Interactive Patient Care (IPC) Market and Interactive Patient Engagement Solutions Market by Product (Hardware (Television, IBT/ Assisted Devices, Tablets), Software), Type (Inpatient, Outpatient), End User (Hospitals, Clinics) and Region - Global Forecast to 2027

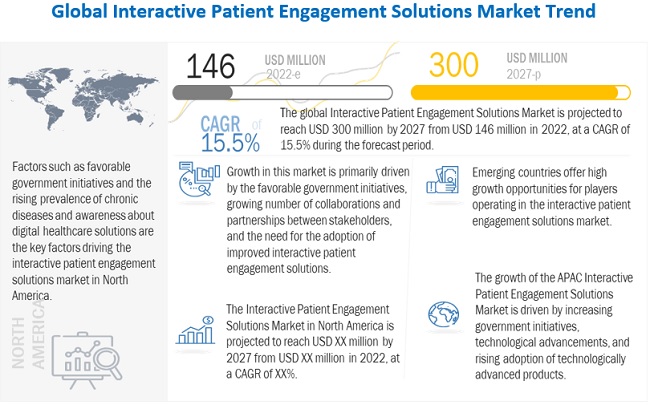

[185 Pages Report] The global interactive patient care market is projected to reach USD 300 million by 2027 from USD 146 million in 2022, at a CAGR of 15.5%. Growingdemand for the adoption of improved interactive patient engagement solutions, a increasing number of collaborations and partnerships between stakeholders, and favorable government initiatives to promote the adoption of these solutions are some of the key factors driving the growth of this market.

However, high infrastructural requirements and implementation costs and protection of patient informationare some of the factors expected to restrain the growth of this market in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Interactive Patient Care Market Dynamics

Drivers: Favorable government regulations and initiatives thatpromoted the adoption of HCIT solutions

The growing patient demand for quality care has prompted healthcare systems across the globe to adopt the latest technologies that help curtail costs, enhance care quality, and reduce administrative inefficiencies. This ensures access to better engagement platforms across hospitals. In the US, the Affordable Care Act (ACA), signed in March 2010, resulted in an increasing number of stakeholders subscribing to patient engagement solutions. The act focuses on value-based reimbursement and quality treatments and has effectively shifted the focus away from the traditional volume-based fee-for-reimbursement system in the country. The US government also provides various incentives to healthcare providers to implement IT infrastructure across their facilities.

Restraints: High infrastructural requirement and implementation costs

The installation of interactive patient engagement solutions is a challenge to most small and medium-sized hospitals, clinics, and ambulatory centers due to budgetary constraints. Interactive bedside terminals require installing bedside arms, TVs, tablets, audio devices, and an internet connection, which increases the cost of implementation. Moreover, engagement services are provided at a higher cost by market players. For instance, Hôpitel provides cable TV services for USD 16.96 for the first day and USD 13.51 for each day afterward. Such high-priced services make it challenging for hospitals to adopt such solutions.

Challenges: Dearth of skilled professionals

The effective use of healthcare IT solutions demands strong IT infrastructure and support within the organization as well as at the solution provider’s end. In a healthcare organization, there is a continuous requirement for technical support for maintaining the server and network for the smooth operation of clinical workflows and the optimum interfacing speed of healthcare IT systems. If the maintenance of the server or network is insufficient, it leads to the generation of screen loads, which slows down the clinical workflow. The dearth of a trained and skilled workforce in major markets is restraining the adoption and implementation of web-based and on-premise HCIT solutions. This may hamper the growth of the interactive patient engagement solutions market.

Opportunities: Increase in the emerging market

A number of factors, such as the implementation of government initiatives supporting the adoption of HCIT solutions and increasing government healthcare expenditure, are driving the growth of interactive patient engagement solutions market in Asia. Technological advancements are playing a key role as authorities in China are concentrating on reforming the country’s healthcare management sector, which is currently confronting challenges such as underfunded rural health centers, overburdened city hospitals, and a nationwide lackof doctors. Companies like Arbor Solutions and Barco NV have established their manufacturing facilities and R&D centers in Asian countries such as China and India to enhance their global reach and strengthen their market presence.

