Interposer and Fan-out Wafer Level Packaging Market by Packaging Component & Design (Silicon, Organic, Glass, Ceramic), Packaging (2.5D, 3D), Device (Logic ICs, LEDs, Memory Devices, MEMS, Imaging & Optoelectronics), Industry - Global Forecast to 2029

Updated on : July 21, 2025

Interposer and Fan-out Wafer Level Packaging Market Size & Growth

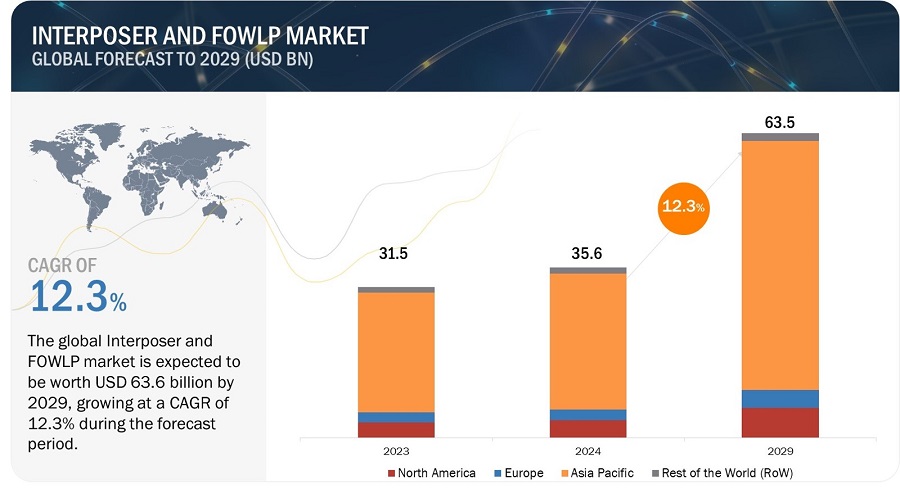

The Global interposer and Interposer and Fan-out Wafer Level Packaging Market size was estimated at USD 35.6 billion in 2024 and is predicted to increase from USD 40.03 billion in 2025 to approximately USD 63.5 billion by 2029, expanding at a CAGR of 12.3% from 2024 to 2029.

The market is experiencing growth driven by the cost advantages offered by advanced packaging and growing demand for consumer electronics and gaming devices. However, challenges surrounding thermal issues in wafer-level packaging are impeding market advancement. Despite these hurdles, opportunities emerge from the integration of advanced electronics in automobiles.

Interposer and Fan-out Wafer Level Packaging Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Interposer and Fan-out Wafer Level Packaging Market Trends:

Driver: Cost advantages offered by advanced packaging

FOWLP offers certain cost advantages compared to traditional packaging methods, contributing to overall economic efficiency in semiconductor manufacturing. One contributing factor is the utilization of wafer-level processes, allowing multiple chips to be processed simultaneously on a single wafer. This parallel processing capability improves throughput and reduces manufacturing costs per unit, as compared to sequential processing of individual chips. Additionally, FOWLP has the potential to enhance overall yield rates in semiconductor production. The technology facilitates a higher number of good die per wafer, minimizing the impact of defects and improving the overall yield, which is crucial for cost-effective mass production..

Restraint: Complex manufacturing process

The production of interposers and WLP involves intricate and advanced manufacturing techniques, which can lead to several challenges for companies in the semiconductor industry. The complexity arises from the need to create precise and intricate structures, often involving multiple layers of materials and intricate patterns of conductive traces and vias. This complexity can result in a higher likelihood of defects during manufacturing, requiring rigorous quality control measures to ensure the reliability of the final product..

Opportunity: Integration of advanced electronics in automobiles

The automotive sector is experiencing a significant increase in the integration of advanced electronics to enhance vehicle performance, safety, and connectivity. Modern vehicles are equipped with a variety of electronic components and systems, including advanced driver-assistance systems (ADAS), in-vehicle infotainment (IVI), engine control units, sensors, and communication modules. These electronic systems contribute to the development of smart and connected vehicles, paving the way for innovations such as autonomous driving and intelligent transportation systems.

Challenge: Complexities in the supply chain

The adoption of advanced packaging technologies introduces intricacies into the semiconductor supply chain, requiring effective coordination among multiple entities involved in the production process. Interposers and wafer-level packaging often involve the collaboration of various suppliers, each contributing different components or services to the final product. Coordinating the production schedules, quality control measures, and delivery timelines among these diverse suppliers can be a complex task. Any disruptions or delays at one stage of the supply chain can have a cascading effect on the entire manufacturing process, potentially leading to increased lead times and production costs..

