Intelligent Power Module Market by Voltage Rating (Up to 600 V, 601-1,200 V, Above 1,200 V), Current Rating, Circuit Configuration (6-Pack, 7-Pack), Power Devices (IGBT, MOSFET), Vertical, Region (North America, Europe, APAC, RoW) - Global Forecast to 2027

Updated on : October 23, 2024

Intelligent Power Module Market Size & Growth

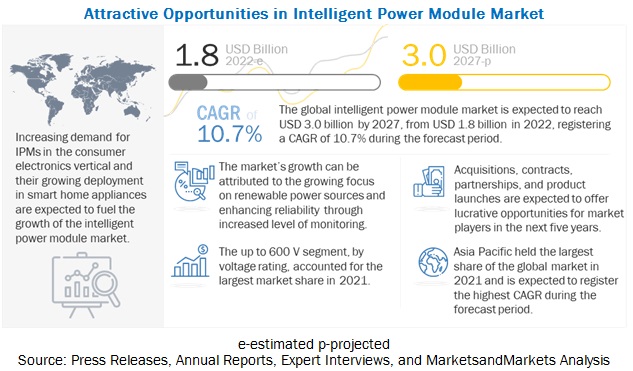

The global intelligent power module market size is anticipated to grow from USD 1.8 billion in 2022 to USD 3.0 billion by 2027, growing at a CAGR of 10.7% during the forecast period from 2022 to 2027.

Rising requirements for power generation through renewable sources, focus of OEMs on providing novel and efficient energy and power monitoring modules as well as surging demand for IPMs in industrial, automotive and consumer electronics vertical are some of the major factors propelling the growth of intelligent power module market.

Impact of AI Intelligent Power Module Market

The integration of artificial intelligence (AI) into the intelligent power module (IPM) market is revolutionizing power electronics by enabling smarter energy management, predictive maintenance, and enhanced system reliability. AI algorithms facilitate real-time monitoring and analysis of power consumption, thermal performance, and fault detection, allowing IPMs to operate more efficiently and safely across applications in electric vehicles, industrial automation, and renewable energy systems. This synergy enhances the adaptability and longevity of power systems while minimizing downtime and energy losses, ultimately driving the evolution of highly efficient, self-optimizing electronic infrastructures in line with Industry 4.0 advancements.

To know about the assumptions considered for the study, Request for Free Sample Report

Intelligent Power Module Market Trends and Dynamics

Driver: Surging global electric vehicle demand

The global automotive industry is in a period of unprecedented changes. The industry needs to make urgent progress in improving its environmental impact. The electrification of vehicle powertrains, ranging from the implementation of start/stop to full battery electric vehicles, is widely seen as the means by which the global automotive industry can move closer toward the goal of true sustainability. Electric vehicles are the backbone of the low-pollution automotive sector; these vehicles can significantly reduce carbon dioxide content and compensate for the greenhouse effect to a certain extent. SAE International, a global association, has defined several vehicle electrification standards, which can help build safe and efficient electric vehicles. Isolation is critical to meet some safety standards for storage batteries, communication networks, and power generation.

The increasing manufacturing and sales of plug-in electric vehicles (PEVs) are expected to create significant opportunities for the power electronics market in the transportation application segment. The increasing number of charging stations is propelling the use of power electronic components, such as power management integrated circuits (PMICs), intelligent power modules (IPMs), insulated gate bipolar transistors (IGBT), and standard & power integrated modules.

Restraint: Slow adoption of novel technologies and complex design of intelligent power modules (IPMs)

The adoption of new trends and technologies in IPMs is necessary for the rapid growth of the IPM market. Although engineers are interested in new technologies and associated benefits, designing a control structure is challenging. Hence, the pace of adoption of new technologies is relatively slow in the IPM market, which would act as a restraining factor for the growth of the technology. Moreover, the players operating in the intelligent power modules industry focus on integrating multiple functionalities into a single chip, resulting in complex design. The designing and integration of complex devices require special skillsets, robust methodology, and toolsets, which increase the overall cost of the devices. The high cost of the devices is expected to hamper the switching process toward advanced technological devices which is expected to restrain the intelligent power module market growth during the forecast period.

Opportunity:Growing adoption of GaN and SiC materials in automobile and power semiconductor applications

The emergence of wide band gap materials, such as GaN and SiC, has changed the landscape of the power electronics market. These new semiconductor materials offer better thermal conductivity and higher switching speeds and are smaller than traditional silicon (Si) ones. The use of SiC and GaN has resulted in improvements in existing semiconductor technologies, such as MOSFETs and isolated gate bipolar transistors (IGBTs). These materials can be used for a wide range of applications. The fastest-growing applications of SiC include electric vehicles (EVs) and EV charging, where SiC plays a vital role in fast chargers and charging stations. While driving an EV, the electronics system is designed to support the complete load of the vehicle’s power capability, which is achievable with SiC-based designs. They are also used in EV inverters, increasing the system’s efficiency by up to 80%. The major advantage of SiC is its drastic efficiency increase. Besides its nearly immediate adoption in energy-oriented industries, such as EVs and solar energy, SiC increases the efficiency of electronics across industries and helps reduce carbon footprint worldwide. Several prominent players, such as ON Semiconductors (US) and Infineon (Germany), are tapping into the market. SiC finds applications in photovoltaics, UPS, motor drives, and power supply

Challenge: Designing and operational challenges related to next-generation intelligent power modules (IPMs)

The new generation of IPMs enables continuous monitoring of several important module parameters. With the help of supporting software, IPMs generate a significant amount of data. Utilizing the data efficiently is a significant engineering challenge. Moreover, an increase in processing power is required to efficiently use the data generated by IPMs. Design challenges related to electromagnetic interference (EMI) increase with the rise in switching frequency. Thus, IPMs operating at high switching frequencies may be more compact but create more design complexities. These technical challenges need to be addressed for further development of the IPM market.