“Hardware segment accounted for the largest share of the global interactive patient engagement solutions for product”

Based on product, the interactive patient engagement solutions market is bifurcated into hardware and software. The hardware segment accounted for the largest share of the interactive patient engagement solutions market in 2021 also expected to grow at the highest CAGR from 2022 to 2027.This can be attributed to the rising development of TV-based solutions and the increased adoption of in-room televisions by hospitals are some of the key factors for the market growth of this segment.

“The inpatient solutions segment is expected to hold the largest share of the Interactive patient engagement solutions market in 2022”

Based on type, the interactive patient engagement solutions market is bifurcated into inpatient and outpatient solutions. The inpatient solutions segment is expected to hold the largest share of the interactive patient engagement solutions market in 2022. The requirement for improved patient care and favorable government initiatives for the adoption of these solutions are the factors driving the growth of this segment.

“Hospitals segment in the end users accounted for the largest and the fastest share of the global Interactive patient engagement solutions market”

Based end users, the interactive patient engagement solutions market is bifurcated into hospitals, clinics, and other end users. In 2021, the hospitals segment accounted for the largest and the fastest share of the interactive patient engagement solutions market and expected to grow at the highest CAGR during the forecast period. Increasing demand for IT tools to tackle the demand of hospital staff and rising demand for effective communication tools are driving the growth of this segment.

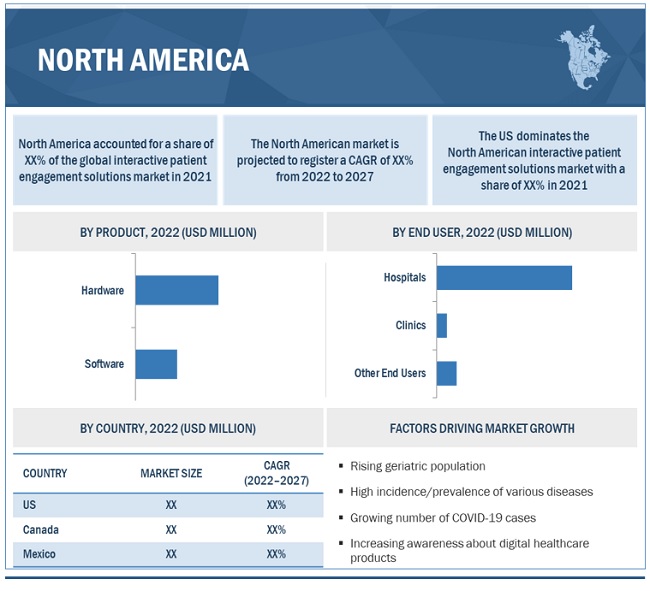

North America accounted for the largest share of the global interactive patient engagement solutions market in 2021.

North America has captured the largest share of the interactive patient engagement solutions market in 2021, followed by Europe and APAC. It is also projected to register the highest CAGR during the forecasted period.

Favorable government initiatives, the rising prevalence of chronic diseases, rising awareness about digital healthcare products and several key players in the interactive patient engagement solutions market are based in the US are key factors driving market growth in the region.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in this market are GetWellNetwork (US), Epic Systems Corporation (US), SONIFI Health (US), Barco (Belgium), Sentrics (US), Advantech Co., Ltd. (Taiwan), Aceso Interactive (US), HealthHub Patient Engagement Solutions (Canada), Lincor Inc. (US), eVideon (US), Remedi Technology (Taiwan), i3solutions (Canada), PDi Communications Systems (US), BEWATEC ConnectedCare GmbH (Germany), Hôpitel (Canada), Hospedia (UK), Onyx Healthcare, Inc. (US), ClinicAll (US), Arbor technology corp. (Taiwan), Healthcare information, LLC (US), Oneview healthcare (Ireland), Siemens (Germany), Vecoton (China), pCare (US), and Medix-Care GmbH (Germany). These players are increasingly focusing on product launches, expansions, acquisitions, and partnerships to expand their product offerings in the interactive patient engagement solutions market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2020-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Product, By Type, By End User & By Region |