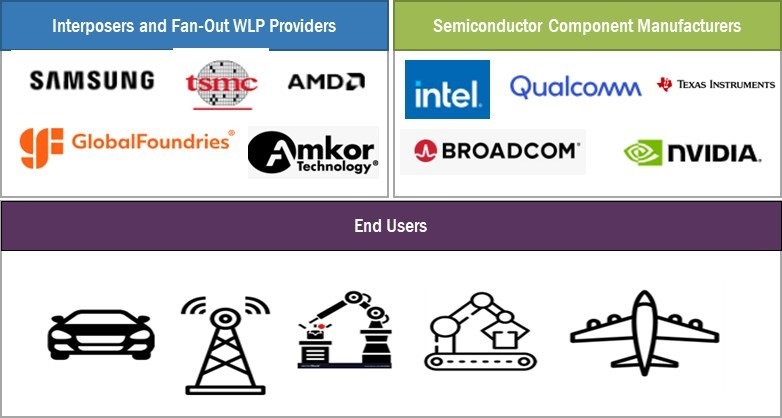

Interposer and Fowlp Market Ecosystem

The interposer and FOWLP market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the interposer and fan-out wafer level packaging market include Samsung (South Korea), Taiwan Semiconductor Manufacturing Company, Ltd. (Taiwan), SK HYNIX INC. (South Korea), ASE Technology Holding Co., Ltd. (Taiwan).

Interposer and Fan-out Wafer Level Packaging Market Segmentation

FOWLP to witness the highest CAGR during the forecast period.

The rise of Fan-Out Wafer Level Packaging (FOWLP) in advanced semiconductor packaging is driven by its capacity to boost device efficiency, minimize size, and facilitate heterogeneous integration, aligning with the growing need for streamlined and powerful electronic solutions. FOWLP's adaptability and cost-efficiency further underscore its significance in meeting dynamic market demands.

3D packaging type to hold the highest CAGR during the forecast period

The ascent of 3D packaging is propelled by its capability to enhance device efficiency, reduce footprint, and promote heterogeneous integration, addressing the escalating demand for compact and high-performance electronic solutions. This trajectory is further fueled by ongoing innovations, technological advancements, and the pursuit of more efficient and miniaturized semiconductor solutions.

MEMS/Sensors in Interposer and FOWLP market to hold the highest market share.

Advanced packaging techniques for MEMS (Micro-Electro-Mechanical Systems) and sensors are increasingly employed to enhance miniaturization, improve performance, and enable integration into compact devices such as wearables, IoT devices, and automotive applications. These packaging methods contribute to the reliability and functionality of MEMS and sensors, addressing the diverse and evolving requirements of modern electronic systems.

Based on the end-user industry, the automotive sector to witness highest CAGR during forecast period

In the automotive industry, advanced packaging plays a crucial role by enabling compact design, improving reliability, and accommodating the integration of complex electronic components such as microcontrollers, sensors, and power modules. These packaging technologies contribute to the development of advanced driver assistance systems (ADAS), electrification, and connectivity features, enhancing overall vehicle performance, safety, and efficiency.

Interposer and Fan-out Wafer Level Packaging Industry Regional Analysis

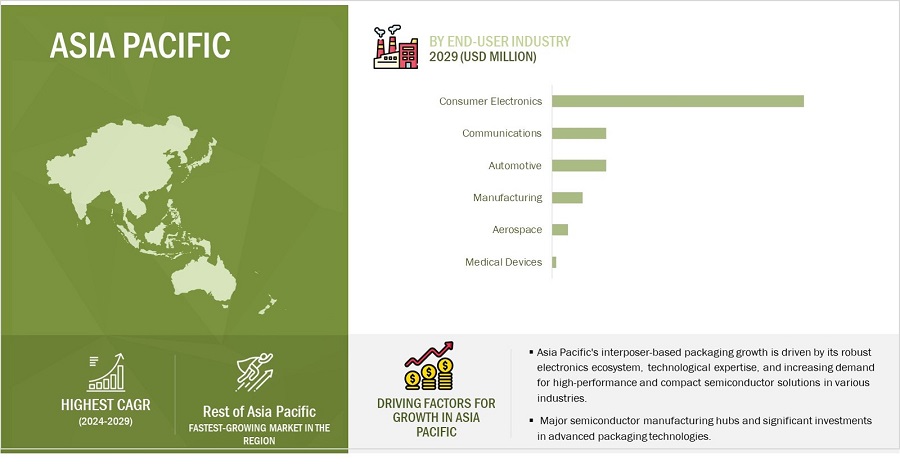

Interposer and FOWLP industry in Asia Pacific region to exhibit highest CAGR during the forecast period

Asia Pacific's interposer-based packaging growth is driven by its robust electronics ecosystem, technological expertise, and increasing demand for high-performance and compact semiconductor solutions in various industries.

Interposer and Fan-out Wafer Level Packaging Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Interposer and Fan-out Wafer Level Packaging Companies - Key Market Players

The interposer and FOWLP companies is dominated by players such as

- Samsung (South Korea),

- Taiwan Semiconductor Manufacturing Company, Ltd. (Taiwan),

- SK HYNIX INC. (South Korea),

- ASE Technology Holding Co., Ltd. (Taiwan) and others.

Interposer and Fan-out Wafer Level Packaging Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 35.6 billion in 2024 |

|

Expected Market Size |

USD 63.5 billion by 2029 |

|

Growth Rate |

CAGR of 12.3% |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Packaging Component & Design; Packaging Type; Device Type; By End-user Industry and Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the world (RoW) |

|

Companies covered |

The major market players include Samsung (South Korea), Taiwan Semiconductor Manufacturing Company, Ltd. (Taiwan), SK HYNIX INC. (South Korea), ASE Technology Holding Co., Ltd. (Taiwan), Amkor Technology (US). (A total of 25 players are profiled) |

Interposer and Fan-out Wafer Level Packaging Market Highlights

The study categorizes the Interposer and FOWLP market based on the following segments:

|

Segment |

Subsegment |

|

By Packaging Component & Design |

|

|

By Packaging Type |

|

|

By Device Type |

|

|

By End-user Industry |

|

|

By Region |

|

Recent Developments in Interposer and Fan-out Wafer Level Packaging Industry

- In October 2023, Advanced Semiconductor Engineering, Inc. (ASE) introduced the Integrated Design Ecosystem (IDE), a collaborative design toolset designed to systematically enhance advanced package architecture throughout its VIPack platform.