Intelligent Power Module Market Segmentation

“Upto 600 V segment is expected to have the largest size of the intelligent power module market in 2021.”

The market for the up to 600 V segment held the largest share of the overall market in 2021. IPMs with voltage ratings up to 600 V exhibit various features, such as reduced time to market, increased reliability, and reduced system cost and space. IPMs with a voltage rating of up to 600 V comprise rugged and efficient high-voltage MOSFETs and IGBTs specifically optimized for variable frequency drives. These IPMs are widely used in consumer electronics. They provide a compact design and high performance for AC motor drives. IPMs using 600 V IGBTs are used in industrial applications such as driving fans, pumps, and compressors.All these features are expected to surge demand for the said segment in intelligent power module market.

“The market for consumer electronics vertical is expected to grow at a higher CAGR during the forecast period.”

The consumer electronics segment is projected to grow at a higher CAGR of the intelligent power module market during the forecast period. The growing use of consumer electronic devices, such as smartphones, tablets, and smart wearables, is expected to drive the demand for power electronics devices in power management applications. The increasing adoption of power electronics in home appliances is also expected to boost the growth of the consumer electronics segment. Manufacturers of consumer electronics are shifting from fixed-speed drives to inverter-based motor controls. Inverter-based control can adjust the speed and torque of the motor instead of just turning the motor on and off the way fixed-speed drives do. While this type of control has its benefits in terms of efficiency, consumers also benefit from the interiorization trend: appliances with digital inverters have longer lifetimes, make less noise, consume less energy, and ultimately help consumers save money. Such trends are expected to boost the market for IPMs in consumer electronics vertical.

To know about the assumptions considered for the study, download the pdf brochure

Intelligent Power Module Industry Regional Analysis

“The intelligent power module market in Asia Pacific to grow at the highest CAGR during the forecast period.”

Asia Pacific is expected to be the largest contributor to intelligent power module market during the forecast period. Rapid industrialization and infrastructure developments are driving the growth of consumer electronics and automotive industries in China that is expected to increase the demand for intelligent power modules in the country. Additionally, there has been observed a growing number of industrial activities due to growing focus of governments on generating power through renewable sources. This ia also expected to provide opportunity for market. Thus, the surging demand for consumer electronics and automotive due to EVs and HEVs as well as other industrial activities in the region will drive huge demand for intelligent power module market in Asia Pacific.

Top Intelligent Power Module Companies - Key Market Players

The intelligent power module market players have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, partnerships, and acquisitions to strengthen their offerings in the market.

The top intelligent power module companies in the market are

- Mitsubishi Electric (Japan),

- ON Semiconductor(US),

- Infineon Technologies(Germany),

- Fuji Electric(Japan),

- Semikron (Germany) among others.

The study includes an in-depth competitive analysis of these key players in the intelligent power module market with their company profiles, recent developments, and key market strategies.

Intelligent Power Module Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.8 billion in 2022 |

|

Expected Market Size |

USD 3.0 billion by 2027 |

|

Growth Rate |

CAGR of 10.7% |

|

Years considered |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD million/ Billion) |

|

Segments covered |

Current Rating, Voltage Rating, Circuit Configuration, Power Devices, Vertical and Region. |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Mitsubishi Electric (Japan), ON Semiconductor(US), Infineon Technologies(Germany), Fuji Electric(Japan), and Semikron (Germany) |

In this report, the overall intelligent power module market share has been segmented based on current rating, voltage rating, circuit configuration, power devices, vertical and region.

By Current Rating

- Up to 100 A

- 101–600 A

- Above 600 A

By Voltage Rating

- Up to 600 V

- 601–12,00 V

- Above 1,200 V

By Circuit Configuartion

- 6-Pack

- 7-Pack

- Others

By Power Device

- IGBT

- MOSFET

By Vertical

- Consumer Electronics

- ICT

- Automotive

- Industrial

- Aerospace

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

-

Rest of the World

- Middle East & Africa

- South America

Recent Developments in Intelligent Power Module Industry

- In May 2022, Siemens Mobility and Mitsubishi Electric Europe B.V. have signed a Memorandum of Understanding (MoU) to cooperate in the field of SiC power module technology to enable efficient and sustainable transportation and electrical energy savings in the transportation sector.

- In February 2022, Infineon Technologies is strengthening its market leadership in power semiconductors by adding significant manufacturing capacities in the field of wide bandgap (SiC and GaN) semiconductors. The company is investing more than USD 2 billion to build a third module at its site in Kulim, Malaysia. Once fully equipped, the new module will generate USD 2 billion in additional annual revenue with products based on silicon carbide and gallium nitride.

- In December 2020, Infineon Technologies AG launched a 1,200 V transfer molded silicon carbide (SiC)) integrated power module (IPM). The CIPOS Maxi IPM IM828 series is the industry’s first in this voltage class. The series provides a compact inverter solution with excellent thermal conduction and a wide range of switching speeds for three-phase AC motors and permanent magnet motors in variable speed drive applications. Amongst others, these can be found in industrial motor drives, pump drives, and active filters for heating, ventilation, and air conditioning (HVAC).

Frequently Asked Questions (FAQ):

What is the market size of Intelligent power module market expected in 2022?

The Intelligent power module market is expected to be valued at USD 1.8 billion in 2022.

What is the total CAGR expected to be recorded for the Intelligent power module market size during 2022-2027?

The global Intelligent power module market is expected to record a CAGR of 10.7% from 2022–2027.

Does this report include the impact of COVID-19 on the Intelligent power module market share?

Yes, the report includes the impact of COVID-19 on the Intelligent power module market. It illustrates the post- COVID-19 market scenario.