|

Geographies covered |

North America (US, Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, and RoAPAC), ROW |

|

Companies covered |

GetWellNetwork (US), Epic Systems Corporation (US), SONIFI Health (US), Barco (Belgium), Sentrics (US), Advantech Co., Ltd. (Taiwan), Aceso Interactive Inc. (US), HealthHub Patient Engagement Solutions (Canada), Lincor, Inc. (US), eVideon (US), Remedi Complete Medical Solutions (Taiwan), i3solutions (Canada), PDi Communication Systems, Inc. (US), BEWATEC ConnectedCare GmbH (Germany), Hôpitel Inc. (Canada), Hospedia (UK), Onyx Healthcare Inc. (US), ClinicAll (US), ARBOR Technology Corp. (Taiwan), Healthcare Information, LLC (US), Oneview Healthcare (Ireland), Siemens (Germany), Vecoton (China), pCare (US), and Medix-Care GmbH (Germany). |

The study categorizes the Interactive patient engagement solutions market into the following segments and subsegments:

By Product

- Hardware,

- In Room Television

- Interactive Bedside Terminal

- Tablets

- Software

By Type

- Inpatient

- Outpatient

By End User

- Hospitals

- Clinics

- other end Users

By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

- Asia Pacific

- Japan

- China

- India

- Rest of APAC (RoAPAC)

- RoW

Recent Developments:

- In 2021, GetWellNetwork (US) entered into a three-year agreement with Hills Health Solutions. Under the terms of this agreement, Hills will become the exclusive distributor of GetWellNetwork’s GetWell Loop and GetWell Inpatient products in Australia and New Zealand.

- In 2021, SONIFI Health (US) partnered with Pennsylvania’s Lehigh Valley Health Network (US) to implement engaging technology solutions that improve patient experiences and clinical interactions across the healthcare organization.

- In 2020, Advantech (Taiwan) and Imprivata (US) partnered to ensure Advantech devices are compatible with the Imprivata OneSign single sign-on (SSO) authentication solution. The partnership aims to validate medical tablets and PCs for increased data security in healthcare.

Frequently Asked Questions (FAQ):

What is the projected market of the global interactive patient engagement solutions market in 2027?

The projected market of the global interactive patient engagement solutions market is expected to be 300 million in 2027.

Who are the leading players in the interactive patient engagement solutions market?

Some of the leading players in the interactive patient engagement solutions market include GetWellNetwork (US), Epic Systems Corporation (US), SONIFI Health (US), Barco (Belgium), Sentrics (US), Advantech Co., Ltd. (Taiwan), Aceso Interactive Inc. (US), HealthHub Patient Engagement Solutions (Canada), Lincor, Inc. (US), eVideon (US), Remedi Complete Medical Solutions (Taiwan), i3solutions (Canada), PDi Communication Systems, Inc. (US), BEWATEC ConnectedCare GmbH (Germany), Hôpitel Inc. (Canada), Hospedia (UK), Onyx Healthcare Inc. (US), ClinicAll (US), ARBOR Technology Corp. (Taiwan), Healthcare Information, LLC (US), Oneview Healthcare (Ireland), Siemens (Germany), Vecoton (China), pCare (US), and Medix-Care GmbH (Germany). These players are increasingly focusing on product launches, expansions, acquisitions, and partnerships to expand their product offerings in the interactive patient engagement solutions market.

What are the major type in the interactive patient engagement solutions market?

Based on type, the interactive patient engagement solutions market is segmented into inpatient and outpatient solutions. The inpatient solutions segment accounted for the largest share of the global interactive patient engagement solutions market

What are the major products in the interactive patient engagement solutions market?

Based on products, the interactive patient engagement solutions market is segmented into hardware and software. The hardware segment accounted for the largest share of the global interactive patient engagement solutions market

What are the major end user in the interactive patient engagement solutions market?

