Pressure Transmitter Market Size, Share & Trends, 2025 To 2030

Pressure Transmitter Market by Technology, Type (Absolute, Gauge, Differential, Multivariable), Design & Functionality (Diaphragm, Hygienic, Wireless), Fluid Type (Liquid, Gas, Steam), Measurement Application, Industry - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The pressure transmitter market is projected to reach USD 3.84 billion by 2030 from USD 3.21 billion in 2025, at a CAGR of 3.7% from 2025 to 2030. The growth of the pressure transmitter market is driven by rising industrial automation, increased IIoT adoption, and stricter safety regulations across process industries, along with expanding water treatment infrastructure and a focus on energy efficiency.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific pressure transmitter market accounted for a 37.8% revenue share in 2024.

-

By TypeBy type, the multivariable segment is expected to register the highest CAGR of 4.1%.

-

By Fluid TypeBy fluid type, the liquid segment is projected to grow at the fastest rate from 2025 to 2030.

-

By ApplicationBy application, the level segment is expected to dominate the market.

-

By IndustryBy Industry, the water & wastewater treatment segment will grow the fastest during the forecast period.

The pressure transmitter market is experiencing steady growth, driven by the increasing demand for precise and reliable pressure monitoring to enhance efficiency, safety, and automation across various industries. Advancements in IoT-enabled sensing, digital communication, and smart calibration are enhancing system reliability and performance. Additionally, strategic partnerships, product innovations, and the development of wireless and self-diagnostic transmitters are redefining market dynamics, supporting the transition toward intelligent, connected, and data-driven industrial environments.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ businesses in the pressure transmitter market arises from evolving operational requirements and technological advancements across industries. Sectors such as oil & gas, power, chemicals, water & wastewater treatment, food & beverages, metals & mining, and pharmaceuticals are the primary users, relying on precise pressure monitoring for safety, efficiency, and regulatory compliance. The growing shift toward automation, digitalization, and real-time process control has a direct impact on production reliability and cost optimization. These evolving needs are driving demand for advanced, smart, and IoT-enabled pressure transmitters, significantly influencing the market’s growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising use of automation by industry players to optimize resources and boost efficiency

-

Increasing implementation of IIOT and Industry 4.0 technologies

Level

-

Requirement for significant investment and technical expertise

-

Need for period calibration of pressure transmitters to ensure precision

Level

-

Development of pressure transmitters with smart calibration and self-diagnostics features

Level

-

Balancing efficiency, compatibility, and sustainability in pressure transmitters in rapid digital transformation

-

Providing quick and efficient services or easy replacement solutions to clients

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising use of automation by industry players to optimize resources and boost efficiency

The growing shift toward industrial automation is driving the pressure transmitter market. Industries are increasingly adopting real-time pressure monitoring to improve efficiency, reduce costs, and ensure safety. Pressure transmitters provide accurate measurement of pressure, flow, and liquid levels, supporting process reliability across sectors such as oil & gas, mining, and automotive. Additionally, initiatives like the U.S. Department of Energy’s USD 33 million AI-enabled smart manufacturing program are accelerating the adoption of intelligent pressure transmitters in modern industrial operations.

Restraint: Need for period calibration of pressure transmitters to ensure precision

Maintaining long-term accuracy remains a key challenge in the pressure transmitter market, as these devices require periodic calibration to prevent sensor drift caused by harsh conditions and mechanical stress. Calibration is often time-consuming and costly, requiring skilled technicians and system downtime. In industries like oil & gas and pharmaceuticals, neglecting calibration can lead to inaccurate readings, inefficiencies, equipment damage, and safety risks.

Opportunity: Development of pressure transmitters with smart calibration and self-diagnostics features

Technological advancements are transforming pressure transmitter maintenance. Smart calibration now enables automatic adjustments to real-time conditions, reducing manual effort and ensuring accuracy. Self-diagnostic features continuously monitor performance, detect faults early, and prevent failures. These innovations enhance reliability, minimize downtime, and lower maintenance costs, improving efficiency and safety in demanding industrial environments.