Which are the top players in the Intelligent power module market share?

The major vendors operating in the Intelligent power module market include Mitsubishi Electric (Japan), ON Semiconductor(US), Infineon Technologies(Germany), Fuji Electric(Japan), and Semikron (Germany) among others.

Which major countries are considered in the North American region?

The report includes an analysis of the US, Canada, and Mexico countries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 INTELLIGENT POWER MODULE MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 INTELLIGENT POWER MODULE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Approach for estimating market size by top-down analysis (supply side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—SUPPLY SIDE

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2—SUPPLY SIDE

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach for estimating market size by bottom-up analysis (demand side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 LIMITATIONS

2.5 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

3.1 INTELLIGENT POWER MODULE MARKET: SCENARIO ANALYSIS

FIGURE 6 MARKET: OPTIMISTIC, REALISTIC, PESSIMISTIC, AND POST-COVID-19 SCENARIO ANALYSIS (2018–2027)

3.2 MARKET: REALISTIC SCENARIO

TABLE 2 REALISTIC SCENARIO (POST-COVID-19): MARKET, 2022–2027 (USD MILLION)

3.3 MARKET: OPTIMISTIC SCENARIO

TABLE 3 OPTIMISTIC SCENARIO (POST-COVID-19): MARKET, 2022–2027 (USD MILLION)

3.4 MARKET: PESSIMISTIC SCENARIO

TABLE 4 PESSIMISTIC SCENARIO (POST-COVID-19): MARKET, 2022–2027 (USD MILLION)

FIGURE 7 UP TO 100 A SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY CURRENT RATING, IN 2022

FIGURE 8 IGBT SEGMENT TO HOLD LARGER SHARE OF MARKET, BY POWER DEVICE, IN 2022

FIGURE 9 6-PACK SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY CIRCUIT CONFIGURATION, IN 2022

FIGURE 10 CONSUMER ELECTRONICS TO BE FASTEST-GROWING VERTICAL IN MARKET DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 12 INCREASING DEMAND FOR INTELLIGENT POWER MODULES IN CONSUMER ELECTRONICS AND INDUSTRIAL VERTICALS TO DRIVE MARKET GROWTH

4.2 MARKET, BY VOLTAGE RATING

FIGURE 13 UP TO 600 V SEGMENT TO HOLD LARGEST MARKET SHARE BY 2027

4.3 MARKET, BY POWER DEVICE

FIGURE 14 IGBT SEGMENT TO HOLD LARGER MARKET SHARE IN 2022

4.4 MARKET, BY VERTICAL

FIGURE 15 INDUSTRIAL VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE DURING 2022–2027

4.5 MARKET, BY COUNTRY

FIGURE 16 CHINA INTELLIGENT POWER MODULE MARKET TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising focus of governments on generating power using renewable sources

5.2.1.2 Surging global electric vehicle demand

5.2.1.3 Growing need for improving system reliability and performance

5.2.1.4 Compact design and high energy efficiency features of intelligent power modules (IPMs)

FIGURE 18 IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Slow adoption of novel technologies and complex design of intelligent power modules (IPMs)

FIGURE 19 IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for intelligent power modules (IPMs) in consumer electronics industry

5.2.3.2 Growing adoption of GaN and SiC materials in automobile and power semiconductor applications

FIGURE 20 IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Designing and operational challenges related to next-generation intelligent power modules (IPMs)

5.2.4.2 Supply chain disruptions and semiconductor shortage owing to COVID-19

FIGURE 21 IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS: INTELLIGENT POWER MODULE MARKET

5.3.1 R&D ENGINEERS

5.3.2 MANUFACTURERS

5.3.3 DISTRIBUTORS

5.3.4 END-USER INDUSTRIES

5.4 ECOSYSTEM: POWER ELECTRONICS

FIGURE 23 POWER ELECTRONICS ECOSYSTEM

5.5 PRICING ANALYSIS

TABLE 5 INDICATIVE PRICES OF INTELLIGENT POWER MODULES

5.6 TECHNOLOGY ANALYSIS

5.7 CASE STUDY ANALYSIS

5.7.1 INFINEON TECHNOLOGIES: HOME APPLIANCES CASE STUDY

5.7.1.1 Use of Infineon’s IPMs in home appliances

5.7.2 MITSUBISHI ELECTRIC: HOME APPLIANCES CASE STUDY

5.7.2.1 Use of Mitsubishi Electric’s IPMs in home appliances

5.7.3 MITSUBISHI ELECTRIC: RENEWABLE ENERGY CASE STUDY

5.7.3.1 Use of Mitsubishi Electric’s IPMs in renewable energy

5.7.4 ON SEMICONDUCTOR: 3-PHASE INVERTER CASE STUDY

5.7.4.1 Use of ON Semiconductor’s IPMs in 3-phase inverters

5.7.5 ON SEMICONDUCTOR: NIO INC CASE STUDY

5.7.5.1 Use of ON Semiconductor’s IPMs in NIO Inc’s next-generation EVs

5.7.6 INFINEON TECHNOLOGIES: SHOWA DENKO K.K. CASE STUDY

5.7.6.1 Use of Infineon Technologies’ SiC-based modules for EVs

5.8 TRADE ANALYSIS

5.8.1 IMPORT SCENARIO OF ELECTRONIC INTEGRATED CIRCUITS

FIGURE 24 IMPORT DATA FOR HS CODE 8542, BY COUNTRY, 2017–2021 (BILLION UNITS)

TABLE 6 IMPORT DATA FOR HS CODE 8542, BY COUNTRY, 2017–2021 (BILLION UNITS)

5.8.2 EXPORT SCENARIO OF ELECTRONIC INTEGRATED CIRCUITS

FIGURE 25 EXPORT DATA FOR HS CODE 8542, BY COUNTRY, 2017–2021 (BILLION UNITS)