Based on end user, the interactive patient engagement solutions market is segmented into hospitals, clinics, and other end users. Hospitals accounted for the largest share of the global interactive patient engagement solutions market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 MARKETS COVERED

FIGURE 1 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

2.2 RESEARCH METHODOLOGY STEPS

FIGURE 2 RESEARCH METHODOLOGY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET

FIGURE 3 RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY RESEARCH

FIGURE 4 PRIMARY SOURCES

2.2.3 KEY INDUSTRY INSIGHTS

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3.1 GROWTH FORECAST

FIGURE 9 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE INTERACTIVE PATIENT ENGAGEMENT MARKET (2022–2027)

FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.4 MARKET DATA ESTIMATION AND TRIANGULATION

FIGURE 11 DATA TRIANGULATION METHODOLOGY

2.5 STUDY ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 12 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 13 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 15 GEOGRAPHICAL SNAPSHOT OF INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET OVERVIEW

FIGURE 16 FAVORABLE GOVERNMENT INITIATIVES TO DRIVE MARKET

4.2 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE AND COUNTRY (2021)

FIGURE 17 INPATIENT SOLUTIONS SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2021

4.3 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET SHARE, BY TYPE, 2022 VS. 2027

FIGURE 18 INPATIENT SOLUTIONS SEGMENT WILL CONTINUE TO DOMINATE INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 45)

5.1 MARKET DYNAMICS

FIGURE 19 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Need for improved interactive patient engagement solutions

5.1.1.2 Growing number of collaborations and partnerships between stakeholders

5.1.1.3 Favorable government regulations and initiatives to promote adoption of HCIT solutions

5.1.2 RESTRAINTS

5.1.2.1 High infrastructural requirement and implementation costs

5.1.2.2 Data security concerns

FIGURE 20 TYPES OF HEALTHCARE BREACHES REPORTED TO THE US DEPARTMENT OF HEALTH AND HUMAN SERVICES, 2018−2020

5.1.3 OPPORTUNITIES

5.1.3.1 Emerging countries offer high-growth potential

5.1.3.2 Technological advancements

5.1.4 CHALLENGES

5.1.4.1 Dearth of skilled professionals

5.2 CASE STUDIES

5.2.1 FOCUS ON REDUCING READMISSION RATES AND IMPROVING CARE

TABLE 1 USE CASE 1: TO REDUCE PATIENT STAY

5.2.2 IMPROVE OUTPATIENT COMMUNICATION

TABLE 2 USE CASE 2: TO CURB COMMUNICATION ISSUES WITH DISCHARGED PATIENTS

5.2.3 INTERACTIVE PLATFORMS IMPROVE HOSPITAL OUTCOMES

TABLE 3 USE CASE 3: TO IMPROVE PATIENT EDUCATION COMPLETION RATES VIA IN-ROOM TELEVISIONS

5.3 ECOSYSTEM COVERAGE

FIGURE 21 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET: ECOSYSTEM ANALYSIS

5.4 TECHNOLOGY ANALYSIS

TABLE 4 TECHNOLOGICAL DEVELOPMENTS BY LEADING VENDORS

5.5 REGULATIONS

5.5.1 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA)

5.5.2 HEALTH INFORMATION TECHNOLOGY FOR ECONOMIC AND CLINICAL HEALTH ACT OF 2009 (HITECH)

5.5.3 CONSUMER PRIVACY PROTECTION ACT OF 2017

5.5.4 NATIONAL CYBERSECURITY PROTECTION ADVANCEMENT ACT OF 2015

5.5.5 CYBERSECURITY LAW OF THE PEOPLE’S REPUBLIC OF CHINA

5.5.6 AFFORDABLE CARE ACT, 2010

5.5.7 GENERAL DATA PROTECTION REGULATION (GDPR)

5.5.8 CALIFORNIA CONSUMER PRIVACY ACT (CCPA)

5.6 PRICING ANALYSIS

5.7 MARKET SURVEY ANALYSIS: END-USER VIEWPOINT

FIGURE 22 FACTORS INFLUENCING THE ADOPTION OF INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 INDUSTRY TRENDS

5.9.1 RISING NEED FOR INTEROPERABILITY AND INTEGRATION OF HCIT SOLUTIONS

5.9.2 GROWING DEMAND FOR VALUE-BASED HEALTHCARE

6 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE (Page No. - 58)