- In October 2022, Samsung (South Korea) collaborated with Cadence (US), an electronic system design company, to provide customers with optimal TSV placement in stacked die designs. With this collaboration, both companies look forward to accelerating 3D-IC design for better performance.

- In October 2022, Synopsys (US) an electronic design automation company collaborated with TSMC (Taiwan) to achieve the multi-die system design technology with advanced packaging and silicon process technology for providing their customers with a comprehensive solution for semiconductor and system-level packaging.

- In November 2021, Samsung launched Hybrid-Substrate Cube (H-Cube) technology, a 2.5D packaging solution that applies silicon interposer technology and hybrid-substrate structure specialized for semiconductors for HPC, AI, data center, and network products that require high-performance and large-area packaging technology.

Frequently Asked Questions(FAQs):

What are the interposer and FOWLP market's major driving factors and opportunities?

The interposer and FOWLP market is driven by Growing demand for consumer electronics and gaming devices. Furthermore, the growing demand for consumer electronics and gaming devices presents additional opportunities for market expansion.

Which region is expected to hold the highest interposer and fan-out wafer level packaging market share?

Asia Pacific commands a larger share of the interposer and FOWLP market due to its highly developed technological landscape. The rise of semiconductor packaging in the Asia Pacific is driven by the region's robust electronics manufacturing, skilled labor availability, advanced packaging facilities, cost-effective production strategies, proximity to key markets, and supportive government policies fostering research and development.

Who are the leading players in the global interposer and FOWLP market?

Companies such as Samsung (South Korea), Taiwan Semiconductor Manufacturing Company, Ltd. (Taiwan), SK HYNIX INC. (South Korea), are the leading players in the market.

What are some of the technological advancements in the interposer and fan-out wafer level packaging market?

Advanced packaging technologies such as 3D stacking and fan-out panel level packaging are some of the technical advancements in the market.

What is the size of the global interposer and FOWLP market?

The global interposer and FOWLP market was valued at USD 35.6 billion in 2024 and is anticipated to reach USD 63.5 billion in 2029 at a CAGR of 12.3% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Surging demand for miniaturized electronic devices- Growing reliance on AI and high-performance computing technologies- Rising popularity of esports and game streaming platforms- Increasing focus on developing advanced chip packaging techniquesRESTRAINTS- Environmental concerns associated with use of chemicals in interposer production facilities- Requirement for advanced and high-cost manufacturing techniquesOPPORTUNITIES- Growing demand for wearable IoT devices- Integration of advanced electronics into automobilesCHALLENGES- Thermal issues in interposer and wafer-level packaging- Managing complex semiconductor supply chain

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM/MARKET MAP

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE OF 12-INCH WAFERS OFFERED BY TWO KEY PLAYERSAVERAGE SELLING PRICE OF 12-INCH WAFERSAVERAGE SELLING PRICE OF 12-INCH WAFERS, BY REGION

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 TECHNOLOGY ANALYSIS3D STACKINGFAN-OUT PANEL-LEVEL PACKAGINGMONOLITHIC 3D3D IC

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISSPTS TECHNOLOGIES PARTNERS WITH IMEC TO REDUCE WAFER THINNING COSTSSEMICONDUCTOR FOUNDRY USES SPTS OMEGA RAPIER XE TO ENHANCE PRODUCTIVITY OF WAFER BACKSIDE VIA REVEAL PROCESSCHROMALOX, INC. DEVELOPS KAPTON HEATERS TO GAIN CONTROL OVER TEMPERATURE-SENSITIVE ETCHING CHEMICALS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.14 TARIFF, REGULATORY LANDSCAPE, AND STANDARDSCOUNTRY-WISE TARIFF FOR HS CODE 381800-COMPLIANT PRODUCTSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS- North America- Europe- Asia Pacific- RoWSTANDARDS

- 6.1 INTRODUCTION

-

6.2 INTERPOSERSSILICON- Implementation of silicon interposers to stack multiple semiconductor dies in single package to foster segmental growthORGANIC- Adoption of organic interposers to facilitate effective thermal management to accelerate segmental growthGLASS- Use of glass interposers to ensure high-speed electrical data transfer to fuel segmental growthCERAMIC- Trend of electronic device miniaturization to augment demand for ceramic interposersOTHER INTERPOSERS

-

6.3 FOWLPVERSATILITY AND FLEXIBLE DESIGN TO BOOST ADOPTION OF FOWLP TECHNOLOGYSINGLE-DIEMULTI-DIE

- 7.1 INTRODUCTION

-

7.2 2.5DADOPTION OF 2.5D PACKAGING TECHNOLOGY TO ENHANCE PERFORMANCE OF COMPUTING SOLUTIONS TO DRIVE MARKET

-

7.3 3DUSE OF 3D PACKAGING SOLUTIONS IN ADVANCED SEMICONDUCTOR MANUFACTURING FACILITIES TO FUEL SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 LOGIC ICSGROWING DEMAND FOR SMART HOME APPLIANCES TO CONTRIBUTE TO SEGMENTAL GROWTH