TABLE 7 EXPORT DATA FOR HS CODE 8542, BY COUNTRY, 2017–2021 (BILLION UNITS)

5.9 PATENT ANALYSIS

TABLE 8 KEY PATENTS REGISTERED, 2003–2022

5.10 REGULATORY LANDSCAPE

TABLE 9 KEY REGULATIONS APPLICABLE TO PLAYERS IN IPM MARKET

6 INTELLIGENT POWER MODULE MARKET, BY CURRENT RATING (Page No. - 70)

6.1 INTRODUCTION

FIGURE 26 MARKET, BY CURRENT RATING

FIGURE 27 UP TO 100 A SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 10 MARKET, BY CURRENT RATING, 2018–2021 (USD MILLION)

TABLE 11 MARKET, BY CURRENT RATING, 2022–2027 (USD MILLION)

6.2 UP TO 100 A

6.2.1 GROWING USE OF INTELLIGENT POWER MODULES WITH CURRENT RATINGS UP TO 100 A IN CONSUMER ELECTRONICS VERTICAL

6.3 101–600 A

6.3.1 RISING APPLICATIONS OF INTELLIGENT POWER MODULES WITH 101–600 A CURRENT RATINGS IN INDUSTRIAL VERTICAL

6.4 ABOVE 600 A

6.4.1 HIGH PREFERENCE FOR ABOVE 600 A INTELLIGENT POWER MODULES IN HEAVY-DUTY INDUSTRIAL APPLICATIONS

7 INTELLIGENT POWER MODULE MARKET, BY VOLTAGE RATING (Page No. - 74)

7.1 INTRODUCTION

FIGURE 28 MARKET, BY VOLTAGE RATING

FIGURE 29 UP TO 600 V SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 12 MARKET, BY VOLTAGE RATING, 2018–2021 (USD MILLION)

TABLE 13 MARKET, BY VOLTAGE RATING, 2022–2027 (USD MILLION)

7.2 UP TO 600 V

7.2.1 HIGH USE OF INTELLIGENT POWER MODULES HAVING UP TO 600 V IN CONSUMER ELECTRONICS

7.3 601–1,200 V

7.3.1 RISING ADOPTION OF 601-1,200 V INTELLIGENT POWER MODULES IN INDUSTRIAL APPLICATIONS

7.4 ABOVE 1,200 V

7.4.1 INCREASING PREFERENCE FOR ABOVE 1,200 V INTELLIGENT POWER MODULES IN INDUSTRIAL VERTICAL

8 INTELLIGENT POWER MODULE MARKET, BY CIRCUIT CONFIGURATION (Page No. - 78)

8.1 INTRODUCTION

FIGURE 30 MARKET, BY CIRCUIT CONFIGURATION

FIGURE 31 6-PACK CIRCUIT CONFIGURATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 14 MARKET, BY CIRCUIT CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 15 MARKET, BY CIRCUIT CONFIGURATION, 2022–2027 (USD MILLION)

8.2 6-PACK

8.2.1 HIGH ADOPTION OF 6-PACK INTELLIGENT POWER MODULES IN CONSUMER ELECTRONICS AND LIGHT-DUTY INDUSTRIAL APPLICATIONS

8.3 7-PACK

8.3.1 RISING PREFERENCE FOR 7-PACK INTELLIGENT POWER MODULES IN HEAVY-DUTY INDUSTRIAL APPLICATIONS

8.4 OTHERS

9 INTELLIGENT POWER MODULE MARKET, BY POWER DEVICE (Page No. - 82)

9.1 INTRODUCTION

FIGURE 32 MARKET, BY POWER DEVICE

FIGURE 33 IGBT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 16 MARKET, BY POWER DEVICE, 2018–2021 (USD MILLION)

TABLE 17 MARKET, BY POWER DEVICE, 2022–2027 (USD MILLION)

9.2 IGBT

9.2.1 IGBT SEGMENT TO HOLD LARGER MARKET SHARE DURING REVIEW PERIOD

9.3 MOSFET

9.3.1 RISING DEMAND FOR MOSFET-BASED IPMS TO INCREASE ENERGY EFFICIENCY OF SYSTEMS TO DRIVE MARKET GROWTH

10 INTELLIGENT POWER MODULE MARKET, BY VERTICAL (Page No. - 86)

10.1 INTRODUCTION

FIGURE 34 MARKET, BY VERTICAL

FIGURE 35 INDUSTRIAL VERTICAL TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 18 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 19 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 CONSUMER ELECTRONICS

10.2.1 GROWING ADOPTION OF CONSUMER ELECTRONICS TO PROPEL MARKET GROWTH

TABLE 20 MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 22 MARKET FOR CONSUMER ELECTRONICS VERTICAL IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 23 MARKET FOR CONSUMER ELECTRONICS VERTICAL IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 24 MARKET FOR CONSUMER ELECTRONICS VERTICAL IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 25 MARKET FOR CONSUMER ELECTRONICS VERTICAL IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 26 MARKET FOR CONSUMER ELECTRONICS VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 27 MARKET FOR CONSUMER ELECTRONICS VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 28 MARKET FOR CONSUMER ELECTRONICS VERTICAL IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 MARKET FOR CONSUMER ELECTRONICS VERTICAL IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.3 ICT

10.3.1 RISING DEMAND FOR ADVANCED POWER DEVICES TO BOOST MARKET GROWTH DURING FORECAST PERIOD

TABLE 30 INTELLIGENT POWER MODULE MARKET FOR ICT VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 MARKET FOR ICT VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 32 MARKET FOR ICT VERTICAL IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 33 MARKET FOR ICT VERTICAL IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 34 MARKET FOR ICT VERTICAL IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 35 MARKET FOR ICT VERTICAL IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 36 MARKET FOR ICT VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR ICT VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 38 MARKET FOR ICT VERTICAL IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 MARKET FOR ICT VERTICAL IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.4 INDUSTRIAL