6.1 INTRODUCTION

TABLE 6 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2 INPATIENT SOLUTIONS

6.2.1 NEED FOR PATIENT INVOLVEMENT IN CARE PROCESS TO SUPPORT MARKET GROWTH

TABLE 7 INPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 8 NORTH AMERICA: INPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 9 EUROPE: INPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 10 ASIA PACIFIC: INPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 OUTPATIENT SOLUTIONS

6.3.1 LARGE NUMBER OF OUTPATIENT PROCEDURES TO DRIVE MARKET

TABLE 11 OUTPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 12 NORTH AMERICA: OUTPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 13 EUROPE: OUTPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 14 ASIA PACIFIC: OUTPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT (Page No. - 64)

7.1 INTRODUCTION

TABLE 15 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

7.2 HARDWARE

TABLE 16 INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 17 INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 18 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 19 EUROPE: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 20 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1 IN-ROOM TELEVISIONS

7.2.1.1 Increase in adoption of in-room televisions by hospitals

TABLE 21 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR IN-ROOM TELEVISIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 22 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR IN-ROOM TELEVISIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 23 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR IN-ROOM TELEVISIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 24 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR IN-ROOM TELEVISIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.2 INTEGRATED BEDSIDE TERMINALS/ASSISTIVE DEVICES

7.2.2.1 Integrated bedside terminals enhance patient experience

TABLE 25 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR INTEGRATED BEDSIDE TERMINALS/ASSISTIVE DEVICES, BY REGION, 2020–2027 (USD MILLION)

TABLE 26 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR INTEGRATED BEDSIDE TERMINALS/ASSISTIVE DEVICES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 27 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR INTEGRATED BEDSIDE TERMINALS/ASSISTIVE DEVICES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 28 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR INTEGRATED BEDSIDE TERMINALS/ASSISTIVE DEVICES, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3 TABLETS

7.2.3.1 Portability and cost-effectiveness of tablets supporting adoption

TABLE 29 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR TABLETS, BY REGION, 2020–2027 (USD MILLION)

TABLE 30 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR TABLETS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 31 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR TABLETS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 32 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR TABLETS, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 SOFTWARE

7.3.1 SOFTWARE HELPS PERFORM PRIMARY TASKS

TABLE 33 INTERACTIVE PATIENT ENGAGEMENT SOFTWARE SOLUTIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOFTWARE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 35 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOFTWARE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 36 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOFTWARE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER (Page No. - 77)

8.1 INTRODUCTION

TABLE 37 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

8.2 HOSPITALS

8.2.1 HOSPITALS LARGEST AND FASTEST-GROWING END USERS OF INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS

TABLE 38 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR HOSPITALS, BY REGION, 2020–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 40 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 41 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 CLINICS

8.3.1 REDUCED MORTALITY RATES WITH USE OF INTERACTIVE BEDSIDE SOLUTIONS

TABLE 42 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR CLINICS, BY REGION, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 44 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 45 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 OTHER END USERS

TABLE 46 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 48 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

9 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY REGION (Page No. - 85)

9.1 INTRODUCTION

TABLE 50 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 23 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET SNAPSHOT

TABLE 51 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 US dominates North American interactive patient engagement solutions market

TABLE 56 US: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 57 US: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 US: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 59 US: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Government initiatives and awareness about digital healthcare solutions to support market growth

TABLE 60 CANADA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 61 CANADA: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 CANADA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 CANADA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Growing COVID-19 cases and need to curtail healthcare costs supporting market growth

TABLE 64 MEXICO: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 65 MEXICO: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 66 MEXICO: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 MEXICO: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 68 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 69 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 70 EUROPE: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany largest market for interactive patient engagement solutions in Europe

TABLE 73 GERMANY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 74 GERMANY: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 GERMANY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 GERMANY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Initiatives to improve healthcare to boost market