Challenge: Balancing efficiency, compatibility, and sustainability, in pressure transmitters in rapid digital transformation

Industries such as energy, chemicals, and manufacturing are evolving with trends like sustainability and digitalization. Pressure transmitter manufacturers are focusing on energy-efficient, eco-friendly, and IIoT-compatible designs. Integrating smart features such as wireless connectivity and predictive maintenance ensures compliance, enhances efficiency, and supports sustainable, connected industrial operations in an increasingly digital world.

Pressure Transmitter Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Emerson Rosemount 3051S used for wellhead and pipeline pressure monitoring in offshore fields. | Improves flow accuracy, safety, and reliability in harsh environments. |

|

ABB 266NRH applied in reactors and distillation units for pressure and flow control. | Ensures stable operations and consistent product quality. |

|

Endress+Hauser Cerabar PMC used in bioreactors and sterile process lines. | Maintains hygiene, accuracy, and GMP/FDA compliance. |

|

ABB 266MST used in hydraulic and pneumatic testing systems. | Delivers reliable pressure control and predictive maintenance. |

|

Yokogawa EJA series used in filtration and pumping systems for water treatment. | Provides precise monitoring and supports regulatory compliance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The pressure transmitter market ecosystem consists of manufacturers (Emerson, ABB, Yokogawa), system integrators (Siemens, Honeywell, Rockwell Automation), distributors (WIKA, Vega), and end users (Nestle, BASF, Pfizer, Pepsico). Manufacturers develop high-precision transmitters, system integrators implement them within automated process networks, distributors facilitate global availability, and end users drive demand for reliable, accurate, and digitally connected pressure measurement solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pressure Transmitter Market, By Type

As of 2024, differential pressure transmitters accounted for the largest share of the pressure transmitter market, driven by their critical role in measuring flow, level, and pressure differences across industries such as oil & gas, chemicals, power generation, and water & wastewater treatment. Known for their precision and reliability in high-pressure and harsh environments, they are extensively used in pipeline flow monitoring, tank level measurement, and subsea operations. Their effectiveness in steam flow control and process optimization further strengthens their dominance across complex industrial applications.

Pressure Transmitter Market, By Fluid Type

As of 2024, the liquid segment dominated the pressure transmitter market, supported by the widespread use of gauge and differential transmitters for liquid level and pressure monitoring. These devices play a vital role in measuring hydrostatic pressure in storage tanks and groundwater systems. In oil & gas operations, they ensure safe drilling, control hydraulic pressure, and monitor subsea flow lines, while in petrochemicals, they enable precise pressure measurement in LPG, crude oil, and petroleum byproducts, ensuring operational safety and process efficiency.

Pressure Transmitter Market, By Measurement Application

As of 2024, the level measurement application segment accounted for the largest share of the pressure transmitter market, driven by the growing need for accurate and reliable monitoring across oil & gas, chemical, and water treatment industries. Pressure transmitters are preferred for measuring liquids, slurries, and bulk solids under extreme conditions due to their cost efficiency, durability, and seamless integration with automation and Industry 4.0 systems, enabling real-time process control and predictive maintenance.

Pressure Transmitter Market, By Industry

The oil & gas industry is projected to remain the dominant end user in the pressure transmitter market, supported by its need for accurate pressure, flow, and level monitoring to ensure safety and efficiency in drilling and production operations. At the same time, the water & wastewater treatment sector is witnessing the fastest growth, driven by the increasing focus on efficient water management and automation. The integration of smart pressure transmitters in treatment facilities enhances process control, reduces maintenance costs, and supports sustainability goals, reinforcing their critical role across industrial operations.

REGION

Asia Pacific to be fastest-growing region in global pressure transmitter market during forecast period

Asia Pacific held the largest share of the global pressure transmitter industry in 2024. The growth is driven by rapid industrialization in key economies, such as China and India, fueling demand for automation in oil & gas, chemical processing, and power generation industries. The adoption of Industry 4.0 and smart manufacturing technologies further boosts the integration of intelligent sensors for real-time monitoring and process optimization. Additionally, the rising investment in the oil & gas sector, increased chemical exports, and expanding wastewater treatment facilities contribute to market expansion. The food & beverages industry’s growth also supports the demand for precise pressure measurement solutions in Asia Pacific.