10.4.1 INCREASED USAGE OF INTELLIGENT POWER MODULES IN RENEWABLE POWER SOURCES TO FUEL MARKET GROWTH

TABLE 40 MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 MARKET FOR INDUSTRIAL VERTICAL IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 43 MARKET FOR INDUSTRIAL VERTICAL IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 44 MARKET FOR INDUSTRIAL VERTICAL IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 45 MARKET FOR INDUSTRIAL VERTICAL IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 46 MARKET FOR INDUSTRIAL VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 47 MARKET FOR INDUSTRIAL VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 48 MARKET FOR INDUSTRIAL VERTICAL IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 MARKET FOR INDUSTRIAL VERTICAL IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.5 AUTOMOTIVE

10.5.1 SURGING ADOPTION OF EVS, HEVS, AND BEVS TO DRIVE MARKET GROWTH

TABLE 50 INTELLIGENT POWER MODULE MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 MARKET FOR AUTOMOTIVE VERTICAL IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 53 MARKET FOR AUTOMOTIVE VERTICAL IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 54 MARKET FOR AUTOMOTIVE VERTICAL IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 55 MARKET FOR AUTOMOTIVE VERTICAL IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 56 MARKET FOR AUTOMOTIVE VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 MARKET FOR AUTOMOTIVE VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 58 MARKET FOR AUTOMOTIVE VERTICAL IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 MARKET FOR AUTOMOTIVE VERTICAL IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.6 AEROSPACE

10.6.1 INCREASED DEMAND FOR ADVANCED MISSION-CRITICAL COMPONENTS IN AEROSPACE VERTICAL TO FUEL MARKET GROWTH

TABLE 60 MARKET FOR AEROSPACE VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 MARKET FOR AEROSPACE VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 MARKET FOR AEROSPACE VERTICAL IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 63 MARKET FOR AEROSPACE VERTICAL IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 64 MARKET FOR AEROSPACE VERTICAL IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 65 MARKET FOR AEROSPACE VERTICAL IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 MARKET FOR AEROSPACE VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 MARKET FOR AEROSPACE VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 MARKET FOR AEROSPACE VERTICAL IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 MARKET FOR AEROSPACE IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.7 OTHERS

TABLE 70 INTELLIGENT POWER MODULE MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 MARKET FOR OTHERS IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 73 MARKET FOR OTHERS IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 74 MARKET FOR OTHERS IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 75 MARKET FOR OTHERS IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 76 MARKET FOR OTHERS IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 MARKET FOR OTHERS IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 MARKET FOR OTHERS IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 MARKET FOR OTHERS IN ROW, BY REGION, 2022–2027 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 112)

11.1 INTRODUCTION

FIGURE 36 GEOGRAPHIC SNAPSHOT (2022–2027): CHINA TO BE FASTEST-GROWING MARKET FOR INTELLIGENT POWER MODULES

TABLE 80 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 37 INTELLIGENT POWER MODULE MARKET: NORTH AMERICA SNAPSHOT

TABLE 82 MARKET IN NORTH AMERICA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 83 MARKET IN NORTH AMERICA, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 84 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 85 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Rising penetration of power semiconductors in automotive and industrial verticals to boost market growth

11.2.2 CANADA

11.2.2.1 Expanding automotive industry in Canada to spur market growth

11.2.3 MEXICO

11.2.3.1 Large manufacturing base and growing aerospace vertical to provide growth opportunities for market players in Mexico

11.3 EUROPE

FIGURE 38 MARKET: EUROPE SNAPSHOT

TABLE 86 MARKET IN EUROPE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 87 MARKET IN EUROPE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 88 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 89 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Rising investments in manufacturing electric and hybrid vehicles to support market growth in Germany

11.3.2 UK

11.3.2.1 Growth of aerospace and automotive verticals to fuel demand for intelligent power modules in UK

11.3.3 FRANCE

11.3.3.1 Expansion of power electronics, aerospace, and industrial verticals to create growth opportunities for market players

11.3.4 ITALY

11.3.4.1 Growing demand for advanced intelligent power modules in automotive vertical to drive market growth

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 39 INTELLIGENT POWER MODULE MARKET: ASIA PACIFIC SNAPSHOT

TABLE 90 MARKET IN ASIA PACIFIC, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 91 MARKET IN ASIA PACIFIC, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 92 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 93 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Expanding automotive and industrial verticals to drive market growth

11.4.2 CHINA

11.4.2.1 Growing consumer electronics and automotive verticals to propel demand for intelligent power modules

11.4.3 INDIA

11.4.3.1 Government-led initiatives to boost domestic manufacturing capacity to fuel demand for intelligent power modules

11.4.4 SOUTH KOREA

11.4.4.1 Rising demand for consumer electronics and automobiles to fuel demand for intelligent power modules

11.4.5 REST OF ASIA PACIFIC

11.5 ROW

TABLE 94 INTELLIGENT POWER MODULE MARKET IN ROW, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 95 MARKET IN ROW, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 96 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 97 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Rising demand for and production of renewable energy to propel market growth

11.5.2 SOUTH AMERICA

11.5.2.1 Rising use of motor-based machinery to promote market growth

12 COMPETITIVE LANDSCAPE (Page No. - 128)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 98 OVERVIEW OF STRATEGIES ADOPTED BY KEY INTELLIGENT POWER MODULE MANUFACTURERS

12.3 REVENUE ANALYSIS OF TOP COMPANIES

FIGURE 40 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN INTELLIGENT POWER MODULE MARKET