TABLE 77 UK: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 78 UK: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 UK: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 UK: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Rising geriatric population in France to support market growth

TABLE 81 FRANCE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 82 FRANCE: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 FRANCE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 FRANCE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Growing burden of chronic diseases driving market

TABLE 85 ITALY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 86 ITALY: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 ITALY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 ITALY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Technological innovations to support market growth

TABLE 89 SPAIN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 90 SPAIN: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 SPAIN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 SPAIN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 93 ROE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 94 ROE: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 ROE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 ROE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 24 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET SNAPSHOT

TABLE 97 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Fast adoption of advanced technologies and rising geriatric population key growth drivers

TABLE 102 JAPAN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 103 JAPAN: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 JAPAN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 JAPAN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Government initiatives to drive market in China

TABLE 106 CHINA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 107 CHINA: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 CHINA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 CHINA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Rising healthcare awareness and changing demographics to drive market

TABLE 110 INDIA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 111 INDIA: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 112 INDIA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 INDIA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 114 ROAPAC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 115 ROAPAC: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 116 ROAPAC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 ROAPAC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 118 ROW: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 119 ROW: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 ROW: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 121 ROW: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 121)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 122 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN THE INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET

10.3 MARKET RANKING

FIGURE 25 RANKING OF COMPANIES IN INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET (2021)

10.4 COMPETITIVE LEADERSHIP MAPPING

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 26 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

10.5 COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES

10.5.1 PROGRESSIVE COMPANIES

10.5.2 STARTING BLOCKS

10.5.3 RESPONSIVE COMPANIES

10.5.4 DYNAMIC COMPANIES

FIGURE 27 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES (2021)

10.6 COMPANY FOOTPRINT

TABLE 123 FOOTPRINT OF COMPANIES

TABLE 124 PRODUCT FOOTPRINT OF COMPANIES

TABLE 125 REGIONAL FOOTPRINT OF COMPANIES

10.7 COMPETITIVE SCENARIO

TABLE 126 PRODUCT LAUNCHES, JANUARY 2018–JUNE 2022

TABLE 127 DEALS, JANUARY 2018–JUNE 2022

TABLE 128 OTHER DEVELOPMENTS, JANUARY 2018–JUNE 2022

11 COMPANY PROFILES (Page No. - 135)

11.1 KEY PLAYERS

(Business Overview, Products & Services Offered, Recent Developments, and MnM View)*

11.1.1 GETWELLNETWORK, INC.

TABLE 129 GETWELLNETWORK, INC.: BUSINESS OVERVIEW

11.1.2 EPIC SYSTEMS CORPORATION

TABLE 130 EPIC SYSTEMS CORPORATION: BUSINESS OVERVIEW

11.1.3 SONIFI HEALTH

TABLE 131 SONIFI HEALTH: BUSINESS OVERVIEW

11.1.4 ADVANTECH CO., LTD.

TABLE 132 ADVANTECH CO., LTD.: BUSINESS OVERVIEW

FIGURE 28 ADVANTECH CO., LTD.: COMPANY SNAPSHOT (2021)

11.1.5 BARCO

TABLE 133 BARCO: BUSINESS OVERVIEW

FIGURE 29 BARCO: COMPANY SNAPSHOT (2021)