Pressure Transmitter Market: COMPANY EVALUATION MATRIX

In the pressure transmitter companies matrix, Emerson (Star) leads with a comprehensive portfolio of high-performance transmitters such as the Rosemount series, offering superior accuracy, reliability, and digital integration across process industries. Fuji Electric (Emerging Leader) is rapidly strengthening its position with innovative, cost-effective transmitter solutions tailored for energy efficiency and smart industrial applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.11 Billion |

| Market Forecast in 2030 (Value) | USD 3.84 Billion |

| Growth Rate | CAGR of 3.7% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Pressure Transmitter Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiling of key market participants with details on product portfolio, market share, strategic initiatives, and technological capabilities. | Enables benchmarking of competitive positioning and assessment of innovation strategies. |

| Regional Market Entry Strategy | Country- and region-specific insights, including certification norms, and end-user adoption trends across industrial applications. | Supports informed regional expansion and compliance planning in high-growth markets. |

| Application-Specific Opportunity Assessment | Evaluation of adoption trends across oil & gas, chemicals, power, pharmaceuticals, and water & wastewater treatment segments. | Helps identify high-demand applications and prioritize product development efforts. |

| Technology Adoption by Industry | Insights into the integration of smart, wireless, and digital transmitters in Industry 4.0 environments and IoT-based monitoring systems. | Guides R&D planning, technology upgrades, and automation-driven differentiation. |

| Pricing & Margin Benchmarking | Analysis of transmitter pricing by range, pressure type across OEM and distribution channels. | Supports pricing optimization, profitability improvement, and channel efficiency. |

RECENT DEVELOPMENTS

- November 2024 : ABB launched the P series portfolio of pressure transmitters, which include the P100, P 300, and P 500 series of pressure transmitters. These new pressure transmitter portfolios, which bring high performance and ultra-accurate measurement to industrial and utility applications, help industrial plants optimize process control and improve energy efficiency. Through the integration of a suite of digital technologies, the new pressure transmitters will support the power and process industries in the digital transformation.

- August 2024 : Huba Control launched a reliable pressure transmitter 560, designed to precisely monitor and control heat pump systems, specifically for natural refrigerants and safety class A2L and A3 media.

- August 2024 : Azbil Corporation established a manufacturing subsidiary in Vietnam, which strengthens its global production system, enhancing capacity, cost efficiency, and competitiveness while mitigating geopolitical risks. This expansion aligns with Azbil Corporation’s strategy for sustainable growth

- April 2024 : Danfoss launched the DST P150 pressure transmitter designed to support the growing hydrogen economy, enabling sustainable hydrogen production and adoption of low-GWP energy sources. It offers reliable performance in hydrogen-powered applications, contributing to decarbonization efforts.