12.4 MARKET SHARE ANALYSIS, 2021

TABLE 99 MARKET SHARE OF TOP FIVE PLAYERS IN MARKET IN 2021

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVES

12.5.4 PARTICIPANTS

FIGURE 41 INTELLIGENT POWER MODULE MARKET: COMPANY EVALUATION QUADRANT, 2021

12.6 COMPETITIVE SCENARIO

12.6.1 PRODUCT LAUNCHES

TABLE 100 PRODUCT LAUNCHES, 2020–2022

12.6.2 DEALS

TABLE 101 DEALS, 2019–2022

12.6.3 OTHERS

TABLE 102 OTHERS, 2020–2022

13 COMPANY PROFILES (Page No. - 136)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

13.1.1 MITSUBISHI ELECTRIC

TABLE 103 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 42 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

TABLE 104 MITSUBISHI ELECTRIC: PRODUCTS OFFERED

TABLE 105 MITSUBISHI ELECTRIC: PRODUCT LAUNCHES

TABLE 106 MITSUBISHI: DEALS

TABLE 107 MITSUBISHI ELECTRIC: OTHERS

13.1.2 ON SEMICONDUCTOR

TABLE 108 ON SEMICONDUCTOR: BUSINESS OVERVIEW

FIGURE 43 ON SEMICONDUCTOR: COMPANY SNAPSHOT

TABLE 109 ON SEMICONDUCTOR: PRODUCTS OFFERED

TABLE 110 ON SEMICONDUCTOR: PRODUCT LAUNCHES

TABLE 111 ON SEMICONDUCTOR: DEALS

13.1.3 INFINEON TECHNOLOGIES

TABLE 112 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 44 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 113 INFINEON TECHNOLOGIES: PRODUCTS OFFERED

TABLE 114 INFINEON TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 115 INFINEON TECHNOLOGIES: DEALS

TABLE 116 INFINEON TECHNOLOGIES: OTHERS

13.1.4 FUJI ELECTRIC

TABLE 117 FUJI ELECTRIC: BUSINESS OVERVIEW

FIGURE 45 FUJI ELECTRIC: COMPANY SNAPSHOT

TABLE 118 FUJI ELECTRIC: PRODUCTS OFFERED

TABLE 119 FUJI ELECTRIC: PRODUCT LAUNCHES

TABLE 120 FUJI ELECTRIC: DEALS

13.1.5 SEMIKRON

TABLE 121 SEMIKRON: BUSINESS OVERVIEW

TABLE 122 SEMIKRON: PRODUCTS OFFERED

TABLE 123 SEMIKRON: PRODUCT LAUNCHES

TABLE 124 SEMIKRON: DEALS

TABLE 125 SEMIKRON: OTHERS

13.1.6 ROHM SEMICONDUCTOR

TABLE 126 ROHM SEMICONDUCTOR: BUSINESS OVERVIEW

FIGURE 46 ROHM SEMICONDUCTOR: COMPANY SNAPSHOT

TABLE 127 ROHM SEMICONDUCTOR: PRODUCTS OFFERED

TABLE 128 ROHM SEMICONDUCTOR: PRODUCT LAUNCHES

TABLE 129 ROHM SEMICONDUCTOR: DEALS

13.1.7 SANKEN ELECTRIC

TABLE 130 SANKEN ELECTRIC: BUSINESS OVERVIEW

FIGURE 47 SANKEN ELECTRIC: COMPANY SNAPSHOT

TABLE 131 SANKEN ELECTRIC: PRODUCTS OFFERED

TABLE 132 SANKEN ELECTRIC: DEALS

13.1.8 STMICROELECTRONICS

TABLE 133 STMICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 48 STMICROELECTRONICS: COMPANY SNAPSHOT

TABLE 134 STMICROELECTRONICS: PRODUCTS OFFERED

TABLE 135 STMICROELECTRONICS: DEALS

13.1.9 HANGZHOU SILAN MICROELECTRONICS

TABLE 136 HANGZHOU SILAN MICROELECTRONICS: BUSINESS OVERVIEW

TABLE 137 HANGZHOU SILAN MICROELECTRONICS: PRODUCTS OFFERED

13.1.10 SINO MICROELECTRONICS

TABLE 138 SINO MICROELECTRONICS: BUSINESS OVERVIEW

TABLE 139 SINO MICROELECTRONICS: PRODUCTS OFFERED

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 ALPHA & OMEGA SEMICONDUCTOR

TABLE 140 ALPHA & OMEGA SEMICONDUCTOR: COMPANY OVERVIEW

13.2.2 CISSOID

TABLE 141 CISSOID: COMPANY OVERVIEW

13.2.3 SENSITRON SEMICONDUCTOR

TABLE 142 SENSITRON SEMICONDUCTOR: COMPANY OVERVIEW

13.2.4 RONGTECH INDUSTRY

TABLE 143 RONGTECH INDUSTRY: COMPANY OVERVIEW

13.2.5 POWEREX

TABLE 144 POWEREX: COMPANY OVERVIEW

13.2.6 OZTEK CORPORATION

TABLE 145 OZTEK CORPORATION: COMPANY OVERVIEW

13.2.7 HIRATA CORPORATION

TABLE 146 HIRATA CORPORATION: COMPANY OVERVIEW

13.2.8 MICROSEMI CORPORATION

TABLE 147 MICROSEMI CORPORATION: COMPANY OVERVIEW

13.2.9 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

TABLE 148 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION: COMPANY OVERVIEW