-

8.3 IMAGING & OPTOELECTRONICSRISING POPULARITY OF AUTONOMOUS VEHICLES TO ACCELERATE SEGMENTAL GROWTH

-

8.4 MEMORY DEVICESINCREASING DEMAND FOR SPECIALIZED AI AND ML HARDWARE COMPONENTS TO DRIVE MARKET

-

8.5 MEMS/SENSORSESCALATING ADOPTION OF ADVANCED CONSUMER ELECTRONICS TO FOSTER SEGMENTAL GROWTH

-

8.6 LEDSINCREASING USE OF LEDS IN TELECOMMUNICATION DEVICES TO PROPEL MARKET

- 8.7 OTHER DEVICE TYPES

- 9.1 INTRODUCTION

-

9.2 CONSUMER ELECTRONICSSURGING DEMAND FOR SLEEK AND MULTIFUNCTIONAL ELECTRONIC GADGETS TO DRIVE MARKET

-

9.3 MANUFACTURINGESCALATING ADOPTION OF SMART MANUFACTURING AND INDUSTRY 4.0 TECHNOLOGIES TO FUEL SEGMENTAL GROWTH

-

9.4 COMMUNICATIONSINCREASING DEVELOPMENT OF DATA CENTERS TO CONTRIBUTE TO SEGMENTAL GROWTH

-

9.5 AUTOMOTIVERISING POPULARITY OF ELECTRIC VEHICLES TO ACCELERATE SEGMENTAL GROWTH

-

9.6 HEALTHCARERAPID ADVANCEMENTS IN WEARABLE HEALTHCARE DEVICES TO FOSTER SEGMENTAL GROWTH

-

9.7 AEROSPACEINCREASING INTEGRATION OF COMPLEX SYSTEMS AND SENSORS INTO AIRCRAFT TO BOOST SEGMENTAL GROWTH

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT ON MARKET IN NORTH AMERICAUS- Rising focus on enhancing performance and functionality of electronic devices to drive marketCANADA- Growing emphasis on enhancing semiconductor design and manufacturing to contribute to market growthMEXICO- Increasing investment in semiconductor R&D projects to fuel market growth

-

10.3 EUROPERECESSION IMPACT ON MARKET IN EUROPEUK- Rapid advancement in 5G technology to foster market growthGERMANY- Increased adoption of connected cars and smart home devices to accelerate market growthFRANCE- Highly developed transport and communication networks to contribute to market growthREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACT ON MARKET IN ASIA PACIFICCHINA- Increasing expansion of automobile and semiconductor manufacturing facilities to propel marketJAPAN- Rising production of advanced consumer electronics to boost market growthSOUTH KOREA- Growing number of semiconductor fabrication plants to augment market growthREST OF ASIA PACIFIC

-

10.5 ROWRECESSION IMPACT ON MARKET IN ROWMIDDLE EAST & AFRICA- High commitment to technological innovation to contribute to market growthSOUTH AMERICA- Increased R&D of advanced packaging technologies to propel market

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2023PRODUCT PORTFOLIO EXPANSIONREGIONAL FOOTPRINT EXPANSIONORGANIC/INORGANIC GROWTH

- 11.3 MARKET SHARE ANALYSIS, 2023

- 11.4 REVENUE ANALYSIS OF KEY PLAYERS IN INTERPOSER AND FOWLP MARKET, 2018–2022

-

11.5 COMPANY EVALUATION MATRIX, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 START-UP/SME EVALUATION MATRIX, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.7 COMPETITIVE SITUATION AND TRENDSPRODUCT LAUNCHESDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSTAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAMSUNG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewASE TECHNOLOGY HOLDING CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMKOR TECHNOLOGY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSK HYNIX INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGLOBAL FOUNDRIES INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDECA TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsJCET GROUP LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsPOWERTECH TECHNOLOGY INC.- Business overview- Products/Solutions/Services offeredADVANCED MICRO DEVICES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

12.3 OTHER PLAYERSNEXLOGIC TECHNOLOGIES INC.SPTS TECHNOLOGIES LTD.TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATIONSAMTECTELEDYNE DIGITAL IMAGING INC.OKMETICAMS-OSRAM AGNEPESNHANCED SEMICONDUCTORSDUPONTALLVIA INC.UNITED MICROELECTRONICS CORPORATIONDAI NIPPON PRINTING CO., LTD.RENA TECHNOLOGIES GMBHMURATA MANUFACTURING CO., LTD

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 INTERPOSER AND FOWLP MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 MARKET: RISK ASSESSMENT

- TABLE 3 INTERPOSER AND FAN-OUT WAFER LEVEL PACKAGING MARKET: PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON MARKET

- TABLE 4 COMPANIES AND THEIR ROLES IN INTERPOSER AND FOWLP ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF 12-INCH WAFERS, 2019–2023 (USD/THOUSAND UNITS)