11.1.6 SENTRICS

TABLE 134 SENTRICS: BUSINESS OVERVIEW

11.1.7 HOSPEDIA LIMITED

TABLE 135 HOSPEDIA LIMITED: BUSINESS OVERVIEW

11.1.8 EVIDEON

TABLE 136 EVIDEON: BUSINESS OVERVIEW

11.1.9 ACESO INTERACTIVE INC.

TABLE 137 ACESO INTERACTIVE INC.: BUSINESS OVERVIEW

11.1.10 PDI COMMUNICATION SYSTEMS, INC.

TABLE 138 PDI COMMUNICATION SYSTEMS, INC.: BUSINESS OVERVIEW

11.1.11 LINCOR, INC.

TABLE 139 LINCOR, INC.: BUSINESS OVERVIEW

11.1.12 CLINICALL

TABLE 140 CLINICALL: BUSINESS OVERVIEW

11.1.13 HÔPITEL INC.

TABLE 141 HÔPITEL INC.: BUSINESS OVERVIEW

11.1.14 I3SOLUTIONS INC.

TABLE 142 I3SOLUTIONS: BUSINESS OVERVIEW

11.1.15 HEALTHHUB PATIENT ENGAGEMENT SOLUTIONS

TABLE 143 HEALTHHUB PATIENT ENGAGEMENT SOLUTIONS: BUSINESS OVERVIEW

11.1.16 ARBOR TECHNOLOGY CORP.

TABLE 144 ARBOR TECHNOLOGY CORP.: BUSINESS OVERVIEW

11.1.17 HEALTHCARE INFORMATION, LLC

TABLE 145 HEALTHCARE INFORMATION, LLC: BUSINESS OVERVIEW

11.1.18 BEWATEC CONNECTEDCARE GMBH

TABLE 146 BEWATEC CONNECTEDCARE GMBH: BUSINESS OVERVIEW

11.1.19 ONYX HEALTHCARE INC.

TABLE 147 ONYX HEALTHCARE INC.: BUSINESS OVERVIEW

11.1.20 REMEDI COMPLETE MEDICAL SOLUTIONS

TABLE 148 REMEDI COMPLETE MEDICAL SOLUTIONS: BUSINESS OVERVIEW

*Business Overview, Products & Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 ONEVIEW HEALTHCARE

11.2.2 SIEMENS

11.2.3 VECOTON

11.2.4 PCARE

11.2.5 MEDIX-CARE GMBH

12 APPENDIX (Page No. - 179)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

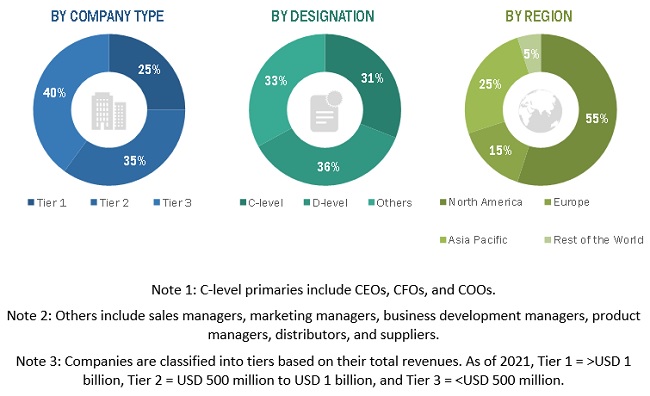

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the Interactive patient engagement solutions market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the Interactive patient engagement solutions was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), Healthcare Information and Management Systems Society (HIMSS), Agency for Healthcare Research and Quality (AHRQ), American Association of Healthcare Administrative Management (AAHAM), American Medical Group Association (AMGA), Institute of Population and Public Health (IPPH), Public Health Agency of Canada, International Association of Health Policy (IAHP), Society for Participatory Medicine, Association for Patient Experience, Institute for Patient and Family-centered Care, Patient Engagement Advisory Committee, American Hospital Association (AHA), Organisation for Economic Co-operation and Development (OECD), America's Health Insurance Plans (AHIP), Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary data was collected and analyzed to arrive at the overall size of the global interactive patient engagement solutions, which was validated through primary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the clinical decision support system market. The primary sources from the demand side included industry experts, consultants, healthcare providers, hospital administration, and government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Both top-down and bottom-up approaches were used to estimate and validate the size of the global interactive patient engagement solutions market and various dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of interactive patient engagement solutions by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the provider, payer, and other industries.

Report Objectives

- To define, describe, and forecast the interactive patient engagement solutions market on the basis of product, type, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions—North America, Europe, the Asia Pacific, and the Rest of the World (RoW).

- To profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, and collaborations in the global interactive patient engagement solutions market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of Interactive patient engagement solutions market.

- Profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Interactive Patient Care (IPC) Market