13.2.10 TEXAS INSTRUMENTS

TABLE 149 TEXAS INSTRUMENTS: COMPANY OVERVIEW

13.2.11 RENESAS ELECTRONICS

TABLE 150 RENESAS ELECTRONICS: COMPANY OVERVIEW

13.2.12 SOLITRON DEVICES

TABLE 151 SOLITRON DEVICES: COMPANY OVERVIEW

13.2.13 VINCOTECH-A GROUP COMPANY OF MITSUBISHI ELECTRIC

TABLE 152 VINCOTECH: COMPANY OVERVIEW

14 ADJACENT MARKET (Page No. - 186)

14.1 IGBT AND THYRISTOR MARKET

14.2 INTRODUCTION

FIGURE 49 IGBT MARKET, BY PACKAGING TYPE

FIGURE 50 IGBT MODULE MARKET TO GROW AT HIGHER CAGR FROM 2020 TO 2025

TABLE 153 IGBT MARKET, BY PACKAGING TYPE, 2017–2025 (USD BILLION)

14.3 IGBT DISCRETE

14.3.1 IGBT DISCRETE OFFERS FAST RESPONSE WITH NO OVERSHOOT

TABLE 154 IGBT DISCRETE MARKET, BY POWER RATING, 2017–2025 (USD MILLION)

TABLE 155 IGBT DISCRETE MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 156 IGBT DISCRETE MARKET FOR POWER TRANSMISSION SYSTEMS, BY REGION, 2017–2025 (USD MILLION)

TABLE 157 IGBT DISCRETE MARKET FOR RENEWABLE ENERGY, BY REGION, 2017–2025 (USD MILLION)

TABLE 158 IGBT DISCRETE MARKET FOR RAIL TRACTION SYSTEMS, BY REGION, 2017–2025 (USD MILLION)

TABLE 159 IGBT DISCRETE MARKET FOR UPS, BY REGION, 2017–2025 (USD MILLION)

TABLE 160 IGBT DISCRETE MARKET FOR ELECTRIC AND HYBRID VEHICLES, BY REGION, 2017–2025 (USD MILLION)

TABLE 161 IGBT DISCRETE MARKET FOR MOTOR DRIVES, BY REGION, 2017–2025 (USD MILLION)

TABLE 162 IGBT DISCRETE MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2025 (USD MILLION)

TABLE 163 IGBT DISCRETE MARKET FOR OTHERS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 164 IGBT DISCRETE MARKET, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 165 IGBT DISCRETE MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 166 IGBT DISCRETE MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 167 IGBT DISCRETE MARKET IN ASIA PACIFIC, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 168 IGBT DISCRETE MARKET IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

14.4 IGBT MODULE

14.4.1 HIGH DURABILITY AND LOW DOWNTIME TO DRIVE MARKET FOR IGBT MODULE

TABLE 169 IGBT MODULE MARKET, BY POWER RATING, 2017–2025 (USD MILLION)

TABLE 170 IGBT MODULE MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 171 IGBT MODULE MARKET FOR POWER TRANSMISSION SYSTEMS, BY REGION, 2017–2025 (USD MILLION)

FIGURE 51 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN IGBT MODULE MARKET FOR RENEWABLE ENERGY FROM 2020 TO 2025

TABLE 172 IGBT MODULE MARKET FOR RENEWABLE ENERGY, BY REGION, 2017–2025 (USD MILLION)

TABLE 173 IGBT MODULE MARKET FOR RAIL TRACTION SYSTEMS, BY REGION, 2017–2025 (USD MILLION)

TABLE 174 IGBT MODULE MARKET FOR UPS, BY REGION, 2017–2025 (USD MILLION)

FIGURE 52 IGBT MODULE MARKET FOR ELECTRIC AND HYBRID ELECTRIC VEHICLES IN ASIA PACIFIC TO GROW AT HIGHER CAGR FROM 2020 TO 2025

TABLE 175 IGBT MODULE MARKET FOR ELECTRIC AND HYBRID ELECTRIC VEHICLES, BY REGION, 2017–2025 (USD MILLION)

TABLE 176 IGBT MODULE MARKET FOR MOTOR DRIVES, BY REGION, 2017–2025 (USD MILLION)

TABLE 177 IGBT MODULE MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2025 (USD MILLION)

TABLE 178 IGBT MODULE MARKET FOR OTHERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 179 IGBT MODULE MARKET, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 180 IGBT MODULE MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 181 IGBT MODULE MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 182 IGBT MODULE MARKET IN ASIA PACIFIC, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 183 IGBT MODULE MARKET IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

15 APPENDIX (Page No. - 200)

15.1 KEY INDUSTRY INSIGHTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

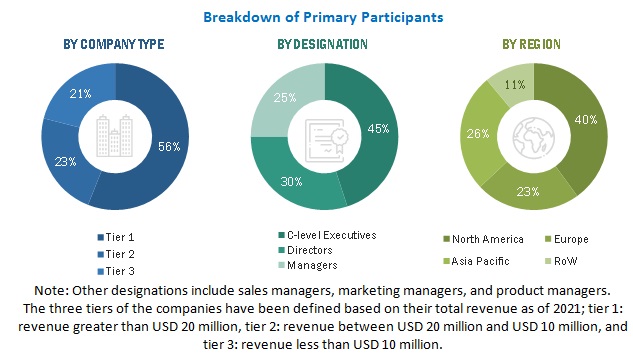

The study involves four major activities for estimating the size of the intelligent power module market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the intelligent power module market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the intelligent power module market through secondary research. Several primary interviews have been conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the intelligent power module market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the intelligent power module market size based on voltage rating, current rating, circuit configuration, power device, and vertical in terms of value

- To describe and forecast the market size of various segments for four regions—North America, Asia Pacific, Europe, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the intelligent power module value chain and analyze the current and future market trends

- To analyze the impact of COVID-19 on the market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their rankings and core competencies2, along with a detailed competitive landscape for the market leaders

- To analyze the strategic approaches adopted by players in the intelligent power module market, such as product launches and developments, acquisitions, collaborations, contracts, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional five market players

Intelligent Power Module Market Overview:

The IPM module, intelligent power distribution module and the market are related but different concepts. An IPM is a power module that combines various power components, such as MOSFETs and IGBTs, along with advanced control and protection functions, into a single package. It is used in various applications such as motor drives, power supplies, and renewable energy systems. The market includes different types of power modules, such as IPMs, gate drivers, power ICs, and others, and is driven by the increasing demand for high-performance and reliable power electronics in various industries. In summary, the IPM module is a part of the broader Intelligent Power Module Market.