Table of Contents

Methodology

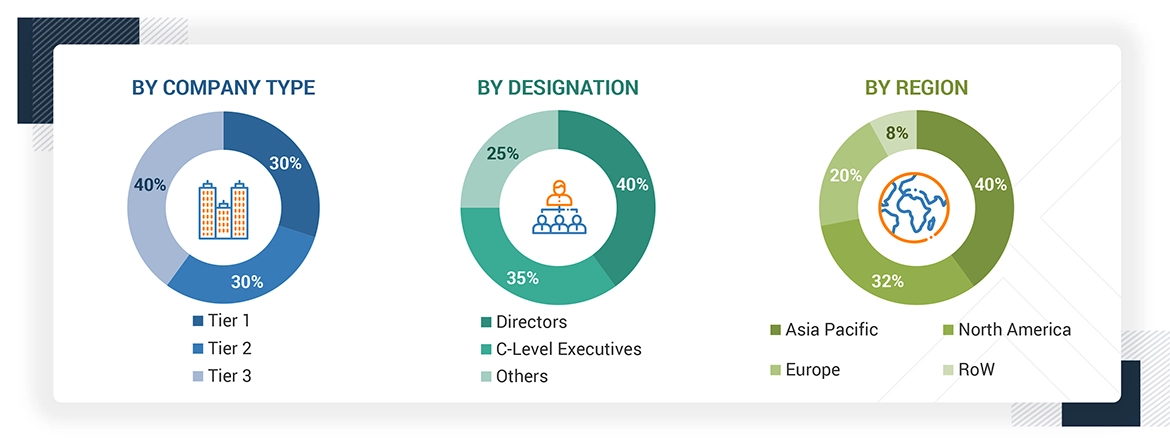

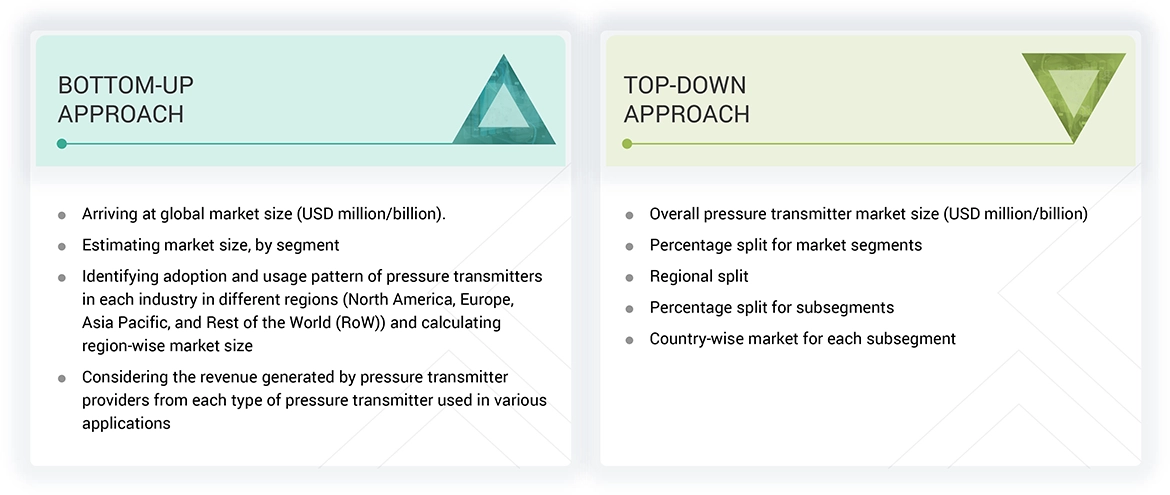

The study involved major activities in estimating the current market size for the pressure transmitter market. Exhaustive secondary research was done to collect information on pressure transmitter industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the pressure transmitter market.

Secondary Research

The market for the companies offering pressure transmitter is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the pressure transmitter market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 30% of the primary interviews were conducted with the demand-side respondents, while approximately 70% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches wete used to estimate and validate the total size of the pressure transmitter market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Pressure Transmitter Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

A pressure transmitter is a field instrument that determines the pressure, level, and flow of liquid, gas, and steam in various applications of process industries. It is used to measure the pressure or level of industrial liquids and gases, the output of which is transmitted to a control system. It utilizes a pressure transducer (for pressure sensing), which is combined with numerous electronic components to allow a digital or an analog signal to be transmitted over long distances. The pressure transmitter provides stable and accurate process measurements, which are used to ensure reliability, optimum productivity, and safety in various industries.

Key Stakeholders

- End users

- Government bodies, venture capitalists, and private equity firms

- Pressure transmitter manufacturers

- Pressure transmitter distributors

- Pressure transmitter industry associations

- Professional service/solution providers

- Research institutions and organizations

- Standards organizations and regulatory authorities

- System integrators

- Technology consultants

Report Objectives

- To describe and forecast the pressure transmitter market, in terms of value, volume, based on type, fluid type, application, industry, and region.

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW).

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth.

- To provide a detailed overview of the value chain of the pressure transmitter ecosystem.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the market .

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2 .

- To analyze the major growth strategies implemented by key market players, such as agreements, acquisitions, product launches, expansions, and partnerships.

- To study the impact of AI on the market under study, along with macroeconomic outlook for each region.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pressure Transmitter Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pressure Transmitter Market