The research study involved four major steps in estimating the size of the industrial hose market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation approaches have been adopted to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect the information required for this study. These sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from market and technology perspectives.

In the industrial hose market report, the global market size has been estimated using the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market have been identified using extensive secondary research, and their presence in the market has been determined using secondary and primary research. All the percentage splits and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

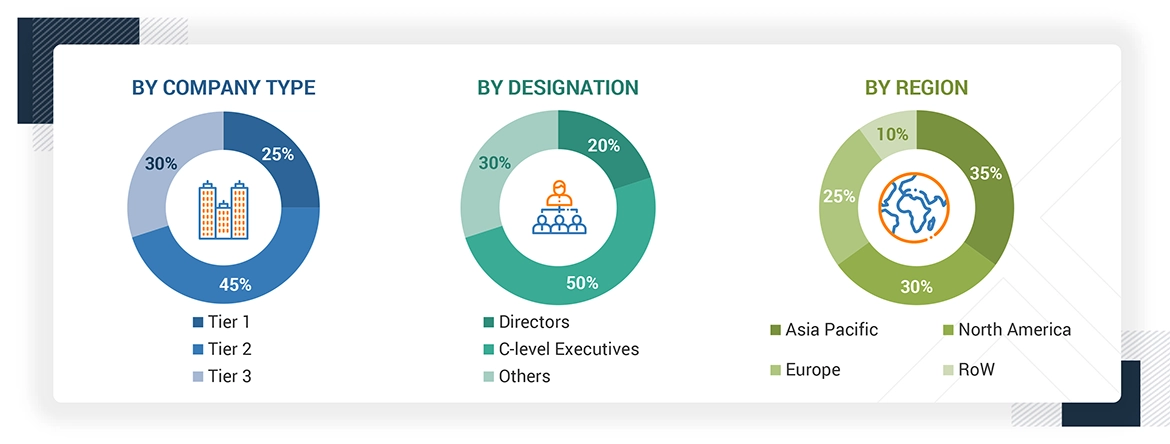

Extensive primary research has been conducted after understanding the industrial hose market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions have been conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject-matter experts’ opinions, has led us to the findings described in the report. The breakdown of primary respondents is as follows:

Note: Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the market size for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report. The following table explains the process flow of the market size estimation.

The key players in the industrial hose market have been identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, and interviews with industry experts, such as chief executive officers, vice presidents, directors, and marketing executives, for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets, and it is presented in this report.

Industrial Hose Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the industrial hose market from the market size estimation processes explained above, the total market has been split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Industrial hoses are flexible, durable tubes designed to transfer various substances, such as liquids, gases, or solids, from one point to another in industrial operations. They are commonly used in manufacturing, construction, agriculture, oil & gas, food processing, and chemicals. These hoses are built to withstand high pressure, extreme temperatures, and harsh environmental conditions, making them essential for transporting water, oil, chemicals, steam, air, or food products safely and efficiently.

Key Stakeholders

-

Raw material suppliers

-

Industrial hose materials manufacturers

-

Manufacturers and distributors of industrial hoses

-

Original equipment manufacturers (OEMs) of industrial hose

-

Device suppliers and distributors

-

Software application providers

-

Manufacturers of hose assembly parts

-

System integrators

-

Middleware providers

-

Assembly, testing, and packaging vendors

-

Research institutes and organizations

-

Technology standards organizations, forums, alliances, and associations

-

Governments, financial institutions, and regulatory bodies

Report Objectives

-

To define, describe, and forecast the industrial hose market, in terms of value by media type, material, industry, and region

-

To forecast the industrial hose market, by material type, in terms of volume

-

To forecast the market size, in terms of value, for various segments about four main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges that influence the growth of the industrial hose market

-

To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

-

To provide a detailed overview of the industrial hose value chain

-

To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the market

-

To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape of the market

-

To analyze competitive developments such as partnerships, mergers and acquisitions, product launches, expansions, and research and development (R&D) activities in the industrial hose market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Growth opportunities and latent adjacency in Industrial Hose Market