Analysis of IPM Market:

The analysis of IPM (Intelligent Power Module) module involves evaluating its performance, efficiency, reliability, and cost-effectiveness in various applications. Some of the key factors to consider in the analysis of IPM modules are:

- Power Rating: The power rating of an IPM module determines its maximum power handling capacity. It is important to select an IPM module with the appropriate power rating for the intended application to ensure optimal performance.

- Efficiency: IPM modules are designed to improve the efficiency of power electronics by reducing power losses and improving power conversion. A high-efficiency IPM module will help to reduce energy consumption and operating costs.

- Reliability: The reliability of an IPM module is crucial, particularly in critical applications such as automotive, aerospace, and medical devices. It is important to select an IPM module with a proven track record of reliability and a low failure rate.

- Cost: The cost of an IPM module is a significant factor in the selection process. The cost of an IPM module should be balanced against its performance, efficiency, and reliability to ensure cost-effectiveness.

- Environmental Impact: The environmental impact of an IPM module should also be considered in the analysis. IPM modules that incorporate environmentally friendly materials and are designed for easy recycling at the end of their life cycle are preferred.

Importance and Benefits of IPM Market:

The importance and benefits of IPM (Intelligent Power Module) modules are numerous and can have a significant impact on various applications. Some of the key importance and benefits of IPM modules are:

- High Efficiency: IPM modules are designed to improve the efficiency of power electronics by reducing power losses and improving power conversion. This translates to energy savings and reduced operating costs, particularly in applications where power consumption is a major concern.

- Simplified Circuit Design: IPM modules integrate several power components such as MOSFETs, IGBTs, and gate drivers, along with advanced control and protection functions, into a single package. This simplifies the circuit design, reduces component count, and minimizes the PCB footprint.

- High Power Density: IPM modules offer high power density, which means that they can handle high power levels in a compact package. This makes them suitable for applications where space is limited and high power handling is required.

- Improved Reliability: IPM modules are designed to provide high reliability and performance, with advanced protection and control functions that help to prevent damage to the module and the connected system.

- Faster Time-to-Market: The use of IPM modules in circuit design can help to reduce design time and accelerate time-to-market. This is because the integration of multiple components in a single package simplifies the design process and reduces the need for complex circuit design.

- Cost-Effective: IPM modules are cost-effective compared to discrete power components because they reduce component count, PCB footprint, and assembly time, leading to lower manufacturing costs.

Applications of Intelligent Power Distribution Module Market:

Intelligent Power Distribution Module (IPDM) finds application in various industries and applications that require intelligent power distribution, protection, and control. Some of the key applications of IPDM are:

- Data Centers: IPDM is used in data centers to distribute power to the server racks, networking equipment, and other critical loads. It provides intelligent power management functions such as remote monitoring, load shedding, and automatic transfer switching, which help to improve the availability and efficiency of the data center.

- Telecom Power Systems: IPDM is used in telecom power systems to distribute power to the base stations, switching equipment, and other critical loads. It provides intelligent power management functions that help to improve the reliability, efficiency, and safety of the telecom network.

- Industrial Automation: IPDM is used in industrial automation systems such as process control systems, robotics, and machine tools. It provides intelligent power management functions that help to improve the efficiency, safety, and reliability of the automation processes.

- Renewable Energy Systems: IPDM is used in renewable energy systems such as solar PV systems, wind turbines, and energy storage systems. It provides intelligent power management functions that help to optimize the power output and ensure reliable operation of the renewable energy system.

- Building Automation Systems: IPDM is used in building automation systems such as lighting control, HVAC control, and security systems. It provides intelligent power management functions that help to improve the energy efficiency, comfort, and safety of the building.

- Electric Vehicles: IPDM is used in electric vehicles (EVs) to distribute power to the electric motors, battery management systems, and other critical loads. It provides intelligent power management functions that help to optimize the power usage and extend the driving range of the EV.

Key Challenges for IPM and Intelligent Power Distribution Module in the Future:

There are several key challenges that IPM and IPDM face in the future. Some of these challenges are:

- Cost: The cost of IPM and IPDM is currently higher than traditional power distribution and protection systems. As the demand for intelligent power management systems increases, there is a need to reduce the cost of IPM and IPDM to make them more accessible to a wider market.

- Complexity: IPM and IPDM are more complex than traditional power distribution and protection systems. This complexity can make them difficult to design, install, and maintain, especially for small and medium-sized enterprises.

- Standardization: There is currently no standardization for IPM and IPDM, which can lead to compatibility issues between different manufacturers and suppliers. The lack of standardization also makes it difficult for customers to compare products and make informed decisions.

- Cybersecurity: IPM and IPDM are connected to the internet, which makes them vulnerable to cyber-attacks. There is a need for robust cybersecurity measures to ensure that the connected systems are secure and protected from unauthorized access.

- Power Quality: IPM and IPDM can be affected by power quality issues such as voltage sags, harmonics, and power surges. These issues can cause the system to malfunction or fail, leading to downtime and loss of productivity.

- Reliability: IPM and IPDM are critical components of power distribution and protection systems. They need to be reliable and operate under harsh environmental conditions. There is a need for continuous testing and monitoring to ensure that the components are functioning properly and can withstand the demands of the application.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Intelligent Power Module Market