.5.1 MAGNETIC AND CORIOLIS FLOW METERS ARE LARGELY USED IN FOOD & BEVERAGES INDUSTRY

FIGURE 41 MAGNETIC FLOW METER MARKET FOR FOOD & BEVERAGES INDUSTRY EXPECTED TO HOLD LARGEST MARKET SIZE IN 2025

TABLE 83 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 84 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

9.6 PULP & PAPER

9.6.1 MAGNETIC AND CORIOLIS FLOW METERS FACILITATE EXPLICIT FLOW MEASUREMENT OF VISCOUS FLUIDS IN PULP & PAPER INDUSTRY

TABLE 85 INTELLIGENT FLOW METER MARKET FOR PULP & PAPER INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 86 MARKET FOR PULP & PAPER INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

9.7 METALS & MINING

9.7.1 DEPLOYMENT OF INTELLIGENT FLOW METERS IN MINING INDUSTRY EXPECTED TO BE NEGATIVELY IMPACTED DUE TO COVID-19

FIGURE 42 METALS & MINING INDUSTRY IN APAC EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 87 MARKET FOR METALS & MINING INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 88 MARKET FOR METALS & MINING INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

9.8 POWER GENERATION

9.8.1 INTELLIGENT FLOW METERS SUPPORT IN GAINING BETTER OPERATIONAL EFFICIENCY OF POWER PLANTS

TABLE 89 INTELLIGENT FLOW METER MARKET FOR POWER GENERATION INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 90 MARKET FOR POWER GENERATION INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

9.9 PHARMACEUTICALS

9.9.1 PHARMACEUTICALS INDUSTRY HAS REMARKABLE GROWTH PROSPECTS FOR MARKET IN NEAR FUTURE

FIGURE 43 ULTRASONIC FLOW METER MARKET FOR PHARMACEUTICALS INDUSTRY EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 91 INTELLIGENT FLOW METER MARKET FOR PHARMACEUTICALS INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 92 MARKET FOR PHARMACEUTICALS INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

9.10 OTHERS

TABLE 93 MARKET FOR OTHER INDUSTRIES, BY TYPE, 2017–2025 (USD MILLION)

TABLE 94 MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2025 (USD MILLION)

9.11 MARKET: COVID-19 UPDATES

9.11.1 OVERVIEW

9.11.2 MOST IMPACTED INDUSTRIES USING INTELLIGENT FLOW METERS

9.11.3 LEAST IMPACTED INDUSTRIES USING INTELLIGENT FLOW METERS

10 INTELLIGENT FLOW METER MARKET, BY REGION (Page No. - 127)

10.1 INTRODUCTION

FIGURE 44 GEOGRAPHIC SNAPSHOT: GLOBAL INTELLIGENT FLOW METER MARKET

TABLE 95 MARKET, BY REGION, 2017–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 45 SNAPSHOT: MARKET IN NORTH AMERICA

TABLE 96 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 97 MARKET IN NORTH AMERICA, BY TYPE, 2017–2025 (USD MILLION)

TABLE 98 MARKET IN NORTH AMERICA, BY INDUSTRY, 2017–2025 (USD MILLION)

10.2.1 US

10.2.1.1 Market in US to be negatively impacted due to COVID-19

10.2.2 CANADA

10.2.2.1 Favorable government regulations and standards driving growth of market in Canada

10.2.3 MEXICO

10.2.3.1 Increasing adoption of industrial automation solutions uplifting market in Mexico

10.3 EUROPE

FIGURE 46 SNAPSHOT: INTELLIGENT FLOW METER MARKET IN EUROPE

TABLE 99 MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 100 MARKET IN EUROPE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 101 MARKET IN EUROPE, BY INDUSTRY, 2017–2025 (USD MILLION)

10.3.1 UK

10.3.1.1 Growing infrastructural activities to support market

10.3.2 GERMANY

10.3.2.1 Deployment of digital technologies in manufacturing and processing plants to propel market growth

10.3.3 FRANCE

10.3.3.1 Focus on technological R&D to fuel market growth

10.3.4 REST OF EUROPE

10.4 APAC

FIGURE 47 SNAPSHOT: MARKET IN APAC

TABLE 102 MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 103 MARKET IN APAC, BY TYPE, 2017–2025 (USD MILLION)

TABLE 104 MARKET IN APAC, BY INDUSTRY, 2017–2025 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Japan has potential opportunities in water & wastewater industry using intelligent flow meters