- TABLE 6 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- TABLE 9 LIST OF PATENTS IN INTERPOSER AND FOWLP MARKET

- TABLE 10 MARKET: LIST OF CONFERENCES AND EVENTS, 2024–2025

- TABLE 11 MFN TARIFF FOR PRODUCTS UNDER HS CODE 381800 EXPORTED BY BRAZIL

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INTERPOSER AND FOWLP MARKET, BY PACKAGING COMPONENT AND DESIGN, 2020–2023 (USD BILLION)

- TABLE 17 MARKET, BY PACKAGING COMPONENT AND DESIGN, 2024–2029 (USD BILLION)

- TABLE 18 INTERPOSERS: MARKET, BY PACKAGING TYPE, 2020–2023 (USD BILLION)

- TABLE 19 INTERPOSERS: MARKET, BY PACKAGING TYPE, 2024–2029 (USD BILLION)

- TABLE 20 INTERPOSERS: MARKET, BY PACKAGING COMPONENT, 2020–2023 (USD MILLION)

- TABLE 21 INTERPOSERS: MARKET, BY PACKAGING COMPONENT, 2024–2029 (USD MILLION)

- TABLE 22 INTERPOSERS: MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 23 INTERPOSERS: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 24 FOWLP: INTERPOSER AND FOWLP MARKET, BY PACKAGING TYPE, 2020–2023 (USD BILLION)

- TABLE 25 FOWLP: INTERPOSER AND FAN-OUT WAFER LEVEL PACKAGING MARKET, BY PACKAGING TYPE, 2024–2029 (USD BILLION)

- TABLE 26 FOWLP: MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 27 FOWLP: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 28 MARKET, BY PACKAGING TYPE, 2020–2023 (USD BILLION)

- TABLE 29 INTERPOSER AND FOWLP MARKET, BY PACKAGING TYPE, 2024–2029 (USD BILLION)

- TABLE 30 2.5D: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 31 2.5D: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 32 3D: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 33 3D: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 34 MARKET, BY DEVICE TYPE, 2020–2023 (USD BILLION)

- TABLE 35 INTERPOSER AND FOWLP MARKET, BY DEVICE TYPE, 2024–2029 (USD BILLION)

- TABLE 36 LOGIC ICS: MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 37 LOGIC ICS: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 38 IMAGING & OPTOELECTRONICS: MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 39 IMAGING & OPTOELECTRONICS: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 40 MEMORY DEVICES: INTERPOSER AND FOWLP MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 41 MEMORY DEVICES: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 42 MEMS/SENSORS: MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 43 MEMS/SENSORS: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 44 LEDS: MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 45 LEDS: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 46 OTHER DEVICE TYPES: MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 47 OTHER DEVICE TYPES: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 48 INTERPOSER AND FOWLP MARKET, BY END-USER INDUSTRY, 2020–2023 (USD BILLION)

- TABLE 49 MARKET, BY END-USER INDUSTRY, 2024–2029 (USD BILLION)

- TABLE 50 CONSUMER ELECTRONICS: INTERPOSER AND FAN-OUT WAFER LEVEL PACKAGING MARKET, BY PACKAGING COMPONENT AND DESIGN, 2020–2023 (USD MILLION)

- TABLE 51 CONSUMER ELECTRONICS: MARKET, BY PACKAGING COMPONENT AND DESIGN, 2024–2029 (USD MILLION)

- TABLE 52 CONSUMER ELECTRONICS: MARKET, BY DEVICE TYPE, 2020–2023 (USD MILLION)

- TABLE 53 CONSUMER ELECTRONICS: MARKET, BY DEVICE TYPE, 2024–2029 (USD MILLION)

- TABLE 54 CONSUMER ELECTRONICS: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 55 CONSUMER ELECTRONICS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 56 MANUFACTURING: INTERPOSER AND FOWLP MARKET, BY PACKAGING COMPONENT AND DESIGN, 2020–2023 (USD MILLION)

- TABLE 57 MANUFACTURING: MARKET, BY PACKAGING COMPONENT AND DESIGN, 2024–2029 (USD MILLION)

- TABLE 58 MANUFACTURING: MARKET, BY DEVICE TYPE, 2020–2023 (USD MILLION)

- TABLE 59 MANUFACTURING: MARKET, BY DEVICE TYPE, 2024–2029 (USD MILLION)

- TABLE 60 MANUFACTURING: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 61 MANUFACTURING: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 62 COMMUNICATIONS: INTERPOSER AND FOWLP MARKET, BY PACKAGING COMPONENT AND DESIGN, 2020–2023 (USD MILLION)

- TABLE 63 COMMUNICATIONS: INTERPOSER AND FAN-OUT WAFER LEVEL PACKAGING MARKET, BY PACKAGING COMPONENT AND DESIGN, 2024–2029 (USD MILLION)

- TABLE 64 COMMUNICATIONS: MARKET, BY DEVICE TYPE, 2020–2023 (USD MILLION)

- TABLE 65 COMMUNICATIONS: MARKET, BY DEVICE TYPE, 2024–2029 (USD MILLION)

- TABLE 66 COMMUNICATIONS: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 67 COMMUNICATIONS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 68 AUTOMOTIVE: INTERPOSER AND FOWLP MARKET, BY PACKAGING COMPONENT AND DESIGN, 2020–2023 (USD MILLION)

- TABLE 69 AUTOMOTIVE: MARKET, BY PACKAGING COMPONENT AND DESIGN, 2024–2029 (USD MILLION)