10.4.2 SOUTH KOREA

10.4.2.1 South Korea is emerging market for intelligent flow meters having potential opportunities

10.4.3 CHINA

10.4.3.1 Deployment of intelligent flow meters in China expected to be adversely impacted owing to COVID-19

10.4.4 INDIA

10.4.4.1 COVID-19 may hinder growth of intelligent flow meter market in India

10.4.5 REST OF APAC

10.5 ROW

TABLE 105 MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 106 MARKET IN ROW, BY TYPE, 2017–2025 (USD MILLION)

TABLE 107 MARKET IN ROW, BY INDUSTRY, 2017–2025 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Oil & gas industry in Middle East substantially propels growth of intelligent flow meter market

10.5.2 SOUTH AMERICA

10.5.2.1 Investments by Asian economies to drive growth of market

11 COMPETITIVE LANDSCAPE (Page No. - 144)

11.1 OVERVIEW

11.2 COMPETITIVE ANALYSIS

TABLE 108 INTELLIGENT FLOW METER MARKET: MARKET SHARE ANALYSIS (2019)

11.3 COMPETITIVE LEADERSHIP MAPPING, 2019

11.3.1 INTRODUCTION

11.3.1.1 Visionary leaders

11.3.1.2 Dynamic differentiators

11.3.1.3 Innovators

11.3.1.4 Emerging companies

FIGURE 48 INTELLIGENT FLOW METER MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

11.4 COMPETITIVE SITUATIONS AND TRENDS

11.4.1 PRODUCT LAUNCHES AND PRODUCT DEVELOPMENTS (2019-2020)

11.4.2 COLLABORATIONS AND ACQUISITIONS (2018)

12 COMPANY PROFILES (Page No. - 149)

(Business overview, Products/solutions/services offered, Recent Developments, SWOT Analysis, MNM view)*

12.1 KEY PLAYERS

12.1.1 EMERSON ELECTRIC

FIGURE 49 EMERSON ELECTRIC: COMPANY SNAPSHOT

12.1.2 ENDRESS+HAUSER

FIGURE 50 ENDRESS+HAUSER: COMPANY SNAPSHOT

12.1.3 YOKOGAWA ELECTRIC

FIGURE 51 YOKOGAWA ELECTRIC: COMPANY SNAPSHOT

12.1.4 ABB

FIGURE 52 ABB: COMPANY SNAPSHOT

12.1.5 SIEMENS

FIGURE 53 SIEMENS: COMPANY SNAPSHOT

12.1.6 HONEYWELL INTERNATIONAL

FIGURE 54 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

12.1.7 AZBIL

FIGURE 55 AZBIL: COMPANY SNAPSHOT

12.1.8 BAKER HUGHES

FIGURE 56 BAKER HUGHES: COMPANY SNAPSHOT

12.1.9 BADGER METER

FIGURE 57 BADGER METER: COMPANY SNAPSHOT

12.1.10 SCHNEIDER ELECTRIC

FIGURE 58 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

12.2 RIGHT-TO-WIN

12.3 OTHER PLAYERS

12.3.1 KROHNE MESSTECHNIK

12.3.2 SIERRA INSTRUMENTS

12.3.3 BROOKS INSTRUMENT

12.3.4 OMEGA ENGINEERING

12.3.5 FUJI ELECTRIC

12.3.6 PROTEUS INDUSTRIES

12.3.7 BRONKHORST

12.3.8 ONICON

12.3.9 LITRE METER

12.3.10 KATRONIC

*Details on Business overview, Products/solutions/services offered, Recent Developments, SWOT Analysis, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 180)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involves four major activities for estimating the size of the intelligent flow meter market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the intelligent flow meter market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size estimations, which has been further validated by primary research.

Primary Research

In the primary research process, a number of primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information pertaining to this report. Several primary interviews have been conducted with market experts from both demand (agriculture and construction companies) and supply sides (intelligent flow meter manufacturers and distributors). This primary data has been collected through questionnaires, emails, and telephonic interviews. Approximately 20% of the primary interviews have been conducted with the demand side and 80% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Additionally, questionnaires and emails were used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the intelligent flow meter market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To define, describe, and forecast the intelligent flow meter market based on type, offering, communication protocol, and industry

- To forecast the market size, in terms of value, for various segments with respect to 4 main regions— North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective key countries

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the intelligent flow meter market

- To provide the impact analysis of the market dynamics with factors currently driving and restraining the growth of the market and opportunities and threats for the same

- To study and analyze the influence of COVID-19 on the intelligent flow meter market during the forecast period

- To strategically analyze the micromarkets with respect to the individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the intelligent flow meter market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies, along with the detailed competitive landscape for the market leaders

- To analyze various competitive developments such as product launches, product developments, collaborations, and acquisitions in the intelligent flow meter market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional five market players

Growth opportunities and latent adjacency in Intelligent Flow Meter Market