- TABLE 70 AUTOMOTIVE: MARKET, BY DEVICE TYPE, 2020–2023 (USD MILLION)

- TABLE 71 AUTOMOTIVE: MARKET, BY DEVICE TYPE, 2024–2029 (USD MILLION)

- TABLE 72 AUTOMOTIVE: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 73 AUTOMOTIVE: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 74 HEALTHCARE: MARKET, BY PACKAGING COMPONENT AND DESIGN, 2020–2023 (USD MILLION)

- TABLE 75 HEALTHCARE: INTERPOSER AND FOWLP MARKET, BY PACKAGING COMPONENT AND DESIGN, 2024–2029 (USD MILLION)

- TABLE 76 HEALTHCARE: MARKET, BY DEVICE TYPE, 2020–2023 (USD MILLION)

- TABLE 77 HEALTHCARE: MARKET, BY DEVICE TYPE, 2024–2029 (USD MILLION)

- TABLE 78 HEALTHCARE: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 79 HEALTHCARE: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 80 AEROSPACE: INTERPOSER AND FOWLP MARKET, BY PACKAGING COMPONENT AND DESIGN, 2020–2023 (USD MILLION)

- TABLE 81 AEROSPACE: MARKET, BY PACKAGING COMPONENT AND DESIGN, 2024–2029 (USD MILLION)

- TABLE 82 AEROSPACE: MARKET, BY DEVICE TYPE, 2020–2023 (USD MILLION)

- TABLE 83 AEROSPACE: MARKET, BY DEVICE TYPE, 2024–2029 (USD MILLION)

- TABLE 84 AEROSPACE: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 85 AEROSPACE: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 86 INTERPOSER AND FOWLP MARKET, BY REGION, 2020–2023 (USD BILLION)

- TABLE 87 MARKET, BY REGION, 2024–2029 (USD BILLION)

- TABLE 88 NORTH AMERICA: INTERPOSER AND FAN-OUT WAFER LEVEL PACKAGING MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY PACKAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY PACKAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 94 EUROPE: INTERPOSER AND FOWLP MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY PACKAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY PACKAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 100 ASIA PACIFIC: INTERPOSER AND FOWLP MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MARKET, BY PACKAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MARKET, BY PACKAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 106 ROW: INTERPOSER AND FOWLP MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 107 ROW: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 108 ROW: MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 109 ROW: MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 110 ROW: MARKET, BY PACKAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 111 ROW: MARKET, BY PACKAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 112 INTERPOSER AND FOWLP MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2023

- TABLE 113 MARKET: DEGREE OF COMPETITION

- TABLE 114 COMPANY PACKAGING TYPE FOOTPRINT (10 KEY COMPANIES)

- TABLE 115 COMPANY PACKAGING COMPONENT AND DESIGN FOOTPRINT (10 KEY COMPANIES)

- TABLE 116 COMPANY REGION FOOTPRINT (10 KEY COMPANIES)

- TABLE 117 OVERALL COMPANY FOOTPRINT (10 KEY COMPANIES)

- TABLE 118 MARKET: LIST OF KEY START-UPS/SMES

- TABLE 119 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 120 MARKET: PRODUCT LAUNCHES, AUGUST 2020–NOVEMBER 2023

- TABLE 121 INTERPOSER AND FOWLP MARKET: DEALS, FEBRUARY 2021–JANUARY 2024

- TABLE 122 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 123 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: PRODUCT LAUNCHES

- TABLE 125 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: DEALS

- TABLE 126 SAMSUNG: COMPANY OVERVIEW

- TABLE 127 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 SAMSUNG: PRODUCT LAUNCHES

- TABLE 129 SAMSUNG: DEALS

- TABLE 130 ASE TECHNOLOGY HOLDING CO., LTD.: COMPANY OVERVIEW

- TABLE 131 ASE TECHNOLOGY HOLDING CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 ASE TECHNOLOGY HOLDING CO., LTD.: PRODUCT LAUNCHES

- TABLE 133 ASE TECHNOLOGY HOLDING CO., LTD.: DEALS

- TABLE 134 AMKOR TECHNOLOGY: COMPANY OVERVIEW

- TABLE 135 AMKOR TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 AMKOR TECHNOLOGY: DEALS

- TABLE 137 AMKOR TECHNOLOGY: OTHERS

- TABLE 138 SK HYNIX INC.: COMPANY OVERVIEW

- TABLE 139 SK HYNIX INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 SK HYNIX INC.: PRODUCT LAUNCHES

- TABLE 141 GLOBAL FOUNDRIES INC.: COMPANY OVERVIEW

- TABLE 142 GLOBAL FOUNDRIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 GLOBAL FOUNDRIES INC.: DEALS

- TABLE 144 GLOBAL FOUNDRIES INC.: OTHERS

- TABLE 145 DECA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 146 DECA TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 DECA TECHNOLOGIES: DEALS

- TABLE 148 JCET GROUP LTD.: COMPANY OVERVIEW

- TABLE 149 JCET GROUP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 JCET GROUP LTD.: PRODUCT LAUNCHES

- TABLE 151 JCET GROUP LTD.: OTHERS

- TABLE 152 POWERTECH TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 153 POWERTECH TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 POWERTECH TECHNOLOGY INC.: DEALS

- TABLE 155 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 156 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES

- TABLE 157 ADVANCED MICRO DEVICES, INC.: PRODUCT LAUNCHES

- FIGURE 1 INTERPOSER AND FOWLP MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET: MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 4 MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET: TOP-DOWN APPROACH

- FIGURE 6 MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET: DATA TRIANGULATION

- FIGURE 8 INTERPOSER AND FOWLP MARKET: RESEARCH LIMITATIONS

- FIGURE 9 CONSUMER ELECTRONICS TO HOLD LARGEST SHARE OF MARKET IN 2029

- FIGURE 10 MEMS/SENSORS TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 11 2.5D PACKAGING TYPE TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 12 INTERPOSER AND FOWLP PACKAGING MARKET IN ASIA PACIFIC TO RECORD HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 13 GROWING DEMAND FOR CONSUMER ELECTRONICS AND GAMING DEVICES TO BOOST MARKET GROWTH

- FIGURE 14 INTERPOSERS TO ACCOUNT FOR LARGER MARKET SHARE IN 2029

- FIGURE 15 MEMORY DEVICES TO DOMINATE INTERPOSER AND FOWLP MARKET DURING FORECAST PERIOD

- FIGURE 16 CONSUMER ELECTRONICS END-USER INDUSTRY AND CHINA HELD LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2023

- FIGURE 17 CHINA TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 18 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 NUMBER OF GLOBAL SMARTPHONE AND MOBILE PHONE USERS, 2020–2025

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 INTERPOSER AND FOWLP MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 KEY PLAYERS IN INTERPOSER AND FOWLP ECOSYSTEM

- FIGURE 26 AVERAGE SELLING PRICE OF 12-INCH WAFERS OFFERED BY TWO KEY PLAYERS (USD/THOUSAND UNITS)

- FIGURE 27 AVERAGE SELLING PRICE OF 12-INCH WAFERS, 2019–2023

- FIGURE 28 AVERAGE SELLING PRICE OF 12-INCH WAFERS, BY REGION, 2019–2023

- FIGURE 29 MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- FIGURE 33 IMPORT DATA FOR HS CODE 381800-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 34 EXPORT DATA FOR HS CODE 381800-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 35 INTERPOSER AND FOWLP MARKET: PATENTS APPLIED AND GRANTED, 2013–2023

- FIGURE 36 INTERPOSERS TO REGISTER HIGHER CAGR BETWEEN 2024 AND 2029

- FIGURE 37 MARKET, BY PACKAGING TYPE

- FIGURE 38 3D PACKAGING TYPE TO DEPICT HIGHER CAGR FROM 2024 TO 2029

- FIGURE 39 MEMORY DEVICES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 40 AUTOMOTIVE END-USER INDUSTRY TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2024 TO 2029

- FIGURE 41 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN MARKET BETWEEN 2024 AND 2029

- FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 43 EUROPE: MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018–2022

- FIGURE 46 INTERPOSER AND FOWLP MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 47 MARKET: START-UP/SME EVALUATION MATRIX, 2023

- FIGURE 48 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 49 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 50 ASE TECHNOLOGY HOLDING CO. LTD.: COMPANY SNAPSHOT

- FIGURE 51 AMKOR TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 52 SK HYNIX INC.: COMPANY SNAPSHOT

- FIGURE 53 GLOBAL FOUNDRIES INC.: COMPANY SNAPSHOT

- FIGURE 54 JCET GROUP LTD.: COMPANY SNAPSHOT

- FIGURE 55 POWERTECH TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 56 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

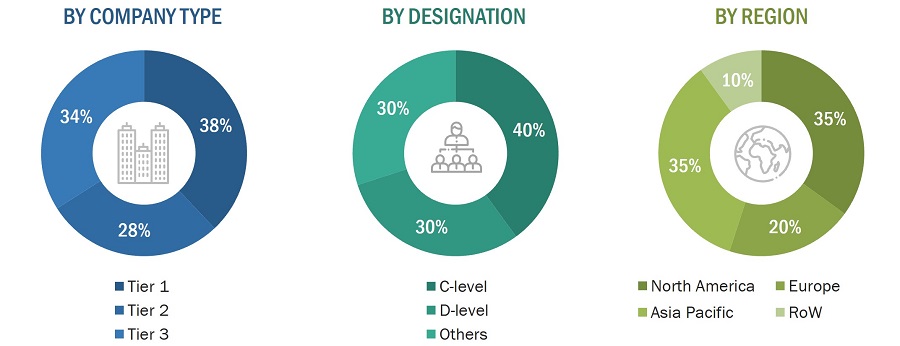

The study involved four major activities in estimating the current size of the interposer and fan-out wafer level packaging (FOWLP) market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Sources |

Web Link |

|

Chinese American Semiconductor Professional Association |

https://www.caspa.com/ |

|

Global Semiconductor Alliance |

https://www.gsaglobal.org/ |

|

Semiconductor Equipment Association of Japan (SEAJ) |

https://www.seaj.or.jp/english/ |

|

China Semiconductor Industry Association |

https://www.csia.net.cn/wsc/ |

|

SEMI |

https://www.semi.org/en |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the interposer and FOWLP market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

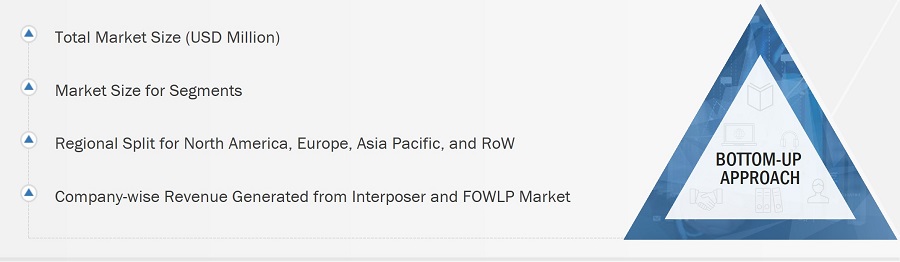

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the interposer and FOWLP market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying entities in the interposer and FOWLP value chain influencing the entire semiconductor packaging industry

- Analyzing each entity along with related major companies identifying technology providers for the implementation of offerings and services

- Estimating the market for these interposers and FOWLP end users

- Tracking ongoing and upcoming implementation of interposer and FOWLP developments by various companies and forecasting the market based on these developments and other critical parameters

- Arriving at the market size by analyzing interposer and FOWLP companies based on their countries and then combining it to get the market estimate by region

- Verifying estimates and crosschecking them by a discussion with key opinion leaders, which include CXOs, directors, and operation managers

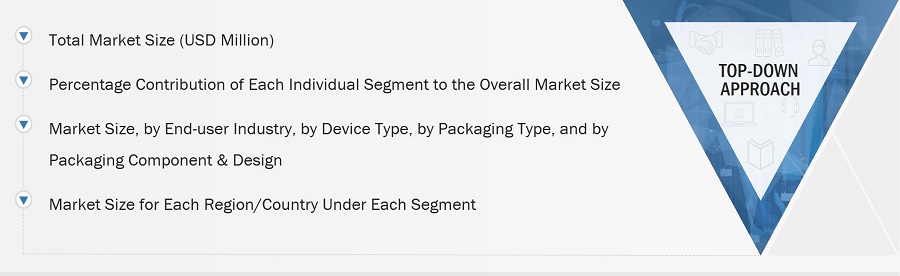

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the market size of specific segments. The top-down approach has been implemented for the data extracted from the secondary research to validate the market size obtained.

Each company’s market share has been estimated to verify the revenue shares used earlier in the top-down approach. This study has determined and confirmed the overall parent market and individual market sizes by the data triangulation method and data validation through primaries. The data triangulation method in this study is explained in the next section.

- Focusing initially on topline investments by market players in the semiconductor packaging ecosystem

- Calculating the market size based on the revenue generated by market players through the sales of interposer and fan-out and wafer level packaging.

- Mapping the use of interposer and FOWLP in different offerings.

- Building and developing the information related to the revenue generated by market players through key products

- Estimating the geographic split using secondary sources considering factors, such as the number of players in a specific country and region, the role of major players in the development of innovative products, and adoption and penetration rates in a particular country for various segments.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Interposer and fan-out wafer level packaging (FOWLP) are key technologies in the semiconductor packaging industry. An interposer serves as an intermediary substrate, allowing the integration of many semiconductor dies into a single package via a network of interconnects and perhaps passive components.

FOWLP is a packaging technology that redistributes external connections from a thinned semiconductor die to the package substrate, resulting in a more compact design with better electrical performance. This market is driven by the growing demand for smaller, more powerful, and energy-efficient electronic devices across various industries.

Key Stakeholders

- Suppliers of Raw Materials and Manufacturing Equipment

- Providers and Manufacturers of Components

- Providers of Software Solutions

- Manufacturers and Providers of Semiconductor Devices

- Original Equipment Manufacturers (OEMs)

- ODM and OEM Technology Solution Providers

- Suppliers and Distributors of Semiconductor Manufacturing Devices

- System Integrators

- Assembly, Testing, and Packaging Vendors

- Market Research and Consulting Firms

- Associations, Organizations, Forums, and Alliances Related to the Semiconductor Packaging

- Technology Investors

- Governments, Regulatory Bodies, and Financial Institutions

- Venture Capitalists, Private Equity Firms, and Startups

- End-user Industries

Report Objectives

- To describe and forecast the interposer and fan-out wafer level packaging (FOWLP) market, in terms of value, based on packaging component & design, packaging type, device type and end-user industry.

- To forecast the market size, in terms of value, for various segments concerning four regions: North America, Europe, Asia Pacific, and the Rest of the World.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges).

- To strategically analyze micromarkets1 for individual growth trends, prospects, and contributions to the total market.

- To analyze market opportunities for stakeholders by identifying well-developed segments of the interposer and fan-out wafer level packaging (FOWLP) market.

- To provide a detailed overview of the market's value chain and analyze market trends with Porter’s five forces analytical framework.

- To strategically profile the key players and comprehensively analyze their market position regarding ranking and core competencies2, along with detailing the competitive landscape for market leaders.

- To analyze strategic developments, such as product launches, related developments, acquisitions, expansions, and agreements in the interposer and fan-out wafer level packaging (FOWLP) market.

- To track and analyze competitive developments, such as partnerships, collaborations, agreements, joint ventures, mergers and acquisitions, expansions, product launches, and other developments in the market.

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of regions into respective countries

Growth opportunities and latent adjacency in Interposer and Fan-out Wafer Level Packaging Market